444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK sports promoters market represents a dynamic and rapidly evolving sector within the broader entertainment and sports industry landscape. Sports promotion encompasses the comprehensive management, marketing, and organization of sporting events, ranging from grassroots competitions to elite professional tournaments. The market has experienced remarkable transformation in recent years, driven by technological advancements, changing consumer preferences, and the increasing commercialization of sports entertainment.

Digital transformation has fundamentally reshaped how sports promoters engage with audiences, with online streaming platforms and social media marketing becoming integral components of promotional strategies. The sector demonstrates robust growth potential, with industry analysts projecting a compound annual growth rate of 8.2% over the next five years. This expansion reflects the growing appetite for diverse sporting content and the increasing sophistication of promotional techniques.

Market participants range from established multinational promotion companies to specialized regional operators focusing on niche sports segments. The competitive landscape encompasses traditional boxing and mixed martial arts promoters, football event organizers, motorsport specialists, and emerging esports promotion entities. Revenue diversification has become a critical success factor, with promoters increasingly leveraging multiple income streams including ticket sales, broadcasting rights, sponsorship deals, and merchandise sales.

The UK sports promoters market refers to the comprehensive ecosystem of companies and organizations responsible for conceptualizing, organizing, marketing, and executing sporting events across the United Kingdom. Sports promotion involves the strategic coordination of various elements including venue selection, athlete recruitment, marketing campaigns, media relations, and commercial partnerships to create compelling sporting spectacles that attract audiences and generate revenue.

Professional sports promotion extends beyond simple event organization to encompass sophisticated business operations involving risk management, regulatory compliance, talent acquisition, and brand development. Modern sports promoters function as entertainment companies, creating narrative-driven experiences that resonate with diverse audience segments while maximizing commercial opportunities through strategic partnerships and innovative marketing approaches.

Market scope includes traditional sports such as boxing, football, rugby, cricket, and tennis, alongside emerging disciplines including esports, mixed martial arts, and extreme sports. The promotional landscape encompasses everything from local amateur competitions to internationally televised championship events, reflecting the diverse nature of sporting entertainment in the contemporary UK market.

Market dynamics within the UK sports promoters sector reveal a landscape characterized by increasing consolidation, technological innovation, and evolving consumer engagement patterns. The industry has demonstrated remarkable resilience, adapting to challenging market conditions while capitalizing on emerging opportunities in digital content distribution and interactive fan experiences.

Key performance indicators suggest that approximately 73% of sports promotion revenue now derives from diversified income streams beyond traditional ticket sales, highlighting the sector’s successful transition toward comprehensive entertainment business models. Digital engagement metrics show substantial growth, with online viewership increasing by 156% over the past three years, demonstrating the effectiveness of modern promotional strategies.

Strategic positioning within the market increasingly depends on technological capabilities, with successful promoters investing heavily in data analytics, customer relationship management systems, and digital marketing platforms. The sector’s evolution reflects broader trends in entertainment consumption, with audiences demanding more personalized, accessible, and interactive sporting experiences.

Future trajectory appears highly promising, with industry experts anticipating continued expansion driven by international market penetration, innovative content formats, and the growing mainstream acceptance of previously niche sporting disciplines. MarkWide Research analysis indicates that the sector’s adaptability and innovation capacity position it favorably for sustained long-term growth.

Market intelligence reveals several critical insights that define the current state and future direction of the UK sports promoters market:

Primary growth catalysts propelling the UK sports promoters market forward encompass a diverse range of technological, social, and economic factors that create favorable conditions for industry expansion.

Digital transformation stands as the most significant driver, enabling promoters to reach global audiences through streaming platforms, social media channels, and interactive applications. This technological revolution has democratized access to sporting content while creating new monetization opportunities through subscription models, pay-per-view events, and targeted advertising.

Consumer behavior evolution reflects changing entertainment preferences, with audiences seeking more personalized, accessible, and engaging sporting experiences. The rise of on-demand content consumption has created opportunities for promoters to develop flexible viewing options that cater to diverse lifestyle patterns and preferences.

Regulatory modernization has streamlined operational processes while maintaining appropriate oversight, creating a more conducive environment for business development and innovation. Updated licensing frameworks and digital broadcasting regulations have facilitated market entry for new participants while supporting established operators’ expansion efforts.

