444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK snack market represents one of the most dynamic and rapidly evolving sectors within the British food industry, characterized by continuous innovation and changing consumer preferences. Market dynamics indicate substantial growth driven by increasing demand for convenient, portable food options that align with modern lifestyles. The sector encompasses a diverse range of products including traditional crisps, nuts, confectionery items, healthy alternatives, and premium artisanal offerings that cater to sophisticated consumer tastes.

Consumer behavior patterns reveal a significant shift toward healthier snacking options, with 65% of consumers actively seeking products with reduced salt, sugar, and artificial additives. The market demonstrates remarkable resilience and adaptability, particularly following the pandemic-induced changes in consumption patterns. Growth trajectories suggest the sector is expanding at a robust 4.2% CAGR, driven by innovation in flavors, packaging formats, and nutritional profiles that meet evolving consumer expectations.

Distribution channels have undergone significant transformation, with traditional retail maintaining dominance while online platforms experience accelerated growth. The integration of convenience stores, supermarkets, and e-commerce platforms creates a comprehensive ecosystem that ensures product accessibility across diverse consumer segments and geographic regions throughout the United Kingdom.

The UK snack market refers to the comprehensive commercial ecosystem encompassing the production, distribution, and retail of portable food products designed for consumption between main meals or as convenient on-the-go options. This market includes traditional categories such as potato crisps, nuts, seeds, confectionery items, biscuits, and emerging segments like protein bars, vegetable chips, and functional snacks enriched with vitamins and minerals.

Market segmentation extends beyond product categories to include various consumption occasions, from workplace snacking and leisure activities to health-conscious choices and indulgent treats. The definition encompasses both branded manufacturer products and private label offerings, spanning price points from budget-friendly options to premium artisanal selections that command higher margins and cater to discerning consumer preferences.

Industry boundaries continue to blur as manufacturers innovate across traditional categories, creating hybrid products that combine elements from different snack segments. This evolution reflects changing consumer lifestyles, dietary preferences, and the increasing importance of convenience in modern British society.

Strategic analysis reveals the UK snack market as a mature yet innovative sector experiencing steady growth through product diversification and consumer-centric development. Key performance indicators demonstrate consistent expansion across multiple product categories, with health-conscious alternatives showing particularly strong momentum as consumers prioritize nutritional value alongside taste and convenience.

Market leaders continue to invest heavily in research and development, focusing on clean label formulations, sustainable packaging solutions, and flavor innovations that reflect Britain’s increasingly diverse culinary landscape. Competitive dynamics intensify as traditional manufacturers face challenges from emerging brands specializing in niche segments such as plant-based snacks, keto-friendly options, and functional foods targeting specific health benefits.

Consumer trends indicate growing sophistication in snack selection, with 72% of consumers reading ingredient labels more carefully than five years ago. This behavioral shift drives manufacturers to reformulate existing products and develop new offerings that meet elevated expectations for transparency, quality, and nutritional value while maintaining the taste profiles that define successful snack products.

Fundamental market insights reveal several critical trends shaping the UK snack landscape:

Primary growth drivers propelling the UK snack market forward include evolving lifestyle patterns that prioritize convenience without compromising nutritional value. Urbanization trends contribute significantly to increased snack consumption as busy professionals seek portable food solutions that fit seamlessly into demanding schedules and commuting routines.

Health awareness campaigns paradoxically drive snack market growth by creating demand for better-for-you alternatives that satisfy cravings while supporting wellness goals. Product innovation in this space includes the development of snacks fortified with protein, fiber, and essential nutrients that transform traditional indulgence categories into functional food options.

Demographic shifts play a crucial role, with younger consumers demonstrating willingness to pay premium prices for snacks that align with their values regarding sustainability, ethical sourcing, and health benefits. Social media influence amplifies product discovery and brand engagement, creating viral marketing opportunities that traditional advertising channels cannot replicate.

