444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK smart grid network market represents a transformative sector within the nation’s energy infrastructure, characterized by the integration of advanced digital technologies with traditional electrical grid systems. Smart grid networks in the United Kingdom are experiencing unprecedented growth as the country accelerates its transition toward renewable energy sources and enhanced grid reliability. The market encompasses sophisticated two-way communication systems, automated control mechanisms, and intelligent monitoring solutions that enable real-time data exchange between utilities and consumers.

Digital transformation within the UK’s energy sector has catalyzed significant investments in smart grid infrastructure, with adoption rates increasing by 12.5% annually across major metropolitan areas. The integration of Internet of Things (IoT) devices, artificial intelligence, and machine learning algorithms has revolutionized how electricity is generated, distributed, and consumed throughout the United Kingdom. Grid modernization initiatives are particularly prominent in England, Scotland, Wales, and Northern Ireland, each implementing region-specific smart grid solutions tailored to local energy demands and regulatory requirements.

Renewable energy integration serves as a primary catalyst for smart grid network deployment, with wind and solar power installations requiring sophisticated grid management systems to handle variable energy generation patterns. The UK’s commitment to achieving net-zero emissions by 2050 has intensified focus on smart grid technologies that can efficiently manage distributed energy resources and optimize grid performance during peak demand periods.

The UK smart grid network market refers to the comprehensive ecosystem of advanced electrical grid infrastructure that utilizes digital communication technologies, automated control systems, and intelligent monitoring solutions to enhance the efficiency, reliability, and sustainability of electricity distribution across the United Kingdom. Smart grid networks represent a fundamental evolution from traditional one-way electrical systems to dynamic, bidirectional networks capable of real-time communication between utilities, consumers, and distributed energy resources.

Advanced metering infrastructure (AMI) forms the foundation of smart grid networks, enabling precise measurement and monitoring of electricity consumption patterns while facilitating demand response programs and dynamic pricing mechanisms. Grid automation technologies within these networks include self-healing capabilities, fault detection systems, and predictive maintenance algorithms that minimize service disruptions and optimize operational efficiency.

Energy management systems integrated within smart grid networks provide utilities with comprehensive visibility into grid operations, enabling proactive decision-making and strategic resource allocation. The market encompasses various technological components including smart meters, distribution automation systems, energy storage solutions, and cybersecurity frameworks designed to protect critical infrastructure from potential threats.

Market dynamics within the UK smart grid network sector reflect a rapidly evolving landscape driven by regulatory mandates, technological innovation, and increasing consumer demand for sustainable energy solutions. Government initiatives supporting smart grid deployment have accelerated market growth, with public-private partnerships facilitating large-scale infrastructure investments across England, Scotland, Wales, and Northern Ireland.

Technology adoption rates demonstrate significant momentum, with smart meter penetration reaching 78% of UK households by 2024, representing substantial progress toward nationwide smart grid implementation. Utility companies are investing heavily in grid modernization projects, focusing on distribution automation, energy storage integration, and advanced analytics capabilities that enhance operational efficiency and customer service delivery.

Competitive landscape features established technology providers, emerging startups, and international corporations competing for market share through innovative solutions and strategic partnerships. Investment flows into smart grid technologies continue expanding, with venture capital and government funding supporting research and development initiatives focused on next-generation grid management systems.

Regional variations in smart grid deployment reflect diverse energy profiles and infrastructure requirements across different UK regions, with urban areas typically demonstrating higher adoption rates compared to rural communities. Future prospects indicate sustained growth potential as the UK pursues ambitious decarbonization targets and enhanced energy security objectives.

Strategic insights reveal several critical factors shaping the UK smart grid network market trajectory and competitive dynamics:

Market segmentation analysis indicates diverse applications across residential, commercial, and industrial sectors, each presenting unique requirements and growth opportunities. Technology evolution continues advancing toward more sophisticated automation and intelligence capabilities that promise enhanced grid performance and operational efficiency.

