444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK pension fund market represents one of the most significant institutional investment sectors in the United Kingdom, encompassing a diverse range of retirement savings vehicles and investment strategies. Pension funds in the UK serve as critical financial intermediaries, managing retirement assets for millions of workers across both public and private sectors. The market has experienced substantial transformation over recent decades, driven by regulatory changes, demographic shifts, and evolving investment approaches.

Market dynamics indicate robust growth in assets under management, with the sector demonstrating resilience despite economic uncertainties. The UK pension fund landscape includes defined benefit schemes, defined contribution plans, and hybrid arrangements, each serving distinct member populations and investment objectives. Institutional investors within this market have increasingly diversified their portfolios, embracing alternative investments and sustainable finance principles.

Growth projections suggest the market will continue expanding at a steady CAGR of 4.2% over the forecast period, supported by automatic enrollment policies and increased contribution rates. The sector’s evolution reflects broader trends in retirement planning, with digital transformation and environmental, social, and governance (ESG) considerations becoming increasingly prominent in investment decision-making processes.

The UK pension fund market refers to the comprehensive ecosystem of retirement savings institutions, investment vehicles, and regulatory frameworks that facilitate long-term wealth accumulation for UK workers and retirees. This market encompasses various pension arrangements including occupational pension schemes, personal pension plans, and stakeholder pensions, all designed to provide financial security during retirement years.

Pension funds operate as collective investment vehicles that pool contributions from multiple members to achieve economies of scale and professional investment management. These institutions invest across diverse asset classes including equities, bonds, real estate, infrastructure, and alternative investments to generate returns that support future pension payments. The market serves both active contributors building retirement wealth and pensioners receiving regular income payments.

Regulatory oversight ensures pension funds operate in members’ best interests while maintaining financial stability and transparency. The market’s structure reflects decades of policy evolution aimed at encouraging retirement savings and addressing the challenges of an aging population and changing employment patterns.

Market leadership in the UK pension fund sector is characterized by a mix of large institutional players, including corporate pension schemes, local government pension funds, and commercial pension providers. The market has demonstrated remarkable adaptability, transitioning from predominantly defined benefit arrangements to defined contribution schemes while maintaining strong asset growth trajectories.

Key performance indicators reveal that approximately 78% of eligible workers are now enrolled in workplace pension schemes, representing a significant increase from pre-automatic enrollment levels. The sector has embraced technological innovation, with digital platforms and robo-advisory services becoming increasingly prevalent in pension administration and member engagement.

Investment strategies have evolved considerably, with pension funds allocating greater proportions of assets to alternative investments and ESG-compliant securities. This strategic shift reflects both the search for enhanced returns in low-yield environments and growing awareness of sustainability considerations among pension fund trustees and members.

Regulatory developments continue shaping market dynamics, with recent reforms focusing on improving member outcomes, enhancing governance standards, and promoting greater transparency in fee structures and investment performance reporting.

Strategic insights reveal several critical trends shaping the UK pension fund market landscape:

Automatic enrollment policies represent the most significant driver of UK pension fund market growth, with legislation requiring employers to enroll eligible workers into workplace pension schemes. This policy has dramatically increased pension participation rates, with enrollment rates exceeding 88% among eligible employees, creating substantial inflows of new contributions and expanding the market’s member base.

Demographic pressures from an aging population are driving increased awareness of retirement planning needs and the importance of adequate pension provision. Life expectancy increases and declining birth rates are creating a larger proportion of retirees relative to working-age populations, emphasizing the critical role of funded pension arrangements in supporting retirement income security.

Government policy support through tax incentives and regulatory frameworks continues encouraging pension savings. Tax relief on pension contributions provides significant incentives for both employers and employees to participate in pension schemes, while regulatory reforms aim to improve member outcomes and increase confidence in pension provision.

Economic conditions and low interest rate environments have prompted pension funds to seek higher-yielding investments and diversify their portfolios. This search for yield has driven innovation in investment strategies and increased allocation to alternative asset classes, supporting market growth and evolution.

Economic volatility poses significant challenges to pension fund performance, with market downturns potentially impacting asset values and member retirement outcomes. Inflation pressures erode the real value of pension savings and create additional complexity in investment planning and benefit provision, particularly affecting those approaching or in retirement.

Regulatory complexity and frequent policy changes create operational challenges for pension fund administrators and employers. Compliance costs associated with evolving regulatory requirements can be substantial, particularly for smaller pension schemes that may lack economies of scale in administrative functions.

