444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK Power EPC market represents a dynamic and rapidly evolving sector within the country’s energy infrastructure landscape. Engineering, Procurement, and Construction services for power generation facilities have become increasingly critical as the United Kingdom transitions toward renewable energy sources and modernizes its aging power infrastructure. The market encompasses comprehensive project management services for various power generation technologies, including wind farms, solar installations, nuclear facilities, and conventional thermal power plants.

Market dynamics indicate robust growth driven by the UK government’s ambitious net-zero carbon emissions target by 2050. The sector has experienced significant transformation with renewable energy projects accounting for approximately 65% of new power generation capacity additions in recent years. This shift has created substantial opportunities for EPC contractors specializing in clean energy technologies while simultaneously challenging traditional fossil fuel-based project developers.

Industry participants range from large multinational corporations to specialized regional contractors, each bringing unique capabilities to complex power infrastructure projects. The market’s evolution reflects broader energy sector trends, including digitalization, grid modernization, and the integration of energy storage solutions. Technological advancement continues to drive efficiency improvements, with modern EPC projects achieving 15-20% faster completion times compared to traditional approaches through enhanced project management methodologies and digital construction technologies.

The UK Power EPC market refers to the comprehensive ecosystem of engineering, procurement, and construction services specifically designed for power generation and transmission infrastructure projects across the United Kingdom. This market encompasses the complete project lifecycle from initial feasibility studies and detailed engineering design through equipment procurement, construction management, commissioning, and handover of operational power facilities.

EPC contractors serve as single-point-of-contact providers who assume full responsibility for delivering turnkey power projects within agreed timeframes, budgets, and performance specifications. These organizations coordinate complex multi-disciplinary activities including civil engineering, electrical systems installation, mechanical equipment integration, and regulatory compliance management. The model provides project owners with reduced risk exposure and streamlined project execution through consolidated accountability structures.

Power EPC services extend beyond traditional construction activities to include advanced project management, supply chain optimization, quality assurance, safety management, and post-completion support services. Modern EPC approaches increasingly incorporate digital technologies, sustainable construction practices, and innovative financing mechanisms to deliver enhanced value propositions for energy infrastructure development across the UK market.

Strategic analysis reveals the UK Power EPC market positioned for sustained expansion driven by unprecedented energy transition requirements and infrastructure modernization needs. The sector benefits from supportive government policies, including renewable energy incentives, grid enhancement programs, and nuclear power development initiatives that collectively create a robust project pipeline extending through the next decade.

Market segmentation demonstrates clear leadership by renewable energy EPC services, particularly offshore wind development where UK contractors have established global expertise. Solar power EPC projects have gained significant momentum with utility-scale installations representing approximately 40% of new solar capacity additions. Nuclear EPC services maintain strategic importance despite longer development cycles, while conventional power plant EPC activities focus primarily on efficiency upgrades and environmental compliance modifications.

Competitive dynamics reflect increasing consolidation among major EPC providers seeking to enhance capabilities across multiple technology platforms. International contractors continue expanding UK operations to capitalize on market opportunities, while domestic firms strengthen specialized expertise in emerging technologies such as energy storage integration and smart grid infrastructure. Digital transformation initiatives have become critical differentiators, with leading contractors achieving 25-30% productivity improvements through advanced project management platforms and construction automation technologies.

Fundamental market drivers include the UK’s legally binding commitment to achieve net-zero carbon emissions, creating unprecedented demand for renewable energy infrastructure development. The following key insights shape current market dynamics:

Government policy initiatives serve as the primary catalyst for UK Power EPC market expansion. The Net Zero Strategy establishes clear targets for renewable energy capacity additions, creating predictable demand for specialized EPC services across multiple technology platforms. Feed-in tariffs, renewable obligation certificates, and contracts for difference mechanisms provide financial incentives that support project viability and encourage private sector investment in power infrastructure development.

Energy security concerns have intensified following recent geopolitical developments, driving accelerated domestic power generation capacity development. The UK government’s Energy Security Strategy emphasizes reduced dependence on energy imports through expanded renewable energy deployment and nuclear power development. This strategic shift creates substantial opportunities for EPC contractors capable of delivering complex infrastructure projects within compressed timeframes while maintaining high safety and quality standards.

