444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK route optimization software market represents a rapidly expanding segment within the broader logistics and transportation technology landscape. This sophisticated software category addresses the critical need for efficient route planning, delivery optimization, and fleet management across diverse industries including retail, e-commerce, logistics, and field services. Route optimization solutions leverage advanced algorithms, artificial intelligence, and real-time data analytics to determine the most efficient paths for vehicles, reducing fuel consumption, minimizing delivery times, and enhancing overall operational efficiency.

Market dynamics indicate substantial growth driven by increasing e-commerce activities, rising fuel costs, environmental sustainability concerns, and the growing complexity of last-mile delivery challenges. The UK market demonstrates particularly strong adoption rates, with businesses experiencing average efficiency improvements of 25-30% following implementation of advanced route optimization systems. Digital transformation initiatives across traditional industries have accelerated the integration of these intelligent routing solutions, creating significant opportunities for technology providers and end-users alike.

Technological advancement continues to reshape the market landscape, with emerging capabilities including predictive analytics, machine learning-powered route suggestions, and integration with Internet of Things (IoT) devices. The market encompasses various deployment models, from cloud-based Software-as-a-Service (SaaS) solutions to on-premise implementations, catering to diverse organizational requirements and security preferences.

The UK route optimization software market refers to the comprehensive ecosystem of technology solutions designed to automatically calculate the most efficient routes for vehicles and mobile workforces across the United Kingdom. These sophisticated systems utilize complex algorithms, real-time traffic data, vehicle constraints, and delivery requirements to generate optimized routing plans that minimize travel time, reduce fuel consumption, and maximize operational efficiency.

Route optimization software encompasses various functionalities including dynamic route planning, real-time route adjustments, fleet tracking, delivery scheduling, and performance analytics. These solutions serve multiple industries ranging from traditional logistics and transportation companies to modern e-commerce platforms, field service organizations, and municipal services. The software typically integrates with existing enterprise resource planning (ERP) systems, customer relationship management (CRM) platforms, and fleet management solutions to provide comprehensive operational visibility.

Core capabilities include multi-stop route planning, vehicle capacity optimization, driver scheduling, customer time window management, and cost analysis. Advanced systems incorporate machine learning algorithms that continuously improve routing suggestions based on historical performance data, traffic patterns, and operational constraints.

Strategic market analysis reveals the UK route optimization software market as a high-growth sector experiencing accelerated adoption across multiple industries. The market benefits from strong fundamentals including increasing delivery volumes, rising operational costs, and growing environmental consciousness among businesses and consumers. Key market drivers include the exponential growth of e-commerce, which has increased delivery complexity by approximately 40% over recent years, and the urgent need for cost-effective logistics solutions in an inflationary environment.

Technology innovation remains a primary catalyst for market expansion, with artificial intelligence and machine learning capabilities enhancing the accuracy and efficiency of routing algorithms. Cloud-based deployment models have democratized access to sophisticated routing capabilities, enabling small and medium enterprises to leverage enterprise-grade optimization tools previously available only to large corporations.

Competitive landscape features a mix of established enterprise software providers, specialized routing solution vendors, and emerging technology startups. Market consolidation trends indicate increasing strategic partnerships and acquisitions as companies seek to expand their technological capabilities and market reach. Regional adoption patterns show particularly strong growth in urban areas where last-mile delivery challenges are most pronounced, with London and other major metropolitan areas leading implementation rates.

Market intelligence reveals several critical insights shaping the UK route optimization software landscape:

Technology trends indicate increasing sophistication in algorithmic approaches, with machine learning and artificial intelligence becoming standard components rather than premium features. User experience improvements focus on intuitive interfaces and automated decision-making capabilities that reduce the technical expertise required for effective system utilization.

Primary growth drivers propelling the UK route optimization software market include several interconnected factors that create compelling business cases for technology adoption. E-commerce expansion represents the most significant driver, with online retail growth creating unprecedented delivery volume increases and complexity challenges that traditional manual routing methods cannot effectively address.

