444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK tofu market represents a dynamic and rapidly expanding segment within the broader plant-based protein industry, driven by increasing consumer awareness of health benefits, environmental sustainability, and ethical considerations surrounding traditional animal protein sources. Market dynamics indicate substantial growth momentum as British consumers increasingly embrace plant-based alternatives, with tofu emerging as a versatile and nutritious protein option that appeals to diverse demographic segments.

Consumer adoption patterns reveal significant shifts in dietary preferences, particularly among younger demographics who demonstrate growing interest in flexitarian and vegetarian lifestyles. The market encompasses various tofu types including silken, firm, extra-firm, and flavored varieties, catering to different culinary applications from traditional Asian cuisine to contemporary Western cooking methods. Distribution channels have expanded considerably, with tofu products now readily available in mainstream supermarkets, health food stores, and online platforms.

Growth trajectories suggest the market is experiencing robust expansion at approximately 8.5% CAGR, reflecting strong consumer demand and increased product innovation. Manufacturing capabilities within the UK have strengthened significantly, with both domestic producers and international brands establishing strong market presence to meet growing demand for high-quality soy-based protein alternatives.

The UK tofu market refers to the comprehensive ecosystem encompassing production, distribution, and consumption of tofu products within the United Kingdom, including traditional soybean-based protein alternatives and innovative plant-based formulations designed to meet diverse consumer preferences and nutritional requirements.

Market scope includes various tofu categories ranging from traditional Asian-style preparations to Western-adapted formulations, encompassing fresh refrigerated products, shelf-stable alternatives, and ready-to-eat convenience options. The market serves multiple consumer segments including health-conscious individuals, vegetarians, vegans, flexitarians, and consumers with specific dietary restrictions or preferences.

Industry participants include specialized tofu manufacturers, large-scale food processing companies, importers, distributors, retailers, and foodservice operators who collectively contribute to market development and consumer accessibility. The market also encompasses supporting industries such as soybean suppliers, packaging manufacturers, and logistics providers essential for effective product delivery.

Market performance demonstrates exceptional growth potential as the UK tofu market continues expanding rapidly, driven by fundamental shifts in consumer dietary preferences and increasing recognition of plant-based proteins as viable alternatives to traditional animal products. Key growth drivers include rising health consciousness, environmental awareness, and expanding product availability across diverse retail channels.

Consumer demographics reveal broad-based adoption spanning multiple age groups, with particularly strong growth among millennials and Generation Z consumers who prioritize sustainability and health considerations in their purchasing decisions. Product innovation has accelerated significantly, with manufacturers introducing enhanced flavors, improved textures, and convenient packaging formats to attract mainstream consumers.

Competitive landscape features established international brands alongside emerging domestic producers, creating dynamic market conditions that foster innovation and competitive pricing. Distribution expansion has been remarkable, with tofu products achieving approximately 75% availability across major UK supermarket chains, representing substantial growth from previous years.

Consumer behavior analysis reveals several critical insights driving market expansion and shaping future growth trajectories:

Health and wellness trends represent the primary catalyst driving UK tofu market expansion, as consumers increasingly prioritize nutritious, low-calorie protein sources that support healthy lifestyle choices. Nutritional awareness has grown substantially, with consumers recognizing tofu’s complete protein profile, essential minerals, and potential health benefits including cardiovascular support and weight management assistance.

Environmental sustainability concerns significantly influence consumer purchasing decisions, with tofu production requiring substantially less water, land, and energy compared to animal protein production. Climate change awareness motivates environmentally conscious consumers to reduce their carbon footprint through dietary choices, positioning tofu as an attractive sustainable protein alternative.

Demographic shifts contribute meaningfully to market growth, particularly among younger consumers who demonstrate greater willingness to experiment with plant-based foods and incorporate them into regular meal planning. Cultural diversity within the UK population has increased familiarity with Asian cuisine and traditional tofu preparations, expanding consumer acceptance and culinary applications.

