444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK real estate market represents one of the most dynamic and influential property sectors globally, encompassing residential, commercial, and industrial properties across England, Scotland, Wales, and Northern Ireland. Market dynamics continue to evolve rapidly, driven by demographic shifts, economic policies, and changing consumer preferences in the post-pandemic era.

Regional variations characterize the UK property landscape, with London maintaining its position as a premium market while emerging regions demonstrate significant growth potential. The market experiences substantial influence from government policies, including stamp duty reforms, Help to Buy schemes, and planning regulations that shape investment patterns and buyer behavior.

Investment flows into UK real estate remain robust, with both domestic and international investors attracted to the market’s stability and growth prospects. Recent data indicates the market is experiencing a 6.2% annual growth rate in certain segments, particularly in the build-to-rent and student accommodation sectors.

Technology integration is transforming traditional real estate practices, with PropTech solutions enhancing property management, virtual viewings, and transaction processes. The market demonstrates resilience through economic uncertainties while adapting to new regulatory frameworks and sustainability requirements.

The UK real estate market refers to the comprehensive ecosystem of property transactions, investments, and developments across residential, commercial, and industrial sectors within the United Kingdom, encompassing buying, selling, renting, and developing properties for various purposes.

Market participants include individual homeowners, property investors, real estate investment trusts (REITs), pension funds, sovereign wealth funds, and institutional investors who collectively drive market activity and price movements. The sector encompasses various property types from single-family homes and apartments to office buildings, retail spaces, warehouses, and specialized facilities.

Regulatory framework governs market operations through planning permissions, building regulations, environmental standards, and taxation policies that influence development patterns and investment decisions. The market operates within established legal structures including freehold and leasehold ownership models, conveyancing processes, and property registration systems.

Economic significance extends beyond direct property transactions to encompass construction, property management, real estate services, and related financial products that contribute substantially to UK economic output and employment generation.

Market resilience defines the current UK real estate landscape, with the sector demonstrating adaptability to economic challenges while maintaining fundamental strength across key segments. The market benefits from sustained demand drivers including population growth, urbanization trends, and evolving lifestyle preferences that support long-term growth prospects.

Investment diversification characterizes recent market trends, with investors increasingly focusing on alternative property sectors including student accommodation, senior living, and logistics facilities. Traditional residential and commercial segments continue to attract significant capital while adapting to changing occupier requirements and sustainability mandates.

Regional rebalancing emerges as a significant trend, with growth opportunities expanding beyond London to include regional cities and emerging markets. This shift reflects changing work patterns, affordability considerations, and government initiatives to promote balanced regional development across the UK.

Technology adoption accelerates across all market segments, enhancing operational efficiency, improving customer experiences, and creating new business models. Digital transformation initiatives demonstrate a 78% adoption rate among leading property companies, indicating widespread industry evolution.

Demand fundamentals remain strong across multiple property sectors, supported by demographic trends and economic recovery patterns. The market demonstrates particular strength in areas aligned with changing lifestyle and work preferences, including suburban residential properties and flexible commercial spaces.

Population growth serves as a fundamental driver of UK real estate demand, with demographic trends supporting sustained housing requirements across all regions. Urban population increases, household formation patterns, and migration flows create consistent demand for residential properties while supporting commercial real estate needs.

Economic recovery following recent global challenges strengthens market confidence and investment activity. Employment growth, wage increases, and business expansion drive demand for both residential and commercial properties, while low interest rate environments historically support property investment and development financing.

Infrastructure development enhances property market prospects through improved connectivity and accessibility. Major transport projects, including rail improvements and road networks, increase property values in benefiting areas while creating new development opportunities and investment zones.

Government policies significantly influence market dynamics through various support schemes, tax incentives, and regulatory frameworks. Housing initiatives, planning reforms, and investment incentives shape market activity while addressing national housing and economic development objectives.

Lifestyle changes drive evolving property preferences, with remote working capabilities, sustainability concerns, and quality of life considerations influencing location choices and property features. These shifts create opportunities in previously undervalued markets while challenging traditional commercial real estate models.

