444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK pet food market represents one of Europe’s most dynamic and rapidly evolving sectors, driven by changing consumer attitudes toward pet care and nutrition. Pet ownership in the United Kingdom has reached unprecedented levels, with households increasingly viewing their pets as family members deserving premium nutrition and specialized dietary solutions. The market encompasses a comprehensive range of products including dry food, wet food, treats, and specialized nutritional supplements for dogs, cats, and other companion animals.

Market dynamics indicate robust growth potential, with the sector experiencing a 6.2% annual growth rate driven by premiumization trends and increasing awareness of pet health benefits. Consumer spending patterns reveal a significant shift toward higher-quality, natural, and organic pet food products, reflecting broader health and wellness trends affecting human food consumption. The market’s resilience has been particularly evident during economic uncertainties, as pet owners prioritize their animals’ nutritional needs regardless of broader economic pressures.

Regional distribution across the UK shows concentrated demand in urban areas, with London and Southeast England accounting for approximately 35% of total market consumption. The market structure includes established multinational corporations, emerging premium brands, and specialized niche players focusing on specific dietary requirements or pet demographics.

The UK pet food market refers to the comprehensive commercial sector encompassing the production, distribution, and retail sale of nutritional products specifically formulated for companion animals including dogs, cats, birds, fish, and small mammals. This market includes manufactured pet foods ranging from basic nutritional maintenance products to specialized therapeutic diets, premium organic formulations, and functional treats designed to support specific health outcomes.

Market scope extends beyond traditional dry and wet food categories to include freeze-dried products, raw food alternatives, nutritional supplements, and specialized dietary solutions for pets with specific health conditions or life stage requirements. The sector encompasses both mass-market products available through supermarkets and specialized premium offerings distributed through pet specialty retailers, veterinary clinics, and direct-to-consumer channels.

The UK pet food market demonstrates exceptional resilience and growth potential, characterized by evolving consumer preferences toward premium, natural, and specialized nutritional products. Market transformation reflects broader societal shifts in pet ownership attitudes, with consumers increasingly willing to invest in high-quality nutrition for their companion animals. The sector benefits from stable demand fundamentals, supported by growing pet ownership rates and increasing per-pet spending on nutritional products.

Key market drivers include the humanization of pets, rising awareness of nutrition’s impact on pet health and longevity, and growing demand for products addressing specific dietary needs and health conditions. Premium segment growth significantly outpaces traditional mass-market categories, with natural and organic products experiencing particularly strong adoption rates of approximately 12% annually.

Competitive landscape features a mix of established multinational corporations and innovative smaller brands, creating dynamic market conditions that foster product innovation and category expansion. Distribution channels continue evolving, with online sales gaining significant traction alongside traditional retail partnerships with supermarkets and pet specialty stores.

Consumer behavior analysis reveals fundamental shifts in pet food purchasing decisions, with quality and ingredient transparency becoming primary selection criteria. Pet owners increasingly research product ingredients, manufacturing processes, and brand values before making purchasing decisions, creating opportunities for brands that effectively communicate their value propositions.

Pet humanization trends represent the primary catalyst driving UK pet food market expansion, as owners increasingly view their companion animals as family members deserving premium nutrition and specialized care. This fundamental shift in pet-owner relationships translates directly into willingness to invest in higher-quality food products that support pet health, longevity, and quality of life.

Health and wellness consciousness among pet owners mirrors broader human health trends, creating demand for natural, organic, and minimally processed pet food options. Veterinary recommendations increasingly emphasize nutrition’s role in preventing common health issues, driving adoption of specialized diets and functional foods designed to support specific health outcomes.

Demographic changes contribute significantly to market growth, with millennials and Gen Z consumers demonstrating particularly strong willingness to spend on premium pet products. These younger demographics prioritize ingredient transparency, ethical sourcing, and brand values alignment when making pet food purchasing decisions.

E-commerce expansion facilitates market access for specialized and premium brands, enabling direct-to-consumer relationships and subscription-based purchasing models that enhance customer loyalty and lifetime value. Digital marketing capabilities allow smaller brands to compete effectively with established players through targeted messaging and community building.

Economic sensitivity remains a significant market constraint, as premium pet food products typically command higher price points that may limit adoption during periods of economic uncertainty. Consumer price consciousness can drive temporary shifts toward value-oriented products, particularly affecting discretionary spending on treats and supplements.