Technological advancement continues driving market growth through improved project economics and enhanced performance capabilities. Modern wind turbine technologies achieve higher capacity factors, while solar photovoltaic systems demonstrate improved efficiency and reduced costs. Energy storage technologies enable better integration of intermittent renewable sources, creating new EPC service categories. Digital construction technologies enhance project delivery efficiency, with advanced contractors reporting 20-25% reduction in project completion times through optimized scheduling and resource management systems.

Climate change commitments established through international agreements and domestic legislation create long-term market stability for renewable energy EPC services. Corporate sustainability initiatives drive private sector demand for clean energy infrastructure, while public sector organizations increasingly prioritize carbon-neutral operations. These trends establish a robust foundation for sustained market growth across multiple customer segments and geographic regions throughout the UK.

Regulatory complexity presents significant challenges for Power EPC contractors operating in the UK market. Planning permission processes for major power infrastructure projects often extend over multiple years, creating uncertainty and increasing project development costs. Environmental impact assessments, grid connection approvals, and safety certifications require specialized expertise and substantial time investments that can impact project economics and delivery schedules.

Supply chain constraints have emerged as critical limiting factors, particularly for specialized power generation equipment and materials. Global demand for renewable energy components creates extended lead times and price volatility that complicate project planning and cost management. Skilled labor shortages in specialized trades such as electrical installation, heavy equipment operation, and project management further constrain market growth potential and increase labor costs across the sector.

Grid infrastructure limitations restrict the pace of new power generation development in certain regions. Transmission network capacity constraints require costly upgrades before new generation facilities can connect, adding complexity and expense to EPC projects. Grid connection queue delays can extend project timelines significantly, impacting contractor resource allocation and project profitability. These infrastructure bottlenecks particularly affect renewable energy projects in areas with high resource potential but limited existing grid capacity.

Financial market conditions influence project development through interest rate fluctuations and capital availability constraints. Large-scale power infrastructure projects require substantial upfront investment, making them sensitive to financing costs and credit market conditions. Currency exchange rate volatility affects projects with significant imported equipment content, while inflation pressures impact construction costs and long-term contract viability for EPC service providers.

Offshore wind expansion represents the most significant growth opportunity for UK Power EPC contractors. The government’s commitment to offshore wind capacity development creates a substantial project pipeline extending through the 2030s. Floating wind technology opens new development areas in deeper waters, requiring specialized EPC expertise and creating opportunities for contractors with advanced marine construction capabilities. The sector’s maturation enables larger project scales and improved economies of scale for experienced EPC providers.

Energy storage integration emerges as a rapidly expanding market segment with diverse applications across the power system. Grid-scale battery storage projects require specialized EPC services combining electrical engineering expertise with advanced control system integration. Pumped hydro storage development offers long-term opportunities for contractors with civil engineering and hydroelectric expertise. Hybrid renewable projects combining generation and storage create complex EPC requirements that favor experienced, well-capitalized contractors.

Nuclear power development provides substantial long-term opportunities despite extended project timelines and complex regulatory requirements. New nuclear power station construction requires highly specialized EPC capabilities and offers significant revenue potential for qualified contractors. Small modular reactor technology development may create new market segments with different EPC service requirements and potentially faster deployment schedules compared to traditional large-scale nuclear projects.

Industrial decarbonization creates emerging opportunities for Power EPC contractors in specialized applications. Green hydrogen production facilities require unique combinations of renewable energy generation and electrolyzer systems. Carbon capture and storage projects need specialized engineering and construction expertise. Industrial heat pump installations and process electrification projects expand the addressable market for power infrastructure EPC services beyond traditional utility-scale applications.

Competitive intensity continues increasing as both domestic and international EPC contractors pursue opportunities in the expanding UK power market. Market consolidation trends reflect the need for enhanced capabilities and financial resources to compete effectively for large-scale projects. Strategic partnerships and joint ventures enable contractors to combine complementary expertise while sharing project risks and capital requirements across complex, multi-year infrastructure developments.

Technology evolution drives continuous adaptation requirements for EPC contractors seeking to maintain competitive positioning. Digital construction technologies including Building Information Modeling, drone surveying, and automated equipment installation require ongoing investment in training and equipment. Contractors achieving successful digital transformation report efficiency improvements of 15-30% in project delivery timelines and cost management performance.

Customer expectations have evolved to emphasize total project value rather than lowest initial cost. Lifecycle performance guarantees, environmental impact minimization, and community engagement capabilities increasingly influence contractor selection decisions. EPC providers must demonstrate comprehensive project management expertise extending beyond traditional construction activities to include stakeholder management, regulatory compliance, and long-term asset performance optimization.

