444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK used car market represents one of Europe’s most dynamic and resilient automotive sectors, demonstrating remarkable adaptability in the face of economic uncertainties and evolving consumer preferences. Market dynamics indicate sustained growth driven by affordability concerns, supply chain disruptions affecting new vehicle availability, and changing mobility patterns following recent global events. The sector has experienced a 12.8% growth rate in transaction volumes over the past year, with digital transformation accelerating consumer adoption of online purchasing platforms.

Consumer behavior has fundamentally shifted toward value-conscious purchasing decisions, with buyers increasingly prioritizing reliability, fuel efficiency, and total cost of ownership over brand prestige. The market encompasses diverse segments ranging from budget-friendly vehicles under five years old to premium luxury models, each serving distinct demographic and economic segments. Digital penetration has reached 78% adoption rates among used car buyers, fundamentally transforming traditional dealership models and creating new opportunities for online-first retailers.

Regional variations across England, Scotland, Wales, and Northern Ireland reflect local economic conditions, population density, and transportation infrastructure development. Urban centers demonstrate higher turnover rates and premium vehicle preferences, while rural areas maintain strong demand for practical, fuel-efficient models suited to longer commuting distances.

The UK used car market refers to the comprehensive ecosystem encompassing the sale, purchase, financing, and trade of pre-owned vehicles across the United Kingdom, including both dealer and private transactions facilitated through traditional and digital channels.

Market participants include established dealership networks, independent traders, online platforms, auction houses, and private sellers, each contributing to a complex value chain that serves millions of consumers annually. The sector encompasses various vehicle categories including passenger cars, commercial vehicles, motorcycles, and specialty vehicles, with passenger cars representing the dominant segment.

Regulatory frameworks governing the market include consumer protection legislation, vehicle safety standards, emissions regulations, and financial services oversight, ensuring transaction transparency and buyer protection. The market operates within broader automotive industry trends including electrification, autonomous vehicle development, and sustainable mobility initiatives that influence long-term demand patterns and vehicle lifecycle management.

Market resilience has emerged as a defining characteristic of the UK used car sector, with robust demand fundamentals supporting sustained growth despite macroeconomic headwinds. Supply constraints in new vehicle production have created unprecedented opportunities for used car retailers, with inventory turnover rates reaching 45% faster cycles compared to pre-pandemic levels.

Digital transformation continues reshaping consumer engagement, with online research influencing 89% of purchase decisions even when final transactions occur through traditional channels. MarkWide Research analysis indicates that hybrid purchasing models combining digital discovery with physical inspection and delivery are becoming the preferred consumer journey.

Price dynamics reflect ongoing supply-demand imbalances, with certain vehicle segments experiencing sustained appreciation rather than traditional depreciation patterns. Electric and hybrid vehicles represent the fastest-growing segment within the used car market, driven by environmental consciousness and government incentives supporting clean transportation adoption.

Financing innovation has democratized access to quality used vehicles through flexible payment options, subscription models, and integrated insurance products. These developments have expanded the addressable market to include younger demographics and credit-constrained consumers previously excluded from traditional automotive financing.

Consumer preferences have evolved significantly, with practical considerations increasingly outweighing emotional factors in purchase decisions. The following insights represent critical market developments:

Economic accessibility remains the primary driver propelling UK used car market growth, as consumers seek transportation solutions that balance functionality with financial prudence. New vehicle affordability challenges have created sustained demand for quality pre-owned alternatives, particularly among first-time buyers and budget-conscious families.

Supply chain disruptions affecting new vehicle production have fundamentally altered market dynamics, extending delivery times and reducing new car availability. This situation has elevated used vehicles from secondary options to primary choices for consumers requiring immediate transportation solutions. Semiconductor shortages and manufacturing delays continue supporting used car demand across all segments.

Digital platform proliferation has democratized market access, enabling consumers to research, compare, and purchase vehicles with unprecedented convenience and transparency. Mobile-first experiences cater to changing consumer behaviors, while integrated services including financing, insurance, and delivery create comprehensive solutions that compete effectively with traditional dealership models.

Environmental consciousness drives increasing interest in fuel-efficient and low-emission vehicles within the used car segment. Government policies supporting clean air zones and emissions reduction targets influence consumer preferences toward newer, cleaner vehicles even within the pre-owned market.