Retail evolution supports market expansion through improved product placement, expanded shelf space allocation, and innovative merchandising strategies that increase impulse purchases and category penetration across diverse consumer segments.

Significant challenges facing the UK snack market include increasing regulatory scrutiny regarding nutritional content, particularly concerning sugar, salt, and saturated fat levels in processed foods. Government initiatives aimed at combating obesity and promoting healthier eating habits create compliance costs and formulation challenges for manufacturers operating in traditional snack categories.

Raw material price volatility affects profit margins and pricing strategies, particularly for products dependent on agricultural commodities subject to weather-related supply disruptions and global market fluctuations. Supply chain complexities have intensified following Brexit-related trade adjustments and pandemic-induced logistics challenges that continue to impact operational efficiency.

Consumer price sensitivity during economic uncertainty limits premium product adoption and forces manufacturers to balance quality improvements with affordability concerns. Private label competition from major retailers creates margin pressure on branded products, requiring increased marketing investments to maintain market share and brand loyalty.

Environmental regulations regarding packaging materials and waste reduction impose additional costs while demanding innovative solutions that maintain product freshness and shelf life without compromising sustainability objectives.

Emerging opportunities within the UK snack market center on the growing intersection of health, convenience, and indulgence that creates space for innovative product development. Functional snacking represents a particularly promising avenue, with consumers increasingly seeking products that deliver specific health benefits such as immune support, digestive wellness, and cognitive enhancement.

Export potential exists for uniquely British snack products that can capitalize on the country’s culinary reputation and premium positioning in international markets. Artisanal and craft segments offer opportunities for smaller manufacturers to establish niche positions with distinctive flavor profiles and storytelling that resonates with experience-seeking consumers.

Technology integration creates possibilities for personalized nutrition solutions, subscription-based delivery models, and smart packaging that enhances consumer engagement and provides valuable consumption data. Sustainability initiatives can differentiate brands while addressing environmental concerns through innovative packaging solutions, carbon-neutral production processes, and ethical sourcing practices.

Cross-category innovation enables manufacturers to blur traditional boundaries and create hybrid products that appeal to multiple consumer needs simultaneously, such as snacks that function as meal replacements or desserts with added nutritional benefits.

Complex market dynamics shape the UK snack landscape through the interplay of consumer preferences, regulatory requirements, competitive pressures, and technological advancements. Supply chain optimization becomes increasingly critical as manufacturers seek to balance cost efficiency with quality maintenance and sustainability commitments.

Innovation cycles accelerate as companies compete to introduce novel flavors, formats, and functional benefits that capture consumer attention in an increasingly crowded marketplace. Brand loyalty patterns show evolution, with consumers demonstrating greater willingness to experiment with new products while maintaining preferences for trusted quality indicators.

Seasonal fluctuations influence demand patterns, creating opportunities for limited-edition products and holiday-themed offerings that generate excitement and drive incremental sales. Economic factors including inflation, employment levels, and disposable income affect purchasing decisions and category mix preferences across different consumer segments.

Regulatory landscape changes require continuous adaptation in product formulations, labeling requirements, and marketing communications to ensure compliance while maintaining competitive positioning and consumer appeal.

Comprehensive research approaches employed in analyzing the UK snack market combine quantitative data collection with qualitative consumer insights to provide holistic market understanding. Primary research methodologies include consumer surveys, focus groups, and in-depth interviews that reveal underlying motivations, preferences, and behavioral patterns driving purchase decisions.

Secondary research sources encompass industry reports, trade publications, regulatory filings, and company financial statements that provide market sizing, competitive positioning, and trend analysis. Data triangulation techniques ensure accuracy and reliability by cross-referencing multiple information sources and validating findings through independent verification processes.

Market modeling approaches utilize statistical analysis, trend extrapolation, and scenario planning to project future market developments and identify potential growth opportunities. Expert interviews with industry professionals, retailers, and supply chain partners provide insider perspectives on market dynamics and emerging challenges.