Investment capital availability from both traditional and alternative sources has enabled promoters to pursue ambitious growth strategies, invest in advanced technologies, and secure high-profile talent. Private equity involvement and venture capital funding have particularly benefited emerging promoters focusing on innovative content formats and digital-native approaches.

Operational challenges within the UK sports promoters market present significant obstacles that require strategic navigation and innovative solutions to maintain growth momentum.

Regulatory complexity remains a persistent challenge, with promoters required to navigate multiple licensing requirements, safety regulations, and broadcasting compliance standards. The evolving regulatory landscape demands continuous adaptation and substantial compliance investments that can strain operational resources, particularly for smaller promotional companies.

Economic uncertainty creates volatility in consumer spending patterns and corporate sponsorship budgets, directly impacting revenue predictability. Market fluctuations affect ticket sales, advertising investments, and partnership commitments, requiring promoters to develop flexible business models capable of weathering economic downturns.

Talent acquisition costs have escalated significantly as competition for high-profile athletes and entertainers intensifies. The increasing commercialization of sports has driven up appearance fees, performance bonuses, and exclusivity agreements, creating substantial financial pressures for promotional companies.

Infrastructure limitations in certain regions constrain event capacity and limit promotional opportunities. Venue availability, transportation accessibility, and technical capabilities can restrict the scale and frequency of promotional activities, particularly in emerging market segments.

Technology investment requirements demand substantial capital commitments for digital platforms, analytics systems, and production capabilities. Smaller promoters may struggle to compete with technologically advanced competitors, creating barriers to market entry and growth.

Emerging opportunities within the UK sports promoters market present compelling prospects for growth, innovation, and market expansion across multiple dimensions.

Esports integration represents a transformative opportunity, with traditional sports promoters increasingly incorporating competitive gaming elements into their portfolios. The convergence of physical and digital sports entertainment creates new audience segments and revenue streams, particularly among younger demographics who demonstrate high engagement with interactive content formats.

International expansion offers substantial growth potential, with UK promoters leveraging domestic expertise to capture opportunities in emerging markets. Strategic partnerships with international venues, broadcasters, and talent agencies can facilitate market entry while minimizing operational risks and capital requirements.

Technology monetization through virtual reality experiences, augmented reality applications, and interactive streaming platforms creates new revenue opportunities while enhancing audience engagement. Innovation in content delivery can differentiate promotional offerings and justify premium pricing strategies.

Corporate partnership development with non-traditional sponsors from technology, healthcare, and sustainability sectors can diversify revenue sources while accessing new customer bases. Cross-industry collaborations create mutually beneficial relationships that extend beyond traditional sponsorship models.

Niche market development in specialized sports segments offers opportunities for focused promotional strategies that can achieve market leadership positions with relatively modest investment requirements. Specialized expertise in emerging sports can create competitive advantages and establish market-leading positions.

Competitive forces shaping the UK sports promoters market create a complex ecosystem where traditional business models intersect with innovative approaches to audience engagement and revenue generation.

Market consolidation trends reflect the increasing importance of scale economies and resource optimization. Larger promotional companies are acquiring specialized operators to expand their capabilities and market reach, while smaller companies are forming strategic alliances to compete effectively against established players.

Consumer preference evolution drives continuous adaptation in promotional strategies, with audiences demanding more personalized, accessible, and interactive sporting experiences. The shift toward digital consumption has fundamentally altered how promoters approach content creation, distribution, and monetization.

Technology disruption continues to reshape operational processes and competitive dynamics. Artificial intelligence applications in audience analytics, virtual reality integration in event experiences, and blockchain technology in ticketing systems are creating new competitive differentiators while requiring substantial investment commitments.

Regulatory evolution influences market structure and operational requirements, with updated broadcasting regulations, safety standards, and licensing frameworks creating both opportunities and challenges for market participants. Compliance capabilities increasingly serve as competitive advantages in securing major promotional contracts.

Economic sensitivity affects consumer spending patterns and corporate partnership budgets, requiring promoters to develop resilient business models capable of maintaining profitability across various economic conditions. Revenue diversification strategies have become essential for sustainable growth.

Comprehensive analysis of the UK sports promoters market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights across all market segments and operational dimensions.