Urbanization trends and changing work patterns have modified transportation needs, with many consumers preferring flexible ownership models over long-term commitments. This shift supports market growth through increased vehicle turnover and diverse ownership structures.

Economic uncertainty poses significant challenges to sustained market growth, with inflation pressures and interest rate fluctuations affecting consumer purchasing power and financing accessibility. Cost of living increases may force consumers to delay vehicle purchases or opt for lower-value alternatives, potentially constraining premium segment growth.

Regulatory complexity surrounding emissions standards, safety requirements, and consumer protection legislation creates compliance burdens for market participants, particularly smaller independent dealers. Brexit-related implications continue affecting vehicle importation, parts availability, and cross-border trade relationships that historically supported market liquidity.

Quality concerns and information asymmetries between buyers and sellers can undermine consumer confidence, particularly in private sale transactions. Vehicle history transparency remains challenging despite technological improvements in tracking and reporting systems.

Insurance costs and ongoing vehicle maintenance expenses represent significant ownership burdens that may discourage purchases, especially among younger demographics already facing financial constraints. Fuel price volatility adds uncertainty to total cost of ownership calculations, complicating consumer decision-making processes.

Competition from alternative mobility solutions including car sharing, ride-hailing services, and public transportation improvements may reduce overall vehicle ownership demand in urban areas, potentially limiting market expansion opportunities.

Electric vehicle adoption within the used car segment presents substantial growth opportunities as early EV adopters begin trading vehicles and battery technology improvements extend vehicle lifecycles. Government incentives supporting clean vehicle adoption create favorable conditions for used EV market development.

Subscription and flexible ownership models represent emerging opportunities to serve consumers preferring access over ownership. These models can expand market reach to demographics traditionally excluded from conventional financing while generating recurring revenue streams for service providers.

Data analytics and artificial intelligence applications offer opportunities to optimize pricing, inventory management, and customer matching processes. Predictive maintenance and vehicle condition assessment technologies can reduce information asymmetries and improve transaction confidence.

Cross-border trade expansion following regulatory stabilization could increase inventory diversity and competitive pricing through broader supplier networks. European integration opportunities may emerge as trade relationships evolve and stabilize.

Rural market penetration remains underdeveloped relative to urban centers, presenting opportunities for targeted service delivery models adapted to lower population density areas. Mobile service provision and hub-and-spoke distribution models could effectively serve these markets.

Commercial vehicle segments including vans, trucks, and specialty vehicles offer growth opportunities driven by e-commerce expansion and last-mile delivery demand increases.

Supply-demand imbalances continue characterizing market dynamics, with limited new vehicle availability supporting sustained demand for quality used alternatives. Inventory management has become increasingly sophisticated, with dealers utilizing data analytics to optimize stock levels and pricing strategies.

Price appreciation trends have replaced traditional depreciation patterns for many vehicle segments, creating new investment considerations for both consumers and dealers. Residual value stability has improved financing terms and reduced ownership risks, supporting market expansion.

Seasonal fluctuations reflect consumer behavior patterns, with spring and autumn representing peak activity periods driven by tax year considerations and weather-related purchasing preferences. Holiday periods demonstrate reduced activity but often feature promotional pricing strategies.

Regional variations in demand patterns reflect local economic conditions, with London and Southeast England maintaining premium pricing while Northern regions demonstrate stronger value-oriented purchasing behaviors. MWR data indicates these regional differences are becoming more pronounced as economic disparities widen.

Technology integration continues accelerating, with virtual reality showrooms, augmented reality vehicle inspection tools, and AI-powered recommendation engines becoming standard market features. These innovations improve customer experience while reducing operational costs for market participants.

Primary research methodologies employed comprehensive market participant interviews, consumer surveys, and dealer network assessments to capture current market conditions and emerging trends. Data collection encompassed quantitative transaction analysis and qualitative insight gathering from industry stakeholders across the value chain.

Secondary research incorporated government statistics, industry association reports, and regulatory filings to establish market baseline measurements and historical trend analysis. Cross-validation techniques ensured data accuracy and reliability across multiple source categories.

Market modeling utilized advanced statistical techniques to project future scenarios and identify key growth drivers and constraint factors. Scenario analysis considered various economic and regulatory conditions to provide robust market outlook assessments.

