444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK spectator sports market represents one of the most vibrant and culturally significant entertainment sectors in the United Kingdom, encompassing professional football, rugby, cricket, tennis, and numerous other sporting disciplines. Market dynamics indicate substantial growth driven by increasing fan engagement, digital transformation, and enhanced stadium experiences. The sector demonstrates remarkable resilience with attendance rates recovering to pre-pandemic levels and digital viewership expanding by 23% annually.

Professional football dominates the landscape, accounting for approximately 65% of total spectator engagement across the UK. The Premier League, Championship, and lower divisions collectively attract millions of supporters annually, while rugby union and cricket maintain strong regional followings. Digital integration has revolutionized fan experiences, with streaming services and mobile applications enhancing accessibility and engagement levels significantly.

Regional distribution shows London commanding the largest market share at 28%, followed by Manchester, Liverpool, and Birmingham metropolitan areas. The sector benefits from world-class infrastructure, including iconic venues like Wembley Stadium, Old Trafford, and Twickenham, which serve as catalysts for both domestic and international sporting events.

The UK spectator sports market refers to the comprehensive ecosystem of professional and semi-professional sporting events where audiences pay to attend or view competitions, encompassing ticket sales, broadcasting rights, merchandise, hospitality services, and associated entertainment experiences across multiple sporting disciplines throughout the United Kingdom.

Spectator sports differentiate themselves from participatory athletics by focusing on entertainment value, competitive excellence, and fan engagement. This market includes traditional sports like football, rugby, and cricket, alongside emerging disciplines such as esports and mixed martial arts. Revenue streams encompass gate receipts, broadcasting partnerships, sponsorship agreements, merchandise sales, and premium hospitality packages.

Market participants include professional clubs, governing bodies, broadcasters, venue operators, and technology providers who collectively create immersive entertainment experiences. The sector’s significance extends beyond pure entertainment, contributing substantially to local economies, tourism, and cultural identity throughout the UK.

Market performance demonstrates robust recovery and growth trajectory following pandemic-related disruptions, with attendance figures surpassing historical benchmarks and digital engagement reaching unprecedented levels. The UK spectator sports market benefits from strong domestic leagues, international competitions, and a passionate fan base that drives consistent demand across multiple sporting categories.

Technology adoption has accelerated significantly, with 78% of venues implementing enhanced digital experiences including mobile ticketing, contactless payments, and augmented reality features. Broadcasting innovations, particularly in 4K and virtual reality formats, have expanded audience reach while creating new revenue opportunities for rights holders and content distributors.

Investment levels continue rising, particularly in infrastructure modernization, player acquisitions, and fan experience enhancements. Professional clubs are increasingly focusing on global brand expansion, youth development programs, and community engagement initiatives that strengthen long-term sustainability and market positioning.

Consumer behavior analysis reveals evolving preferences toward premium experiences, with hospitality and VIP packages showing 15% annual growth. Younger demographics increasingly value digital integration, social media connectivity, and interactive features that enhance traditional spectating experiences.

Cultural significance of sports in British society continues driving sustained market growth, with football, rugby, and cricket deeply embedded in national identity and community traditions. Generational loyalty ensures consistent fan bases while new supporters are attracted through enhanced marketing campaigns and accessible pricing strategies.

Broadcasting evolution has transformed revenue models, with streaming services complementing traditional television coverage and creating global audience expansion opportunities. Digital platforms enable personalized content delivery, interactive features, and multi-device accessibility that appeals to modern consumers seeking flexible viewing options.

Infrastructure investment in stadium modernization, transportation links, and hospitality facilities enhances spectator experiences while attracting major international competitions. Government support through sports development funding and tourism promotion initiatives creates favorable operating environments for professional clubs and event organizers.

Sponsorship growth from both domestic and international brands seeking association with premium sporting properties drives commercial revenue expansion. Corporate partnerships extend beyond traditional advertising to include naming rights, technology integration, and community engagement programs that create mutual value propositions.

Economic pressures affecting household disposable income can impact ticket sales, particularly for premium seating and hospitality packages during periods of financial uncertainty. Cost of living increases may force fans to prioritize essential expenses over entertainment spending, potentially reducing attendance at certain events.