Affordability challenges constrain market participation, particularly in high-value regions where property prices exceed income growth rates. First-time buyer difficulties and rental affordability issues limit market accessibility while creating social and economic policy concerns.

Planning constraints restrict development supply in many areas, creating bottlenecks in new property delivery. Complex planning processes, environmental regulations, and local opposition to development projects limit the market’s ability to respond to demand pressures effectively.

Economic uncertainties periodically impact market confidence and investment decisions. Global economic volatility, inflation concerns, and policy changes create cautious market sentiment that can reduce transaction volumes and delay development projects.

Regulatory complexity increases operational costs and development timelines. Building regulations, environmental standards, and taxation changes require significant compliance investments while creating uncertainty for market participants and long-term planning.

Skills shortages in construction and related industries constrain development capacity and increase project costs. Labor availability issues impact delivery timelines while contributing to cost inflation across the development and maintenance sectors.

Regional development presents significant growth opportunities as economic activity spreads beyond traditional centers. Government leveling-up initiatives, infrastructure investments, and changing work patterns create attractive investment prospects in emerging regional markets with strong growth potential.

Sustainability transformation offers substantial opportunities for property improvement, development, and investment. The transition to net-zero carbon emissions creates demand for energy-efficient properties, retrofit services, and sustainable development projects that align with environmental objectives.

Technology integration enables new business models and operational efficiencies across all property sectors. PropTech solutions, smart building technologies, and digital platforms create opportunities for innovation while improving property management and user experiences.

Alternative property sectors demonstrate strong growth potential, including student accommodation, senior living, healthcare facilities, and logistics properties. These specialized sectors benefit from demographic trends and changing economic patterns while offering diversification opportunities for investors.

International investment continues to view UK real estate favorably, creating opportunities for joint ventures, development partnerships, and capital deployment. Global investors seek exposure to UK property markets while bringing expertise and resources to support market development.

Supply-demand imbalances characterize many UK property markets, with demand consistently exceeding supply in key residential areas. This fundamental dynamic supports property values while creating development opportunities and investment returns, though it also contributes to affordability challenges.

Interest rate sensitivity influences market activity significantly, with borrowing costs affecting both property purchases and development financing. Market participants closely monitor monetary policy changes and their implications for property investment returns and financing availability.

Regional performance variations reflect different economic conditions, development constraints, and investment flows across UK markets. London maintains premium status while regional cities demonstrate strong growth potential, creating diverse investment opportunities and risk profiles.

Sector rotation occurs as investor preferences shift between property types based on performance expectations and market conditions. Recent trends show increased interest in industrial and alternative sectors while traditional office markets face challenges from changing work patterns.

Policy responsiveness demonstrates the market’s sensitivity to government interventions, tax changes, and regulatory modifications. Market participants adapt strategies based on policy developments while government measures aim to address housing supply, affordability, and economic development objectives.

Comprehensive analysis of UK real estate market conditions employs multiple research approaches including primary data collection, secondary source analysis, and expert consultations. Research methodology encompasses quantitative market data analysis alongside qualitative insights from industry participants and market observers.

Data collection utilizes official statistics from government sources, industry associations, and regulatory bodies to establish market baselines and trend analysis. Property transaction data, planning application information, and economic indicators provide quantitative foundations for market assessment and forecasting.

Market participant surveys capture insights from property developers, investors, agents, and occupiers to understand market sentiment, investment intentions, and operational challenges. These primary research activities provide current market perspectives and forward-looking indicators.

Regional analysis examines market conditions across different UK regions and property sectors to identify variations in performance, opportunities, and challenges. This geographic approach ensures comprehensive market coverage and recognition of local market dynamics.

Trend analysis incorporates historical data patterns with current market indicators to identify emerging trends and forecast future market directions. This analytical approach supports strategic planning and investment decision-making for market participants.