Primary research activities include extensive interviews with industry executives, promotional company leaders, venue operators, and regulatory officials to gather firsthand insights into market trends, challenges, and opportunities. Stakeholder engagement encompasses both established market leaders and emerging companies to capture diverse perspectives on industry evolution.

Secondary research components involve analysis of financial reports, industry publications, regulatory filings, and market intelligence databases to establish quantitative baselines and identify trend patterns. Data triangulation ensures consistency and accuracy across multiple information sources.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop robust projections and identify potential market developments. Quantitative analysis focuses on growth rates, market share distributions, and performance metrics rather than absolute market valuations.

Industry validation processes include expert review panels, peer verification, and cross-reference checking to ensure research findings accurately reflect market realities and provide actionable insights for stakeholders. Quality assurance protocols maintain research integrity throughout the analytical process.

Geographic distribution of sports promotion activities across the UK reveals distinct regional characteristics, market concentrations, and growth opportunities that influence strategic planning and resource allocation decisions.

London and Southeast England dominate the market landscape, accounting for approximately 42% of total promotional activity due to venue concentration, media infrastructure, and international accessibility. The region’s established entertainment ecosystem provides comprehensive support services while offering access to diverse audience segments and corporate partnership opportunities.

Northern England represents a significant growth market, with cities like Manchester, Liverpool, and Leeds demonstrating strong audience engagement and venue development initiatives. Regional sports heritage creates authentic promotional opportunities while lower operational costs enable competitive pricing strategies.

Scotland’s market shows particular strength in traditional sports promotion, with Edinburgh and Glasgow serving as primary hubs for major events. Cultural identity influences promotional approaches, with successful campaigns incorporating local traditions and community engagement elements.

Wales and Northern Ireland present emerging opportunities for specialized promotional activities, particularly in rugby, football, and emerging sports segments. Government support initiatives for sports development create favorable conditions for promotional expansion.

Regional infrastructure development continues to influence market dynamics, with venue improvements, transportation enhancements, and technology upgrades creating new promotional opportunities across previously underserved areas. Decentralization trends suggest growing opportunities outside traditional metropolitan centers.

Market leadership within the UK sports promoters sector encompasses a diverse range of companies operating across different sports segments, scale levels, and business models.

Competitive differentiation increasingly depends on technological capabilities, content innovation, and audience engagement strategies rather than traditional promotional approaches. Market positioning reflects specialization in specific sports segments while maintaining operational flexibility to capitalize on emerging opportunities.

Strategic partnerships between promotional companies, broadcasters, venues, and technology providers create comprehensive value propositions that enhance competitive positioning while sharing operational risks and investment requirements.

Market segmentation within the UK sports promoters sector reflects diverse operational approaches, target audiences, and revenue models that characterize this multifaceted industry.

By Sport Type:

By Event Scale:

By Revenue Model:

Combat sports promotion demonstrates exceptional growth potential, with boxing and mixed martial arts events generating substantial pay-per-view revenue and international broadcasting interest. Personality-driven marketing creates compelling narratives that transcend traditional sports audiences while generating significant social media engagement.

Team sports promotion benefits from established fan bases and seasonal programming structures that enable predictable revenue planning and long-term partnership development. Community engagement initiatives strengthen local market positions while creating authentic promotional opportunities.

Esports promotion represents the fastest-growing segment, with digital-native audiences demonstrating high engagement levels and substantial commercial value. Technology integration enables innovative content formats and interactive experiences that differentiate esports from traditional sporting entertainment.

Niche sports promotion offers opportunities for specialized operators to achieve market leadership positions with focused strategies and dedicated audience development. Authenticity and expertise serve as key competitive advantages in specialized market segments.

International event promotion leverages UK market expertise to capture global opportunities while bringing international content to domestic audiences. Cross-cultural marketing capabilities enable successful promotion of diverse sporting content across different demographic segments.

Sports promoters benefit from expanding market opportunities, technological advancement, and diversified revenue streams that enhance business sustainability and growth potential.

Revenue diversification opportunities enable promoters to reduce dependence on single income sources while capitalizing on multiple monetization channels including broadcasting rights, sponsorship agreements, merchandise sales, and digital content subscriptions. Risk mitigation through portfolio diversification improves financial stability and operational resilience.