Cost optimization pressures intensify as fuel prices, labor costs, and vehicle maintenance expenses continue rising. Organizations implementing route optimization solutions typically achieve fuel cost reductions of 15-25% while simultaneously improving delivery performance metrics. Environmental sustainability initiatives drive adoption as companies seek to reduce their carbon footprint and meet increasingly stringent environmental regulations and corporate social responsibility commitments.

Customer expectations for faster, more reliable deliveries create operational pressures that necessitate advanced routing capabilities. The demand for real-time delivery tracking, accurate time estimates, and flexible delivery options requires sophisticated backend optimization systems. Labor shortage challenges in the transportation and logistics sector make efficient resource utilization critical for maintaining service levels with limited workforce availability.

Regulatory compliance requirements including driver hours regulations, vehicle weight restrictions, and urban access limitations create complex constraints that manual planning cannot effectively manage. Digital transformation initiatives across industries accelerate the adoption of integrated technology solutions that provide comprehensive operational visibility and control.

Implementation challenges present significant barriers to market adoption, particularly for smaller organizations with limited technical resources and expertise. Initial investment costs for comprehensive route optimization solutions can be substantial, including software licensing, hardware requirements, integration services, and staff training expenses. Many potential adopters struggle to justify the upfront investment despite clear long-term benefits.

Integration complexity with existing enterprise systems creates technical hurdles that can delay implementation and increase project costs. Legacy system compatibility issues, data migration challenges, and the need for custom integration development can extend implementation timelines significantly. Change management resistance from operational staff accustomed to traditional routing methods can impede successful adoption and realization of expected benefits.

Data quality requirements pose ongoing challenges, as route optimization systems depend on accurate, up-to-date information about customers, vehicles, drivers, and operational constraints. Poor data quality can significantly impact system performance and user confidence. Technical complexity of advanced optimization algorithms can overwhelm organizations lacking sufficient technical expertise, leading to suboptimal system utilization.

Vendor selection difficulties arise from the proliferation of solution providers offering varying capabilities, pricing models, and implementation approaches. Security and privacy concerns regarding sensitive operational data and customer information create additional evaluation criteria that can complicate the selection process.

Emerging opportunities within the UK route optimization software market present significant growth potential for both technology providers and end-users. Artificial intelligence integration offers possibilities for predictive routing capabilities that anticipate traffic patterns, weather conditions, and customer behavior to optimize routes proactively rather than reactively.

Internet of Things (IoT) connectivity creates opportunities for real-time vehicle monitoring, automated data collection, and dynamic route adjustments based on actual operational conditions. Smart city initiatives across UK municipalities present opportunities for integrated traffic management and logistics optimization that could revolutionize urban delivery efficiency.

Vertical market specialization offers opportunities for solution providers to develop industry-specific capabilities addressing unique requirements in sectors such as healthcare, food service, retail, and field services. Small and medium enterprise (SME) market penetration remains largely untapped, with simplified, cost-effective solutions needed to serve this significant market segment.

Sustainability-focused solutions present opportunities for electric vehicle route optimization, carbon footprint tracking, and environmental impact reporting capabilities. Cross-border logistics optimization becomes increasingly important as UK businesses navigate post-Brexit trade relationships and supply chain complexities. Mobile workforce optimization extends beyond traditional delivery applications to field service, sales, and maintenance operations.

Market dynamics reflect the complex interplay of technological advancement, economic pressures, and evolving customer expectations that shape the UK route optimization software landscape. Competitive intensity continues increasing as new entrants challenge established players with innovative approaches and specialized capabilities. This competition drives continuous innovation and helps maintain reasonable pricing levels for end-users.

Technology evolution accelerates market transformation, with cloud computing, artificial intelligence, and mobile technologies enabling new deployment models and capabilities. MarkWide Research analysis indicates that organizations utilizing advanced route optimization technologies achieve operational efficiency improvements of 20-35% compared to traditional manual planning methods.

Economic factors including inflation, fuel price volatility, and labor cost increases create both challenges and opportunities for market participants. While these factors increase operational pressures, they also strengthen the business case for efficiency-improving technologies. Regulatory environment changes, particularly regarding environmental standards and urban access restrictions, influence solution requirements and adoption patterns.

