444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK white cement market represents a specialized segment within the broader construction materials industry, characterized by its distinctive properties and premium applications. White cement differs from ordinary Portland cement through its refined manufacturing process and carefully selected raw materials, resulting in a product with superior aesthetic qualities and enhanced performance characteristics. The market has experienced steady growth driven by increasing demand from architectural applications, decorative concrete projects, and specialized construction requirements.

Market dynamics indicate robust expansion across multiple sectors, with the construction industry’s focus on aesthetic appeal and sustainable building practices contributing to increased adoption. The UK market benefits from advanced manufacturing capabilities and strong distribution networks that serve both domestic and export markets. Growth rates have remained consistently positive, with the market experiencing approximately 4.2% annual growth over recent years, reflecting the material’s growing importance in modern construction projects.

Regional distribution shows concentrated activity in major urban centers and construction hubs, with London and surrounding areas accounting for approximately 35% of total consumption. The market’s evolution reflects broader trends in construction technology, environmental consciousness, and architectural innovation, positioning white cement as an increasingly vital component in contemporary building practices.

The UK white cement market refers to the production, distribution, and consumption of specialized cement products characterized by their high whiteness and superior aesthetic properties within the United Kingdom’s construction and building materials sector. White cement is manufactured using carefully selected raw materials with minimal iron oxide content and processed under controlled conditions to achieve its distinctive color and enhanced performance characteristics.

Manufacturing processes involve precise temperature control and specialized grinding techniques that preserve the material’s whiteness while maintaining structural integrity. The product serves multiple applications including architectural concrete, decorative elements, terrazzo flooring, and specialized construction projects requiring superior finish quality. Market participants include manufacturers, distributors, contractors, and end-users across residential, commercial, and infrastructure development sectors.

Quality standards governing the UK market ensure consistency and performance reliability, with products meeting stringent specifications for whiteness index, compressive strength, and durability. The market encompasses both domestic production and imported products, creating a competitive landscape that drives innovation and quality improvements across the supply chain.

Market performance in the UK white cement sector demonstrates sustained growth momentum driven by increasing architectural sophistication and construction industry evolution. The market benefits from strong fundamentals including robust construction activity, growing emphasis on aesthetic building materials, and expanding applications in specialized construction projects. Key drivers include urbanization trends, infrastructure modernization, and increasing consumer preference for premium building materials.

Competitive dynamics feature established manufacturers competing alongside emerging players, creating an environment that fosters innovation and product development. The market experiences approximately 65% domestic production with the remainder supplied through strategic imports from European and international sources. Application diversity spans residential construction, commercial development, infrastructure projects, and specialized architectural applications.

Future prospects remain positive with projected growth supported by continued construction activity, technological advancement, and expanding market awareness. Sustainability initiatives within the construction sector contribute to market expansion as white cement’s properties align with green building practices and energy-efficient construction methods. The market’s trajectory reflects broader economic recovery and construction sector revitalization across the UK.

Strategic insights reveal several critical factors shaping the UK white cement market landscape. The following key observations provide comprehensive understanding of market dynamics:

Market maturity indicators suggest continued evolution with opportunities for product innovation and application development. Consumer awareness regarding white cement benefits continues expanding, supporting market growth across traditional and emerging application areas.

Primary drivers propelling the UK white cement market include fundamental shifts in construction practices and architectural preferences. Aesthetic considerations have become increasingly important in modern construction projects, with architects and designers seeking materials that offer superior visual appeal and design flexibility. The growing emphasis on architectural concrete applications drives demand for white cement products that enable creative expression and distinctive building designs.

Construction sector growth provides substantial momentum for market expansion, with residential and commercial development projects incorporating white cement for both structural and decorative applications. Infrastructure modernization initiatives across the UK create additional demand channels, particularly for specialized applications requiring high-performance materials. The market benefits from approximately 28% growth in premium construction material adoption over recent years.

Sustainability trends within the construction industry align favorably with white cement properties, including enhanced thermal performance and reduced environmental impact in specific applications. Technological advancement in manufacturing processes improves product quality while reducing production costs, making white cement more accessible to broader market segments. Consumer sophistication regarding building materials drives demand for products offering superior performance and aesthetic qualities.

Cost considerations represent the primary constraint affecting UK white cement market expansion, with premium pricing limiting adoption in cost-sensitive construction projects. Manufacturing complexity associated with white cement production results in higher production costs compared to ordinary cement, creating pricing pressures that impact market penetration. The material typically costs 15-25% more than conventional cement products, affecting budget-conscious construction projects.

Technical limitations in certain applications restrict market growth, particularly where structural requirements exceed white cement’s performance characteristics. Supply chain constraints occasionally impact product availability, especially during peak construction periods when demand exceeds production capacity. Skilled labor requirements for proper application and finishing techniques create barriers in markets with limited expertise.