Supply chain resilience has become a critical competitive differentiator following recent global disruptions. Successful EPC contractors invest in diversified supplier networks, strategic inventory management, and local content development to mitigate project delivery risks. Vertical integration strategies enable some contractors to control critical supply chain elements while reducing dependence on external suppliers for specialized components and services.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into UK Power EPC market dynamics. Primary research activities include structured interviews with industry executives, project managers, and technical specialists across major EPC contractors, utility companies, and government agencies. These discussions provide qualitative insights into market trends, competitive dynamics, and emerging opportunities that complement quantitative data analysis.

Secondary research incorporates analysis of government publications, industry reports, company financial statements, and project databases to establish market sizing, growth trends, and competitive positioning. Regulatory filing analysis provides insights into project pipelines, capacity development plans, and investment commitments across different power generation technologies. Trade publication monitoring ensures awareness of latest industry developments, technological innovations, and policy changes affecting market conditions.

Data validation processes include cross-referencing multiple information sources, expert review panels, and statistical analysis to ensure research accuracy and reliability. Market modeling techniques incorporate historical performance data, policy impact assessments, and technology adoption curves to develop realistic growth projections and market scenario analysis. MarkWide Research employs rigorous quality control procedures to maintain high standards for market intelligence and strategic analysis across all research deliverables.

Industry expert networks provide ongoing market monitoring and validation of research findings through regular consultation with experienced professionals across the power EPC value chain. These relationships enable real-time market intelligence gathering and ensure research outputs reflect current industry conditions and emerging trends affecting contractor performance and market development opportunities.

Scotland leads UK renewable energy EPC activity with extensive offshore wind development and onshore wind farm construction. The region benefits from excellent wind resources, supportive government policies, and established supply chain infrastructure. Scottish offshore wind projects account for approximately 45% of UK offshore wind capacity under development. The region’s expertise in oil and gas infrastructure provides transferable skills for offshore renewable energy construction, creating competitive advantages for local EPC contractors.

England represents the largest market segment by total project value, encompassing diverse power generation technologies across multiple regions. Southeast England focuses on grid infrastructure modernization and distributed generation projects, while northern regions emphasize large-scale renewable energy development. Nuclear power EPC activities concentrate in specific locations with existing nuclear expertise and infrastructure. Industrial regions create opportunities for specialized EPC services supporting manufacturing sector decarbonization initiatives.

Wales demonstrates strong growth in renewable energy EPC projects, particularly onshore wind and solar development. The region’s mountainous terrain provides excellent wind resources, while coastal areas offer potential for offshore wind development. Welsh government policies actively support renewable energy development, creating a favorable environment for EPC contractors. Traditional industrial areas present opportunities for power infrastructure modernization and clean energy transition projects.

Northern Ireland represents a smaller but growing market segment with unique characteristics related to island grid operations and cross-border electricity trading. Grid interconnection projects with the Republic of Ireland create specialized EPC opportunities requiring expertise in submarine cable installation and grid integration technologies. The region’s renewable energy potential, particularly in wind and solar resources, supports continued EPC market development despite smaller overall market size compared to other UK regions.

Market leadership reflects a combination of domestic expertise and international capabilities, with several categories of competitors serving different market segments. The competitive environment continues evolving as contractors adapt to changing technology requirements and customer expectations across the expanding UK power infrastructure market.

Competitive differentiation increasingly depends on specialized expertise, financial capacity, and track record in specific technology areas. Digital capabilities and sustainability credentials become important selection criteria for major projects, while local content requirements favor contractors with established UK supply chain relationships and workforce development programs.

Technology-based segmentation reveals distinct market characteristics and growth patterns across different power generation categories. Each segment requires specialized expertise, equipment, and project management approaches that influence contractor positioning and competitive dynamics.

By Technology:

By Project Scale:

By Service Type:

Renewable Energy EPC dominates market growth with offshore wind leading capacity additions and investment activity. Offshore wind projects require unique combinations of marine engineering, heavy lift capabilities, and grid integration expertise. Project complexity continues increasing with larger turbines, greater water depths, and longer transmission distances creating enhanced technical requirements for EPC contractors. Supply chain coordination becomes critical for managing specialized equipment delivery and installation scheduling across multiple project phases.