Consumer behavior analysis incorporates demographic segmentation, psychographic profiling, and purchase journey mapping to understand how different consumer groups interact with snack products across various touchpoints and decision-making contexts.

Geographic distribution across the UK reveals distinct regional preferences and consumption patterns that influence product development and marketing strategies. London and Southeast England demonstrate the highest consumption of premium and international snack varieties, reflecting diverse population demographics and higher disposable income levels that support experimentation with novel products.

Northern England regions show strong preference for traditional snack categories with 38% market share concentrated in established brands and familiar flavors. Scotland and Wales exhibit growing interest in locally-sourced and artisanal products that celebrate regional culinary heritage while meeting modern convenience requirements.

Urban versus rural dynamics create different distribution challenges and opportunities, with city centers favoring convenience store formats and grab-and-go options, while rural areas rely more heavily on supermarket shopping and bulk purchasing patterns. Regional retail partnerships become crucial for market penetration and brand building in areas with strong local retailer presence.

Cultural influences vary significantly across regions, affecting flavor preferences, portion size expectations, and price sensitivity levels that require tailored marketing approaches and product positioning strategies to maximize regional market potential.

Market leadership in the UK snack sector is characterized by a mix of multinational corporations and innovative smaller brands that compete across different segments and price points. Established players maintain strong positions through extensive distribution networks, significant marketing investments, and continuous product innovation that keeps pace with evolving consumer preferences.

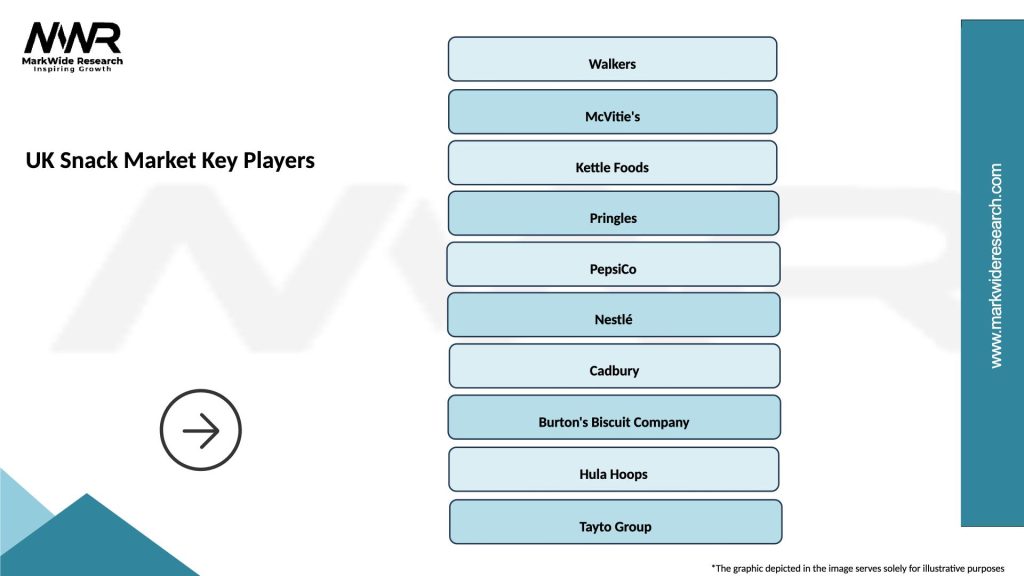

Key market participants include:

Competitive strategies increasingly focus on differentiation through health positioning, sustainability credentials, and premium quality attributes that justify higher price points and build consumer loyalty in competitive retail environments.

Product-based segmentation divides the UK snack market into distinct categories that serve different consumer needs and consumption occasions:

By Product Type:

By Distribution Channel:

Potato crisp category maintains market leadership through continuous flavor innovation and format diversification that appeals to broad consumer segments. Premium positioning within this category grows as consumers seek artisanal quality and unique taste experiences that justify higher price points compared to standard offerings.