Regulatory complexity presents ongoing challenges for market participants, particularly smaller brands seeking to introduce innovative products or make specific health claims. Compliance requirements for pet food manufacturing, labeling, and marketing create barriers to entry and ongoing operational costs that can limit market participation.

Supply chain vulnerabilities affect ingredient availability and pricing stability, particularly for specialized or imported ingredients used in premium formulations. Raw material price volatility can impact profit margins and force difficult decisions regarding product pricing or formulation modifications.

Consumer education needs represent an ongoing challenge, as many pet owners lack comprehensive understanding of pet nutritional requirements and may make purchasing decisions based on incomplete or inaccurate information. Marketing investment requirements for educating consumers about product benefits can strain resources, particularly for smaller market participants.

Specialized nutrition segments offer substantial growth opportunities, particularly products addressing specific health conditions, life stages, or dietary restrictions. Therapeutic diets for pets with allergies, digestive issues, or chronic health conditions represent underserved market niches with significant expansion potential and premium pricing opportunities.

Sustainable and ethical products align with growing consumer consciousness about environmental impact and animal welfare, creating opportunities for brands that can effectively communicate their sustainability credentials. Plant-based alternatives and insect protein formulations represent emerging categories with potential for significant market disruption.

Technology integration presents opportunities for personalized nutrition solutions, including customized formulations based on individual pet characteristics, health status, and activity levels. Smart packaging solutions incorporating freshness indicators or portion control features can differentiate products and enhance consumer value perception.

Export market development offers growth opportunities for successful UK brands seeking international expansion, particularly in markets with similar pet ownership cultures and premium product demand. Private label partnerships with major retailers can provide market access and scale opportunities for specialized manufacturers.

Competitive intensity continues increasing as new entrants challenge established market leaders through innovative products, direct-to-consumer business models, and targeted marketing strategies. Market fragmentation creates opportunities for specialized players while requiring established brands to defend market share through continuous innovation and brand investment.

Consumer loyalty patterns show increasing volatility as pet owners become more willing to experiment with new brands and products, particularly when motivated by health concerns or ingredient preferences. Brand switching behavior creates both challenges and opportunities, requiring companies to focus on customer retention while pursuing new customer acquisition.

Retail channel evolution reflects changing consumer shopping preferences, with online sales experiencing accelerated growth rates of approximately 18% annually while traditional retail channels adapt their strategies to maintain relevance. Omnichannel integration becomes increasingly important for brands seeking to maximize market reach and customer touchpoints.

Innovation cycles accelerate as companies seek competitive differentiation through new ingredients, processing methods, and product formats. Research and development investment becomes critical for maintaining market position and meeting evolving consumer expectations for product performance and quality.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights, combining quantitative data collection with qualitative consumer behavior analysis. Primary research activities include consumer surveys, retailer interviews, and industry expert consultations to gather firsthand market intelligence and validate secondary research findings.

Data collection processes utilize both traditional market research techniques and modern digital analytics to capture comprehensive market dynamics and consumer behavior patterns. Statistical analysis methods ensure data accuracy and reliability while identifying significant market trends and growth opportunities.

Market segmentation analysis examines multiple dimensions including product categories, price points, distribution channels, and consumer demographics to provide detailed market understanding. Competitive intelligence gathering monitors market participant strategies, product launches, and performance metrics to assess competitive dynamics and market positioning.

Validation procedures include cross-referencing multiple data sources and conducting follow-up research to confirm key findings and market projections. Quality assurance protocols ensure research methodology consistency and data integrity throughout the analysis process.

London and Southeast England dominate UK pet food consumption, representing approximately 35% of total market demand driven by high pet ownership rates, disposable income levels, and access to premium product retailers. Urban concentration in these regions supports specialized pet food retailers and facilitates direct-to-consumer delivery services that enhance premium product accessibility.

Northern England regions show strong growth potential, with Manchester, Leeds, and Liverpool metropolitan areas experiencing increasing pet ownership rates and growing demand for premium pet food products. Regional income growth supports market expansion as consumers gain capacity for discretionary spending on pet care products.

Scotland and Wales represent significant market opportunities, with rural areas showing particular interest in natural and locally-sourced pet food options. Regional preferences for products supporting active outdoor lifestyles create opportunities for specialized formulations targeting working dogs and outdoor companion animals.

