444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK plant protein market represents a transformative sector within the broader food and beverage industry, experiencing unprecedented growth driven by evolving consumer preferences and sustainability concerns. Plant-based proteins have emerged as a cornerstone of the modern British diet, with increasing numbers of consumers adopting flexitarian, vegetarian, and vegan lifestyles. The market encompasses a diverse range of protein sources including pea, soy, wheat, rice, and emerging alternatives like hemp and algae proteins.

Market dynamics indicate robust expansion across multiple application segments, from traditional meat alternatives to innovative protein-enriched beverages and snacks. The sector benefits from growing health consciousness, environmental awareness, and technological advancements in protein extraction and processing. Consumer adoption rates have accelerated significantly, with plant protein consumption growing at 12.5% annually across various demographic segments.

Regional distribution shows concentrated activity in urban centers, with London, Manchester, and Birmingham leading consumption trends. The market demonstrates strong penetration in retail channels, foodservice establishments, and direct-to-consumer platforms. Innovation cycles continue to drive product development, with manufacturers investing heavily in taste improvement, nutritional enhancement, and sustainable packaging solutions.

The UK plant protein market refers to the comprehensive ecosystem of plant-derived protein ingredients, products, and solutions designed to meet nutritional needs while addressing environmental and ethical concerns. This market encompasses protein extraction, processing, formulation, and distribution of plant-based alternatives to traditional animal proteins.

Plant proteins are derived from various botanical sources through sophisticated extraction processes that isolate and concentrate protein content while maintaining functional properties. These proteins serve as primary ingredients in meat alternatives, dairy substitutes, protein powders, and functional food applications. The market includes both established protein sources like soy and wheat gluten, alongside emerging alternatives such as pea, hemp, and novel protein sources.

Market scope extends beyond simple ingredient supply to encompass complete product ecosystems including ready-to-eat meals, beverages, snacks, and supplements. The definition also includes supporting infrastructure such as processing facilities, research and development capabilities, and distribution networks specifically designed for plant protein products.

Market transformation characterizes the current state of the UK plant protein sector, with fundamental shifts in consumer behavior driving sustained growth across all major segments. The industry has evolved from niche health food applications to mainstream market penetration, supported by significant investments in technology, infrastructure, and brand development.

Key growth drivers include increasing health awareness, environmental sustainability concerns, and improved product quality that closely mimics traditional animal proteins. Consumer acceptance rates have reached 68% among millennials and 45% across all age groups, indicating broad market appeal beyond traditional vegetarian demographics. The sector benefits from supportive regulatory frameworks and government initiatives promoting sustainable food systems.

Competitive landscape features a mix of established food manufacturers, specialized plant protein companies, and innovative startups developing next-generation protein solutions. Market leaders have invested substantially in research and development, resulting in products that meet consumer expectations for taste, texture, and nutritional value. Distribution channels have expanded rapidly, with plant protein products now available across mainstream retail, foodservice, and e-commerce platforms.

Future prospects remain highly favorable, with continued innovation in protein sources, processing technologies, and application development expected to drive sustained market expansion throughout the forecast period.

Consumer behavior analysis reveals significant shifts in purchasing patterns, with plant protein adoption accelerating across diverse demographic segments. The market demonstrates strong momentum driven by health-conscious consumers, environmental advocates, and flexitarian dieters seeking to reduce animal protein consumption without compromising nutritional requirements.

Health consciousness represents the primary driver propelling UK plant protein market expansion, with consumers increasingly recognizing the nutritional benefits of plant-based proteins. Scientific research supporting plant proteins’ role in reducing chronic disease risk, improving digestive health, and supporting weight management has significantly influenced consumer purchasing decisions.

Environmental sustainability concerns continue to drive market growth, with consumers seeking food choices that minimize ecological impact. Plant protein production requires substantially less water, land, and energy compared to animal protein alternatives, appealing to environmentally conscious consumers. Climate change awareness has reached 78% of UK consumers, directly influencing food purchasing decisions toward more sustainable options.

Technological advancement in protein extraction and processing has dramatically improved product quality, taste, and functionality. Modern processing techniques enable manufacturers to create plant proteins that closely replicate the sensory experience of traditional animal proteins, removing previous barriers to consumer adoption. Innovation in formulation has resulted in products that meet or exceed nutritional profiles of conventional protein sources.

Government support through sustainability initiatives, research funding, and favorable regulatory frameworks has created an enabling environment for market growth. Policy initiatives promoting sustainable agriculture and alternative protein development have encouraged investment and innovation within the sector.