London market maintains its position as the UK’s premier property destination, attracting significant international investment while facing affordability and supply challenges. The capital demonstrates resilience through economic cycles while adapting to changing work patterns and sustainability requirements. Recent data indicates London holds approximately 35% market share of total UK commercial property investment.

South East England benefits from proximity to London while offering more affordable alternatives for both residential and commercial occupiers. The region demonstrates strong connectivity advantages and development potential, particularly in areas benefiting from transport infrastructure improvements and economic growth initiatives.

Regional cities including Manchester, Birmingham, Leeds, and Edinburgh demonstrate significant growth potential driven by economic diversification, infrastructure investment, and changing location preferences. These markets attract increasing investor attention while offering development opportunities and yield advantages compared to London.

Scotland and Wales present unique market characteristics with distinct regulatory frameworks and economic drivers. Both regions benefit from government support for economic development while offering attractive investment opportunities in residential, commercial, and alternative property sectors.

Northern England experiences regeneration and investment growth, supported by government leveling-up initiatives and major infrastructure projects. Cities like Liverpool, Newcastle, and Sheffield demonstrate improving market fundamentals while offering attractive entry points for property investment and development.

Market leadership encompasses various participant categories including major property developers, institutional investors, real estate investment trusts, and international investment funds. The competitive environment reflects diverse strategies and market focuses across different property sectors and geographic regions.

International players maintain significant presence in UK real estate markets, bringing global expertise and capital resources. These participants contribute to market liquidity and development activity while providing alternative investment and development approaches.

Property type segmentation divides the UK real estate market into distinct categories based on usage and investment characteristics. Each segment demonstrates unique performance patterns, risk profiles, and growth opportunities that attract different investor types and strategies.

Residential sector encompasses various housing types from apartments and houses to specialized accommodation including student housing and senior living facilities. This segment benefits from fundamental demand drivers while facing supply constraints and affordability challenges in many markets.

Commercial properties include office buildings, retail spaces, and mixed-use developments that serve business and consumer needs. The sector undergoes significant transformation driven by changing work patterns, e-commerce growth, and evolving occupier requirements for flexible and sustainable spaces.

Industrial and logistics properties demonstrate strong performance driven by e-commerce growth and supply chain evolution. This segment includes warehouses, distribution centers, manufacturing facilities, and specialized industrial properties that benefit from changing consumption patterns and business models.

Alternative sectors encompass specialized property types including healthcare facilities, data centers, educational properties, and leisure facilities. These segments often demonstrate stable income characteristics while serving essential social and economic functions.

By Property Type:

By Investment Strategy:

By Geographic Focus:

Investors benefit from portfolio diversification opportunities across multiple property sectors and geographic regions. The UK real estate market offers various risk-return profiles suitable for different investment strategies while providing inflation protection and steady income generation potential.

Property developers access substantial development opportunities driven by housing demand, infrastructure investment, and urban regeneration initiatives. Market conditions support development activity while government policies provide various incentives and support mechanisms for qualifying projects.

Occupiers gain from improved property standards, technological integration, and flexible space solutions that enhance operational efficiency and employee satisfaction. Market competition drives innovation in property design and management while providing choice across different locations and price points.

Local communities benefit from property investment through job creation, infrastructure improvements, and economic development. Real estate development contributes to community regeneration while providing essential housing and commercial facilities that support local economic activity.

Financial institutions participate through property lending, investment products, and advisory services that generate revenue while supporting market activity. The sector provides opportunities for mortgage lending, development finance, and investment management services across various market segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend across all property sectors, with environmental performance becoming a key factor in investment decisions and property valuations. MarkWide Research analysis indicates that 68% of institutional investors now prioritize ESG criteria in property investment strategies.

Technology adoption accelerates throughout the real estate value chain, from property search and transaction processes to building management and tenant services. Smart building technologies, IoT integration, and data analytics enhance operational efficiency while improving user experiences and property performance.

Flexible space solutions gain prominence as occupiers seek adaptable properties that can respond to changing business needs and work patterns. This trend affects both commercial and residential sectors, driving demand for flexible lease terms and multipurpose space designs.