Competition intensity from alternative entertainment options, including streaming services, gaming, and other leisure activities, requires continuous innovation to maintain audience engagement. Generational shifts in entertainment preferences challenge traditional spectator sports to adapt their offerings and marketing approaches.

Regulatory challenges surrounding player safety, venue capacity, and broadcasting rights can create operational complexities and compliance costs. Brexit implications continue affecting player transfers, international competition participation, and European broadcasting arrangements, creating ongoing uncertainty for some market segments.

Infrastructure limitations at older venues may restrict capacity expansion or modern amenity integration, potentially limiting revenue growth opportunities. Transportation constraints and parking availability can deter attendance, particularly for venues in congested urban areas.

International expansion presents significant growth potential, with UK sporting brands and competitions gaining global recognition and commercial partnerships. Emerging markets in Asia, Africa, and the Americas offer substantial audience development opportunities for established leagues and clubs seeking revenue diversification.

Technology integration creates numerous innovation possibilities, including virtual reality experiences, artificial intelligence-powered analytics, and blockchain-based fan engagement platforms. Data monetization through fan behavior analysis and personalized marketing campaigns can generate additional revenue streams while improving customer satisfaction.

Women’s sports development represents an underexploited market segment with growing commercial interest and audience engagement. Investment opportunities in female competitions, infrastructure, and marketing can capture expanding demographics while promoting inclusivity and diversity initiatives.

Sustainability initiatives align with consumer values while creating operational efficiencies and potential cost savings. Green technology adoption in venues, transportation solutions, and waste management can enhance brand reputation while attracting environmentally conscious sponsors and supporters.

Supply and demand equilibrium varies significantly across different sporting disciplines, with premium football matches often experiencing excess demand while other sports may struggle with capacity utilization. Pricing strategies reflect this dynamic, with successful clubs implementing dynamic pricing models that optimize revenue while maintaining accessibility for diverse fan segments.

Seasonal fluctuations create natural market rhythms, with football dominating winter months while cricket and tennis peak during summer periods. Cross-seasonal programming helps venues and broadcasters maintain consistent revenue streams throughout the year, reducing dependency on specific sporting calendars.

Competitive intensity between clubs, leagues, and sports creates continuous pressure for performance improvement and fan experience enhancement. Market consolidation trends show larger organizations acquiring smaller entities to achieve economies of scale and expanded market reach.

According to MarkWide Research analysis, digital engagement metrics show 42% improvement in fan interaction levels across social media platforms and mobile applications, indicating successful technology adoption strategies throughout the sector.

Comprehensive data collection encompasses primary research through industry stakeholder interviews, fan surveys, and venue operator consultations, combined with secondary analysis of publicly available financial reports, attendance statistics, and broadcasting data. Quantitative analysis includes ticket sales trends, viewership metrics, and revenue performance across multiple sporting categories.

Market segmentation analysis examines performance variations across geographic regions, demographic groups, and sporting disciplines to identify growth patterns and emerging opportunities. Competitive landscape assessment evaluates major clubs, leagues, and supporting organizations to understand market positioning and strategic initiatives.

Trend identification utilizes historical data analysis combined with forward-looking indicators to project future market developments and growth trajectories. Technology impact assessment examines digital transformation effects on traditional business models and consumer behavior patterns.

Validation processes include cross-referencing multiple data sources, expert opinion integration, and statistical modeling to ensure accuracy and reliability of market insights and projections presented throughout this comprehensive analysis.

London dominates the UK spectator sports landscape, accounting for approximately 28% of total market activity, driven by iconic venues including Wembley Stadium, The Oval, and Wimbledon. Premier League clubs Arsenal, Chelsea, Tottenham, and others contribute significantly to the capital’s sporting economy while attracting international visitors and media attention.

Northwest England represents the second-largest regional market at 22% market share, anchored by Manchester United, Manchester City, and Liverpool’s global football brands. Rugby league strongholds in Lancashire and Yorkshire maintain dedicated fan bases while contributing to regional sporting identity and economic activity.

