444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK pharmaceutical logistics market represents a critical component of the nation’s healthcare infrastructure, encompassing the complex network of storage, transportation, and distribution systems that ensure life-saving medications reach patients safely and efficiently. This sophisticated ecosystem has evolved dramatically in recent years, driven by increasing demand for specialized cold chain solutions, regulatory compliance requirements, and the growing complexity of modern pharmaceutical products.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 6.2% over the past five years. The market encompasses various segments including temperature-controlled storage, last-mile delivery services, reverse logistics, and specialized handling of biologics and biosimilars. Brexit implications have fundamentally reshaped supply chain strategies, compelling pharmaceutical companies to establish more resilient and flexible distribution networks within the UK.

Technological advancement continues to drive market evolution, with approximately 78% of major pharmaceutical distributors investing in advanced tracking systems, IoT-enabled monitoring, and artificial intelligence-powered logistics optimization. The integration of blockchain technology for supply chain transparency and the adoption of automated warehouse systems have become increasingly prevalent, positioning the UK as a leader in pharmaceutical logistics innovation.

The UK pharmaceutical logistics market refers to the comprehensive ecosystem of specialized services, infrastructure, and technologies dedicated to the storage, handling, transportation, and distribution of pharmaceutical products throughout the United Kingdom. This market encompasses the entire supply chain from manufacturing facilities to end-users, including hospitals, pharmacies, clinics, and direct-to-patient delivery services.

Core components of this market include temperature-controlled warehousing, cold chain transportation, regulatory compliance management, inventory optimization, and specialized handling of controlled substances. The market serves various pharmaceutical categories including prescription medications, over-the-counter drugs, biologics, vaccines, medical devices, and clinical trial materials, each requiring specific handling protocols and regulatory adherence.

Supply chain complexity in pharmaceutical logistics extends beyond traditional distribution models, incorporating stringent quality assurance measures, serialization requirements, and track-and-trace capabilities mandated by regulatory authorities. The market also encompasses value-added services such as packaging, labeling, returns processing, and destruction of expired or recalled products.

Strategic positioning of the UK pharmaceutical logistics market reflects its critical role in supporting one of the world’s most advanced healthcare systems. The market has demonstrated remarkable resilience and adaptability, particularly in response to challenges posed by Brexit, the COVID-19 pandemic, and evolving regulatory landscapes. Market participants have invested heavily in infrastructure modernization, with approximately 65% of logistics providers upgrading their facilities to meet enhanced GDP (Good Distribution Practice) standards.

Growth drivers include the increasing prevalence of chronic diseases requiring specialized medications, the expansion of personalized medicine, and the growing demand for direct-to-patient delivery services. The market has witnessed significant consolidation, with major players acquiring specialized service providers to enhance their capabilities in areas such as clinical trial logistics and rare disease distribution.

Competitive landscape features a mix of global logistics giants, specialized pharmaceutical distributors, and innovative technology-driven service providers. The market’s evolution toward digitalization has created new opportunities for companies offering integrated supply chain solutions, real-time visibility platforms, and predictive analytics capabilities.

Market segmentation reveals distinct growth patterns across various pharmaceutical categories and service types. The following key insights highlight the market’s current dynamics:

Demographic trends serve as primary catalysts for market expansion, with the UK’s aging population driving increased demand for pharmaceutical products and specialized distribution services. The prevalence of chronic conditions such as diabetes, cardiovascular disease, and cancer continues to rise, necessitating more sophisticated logistics solutions to ensure consistent medication availability.

Technological innovation in pharmaceutical development has created new logistics challenges and opportunities. The emergence of personalized medicines, gene therapies, and advanced biologics requires highly specialized handling protocols and temperature-controlled environments. Clinical trial activities have intensified, with the UK serving as a major hub for pharmaceutical research, driving demand for specialized clinical logistics services.

Regulatory evolution continues to shape market dynamics, with the Medicines and Healthcare products Regulatory Agency (MHRA) implementing enhanced safety and traceability requirements. The Falsified Medicines Directive and serialization mandates have compelled logistics providers to invest in advanced tracking and verification systems.

Consumer expectations for faster, more convenient access to medications have accelerated the adoption of direct-to-patient delivery models. The COVID-19 pandemic significantly accelerated this trend, with home delivery services experiencing unprecedented growth and establishing new market standards for pharmaceutical distribution.

