444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK respiratory devices market represents a critical segment of the healthcare technology landscape, encompassing a comprehensive range of therapeutic and diagnostic equipment designed to address respiratory conditions. This market has experienced remarkable transformation driven by technological innovations, demographic shifts, and evolving healthcare delivery models across the United Kingdom. Respiratory devices serve millions of patients suffering from conditions such as chronic obstructive pulmonary disease (COPD), asthma, sleep apnea, and other breathing disorders.

Market dynamics indicate substantial growth potential, with the sector demonstrating resilience and adaptability in response to changing healthcare needs. The market encompasses various device categories including ventilators, nebulizers, oxygen concentrators, CPAP machines, spirometers, and portable respiratory monitoring systems. Healthcare providers across the UK are increasingly adopting advanced respiratory technologies to improve patient outcomes and reduce healthcare costs.

Recent developments show the market expanding at a compound annual growth rate of 6.8%, reflecting strong demand for innovative respiratory solutions. The integration of digital health technologies, artificial intelligence, and remote monitoring capabilities has revolutionized traditional respiratory care approaches. Patient-centric care models are driving adoption of home-based respiratory devices, reducing hospital readmissions and improving quality of life for chronic respiratory disease patients.

The UK respiratory devices market refers to the comprehensive ecosystem of medical equipment, technologies, and solutions designed to diagnose, monitor, and treat respiratory conditions within the United Kingdom healthcare system. This market encompasses both invasive and non-invasive devices that support breathing function, deliver therapeutic interventions, and provide diagnostic capabilities for respiratory disorders.

Respiratory devices include a broad spectrum of equipment ranging from basic nebulizers and inhalers to sophisticated mechanical ventilators and advanced sleep therapy systems. These devices serve diverse patient populations across various healthcare settings including hospitals, clinics, home care environments, and long-term care facilities. Market participants include device manufacturers, healthcare providers, distributors, and technology integrators working collaboratively to deliver comprehensive respiratory care solutions.

The market definition extends beyond traditional medical devices to include digital health platforms, remote monitoring systems, and integrated care solutions that support respiratory health management. This holistic approach reflects the evolving nature of respiratory care delivery in the UK healthcare landscape.

The UK respiratory devices market demonstrates robust growth trajectory supported by increasing prevalence of respiratory diseases, aging population demographics, and technological advancement in medical device innovation. Key market drivers include rising COPD incidence rates, growing awareness of sleep disorders, and expanding home healthcare adoption across the United Kingdom.

Market segmentation reveals diverse opportunities across product categories, with mechanical ventilators, oxygen therapy devices, and sleep apnea treatment systems representing the largest market segments. Healthcare digitization trends are creating new growth avenues through connected devices, telemedicine integration, and artificial intelligence-powered diagnostic solutions.

Competitive landscape features established global manufacturers alongside innovative technology companies developing next-generation respiratory solutions. The market benefits from strong regulatory framework provided by the Medicines and Healthcare products Regulatory Agency (MHRA) and National Health Service (NHS) procurement processes. Future growth prospects remain positive, with market expansion expected to accelerate at 7.2% annually through the forecast period.

Strategic market analysis reveals several critical insights shaping the UK respiratory devices landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Multiple factors are propelling growth in the UK respiratory devices market, creating sustained demand for innovative respiratory solutions across diverse healthcare settings. Primary market drivers include epidemiological trends, technological advancement, and evolving healthcare delivery models.

Respiratory disease prevalence continues increasing across the UK population, with COPD affecting approximately 3.2% of adults and asthma impacting over 5.4 million people nationwide. These chronic conditions require ongoing respiratory support and monitoring, driving consistent demand for therapeutic devices and diagnostic equipment. Air quality concerns and environmental factors are contributing to rising respiratory disease incidence rates, particularly in urban areas.

Healthcare system transformation toward value-based care models is encouraging adoption of respiratory devices that demonstrate clinical efficacy and cost-effectiveness. NHS initiatives focused on reducing hospital readmissions and improving patient outcomes are creating favorable conditions for home-based respiratory therapy solutions. Digital health integration is enabling remote patient monitoring and telemedicine applications that enhance respiratory care delivery while reducing healthcare costs.