Midlands region captures 18% of market activity, with Birmingham, Coventry, and surrounding areas hosting diverse sporting events from football to rugby union. Venue diversity includes traditional grounds alongside modern facilities that accommodate multiple sports and entertainment formats.

Scotland maintains distinct market characteristics with 12% regional share, dominated by Glasgow and Edinburgh football clubs alongside rugby union and golf tournaments. Cultural traditions surrounding Scottish football create unique fan engagement patterns and commercial opportunities that differ from English market dynamics.

Wales and Northern Ireland collectively represent 8% of market activity, with rugby union particularly strong in Wales while Northern Ireland focuses primarily on football and Gaelic sports. Regional pride drives passionate support levels that often exceed per-capita averages found in larger metropolitan areas.

Market leadership varies by sporting discipline, with football clubs demonstrating the strongest commercial performance and global brand recognition. Premier League dominance extends beyond domestic boundaries, with clubs like Manchester United, Liverpool, and Arsenal maintaining worldwide fan bases and commercial partnerships.

Competitive differentiation increasingly focuses on fan experience innovation, digital platform development, and community engagement programs that build long-term loyalty beyond pure sporting performance. Investment strategies emphasize youth development, infrastructure modernization, and global market expansion to maintain competitive advantages.

By Sport Category:

By Revenue Stream:

By Demographics:

Football category maintains overwhelming market dominance with the Premier League generating the highest commercial revenues and global audience engagement. Championship and lower divisions provide essential grassroots support while developing future talent and maintaining community connections throughout England.

Rugby union demonstrates strong traditional values and loyal supporter bases, particularly during Six Nations competitions and domestic Premiership matches. International tournaments create significant economic impact while showcasing British rugby excellence on global stages.

Cricket evolution through The Hundred format has successfully attracted younger demographics while maintaining traditional county championship appeal. International matches at iconic venues like Lord’s and The Oval continue generating substantial tourism and media interest.

Tennis excellence centers around Wimbledon’s unmatched global prestige, creating annual economic benefits that extend far beyond the tournament fortnight. Grass court tradition and royal patronage maintain unique market positioning that competitors cannot replicate.

Emerging sports including esports and mixed martial arts are gaining mainstream acceptance and commercial investment, particularly among younger demographics seeking alternative entertainment experiences. Digital integration in these categories often exceeds traditional sports adoption rates.

Professional clubs benefit from multiple revenue streams including ticket sales, broadcasting rights, merchandise, and sponsorship agreements that create financial stability and growth opportunities. Brand development through sporting success and community engagement enhances commercial value and supporter loyalty.

Broadcasters gain premium content that attracts large audiences and advertising revenue, while streaming platforms use sports programming to drive subscription growth and market penetration. Technology partnerships create innovation opportunities that enhance viewing experiences and audience engagement.

Sponsors achieve brand visibility and association with successful sporting properties that resonate with target demographics. Corporate hospitality opportunities provide valuable business networking and client entertainment platforms that generate additional commercial value.

Local communities benefit from economic activity, employment opportunities, and cultural identity enhancement that professional sports provide. Tourism impact extends beyond match days, with visitors exploring local attractions and contributing to regional economic development.

Government stakeholders recognize sports’ contribution to public health, social cohesion, and international reputation enhancement. Tax revenue generation and employment creation justify continued support for sporting infrastructure and development programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping fan experiences through mobile applications, augmented reality features, and personalized content delivery systems. Social media integration enables real-time engagement and community building that extends far beyond traditional match attendance.

Sustainability initiatives are becoming integral to venue operations and corporate responsibility programs, with carbon neutral goals driving innovation in energy systems, waste management, and transportation solutions. Fan expectations increasingly include environmental considerations in their support decisions.

Women’s sports investment shows accelerating momentum with improved broadcasting coverage, sponsorship deals, and facility access creating professional opportunities previously unavailable. Audience growth demonstrates substantial commercial potential that organizations are beginning to recognize and develop.

