444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK pet treats market represents a dynamic and rapidly expanding segment within the broader pet care industry, driven by evolving consumer preferences and increasing pet humanization trends. Pet owners across the United Kingdom are demonstrating unprecedented willingness to invest in premium, nutritious, and specialized treats for their beloved companions, creating substantial opportunities for manufacturers and retailers alike.

Market dynamics indicate that the UK pet treats sector is experiencing robust growth, with industry analysts projecting a compound annual growth rate (CAGR) of 8.2% over the forecast period. This expansion is primarily attributed to the growing pet population, increased disposable income among pet owners, and heightened awareness regarding pet nutrition and wellness. Premium and organic pet treats are gaining significant traction, representing approximately 35% of total market share as consumers prioritize quality over price considerations.

Regional distribution across the UK shows concentrated demand in urban areas, with London and surrounding metropolitan regions accounting for 42% of market consumption. The market encompasses various product categories including training treats, dental chews, natural and organic options, functional treats with health benefits, and seasonal specialty items. E-commerce channels have emerged as a dominant distribution platform, capturing 28% of total sales volume and continuing to expand rapidly.

The UK pet treats market refers to the comprehensive commercial ecosystem encompassing the production, distribution, and retail sale of supplementary food products specifically designed for companion animals, primarily dogs and cats, within the United Kingdom territory. These products serve multiple purposes beyond basic nutrition, including training reinforcement, dental health maintenance, behavioral modification, and emotional bonding between pets and their owners.

Pet treats are distinguished from regular pet food by their intended use as occasional rewards, training aids, or supplementary nutrition sources rather than primary dietary components. The market includes various product formats such as biscuits, jerky, dental chews, freeze-dried options, soft treats, and functional supplements designed to address specific health concerns or behavioral needs.

The UK pet treats market demonstrates exceptional resilience and growth potential, supported by fundamental shifts in consumer behavior and pet ownership patterns. Market penetration has reached significant levels across all demographic segments, with particularly strong adoption among millennials and Generation Z pet owners who view their animals as family members deserving premium care and nutrition.

Key growth drivers include the increasing humanization of pets, rising awareness of pet health and wellness, expansion of premium product offerings, and the proliferation of specialized retail channels. Natural and organic treats represent the fastest-growing segment, with adoption rates increasing by 15.3% annually as consumers seek healthier alternatives for their pets.

Market challenges encompass regulatory compliance requirements, supply chain complexities, intense competition among established brands, and price sensitivity among certain consumer segments. However, opportunities for innovation in functional treats, sustainable packaging, and personalized nutrition solutions continue to drive market expansion and attract new market entrants.

Strategic market analysis reveals several critical insights that shape the competitive landscape and future growth trajectory of the UK pet treats market:

Primary market drivers propelling the UK pet treats market forward encompass both demographic trends and evolving consumer behaviors that fundamentally reshape industry dynamics. Pet humanization stands as the most significant driver, with pet owners increasingly treating their animals as family members deserving premium care, nutrition, and attention.

Rising disposable income among UK households enables increased spending on pet-related products, with treat purchases often viewed as affordable luxury items that enhance pet well-being and owner satisfaction. Health consciousness extends from human nutrition trends to pet care, driving demand for natural, organic, and functional treat options that support specific health outcomes.

Demographic shifts favor market expansion, particularly the growing population of millennial and Generation Z pet owners who demonstrate higher spending propensity and greater willingness to invest in premium pet products. Urban lifestyle changes contribute to increased reliance on treats for training, behavioral management, and emotional bonding in apartment and small-space living environments.

E-commerce proliferation facilitates market access and enables consumers to discover specialized products, compare options, and access subscription-based delivery services that enhance convenience and ensure consistent product availability. Social media influence amplifies product awareness and creates viral marketing opportunities for innovative treat brands.

Market restraints present significant challenges that may limit growth potential and create barriers for market participants seeking to establish or expand their presence in the UK pet treats sector. Regulatory complexity surrounding pet food safety, labeling requirements, and ingredient approval processes creates compliance burdens that particularly impact smaller manufacturers and new market entrants.

Price sensitivity among certain consumer segments limits market expansion, especially during economic uncertainty when discretionary spending on pet treats may be reduced in favor of essential pet care expenses. Supply chain disruptions affecting ingredient availability, transportation costs, and manufacturing capacity can significantly impact product availability and pricing stability.