Technological innovation in respiratory device design is improving patient compliance, treatment effectiveness, and quality of life outcomes. Advanced features such as smart connectivity, automated therapy adjustment, and integrated data analytics are making respiratory devices more user-friendly and clinically valuable.

Several challenges are constraining growth potential in the UK respiratory devices market, requiring strategic approaches from market participants to address these limitations effectively. Key market restraints include regulatory complexities, cost pressures, and technological barriers.

Regulatory compliance requirements impose significant development costs and time-to-market delays for respiratory device manufacturers. Post-Brexit regulatory landscape has created additional complexity for international manufacturers seeking UK market access, requiring separate regulatory approvals and compliance processes. Clinical evidence requirements for new respiratory devices are becoming increasingly stringent, demanding comprehensive clinical trials and long-term outcome studies.

Healthcare budget constraints within the NHS are limiting procurement of advanced respiratory devices, particularly in non-critical care settings. Cost-containment pressures are forcing healthcare providers to prioritize essential respiratory equipment while deferring investments in innovative technologies. Reimbursement challenges for certain respiratory device categories are creating barriers to market adoption and patient access.

Technical complexity of advanced respiratory devices can create implementation challenges for healthcare providers lacking specialized training and support resources. Interoperability issues between different respiratory device systems and electronic health records are complicating clinical workflow integration and data management processes.

Significant opportunities exist within the UK respiratory devices market for companies developing innovative solutions that address unmet clinical needs and emerging healthcare trends. Market opportunities span across technology innovation, care delivery transformation, and demographic-driven demand growth.

Digital health integration presents substantial opportunities for respiratory device manufacturers to develop connected solutions that enable remote monitoring, predictive analytics, and personalized therapy optimization. Artificial intelligence applications in respiratory care are creating new possibilities for automated diagnosis, treatment recommendation, and outcome prediction. Telemedicine expansion is driving demand for respiratory devices compatible with virtual care delivery models.

Home healthcare growth represents a major opportunity for portable and user-friendly respiratory devices that enable effective treatment outside traditional healthcare settings. Patient empowerment trends are creating demand for respiratory devices that provide real-time feedback, educational content, and self-management capabilities. Chronic disease management programs are expanding opportunities for comprehensive respiratory care solutions that integrate multiple device types and services.

Emerging market segments including pediatric respiratory care, sleep medicine, and respiratory rehabilitation are presenting new growth avenues for specialized device manufacturers. Public health initiatives focused on respiratory disease prevention and early intervention are creating opportunities for diagnostic and screening devices.

Complex market dynamics are shaping the evolution of the UK respiratory devices market, influenced by healthcare policy changes, technological advancement, and competitive pressures. Market forces include supply and demand factors, regulatory influences, and innovation cycles that collectively determine market growth patterns and competitive positioning.

Demand-side dynamics are driven by increasing respiratory disease prevalence, aging population demographics, and growing awareness of respiratory health importance. Healthcare provider preferences are shifting toward respiratory devices that offer clinical evidence, cost-effectiveness, and integration capabilities with existing healthcare systems. Patient expectations for convenient, effective, and user-friendly respiratory devices are influencing product development priorities and market positioning strategies.

Supply-side dynamics include manufacturing capacity expansion, technological innovation investments, and strategic partnerships between device manufacturers and healthcare providers. Competitive pressures are driving continuous product improvement, pricing optimization, and service enhancement initiatives across the respiratory devices sector. Regulatory dynamics continue evolving in response to technological advancement and safety considerations, requiring adaptive strategies from market participants.

Economic factors including healthcare spending patterns, reimbursement policies, and currency fluctuations are influencing market accessibility and growth potential. According to MarkWide Research, market dynamics indicate sustained growth momentum with efficiency improvements of 23% in respiratory care delivery through advanced device technologies.