Distribution network development varies significantly across regions, with urban areas benefiting from comprehensive retail coverage while rural regions increasingly rely on online purchasing and specialized pet supply retailers. Logistics infrastructure improvements continue expanding market access for premium brands seeking national distribution coverage.

Market leadership remains concentrated among several major international corporations that leverage extensive distribution networks, marketing resources, and product development capabilities to maintain competitive advantages. Established players continue investing in innovation and brand building to defend market share against emerging competitors.

Emerging competitors challenge established players through innovative products, direct-to-consumer business models, and targeted marketing strategies that resonate with specific consumer segments. Market entry barriers continue lowering as e-commerce platforms facilitate market access for smaller brands with limited distribution resources.

Product category segmentation reveals distinct market dynamics across different pet food types, with dry food maintaining the largest market share while wet food and treats experience faster growth rates. Premium segments consistently outperform mass-market categories, reflecting consumer willingness to invest in higher-quality nutrition for their pets.

By Product Type:

By Pet Type:

By Distribution Channel:

Premium dry food categories demonstrate exceptional growth potential, with natural and organic formulations experiencing particularly strong consumer adoption. Grain-free options maintain popularity despite ongoing nutritional debates, reflecting consumer preferences for perceived natural feeding approaches.

Wet food innovation focuses on texture variety, portion control packaging, and specialized formulations targeting specific health outcomes. Convenience packaging developments including resealable containers and single-serve portions address consumer lifestyle needs while maintaining product freshness.

Functional treats segment shows remarkable expansion as consumers seek products that provide health benefits beyond basic nutrition. Dental health treats, joint support supplements, and calming formulations represent high-growth subcategories with premium pricing opportunities.

Raw and alternative diet categories attract dedicated consumer segments willing to invest significant time and money in specialized feeding approaches. Freeze-dried products offer convenience advantages over traditional raw feeding while maintaining perceived nutritional benefits.

Manufacturers benefit from stable demand fundamentals and growing consumer willingness to pay premium prices for high-quality products. Innovation opportunities in specialized nutrition, sustainable packaging, and personalized formulations provide competitive differentiation possibilities and margin expansion potential.

Retailers gain from pet food’s role as a traffic-driving category that encourages frequent store visits and cross-selling opportunities. Premium product margins offer improved profitability compared to traditional mass-market pet food categories, while subscription services provide predictable revenue streams.

Pet owners receive unprecedented access to specialized nutrition solutions that can improve their pets’ health, longevity, and quality of life. Product transparency and ingredient information enable informed purchasing decisions that align with personal values and pet-specific needs.

Veterinary professionals benefit from expanded therapeutic diet options and improved client compliance with nutritional recommendations. Educational partnerships with pet food manufacturers enhance professional development opportunities and client service capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Humanization of pet nutrition continues driving market evolution, with consumers increasingly applying human food trends to their pet food purchasing decisions. Clean label preferences emphasize recognizable ingredients, minimal processing, and transparent sourcing practices that align with human food consumption patterns.

Personalization trends emerge as technology enables customized nutrition solutions based on individual pet characteristics, health status, and lifestyle factors. Subscription-based services leverage data analytics to optimize feeding recommendations and automate product delivery for enhanced customer convenience.

Sustainability consciousness influences purchasing decisions as environmentally aware consumers seek products with reduced environmental impact. Alternative protein sources including insect-based formulations and plant-based options gain consideration as sustainable nutrition alternatives.

Functional nutrition emphasis shifts focus from basic sustenance to targeted health outcomes, with products designed to support specific physiological functions or address particular health concerns. Preventive health approaches gain traction as consumers recognize nutrition’s role in maintaining long-term pet health and reducing veterinary costs.

Recent market developments reflect accelerating innovation cycles and increasing investment in specialized nutrition solutions. MarkWide Research analysis indicates significant merger and acquisition activity as established companies seek to acquire innovative brands and specialized capabilities.

Technology integration advances include smart packaging solutions, personalized nutrition platforms, and direct-to-consumer subscription services that enhance customer relationships and provide valuable consumption data. Manufacturing innovations focus on improving product quality, extending shelf life, and reducing environmental impact through sustainable production processes.

Regulatory developments continue evolving to address new ingredients, health claims, and labeling requirements that reflect changing consumer expectations and scientific understanding of pet nutrition. Industry collaboration increases between pet food manufacturers, veterinary professionals, and research institutions to advance nutritional science and product development.