Intense competition from established brands with significant marketing budgets and distribution networks creates barriers for emerging companies seeking market share. Quality control challenges related to ingredient sourcing, manufacturing consistency, and product safety can result in costly recalls and damage brand reputation.

Consumer education requirements regarding proper treat usage, feeding guidelines, and ingredient understanding necessitate ongoing marketing investments that may strain resources for smaller companies. Seasonal demand fluctuations create inventory management challenges and cash flow pressures for manufacturers and retailers.

Emerging opportunities within the UK pet treats market present substantial potential for growth and innovation, driven by evolving consumer preferences and technological advancements. Functional treats addressing specific health concerns such as anxiety reduction, joint support, and digestive health represent rapidly expanding market segments with premium pricing potential.

Personalized nutrition solutions leveraging pet health data, breed-specific requirements, and individual dietary needs offer opportunities for differentiation and customer loyalty development. Sustainable packaging innovations addressing environmental concerns while maintaining product freshness and shelf life appeal to environmentally conscious consumers.

Direct-to-consumer channels enable brands to build stronger customer relationships, gather valuable consumer insights, and capture higher margins while providing personalized service and subscription-based convenience. International expansion opportunities allow successful UK brands to leverage their expertise and product innovations in global markets.

Technology integration including smart packaging, mobile applications for feeding tracking, and IoT-enabled treat dispensers create opportunities for enhanced customer engagement and data collection. Partnership opportunities with veterinarians, pet trainers, and animal behaviorists provide credible endorsements and access to targeted customer segments.

Market dynamics within the UK pet treats sector reflect complex interactions between supply-side innovations, demand-side preferences, and regulatory frameworks that collectively shape competitive positioning and growth trajectories. Consumer behavior evolution demonstrates increasing sophistication in product selection criteria, with pet owners actively researching ingredients, nutritional benefits, and brand reputation before making purchase decisions.

Competitive intensity continues to escalate as established pet food companies expand their treat portfolios while specialized treat manufacturers seek to capture market share through innovation and targeted marketing strategies. Price competition remains significant in commodity treat segments, while premium and functional categories maintain healthier margin structures.

Distribution channel evolution reflects the growing importance of e-commerce platforms, specialty pet retailers, and direct-to-consumer models that complement traditional supermarket and pet store channels. Innovation cycles accelerate as companies invest in research and development to create differentiated products that address emerging consumer needs and preferences.

Regulatory environment continues to evolve with enhanced focus on ingredient transparency, nutritional claims substantiation, and manufacturing quality standards that influence product development and marketing strategies. Supply chain optimization becomes increasingly critical as companies seek to balance cost efficiency with quality assurance and sustainability objectives.

Comprehensive research methodology employed in analyzing the UK pet treats market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and actionable insights. Primary research encompasses extensive surveys of pet owners across diverse demographic segments, in-depth interviews with industry executives, and focus groups examining consumer preferences and purchasing behaviors.

Secondary research leverages industry reports, government statistics, trade association data, and company financial disclosures to establish market baselines and validate primary research findings. Quantitative analysis employs statistical modeling techniques to identify trends, correlations, and predictive indicators that inform market projections and strategic recommendations.

Market segmentation analysis utilizes advanced clustering techniques to identify distinct consumer groups, product categories, and regional variations that influence market dynamics. Competitive intelligence gathering involves systematic monitoring of competitor activities, product launches, pricing strategies, and marketing campaigns to assess market positioning and strategic responses.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert consultations, and statistical verification methods. Trend analysis incorporates historical data patterns, current market indicators, and forward-looking projections to develop comprehensive market outlook assessments.

Regional market distribution across the United Kingdom reveals significant variations in consumption patterns, preferences, and growth potential that influence strategic planning and resource allocation decisions. London and Southeast England dominate market consumption, accounting for approximately 45% of total market volume, driven by higher disposable incomes, dense pet populations, and greater accessibility to premium product offerings.

Northern England represents a substantial market segment with strong growth potential, particularly in urban centers such as Manchester, Liverpool, and Leeds where changing demographics and lifestyle patterns support increased pet treat consumption. Scotland demonstrates unique preferences for locally sourced and traditional treat formulations while showing growing acceptance of premium and functional products.