Data analytics utilization enhances performance analysis, fan behavior understanding, and commercial decision-making across all market segments. Predictive modeling helps optimize pricing strategies, marketing campaigns, and operational efficiency while improving spectator experiences.

Global content distribution through streaming platforms and digital partnerships expands audience reach while creating new revenue opportunities. Time zone optimization and multilingual content development cater to international markets seeking UK sporting content.

Stadium modernization projects across multiple venues demonstrate significant capital investment in fan experience enhancement and operational efficiency improvements. Technology integration includes contactless payment systems, mobile ticketing, and enhanced connectivity that meets modern consumer expectations.

Broadcasting partnerships continue evolving with streaming services complementing traditional television coverage while creating more flexible viewing options. Content innovation includes behind-the-scenes access, interactive features, and personalized programming that enhances audience engagement.

Regulatory developments surrounding player welfare, financial fair play, and competition integrity create ongoing compliance requirements while protecting sport integrity. Government initiatives supporting grassroots development and facility improvement demonstrate continued public sector commitment to sporting excellence.

MWR analysis indicates that corporate partnership evolution shows brands seeking deeper integration beyond traditional sponsorship models, including naming rights, technology collaboration, and community engagement programs that create mutual value propositions.

International competition expansion through new tournament formats and global partnerships increases commercial opportunities while maintaining competitive standards. Youth development investment ensures future talent pipelines while creating community engagement and social impact benefits.

Investment priorities should focus on digital infrastructure development, fan experience enhancement, and global market expansion opportunities that leverage existing brand strength. Technology adoption requires careful balance between innovation and traditional sporting values that core supporters cherish.

Revenue diversification through multiple income streams reduces dependency on any single source while creating resilience against economic fluctuations. International partnerships and content distribution agreements can significantly expand market reach without requiring substantial physical infrastructure investment.

Sustainability integration should be viewed as both operational efficiency opportunity and brand differentiation strategy that appeals to environmentally conscious consumers and sponsors. Long-term planning must consider changing demographic preferences and entertainment consumption patterns.

Community engagement programs create social impact while building loyal supporter bases that transcend pure sporting performance. Youth development initiatives ensure future talent pipelines while demonstrating commitment to grassroots sport development and social responsibility.

Data utilization capabilities should be enhanced to improve decision-making across commercial, operational, and sporting domains. Personalization strategies can increase fan engagement and spending while creating more targeted marketing opportunities.

Market projections indicate continued growth driven by digital innovation, international expansion, and enhanced fan experiences that attract new demographics while retaining traditional supporters. Technology integration will accelerate with virtual reality, artificial intelligence, and blockchain applications creating unprecedented engagement opportunities.

Global expansion potential remains substantial, particularly in emerging markets where UK sporting brands maintain strong recognition and commercial appeal. Streaming platforms will continue disrupting traditional broadcasting models while creating new revenue streams and audience development possibilities.

Women’s sports development represents significant untapped potential with growing investment, media coverage, and commercial interest creating professional opportunities and audience expansion. Demographic shifts toward younger, more diverse audiences will drive continued innovation in engagement strategies and content delivery.

Sustainability requirements will become increasingly important for operational licenses, sponsor relationships, and fan loyalty. Environmental leadership can create competitive advantages while contributing to broader social responsibility goals and regulatory compliance.

According to MarkWide Research projections, digital engagement growth is expected to reach 35% annually over the next five years, driven by enhanced mobile experiences, social media integration, and personalized content delivery systems that transform traditional spectator relationships with sporting organizations.

The UK spectator sports market demonstrates remarkable resilience and growth potential, driven by cultural significance, technological innovation, and global brand recognition that creates sustainable competitive advantages. Digital transformation continues reshaping traditional business models while opening new revenue streams and audience engagement opportunities that extend far beyond physical venue attendance.

Market diversity across multiple sporting disciplines provides stability while allowing for specialized development strategies that cater to different demographic segments and commercial opportunities. Infrastructure excellence and broadcasting capabilities maintain UK sports’ global leadership position while creating substantial economic impact throughout local communities.