Competition from alternatives including pigmented concrete and surface treatments provides substitution options that may limit white cement adoption. Economic sensitivity affects construction activity levels, with market demand closely tied to broader economic conditions and construction industry health. Regulatory compliance requirements add complexity to manufacturing and distribution processes, potentially impacting cost structures and market accessibility.

Emerging opportunities within the UK white cement market reflect evolving construction practices and expanding application possibilities. Green building initiatives create substantial growth potential as white cement’s reflective properties contribute to energy-efficient building designs and sustainable construction practices. The market opportunity in eco-friendly construction represents approximately 18% annual growth potential as environmental considerations become increasingly important.

Architectural innovation drives demand for specialized cement products that enable creative design solutions and distinctive building aesthetics. Restoration projects across the UK’s historic building stock create niche market opportunities requiring high-quality materials that match original construction specifications. Export potential exists for UK manufacturers to serve European and international markets with premium white cement products.

Technology integration opportunities include development of enhanced formulations and application techniques that expand market reach. Partnership development with architects, designers, and construction companies creates channels for market expansion and product promotion. Value-added services including technical support and application guidance represent opportunities for market differentiation and customer loyalty development.

Dynamic interactions within the UK white cement market create complex relationships between supply, demand, and competitive forces. Supply-side dynamics reflect manufacturing capacity constraints and raw material availability, with production levels influenced by energy costs and environmental regulations. Demand fluctuations correlate closely with construction activity cycles and economic conditions, creating periodic market volatility.

Competitive pressures drive continuous improvement in product quality and manufacturing efficiency, with market participants investing in technology upgrades and process optimization. Price dynamics reflect raw material costs, energy expenses, and competitive positioning, with premium pricing maintained through quality differentiation. The market experiences seasonal variations of approximately 12-15% due to construction activity patterns and weather-related factors.

Innovation cycles influence market evolution through introduction of enhanced products and application techniques. Regulatory changes impact manufacturing processes and product specifications, requiring continuous adaptation by market participants. Economic indicators including construction spending and infrastructure investment directly influence market performance and growth trajectories. Consumer preferences continue evolving toward premium materials and sustainable construction practices, supporting long-term market expansion.

Comprehensive research methodology employed in analyzing the UK white cement market combines primary and secondary research approaches to ensure accuracy and reliability. Primary research includes direct engagement with industry participants including manufacturers, distributors, contractors, and end-users through structured interviews and surveys. Data collection encompasses production statistics, consumption patterns, pricing trends, and market share analysis across multiple time periods.

Secondary research utilizes industry publications, government statistics, trade association reports, and regulatory documentation to validate findings and provide historical context. Market analysis incorporates quantitative and qualitative assessment methodologies to identify trends, opportunities, and challenges affecting market development. Validation processes ensure data accuracy through cross-referencing multiple sources and expert consultation.

Analytical frameworks include competitive analysis, SWOT assessment, and trend identification to provide comprehensive market understanding. Forecasting models utilize historical data and current market indicators to project future market performance and growth trajectories. Quality assurance measures ensure research reliability through systematic verification and expert review processes. The methodology provides 95% confidence levels in key market projections and trend analysis.

Regional distribution across the UK white cement market reveals significant concentration in major urban centers and construction hubs. London and Southeast England dominate market consumption, accounting for approximately 40% of total demand due to high construction activity levels and premium project concentration. Market characteristics in this region include sophisticated architectural applications and high-value construction projects that justify premium material costs.

Northern England represents approximately 25% of market share with strong industrial and commercial construction activity driving demand. Regional preferences favor practical applications while maintaining quality standards for architectural projects. Scotland and Wales collectively account for 20% of consumption with growing emphasis on sustainable construction and heritage restoration projects requiring specialized materials.

Midlands region contributes 15% of market demand with balanced residential and commercial construction activity. Distribution networks serve regional markets through strategic depot locations and specialized transportation arrangements. Market development varies by region based on construction activity levels, economic conditions, and local building practices. Growth patterns reflect regional economic development and infrastructure investment priorities across different UK territories.

Competitive structure within the UK white cement market features established manufacturers competing alongside specialized suppliers and importers. Market leadership positions reflect manufacturing capability, distribution reach, and product quality consistency. The competitive environment fosters innovation and quality improvement across all market participants.

Competitive strategies emphasize product quality, technical support, and customer service differentiation. Market positioning varies from volume suppliers to specialized providers focusing on premium applications and technical expertise. Innovation focus drives product development and application technique advancement across the competitive landscape.

Market segmentation analysis reveals diverse application categories and end-user segments within the UK white cement market. Application-based segmentation provides insight into consumption patterns and growth opportunities across different use cases.

By Application:

By End-User Sector:

Geographic segmentation reflects regional consumption patterns and market characteristics across different UK territories. Product segmentation includes various white cement grades and specialized formulations for specific applications.