Price sensitivity remains a significant constraint for broader market adoption, with many plant protein products carrying premium pricing compared to conventional alternatives. Cost considerations particularly impact price-conscious consumers and limit penetration in value-oriented market segments, despite improving cost competitiveness over time.

Taste and texture challenges continue to present barriers for some consumer segments, particularly those with strong preferences for traditional animal proteins. While significant improvements have been achieved, certain applications still struggle to replicate the exact sensory experience that consumers expect from conventional protein sources.

Nutritional concerns regarding protein quality, bioavailability, and amino acid completeness create hesitation among health-focused consumers. Consumer education requirements around proper plant protein combining and nutritional adequacy represent ongoing market challenges that require continued industry investment in education and product development.

Supply chain limitations in raw material availability, processing capacity, and specialized infrastructure constrain rapid market expansion. Seasonal variations in crop yields and quality can impact product consistency and availability, creating challenges for manufacturers seeking to scale operations efficiently.

Product innovation presents substantial opportunities for market expansion through development of novel protein sources, improved processing technologies, and enhanced functional properties. Emerging protein sources including algae, insects, and fermentation-derived proteins offer potential for differentiation and market growth beyond traditional plant proteins.

Application diversification across food categories provides significant growth potential, with opportunities in beverages, snacks, baked goods, and functional foods. Foodservice integration represents a major opportunity as restaurants, cafes, and institutional food providers increasingly incorporate plant protein options to meet consumer demand.

Export potential offers opportunities for UK manufacturers to leverage domestic expertise and innovation in international markets. The country’s reputation for food safety, quality, and innovation positions UK plant protein companies favorably for global expansion, particularly in European and Commonwealth markets.

Partnership opportunities with traditional food manufacturers, retailers, and foodservice operators enable rapid market penetration and scale development. Collaborative innovation between plant protein specialists and established food companies can accelerate product development and market access while sharing risks and resources.

Supply chain evolution reflects the dynamic nature of the UK plant protein market, with continuous adaptation to meet growing demand while maintaining quality and sustainability standards. Vertical integration strategies among leading companies have improved supply security and cost control, while specialized suppliers focus on innovation and niche applications.

Consumer education initiatives play a crucial role in market dynamics, with manufacturers, retailers, and advocacy organizations investing in awareness campaigns that highlight plant protein benefits. Digital marketing strategies have proven particularly effective in reaching younger demographics, with social media engagement rates for plant protein content exceeding 15% above industry averages.

Regulatory landscape continues to evolve, with food safety authorities developing specific guidelines for novel protein sources and processing methods. Labeling requirements and nutritional claims regulations directly impact product positioning and marketing strategies, requiring ongoing compliance investment from market participants.

Competitive intensity has increased significantly as traditional food manufacturers enter the plant protein space alongside specialized companies. This competition drives innovation, improves product quality, and expands consumer choice while potentially pressuring margins and requiring differentiation strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive consumer surveys, industry expert interviews, and supply chain stakeholder consultations to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and academic studies to establish market context and identify trends. Data triangulation methods ensure consistency and reliability across multiple information sources, while statistical analysis provides quantitative validation of qualitative insights.

Market modeling utilizes advanced analytical techniques to project future market scenarios and identify key growth drivers and constraints. Scenario analysis considers multiple potential market developments, including regulatory changes, technological breakthroughs, and consumer behavior shifts that could impact market trajectory.

Industry validation through expert review panels and stakeholder feedback ensures research accuracy and practical relevance. Continuous monitoring of market developments enables real-time updates and refinement of market analysis to maintain currency and accuracy of insights.

London and Southeast England dominate the UK plant protein market, accounting for approximately 42% of total consumption due to higher disposable incomes, diverse demographics, and strong health consciousness. The region benefits from concentrated retail presence, foodservice innovation, and early adoption of plant-based lifestyle trends.

Northern England represents a rapidly growing market segment, with cities like Manchester, Liverpool, and Leeds showing 18% annual growth rates in plant protein adoption. The region’s industrial heritage has evolved to include food processing capabilities that support local plant protein manufacturing and distribution.

Scotland demonstrates strong market potential driven by sustainability awareness and government support for alternative protein development. Edinburgh and Glasgow lead regional consumption, while rural areas show growing interest in locally-sourced plant protein options that support agricultural diversification.