Geographic segmentation analysis examined regional variations in demand patterns, pricing dynamics, and competitive landscapes across England, Scotland, Wales, and Northern Ireland. Demographic analysis identified consumer behavior patterns across age groups, income levels, and lifestyle categories.

Technology impact assessment evaluated digital transformation effects on traditional market structures and emerging business model viability. Competitive intelligence gathered through systematic market participant analysis and strategic positioning evaluation.

England dominates market activity with 78% of total transactions, driven by population concentration and economic activity in major urban centers. London and Southeast England represent the most dynamic segments, characterized by premium vehicle preferences and rapid adoption of digital purchasing platforms.

Northern England demonstrates strong value-oriented purchasing behaviors with emphasis on reliability and fuel efficiency over luxury features. Manufacturing heritage in regions like Birmingham and Manchester supports robust commercial vehicle segments alongside passenger car demand.

Scotland accounts for approximately 8% of market share, with Edinburgh and Glasgow driving urban demand while rural areas maintain preference for practical, all-weather capable vehicles. Geographic challenges and lower population density create opportunities for innovative service delivery models.

Wales represents a distinct market segment with 5% market share, characterized by rural transportation needs and strong preference for reliable, fuel-efficient vehicles. Tourism industry influences seasonal demand patterns and creates opportunities for specialty vehicle segments.

Northern Ireland maintains unique market characteristics influenced by cross-border trade relationships and distinct regulatory considerations. Agricultural sector demands support commercial vehicle segments while urban centers demonstrate growing interest in environmental-friendly options.

Regional price variations reflect local economic conditions and competitive dynamics, with premium markets in Southeast England contrasting with value-focused segments in other regions.

Market structure encompasses diverse participant categories ranging from large dealership groups to independent traders and emerging digital platforms. Consolidation trends continue reshaping the competitive landscape as scale advantages become increasingly important.

Competitive differentiation increasingly centers on customer experience, digital capabilities, and integrated service offerings rather than traditional price-based competition. Technology investment has become essential for maintaining market position and attracting digitally-native consumers.

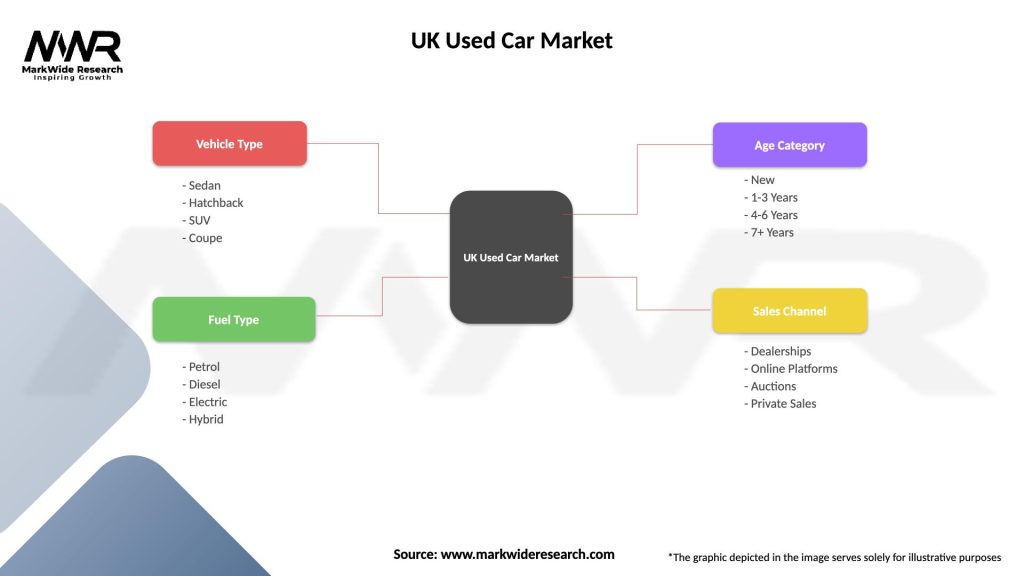

By Vehicle Age:

By Vehicle Type:

By Fuel Type:

Premium segment vehicles demonstrate exceptional resilience with sustained demand for German luxury brands including BMW, Mercedes-Benz, and Audi. These vehicles maintain strong residual values and appeal to aspirational buyers seeking prestige and advanced technology features.