Government mandates represent the primary driver for UK smart grid network adoption, with regulatory requirements compelling utilities to modernize aging infrastructure and implement advanced metering systems. Climate change commitments under the Paris Agreement have established ambitious decarbonization targets that necessitate sophisticated grid management capabilities to accommodate increasing renewable energy penetration.

Energy security concerns following recent geopolitical events have heightened focus on domestic energy independence and grid resilience, driving investments in smart grid technologies that enhance system reliability and reduce dependence on energy imports. Consumer demand for greater control over energy consumption and costs is accelerating adoption of smart home technologies and demand response programs.

Technological advancements in IoT devices, cloud computing, and artificial intelligence are reducing implementation costs while improving smart grid functionality and performance. Economic benefits associated with reduced operational costs, improved efficiency, and enhanced asset utilization are compelling utilities to invest in smart grid modernization projects.

Grid modernization requirements driven by aging infrastructure and increasing electricity demand are creating urgent needs for advanced monitoring, control, and automation systems. Renewable energy integration challenges require sophisticated grid management solutions capable of handling variable generation patterns and maintaining system stability.

High implementation costs associated with smart grid infrastructure deployment present significant barriers for utilities operating under tight budget constraints and regulatory cost recovery limitations. Technical complexity involved in integrating legacy systems with modern smart grid technologies creates implementation challenges and potential compatibility issues.

Cybersecurity concerns regarding increased digital connectivity and potential vulnerabilities in smart grid networks are causing some utilities to proceed cautiously with deployment plans. Consumer privacy issues related to detailed energy consumption data collection and usage monitoring are generating resistance among certain customer segments.

Regulatory uncertainty surrounding evolving energy policies and market structures can delay investment decisions and slow smart grid deployment timelines. Skills shortage in specialized technical areas required for smart grid implementation and maintenance is constraining market growth and increasing labor costs.

Interoperability challenges between different vendor solutions and legacy infrastructure components can complicate system integration and increase project complexity. Return on investment concerns related to long payback periods and uncertain revenue streams may limit utility willingness to pursue aggressive smart grid modernization strategies.

Electric vehicle adoption presents substantial opportunities for smart grid network expansion, with EV charging infrastructure requiring sophisticated load management and grid integration capabilities. Distributed energy resources including rooftop solar, battery storage, and microgrids are creating new market segments for smart grid technologies and services.

Data monetization opportunities through advanced analytics and energy insights services offer utilities new revenue streams beyond traditional electricity sales. Energy-as-a-Service business models enabled by smart grid technologies are opening innovative market approaches and customer engagement strategies.

International expansion opportunities exist for UK-based smart grid technology providers to export solutions and expertise to emerging markets pursuing grid modernization initiatives. Public-private partnerships are facilitating large-scale smart grid projects that combine government funding with private sector innovation and efficiency.

Smart city initiatives across major UK metropolitan areas are driving integrated approaches to energy, transportation, and infrastructure management that rely heavily on smart grid technologies. Industrial IoT applications in manufacturing and commercial sectors are expanding demand for specialized smart grid solutions and energy management systems.

Supply chain dynamics within the UK smart grid network market reflect a complex ecosystem of technology providers, system integrators, and service companies collaborating to deliver comprehensive solutions. Vendor relationships are evolving toward long-term partnerships that emphasize ongoing support, maintenance, and system optimization rather than traditional transactional approaches.

Competitive pressures are intensifying as established utility companies face challenges from new market entrants offering innovative energy services and customer engagement platforms. Technology convergence between telecommunications, information technology, and energy sectors is creating new competitive dynamics and partnership opportunities.

Customer expectations are rising for enhanced service reliability, real-time information access, and personalized energy management solutions that smart grid networks can provide. Regulatory evolution continues shaping market dynamics through updated standards, incentive programs, and performance requirements for smart grid implementations.