Customer behavior evolution toward on-demand services, real-time visibility, and sustainable practices drives feature development and market positioning strategies. Partnership ecosystems become increasingly important as solution providers collaborate with complementary technology vendors, system integrators, and industry consultants to deliver comprehensive solutions.

Comprehensive research methodology employed for analyzing the UK route optimization software market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes structured interviews with industry executives, technology providers, end-users, and subject matter experts across various sectors utilizing route optimization solutions.

Secondary research encompasses analysis of industry reports, company financial statements, technology documentation, and regulatory publications. Market surveys conducted among current and potential users provide insights into adoption patterns, feature preferences, implementation challenges, and satisfaction levels with existing solutions.

Quantitative analysis utilizes statistical modeling techniques to identify market trends, growth patterns, and correlation factors affecting adoption rates and market development. Qualitative assessment includes case study development, best practice identification, and trend analysis based on expert opinions and industry observations.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert review, and logical consistency checks. Competitive intelligence gathering includes analysis of product capabilities, pricing strategies, market positioning, and strategic initiatives of key market participants. Technology assessment evaluates emerging capabilities, development trends, and potential disruptive innovations that could impact market dynamics.

Regional market distribution across the UK reveals distinct adoption patterns and growth opportunities influenced by economic activity concentration, infrastructure development, and industry clustering. London and Southeast England dominate market activity, accounting for approximately 45% of total market adoption, driven by high e-commerce activity, dense urban delivery requirements, and concentration of logistics operations.

Northern England demonstrates strong growth potential, particularly in manufacturing and industrial logistics applications, with cities like Manchester, Liverpool, and Leeds showing increasing implementation rates. Scotland presents unique opportunities related to rural delivery optimization and integration with ferry and air transport networks for island communities.

Midlands region benefits from its central location and manufacturing heritage, with Birmingham serving as a major logistics hub driving route optimization adoption. Wales shows growing interest in solutions addressing rural delivery challenges and integration with cross-border logistics operations.

Southwest England demonstrates particular strength in tourism-related logistics and seasonal demand optimization, while Northern Ireland focuses on cross-border trade optimization and integration with Republic of Ireland operations. Regional variations in infrastructure quality, traffic patterns, and delivery density create different optimization requirements and solution preferences across geographic areas.

Competitive environment within the UK route optimization software market features diverse participants ranging from global enterprise software providers to specialized routing solution vendors and emerging technology startups. Market leadership positions are held by companies offering comprehensive capabilities, strong integration options, and proven implementation track records.

Competitive strategies focus on technological innovation, vertical market specialization, and strategic partnerships. Market differentiation occurs through algorithm sophistication, user experience design, integration capabilities, and industry-specific functionality development.

Market segmentation analysis reveals distinct categories based on deployment model, organization size, industry vertical, and functional capabilities. By Deployment Model: Cloud-based solutions dominate with approximately 70% market share due to lower upfront costs, easier implementation, and automatic updates, while on-premise deployments serve organizations with specific security or integration requirements.

By Organization Size: Large enterprises represent the primary market segment, though small and medium enterprises show the fastest growth rates as affordable cloud solutions become more accessible. By Industry Vertical: Logistics and transportation companies lead adoption, followed by retail, e-commerce, food and beverage, and field services sectors.

By Functional Capability: Multi-stop route optimization represents the core functionality, with additional features including real-time tracking, driver mobile applications, customer communication, and analytics reporting. By Vehicle Type: Solutions cater to various vehicle categories from small delivery vans to large commercial trucks, each requiring different optimization algorithms and constraints.

Geographic segmentation reflects urban versus rural optimization requirements, with urban solutions focusing on traffic management and delivery density, while rural solutions emphasize distance optimization and fuel efficiency. Integration complexity creates segments based on standalone solutions versus comprehensive platform integrations with existing enterprise systems.

E-commerce and Retail: This category demonstrates the highest growth rates and most sophisticated requirements, driven by customer expectations for fast, flexible delivery options. Last-mile optimization capabilities are critical, with features including delivery time windows, customer preferences, and real-time delivery tracking. Solutions must handle high-volume, multi-stop routes with frequent changes and exceptions.