Technology integration benefits include enhanced audience analytics, improved operational efficiency, and innovative content delivery capabilities that create competitive advantages while reducing operational costs. Data-driven decision making enables more effective marketing strategies and resource allocation.

Athletes and talent gain access to professional promotional platforms that enhance career development opportunities, increase earning potential, and provide comprehensive support services for performance optimization and brand development.

Venues and facilities benefit from increased utilization rates, enhanced revenue opportunities, and infrastructure development investments that improve long-term asset value and operational capabilities.

Broadcasters and media companies access high-quality content programming that attracts diverse audiences while generating advertising revenue and subscription income through compelling sporting entertainment.

Sponsors and corporate partners leverage sports promotion platforms to reach target audiences through authentic engagement opportunities that create brand awareness, customer loyalty, and measurable marketing returns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues reshaping promotional strategies, with virtual and augmented reality technologies creating immersive fan experiences that extend beyond traditional event attendance. Interactive content formats enable personalized engagement while generating new revenue opportunities through premium digital experiences.

Sustainability integration has become a critical consideration, with promoters implementing eco-friendly event management practices, carbon-neutral transportation options, and sustainable venue operations. Environmental consciousness influences consumer preferences and corporate partnership decisions, creating competitive advantages for environmentally responsible promoters.

Data analytics sophistication enables precise audience targeting, personalized marketing campaigns, and optimized operational efficiency. Predictive analytics applications improve event planning, pricing strategies, and resource allocation while enhancing customer satisfaction through tailored experiences.

Cross-platform content distribution maximizes audience reach through simultaneous broadcasting across traditional television, streaming services, social media platforms, and mobile applications. Multi-channel strategies capture diverse audience segments while optimizing advertising revenue and subscription income.

Community engagement emphasis strengthens local market connections through grassroots initiatives, youth development programs, and charitable partnerships. Social responsibility programs enhance brand reputation while creating authentic promotional opportunities that resonate with socially conscious consumers.

Strategic acquisitions have reshaped the competitive landscape, with major promotional companies expanding their capabilities through targeted acquisitions of specialized operators, technology providers, and content creators. Vertical integration strategies enable comprehensive control over promotional value chains while reducing operational dependencies.

Broadcasting partnership evolution reflects changing media consumption patterns, with promoters developing direct-to-consumer streaming platforms while maintaining traditional television relationships. Hybrid distribution models maximize audience reach while optimizing revenue generation across multiple channels.

Technology investment acceleration has seen promoters implementing advanced analytics platforms, virtual reality production capabilities, and artificial intelligence applications for audience engagement and operational optimization. Innovation partnerships with technology companies enable access to cutting-edge capabilities without substantial capital investments.

International expansion initiatives demonstrate UK promoters’ growing global ambitions, with strategic partnerships, joint ventures, and direct market entry strategies targeting high-growth international markets. Export success validates UK promotional expertise while creating new revenue opportunities.

Regulatory modernization has streamlined operational processes while maintaining appropriate oversight, creating more favorable conditions for business development and innovation. Digital broadcasting regulations have particularly benefited online content distribution strategies.

Strategic recommendations for UK sports promoters emphasize the importance of technological innovation, audience diversification, and operational excellence in maintaining competitive advantages within an increasingly dynamic market environment.

Digital capability development should prioritize comprehensive analytics platforms, interactive content creation tools, and multi-channel distribution systems that enable personalized audience engagement while optimizing operational efficiency. Technology partnerships can provide access to advanced capabilities without requiring substantial internal development investments.

Revenue diversification strategies must extend beyond traditional income sources to include digital subscriptions, virtual experiences, merchandise sales, and educational content offerings. Portfolio expansion reduces market risk while capitalizing on emerging opportunities in adjacent market segments.

International market development offers substantial growth potential, with MWR analysis suggesting that UK promotional expertise translates effectively to global markets through strategic partnerships and localized content adaptation. Export strategies should emphasize competitive advantages in content quality, operational excellence, and regulatory compliance.

Sustainability integration should become a core operational principle rather than a peripheral consideration, with environmental responsibility influencing venue selection, transportation planning, and partnership development. Green promotional practices create competitive differentiation while addressing growing consumer environmental consciousness.