Product innovation continues driving market expansion through improved textures, enhanced flavors, and convenient packaging formats that appeal to busy consumers seeking healthy, quick meal solutions. Manufacturing advancements have resulted in higher-quality products that better meet Western taste preferences while maintaining nutritional integrity.

Consumer perception challenges remain significant barriers to broader market adoption, as some consumers maintain negative preconceptions about tofu’s taste, texture, or culinary versatility. Cultural resistance persists among traditional consumers who view tofu as unfamiliar or unsuitable for conventional British cuisine, limiting market penetration in certain demographic segments.

Price sensitivity affects purchasing decisions, particularly when premium tofu products command higher prices than conventional protein sources, potentially deterring budget-conscious consumers from regular purchases. Economic pressures during challenging financial periods may cause consumers to prioritize familiar, lower-cost protein options over plant-based alternatives.

Supply chain complexities present ongoing challenges, including sourcing high-quality soybeans, maintaining cold chain integrity, and managing relatively short product shelf life compared to processed alternatives. Seasonal demand fluctuations can create inventory management difficulties for retailers and distributors.

Regulatory considerations surrounding labeling, health claims, and food safety standards require ongoing compliance investments that may impact smaller producers’ ability to compete effectively in the marketplace.

Product diversification presents substantial growth opportunities through development of innovative tofu varieties, including flavored options, convenient ready-to-eat formats, and products specifically designed for British taste preferences. Functional food development offers potential for creating fortified tofu products with added vitamins, minerals, or probiotics to enhance nutritional value.

Foodservice expansion represents significant untapped potential, as restaurants, cafes, and institutional catering operations increasingly seek plant-based protein options to meet growing consumer demand. Menu integration opportunities exist across diverse culinary segments, from casual dining to fine dining establishments.

Export opportunities may emerge as UK-based manufacturers develop expertise and scale, potentially serving European markets with similar demographic trends and consumer preferences. Private label development offers retailers opportunities to capture higher margins while providing consumers with competitively priced alternatives.

Technology integration through e-commerce platforms, subscription services, and direct-to-consumer sales channels could enhance market reach and customer engagement. Educational marketing initiatives focusing on cooking techniques, nutritional benefits, and recipe development could accelerate consumer adoption rates.

Supply and demand equilibrium continues evolving as production capacity expands to meet growing consumer interest, with manufacturers investing in enhanced production facilities and quality control systems. Market maturation processes indicate increasing sophistication in both product offerings and consumer expectations, driving continuous innovation and improvement.

Competitive intensity has increased substantially as established food companies recognize market potential and enter the segment through acquisitions, partnerships, or organic product development. Price competition remains balanced between maintaining product quality and achieving market accessibility, with premium products commanding higher margins while mainstream options focus on volume growth.

Distribution evolution reflects changing retail landscapes, with online sales channels gaining importance alongside traditional brick-and-mortar stores. Consumer education efforts by manufacturers and retailers contribute to market development by addressing knowledge gaps and demonstrating product versatility.

Regulatory environment continues supporting market growth through clear labeling requirements and food safety standards that build consumer confidence. Industry collaboration among producers, retailers, and advocacy organizations helps promote category growth and consumer awareness.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights, combining quantitative data collection with qualitative consumer behavior analysis. Primary research includes consumer surveys, focus groups, and industry expert interviews to gather firsthand insights about market trends, preferences, and growth drivers.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market context and validate primary findings. Data triangulation methods ensure research accuracy by comparing multiple information sources and identifying consistent trends and patterns.

Market segmentation analysis utilizes demographic, psychographic, and behavioral variables to identify distinct consumer groups and their specific preferences, purchasing patterns, and growth potential. Competitive intelligence gathering includes analysis of product offerings, pricing strategies, distribution channels, and marketing approaches employed by key market participants.

Trend analysis incorporates historical data review, current market assessment, and forward-looking projections to identify emerging opportunities and potential challenges. Statistical modeling techniques support growth projections and market forecasting based on identified drivers and restraints.