Logistics and Transportation: Traditional logistics companies focus on cost optimization and operational efficiency, requiring robust capabilities for handling complex vehicle constraints, driver regulations, and multi-day route planning. Fleet management integration and fuel optimization are primary concerns, with solutions needing to accommodate various vehicle types and cargo requirements.

Field Services: This category emphasizes technician scheduling, skill matching, and appointment optimization rather than pure delivery routing. Service time estimation and customer communication capabilities are essential, with solutions requiring integration with work order management and customer relationship management systems.

Food and Beverage: Temperature-sensitive cargo and strict delivery time requirements create unique optimization challenges. Cold chain management integration and route efficiency for perishable goods drive solution selection, with emphasis on minimizing delivery times and maintaining product quality.

Operational efficiency improvements represent the primary benefit category, with organizations typically achieving significant cost reductions of 15-30% through optimized routing, reduced fuel consumption, and improved vehicle utilization. Customer satisfaction enhancement results from more reliable delivery times, improved communication, and increased delivery flexibility.

Environmental impact reduction provides both cost savings and sustainability benefits, with optimized routes reducing carbon emissions and supporting corporate environmental initiatives. Scalability advantages enable organizations to handle growth without proportional increases in operational complexity or resource requirements.

Data-driven decision making capabilities provide insights into operational performance, customer patterns, and improvement opportunities. Competitive advantage accrues to early adopters who can offer superior service levels while maintaining cost competitiveness. Risk mitigation through better planning and real-time visibility reduces operational disruptions and improves service reliability.

Workforce productivity improvements result from eliminating manual planning tasks, reducing driver confusion, and providing clear operational guidance. Compliance management capabilities help organizations meet regulatory requirements and maintain operational standards. Integration benefits create operational synergies when route optimization connects with other business systems and processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as the dominant trend, with machine learning algorithms improving route optimization accuracy and enabling predictive capabilities. Real-time optimization becomes standard functionality rather than premium feature, driven by customer expectations for dynamic routing adjustments based on current conditions.

Mobile-first design prioritizes driver and field worker user experiences, with intuitive mobile applications becoming critical success factors. Sustainability focus drives development of carbon footprint tracking, electric vehicle optimization, and environmental impact reporting capabilities.

API-first architecture enables easier integration and ecosystem development, allowing organizations to build comprehensive logistics technology stacks. Industry specialization increases as vendors develop vertical-specific capabilities addressing unique sector requirements and regulations.

Subscription pricing models become predominant, offering lower entry barriers and predictable cost structures for adopting organizations. Analytics advancement provides deeper insights into operational performance, customer behavior, and optimization opportunities. Autonomous vehicle preparation begins influencing solution design as organizations prepare for future transportation technologies.

Strategic partnerships between route optimization providers and complementary technology vendors create comprehensive solution ecosystems. Acquisition activity increases as larger software companies seek to expand their logistics technology portfolios through targeted acquisitions of specialized routing solution providers.

Cloud migration accelerates as organizations seek to modernize their technology infrastructure and reduce operational complexity. API ecosystem development enables third-party developers to build specialized applications and integrations, expanding solution capabilities and market reach.

Regulatory compliance features expand to address evolving transportation regulations, environmental standards, and data protection requirements. International expansion by UK-based solution providers creates opportunities for global market penetration and revenue growth.

Technology innovation continues with developments in quantum computing applications for complex optimization problems, though practical implementation remains several years away. Sustainability initiatives drive development of green logistics capabilities and carbon-neutral delivery optimization features. Customer experience enhancement focuses on improving end-customer delivery experiences through better communication and flexibility options.

Strategic recommendations for organizations considering route optimization software implementation emphasize the importance of comprehensive needs assessment and clear objective definition before vendor selection. MWR analysis suggests that successful implementations require executive sponsorship, dedicated project management, and comprehensive change management planning.

Vendor selection should prioritize integration capabilities, scalability, and long-term technology roadmap alignment over initial feature comparisons. Implementation approach recommendations favor phased deployments that allow for learning and adjustment rather than comprehensive system replacements.

Data preparation represents a critical success factor, with organizations advised to invest in data quality improvement before system implementation. Training and adoption programs should address both technical system usage and optimization principle understanding to maximize benefit realization.