Wales and Southwest England exhibit moderate but steady growth in plant protein adoption, with particular strength in organic and premium product segments. The regions benefit from agricultural resources suitable for plant protein crop production, creating opportunities for local supply chain development.

Regional distribution patterns reflect urban concentration with gradual expansion into suburban and rural markets as product availability and awareness increase. MarkWide Research analysis indicates regional growth rates vary significantly, with urban areas showing 25% higher adoption rates compared to rural regions.

Market leadership is distributed among several key categories of companies, each bringing unique strengths and market positioning strategies. The competitive environment features intense innovation competition, with companies investing heavily in research and development to differentiate their offerings.

Competitive strategies focus on product innovation, brand building, and distribution expansion. Companies are investing in taste improvement, nutritional enhancement, and sustainable packaging to differentiate their offerings in an increasingly crowded marketplace.

By Protein Source:

By Application:

By Distribution Channel:

Meat Alternative Category dominates market share with continuous innovation in taste, texture, and nutritional profiles. Burger alternatives lead this segment, with products achieving taste parity with traditional beef burgers driving mainstream adoption. Chicken alternatives represent the fastest-growing subsegment, with 35% annual growth driven by health-conscious consumers seeking familiar protein experiences.

Dairy Alternative Category shows robust growth across multiple product types, with plant-based milk leading adoption followed by yogurt and cheese alternatives. Oat-based products have gained significant market share due to superior taste and texture characteristics, while protein fortification addresses nutritional concerns among health-focused consumers.

Protein Powder Category benefits from growing fitness awareness and sports nutrition trends. Pea protein powders dominate this segment due to excellent solubility and neutral taste, while hemp protein appeals to consumers seeking complete nutritional profiles with additional health benefits.

Beverage Category represents significant growth potential with ready-to-drink protein beverages gaining popularity among busy consumers. Functional beverages combining plant proteins with vitamins, minerals, and other beneficial ingredients show particular promise for market expansion.

Manufacturers benefit from growing market demand, premium pricing opportunities, and potential for product differentiation through innovation. Operational advantages include lower raw material costs compared to animal proteins, reduced regulatory complexity, and alignment with sustainability trends that enhance brand reputation.

Retailers gain from higher margin opportunities, increased customer traffic from health-conscious consumers, and differentiation through comprehensive plant protein offerings. Private label opportunities in plant proteins offer retailers significant margin improvement and customer loyalty benefits.

Consumers benefit from improved health outcomes, environmental impact reduction, and expanding product choices that meet diverse dietary preferences and restrictions. Nutritional advantages include reduced saturated fat intake, increased fiber consumption, and access to complete protein sources without animal products.

Investors find attractive opportunities in a rapidly growing market with strong consumer trends, technological innovation potential, and sustainability alignment. Growth prospects remain favorable with multiple expansion opportunities across product categories, applications, and geographic markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean Label Movement drives demand for plant proteins with minimal processing and recognizable ingredients. Transparency requirements from consumers have led manufacturers to simplify formulations and highlight natural protein sources, creating opportunities for premium positioning and brand differentiation.

Personalized Nutrition trends are influencing plant protein product development, with companies creating targeted formulations for specific demographic groups, dietary requirements, and health goals. Customization capabilities enable brands to address diverse consumer needs while building stronger customer relationships.

Sustainable Packaging has become a critical consideration for plant protein brands seeking to align packaging with product sustainability values. Eco-friendly packaging solutions including compostable materials and reduced packaging waste support brand positioning and consumer expectations.

Functional Food Integration represents a growing trend where plant proteins are combined with other beneficial ingredients like probiotics, vitamins, and minerals. Multi-benefit products appeal to health-conscious consumers seeking comprehensive nutritional solutions in convenient formats.

Foodservice Innovation shows restaurants and food providers increasingly incorporating plant proteins into menu offerings. MWR analysis indicates foodservice adoption rates have increased 28% annually, driven by consumer demand and operational cost benefits.

Technology Partnerships between plant protein companies and food technology firms have accelerated innovation in processing methods, flavor development, and nutritional enhancement. These collaborations have resulted in breakthrough products that more closely replicate traditional animal proteins while maintaining plant-based benefits.

Retail Expansion initiatives have significantly increased plant protein product availability across mainstream retail channels. Major supermarket chains have dedicated increased shelf space to plant protein products while developing comprehensive private label offerings that compete directly with branded alternatives.