Investment patterns show increasing focus on software-defined grid solutions and cloud-based platforms that offer greater flexibility and scalability compared to traditional hardware-centric approaches. Market consolidation trends are emerging as larger companies acquire specialized technology providers to expand their smart grid capabilities and market reach.

Comprehensive analysis of the UK smart grid network market employs multiple research methodologies to ensure accurate and reliable insights into market trends, competitive dynamics, and growth opportunities. Primary research activities include extensive interviews with industry executives, utility managers, technology providers, and regulatory officials to gather firsthand perspectives on market developments.

Secondary research encompasses detailed analysis of government publications, industry reports, academic studies, and company financial statements to validate primary findings and identify emerging trends. Market surveys conducted among utility companies, technology vendors, and end-users provide quantitative data on adoption rates, investment priorities, and technology preferences.

Data triangulation techniques ensure research accuracy by cross-referencing information from multiple sources and validating findings through independent verification methods. Expert consultations with industry specialists and academic researchers provide additional insights into technical developments and market implications.

Quantitative modeling approaches utilize statistical analysis and forecasting techniques to project market growth trajectories and identify key performance indicators. Qualitative assessments examine market dynamics, competitive strategies, and regulatory impacts that influence smart grid network adoption and development patterns.

England dominates the UK smart grid network market with approximately 65% market share, driven by high population density, extensive industrial activity, and advanced telecommunications infrastructure supporting smart grid deployment. London and Southeast England demonstrate particularly strong adoption rates due to concentrated urban development and progressive energy policies.

Scotland represents a significant growth region with 18% market share, benefiting from abundant renewable energy resources and government support for smart grid technologies that facilitate wind power integration. Scottish utilities are implementing innovative grid management solutions to handle variable renewable generation and maintain system stability.

Wales accounts for approximately 12% market share, with smart grid investments focused on rural electrification improvements and renewable energy integration projects. Welsh government initiatives supporting sustainable energy development are driving smart grid adoption in both urban and rural communities.

Northern Ireland holds the remaining 5% market share, with smart grid development concentrated in Belfast and surrounding metropolitan areas. Cross-border energy trading with the Republic of Ireland is creating unique requirements for smart grid technologies that facilitate international electricity exchange and grid synchronization.

Regional variations in smart grid deployment reflect different energy profiles, infrastructure conditions, and regulatory environments across the UK’s constituent nations. Urban-rural disparities in technology adoption rates highlight the need for tailored smart grid solutions that address diverse geographic and demographic requirements.