Comprehensive research methodology employed for analyzing the UK respiratory devices market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights. Research approach combines quantitative analysis with qualitative assessment to provide holistic understanding of market dynamics and growth opportunities.

Primary research activities include structured interviews with healthcare professionals, respiratory device manufacturers, distributors, and regulatory experts across the UK healthcare ecosystem. Survey methodologies capture insights from hospital administrators, clinical specialists, and home healthcare providers regarding respiratory device adoption patterns, preferences, and challenges. Expert consultations with respiratory medicine specialists and healthcare technology analysts provide clinical and technical perspectives on market trends.

Secondary research sources encompass government healthcare statistics, medical device regulatory databases, clinical literature, and industry publications. Market data validation processes include cross-referencing multiple sources, statistical analysis, and expert review to ensure data accuracy and consistency. Analytical frameworks incorporate market sizing methodologies, competitive analysis models, and trend projection techniques.

Research limitations are acknowledged and addressed through conservative estimation approaches and sensitivity analysis. Data collection timeframes span multiple years to capture market evolution patterns and cyclical variations in respiratory device demand and adoption.

Regional market analysis reveals significant variations in respiratory device adoption, healthcare infrastructure, and market growth potential across different areas of the United Kingdom. Geographic distribution of respiratory disease prevalence and healthcare resources creates distinct regional market characteristics and opportunities.

England dominates the UK respiratory devices market with approximately 84% market share, driven by large population base, extensive healthcare infrastructure, and concentration of major medical centers. London and Southeast regions represent the highest-value markets due to advanced healthcare facilities, research institutions, and higher healthcare spending levels. Northern England regions show strong growth potential driven by industrial heritage and associated respiratory health challenges.

Scotland accounts for approximately 8% of market share, with Edinburgh and Glasgow serving as primary market centers for respiratory device distribution and clinical services. Scottish healthcare initiatives focused on rural healthcare delivery are creating opportunities for portable and telemedicine-enabled respiratory devices. Wales represents about 5% market share, with Cardiff and Swansea leading regional demand for respiratory care solutions.

Northern Ireland comprises roughly 3% of market share, with Belfast serving as the primary healthcare hub for respiratory device services. Cross-border healthcare cooperation with the Republic of Ireland creates unique market dynamics and regulatory considerations for respiratory device manufacturers and distributors.

The competitive landscape of the UK respiratory devices market features a diverse mix of global medical device manufacturers, specialized respiratory care companies, and emerging technology innovators. Market competition is characterized by continuous innovation, strategic partnerships, and focus on clinical evidence and cost-effectiveness.

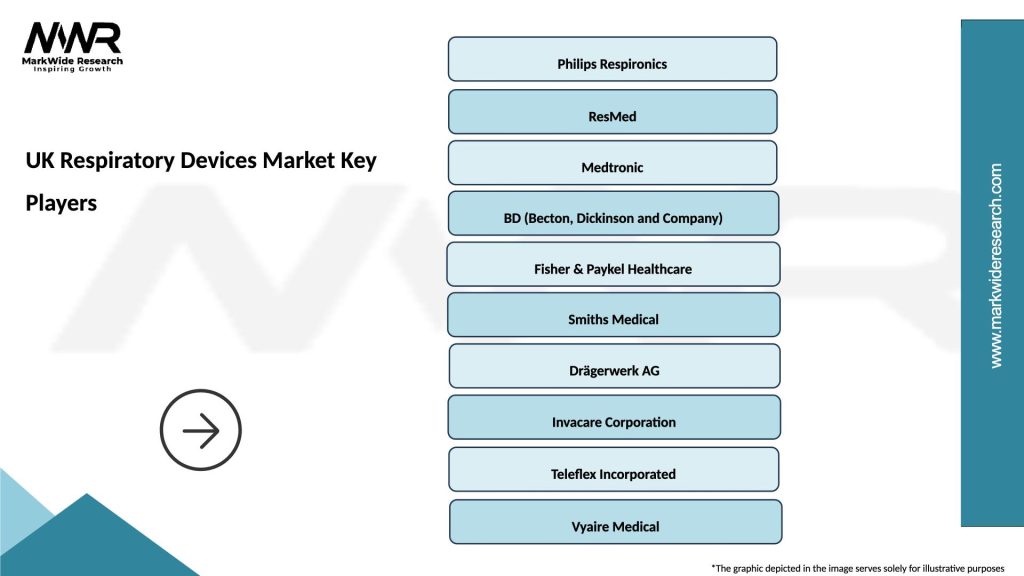

Leading market participants include established companies with comprehensive respiratory device portfolios and strong UK market presence:

Competitive strategies include product innovation, clinical evidence development, strategic acquisitions, and partnership formation with UK healthcare providers. Market differentiation focuses on technological advancement, clinical outcomes, and total cost of ownership considerations.

Market segmentation analysis provides detailed understanding of the UK respiratory devices market structure, revealing distinct product categories, application areas, and end-user segments with unique characteristics and growth patterns. Segmentation framework enables targeted market strategies and opportunity identification across diverse respiratory care applications.

By Product Type:

By Application:

By End User:

Detailed category analysis reveals specific market dynamics, growth drivers, and competitive factors within major respiratory device segments, providing actionable insights for market participants and stakeholders. Category performance varies significantly based on clinical applications, technological maturity, and regulatory requirements.

Mechanical Ventilators Category: Represents the highest-value segment within the UK respiratory devices market, driven by critical care applications and technological advancement. Intensive care ventilators dominate this category, with increasing demand for portable and transport ventilators. Innovation focus includes artificial intelligence integration, automated weaning protocols, and enhanced patient-ventilator synchronization capabilities.

Sleep Therapy Devices Category: Demonstrates the strongest growth momentum with annual expansion of 9.1%, reflecting increased sleep disorder diagnosis and treatment awareness. CPAP machines represent the largest subsegment, while BiPAP devices show growing adoption for complex sleep apnea cases. Connected devices with remote monitoring capabilities are gaining significant market traction.

Oxygen Therapy Devices Category: Shows steady growth driven by COPD prevalence and home healthcare expansion. Portable oxygen concentrators represent the fastest-growing subsegment, enabling patient mobility and improved quality of life. Stationary concentrators maintain strong demand for home-based long-term oxygen therapy applications.

Nebulizers and Inhalation Devices Category: Benefits from asthma and COPD treatment requirements, with mesh nebulizers gaining preference over traditional jet nebulizers due to efficiency and portability advantages. Smart inhalers with digital tracking capabilities represent emerging growth opportunities within this category.

Industry participants and stakeholders across the UK respiratory devices market ecosystem can realize significant benefits through strategic positioning and collaborative approaches. Value creation opportunities exist for manufacturers, healthcare providers, distributors, and technology partners willing to invest in market development and innovation.

For Device Manufacturers:

For Healthcare Providers:

For Patients and Caregivers:

Comprehensive SWOT analysis provides strategic assessment of the UK respiratory devices market, identifying internal strengths and weaknesses alongside external opportunities and threats that influence market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends are reshaping the UK respiratory devices landscape, driven by technological innovation, changing healthcare delivery models, and evolving patient expectations. Key trends provide strategic insights for market participants seeking to capitalize on growth opportunities and address emerging challenges.

Digital Health Integration Trend: Respiratory devices are increasingly incorporating connectivity features, enabling remote monitoring, data analytics, and telemedicine applications. Connected devices allow healthcare providers to track patient compliance, monitor treatment effectiveness, and adjust therapy protocols remotely. Artificial intelligence integration is enabling predictive analytics and automated treatment optimization capabilities.

Home Healthcare Expansion Trend: Shift toward home-based respiratory care is accelerating, driven by patient preferences, cost-containment pressures, and improved device portability. Portable oxygen concentrators, home ventilators, and sleep therapy devices are experiencing strong demand growth. Patient education programs and remote support services are becoming integral components of home respiratory care delivery.

Personalized Medicine Trend: Respiratory care is becoming increasingly personalized through advanced diagnostic capabilities and customized treatment protocols. Precision medicine approaches are enabling targeted therapy selection based on patient-specific factors and biomarkers. Adaptive therapy algorithms automatically adjust treatment parameters based on real-time patient response and clinical data.