Performance measurement frameworks should establish baseline metrics before implementation and track both operational improvements and user satisfaction throughout the deployment process. Continuous improvement processes should be established to optimize system configuration and operational procedures based on performance data and user feedback.

Market trajectory indicates continued strong growth driven by increasing delivery complexity, cost optimization pressures, and technological advancement. MarkWide Research projects that adoption rates will continue accelerating, with penetration rates expected to exceed 75% among logistics-intensive organizations over the next five years.

Technology evolution will focus on artificial intelligence enhancement, real-time optimization capabilities, and integration with emerging technologies such as autonomous vehicles and drone delivery systems. Market consolidation is expected to continue as larger technology companies acquire specialized providers to build comprehensive logistics technology platforms.

Vertical market expansion will create opportunities in sectors currently underserved by route optimization solutions, including healthcare, municipal services, and specialized industrial applications. International expansion by UK-based providers will create global growth opportunities and competitive positioning advantages.

Sustainability requirements will increasingly influence solution development and selection criteria, with environmental impact optimization becoming a standard capability rather than specialized feature. Economic factors including continued inflation and resource scarcity will strengthen the business case for efficiency-improving technologies, supporting continued market growth despite potential economic uncertainties.

The UK route optimization software market represents a dynamic and rapidly expanding sector positioned for continued strong growth driven by fundamental shifts in commerce, technology, and operational requirements. Market fundamentals remain robust, with increasing delivery complexity, cost optimization pressures, and environmental sustainability concerns creating compelling drivers for technology adoption across diverse industries.

Technological advancement continues to enhance solution capabilities and accessibility, with artificial intelligence, cloud computing, and mobile technologies democratizing access to sophisticated optimization capabilities. Competitive dynamics foster continued innovation while maintaining reasonable pricing levels, benefiting end-users through improved functionality and value propositions.

Strategic opportunities abound for both technology providers and adopting organizations, with vertical market specialization, small enterprise penetration, and international expansion creating multiple growth vectors. Implementation success requires careful planning, comprehensive change management, and commitment to continuous improvement, but organizations achieving successful deployments typically realize substantial operational and financial benefits.

Future market development will be shaped by continued technological innovation, evolving customer expectations, and increasing regulatory requirements around sustainability and operational efficiency. The UK route optimization software market is well-positioned to capitalize on these trends, offering significant value creation opportunities for all market participants committed to excellence in logistics optimization and operational efficiency.

What is Route Optimization Software?

Route Optimization Software refers to tools and applications designed to enhance the efficiency of transportation routes. These solutions help businesses minimize travel time and costs while improving delivery schedules and customer satisfaction.

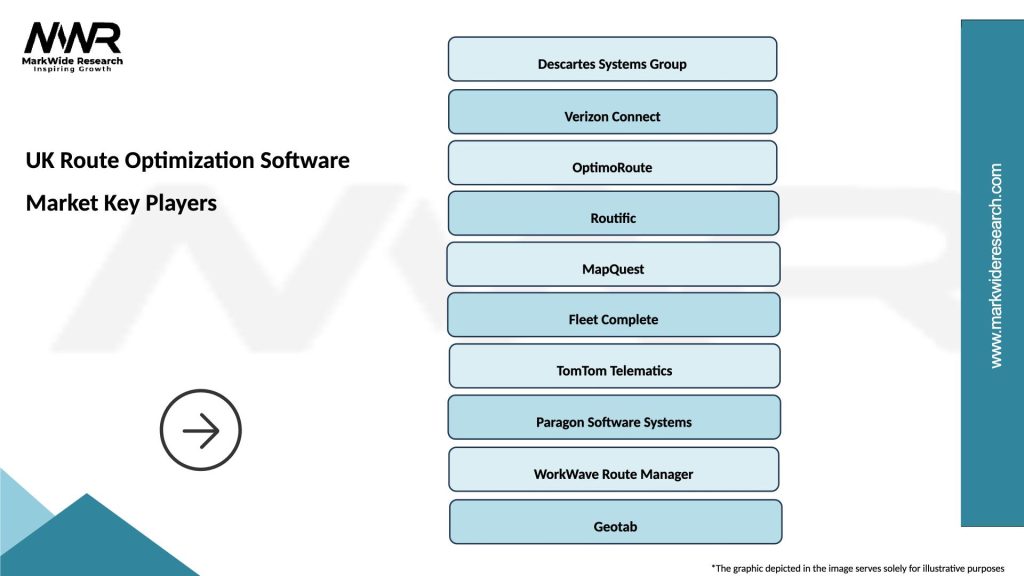

What are the key players in the UK Route Optimization Software Market?

