444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK road freight services market represents a cornerstone of the nation’s logistics infrastructure, facilitating the movement of goods across diverse sectors including retail, manufacturing, construction, and e-commerce. This dynamic market encompasses various transportation modes, from last-mile delivery services to long-haul freight operations, serving as the backbone of supply chain networks throughout England, Scotland, Wales, and Northern Ireland.

Market dynamics indicate robust growth driven by increasing e-commerce penetration, which has reached 28.5% of total retail sales, and the ongoing digital transformation of traditional logistics operations. The sector has demonstrated remarkable resilience, adapting to changing consumer behaviors and regulatory requirements while maintaining operational efficiency across urban and rural distribution networks.

Technological advancement continues to reshape the landscape, with fleet operators increasingly adopting telematics systems, route optimization software, and electric vehicle technologies. The integration of artificial intelligence and machine learning algorithms has enhanced delivery precision and reduced operational costs by approximately 15-20% for leading service providers.

Regional distribution shows concentrated activity in major metropolitan areas including London, Manchester, Birmingham, and Glasgow, while rural connectivity remains essential for comprehensive national coverage. The market serves diverse customer segments ranging from small businesses requiring flexible delivery solutions to large corporations demanding sophisticated logistics partnerships.

The UK road freight services market refers to the comprehensive ecosystem of commercial transportation services that facilitate the movement of goods via road networks across the United Kingdom, encompassing everything from local delivery operations to international freight forwarding services.

Service categories within this market include full truckload (FTL) services, less-than-truckload (LTL) operations, express delivery services, specialized freight handling, temperature-controlled transportation, and last-mile delivery solutions. These services form an integrated network that supports domestic commerce and international trade flows.

Market participants range from multinational logistics corporations operating extensive fleet networks to specialized regional carriers focusing on niche market segments. The sector includes both asset-based operators maintaining their own vehicle fleets and asset-light brokers coordinating transportation services through partner networks.

Regulatory framework governing the market includes driver working time regulations, vehicle safety standards, environmental compliance requirements, and licensing protocols administered by the Driver and Vehicle Standards Agency (DVSA) and other relevant authorities.

Strategic positioning of the UK road freight services market reflects its critical role in supporting economic activity across all sectors, with particular strength in serving the rapidly expanding e-commerce segment and maintaining resilient supply chains for essential goods distribution.

Growth trajectory demonstrates consistent expansion despite periodic challenges, with the market experiencing accelerated demand driven by changing consumer expectations for faster delivery times and increased online shopping penetration, which grew by 12.3% year-over-year in recent periods.

Competitive landscape features a mix of established international players, regional specialists, and emerging technology-focused entrants, creating a dynamic environment that encourages innovation and service differentiation. Market consolidation trends have intensified as operators seek economies of scale and expanded geographic coverage.

Technology adoption has become a key differentiator, with leading operators investing heavily in digital platforms, automated sorting systems, and sustainable transportation solutions. The implementation of advanced analytics and predictive modeling has improved delivery success rates by approximately 18% across major service providers.

Future outlook indicates continued growth supported by infrastructure investments, regulatory support for clean transportation technologies, and ongoing evolution of consumer commerce patterns favoring flexible, responsive logistics solutions.

Operational excellence has emerged as a primary competitive advantage, with successful operators demonstrating superior performance across key metrics including on-time delivery rates, damage reduction, and customer satisfaction scores.

E-commerce expansion continues to serve as the primary growth catalyst, with online retail penetration creating unprecedented demand for flexible, responsive delivery services. The shift toward omnichannel retail strategies has generated complex logistics requirements that traditional freight operators are adapting to meet.

Consumer expectations for faster delivery times and real-time tracking capabilities have fundamentally altered service standards across the industry. Same-day and next-day delivery options have transitioned from premium services to standard offerings, driving operational innovation and network optimization.

Supply chain localization trends have increased demand for regional distribution services as businesses seek to reduce dependency on extended international supply chains. This shift has created opportunities for domestic freight operators to capture additional market share.

Infrastructure investments in road networks, digital connectivity, and logistics facilities have enhanced operational capabilities and reduced transportation costs. Government support for clean transportation initiatives has accelerated fleet modernization programs across the sector.