Architectural concrete applications represent the largest market category, driven by increasing emphasis on building aesthetics and design innovation. This segment experiences strong growth momentum with architects and designers increasingly specifying white cement for high-visibility projects. Performance requirements in this category emphasize both structural integrity and visual appeal, creating demand for premium products.

Decorative elements category shows robust expansion as construction projects incorporate more sophisticated design features. Market trends favor customized solutions and specialized formulations that enable unique architectural expressions. Technical expertise becomes crucial in this segment as application complexity increases with design sophistication.

Terrazzo and flooring applications benefit from renewed interest in durable, attractive flooring solutions for commercial and residential projects. Product innovation in this category focuses on enhanced durability and aesthetic properties. Precast products segment leverages manufacturing efficiency while maintaining quality standards for architectural components. Restoration applications require specialized expertise and products that match historical building requirements, creating niche market opportunities with premium pricing potential.

Manufacturers benefit from premium pricing opportunities and product differentiation advantages within the broader cement market. Production efficiency improvements and quality enhancement initiatives create competitive advantages and market share expansion opportunities. Technology investment in manufacturing processes yields long-term benefits through improved product consistency and reduced production costs.

Distributors gain from higher margin opportunities and specialized market positioning that differentiates their offerings from commodity cement products. Technical expertise development enables value-added services and stronger customer relationships. Market expansion opportunities exist through geographic coverage extension and application diversification.

Contractors and applicators benefit from access to premium materials that enable superior project outcomes and customer satisfaction. Skill development in white cement application techniques creates competitive advantages and premium service positioning. End-users receive superior aesthetic results and enhanced building performance through white cement utilization. Architects and designers gain access to materials that enable creative expression and distinctive project outcomes, supporting their professional reputation and client satisfaction objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend shaping the UK white cement market, with manufacturers developing eco-friendly production processes and products that support green building initiatives. Energy efficiency considerations drive demand for white cement’s reflective properties that contribute to building thermal performance. The trend toward sustainable construction shows approximately 22% annual growth in related applications.

Digital transformation influences market operations through advanced manufacturing controls, quality monitoring systems, and customer engagement platforms. Customization trends favor specialized formulations and application-specific products that meet unique project requirements. Architectural sophistication continues expanding with designers seeking materials that enable innovative building designs and distinctive aesthetic outcomes.

Supply chain optimization focuses on efficiency improvement and cost reduction while maintaining quality standards. Technical service expansion becomes increasingly important as customers seek comprehensive support for complex applications. Market consolidation trends may reshape competitive dynamics through strategic partnerships and acquisitions. Innovation acceleration drives continuous product development and application technique advancement across the market.

Recent developments within the UK white cement market reflect ongoing evolution and adaptation to changing market conditions. Manufacturing investments focus on capacity expansion and technology upgrades that enhance product quality and production efficiency. MarkWide Research analysis indicates significant investment in sustainable production technologies across major market participants.

Product innovations include development of enhanced formulations with improved performance characteristics and specialized applications. Partnership formations between manufacturers and construction companies create integrated supply chains and technical support systems. Distribution network expansion improves market coverage and customer accessibility across different UK regions.

Regulatory compliance initiatives address environmental standards and safety requirements affecting manufacturing and application processes. Market expansion activities include geographic coverage extension and new application development. Technology adoption encompasses digital systems for production control, quality assurance, and customer service enhancement. Sustainability programs focus on environmental impact reduction and resource efficiency improvement throughout the supply chain.

Strategic recommendations for UK white cement market participants emphasize diversification and value enhancement initiatives. Product development should focus on specialized formulations that address specific market needs and application requirements. Market expansion opportunities exist through geographic coverage extension and new application segment development.

Investment priorities should emphasize manufacturing efficiency improvement and quality enhancement technologies. Partnership development with architects, designers, and construction companies creates market access and technical collaboration opportunities. Sustainability initiatives align with market trends and regulatory requirements while supporting long-term competitiveness.

Customer service enhancement through technical support and application guidance creates competitive differentiation and customer loyalty. Supply chain optimization focuses on cost reduction and service improvement while maintaining quality standards. Innovation investment in product development and application techniques supports market leadership and growth objectives. Market intelligence systems enable responsive strategy development and competitive positioning optimization.

Future prospects for the UK white cement market remain positive with continued growth expected across multiple application segments. Market expansion will be driven by increasing architectural sophistication, sustainable construction trends, and infrastructure development initiatives. Growth projections indicate sustained expansion at approximately 4.8% annually over the next five years, supported by favorable market fundamentals.

Technology advancement will continue influencing market evolution through improved manufacturing processes and enhanced product capabilities. Sustainability focus will intensify as environmental considerations become increasingly important in construction material selection. Market maturation will create opportunities for specialization and premium positioning strategies.