Key players in the UK Route Optimization Software Market include companies like Descartes Systems Group, Trimble, and Verizon Connect, among others. These companies offer various solutions tailored to logistics, fleet management, and delivery services.

What are the main drivers of growth in the UK Route Optimization Software Market?

The main drivers of growth in the UK Route Optimization Software Market include the increasing demand for efficient logistics solutions, the rise of e-commerce, and the need for cost reduction in transportation. Additionally, advancements in technology and data analytics are enhancing route planning capabilities.

What challenges does the UK Route Optimization Software Market face?

Challenges in the UK Route Optimization Software Market include the complexity of integrating software with existing systems, data privacy concerns, and the need for continuous updates to adapt to changing regulations and traffic conditions. These factors can hinder adoption and implementation.

What opportunities exist in the UK Route Optimization Software Market?

Opportunities in the UK Route Optimization Software Market include the growing trend of smart city initiatives, which require efficient transportation solutions, and the increasing adoption of electric vehicles that necessitate optimized routing for sustainability. Additionally, the rise of AI and machine learning can enhance software capabilities.

What trends are shaping the UK Route Optimization Software Market?

Trends shaping the UK Route Optimization Software Market include the integration of real-time data analytics, the use of cloud-based solutions for scalability, and the focus on sustainability in logistics. These trends are driving innovation and improving the overall efficiency of route planning.

UK Route Optimization Software Market

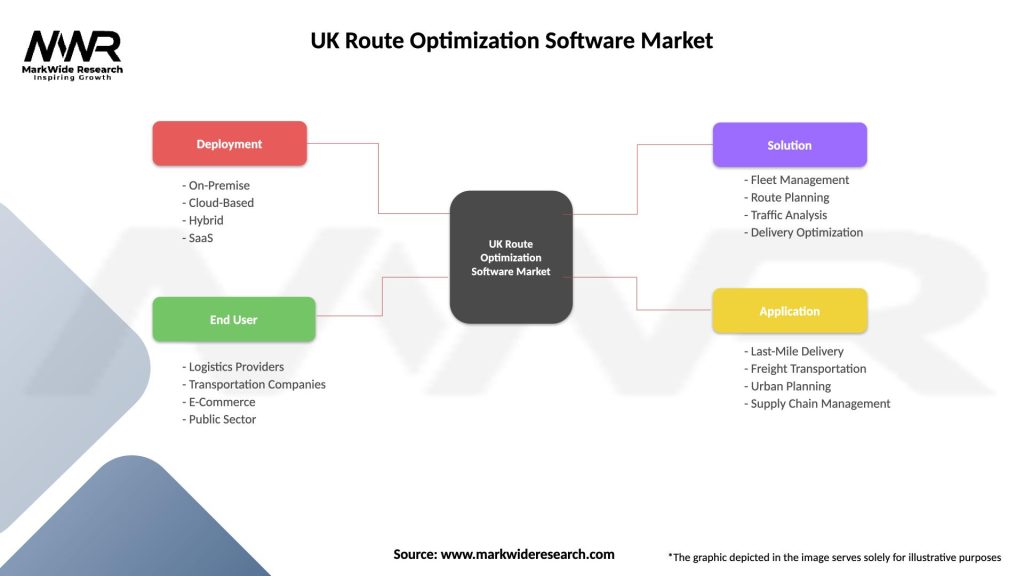

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | Logistics Providers, Transportation Companies, E-Commerce, Public Sector |

| Solution | Fleet Management, Route Planning, Traffic Analysis, Delivery Optimization |

| Application | Last-Mile Delivery, Freight Transportation, Urban Planning, Supply Chain Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Route Optimization Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at