Regulatory compliance requirements related to environmental standards and safety protocols have driven technological advancement and operational improvements, creating competitive advantages for early adopters of compliant systems and processes.

Driver shortage represents a significant operational challenge, with the industry experiencing persistent difficulties in recruiting and retaining qualified commercial drivers. This constraint has led to increased labor costs and operational limitations for many service providers.

Fuel price volatility creates ongoing cost pressures that impact profitability and pricing strategies. Operators must continuously adjust service rates and operational procedures to maintain margins while remaining competitive in price-sensitive market segments.

Regulatory complexity associated with environmental compliance, working time restrictions, and safety requirements increases operational costs and administrative burden. Smaller operators particularly struggle with the resources required for comprehensive compliance management.

Infrastructure constraints in urban areas, including traffic congestion, parking limitations, and access restrictions, create operational inefficiencies and increased delivery costs. These challenges are particularly acute in major metropolitan areas during peak traffic periods.

Economic uncertainty and fluctuating demand patterns make capacity planning and investment decisions more challenging. Operators must balance fleet expansion with the risk of overcapacity during economic downturns.

Green logistics initiatives present substantial growth opportunities as businesses and consumers increasingly prioritize environmental sustainability. The transition to electric and alternative fuel vehicles opens new market segments and potential government incentive programs.

Technology integration offers multiple avenues for service enhancement and cost reduction. Opportunities include autonomous vehicle deployment, advanced route optimization, predictive maintenance systems, and enhanced customer communication platforms.

Specialized services development can create premium revenue streams through temperature-controlled transportation, hazardous materials handling, oversized cargo movement, and time-critical delivery solutions. These niche segments often command higher margins and customer loyalty.

International expansion opportunities exist through strategic partnerships and cross-border service development, particularly as trade relationships evolve and new market access agreements are established.

Value-added services including warehousing, inventory management, packaging, and reverse logistics can differentiate operators and create additional revenue streams while strengthening customer relationships.

Competitive intensity continues to escalate as traditional freight operators face competition from technology-enabled startups, e-commerce giants developing internal logistics capabilities, and international players expanding their UK operations. This dynamic environment rewards innovation and operational excellence while pressuring profit margins.

Customer expectations have evolved significantly, with businesses demanding greater transparency, flexibility, and reliability from their logistics partners. The ability to provide real-time tracking, flexible delivery windows, and responsive customer service has become essential for market success.

Technology disruption is reshaping operational models across the industry, with artificial intelligence, machine learning, and Internet of Things (IoT) technologies enabling new levels of efficiency and service quality. Early adopters are gaining significant competitive advantages through improved route optimization and predictive analytics.

Regulatory evolution continues to influence market dynamics, particularly regarding environmental standards, safety requirements, and cross-border trade procedures. Operators must maintain agility to adapt to changing regulatory landscapes while ensuring compliance across all operational areas.

Market consolidation trends reflect the need for scale economies and comprehensive service capabilities. Strategic acquisitions and partnerships are reshaping the competitive landscape as operators seek to expand geographic coverage and service portfolios.

Comprehensive analysis of the UK road freight services market incorporates multiple research approaches to ensure accuracy and depth of insights. Primary research methodologies include structured interviews with industry executives, operational managers, and key stakeholders across the logistics value chain.

Data collection processes encompass quantitative analysis of market performance metrics, operational statistics, and financial indicators from leading service providers. Secondary research incorporates industry reports, regulatory filings, and trade association publications to validate findings and identify emerging trends.

Market segmentation analysis examines performance across different service categories, geographic regions, and customer segments to identify growth opportunities and competitive dynamics. This approach provides granular insights into market behavior and strategic positioning requirements.

Stakeholder engagement includes consultations with customers, suppliers, regulatory bodies, and industry associations to understand market drivers, challenges, and future development prospects. These interactions provide qualitative context for quantitative findings.

Trend analysis incorporates historical performance data, current market conditions, and forward-looking indicators to develop comprehensive market projections and strategic recommendations for industry participants.