Sustainability Focus Trend: Environmental considerations are influencing respiratory device design, manufacturing, and disposal processes. Eco-friendly materials, energy-efficient operation, and recyclable components are becoming important product differentiation factors. Circular economy principles are being applied to device lifecycle management and waste reduction initiatives.

Recent industry developments demonstrate the dynamic nature of the UK respiratory devices market, with significant innovations, partnerships, and regulatory changes shaping market evolution. Industry developments provide insights into competitive strategies and emerging growth opportunities.

Technology Innovation Developments: Major respiratory device manufacturers have launched next-generation products featuring artificial intelligence, advanced sensors, and cloud connectivity. Smart ventilators with automated weaning protocols and predictive analytics capabilities are gaining clinical adoption. Wearable respiratory monitors enabling continuous patient tracking outside healthcare facilities represent emerging technology categories.

Strategic Partnership Developments: Healthcare providers are forming strategic alliances with respiratory device manufacturers to develop integrated care delivery models. NHS trusts are establishing long-term partnerships for comprehensive respiratory care solutions including devices, services, and clinical support. Technology companies are collaborating with medical device manufacturers to integrate digital health platforms with respiratory devices.

Regulatory Developments: Post-Brexit regulatory framework has created new pathways for respiratory device approval and market access. MHRA initiatives are streamlining regulatory processes while maintaining safety and efficacy standards. Reimbursement policy updates are expanding coverage for innovative respiratory devices and home-based therapy programs.

Market Expansion Developments: International respiratory device manufacturers are establishing UK manufacturing and distribution facilities to serve the domestic market more effectively. Investment in local operations is creating employment opportunities and strengthening supply chain resilience. MWR analysis indicates that market expansion initiatives are contributing to 12% improvement in device availability and service delivery across UK regions.

Strategic recommendations for UK respiratory devices market participants focus on leveraging growth opportunities while addressing market challenges and competitive pressures. Analyst insights provide actionable guidance for manufacturers, healthcare providers, and investors seeking to optimize market positioning and performance.

For Device Manufacturers: Prioritize development of connected respiratory devices with integrated digital health capabilities to meet growing demand for remote monitoring and telemedicine applications. Investment in artificial intelligence and machine learning technologies will enable differentiated product offerings and improved clinical outcomes. Strategic partnerships with UK healthcare providers and technology companies can accelerate market penetration and clinical adoption.

For Healthcare Providers: Develop comprehensive respiratory care programs that integrate advanced devices with clinical protocols and patient education initiatives. Home healthcare expansion should focus on patient selection criteria, remote monitoring capabilities, and clinical support services. Staff training programs are essential for maximizing respiratory device utilization and clinical benefits.

For Investors: Focus investment strategies on companies developing innovative respiratory technologies with strong clinical evidence and regulatory approval pathways. Digital health integration and artificial intelligence applications represent high-growth investment opportunities. Market consolidation trends may create acquisition opportunities for strategic investors seeking respiratory device market exposure.

For Policymakers: Continue supporting respiratory device innovation through research funding, regulatory streamlining, and reimbursement policy optimization. Public health initiatives focused on respiratory disease prevention and early intervention can drive sustainable market growth while improving population health outcomes.

Future market outlook for the UK respiratory devices market remains highly positive, supported by favorable demographic trends, technological advancement, and evolving healthcare delivery models. Long-term growth prospects are enhanced by increasing respiratory disease prevalence, aging population demographics, and expanding applications for respiratory monitoring and therapy.

Technology evolution will continue driving market transformation through artificial intelligence integration, advanced sensor technologies, and cloud-based data analytics platforms. Next-generation respiratory devices will offer unprecedented levels of automation, personalization, and clinical intelligence. Interoperability standards will enable seamless integration between respiratory devices and broader healthcare technology ecosystems.