Volume segment brands including Ford, Vauxhall, and Volkswagen serve the mainstream market with emphasis on reliability, parts availability, and service network accessibility. Fleet vehicle returns provide steady inventory supply for this segment.

Japanese manufacturers including Toyota, Honda, and Nissan maintain strong reputation for reliability and fuel efficiency, appealing particularly to value-conscious consumers prioritizing total cost of ownership over initial purchase price.

Electric vehicle category led by Tesla demonstrates unique market dynamics with strong residual values and growing mainstream acceptance. Traditional manufacturers entering the EV space create increasing choice and competitive pricing pressure.

Commercial vehicle segment serves diverse business needs from small van requirements to heavy goods transportation, with e-commerce growth driving sustained demand for delivery-capable vehicles.

Specialty categories including convertibles, performance vehicles, and luxury SUVs serve niche markets with distinct seasonal patterns and enthusiast-driven demand characteristics.

Dealers benefit from improved inventory turnover rates and enhanced profit margins compared to new vehicle sales. Digital integration reduces operational costs while expanding market reach beyond traditional geographic boundaries.

Consumers gain access to diverse vehicle options at various price points with improved transparency and purchasing convenience. Financing innovation democratizes access to quality transportation while flexible ownership models reduce long-term commitment concerns.

Financial institutions find attractive lending opportunities with secured asset backing and diverse risk profiles across market segments. Insurance providers benefit from expanded customer bases and opportunities for integrated product offerings.

Technology companies discover significant opportunities in areas including vehicle valuation, condition assessment, digital marketplace development, and customer relationship management solutions.

Government stakeholders achieve policy objectives including emissions reduction, economic stimulus, and consumer protection through effective market regulation and incentive programs.

Environmental benefits emerge through extended vehicle lifecycles, reduced manufacturing demand, and accelerated adoption of cleaner technologies within the existing vehicle fleet.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues accelerating with virtual showrooms, augmented reality vehicle inspection tools, and AI-powered recommendation engines becoming standard market features. Mobile-first experiences cater to changing consumer behaviors while integrated services create comprehensive solutions.

Sustainability focus drives increasing interest in electric and hybrid vehicles within the used car segment, supported by government incentives and expanding charging infrastructure. Circular economy principles promote vehicle lifecycle extension and responsible disposal practices.

Subscription and flexible ownership models gain traction among consumers preferring access over ownership, particularly in urban areas where traditional ownership models face parking and congestion challenges.

Data-driven decision making transforms pricing strategies, inventory management, and customer acquisition approaches. Predictive analytics improve demand forecasting and operational efficiency across market participants.

Omnichannel customer journeys blend digital research with physical inspection and delivery, creating seamless experiences that combine online convenience with traditional automotive retail elements.

Quality assurance improvements through standardized inspection processes, comprehensive warranties, and transparent vehicle history reporting build consumer confidence and reduce purchase risks.

Platform consolidation has accelerated with major digital marketplaces acquiring smaller competitors and traditional dealers investing heavily in online capabilities. MarkWide Research indicates this trend will continue as scale advantages become increasingly important.

Electric vehicle infrastructure expansion supports growing EV adoption within the used car market, with charging network development reducing range anxiety concerns among potential buyers.

Regulatory developments including updated consumer protection legislation and enhanced vehicle safety standards continue shaping market practices and participant obligations.

Technology partnerships between traditional dealers and fintech companies create innovative financing solutions and integrated service offerings that improve customer experience and operational efficiency.

International expansion efforts by major UK market participants seek growth opportunities in European and global markets, leveraging digital platform capabilities and operational expertise.

Sustainability initiatives including carbon-neutral delivery services and renewable energy adoption demonstrate industry commitment to environmental responsibility while appealing to conscious consumers.

Market participants should prioritize digital capability development to remain competitive in an increasingly online-driven marketplace. Investment in technology including customer relationship management systems, inventory management platforms, and data analytics capabilities will determine long-term success.

Customer experience optimization through seamless omnichannel journeys, transparent pricing, and comprehensive service offerings will differentiate successful participants from traditional competitors. Quality assurance and warranty programs build consumer confidence and support premium pricing strategies.