London and Southeast England demonstrate the highest market penetration rates, with approximately 35% market share, driven by diverse demographics, higher disposable incomes, and greater exposure to international cuisine. Urban centers throughout this region show particularly strong adoption rates among young professionals and health-conscious consumers.

Northern England represents emerging growth opportunities, with cities like Manchester, Leeds, and Liverpool showing increasing consumer interest and retail availability. Market development in these areas benefits from growing university populations and expanding Asian communities that drive cultural familiarity with tofu products.

Scotland and Wales exhibit moderate but growing market presence, with Edinburgh, Glasgow, and Cardiff leading regional adoption. Rural areas throughout the UK show lower penetration rates but represent significant growth potential as distribution networks expand and consumer awareness increases.

Regional preferences vary considerably, with urban areas favoring premium and organic varieties while suburban and rural consumers show greater price sensitivity. Distribution patterns reflect these regional differences, with specialty health food stores playing larger roles in areas with limited mainstream supermarket presence.

Market leadership features a diverse mix of international brands and domestic producers, creating dynamic competitive conditions that foster innovation and consumer choice:

Competitive strategies focus on product differentiation, brand building, and distribution expansion, with companies investing heavily in marketing campaigns that educate consumers about tofu benefits and culinary applications. Innovation cycles continue accelerating as companies develop new flavors, textures, and packaging formats to capture market share.

By Product Type: The market segments into distinct categories based on texture, preparation method, and intended culinary application, each serving specific consumer needs and preferences.

By Distribution Channel: Market access varies significantly across different retail and foodservice channels, each requiring tailored marketing and distribution strategies.

Organic tofu segment demonstrates exceptional growth momentum, with sales increasing at approximately 12% annually as consumers prioritize natural, chemical-free food options. Premium positioning allows organic producers to command higher margins while building brand loyalty among health-conscious consumers who value sustainable production methods.

Ready-to-eat varieties represent the fastest-growing category, appealing to busy consumers seeking convenient protein options that require minimal preparation time. Innovation focus in this segment includes pre-marinated products, seasoned varieties, and packaging formats that support on-the-go consumption.

Traditional plain tofu maintains steady market presence, particularly among experienced users who prefer versatility and value pricing. Bulk purchasing patterns in this category indicate regular consumption habits and established customer loyalty.

Specialty formulations including high-protein, low-sodium, and fortified varieties cater to specific dietary requirements and health goals. Market research by MarkWide Research indicates growing consumer interest in functional food attributes that provide additional health benefits beyond basic nutrition.

Manufacturers benefit from expanding market opportunities, increasing consumer acceptance, and growing distribution networks that support business growth and profitability. Production scaling advantages emerge as demand increases, allowing for improved operational efficiency and cost management.

Retailers gain from category growth that drives foot traffic, increases basket size, and attracts health-conscious consumers who typically demonstrate higher lifetime value. Margin opportunities exist through private label development and premium product positioning.

Consumers receive substantial benefits including improved nutrition, environmental sustainability, and culinary variety that enhances meal planning and dietary satisfaction. Health advantages encompass complete protein intake, reduced saturated fat consumption, and potential cardiovascular benefits.

Foodservice operators can differentiate their offerings, attract diverse customer segments, and respond to growing demand for plant-based menu options. Cost benefits may emerge as tofu prices become increasingly competitive with traditional protein sources.

Supply chain participants including distributors, logistics providers, and packaging companies benefit from category growth and increasing transaction volumes. Innovation opportunities exist throughout the value chain to improve efficiency and product quality.

Strengths:

Weaknesses:

Opportunities:

Threats:

Flavor innovation represents a dominant trend as manufacturers develop products that appeal to British taste preferences, including varieties infused with traditional herbs, spices, and seasonings familiar to local consumers. Texture improvements focus on creating products that more closely resemble conventional protein sources in mouthfeel and cooking behavior.