Low interest rate environments have created significant challenges for pension funds, particularly those with defined benefit obligations. Reduced yields on traditional fixed-income investments have forced funds to take greater investment risks or accept lower expected returns, potentially impacting future pension adequacy.

Member engagement challenges persist despite technological advances, with many pension scheme members remaining relatively passive about their retirement planning. Financial literacy limitations and complex pension arrangements can prevent members from making optimal decisions about their retirement savings and investment choices.

Digital transformation opportunities present significant potential for enhancing member experiences and operational efficiency within the UK pension fund market. Artificial intelligence and machine learning technologies can improve investment decision-making, risk management, and member communication, while blockchain technology offers possibilities for enhanced transparency and reduced administrative costs.

ESG investment growth represents a substantial opportunity as pension funds increasingly integrate sustainability considerations into their investment strategies. Green finance initiatives and impact investing are attracting growing interest from both pension fund trustees and members, creating opportunities for funds that can demonstrate strong ESG credentials and positive societal impact.

Alternative investment expansion offers pension funds opportunities to diversify portfolios and potentially enhance returns through investments in infrastructure, private equity, real estate, and other non-traditional asset classes. Institutional scale advantages allow larger pension funds to access these opportunities directly, while smaller funds can participate through collective investment vehicles.

International diversification presents opportunities for UK pension funds to access global investment opportunities and reduce concentration risk in domestic markets. Emerging market exposure and global equity strategies can provide enhanced growth potential and portfolio diversification benefits for long-term investors like pension funds.

Competitive dynamics within the UK pension fund market are characterized by ongoing consolidation as smaller schemes merge to achieve economies of scale and improved member outcomes. Master trust arrangements have gained significant traction, with approximately 42% of defined contribution assets now held in these collective structures that offer professional governance and reduced costs.

Investment performance pressures are driving innovation in asset allocation strategies and risk management approaches. Pension funds are increasingly adopting sophisticated investment frameworks that incorporate factor-based investing, alternative risk premia strategies, and dynamic asset allocation models to enhance risk-adjusted returns.

Regulatory influence continues shaping market dynamics through evolving governance requirements, disclosure standards, and member protection measures. The Pension Regulator’s increased focus on value for money and member outcomes is driving improvements in scheme governance and investment practices across the market.

Technological disruption is transforming traditional pension fund operations, with digital platforms enabling more efficient administration, improved member engagement, and enhanced investment capabilities. Data analytics and predictive modeling are becoming increasingly important tools for pension fund management and member outcome optimization.

Comprehensive market analysis for the UK pension fund sector employs multiple research methodologies to ensure accurate and reliable insights. Primary research involves direct engagement with pension fund trustees, investment managers, administrators, and regulatory bodies to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of regulatory filings, industry reports, academic studies, and government statistics to provide comprehensive market context and historical trend analysis. Quantitative analysis of pension fund performance data, asset allocation patterns, and member demographics provides statistical foundation for market assessments and projections.

Expert interviews with industry professionals, including pension consultants, investment managers, and regulatory specialists, provide qualitative insights into market dynamics and future development prospects. Stakeholder surveys capture perspectives from pension scheme members, employers, and service providers to understand evolving needs and preferences.

Data validation processes ensure research findings are accurate and representative of the broader UK pension fund market. Cross-referencing multiple data sources and applying statistical verification methods helps maintain research quality and reliability standards throughout the analysis process.

London and Southeast England dominate the UK pension fund market, hosting the majority of large corporate pension schemes and investment management operations. This region accounts for approximately 65% of total pension fund assets, reflecting the concentration of major employers and financial services companies in the capital and surrounding areas.

Northern England represents a significant portion of the market, particularly through large local government pension schemes serving metropolitan areas including Manchester, Liverpool, and Leeds. Industrial heritage in these regions has created substantial defined benefit pension obligations, while economic diversification is driving growth in defined contribution arrangements.

Scotland maintains a distinct pension fund landscape, with the Local Government Pension Scheme Scotland and various corporate schemes serving the region’s workforce. Edinburgh’s financial services sector contributes significantly to pension fund management and administration capabilities, while energy sector pension schemes reflect the region’s oil and gas industry presence.