Market consolidation trends see larger companies acquiring specialized brands to expand product portfolios and access niche market segments. Investment activity in emerging brands and innovative technologies demonstrates continued confidence in market growth potential and consumer demand for premium products.

Strategic recommendations for market participants emphasize the importance of innovation, brand differentiation, and customer relationship management in an increasingly competitive environment. Product development priorities should focus on specialized nutrition solutions, sustainable packaging, and functional benefits that address specific consumer needs and preferences.

Distribution strategy optimization requires balancing traditional retail partnerships with direct-to-consumer capabilities that enable better customer relationships and higher margins. E-commerce investment becomes critical for reaching younger demographics and providing convenient purchasing options that support customer loyalty.

Brand positioning strategies should emphasize transparency, quality, and health benefits while building emotional connections with pet owners who view their animals as family members. Marketing communications must effectively educate consumers about nutritional benefits while building trust and credibility through scientific backing and veterinary endorsements.

Operational excellence in supply chain management, quality control, and customer service becomes increasingly important as consumer expectations rise and competitive pressure intensifies. Sustainability initiatives should address both environmental impact and ethical sourcing to align with evolving consumer values and regulatory requirements.

Long-term market prospects remain highly favorable, supported by fundamental demographic trends including growing pet ownership, increasing pet spending, and continued premiumization of pet care products. MWR projections indicate sustained growth potential driven by innovation in specialized nutrition and expanding consumer awareness of nutrition’s impact on pet health and longevity.

Technology integration will likely accelerate, with personalized nutrition solutions, smart packaging, and data-driven feeding recommendations becoming mainstream market features. Artificial intelligence applications may enable more sophisticated product recommendations and customized formulations based on individual pet characteristics and health monitoring data.

Sustainability requirements will increasingly influence product development, packaging design, and supply chain management as environmental consciousness continues growing among consumers and regulators. Alternative protein sources and circular economy principles may reshape traditional pet food manufacturing approaches.

Market structure evolution may see continued consolidation among larger players while creating opportunities for specialized brands that can effectively serve niche market segments. International expansion opportunities will likely increase for successful UK brands as global pet ownership trends mirror domestic market developments.

The UK pet food market represents a dynamic and resilient sector characterized by strong growth fundamentals, evolving consumer preferences, and continuous innovation in product development and distribution strategies. Market transformation reflects broader societal changes in pet ownership attitudes, with consumers increasingly viewing their companion animals as family members deserving premium nutrition and specialized care.

Growth opportunities remain substantial across multiple market segments, particularly in specialized nutrition, sustainable products, and direct-to-consumer channels that enable enhanced customer relationships and improved margins. Competitive dynamics continue evolving as new entrants challenge established players through innovative products and targeted marketing strategies that resonate with specific consumer segments.

Success factors for market participants include maintaining focus on product quality and innovation, building strong brand relationships with consumers, and adapting distribution strategies to meet changing shopping preferences. Long-term market outlook remains highly positive, supported by demographic trends, increasing pet spending, and growing recognition of nutrition’s importance in pet health and wellness outcomes.

What is Pet Food?

Pet food refers to food specifically formulated and intended for consumption by pets, including dogs, cats, birds, and other domesticated animals. It encompasses a variety of products such as dry kibble, wet food, treats, and specialized diets for health conditions.