Convenience packaging trends emphasize portion control, extended shelf life, and easy preparation methods that support busy lifestyles. Sustainable packaging initiatives align with environmental consciousness, featuring recyclable materials and reduced plastic usage.

Premium positioning continues gaining traction as consumers demonstrate willingness to pay higher prices for organic, non-GMO, and artisanal products that meet quality expectations. Health positioning emphasizes functional benefits including protein content, mineral density, and potential wellness advantages.

Digital marketing strategies increasingly focus on social media engagement, influencer partnerships, and content marketing that educates consumers about preparation methods and nutritional benefits. Recipe development and cooking demonstrations help overcome preparation barriers and expand culinary applications.

Manufacturing investments have increased substantially as companies expand production capacity to meet growing demand, with several major facilities announced or completed within the past year. Technology upgrades focus on improving product consistency, extending shelf life, and enhancing nutritional profiles.

Retail partnerships continue expanding as major supermarket chains increase tofu product ranges and improve shelf placement to enhance visibility and accessibility. Private label development initiatives by leading retailers create additional market opportunities and competitive dynamics.

Acquisition activity reflects growing corporate interest in plant-based protein markets, with established food companies acquiring specialized tofu producers to enter the category. Investment funding for innovative startups supports product development and market expansion initiatives.

Regulatory developments include updated labeling guidelines and food safety standards that support market growth while ensuring consumer protection. Industry associations have formed to promote category development and address common challenges facing market participants.

Market entry strategies should prioritize consumer education and product sampling to overcome taste and preparation barriers that limit broader adoption. Distribution focus on mainstream retail channels remains critical for achieving scale and market penetration among target demographics.

Product development recommendations emphasize flavor innovation and texture improvements that appeal to British consumers while maintaining nutritional integrity. Pricing strategies should balance accessibility with quality positioning to capture diverse market segments effectively.

Marketing investments in digital channels and influencer partnerships can effectively reach younger demographics who drive category growth. Partnership opportunities with foodservice operators and meal kit companies could accelerate market expansion and consumer trial.

Supply chain optimization should focus on cold chain management, inventory turnover, and sustainable sourcing practices that support long-term growth. Quality consistency remains paramount for building consumer trust and repeat purchase behavior.

Growth projections indicate continued market expansion at approximately 9.2% CAGR over the next five years, driven by increasing consumer acceptance, product innovation, and expanding distribution networks. Market maturation processes suggest evolving consumer sophistication and higher quality expectations that will drive continuous improvement.

Innovation trends point toward enhanced functionality, improved taste profiles, and convenient packaging formats that support mainstream adoption. Technology integration may include smart packaging, extended shelf life solutions, and personalized nutrition applications that enhance consumer experience.

Demographic shifts suggest continued growth among younger consumers while gradual adoption among older demographics expands total market potential. Cultural integration of tofu into traditional British cuisine represents significant long-term opportunity for market expansion.

Competitive evolution will likely feature increased consolidation, enhanced product differentiation, and strategic partnerships that strengthen market positions. MarkWide Research analysis indicates potential for significant market development as consumer awareness and acceptance continue growing across diverse demographic segments.

Market assessment reveals the UK tofu market represents a compelling growth opportunity driven by fundamental shifts in consumer preferences toward plant-based proteins, health consciousness, and environmental sustainability. Strong fundamentals including increasing consumer acceptance, expanding distribution, and continuous product innovation support optimistic long-term growth projections.

Success factors for market participants include consumer education, product quality consistency, competitive pricing, and effective distribution strategies that maximize market reach. Innovation focus on taste, texture, and convenience will remain critical for attracting mainstream consumers and driving category expansion.

Future potential appears substantial as demographic trends, health awareness, and environmental concerns continue supporting plant-based protein adoption. Market development opportunities exist across product categories, distribution channels, and consumer segments, creating multiple pathways for growth and profitability in this dynamic and evolving marketplace.

What is Tofu?