Competitive dynamics will evolve through innovation, service enhancement, and strategic positioning initiatives. Application diversification will expand market opportunities beyond traditional uses into emerging construction technologies and design approaches. MWR projections suggest continued market strength with resilience to economic fluctuations due to premium positioning and specialized applications. Long-term outlook remains favorable with structural growth drivers supporting sustained market expansion and development opportunities.

The UK white cement market demonstrates robust fundamentals and positive growth trajectory supported by diverse application segments and evolving construction industry requirements. Market dynamics favor continued expansion through architectural innovation, sustainability trends, and premium construction material demand. Competitive positioning opportunities exist for participants who invest in quality enhancement, technical expertise, and customer service excellence.

Strategic success in this market requires focus on product differentiation, application expertise, and value-added services that justify premium positioning. Future growth will be driven by construction industry evolution, environmental consciousness, and architectural sophistication trends that favor high-quality building materials. The UK white cement market represents a specialized but vital segment within the broader construction materials industry, offering sustainable growth opportunities for committed market participants who understand and serve evolving customer needs effectively.

What is White Cement?

White Cement is a type of cement that is characterized by its white color, which is achieved through the use of raw materials with low iron content. It is commonly used in architectural applications, decorative concrete, and precast products due to its aesthetic appeal and ability to reflect light.

What are the key players in the UK White Cement Market?

Key players in the UK White Cement Market include companies such as LafargeHolcim, CEMEX, and Breedon Group, which are known for their production and supply of white cement for various construction applications, among others.

What are the growth factors driving the UK White Cement Market?

The growth of the UK White Cement Market is driven by increasing demand for aesthetically pleasing construction materials, the rise in infrastructure projects, and the growing popularity of sustainable building practices that utilize white cement for its reflective properties.

What challenges does the UK White Cement Market face?

The UK White Cement Market faces challenges such as the high production costs associated with white cement manufacturing and competition from alternative materials that may offer similar aesthetic benefits at lower prices.

What opportunities exist in the UK White Cement Market?

Opportunities in the UK White Cement Market include the expansion of green building initiatives, increased investment in infrastructure, and the potential for innovation in product formulations that enhance performance and sustainability.

What trends are shaping the UK White Cement Market?

Trends in the UK White Cement Market include a growing emphasis on eco-friendly construction practices, advancements in technology for improved cement production, and an increasing preference for decorative concrete solutions in residential and commercial projects.

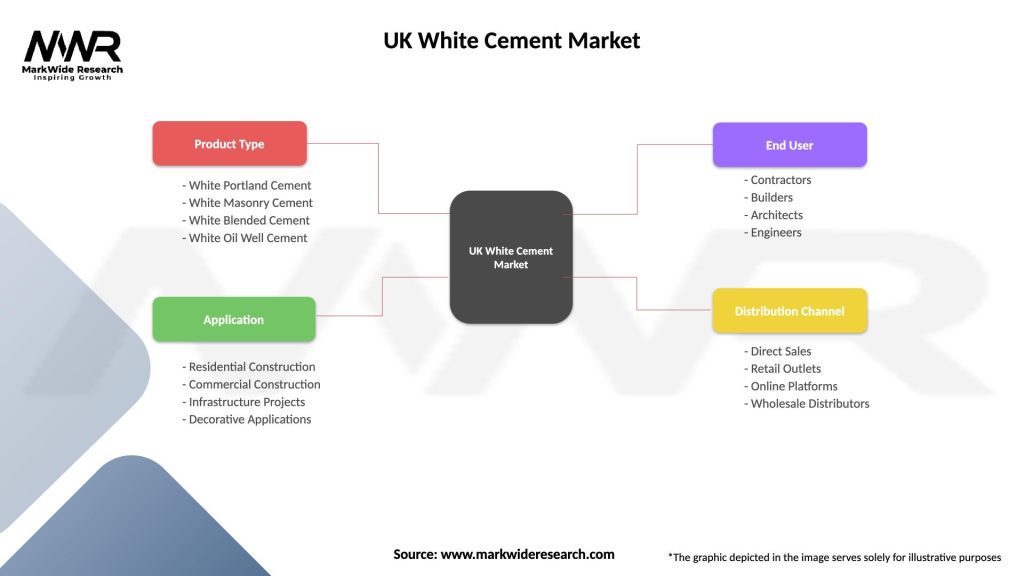

UK White Cement Market

| Segmentation Details | Description |

|---|---|

| Product Type | White Portland Cement, White Masonry Cement, White Blended Cement, White Oil Well Cement |

| Application | Residential Construction, Commercial Construction, Infrastructure Projects, Decorative Applications |

| End User | Contractors, Builders, Architects, Engineers |

| Distribution Channel | Direct Sales, Retail Outlets, Online Platforms, Wholesale Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK White Cement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at