Healthy snack segments experience accelerated growth with 28% annual expansion driven by increasing health consciousness and demand for functional benefits. Protein-enriched products particularly resonate with fitness-focused consumers and busy professionals seeking nutritious convenience options.

Confectionery snacks adapt to changing consumer preferences through portion control innovations, reduced sugar formulations, and premium chocolate positioning that maintains indulgence appeal while addressing health concerns. Seasonal variations create significant sales opportunities during holidays and special occasions.

International flavor profiles gain traction across all categories as British consumers embrace global cuisine influences and seek authentic taste experiences that reflect the country’s multicultural food landscape and adventurous eating habits.

Manufacturers benefit from the UK snack market’s stability and growth potential through diversified revenue streams and opportunities for premium product development. Innovation capabilities allow companies to respond quickly to consumer trends and maintain competitive advantages through proprietary formulations and unique positioning strategies.

Retailers gain from high-margin snack categories that generate significant foot traffic and impulse purchases while requiring minimal specialized storage or handling requirements. Cross-merchandising opportunities enable strategic product placement that increases basket size and customer satisfaction through convenient shopping experiences.

Consumers enjoy unprecedented variety and quality in snack options that cater to diverse dietary requirements, taste preferences, and lifestyle needs. Nutritional improvements across traditional categories provide guilt-free indulgence options that support health goals without sacrificing taste satisfaction.

Supply chain partners benefit from consistent demand and opportunities for value-added services including specialized packaging, logistics solutions, and ingredient sourcing that support manufacturer requirements and consumer expectations for quality and freshness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the UK snack market reflect broader societal shifts toward health consciousness, environmental responsibility, and convenience-driven consumption patterns. Clean label movement drives reformulation efforts as consumers demand transparency in ingredient lists and manufacturing processes.

Plant-based innovation extends beyond traditional categories to create entirely new product segments that appeal to vegan consumers and flexitarians seeking occasional meat alternatives. Functional snacking integrates wellness benefits such as probiotics, adaptogens, and superfoods into familiar formats that deliver health benefits alongside taste satisfaction.

Sustainability initiatives encompass packaging innovations, carbon-neutral production methods, and ethical sourcing practices that resonate with environmentally conscious consumers willing to pay premiums for responsible products. Personalization trends enable customized snack selections based on individual dietary requirements, taste preferences, and nutritional goals.

Technology integration creates smart packaging solutions, augmented reality marketing experiences, and data-driven product development that enhances consumer engagement and provides valuable insights for continuous improvement and innovation strategies.

Recent industry developments demonstrate the dynamic nature of the UK snack market and the continuous evolution required to meet changing consumer expectations. Merger and acquisition activity intensifies as companies seek to expand product portfolios, access new distribution channels, and achieve operational synergies that improve competitive positioning.

Sustainability investments accelerate across the industry, with major manufacturers committing to carbon neutrality targets, recyclable packaging transitions, and regenerative agriculture partnerships that address environmental concerns while building brand differentiation. MarkWide Research indicates that 83% of companies have implemented sustainability initiatives within the past two years.

Technology adoption includes artificial intelligence applications for flavor development, blockchain systems for supply chain transparency, and IoT sensors for quality monitoring that enhance operational efficiency and consumer trust. Direct-to-consumer platforms expand as brands seek closer customer relationships and higher margin opportunities outside traditional retail channels.

Regulatory adaptations require industry-wide adjustments to labeling requirements, nutritional standards, and marketing restrictions that influence product development priorities and communication strategies across all market segments and consumer touchpoints.

Strategic recommendations for UK snack market participants emphasize the importance of balancing innovation with operational excellence while maintaining focus on consumer-centric product development. Portfolio diversification across health-positioned and indulgent categories provides risk mitigation and captures broader consumer segments with varying needs and preferences.

Investment priorities should focus on sustainable packaging solutions, clean label reformulations, and digital marketing capabilities that enhance brand visibility and consumer engagement in increasingly competitive retail environments. Supply chain resilience requires diversified sourcing strategies and flexible manufacturing capabilities that can adapt to disruptions and changing demand patterns.

