444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The UK prepaid cards market has experienced significant growth in recent years, driven by the increasing demand for convenient and secure payment solutions. Prepaid cards, also known as stored-value cards, are a type of payment card that allows users to load a specific amount of money onto the card in advance. These cards offer a viable alternative to traditional banking services and are widely used for various purposes, including everyday spending, travel, gifting, and budgeting.

Meaning

Prepaid cards function as a financial tool that enables users to manage their finances effectively. They are typically issued by banks, payment service providers, or other financial institutions. Unlike credit cards, prepaid cards do not extend a line of credit to the cardholder. Instead, they are loaded with funds in advance, allowing users to spend only the amount they have loaded onto the card. This feature makes prepaid cards a popular choice for individuals who want to control their spending or for those who may not have access to traditional banking services.

Executive Summary

The UK prepaid cards market has witnessed robust growth in recent years, driven by factors such as convenience, security, and the increasing adoption of digital payment solutions. The market is characterized by intense competition among various players, including established financial institutions, fintech companies, and payment service providers. As the demand for alternative payment options continues to rise, the prepaid cards market in the UK is expected to expand further in the coming years.

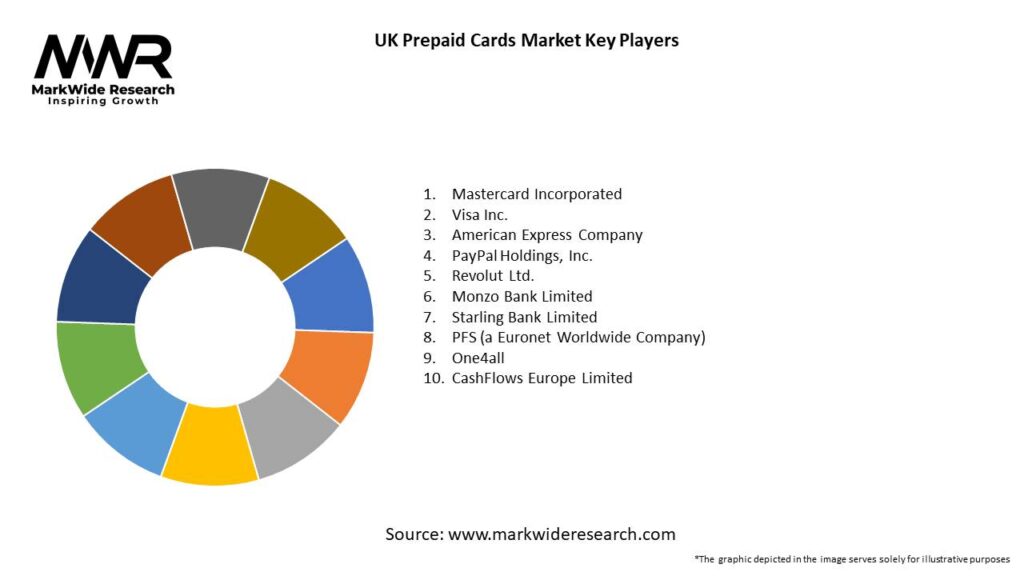

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The following factors are driving the growth of the UK prepaid cards market:

Market Restraints

Despite the positive growth trajectory, the UK prepaid cards market faces certain challenges:

Market Opportunities

The UK prepaid cards market presents several opportunities for growth and innovation:

Market Dynamics

The UK prepaid cards market is characterized by dynamic factors that influence its growth and evolution. Changing consumer preferences, advancements in technology, regulatory developments, and competitive forces shape the market dynamics. To stay competitive, market players need to continuously adapt to these dynamics and innovate their offerings.

Regional Analysis

The UK prepaid cards market exhibits regional variations, influenced by factors such as population density, urbanization, and economic development. Major metropolitan areas, including London, Manchester, and Birmingham, are key hubs for prepaid card usage. These regions offer a higher concentration of merchants and a greater acceptance of digital payment solutions, contributing to market growth.

Competitive Landscape

Leading Companies in the UK Prepaid Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The UK prepaid cards market can be segmented based on various criteria, including card type, target audience, and use cases. Some common segments include:

Category-wise Insights

The UK prepaid cards market can be further analyzed based on specific categories:

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the UK prepaid cards market. The shift towards digital payments accelerated during the pandemic, with consumers preferring contactless and online transactions to minimize physical contact. Prepaid cards, with their convenience and safety features, experienced increased adoption during this period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the UK prepaid cards market looks promising, with continued growth expected. Factors such as increased digitalization, evolving consumer preferences, and the need for financial inclusion will drive market expansion. Providers that prioritize innovation, customer-centric offerings, and strategic partnerships are likely to thrive in this dynamic market.

Conclusion

The UK prepaid cards market has experienced significant growth, driven by the demand for convenient and secure payment solutions. Prepaid cards offer flexibility, control over spending, and access to digital payment options, contributing to their popularity among consumers. As the market continues to evolve, providers must adapt to changing consumer preferences, embrace technological advancements, and foster trust to capitalize on the growth opportunities offered by the prepaid cards market in the UK.

UK Prepaid Cards Market

| Segmentation Details | Description |

|---|---|

| Product Type | General Purpose, Gift Cards, Travel Cards, Reloadable Cards |

| End User | Consumers, Businesses, Students, Tourists |

| Distribution Channel | Online, Retail Stores, Banks, Mobile Apps |

| Service Type | Prepaid Debit, Virtual Cards, Corporate Cards, Others |

Leading Companies in the UK Prepaid Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at