Nuclear Power EPC represents the highest value segment per project despite limited number of active developments. Regulatory compliance requirements demand specialized expertise in nuclear safety, quality assurance, and project management systems. Long project timelines and complex stakeholder management requirements favor experienced contractors with proven nuclear construction capabilities. Skills development and workforce training become critical success factors given the specialized nature of nuclear construction activities.

Grid Infrastructure EPC encompasses transmission line construction, substation development, and smart grid technology deployment. Grid modernization projects require expertise in advanced control systems, cybersecurity, and integration with existing infrastructure. The segment benefits from consistent demand driven by renewable energy integration requirements and aging infrastructure replacement needs. Digital technologies increasingly influence project design and construction methodologies across grid infrastructure applications.

Energy Storage EPC emerges as a high-growth category with diverse applications across the power system. Battery storage projects combine electrical engineering expertise with advanced control system integration and grid connection requirements. Project economics continue improving through technology advancement and scale effects, creating opportunities for contractors with specialized capabilities. Hybrid projects combining renewable generation with storage create complex EPC requirements that favor experienced, well-capitalized contractors with comprehensive technical capabilities.

EPC contractors benefit from expanding market opportunities driven by energy transition requirements and infrastructure modernization needs. Revenue diversification across multiple technology platforms reduces dependence on any single market segment while enabling contractors to leverage complementary expertise and resources. Long-term government commitments to renewable energy development provide predictable demand and support strategic planning for capacity expansion and capability development.

Utility companies gain access to specialized expertise and risk management capabilities through EPC partnerships. Turnkey project delivery reduces internal resource requirements and enables utilities to focus on core operations while accessing latest construction technologies and project management practices. Fixed-price EPC contracts provide cost certainty and transfer construction risks to specialized contractors with appropriate expertise and financial capacity.

Government agencies achieve policy objectives more effectively through private sector EPC capabilities that accelerate infrastructure development and reduce public sector investment requirements. Economic development benefits include job creation, skills development, and supply chain investment that support broader economic growth objectives. Environmental benefits from renewable energy development contribute to climate change mitigation and air quality improvement goals.

Financial institutions benefit from reduced project risks through experienced EPC contractor involvement and comprehensive project delivery capabilities. Standardized approaches and proven track records enable more efficient project evaluation and financing decisions. Performance guarantees and warranty provisions provide additional security for infrastructure investment financing across the expanding UK power market.

Local communities benefit from economic development opportunities, improved infrastructure, and environmental improvements associated with modern power generation facilities. Employment opportunities during construction and ongoing operations support local economic development, while community benefit programs provide direct financial returns from power infrastructure development projects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the UK Power EPC market with contractors increasingly adopting advanced technologies for project planning, execution, and monitoring. Building Information Modeling becomes standard practice for complex projects, enabling improved coordination and reduced construction risks. Drone technology and satellite monitoring provide enhanced project oversight capabilities, while artificial intelligence applications optimize scheduling and resource allocation. Digital twin technology enables virtual project testing and optimization before physical construction begins.

Sustainability integration extends beyond power generation technology to encompass entire project lifecycle considerations. Circular economy principles influence material selection, construction methodologies, and end-of-life planning for power infrastructure projects. Carbon footprint reduction during construction becomes a key performance indicator, with contractors achieving 20-25% emissions reduction through optimized logistics and equipment selection. Biodiversity protection and ecosystem enhancement increasingly influence project design and execution approaches.

Modularization and standardization trends enable improved project efficiency and cost reduction across multiple technology platforms. Prefabricated components reduce on-site construction time and improve quality control, while standardized designs enable economies of scale across project portfolios. Factory-built modules for substations, control systems, and auxiliary equipment streamline installation processes and reduce weather-related delays. These approaches particularly benefit offshore wind and solar projects where site access and working conditions present challenges.

Energy storage integration becomes increasingly common across power generation projects, creating hybrid EPC requirements that combine multiple technologies. Co-located storage with renewable generation optimizes grid integration and project economics while requiring specialized expertise in system integration and control. Grid-forming capabilities enable renewable projects to provide grid stability services, adding complexity to EPC requirements but improving project value propositions.

Offshore wind advancement continues with larger turbine technologies and floating platform development expanding accessible resource areas. Recent project awards demonstrate increasing scale and complexity, with individual projects exceeding previous capacity records. Supply chain localization initiatives create new manufacturing facilities and port infrastructure specifically designed for offshore wind construction and maintenance activities.