Talent development investment in both athletic and operational personnel ensures long-term competitive sustainability while creating authentic promotional narratives that resonate with audiences. Human capital optimization remains fundamental to promotional success across all market segments.

Market trajectory for the UK sports promoters sector appears highly favorable, with multiple growth drivers converging to create substantial expansion opportunities over the next decade. Industry evolution will likely accelerate as technological capabilities mature and consumer preferences continue shifting toward digital-first entertainment experiences.

Growth projections indicate sustained expansion at approximately 8.2% compound annual growth rate, driven by digital platform adoption, international market penetration, and emerging sports segment development. Market maturation will likely favor operators with comprehensive technological capabilities and diversified revenue models.

Technology integration will become increasingly sophisticated, with artificial intelligence, virtual reality, and blockchain applications creating new promotional possibilities while enhancing operational efficiency. Innovation adoption will serve as a primary competitive differentiator, requiring continuous investment and adaptation.

International expansion opportunities will multiply as UK promotional expertise gains global recognition and digital distribution eliminates traditional geographic barriers. Export potential suggests that domestic market leadership can translate into significant international revenue opportunities.

Regulatory evolution will likely support continued market development while maintaining appropriate consumer protection and competitive fairness standards. Policy modernization should create more favorable conditions for innovation and business development across all market segments.

Consumer engagement patterns will continue evolving toward more personalized, interactive, and accessible sporting experiences that blur traditional boundaries between live events and digital entertainment. Audience expectations will drive continuous innovation in content creation and delivery methods.

The UK sports promoters market stands at a pivotal juncture, with technological advancement, changing consumer preferences, and global expansion opportunities creating unprecedented potential for growth and innovation. Market dynamics favor operators who successfully integrate digital capabilities with traditional promotional expertise while maintaining operational excellence and regulatory compliance.

Strategic success in this evolving landscape requires comprehensive understanding of audience preferences, technological capabilities, and international market opportunities. Revenue diversification and sustainability integration have emerged as fundamental requirements for long-term competitive advantage, while innovation adoption serves as the primary differentiator between market leaders and followers.

Future prospects remain exceptionally promising, with industry fundamentals supporting sustained growth across multiple market segments and geographic regions. MarkWide Research analysis suggests that UK sports promoters are well-positioned to capitalize on emerging opportunities while navigating potential challenges through strategic planning and operational excellence. The sector’s continued evolution will likely accelerate as digital transformation matures and global market integration deepens, creating substantial value for stakeholders across the entire promotional ecosystem.

What is UK Sports Promoters?

UK Sports Promoters are entities or individuals that organize, manage, and promote sports events, athletes, and teams within the UK. They play a crucial role in the sports ecosystem by facilitating sponsorships, marketing, and event management.

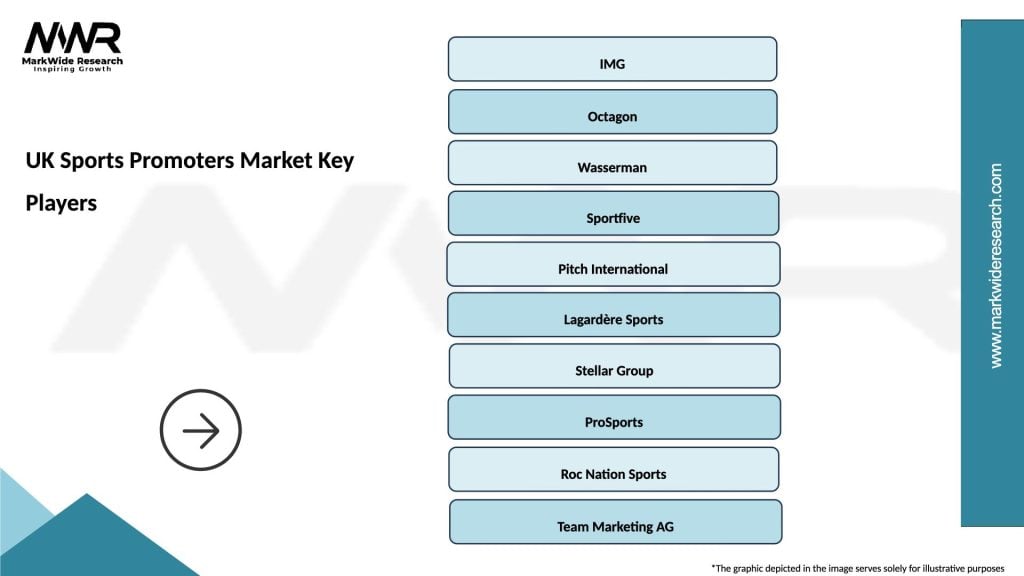

What are the key players in the UK Sports Promoters Market?