Wales and Northern Ireland represent smaller but important segments of the UK pension fund market, with regional pension schemes serving public sector workers and local private sector employers. Cross-border arrangements and regulatory harmonization ensure these regions remain integrated within the broader UK pension fund ecosystem while maintaining some distinct characteristics.

Market leadership in the UK pension fund sector encompasses various categories of providers and administrators:

Competitive differentiation increasingly focuses on technology capabilities, member engagement tools, investment performance, and value for money propositions. Service quality and regulatory compliance remain fundamental competitive factors, while ESG credentials are becoming increasingly important for pension fund selection decisions.

By Pension Type:

By Sector:

By Asset Size:

Defined Contribution Growth: The defined contribution segment continues expanding rapidly, driven by automatic enrollment and the shift away from defined benefit provision. Asset accumulation in this category is projected to grow at approximately 6.8% annually, supported by increasing contribution rates and growing member participation.

Master Trust Expansion: Master trust arrangements are gaining significant market share, with membership growth exceeding 15% annually as employers seek cost-effective pension solutions. These arrangements offer professional governance, economies of scale, and simplified administration for participating employers.

ESG Integration: Environmental, social, and governance considerations are becoming mainstream across all pension fund categories. Sustainable investment strategies now represent a significant portion of pension fund assets, with climate-aware investing becoming standard practice among institutional investors.

Technology Adoption: Digital transformation is accelerating across all pension fund segments, with mobile applications, online portals, and automated advice tools enhancing member experiences and operational efficiency. Artificial intelligence applications in investment management and member communication are becoming increasingly sophisticated.

Alternative Investments: Pension funds across all categories are increasing allocations to alternative asset classes, with infrastructure investments and private equity gaining particular traction among larger schemes seeking enhanced returns and portfolio diversification.

For Pension Scheme Members:

For Employers:

For Investment Managers:

Strengths:

Weaknesses:

Opportunities:

Threats:

ESG Integration Acceleration: Environmental, social, and governance factors are becoming central to pension fund investment strategies, with climate risk assessment and sustainable investing now standard practices. Net-zero commitments from major pension funds are driving significant capital allocation toward clean energy and sustainable infrastructure projects.

Digital-First Member Experience: Pension providers are investing heavily in digital platforms and mobile applications to enhance member engagement and simplify retirement planning. Artificial intelligence and machine learning are enabling personalized advice and automated portfolio management services.

Consolidation and Scale: The market continues experiencing consolidation as smaller pension schemes merge or join master trust arrangements to achieve economies of scale and improved governance. Mega-schemes with substantial assets are becoming increasingly dominant in the market landscape.

Alternative Asset Allocation: Pension funds are significantly increasing allocations to alternative investments including infrastructure, private equity, real estate, and commodities. Illiquid investments are gaining acceptance as pension funds seek enhanced returns and inflation protection.

Outcome-Focused Investing: Investment strategies are increasingly focused on delivering specific retirement outcomes rather than simply maximizing returns. Target-date funds and lifestyle strategies are becoming more sophisticated in their approach to risk management and income generation.

Regulatory Evolution: Recent regulatory developments include enhanced governance requirements, improved transparency standards, and stronger member protection measures. The Pension Regulator has increased focus on value for money assessments and member outcome optimization across all pension scheme types.

Technology Advancement: Major pension providers have launched advanced digital platforms incorporating artificial intelligence, predictive analytics, and automated advice capabilities. Blockchain technology pilots are exploring applications in pension administration and member record keeping.

ESG Milestone Achievements: Several large UK pension funds have made significant net-zero commitments and implemented comprehensive ESG integration strategies. Climate risk disclosure requirements are driving enhanced transparency and accountability in pension fund investment practices.

Market Consolidation: Notable mergers and acquisitions have reshaped the competitive landscape, with several major consolidation transactions creating larger, more efficient pension fund operations. Master trust growth continues accelerating as employers seek simplified pension arrangements.

Investment Innovation: Pension funds have launched innovative investment strategies including direct infrastructure investment, private market access for smaller schemes, and sophisticated liability-driven investment approaches. MarkWide Research analysis indicates these developments are enhancing portfolio diversification and risk management capabilities.

Strategic Recommendations for pension fund stakeholders focus on several key areas for optimization and growth:

For Pension Fund Trustees: Prioritize governance enhancement through trustee education, professional development, and independent advice utilization. Investment strategy reviews should incorporate ESG considerations, alternative asset opportunities, and outcome-focused approaches to better serve member interests.