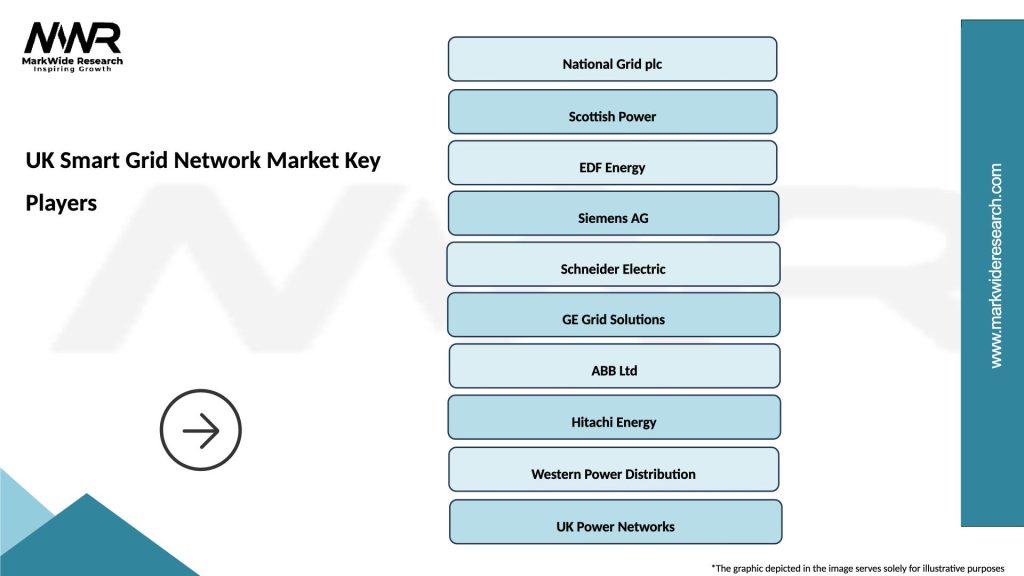

Market leadership within the UK smart grid network sector features a diverse mix of international technology giants, specialized solution providers, and emerging innovative companies competing across various market segments:

Strategic partnerships between technology providers and utility companies are becoming increasingly common as organizations seek to leverage complementary capabilities and share implementation risks. Innovation focus areas include artificial intelligence integration, cybersecurity enhancement, and advanced analytics capabilities that differentiate competitive offerings.

Market positioning strategies vary significantly among competitors, with some emphasizing comprehensive end-to-end solutions while others focus on specialized niche technologies and services. Acquisition activity continues as larger companies seek to expand their smart grid portfolios and geographic reach through strategic purchases of innovative technology providers.

Technology segmentation within the UK smart grid network market encompasses several distinct categories that address different aspects of grid modernization and optimization:

By Technology:

By Application:

By Component:

Advanced Metering Infrastructure represents the largest market segment, with smart meter deployments achieving 78% penetration across UK households and driving substantial investments in communication networks and data management systems. AMI technologies are evolving toward more sophisticated capabilities including real-time pricing, outage detection, and integration with home energy management systems.

Distribution Automation segment demonstrates strong growth potential as utilities prioritize grid reliability and operational efficiency improvements. Self-healing grid technologies are particularly attractive for reducing outage duration and improving customer satisfaction metrics. Fault detection systems utilizing advanced sensors and analytics are becoming standard components of modern distribution networks.

Demand Response applications are gaining traction as utilities seek to manage peak demand and integrate variable renewable energy sources more effectively. Consumer participation in demand response programs is increasing through improved incentive structures and user-friendly technology interfaces. Industrial demand response offers particularly significant opportunities for large-scale load management and grid stabilization.

Energy Storage Integration represents a rapidly growing segment as battery costs decline and grid-scale storage becomes economically viable. Residential storage systems are increasingly popular among consumers seeking energy independence and backup power capabilities. Utility-scale storage projects are essential for managing renewable energy variability and providing grid services.

Utility companies benefit significantly from smart grid network implementations through improved operational efficiency, reduced maintenance costs, and enhanced customer service capabilities. Grid optimization enabled by smart technologies can reduce operational expenses by 15-20% while improving system reliability and performance metrics.

Consumers gain substantial advantages including greater control over energy consumption, access to real-time usage information, and opportunities to participate in demand response programs that reduce electricity costs. Energy management capabilities provided by smart grid technologies enable households to optimize their energy usage patterns and reduce monthly utility bills.

Technology providers benefit from expanding market opportunities, long-term service contracts, and recurring revenue streams associated with smart grid infrastructure deployment and maintenance. Innovation opportunities in areas such as artificial intelligence, cybersecurity, and data analytics create competitive advantages and market differentiation possibilities.

Government entities achieve policy objectives related to carbon emission reduction, energy security enhancement, and economic development through smart grid investments. Regulatory benefits include improved grid monitoring capabilities, enhanced compliance reporting, and better coordination of energy policies across different sectors.

Environmental stakeholders benefit from reduced carbon emissions, improved renewable energy integration, and enhanced overall energy efficiency achieved through smart grid technologies. Sustainability goals are advanced through optimized energy distribution and reduced waste in the electricity system.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents a transformative trend within UK smart grid networks, with AI-powered systems enabling predictive maintenance, automated fault detection, and optimized energy distribution. Machine learning algorithms are increasingly deployed to analyze vast amounts of grid data and identify patterns that improve operational efficiency and reliability.