Build-to-rent expansion transforms residential markets as institutional investors develop purpose-built rental properties offering professional management and enhanced amenities. This sector demonstrates strong growth potential while addressing changing housing preferences and demographic shifts.

Regional rebalancing continues as economic activity and investment flows spread beyond London to regional cities and emerging markets. Infrastructure improvements and government initiatives support this trend while creating new investment opportunities and development potential.

Planning system reforms aim to streamline development processes and increase housing supply through simplified procedures and increased permitted development rights. These changes potentially accelerate development timelines while addressing long-standing supply constraints in many markets.

Net-zero commitments drive significant investment in property energy efficiency improvements and sustainable development practices. Government targets and investor requirements create substantial opportunities for retrofit services and green building technologies across all property sectors.

Infrastructure investment programs including transport improvements and digital connectivity enhancements support property market development and value creation. Major projects create development opportunities while improving accessibility and economic prospects for benefiting areas.

Alternative finance growth provides new funding sources for property development and investment through crowdfunding platforms, peer-to-peer lending, and alternative investment structures. These innovations increase market accessibility while providing additional capital sources for development projects.

International partnership expansion brings global expertise and capital to UK real estate markets through joint ventures and strategic alliances. These partnerships support market development while providing access to international best practices and investment resources.

Diversification strategies should encompass multiple property sectors and geographic regions to optimize risk-adjusted returns while capturing growth opportunities across different market segments. MWR recommends balanced portfolio approaches that include both traditional and alternative property investments.

Sustainability focus becomes essential for long-term property investment success as environmental regulations tighten and investor preferences shift toward ESG-compliant assets. Early adoption of sustainable practices and technologies provides competitive advantages while future-proofing property investments.

Technology integration offers significant opportunities for operational efficiency improvements and enhanced property performance. Investors and developers should prioritize PropTech adoption while ensuring technology solutions align with occupier needs and market demands.

Regional market exploration presents attractive opportunities for investors seeking yield advantages and growth potential outside traditional prime markets. Careful market selection based on economic fundamentals and infrastructure development prospects can generate superior returns.

Flexible investment approaches enable adaptation to changing market conditions and occupier requirements. Strategies that incorporate flexibility in lease terms, space design, and property usage can better respond to evolving market dynamics and user preferences.

Market evolution continues toward greater sustainability, technology integration, and occupier-focused solutions that address changing lifestyle and business requirements. The UK real estate market demonstrates strong fundamentals supporting long-term growth while adapting to contemporary challenges and opportunities.

Growth projections indicate sustained market expansion driven by demographic trends, economic recovery, and infrastructure investment. Regional markets show particular promise with projected growth rates of 8.5% annually in key development areas, while alternative property sectors maintain strong performance expectations.

Investment flows are expected to remain robust as both domestic and international capital seeks exposure to UK real estate opportunities. Market diversification trends support investment across multiple sectors while sustainability requirements drive capital toward environmentally compliant properties.

Innovation adoption will accelerate across all market segments, with technology solutions becoming integral to property operations and investment strategies. Digital transformation initiatives demonstrate significant potential for efficiency improvements and enhanced user experiences throughout the real estate ecosystem.

Policy developments will continue to shape market dynamics through planning reforms, sustainability regulations, and economic support measures. Government initiatives aimed at addressing housing supply and regional development create opportunities while establishing new operational frameworks for market participants.

The UK real estate market demonstrates remarkable resilience and adaptability while maintaining its position as a leading global property investment destination. Market fundamentals remain strong across multiple sectors, supported by demographic growth, economic recovery, and continued infrastructure investment that enhances long-term prospects.

Transformation trends including sustainability integration, technology adoption, and changing occupier preferences create both challenges and opportunities for market participants. Successful navigation of these trends requires strategic adaptation while maintaining focus on fundamental market drivers and investment principles.

Regional diversification emerges as a key theme, with growth opportunities expanding beyond traditional prime markets to include emerging regional centers and alternative property sectors. This evolution supports market stability while providing diverse investment opportunities across different risk-return profiles.