Wales and Southwest England exhibit strong demand for natural and organic treat options, reflecting regional preferences for sustainable and environmentally conscious products. Rural areas across all regions show different consumption patterns, with emphasis on value-oriented products and bulk purchasing behaviors compared to urban counterparts.

Regional distribution channels vary significantly, with urban areas showing higher e-commerce adoption rates of 32% of total purchases compared to rural areas where traditional retail channels remain dominant. Market penetration rates differ across regions, with opportunities for expansion in underserved areas through targeted marketing and distribution strategies.

The competitive landscape within the UK pet treats market features a diverse mix of multinational corporations, regional specialists, and emerging brands that compete across multiple dimensions including product quality, innovation, pricing, and distribution reach. Market leadership is distributed among several key players who have established strong brand recognition and customer loyalty through consistent quality and strategic marketing investments.

Major market participants include:

Competitive strategies encompass product differentiation through ingredient innovation, premium positioning, targeted marketing campaigns, and strategic partnerships with retailers and veterinary professionals. Market consolidation trends indicate ongoing acquisition activity as larger companies seek to expand their treat portfolios and market reach.

Market segmentation within the UK pet treats sector reveals distinct categories based on multiple criteria including product type, target animal, price positioning, and functional benefits. Product-based segmentation encompasses various treat formats that serve different purposes and appeal to diverse consumer preferences and pet needs.

By Product Type:

By Target Animal:

By Price Positioning:

Category-specific analysis reveals distinct growth patterns, consumer preferences, and competitive dynamics that influence strategic positioning and investment priorities within the UK pet treats market. Premium natural treats demonstrate the strongest growth trajectory, with annual expansion rates of 12.4% driven by health-conscious consumers willing to pay higher prices for quality ingredients.

Dental chew category shows exceptional promise as pet owners increasingly recognize the importance of oral health maintenance, with veterinary endorsements driving adoption rates and supporting premium pricing strategies. Training treats benefit from growing pet ownership among younger demographics who prioritize professional training and behavioral development.

Functional treats addressing specific health concerns such as joint support, anxiety reduction, and digestive health represent emerging opportunities with significant growth potential as consumers seek convenient ways to address pet health issues. Seasonal and specialty treats create opportunities for limited-edition products and gift-oriented marketing campaigns.

Organic certification increasingly influences purchasing decisions, with certified organic treats commanding premium prices and demonstrating superior customer loyalty compared to conventional alternatives. Grain-free formulations continue to gain traction despite ongoing regulatory discussions regarding nutritional adequacy and health implications.

Industry participants and stakeholders within the UK pet treats market enjoy numerous benefits from market participation, ranging from financial returns to strategic positioning advantages that support long-term business sustainability and growth objectives.

For Manufacturers:

For Retailers:

For Pet Owners:

Comprehensive SWOT analysis provides strategic insights into the UK pet treats market’s internal capabilities and external environment factors that influence competitive positioning and growth potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends within the UK pet treats sector reflect evolving consumer preferences, technological innovations, and industry dynamics that shape future growth directions and competitive strategies. Humanization of pets continues to drive demand for premium, human-grade ingredients and sophisticated product formulations that mirror human food trends.

Sustainability consciousness increasingly influences purchasing decisions, with consumers seeking environmentally responsible packaging, ethical sourcing practices, and carbon-neutral manufacturing processes. Personalization trends drive demand for customized treat solutions based on individual pet characteristics, health conditions, and dietary requirements.

Functional nutrition represents a rapidly expanding trend as pet owners seek treats that provide specific health benefits beyond basic nutrition, including joint support, cognitive enhancement, and stress reduction. Transparency demands require brands to provide detailed ingredient information, sourcing details, and manufacturing processes to build consumer trust.

Digital integration encompasses smart packaging technologies, mobile applications for feeding tracking, and IoT-enabled treat dispensers that enhance customer engagement and provide valuable usage data. Subscription models gain popularity as consumers seek convenience and consistent product delivery while brands benefit from predictable revenue streams and customer retention.

Local sourcing preferences reflect growing interest in supporting domestic agriculture and reducing transportation environmental impact while ensuring ingredient freshness and quality control. Artisanal and craft treats appeal to consumers seeking unique, small-batch products with distinctive flavors and premium positioning.