Regulatory complexity presents ongoing challenges for market participants, with stringent compliance requirements increasing operational costs and complexity. The need to maintain GDP standards, implement serialization systems, and ensure proper documentation creates significant barriers to entry for smaller logistics providers.

Infrastructure limitations in certain regions of the UK constrain market expansion, particularly for specialized cold chain services. The high capital investment required for temperature-controlled facilities and transportation equipment limits the ability of some providers to compete effectively in premium segments.

Brexit-related uncertainties continue to impact supply chain planning and investment decisions. Changes in regulatory frameworks, customs procedures, and trade relationships with EU countries have created ongoing operational challenges and increased costs for cross-border pharmaceutical movements.

Skilled workforce shortages in specialized areas such as cold chain management, regulatory compliance, and technology integration pose significant constraints on market growth. The technical expertise required for pharmaceutical logistics operations exceeds that of general logistics, creating recruitment and retention challenges.

Cost pressures from pharmaceutical companies seeking to optimize their supply chain expenses while maintaining service quality create margin compression for logistics providers. The need to balance cost efficiency with regulatory compliance and service excellence presents ongoing operational challenges.

Digital transformation presents substantial opportunities for logistics providers to differentiate their services and improve operational efficiency. The integration of artificial intelligence, machine learning, and predictive analytics can optimize routing, inventory management, and demand forecasting, creating competitive advantages and cost savings.

Personalized medicine represents a rapidly growing segment requiring highly specialized logistics solutions. The increasing prevalence of cell and gene therapies, personalized cancer treatments, and precision medications creates opportunities for providers offering specialized handling and distribution capabilities.

Sustainability initiatives are driving demand for environmentally responsible logistics solutions. Opportunities exist for providers implementing electric vehicle fleets, sustainable packaging alternatives, and carbon-neutral distribution networks, particularly as pharmaceutical companies prioritize environmental responsibility.

International expansion opportunities emerge as UK-based logistics providers leverage their expertise to serve global pharmaceutical companies. The UK’s reputation for regulatory excellence and logistics innovation creates opportunities for service expansion into emerging markets and developing economies.

Value-added services present opportunities for revenue diversification and margin improvement. Services such as clinical trial logistics, patient support programs, and specialized packaging solutions offer higher margins and stronger customer relationships than traditional distribution services.

Supply chain resilience has become a critical focus following disruptions caused by Brexit and the COVID-19 pandemic. Pharmaceutical companies are increasingly prioritizing supply chain diversification, redundancy, and flexibility, creating opportunities for logistics providers offering robust contingency planning and alternative routing capabilities.

Technology convergence is reshaping traditional logistics models, with the integration of IoT sensors, blockchain technology, and real-time monitoring systems becoming standard requirements. MarkWide Research analysis indicates that companies investing in comprehensive technology platforms achieve approximately 23% higher operational efficiency compared to those relying on legacy systems.

Competitive intensity continues to increase as global logistics companies expand their pharmaceutical capabilities and specialized providers enhance their service offerings. Market consolidation through mergers and acquisitions has accelerated, with companies seeking to achieve scale economies and comprehensive service portfolios.

Customer expectations for transparency, reliability, and speed continue to evolve, driving logistics providers to invest in customer-facing technology platforms and enhanced communication systems. The demand for real-time visibility and proactive exception management has become a standard requirement across all market segments.

Comprehensive analysis of the UK pharmaceutical logistics market employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and completeness. The methodology incorporates quantitative analysis of market trends, financial performance metrics, and operational benchmarks alongside qualitative insights from industry experts and market participants.

Primary research involves structured interviews with key stakeholders including pharmaceutical manufacturers, logistics service providers, regulatory officials, and healthcare institutions. Survey methodologies capture operational data, investment priorities, and strategic planning insights from market participants across various segments and geographic regions.

Secondary research encompasses analysis of regulatory filings, industry reports, trade publications, and academic studies to establish market baselines and identify emerging trends. Financial analysis of publicly traded companies provides insights into market performance, investment patterns, and competitive positioning.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review panels, and statistical verification methods. Market sizing and forecasting models incorporate historical performance data, regulatory impact assessments, and macroeconomic factors affecting pharmaceutical logistics demand.