Market expansion is projected to accelerate with compound annual growth rate of 7.4% through the next five years, driven by home healthcare adoption, digital health integration, and preventive care initiatives. Home-based respiratory therapy will represent the fastest-growing market segment, with adoption rates increasing by 15% annually as healthcare systems prioritize cost-effective care delivery models.

Regulatory environment will continue evolving to support innovation while ensuring patient safety and clinical efficacy. Post-Brexit regulatory framework will provide greater flexibility for UK-specific market approaches and international collaboration opportunities. Reimbursement policies will expand to cover innovative respiratory technologies demonstrating clinical and economic value.

Competitive landscape will become increasingly dynamic as new market entrants introduce disruptive technologies and business models. Strategic consolidation may accelerate as companies seek to build comprehensive respiratory care portfolios and expand geographic reach. MarkWide Research projections indicate that market leadership will increasingly depend on innovation capabilities, clinical evidence, and integrated service offerings rather than traditional product-focused strategies.

The UK respiratory devices market represents a dynamic and rapidly evolving healthcare technology sector with substantial growth potential and strategic importance for improving respiratory health outcomes across the United Kingdom. Market analysis reveals a complex ecosystem driven by demographic trends, technological innovation, and healthcare system transformation that creates diverse opportunities for market participants and stakeholders.

Key success factors for navigating this market include focus on clinical evidence, digital health integration, and patient-centered care delivery models. Technology advancement through artificial intelligence, connectivity, and personalized medicine approaches will continue driving market differentiation and competitive advantage. Strategic partnerships between device manufacturers, healthcare providers, and technology companies will be essential for developing comprehensive respiratory care solutions.

Market outlook remains highly favorable, with sustained growth expected across all major device categories and application areas. Home healthcare expansion, aging population demographics, and increasing respiratory disease prevalence will continue supporting market demand. Regulatory environment provides stable foundation for innovation and market development while ensuring patient safety and clinical efficacy standards.

Future market leadership will belong to organizations that successfully combine technological innovation with clinical excellence, regulatory compliance, and cost-effective care delivery models. The UK respiratory devices market is positioned for continued expansion and evolution, offering significant opportunities for companies committed to improving respiratory health outcomes through innovative medical device solutions and comprehensive care delivery approaches.

What is Respiratory Devices?

Respiratory devices are medical instruments used to assist patients with breathing difficulties. They include products such as nebulizers, inhalers, and ventilators, which are essential in treating conditions like asthma, COPD, and other respiratory disorders.

What are the key players in the UK Respiratory Devices Market?

Key players in the UK Respiratory Devices Market include Philips Healthcare, ResMed, and GSK, among others. These companies are known for their innovative products and solutions that cater to various respiratory conditions.

What are the growth factors driving the UK Respiratory Devices Market?

The UK Respiratory Devices Market is driven by factors such as the increasing prevalence of respiratory diseases, advancements in technology, and a growing aging population. Additionally, rising awareness about respiratory health is contributing to market growth.

What challenges does the UK Respiratory Devices Market face?

The UK Respiratory Devices Market faces challenges such as stringent regulatory requirements and high costs associated with advanced respiratory technologies. Moreover, the market is impacted by competition from alternative therapies and devices.

What opportunities exist in the UK Respiratory Devices Market?

Opportunities in the UK Respiratory Devices Market include the development of smart inhalers and telehealth solutions. The increasing focus on personalized medicine and home healthcare also presents significant growth potential.

What trends are shaping the UK Respiratory Devices Market?

Trends in the UK Respiratory Devices Market include the integration of digital health technologies, such as mobile apps for monitoring respiratory conditions, and the rise of portable devices. Additionally, there is a growing emphasis on sustainability in device manufacturing.

UK Respiratory Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Inhalers, Nebulizers, CPAP Machines, Oxygen Concentrators |

| Technology | Digital Health, Smart Inhalers, Portable Devices, Wearable Monitors |

| End User | Hospitals, Homecare, Clinics, Rehabilitation Centers |

| Application | Chronic Obstructive Pulmonary Disease, Asthma, Sleep Apnea, Respiratory Infections |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Respiratory Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at