Future success will depend on balancing traditional sporting values with modern consumer expectations, technological innovation, and sustainability requirements. Strategic investment in digital capabilities, international expansion, and fan experience enhancement will determine long-term market positioning and commercial viability across all sporting categories within the dynamic UK spectator sports landscape.

What is Spectator Sports?

Spectator sports refer to organized sports events that are primarily designed for an audience to watch, including activities like football, rugby, cricket, and motorsports. These events often involve professional teams and athletes competing at various levels, attracting large crowds and significant media attention.

What are the key companies in the UK Spectator Sports Market?

Key companies in the UK Spectator Sports Market include the English Premier League, the Rugby Football Union, and the British Horseracing Authority, among others. These organizations play a crucial role in organizing events, managing teams, and promoting spectator engagement.

What are the growth factors driving the UK Spectator Sports Market?

The UK Spectator Sports Market is driven by factors such as increasing disposable income, a growing interest in sports among the youth, and advancements in broadcasting technology. Additionally, major sporting events and tournaments significantly boost attendance and viewership.

What challenges does the UK Spectator Sports Market face?

Challenges in the UK Spectator Sports Market include the impact of economic downturns on ticket sales, competition from other entertainment options, and the need for enhanced safety measures at events. These factors can affect attendance and overall revenue generation.

What opportunities exist in the UK Spectator Sports Market?

Opportunities in the UK Spectator Sports Market include the potential for digital engagement through streaming services, the rise of e-sports as a spectator activity, and the expansion of women’s sports. These trends can attract new audiences and increase revenue streams.

What trends are shaping the UK Spectator Sports Market?

Trends in the UK Spectator Sports Market include the integration of technology in fan experiences, such as virtual reality and mobile apps, and a growing emphasis on sustainability in event management. Additionally, the increasing popularity of social media is changing how fans interact with sports.

UK Spectator Sports Market

| Segmentation Details | Description |

|---|---|

| Product Type | Football, Rugby, Cricket, Tennis |

| Customer Type | Individuals, Families, Corporate Groups, Schools |

| Distribution Channel | Online, Retail, Direct Sales, Event Venues |

| Event Type | League Matches, Tournaments, Friendly Games, Championships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

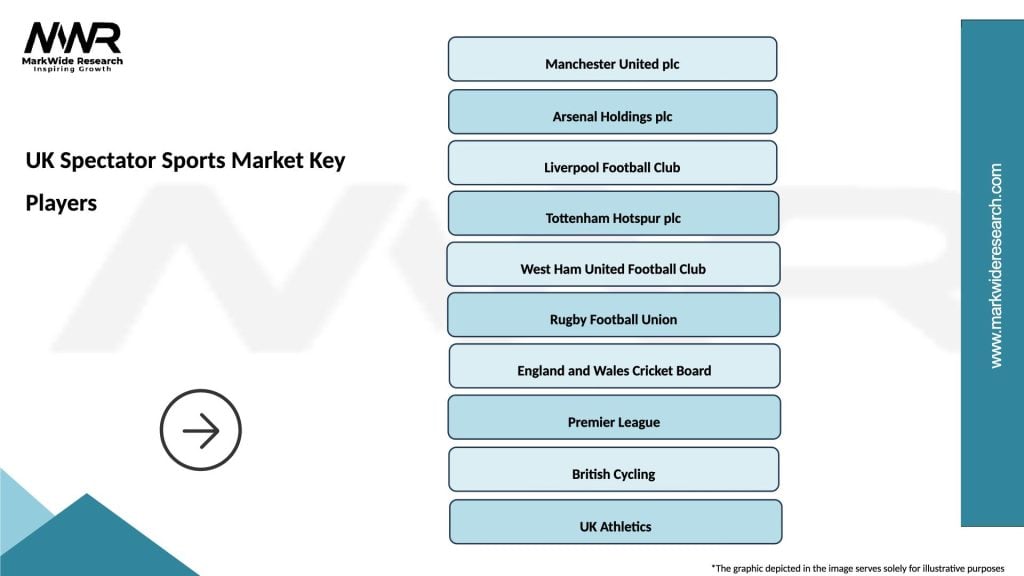

Leading companies in the UK Spectator Sports Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at