For Employers: Consider master trust arrangements for improved cost efficiency and governance standards while maintaining focus on member engagement and education initiatives. Contribution rate optimization and automatic enrollment enhancement can significantly improve employee retirement outcomes.

For Investment Managers: Develop sophisticated ESG integration capabilities and alternative investment access to meet evolving pension fund requirements. Technology investment in digital platforms and data analytics will be crucial for competitive positioning and client service enhancement.

For Policymakers: Continue supporting automatic enrollment expansion while addressing pension adequacy challenges through contribution rate increases and improved member engagement. Regulatory stability and long-term policy consistency will support market development and member confidence.

For Service Providers: Invest in technology capabilities and operational efficiency improvements to deliver enhanced value propositions. Consolidation opportunities should be evaluated to achieve scale advantages and improved member outcomes.

Growth projections for the UK pension fund market remain positive, with continued expansion expected across all major segments. MarkWide Research forecasts indicate the market will experience sustained growth driven by automatic enrollment maturation, increasing contribution rates, and demographic trends supporting retirement savings accumulation.

Technology transformation will accelerate over the forecast period, with artificial intelligence, machine learning, and blockchain technologies becoming increasingly integrated into pension fund operations. Digital-native solutions will enhance member experiences while reducing operational costs and improving investment outcomes.

ESG integration will deepen significantly, with climate considerations becoming central to investment decision-making processes. Sustainable finance and impact investing are expected to represent substantial portions of pension fund portfolios, driven by both regulatory requirements and member preferences.

Market consolidation trends will continue, with smaller pension schemes increasingly joining master trust arrangements or merging to achieve scale advantages. Mega-schemes will dominate the landscape, offering enhanced governance, reduced costs, and improved investment opportunities for members.

Investment innovation will focus on outcome-oriented strategies, alternative asset access, and sophisticated risk management approaches. Private market investments and infrastructure allocations are projected to grow substantially as pension funds seek enhanced returns and inflation protection.

The UK pension fund market stands at a pivotal juncture, characterized by robust growth prospects, technological transformation, and evolving investment strategies. Automatic enrollment success has fundamentally reshaped the market landscape, creating substantial asset growth and expanding pension participation across the workforce.

Future market development will be driven by continued regulatory evolution, technology advancement, and growing emphasis on sustainable investing practices. ESG integration and climate risk management are becoming central to pension fund operations, reflecting both regulatory requirements and evolving stakeholder expectations.

Consolidation trends and scale advantages will continue reshaping the competitive landscape, with master trust arrangements and large institutional players gaining market share. Technology innovation will enhance operational efficiency, member engagement, and investment capabilities across the sector.

The market’s long-term outlook remains positive, supported by demographic trends, regulatory frameworks, and continued innovation in pension provision. Stakeholder collaboration between regulators, employers, providers, and members will be essential for addressing challenges and maximizing opportunities in this critical sector of the UK financial services industry.

What is UK Pension Fund?

UK Pension Funds are investment pools that collect and manage contributions from employers and employees to provide retirement benefits. They play a crucial role in the financial security of individuals post-retirement by investing in various assets such as stocks, bonds, and real estate.