London and Southeast England dominate market activity, accounting for approximately 35% of total freight volumes due to high population density, extensive commercial activity, and major port facilities. This region demonstrates the highest adoption rates for advanced logistics technologies and premium service offerings.

Midlands region serves as a critical distribution hub, leveraging its central geographic position to support nationwide logistics networks. The area hosts major fulfillment centers and cross-docking facilities that facilitate efficient goods movement across the UK.

Northern England including Manchester, Liverpool, and Leeds represents a significant market segment with strong industrial heritage and growing e-commerce activity. The region benefits from excellent transport infrastructure and competitive operational costs.

Scotland presents unique challenges and opportunities, with concentrated urban markets in Glasgow and Edinburgh balanced by extensive rural territories requiring specialized delivery solutions. Cross-border connectivity with England remains essential for comprehensive service coverage.

Wales and Northern Ireland represent smaller but important market segments with specific geographic and regulatory considerations. These regions require tailored service approaches that account for terrain challenges and cross-border logistics requirements.

Market leadership is distributed among several categories of operators, each with distinct competitive advantages and strategic positioning. The landscape includes international logistics giants, domestic specialists, and emerging technology-focused entrants.

Competitive differentiation increasingly focuses on technology capabilities, sustainability initiatives, and specialized service offerings rather than traditional price competition alone.

By Service Type: The market encompasses diverse service categories including express delivery, standard parcel services, full truckload operations, less-than-truckload services, and specialized freight handling. Express delivery segments demonstrate the highest growth rates, driven by e-commerce demand and consumer expectations for rapid fulfillment.

By End-User Industry: Key customer segments include retail and e-commerce, manufacturing, automotive, healthcare and pharmaceuticals, food and beverage, construction, and government sectors. Each segment presents unique requirements for service levels, handling procedures, and regulatory compliance.

By Geographic Coverage: Services range from local and regional operations to national and international connectivity. Urban delivery services show different characteristics compared to rural and remote area coverage, with varying cost structures and operational challenges.

By Vehicle Type: Fleet composition includes light commercial vehicles, medium-duty trucks, heavy-duty tractors and trailers, and specialized vehicles for temperature-controlled or hazardous materials transport. Electric and hybrid vehicles represent a growing segment within fleet modernization programs.

By Technology Integration: Segmentation includes traditional operators, technology-enhanced services, and fully digital platforms. Advanced technology adoption correlates with premium service capabilities and higher customer satisfaction rates.

Express Delivery Services continue to experience robust growth, with same-day and next-day delivery options becoming standard expectations rather than premium services. This category benefits from high margins but requires significant infrastructure investment and operational sophistication.

E-commerce Fulfillment represents the fastest-growing segment, with specialized services including returns handling, flexible delivery windows, and customer communication systems. Operators in this category must balance cost efficiency with service quality to maintain competitiveness.

B2B Freight Services maintain steady demand from manufacturing and wholesale sectors, with emphasis on reliability, capacity flexibility, and integrated supply chain solutions. This segment values long-term partnerships and consistent service performance over price competition.

Specialized Transport including temperature-controlled, hazardous materials, and oversized cargo services command premium pricing due to regulatory requirements and specialized equipment needs. These categories offer defensive market positions with higher barriers to entry.

Last-Mile Delivery innovations including locker networks, collection points, and alternative delivery methods are reshaping urban logistics. This category shows significant potential for technology-driven disruption and service enhancement.

Operational efficiency improvements through technology adoption and process optimization enable cost reduction and service enhancement. Leading operators report operational cost savings of 12-15% through advanced route optimization and fleet management systems.

Market expansion opportunities arise from growing e-commerce penetration and changing consumer behaviors. Operators can capture additional market share by developing specialized services and expanding geographic coverage.

Customer relationship strengthening through enhanced service capabilities and communication systems creates competitive advantages and revenue stability. Long-term partnerships with major retailers and manufacturers provide predictable revenue streams.

Technology leverage enables new service offerings and operational capabilities that differentiate operators in competitive markets. Investment in digital platforms and automation systems generates long-term competitive advantages.

Sustainability positioning through clean transportation initiatives and environmental compliance creates positive brand differentiation and access to environmentally conscious customer segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation is accelerating across the industry, with operators investing heavily in electric vehicle fleets, alternative fuel systems, and carbon reduction programs. This trend reflects both regulatory requirements and customer preferences for environmentally responsible logistics partners.