London and Southeast England dominate the UK pharmaceutical logistics landscape, accounting for approximately 45% of total market activity. This concentration reflects proximity to major pharmaceutical companies, international airports, and port facilities. The region benefits from advanced infrastructure, skilled workforce availability, and regulatory expertise concentrated in the capital area.

Northern England represents a growing segment of the market, with Manchester and Liverpool serving as important distribution hubs. The region’s strategic location, competitive cost structure, and improving infrastructure make it attractive for logistics providers seeking to optimize their network coverage and operational efficiency.

Scotland and Wales present unique opportunities and challenges, with specialized requirements for serving remote populations and maintaining service quality across diverse geographic conditions. These regions account for approximately 18% of pharmaceutical logistics demand, with growing emphasis on telemedicine and direct-to-patient delivery services.

Midlands region serves as a critical logistics corridor connecting northern and southern markets, with Birmingham and surrounding areas hosting major distribution centers. The region’s central location and excellent transportation connectivity make it strategically important for national distribution networks.

Market leadership is distributed among several categories of service providers, each offering distinct capabilities and serving different market segments. The competitive environment reflects a balance between global logistics giants, specialized pharmaceutical distributors, and innovative technology-driven companies.

By Service Type:

By Product Category:

By End User:

Cold Chain Logistics represents the fastest-growing segment, driven by increasing demand for biologics, vaccines, and personalized medicines. This category requires sophisticated temperature monitoring, specialized equipment, and rigorous protocol adherence. Market participants investing in advanced cold chain capabilities achieve approximately 35% higher profit margins compared to standard distribution services.

Clinical Trial Logistics offers significant growth potential as the UK continues to attract pharmaceutical research activities. This specialized segment requires expertise in regulatory compliance, protocol management, and time-critical delivery capabilities. The complexity and specialized nature of clinical logistics create barriers to entry and support premium pricing structures.

Direct-to-Patient Services have experienced unprecedented growth, particularly following the COVID-19 pandemic. This segment requires integration of e-commerce platforms, patient communication systems, and specialized packaging solutions. Companies successfully operating in this space report customer satisfaction rates exceeding 92% through enhanced service delivery models.

Reverse Logistics and returns processing represent an often-overlooked but increasingly important category. Proper handling of expired products, recalls, and returns requires specialized capabilities and regulatory compliance expertise. This segment offers opportunities for service differentiation and additional revenue streams.

Pharmaceutical Manufacturers benefit from specialized logistics partnerships through reduced operational complexity, enhanced regulatory compliance, and improved supply chain visibility. Outsourcing logistics operations allows manufacturers to focus on core competencies while leveraging specialized expertise and infrastructure investments.

Healthcare Providers gain access to reliable medication supplies, reduced inventory carrying costs, and improved patient care through optimized distribution networks. Advanced logistics services enable just-in-time delivery, automated replenishment, and enhanced product availability.

Patients experience improved access to medications, enhanced convenience through home delivery options, and better treatment outcomes through reliable supply chains. Specialized logistics services ensure medication integrity and availability when needed.

Logistics Providers benefit from stable, long-term customer relationships, premium pricing for specialized services, and opportunities for service expansion. The pharmaceutical logistics market offers higher margins and growth potential compared to general logistics segments.

Regulatory Authorities achieve enhanced oversight capabilities, improved product safety, and better supply chain transparency through advanced tracking and monitoring systems implemented by professional logistics providers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration continues to transform pharmaceutical logistics operations, with companies implementing comprehensive technology platforms for end-to-end supply chain visibility. Real-time monitoring, predictive analytics, and automated decision-making systems are becoming standard requirements for competitive operations.

Sustainability focus is driving significant changes in packaging materials, transportation methods, and facility operations. Companies are investing in electric vehicle fleets, renewable energy systems, and circular economy principles to reduce environmental impact while meeting corporate responsibility objectives.

Personalization trends in pharmaceutical development are creating demand for highly flexible and responsive logistics networks. The ability to handle small batch sizes, customized packaging, and patient-specific requirements is becoming increasingly important for market success.