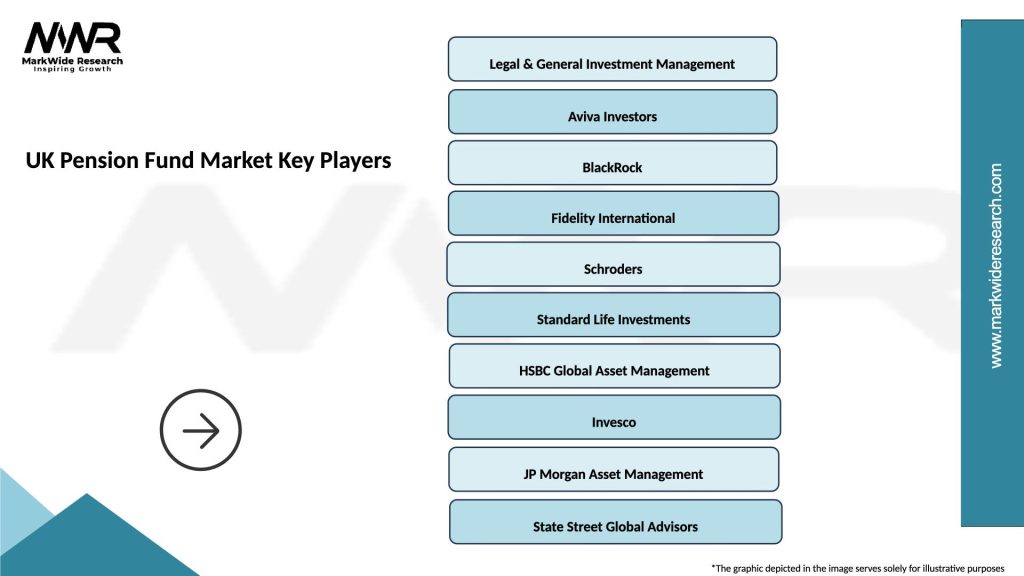

What are the key players in the UK Pension Fund Market?

Key players in the UK Pension Fund Market include large institutions such as the Universities Superannuation Scheme, the National Employment Savings Trust, and the British Airways Pension Fund. These organizations manage substantial assets and influence market trends, among others.

What are the growth factors driving the UK Pension Fund Market?

The UK Pension Fund Market is driven by factors such as increasing life expectancy, the shift towards defined contribution schemes, and the growing need for retirement savings. Additionally, regulatory changes and the rising awareness of financial planning contribute to market growth.

What challenges does the UK Pension Fund Market face?

The UK Pension Fund Market faces challenges including regulatory compliance, market volatility, and the need for sustainable investment strategies. Additionally, demographic shifts and low-interest rates can impact fund performance and sustainability.

What opportunities exist in the UK Pension Fund Market?

Opportunities in the UK Pension Fund Market include the integration of technology for better fund management, the rise of ESG (Environmental, Social, and Governance) investing, and the potential for innovative retirement products. These trends can enhance fund performance and attract new investors.

What trends are shaping the UK Pension Fund Market?

Trends shaping the UK Pension Fund Market include a growing focus on sustainable investments, the adoption of digital platforms for fund management, and increased collaboration between pension funds and fintech companies. These trends are transforming how funds operate and engage with members.

UK Pension Fund Market

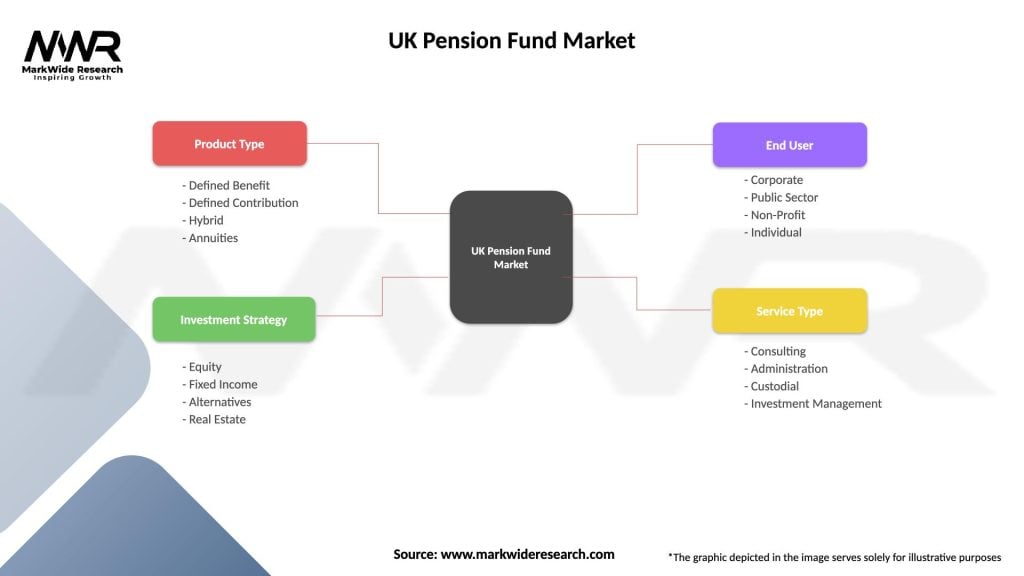

| Segmentation Details | Description |

|---|---|

| Product Type | Defined Benefit, Defined Contribution, Hybrid, Annuities |

| Investment Strategy | Equity, Fixed Income, Alternatives, Real Estate |

| End User | Corporate, Public Sector, Non-Profit, Individual |

| Service Type | Consulting, Administration, Custodial, Investment Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Pension Fund Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at