Digital integration continues to reshape customer interactions and operational processes. Advanced mobile applications, real-time tracking systems, and predictive analytics are becoming standard capabilities rather than competitive differentiators.

Micro-fulfillment networks are emerging in urban areas to support rapid delivery requirements. These facilities enable same-day and even hourly delivery services while reducing transportation costs and environmental impact.

Autonomous vehicle development represents a long-term transformation opportunity, with several operators conducting pilot programs and feasibility studies. While full deployment remains years away, the technology promises significant operational efficiency improvements.

Collaborative logistics models including shared transportation networks and consolidated delivery services are gaining traction as operators seek to optimize capacity utilization and reduce costs.

Fleet electrification initiatives have accelerated significantly, with major operators announcing substantial investments in electric vehicle procurement and charging infrastructure development. These programs reflect both environmental commitments and operational cost reduction strategies.

Technology partnerships between traditional logistics operators and software companies are creating enhanced service capabilities and operational efficiencies. These collaborations focus on route optimization, predictive maintenance, and customer communication systems.

Acquisition activity has intensified as operators seek to expand geographic coverage, acquire specialized capabilities, and achieve scale economies. Strategic consolidation is reshaping the competitive landscape across multiple market segments.

Regulatory adaptations following Brexit have required significant operational adjustments for cross-border services. Operators have invested in customs clearance capabilities and documentation systems to maintain service continuity.

Infrastructure investments by both private operators and government agencies are enhancing transportation networks and logistics facilities. These developments support capacity expansion and operational efficiency improvements across the sector.

Technology investment should remain a priority for operators seeking competitive advantage and operational efficiency. MarkWide Research analysis indicates that companies investing in advanced digital platforms achieve 20-25% higher customer satisfaction scores compared to traditional operators.

Sustainability initiatives require immediate attention as regulatory requirements tighten and customer preferences shift toward environmentally responsible service providers. Early adoption of clean transportation technologies provides competitive positioning advantages.

Workforce development programs addressing driver shortages and skill requirements should receive increased focus. Successful operators are implementing comprehensive training, retention, and recruitment strategies to maintain operational capacity.

Service diversification into specialized segments and value-added services can improve profit margins and customer retention. Operators should evaluate opportunities in temperature-controlled transport, reverse logistics, and integrated supply chain solutions.

Strategic partnerships with technology providers, e-commerce platforms, and complementary service providers can accelerate capability development and market expansion while sharing investment risks and costs.

Growth trajectory for the UK road freight services market remains positive, supported by continued e-commerce expansion, infrastructure investments, and technological advancement. MWR projections indicate sustained growth driven by evolving consumer behaviors and business logistics requirements.

Technology integration will accelerate, with artificial intelligence, machine learning, and automation systems becoming standard operational tools. These technologies will enable new service capabilities while reducing costs and improving reliability.

Environmental compliance requirements will intensify, driving continued fleet modernization and operational optimization. Operators that proactively adopt sustainable practices will gain competitive advantages and regulatory compliance benefits.

Market consolidation is expected to continue as operators seek scale economies and comprehensive service capabilities. Strategic acquisitions and partnerships will reshape the competitive landscape over the next five years.

Customer expectations will continue evolving toward greater flexibility, transparency, and sustainability. Successful operators will differentiate through superior service quality and innovative delivery solutions rather than price competition alone.

The UK road freight services market represents a dynamic and essential component of the national economy, demonstrating resilience and adaptability in response to changing market conditions and customer requirements. The sector’s evolution from traditional transportation services to sophisticated logistics solutions reflects broader economic trends and technological advancement.

Strategic positioning for future success requires balanced investment in technology capabilities, sustainability initiatives, and operational excellence. Operators that successfully integrate these elements while maintaining cost competitiveness will capture the greatest market opportunities in the evolving landscape.

Market fundamentals remain strong, supported by continued e-commerce growth, infrastructure development, and regulatory frameworks that encourage innovation and service quality improvement. The sector’s critical role in supporting economic activity ensures continued relevance and growth potential across diverse market segments.