Nuclear power revival gains momentum with government support for new nuclear development and small modular reactor technology advancement. Regulatory framework updates streamline approval processes while maintaining safety standards, potentially reducing project development timelines. International partnerships bring advanced nuclear technologies and financing capabilities to UK market development opportunities.

Grid infrastructure investment accelerates with major transmission network enhancement programs supporting renewable energy integration. Smart grid deployment requires specialized EPC capabilities combining traditional electrical construction with advanced digital technologies. Interconnection projects with European markets create opportunities for submarine cable installation and grid integration expertise.

Green hydrogen development emerges as a significant new market segment requiring unique combinations of renewable energy generation and electrolyzer systems. Industrial applications drive demand for large-scale hydrogen production facilities, while transport sector requirements create distributed production opportunities. Government support programs provide funding and policy frameworks supporting early market development across multiple application areas.

Strategic positioning recommendations emphasize the importance of developing specialized expertise in high-growth technology segments while maintaining capabilities across multiple market areas. Successful contractors should invest in offshore wind capabilities given the substantial project pipeline and UK market leadership position. Energy storage integration expertise becomes increasingly valuable as hybrid projects become more common across renewable energy development.

Digital transformation investment should focus on technologies that provide measurable productivity improvements and competitive differentiation. MarkWide Research analysis indicates contractors achieving successful digital implementation report 15-25% improvement in project delivery efficiency. Data analytics capabilities enable better project risk management and resource optimization across multiple concurrent projects.

Supply chain resilience development requires diversified supplier networks and strategic inventory management for critical components. Local content development creates competitive advantages while reducing supply chain risks and supporting government policy objectives. Vertical integration opportunities should be evaluated for specialized components where market availability or cost considerations justify internal capabilities.

Workforce development programs must address skills shortages in emerging technology areas while maintaining expertise in traditional power generation technologies. Training partnerships with educational institutions and equipment manufacturers provide access to latest technical knowledge and certification programs. Apprenticeship programs support long-term workforce development while addressing immediate project staffing requirements.

International expansion opportunities should leverage UK expertise in offshore wind and nuclear power for global market development. Strategic partnerships with local contractors in target markets provide market access while sharing risks and capital requirements. Technology transfer and knowledge sharing create additional revenue streams while supporting international business development objectives.

Long-term growth prospects remain highly favorable for the UK Power EPC market driven by sustained energy transition requirements and infrastructure modernization needs. Government policy commitments extending through 2050 provide unprecedented visibility for renewable energy development, while nuclear power renaissance creates substantial long-term opportunities for specialized contractors. Market expansion is expected to continue at robust rates with renewable energy EPC services leading growth across multiple technology platforms.

Technology evolution will continue reshaping market requirements with floating offshore wind, advanced energy storage, and green hydrogen production creating new EPC service categories. Digital construction technologies will become standard practice across all project types, enabling improved efficiency and risk management capabilities. Artificial intelligence applications in project management and construction optimization are projected to achieve 20-30% productivity improvements for early adopters over the next five years.

Market consolidation trends are expected to continue as contractors seek enhanced capabilities and financial resources for increasingly complex projects. Strategic partnerships and joint ventures will become more common for large-scale developments requiring diverse expertise and substantial capital commitments. International contractors will continue expanding UK operations while domestic firms strengthen specialized capabilities and explore export opportunities.

Regulatory environment evolution should streamline approval processes while maintaining safety and environmental standards. Planning system reforms may reduce project development timelines and costs, improving project economics and market attractiveness. Grid infrastructure investment will address current constraints and enable accelerated renewable energy deployment across all UK regions.

Innovation acceleration will drive continuous improvement in project delivery efficiency, safety performance, and environmental impact reduction. Collaborative research programs between contractors, technology developers, and academic institutions will advance construction methodologies and equipment capabilities. Sustainability integration will extend beyond power generation technology to encompass entire project lifecycle considerations, creating new competitive differentiators and market opportunities for forward-thinking EPC contractors.

The UK Power EPC market stands at a pivotal moment characterized by unprecedented growth opportunities driven by energy transition requirements and infrastructure modernization needs. Government policy commitments to net-zero emissions create a robust foundation for sustained market expansion across multiple technology platforms, while technological advancement continues improving project economics and performance capabilities.