Cybersecurity Enhancement has become a critical focus area as smart grid networks face evolving cyber threats and security challenges. Advanced security frameworks incorporating blockchain technology, encryption protocols, and continuous monitoring systems are being implemented to protect critical infrastructure from potential attacks.

Edge Computing Adoption is accelerating within smart grid applications to reduce latency, improve real-time decision-making, and enhance system responsiveness. Distributed computing architectures enable faster processing of grid data and more efficient management of distributed energy resources.

Microgrids Development is gaining momentum as communities and organizations seek greater energy independence and resilience. Local energy networks integrated with smart grid technologies provide backup power capabilities and optimize local renewable energy resources.

Blockchain Applications are emerging for peer-to-peer energy trading, renewable energy certificate management, and transparent transaction recording within smart grid networks. Distributed ledger technologies enable new business models and enhance trust in energy transactions between grid participants.

Major utility companies across the UK are announcing significant smart grid investment programs, with National Grid leading initiatives to modernize transmission infrastructure and enhance grid flexibility. Regional distribution network operators are implementing comprehensive smart grid upgrades to improve service reliability and accommodate distributed energy resources.

Technology partnerships between UK utilities and international smart grid providers are accelerating deployment timelines and bringing advanced capabilities to the domestic market. Collaborative projects involving multiple stakeholders are demonstrating innovative approaches to grid modernization and renewable energy integration.

Government funding programs continue supporting smart grid research and development initiatives through grants, tax incentives, and public-private partnership opportunities. Innovation competitions are encouraging startup companies and established firms to develop next-generation smart grid technologies and solutions.

Regulatory updates from Ofgem are establishing new standards and requirements for smart grid implementations while providing clearer guidance on cost recovery mechanisms and performance expectations. Policy frameworks are evolving to support emerging technologies and business models within the smart grid ecosystem.

International collaborations are expanding UK participation in global smart grid standardization efforts and technology sharing initiatives. Research partnerships with European and international organizations are advancing smart grid innovation and best practice development.

Strategic recommendations for market participants emphasize the importance of comprehensive planning and phased implementation approaches to smart grid deployment. MarkWide Research analysis suggests that utilities should prioritize cybersecurity investments and stakeholder engagement initiatives to ensure successful smart grid adoption and public acceptance.

Technology integration strategies should focus on interoperability standards and vendor-neutral approaches that avoid lock-in situations and enable future flexibility. Investment priorities should balance immediate operational improvements with long-term strategic capabilities that support evolving grid requirements and regulatory expectations.

Partnership development between utilities, technology providers, and service companies is essential for sharing risks, leveraging expertise, and accelerating deployment timelines. Collaborative approaches can reduce individual company investment burdens while improving overall market development and innovation outcomes.

Customer engagement initiatives should emphasize education, transparency, and value demonstration to build public support for smart grid technologies and programs. Communication strategies must address privacy concerns, explain benefits clearly, and provide customers with meaningful control over their energy usage and data sharing preferences.

Regulatory engagement remains crucial for ensuring favorable policy environments and appropriate cost recovery mechanisms for smart grid investments. Industry advocacy efforts should focus on demonstrating smart grid benefits and supporting regulatory frameworks that encourage innovation while protecting consumer interests.

Long-term prospects for the UK smart grid network market remain highly positive, with continued growth expected through 2030 and beyond as the country pursues ambitious decarbonization targets and enhanced energy security objectives. Market expansion is projected to accelerate at a compound annual growth rate of 8.2% driven by increasing renewable energy integration and electric vehicle adoption.

Technology evolution will continue advancing toward more sophisticated automation, artificial intelligence integration, and enhanced cybersecurity capabilities that improve grid performance and reliability. Next-generation solutions incorporating quantum computing, advanced materials, and novel communication technologies promise further improvements in smart grid functionality and efficiency.