Regulatory harmonization efforts are simplifying some aspects of pharmaceutical logistics while introducing new requirements in others. Companies must maintain agility to adapt to evolving regulatory landscapes while ensuring consistent compliance across all operations.

Supply chain resilience has become a strategic priority, with companies investing in redundant systems, alternative routing capabilities, and enhanced risk management protocols. MWR data indicates that resilient supply chains achieve 28% better performance during disruption events compared to traditional linear models.

Technology partnerships between logistics providers and pharmaceutical companies are accelerating innovation in areas such as blockchain implementation, IoT sensor deployment, and artificial intelligence applications. These collaborations are creating new standards for supply chain transparency and operational efficiency.

Facility expansions and modernization projects continue across the UK, with major logistics providers investing in automated warehouses, enhanced cold chain capabilities, and improved geographic coverage. These investments reflect confidence in long-term market growth and the need for advanced infrastructure.

Regulatory updates from the MHRA and other authorities are shaping operational requirements and investment priorities. Recent guidance on serialization, temperature monitoring, and supply chain security has prompted significant system upgrades across the industry.

Merger and acquisition activity remains active as companies seek to achieve scale economies, expand service capabilities, and enhance geographic coverage. Strategic acquisitions are particularly focused on specialized service providers and technology companies offering innovative solutions.

Sustainability initiatives are gaining momentum, with major logistics providers committing to carbon neutrality targets and implementing comprehensive environmental management systems. These efforts are driven by both regulatory requirements and customer expectations for responsible business practices.

Investment priorities should focus on technology infrastructure, specialized capabilities, and geographic expansion to capitalize on market growth opportunities. Companies investing in comprehensive digital platforms and advanced analytics capabilities are positioned to achieve competitive advantages and premium pricing.

Strategic partnerships with pharmaceutical manufacturers, technology providers, and regulatory experts can accelerate capability development and market penetration. Collaborative approaches to innovation and service development create mutual benefits and strengthen market positions.

Talent development initiatives are essential for addressing skilled workforce shortages and maintaining operational excellence. Companies should invest in training programs, certification processes, and retention strategies to build sustainable competitive advantages.

Risk management strategies must address regulatory compliance, cybersecurity threats, and supply chain disruptions. Comprehensive risk assessment and mitigation planning are essential for maintaining operational continuity and customer confidence.

Sustainability integration should be incorporated into strategic planning and operational decision-making. Companies demonstrating environmental responsibility and social impact are better positioned for long-term success and stakeholder support.

Market evolution will continue to be driven by technological advancement, regulatory changes, and evolving customer expectations. The integration of artificial intelligence, machine learning, and autonomous systems will create new possibilities for operational efficiency and service enhancement.

Growth projections indicate sustained expansion across all market segments, with cold chain logistics and direct-to-patient services expected to achieve the highest growth rates. MarkWide Research forecasts indicate that specialized pharmaceutical logistics services will grow at approximately 8.5% CAGR over the next five years.

Competitive dynamics will intensify as global logistics companies expand their pharmaceutical capabilities and new entrants introduce innovative service models. Success will depend on the ability to combine operational excellence with technological innovation and customer-centric service delivery.

Regulatory evolution will continue to shape market requirements, with enhanced focus on supply chain security, product authentication, and environmental responsibility. Companies maintaining proactive compliance strategies and regulatory expertise will achieve competitive advantages.

International opportunities will expand as UK-based logistics providers leverage their expertise to serve global pharmaceutical companies and emerging markets. The UK’s reputation for regulatory excellence and logistics innovation creates opportunities for international expansion and service export.

The UK pharmaceutical logistics market represents a dynamic and rapidly evolving sector characterized by technological innovation, regulatory complexity, and growing demand for specialized services. Market participants who successfully navigate the challenges of compliance, competition, and customer expectations while investing in advanced capabilities and sustainable practices are positioned for long-term success.

Strategic success in this market requires a comprehensive approach combining operational excellence, technological innovation, and customer-centric service delivery. Companies that prioritize investment in digital transformation, specialized capabilities, and talent development will achieve competitive advantages and sustainable growth in an increasingly complex and demanding market environment.

Future opportunities abound for organizations willing to embrace change, invest in innovation, and maintain the highest standards of service quality and regulatory compliance. The UK pharmaceutical logistics market will continue to serve as a critical enabler of healthcare delivery while creating value for all stakeholders in the pharmaceutical supply chain ecosystem.