Market expansion strategies should consider regional preferences, demographic trends, and emerging consumption occasions that create opportunities for targeted product development and marketing initiatives. Partnership opportunities with health and wellness brands, sustainability organizations, and technology providers can accelerate innovation and market penetration.

Long-term success depends on maintaining authentic brand positioning while adapting to evolving consumer values and regulatory requirements that shape market dynamics and competitive landscapes across all product categories and distribution channels.

Future projections for the UK snack market indicate continued growth driven by innovation in health-positioned products and premium offerings that command higher margins while meeting evolving consumer expectations. Market evolution will likely accelerate toward functional snacking solutions that blur traditional category boundaries and create new consumption occasions.

Technological advancement will enable more sophisticated personalization capabilities, predictive analytics for demand forecasting, and automated production systems that improve efficiency while maintaining quality standards. Sustainability integration will become a competitive necessity rather than a differentiator, requiring industry-wide adoption of environmentally responsible practices.

Consumer sophistication will continue increasing, demanding greater transparency, authenticity, and value alignment from brands across all price points and product categories. MWR analysis suggests the market will experience sustained growth of 4.5% annually over the next five years, driven primarily by health-conscious innovation and premium positioning strategies.

Regulatory landscape evolution will likely introduce additional requirements for nutritional labeling, marketing restrictions, and environmental compliance that reshape competitive dynamics and operational priorities across the industry.

The UK snack market stands as a testament to the industry’s ability to adapt and thrive amid changing consumer preferences, regulatory challenges, and competitive pressures. Market resilience demonstrates through continuous innovation, strategic positioning, and operational excellence that maintains growth momentum while addressing evolving consumer needs and societal expectations.

Success factors for market participants include embracing health-conscious formulations, investing in sustainable practices, and leveraging technology to enhance consumer experiences and operational efficiency. Future opportunities lie in the intersection of convenience, nutrition, and indulgence that creates space for innovative products serving multiple consumer needs simultaneously.

The market’s trajectory toward premiumization, health positioning, and sustainability leadership positions the UK snack sector for continued expansion and evolution that benefits all stakeholders while contributing to broader food industry transformation and consumer wellness objectives.

What is a snack?

A snack is a small portion of food typically eaten between meals. Snacks can include a variety of items such as chips, nuts, fruits, and baked goods, catering to different consumer preferences and dietary needs.

What are the key players in the UK Snack Market?

Key players in the UK Snack Market include companies like Walkers, Pringles, and Cadbury, which offer a wide range of snack products. These companies compete on factors such as flavor innovation, packaging, and marketing strategies, among others.

What are the growth factors driving the UK Snack Market?

The UK Snack Market is driven by factors such as increasing consumer demand for convenient food options, the rise of health-conscious snacking, and the growing popularity of plant-based snacks. Additionally, busy lifestyles contribute to the preference for on-the-go snack solutions.

What challenges does the UK Snack Market face?

The UK Snack Market faces challenges such as rising raw material costs, health concerns related to high sugar and fat content, and increasing competition from healthier snack alternatives. These factors can impact product pricing and consumer choices.

What opportunities exist in the UK Snack Market?

Opportunities in the UK Snack Market include the expansion of healthier snack options, the introduction of innovative flavors, and the growth of online retail channels. Brands can also explore sustainability initiatives to appeal to environmentally conscious consumers.

What trends are shaping the UK Snack Market?

Trends in the UK Snack Market include the rise of plant-based snacks, the demand for gluten-free and organic options, and the popularity of international flavors. Additionally, there is a growing focus on packaging sustainability and transparency in ingredient sourcing.

UK Snack Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chips, Nuts, Popcorn, Crackers |

| Price Tier | Premium, Mid-range, Budget, Value |

| Distribution Channel | Supermarkets, Convenience Stores, Online, Wholesalers |

| Customer Type | Families, Young Adults, Health-conscious Consumers, Students |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Snack Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at