Market consolidation trends are expected to continue as larger companies acquire specialized technology providers and utilities seek comprehensive solution partnerships. Vertical integration strategies may emerge as companies attempt to control more aspects of the smart grid value chain and capture additional revenue opportunities.

International expansion opportunities for UK-based smart grid companies are likely to grow as global demand for grid modernization increases and UK expertise gains recognition in international markets. Export potential exists in emerging economies pursuing rapid electrification and developed countries upgrading aging infrastructure.

Regulatory evolution will continue shaping market dynamics through updated standards, performance requirements, and incentive structures that encourage innovation while ensuring grid reliability and consumer protection. Policy support for smart grid development is expected to remain strong as governments recognize the critical role of modernized electricity infrastructure in achieving climate and energy security goals.

The UK smart grid network market represents a dynamic and rapidly evolving sector that plays a crucial role in the nation’s energy transition and infrastructure modernization efforts. Strong government support, favorable regulatory frameworks, and increasing recognition of smart grid benefits are driving sustained market growth and investment activity across England, Scotland, Wales, and Northern Ireland.

Technology advancement continues accelerating with artificial intelligence, cybersecurity enhancement, and edge computing integration creating new capabilities and market opportunities. Competitive dynamics feature established international players alongside innovative startups, fostering an environment of continuous innovation and solution development that benefits all market participants.

Market challenges including high implementation costs, technical complexity, and cybersecurity concerns require careful attention and strategic planning to ensure successful smart grid deployment outcomes. Stakeholder collaboration between utilities, technology providers, regulators, and consumers remains essential for addressing these challenges and maximizing smart grid benefits.

Future growth prospects appear robust as the UK pursues net-zero emission targets, enhances energy security, and accommodates increasing renewable energy penetration through sophisticated grid management solutions. The UK smart grid network market is well-positioned to continue its expansion trajectory while contributing significantly to the nation’s sustainable energy future and economic development objectives.

What is Smart Grid Network?

A Smart Grid Network refers to an advanced electrical grid that utilizes digital technology to monitor and manage the transport of electricity from all generation sources to meet the varying electricity demands of end users. It incorporates smart meters, automated control systems, and communication technologies to enhance efficiency and reliability.

What are the key companies in the UK Smart Grid Network Market?

Key companies in the UK Smart Grid Network Market include Siemens, Schneider Electric, and National Grid, among others. These companies are involved in developing technologies and solutions that enhance grid management and energy distribution.

What are the drivers of growth in the UK Smart Grid Network Market?

Drivers of growth in the UK Smart Grid Network Market include the increasing demand for renewable energy integration, the need for improved energy efficiency, and government initiatives promoting smart grid technologies. These factors are pushing utilities to modernize their infrastructure.

What challenges does the UK Smart Grid Network Market face?

The UK Smart Grid Network Market faces challenges such as high initial investment costs, cybersecurity risks, and regulatory hurdles. These issues can hinder the adoption and implementation of smart grid technologies.

What opportunities exist in the UK Smart Grid Network Market?

Opportunities in the UK Smart Grid Network Market include advancements in energy storage solutions, the rise of electric vehicles, and the potential for enhanced demand response programs. These developments can lead to more efficient energy management.

What trends are shaping the UK Smart Grid Network Market?

Trends shaping the UK Smart Grid Network Market include the increasing deployment of smart meters, the integration of Internet of Things (IoT) devices, and the focus on sustainability and carbon reduction. These trends are driving innovation and investment in smart grid technologies.

UK Smart Grid Network Market

| Segmentation Details | Description |

|---|---|

| Technology | Smart Meters, Demand Response, Energy Management Systems, Advanced Metering Infrastructure |

| End User | Utilities, Commercial Buildings, Residential Customers, Industrial Facilities |

| Application | Load Balancing, Renewable Integration, Grid Monitoring, Energy Storage Management |

| Deployment | On-Premises, Cloud-Based, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Smart Grid Network Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at