Recent industry developments demonstrate the dynamic nature of the UK pet treats market, with significant innovations, strategic partnerships, and regulatory changes that influence competitive positioning and growth opportunities. Product innovation continues at an accelerated pace, with companies investing heavily in research and development to create differentiated offerings that address emerging consumer needs.

Acquisition activity remains robust as larger companies seek to expand their treat portfolios through strategic purchases of specialized brands and innovative manufacturers. Sustainability initiatives gain prominence with companies implementing comprehensive environmental programs covering packaging, sourcing, and manufacturing processes.

Technology adoption accelerates across the industry, with companies leveraging artificial intelligence for product development, blockchain for supply chain transparency, and advanced analytics for consumer insights and market intelligence. Regulatory developments continue to evolve with enhanced focus on ingredient safety, nutritional claims substantiation, and manufacturing quality standards.

Distribution channel evolution reflects the growing importance of direct-to-consumer models, subscription services, and specialized e-commerce platforms that complement traditional retail channels. International expansion activities increase as successful UK brands seek growth opportunities in global markets while international companies enter the UK market.

Partnership strategies encompass collaborations with veterinarians, pet trainers, and animal behaviorists to enhance product credibility and access targeted customer segments. Marketing innovation includes social media campaigns, influencer partnerships, and experiential marketing programs that build brand awareness and customer engagement.

Strategic recommendations from MarkWide Research analysis emphasize the importance of balanced approaches that capitalize on growth opportunities while managing inherent market risks and competitive challenges. Product portfolio diversification should focus on functional treats that address specific health concerns while maintaining core offerings that appeal to mainstream consumers.

Investment priorities should emphasize research and development capabilities, supply chain optimization, and digital marketing infrastructure that support long-term competitive advantages. Brand positioning strategies must clearly communicate value propositions while building emotional connections with pet owners through authentic storytelling and community engagement.

Distribution strategy optimization requires balanced approaches that leverage both traditional retail partnerships and emerging digital channels to maximize market reach and customer accessibility. Quality assurance investments remain critical for maintaining consumer trust and regulatory compliance while supporting premium positioning strategies.

Sustainability integration should encompass comprehensive environmental programs that address packaging, sourcing, and manufacturing processes while communicating these efforts effectively to environmentally conscious consumers. Market expansion opportunities should be evaluated based on demographic trends, competitive intensity, and regulatory requirements in target regions.

Innovation focus areas should prioritize functional nutrition, personalized solutions, and technology integration that enhance customer experience and provide competitive differentiation. Partnership development with veterinary professionals, pet retailers, and complementary service providers can enhance market access and product credibility.

Future market prospects for the UK pet treats sector remain exceptionally positive, supported by fundamental demographic trends, evolving consumer preferences, and continuous innovation opportunities that drive sustained growth and market expansion. Market evolution will likely accelerate toward premium, functional, and personalized product offerings that command higher margins and stronger customer loyalty.

Technological integration will become increasingly important as companies leverage artificial intelligence, machine learning, and IoT technologies to enhance product development, customer engagement, and operational efficiency. Sustainability requirements will intensify as environmental consciousness becomes a primary purchasing criterion for growing segments of pet owners.

Regulatory environment evolution will likely emphasize enhanced transparency, stricter quality standards, and more comprehensive nutritional claims substantiation requirements that favor established companies with robust compliance capabilities. Market consolidation may accelerate as larger companies seek to acquire innovative brands and specialized manufacturers to expand their treat portfolios.

Growth projections indicate continued market expansion with projected annual growth rates of 7.5% over the next five years, driven by increasing pet ownership, rising disposable incomes, and growing awareness of pet nutrition and wellness. E-commerce channels are expected to capture an increasing share of total market volume, potentially reaching 40% of total sales within the forecast period.

Innovation opportunities will focus on functional nutrition, sustainable packaging, personalized solutions, and technology-enhanced products that provide superior customer value and competitive differentiation. International expansion potential remains significant for successful UK brands seeking growth opportunities in global markets with similar demographic and consumer trends.

The UK pet treats market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by fundamental shifts in consumer behavior, demographic trends, and technological innovations. Market participants who successfully navigate the competitive landscape through strategic positioning, product innovation, and customer-centric approaches will capture significant opportunities for sustainable growth and profitability.