Investment Activity in the UK plant protein sector has reached unprecedented levels, with venture capital, private equity, and strategic investors funding expansion, innovation, and market development initiatives. Funding availability has enabled companies to scale operations and accelerate product development timelines.

Regulatory Developments have provided clearer guidelines for plant protein labeling, health claims, and novel food approvals. Regulatory clarity has reduced market uncertainty and enabled companies to make confident investments in product development and market expansion strategies.

Product Development Focus should prioritize taste and texture improvements to address remaining consumer barriers while maintaining nutritional advantages. Sensory optimization through advanced processing techniques and ingredient combinations can significantly expand market appeal beyond current consumer base.

Cost Reduction Strategies are essential for broader market penetration, requiring investment in manufacturing efficiency, supply chain optimization, and economies of scale. Price competitiveness will determine success in mainstream market segments where price sensitivity remains high.

Distribution Channel Diversification should include expanded foodservice presence, online retail optimization, and international market development. Channel strategy must align with consumer shopping behaviors while maximizing product accessibility and brand visibility.

Consumer Education Investment remains crucial for market development, requiring comprehensive programs that address nutritional questions, cooking guidance, and sustainability benefits. Educational initiatives should utilize digital platforms and partnerships with health professionals to build consumer confidence.

Sustainability Communication should clearly articulate environmental benefits while avoiding greenwashing concerns. Transparent reporting of environmental impact metrics and sustainable sourcing practices will strengthen brand positioning and consumer trust.

Market trajectory remains highly positive with sustained growth expected across all major segments driven by continued consumer adoption and product innovation. Long-term prospects indicate plant proteins will become increasingly mainstream, with growth rates maintaining momentum through technological advancement and expanding applications.

Innovation pipeline suggests significant improvements in product quality, nutritional profiles, and cost competitiveness over the forecast period. Emerging technologies including fermentation-based proteins and cellular agriculture may create new market opportunities while complementing traditional plant protein sources.

Consumer adoption patterns indicate continued expansion beyond traditional vegetarian demographics into mainstream consumer segments. Demographic analysis shows particularly strong growth potential among younger consumers, with millennial adoption rates expected to reach 75% by 2028.

Market maturation will likely result in increased competition, margin pressure, and consolidation among smaller players while creating opportunities for market leaders to strengthen positions through scale advantages and innovation capabilities. MarkWide Research projects sustained market expansion with continued premiumization opportunities for innovative products.

The UK plant protein market represents a dynamic and rapidly evolving sector with substantial growth potential driven by fundamental shifts in consumer behavior, environmental consciousness, and technological innovation. Market fundamentals remain strong with multiple growth drivers supporting sustained expansion across diverse product categories and applications.

Strategic opportunities exist for companies that can successfully address remaining challenges around taste, texture, and cost while capitalizing on growing consumer demand for sustainable and healthy protein alternatives. Success factors include continuous innovation, effective consumer education, and strategic distribution channel development.

Future market development will likely be characterized by increased mainstream adoption, improved product quality, and expanded application opportunities. Companies that invest in technology advancement, consumer understanding, and sustainable practices are well-positioned to capture significant value from this transformative market opportunity.

What is Plant Protein?

Plant protein refers to protein derived from plants, which includes sources such as legumes, nuts, seeds, and grains. It is increasingly popular due to its health benefits and sustainability compared to animal protein.