Geographic expansion opportunities exist in underserved rural markets through innovative service delivery models including mobile showrooms and hub-and-spoke distribution networks.

Partnership strategies with fintech companies, insurance providers, and technology firms can create integrated solutions that improve customer value propositions while generating additional revenue streams.

Sustainability positioning will become increasingly important as environmental consciousness grows among consumers and regulatory requirements evolve. Electric vehicle expertise development positions participants for future growth opportunities.

Data monetization opportunities through market insights, consumer behavior analysis, and predictive modeling can create additional value streams beyond traditional vehicle sales activities.

Market growth is projected to continue at a steady 8-12% annual rate over the next five years, driven by sustained demand fundamentals and ongoing new vehicle supply constraints. Digital penetration will likely reach 85% of transactions by 2028 as younger demographics become dominant market participants.

Electric vehicle adoption within the used car segment is expected to accelerate significantly, potentially reaching 25% of transactions by 2030 as early adopters begin trading vehicles and battery technology improvements extend vehicle lifecycles.

Consolidation trends will continue reshaping the competitive landscape, with scale advantages becoming increasingly important for operational efficiency and technology investment capabilities. Independent dealers may face pressure to join larger networks or develop specialized niche strategies.

Regulatory evolution will likely focus on environmental standards, consumer protection enhancement, and digital marketplace oversight. Brexit implications will stabilize as new trade relationships mature and regulatory frameworks adapt.

Technology integration will deepen with artificial intelligence, machine learning, and blockchain applications improving various market functions from pricing to vehicle history verification. Autonomous vehicle development may begin influencing long-term market dynamics toward the end of the forecast period.

The UK used car market demonstrates remarkable resilience and adaptability, positioning itself as a critical component of the broader automotive ecosystem. Digital transformation has fundamentally altered traditional market structures while creating new opportunities for innovation and customer service excellence.

Market fundamentals remain strong with sustained demand driven by economic accessibility, supply chain constraints affecting new vehicles, and evolving consumer preferences toward flexible ownership models. Regional diversity provides multiple growth opportunities while technological advancement continues improving operational efficiency and customer experience.

Future success will depend on participants’ ability to embrace digital transformation, develop comprehensive service offerings, and adapt to changing regulatory and environmental requirements. The market’s evolution toward sustainability and technology integration presents both challenges and opportunities for stakeholders across the value chain.

What is a used car?

A used car refers to any vehicle that has had one or more previous owners. In the context of the UK used car market, these vehicles are typically sold through dealerships or private sales and can vary widely in age, condition, and price.

What are the key players in the UK Used Car Market?

Key players in the UK used car market include major dealerships like Arnold Clark and Lookers, as well as online platforms such as AutoTrader and CarGurus. These companies play significant roles in facilitating the buying and selling of used vehicles, among others.

What are the main drivers of growth in the UK Used Car Market?

The growth of the UK used car market is driven by factors such as increasing consumer demand for affordable vehicles, the rising popularity of online car sales platforms, and the availability of a wide range of vehicle options. Additionally, economic conditions and changing consumer preferences also contribute to market dynamics.

What challenges does the UK Used Car Market face?

The UK used car market faces challenges such as fluctuating vehicle prices, the impact of economic uncertainty on consumer spending, and increasing competition from new car sales. Additionally, issues related to vehicle history transparency and consumer trust can also pose challenges.

What opportunities exist in the UK Used Car Market?

Opportunities in the UK used car market include the growth of electric and hybrid vehicle sales, the expansion of online sales channels, and the potential for enhanced customer service through technology. These trends can help attract a broader customer base and improve sales.

What trends are shaping the UK Used Car Market?

Trends shaping the UK used car market include the increasing adoption of digital platforms for buying and selling cars, a growing focus on sustainability with more consumers seeking eco-friendly vehicles, and the rise of subscription services as an alternative to traditional ownership. These trends are influencing consumer behavior and market strategies.

UK Used Car Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Sedan, Hatchback, SUV, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Age Category | New, 1-3 Years, 4-6 Years, 7+ Years |

| Sales Channel | Dealerships, Online Platforms, Auctions, Private Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Used Car Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at