Future success will depend on operators’ ability to adapt to changing customer expectations, regulatory requirements, and competitive dynamics while maintaining operational efficiency and service quality. The UK road freight services market is well-positioned to continue its evolution as a cornerstone of modern commerce and logistics infrastructure.

What is UK Road Freight Services?

UK Road Freight Services refer to the transportation of goods by road within the United Kingdom. This includes various logistics operations such as trucking, delivery services, and freight forwarding that facilitate the movement of products across regions.

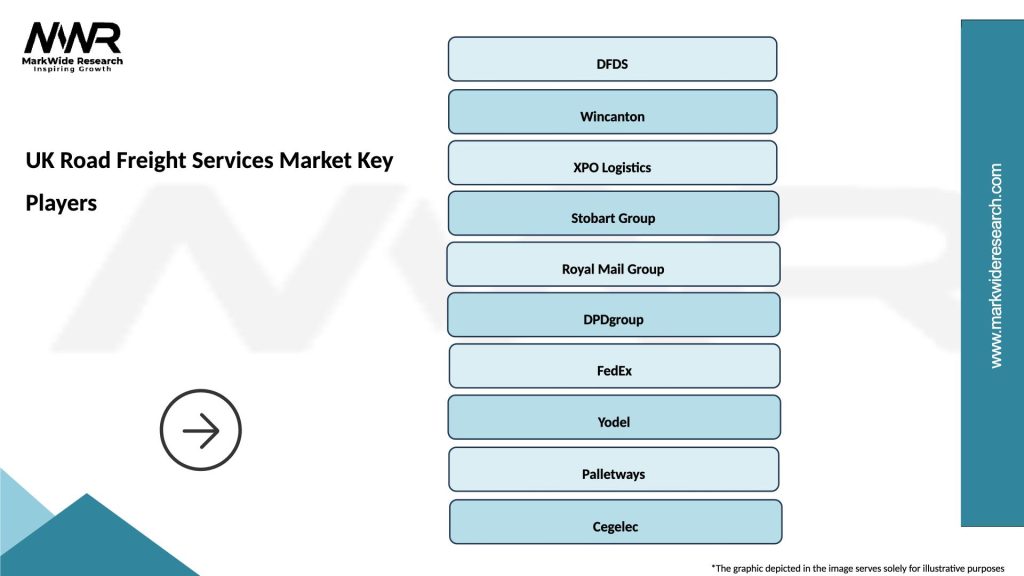

What are the key players in the UK Road Freight Services Market?

Key players in the UK Road Freight Services Market include companies like DHL, XPO Logistics, and Eddie Stobart, which provide comprehensive logistics and transportation solutions. These companies are known for their extensive networks and innovative service offerings, among others.

What are the main drivers of growth in the UK Road Freight Services Market?

The main drivers of growth in the UK Road Freight Services Market include the increasing demand for e-commerce logistics, the rise in consumer goods transportation, and advancements in supply chain management technologies. These factors contribute to a more efficient and responsive freight service.

What challenges does the UK Road Freight Services Market face?

The UK Road Freight Services Market faces challenges such as rising fuel costs, driver shortages, and regulatory compliance issues. These factors can impact operational efficiency and service delivery in the sector.

What opportunities exist in the UK Road Freight Services Market?

Opportunities in the UK Road Freight Services Market include the growth of green logistics initiatives, the adoption of digital technologies for tracking and management, and the expansion of last-mile delivery services. These trends can enhance service offerings and customer satisfaction.

What trends are shaping the UK Road Freight Services Market?

Trends shaping the UK Road Freight Services Market include the increasing use of automation and AI in logistics, the shift towards sustainable transportation solutions, and the integration of real-time data analytics for improved decision-making. These innovations are transforming how freight services operate.

UK Road Freight Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Full Truck Load, Less Than Truck Load, Dedicated Freight, Intermodal Transport |

| Vehicle Type | Articulated Lorry, Rigid Truck, Van, Refrigerated Truck |

| End User | Retail, Manufacturing, Construction, E-commerce |

| Fuel Type | Diesel, Electric, Hybrid, Compressed Natural Gas |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Road Freight Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at