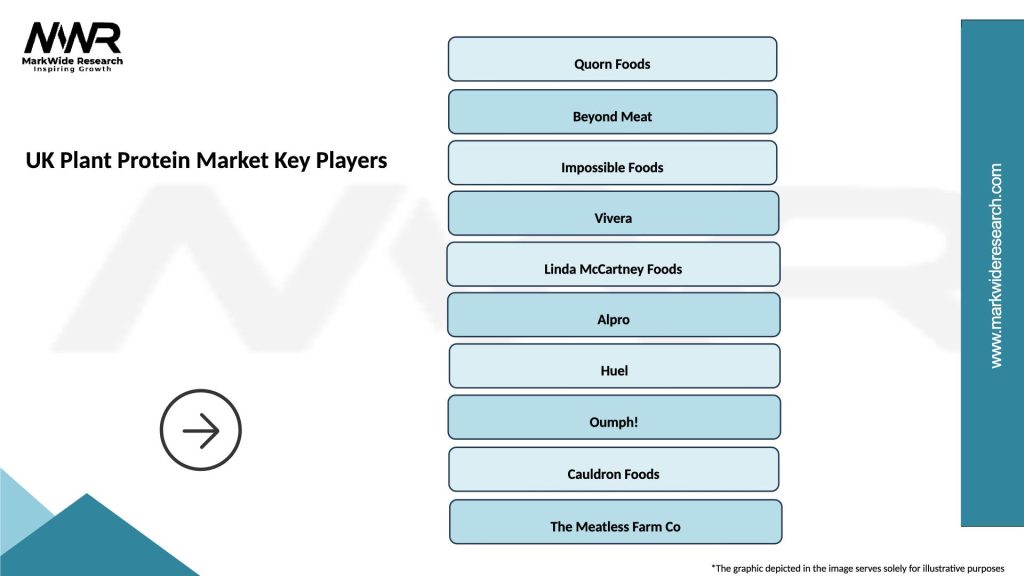

What are the key players in the UK Plant Protein Market?

Key players in the UK Plant Protein Market include companies like Quorn Foods, Beyond Meat, and Oatly, which are known for their innovative plant-based products. These companies are driving growth in the market by catering to the rising demand for plant-based diets among consumers.

What are the growth factors driving the UK Plant Protein Market?

The UK Plant Protein Market is driven by increasing health consciousness among consumers, a rise in vegan and vegetarian diets, and growing concerns about the environmental impact of animal farming. Additionally, the demand for sustainable food sources is contributing to market growth.

What challenges does the UK Plant Protein Market face?

Challenges in the UK Plant Protein Market include consumer perception issues regarding taste and texture compared to animal proteins, as well as potential supply chain disruptions. Additionally, competition from traditional protein sources remains a significant hurdle.

What opportunities exist in the UK Plant Protein Market?

The UK Plant Protein Market presents opportunities for innovation in product development, particularly in creating new flavors and textures that appeal to a broader audience. There is also potential for growth in sectors like snacks and ready-to-eat meals that incorporate plant proteins.

What trends are shaping the UK Plant Protein Market?

Trends in the UK Plant Protein Market include the rise of flexitarian diets, increased investment in plant-based food startups, and a growing focus on clean label products. Additionally, advancements in food technology are leading to more appealing plant protein options for consumers.

UK Plant Protein Market

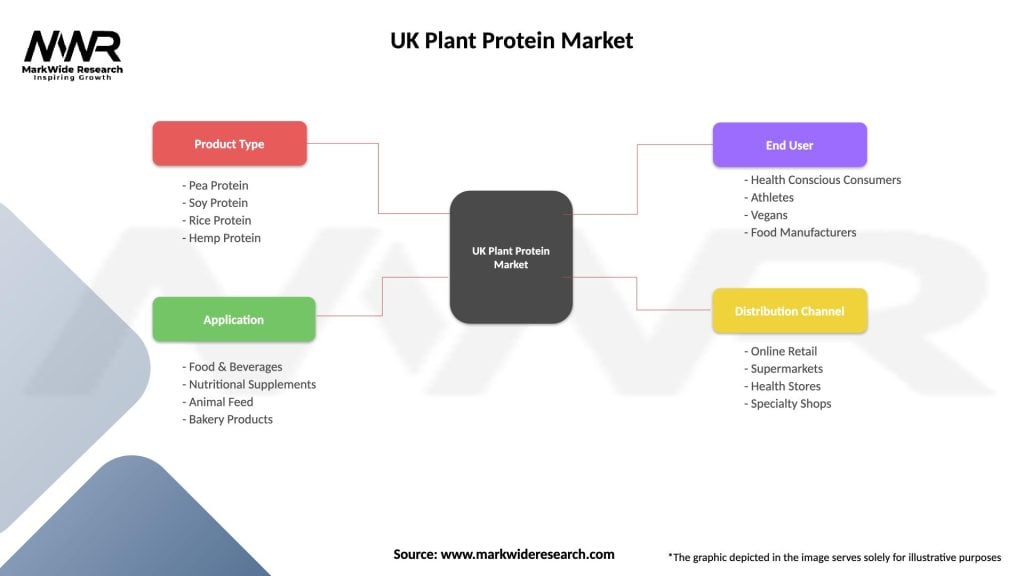

| Segmentation Details | Description |

|---|---|

| Product Type | Pea Protein, Soy Protein, Rice Protein, Hemp Protein |

| Application | Food & Beverages, Nutritional Supplements, Animal Feed, Bakery Products |

| End User | Health Conscious Consumers, Athletes, Vegans, Food Manufacturers |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Specialty Shops |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Plant Protein Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at