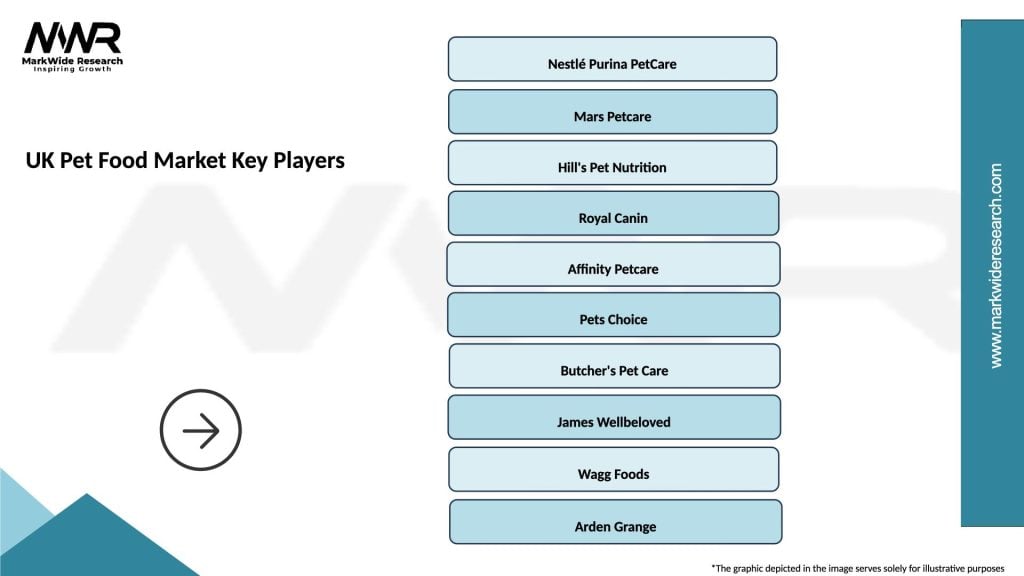

What are the key players in the UK Pet Food Market?

Key players in the UK Pet Food Market include companies like Nestlé Purina, Mars Petcare, and Hill’s Pet Nutrition. These companies dominate the market with a wide range of products catering to different pet needs and preferences, among others.

What are the growth factors driving the UK Pet Food Market?

The UK Pet Food Market is driven by increasing pet ownership, a growing trend towards premium and natural pet food products, and rising awareness of pet health and nutrition. Additionally, the humanization of pets has led to higher spending on quality pet food.

What challenges does the UK Pet Food Market face?

The UK Pet Food Market faces challenges such as fluctuating raw material prices, regulatory compliance regarding pet food safety, and competition from private label brands. These factors can impact profit margins and market dynamics.

What opportunities exist in the UK Pet Food Market?

Opportunities in the UK Pet Food Market include the growing demand for organic and sustainable pet food options, innovations in pet nutrition, and the expansion of online sales channels. Brands that adapt to these trends may capture a larger market share.

What trends are shaping the UK Pet Food Market?

Trends in the UK Pet Food Market include the rise of plant-based pet food, increased focus on pet wellness and health, and the use of technology in product development and marketing. These trends reflect changing consumer preferences and a shift towards more responsible pet ownership.

UK Pet Food Market

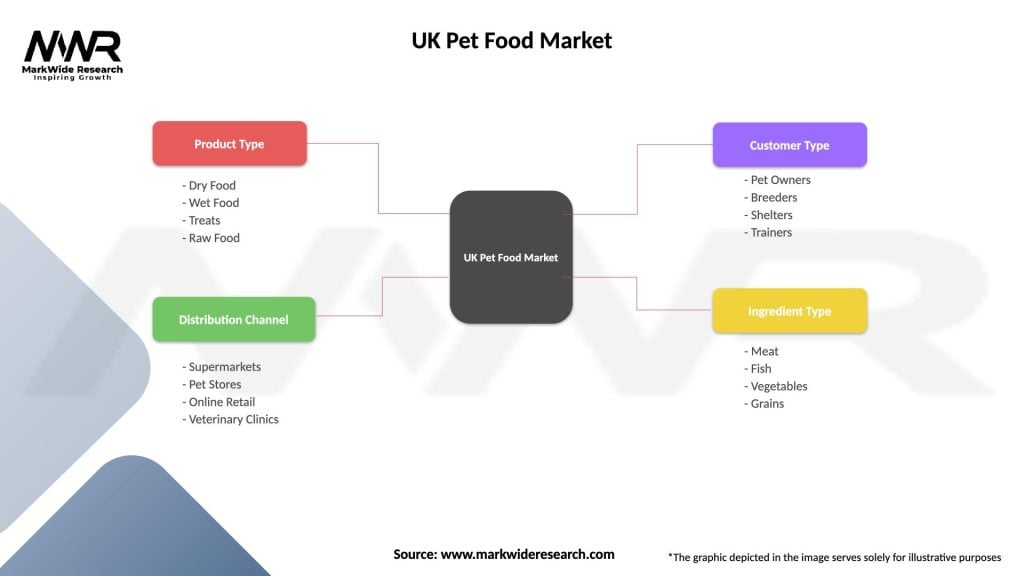

| Segmentation Details | Description |

|---|---|

| Product Type | Dry Food, Wet Food, Treats, Raw Food |

| Distribution Channel | Supermarkets, Pet Stores, Online Retail, Veterinary Clinics |

| Customer Type | Pet Owners, Breeders, Shelters, Trainers |

| Ingredient Type | Meat, Fish, Vegetables, Grains |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Pet Food Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at