Market dynamics favor contractors with specialized expertise, strong financial capabilities, and comprehensive digital transformation strategies. Offshore wind development represents the largest growth opportunity, while emerging segments such as energy storage integration and green hydrogen production create new revenue streams for innovative contractors. Competitive success increasingly depends on ability to deliver complex, multi-technology projects while maintaining high standards for safety, quality, and environmental performance.

Strategic positioning for long-term success requires balanced investment in proven technologies and emerging market segments, supported by robust supply chain management and workforce development programs. Digital transformation initiatives enable competitive differentiation through improved project delivery efficiency and enhanced customer value propositions. The market outlook remains highly favorable for contractors capable of adapting to evolving technology requirements while maintaining operational excellence across diverse project portfolios throughout the expanding UK power infrastructure landscape.

What is Power EPC?

Power EPC refers to Engineering, Procurement, and Construction services specifically tailored for the power sector, encompassing the design, procurement of materials, and construction of power generation facilities such as solar, wind, and thermal plants.

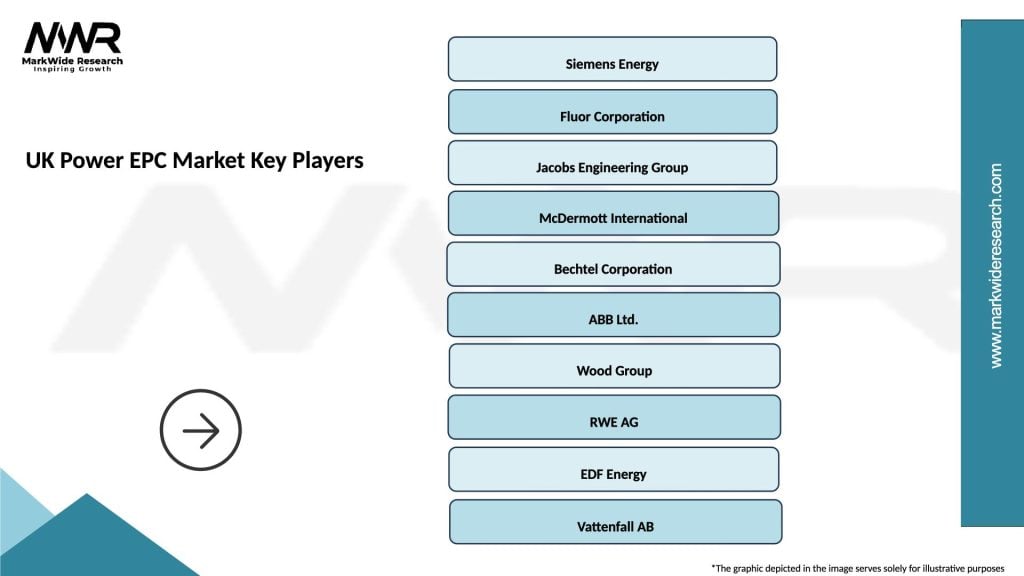

What are the key players in the UK Power EPC Market?

Key players in the UK Power EPC Market include companies like Siemens, Balfour Beatty, and Mott MacDonald, which provide comprehensive services in the development and construction of power projects, among others.

What are the growth factors driving the UK Power EPC Market?

The UK Power EPC Market is driven by factors such as the increasing demand for renewable energy sources, government initiatives promoting sustainable energy, and advancements in power generation technologies.

What challenges does the UK Power EPC Market face?

Challenges in the UK Power EPC Market include regulatory hurdles, fluctuating material costs, and the need for skilled labor, which can impact project timelines and budgets.

What opportunities exist in the UK Power EPC Market?

Opportunities in the UK Power EPC Market include the expansion of offshore wind farms, investment in energy storage solutions, and the integration of smart grid technologies to enhance energy efficiency.

What trends are shaping the UK Power EPC Market?

Trends in the UK Power EPC Market include a shift towards modular construction techniques, increased focus on sustainability and ESG compliance, and the adoption of digital technologies for project management and monitoring.

UK Power EPC Market

| Segmentation Details | Description |

|---|---|

| Type | Renewable, Conventional, Hybrid, Nuclear |

| Technology | Solar, Wind, Biomass, Geothermal |

| End User | Utilities, Industrial, Commercial, Residential |

| Service Type | Design, Procurement, Construction, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Power EPC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at