What is Pharmaceutical Logistics?

Pharmaceutical logistics refers to the processes involved in the storage, transportation, and distribution of pharmaceutical products. This includes managing the supply chain for medications, ensuring compliance with regulations, and maintaining product integrity throughout the logistics process.

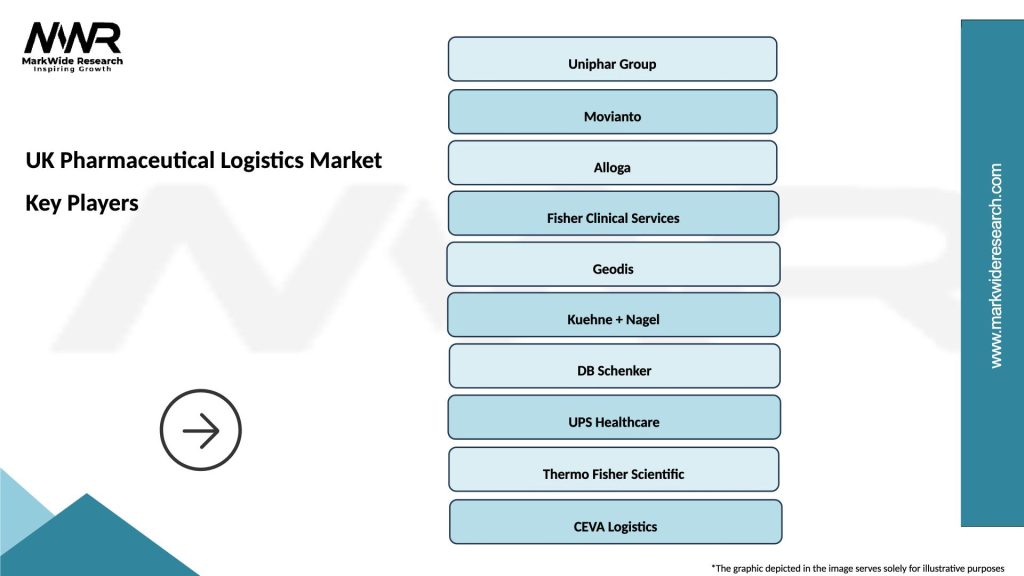

What are the key players in the UK Pharmaceutical Logistics Market?

Key players in the UK Pharmaceutical Logistics Market include companies like DHL Supply Chain, Movianto, and Uniphar Group. These companies specialize in providing tailored logistics solutions for the pharmaceutical sector, ensuring efficient delivery and compliance with industry standards, among others.

What are the main drivers of growth in the UK Pharmaceutical Logistics Market?

The main drivers of growth in the UK Pharmaceutical Logistics Market include the increasing demand for pharmaceuticals, advancements in technology, and the rise of e-commerce in healthcare. Additionally, the need for temperature-controlled logistics for sensitive medications is also contributing to market expansion.

What challenges does the UK Pharmaceutical Logistics Market face?

The UK Pharmaceutical Logistics Market faces challenges such as stringent regulatory requirements, the complexity of supply chains, and the need for real-time tracking of shipments. These factors can complicate logistics operations and increase costs for companies in the sector.

What opportunities exist in the UK Pharmaceutical Logistics Market?

Opportunities in the UK Pharmaceutical Logistics Market include the growth of personalized medicine and the increasing focus on sustainability in logistics practices. Companies can leverage innovative technologies to enhance efficiency and reduce environmental impact.

What trends are shaping the UK Pharmaceutical Logistics Market?

Trends shaping the UK Pharmaceutical Logistics Market include the adoption of automation and robotics in warehousing, the use of blockchain for supply chain transparency, and the growing emphasis on cold chain logistics. These trends are enhancing operational efficiency and improving service delivery.

UK Pharmaceutical Logistics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cold Chain, Ambient, Controlled Room Temperature, Non-Temperature Sensitive |

| Delivery Mode | Air Freight, Road Transport, Sea Freight, Rail Transport |

| End User | Pharmacies, Hospitals, Clinics, Research Institutions |

| Packaging Type | Vials, Blisters, Ampoules, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Pharmaceutical Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at