Key success factors include maintaining high product quality standards, developing strong brand recognition, optimizing distribution strategies, and investing in research and development capabilities that support continuous innovation. Future market leaders will likely be those companies that effectively balance premium positioning with accessibility, sustainability with profitability, and innovation with operational excellence.

Strategic priorities for market participants should emphasize building authentic customer relationships, developing differentiated product portfolios, and creating sustainable competitive advantages through quality, innovation, and brand strength. Market outlook remains highly favorable, with continued expansion expected across all major segments and distribution channels, creating substantial opportunities for both established players and emerging brands in the thriving UK pet treats market.

What is Pet Treats?

Pet treats are snacks or food items specifically designed for pets, often used as rewards or training aids. They come in various forms, including biscuits, chews, and soft treats, catering to different pet preferences and dietary needs.

What are the key players in the UK Pet Treats Market?

Key players in the UK Pet Treats Market include companies like Mars Petcare, Nestlé Purina, and PetSmart, which offer a wide range of products for dogs and cats. These companies focus on innovation and quality to meet consumer demands, among others.

What are the growth factors driving the UK Pet Treats Market?

The UK Pet Treats Market is driven by increasing pet ownership, rising disposable incomes, and a growing trend towards premium and natural pet products. Additionally, the humanization of pets has led to higher spending on pet treats.

What challenges does the UK Pet Treats Market face?

Challenges in the UK Pet Treats Market include regulatory compliance regarding pet food safety and quality, as well as competition from private label brands. Additionally, fluctuating ingredient prices can impact production costs.

What opportunities exist in the UK Pet Treats Market?

Opportunities in the UK Pet Treats Market include the growing demand for organic and health-focused treats, as well as the potential for online sales growth. Innovations in product formulations and packaging can also attract new consumers.

What trends are shaping the UK Pet Treats Market?

Trends in the UK Pet Treats Market include the rise of functional treats that offer health benefits, such as dental care and joint support. Additionally, sustainability in sourcing and packaging is becoming increasingly important to consumers.

UK Pet Treats Market

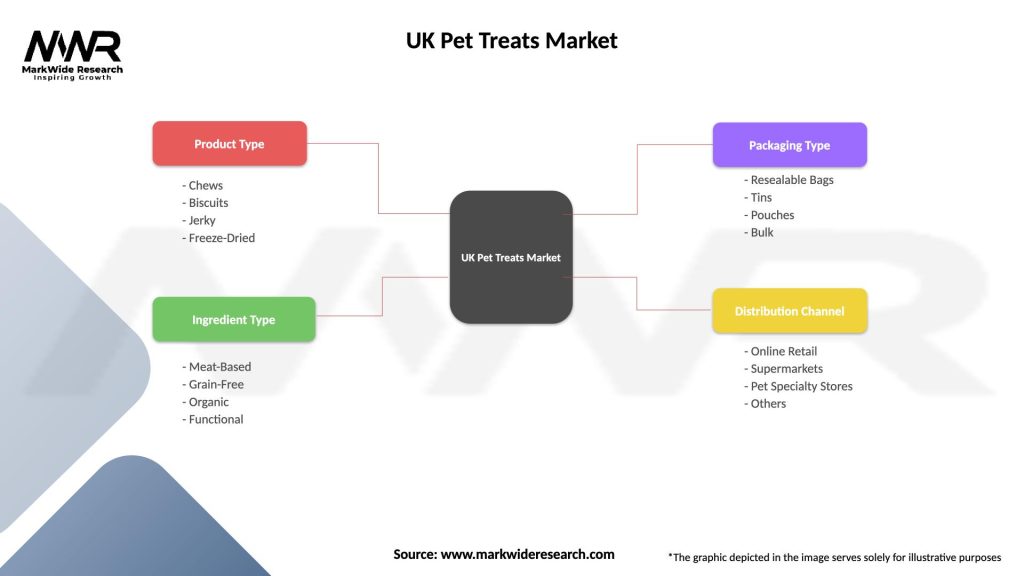

| Segmentation Details | Description |

|---|---|

| Product Type | Chews, Biscuits, Jerky, Freeze-Dried |

| Ingredient Type | Meat-Based, Grain-Free, Organic, Functional |

| Packaging Type | Resealable Bags, Tins, Pouches, Bulk |

| Distribution Channel | Online Retail, Supermarkets, Pet Specialty Stores, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Pet Treats Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at