Tofu is a food product made from soybeans, known for its high protein content and versatility in various dishes. It is commonly used in vegetarian and vegan diets as a meat substitute and can be found in various forms such as silken, firm, and extra-firm.

What are the key players in the UK Tofu Market?

Key players in the UK Tofu Market include companies like Cauldron Foods, Tofoo, and Alpro, which offer a range of tofu products catering to different consumer preferences. These companies focus on innovation and quality to meet the growing demand for plant-based protein options among consumers.

What are the growth factors driving the UK Tofu Market?

The UK Tofu Market is driven by increasing consumer awareness of health benefits associated with plant-based diets, rising vegetarian and vegan populations, and a growing demand for sustainable food sources. Additionally, the versatility of tofu in various cuisines contributes to its popularity.

What challenges does the UK Tofu Market face?

The UK Tofu Market faces challenges such as competition from other plant-based protein sources, fluctuating soybean prices, and consumer perceptions regarding the taste and texture of tofu. These factors can impact market growth and product acceptance.

What opportunities exist in the UK Tofu Market?

Opportunities in the UK Tofu Market include the potential for product innovation, such as flavored or ready-to-eat tofu options, and expanding distribution channels in supermarkets and online platforms. Additionally, increasing interest in health and wellness can drive further growth.

What trends are shaping the UK Tofu Market?

Trends in the UK Tofu Market include a rise in demand for organic and non-GMO tofu products, as well as the incorporation of tofu into convenience foods and meal kits. There is also a growing interest in ethnic cuisines that utilize tofu, enhancing its appeal to a broader audience.

UK Tofu Market

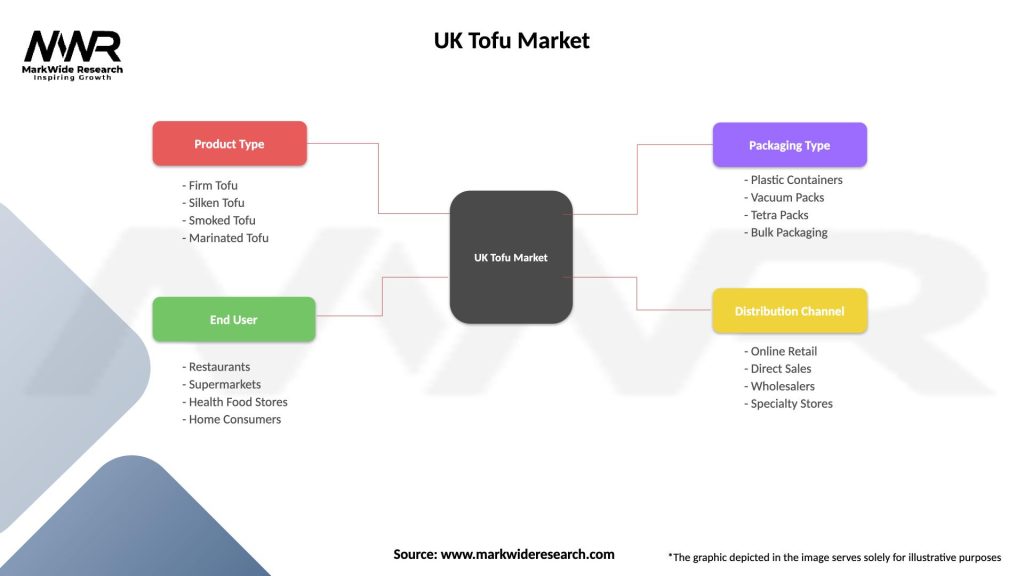

| Segmentation Details | Description |

|---|---|

| Product Type | Firm Tofu, Silken Tofu, Smoked Tofu, Marinated Tofu |

| End User | Restaurants, Supermarkets, Health Food Stores, Home Consumers |

| Packaging Type | Plastic Containers, Vacuum Packs, Tetra Packs, Bulk Packaging |

| Distribution Channel | Online Retail, Direct Sales, Wholesalers, Specialty Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Tofu Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at