Key players in the UK Sports Promoters Market include companies like Octagon, Wasserman, and CAA Sports, which specialize in athlete representation and event promotion. These firms are known for their extensive networks and expertise in managing sports marketing campaigns, among others.

What are the growth factors driving the UK Sports Promoters Market?

The UK Sports Promoters Market is driven by increasing sports viewership, rising sponsorship deals, and the growing popularity of e-sports. Additionally, advancements in digital marketing and social media engagement are enhancing promotional strategies.

What challenges does the UK Sports Promoters Market face?

Challenges in the UK Sports Promoters Market include intense competition among promoters, fluctuating economic conditions affecting sponsorship budgets, and the need to adapt to changing consumer preferences in sports entertainment.

What opportunities exist in the UK Sports Promoters Market?

Opportunities in the UK Sports Promoters Market include the expansion of virtual and hybrid events, increased investment in women’s sports, and the potential for innovative partnerships with technology companies to enhance fan engagement.

What trends are shaping the UK Sports Promoters Market?

Trends in the UK Sports Promoters Market include the rise of influencer marketing, the integration of data analytics for targeted promotions, and a focus on sustainability in event management. These trends are reshaping how sports events are marketed and experienced.

UK Sports Promoters Market

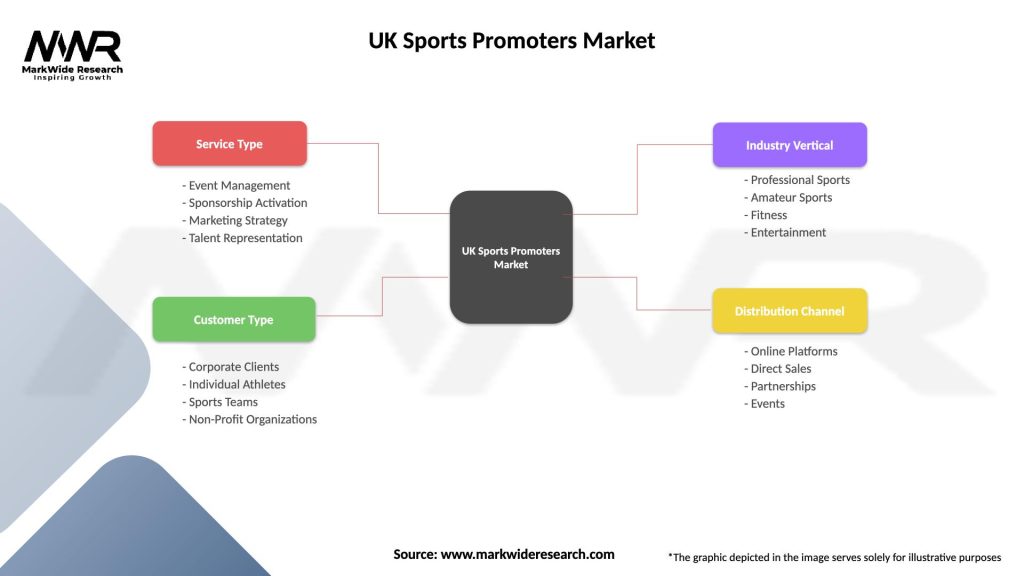

| Segmentation Details | Description |

|---|---|

| Service Type | Event Management, Sponsorship Activation, Marketing Strategy, Talent Representation |

| Customer Type | Corporate Clients, Individual Athletes, Sports Teams, Non-Profit Organizations |

| Industry Vertical | Professional Sports, Amateur Sports, Fitness, Entertainment |

| Distribution Channel | Online Platforms, Direct Sales, Partnerships, Events |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Sports Promoters Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at