Future success in the UK real estate market will depend on embracing innovation, prioritizing sustainability, and maintaining flexibility to adapt to evolving market conditions. The sector’s continued evolution positions it well for sustained growth while addressing contemporary social and economic challenges through responsible development and investment practices.

What is UK Real Estate?

UK Real Estate refers to the buying, selling, and leasing of properties in the United Kingdom, including residential, commercial, and industrial real estate. It encompasses various activities such as property development, investment, and management.

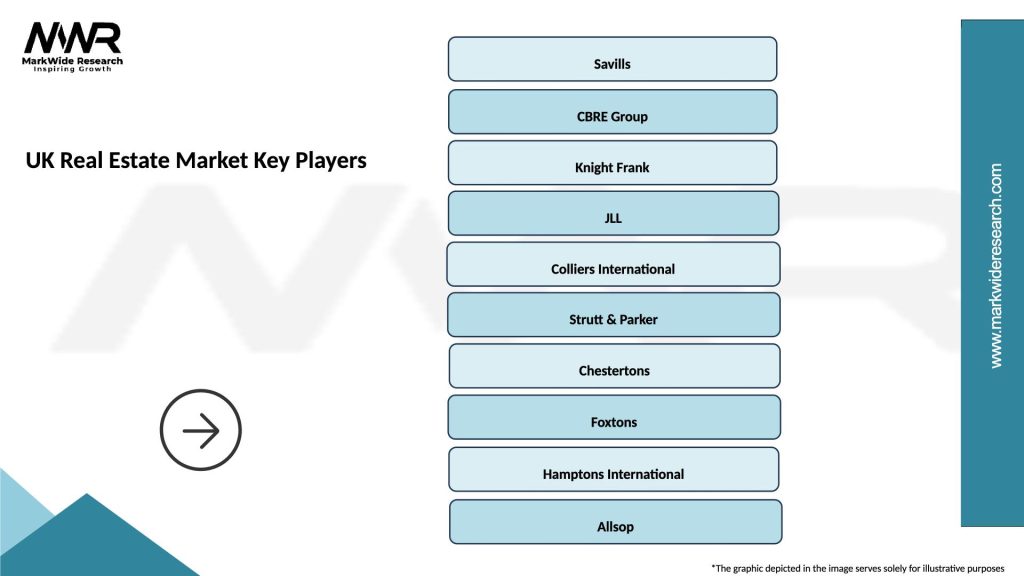

What are the key players in the UK Real Estate Market?

Key players in the UK Real Estate Market include companies like Savills, Knight Frank, and CBRE, which provide services in property management, valuation, and consultancy. These firms play a significant role in shaping market trends and facilitating transactions, among others.

What are the main drivers of the UK Real Estate Market?

The main drivers of the UK Real Estate Market include population growth, urbanization, and economic stability. Additionally, low interest rates and government policies aimed at promoting home ownership also contribute to market dynamics.

What challenges does the UK Real Estate Market face?

The UK Real Estate Market faces challenges such as affordability issues, regulatory changes, and economic uncertainty. These factors can impact buyer confidence and investment levels in the market.

What opportunities exist in the UK Real Estate Market?

Opportunities in the UK Real Estate Market include the growing demand for sustainable housing and the rise of remote work, which is increasing interest in suburban properties. Additionally, technology integration in property management presents new avenues for growth.

What trends are shaping the UK Real Estate Market?

Trends shaping the UK Real Estate Market include a shift towards eco-friendly developments, increased use of digital platforms for property transactions, and a focus on mixed-use developments. These trends reflect changing consumer preferences and technological advancements.

UK Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Residential, Commercial, Industrial, Mixed-Use |

| Market Segment | Luxury, Affordable, Student Housing, Social Housing |

| Buyer Type | First-Time Buyers, Investors, Landlords, Developers |

| Sales Channel | Online Platforms, Real Estate Agents, Auctions, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at