444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK outdoor LED lighting market represents a dynamic and rapidly evolving sector within the broader lighting industry, characterized by significant technological advancement and increasing adoption across multiple applications. Market dynamics indicate robust growth driven by government initiatives promoting energy efficiency, smart city development projects, and growing environmental consciousness among consumers and businesses alike.

LED technology adoption in outdoor applications has accelerated dramatically, with the market experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This growth trajectory reflects the superior energy efficiency, longer lifespan, and reduced maintenance requirements that LED solutions offer compared to traditional lighting technologies such as high-pressure sodium and metal halide systems.

Government regulations and sustainability mandates have played a crucial role in market expansion, with local councils and municipalities increasingly replacing conventional street lighting with LED alternatives. The transition has been further supported by favorable financing schemes and energy service company (ESCO) models that reduce upfront investment barriers for public sector organizations.

Smart lighting integration has emerged as a key differentiator, with approximately 35% of new outdoor LED installations incorporating intelligent control systems, sensors, and connectivity features. These advanced systems enable remote monitoring, adaptive lighting control, and integration with broader smart city infrastructure initiatives across major UK metropolitan areas.

The UK outdoor LED lighting market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, installation, and maintenance of light-emitting diode lighting solutions specifically designed for exterior applications across residential, commercial, industrial, and public infrastructure sectors throughout the United Kingdom.

Outdoor LED lighting systems include a diverse range of products such as street lights, area lighting, architectural lighting, landscape lighting, sports lighting, and specialized applications for transportation infrastructure. These systems are characterized by their solid-state lighting technology, which converts electrical energy directly into light through semiconductor materials, offering superior efficiency and longevity compared to traditional lighting technologies.

Market scope encompasses both retrofit applications, where existing lighting infrastructure is upgraded to LED technology, and new installations in developing areas, smart city projects, and infrastructure expansion initiatives. The market also includes associated components such as drivers, control systems, sensors, and smart lighting management platforms that enhance functionality and operational efficiency.

Market performance in the UK outdoor LED lighting sector demonstrates exceptional resilience and growth potential, driven by convergence of regulatory support, technological innovation, and increasing awareness of environmental sustainability. The sector has witnessed accelerated adoption across multiple application segments, with particular strength in municipal street lighting and commercial outdoor applications.

Key growth drivers include government commitments to carbon neutrality, smart city initiatives, and the proven return on investment that LED technology delivers through reduced energy consumption and maintenance costs. Energy savings of up to 70% compared to conventional lighting have made LED solutions increasingly attractive to cost-conscious organizations and municipalities facing budget constraints.

Technology advancement continues to reshape market dynamics, with innovations in smart controls, IoT integration, and adaptive lighting systems creating new value propositions for end users. The integration of sensors, wireless connectivity, and data analytics capabilities has transformed outdoor lighting from a basic utility service into an intelligent infrastructure platform supporting broader urban management objectives.

Competitive landscape features a mix of established international lighting manufacturers, specialized LED technology companies, and emerging smart lighting solution providers. Market consolidation has occurred as companies seek to expand their technological capabilities and geographic reach, while new entrants focus on niche applications and innovative control technologies.

Market segmentation reveals distinct growth patterns across different application categories, with street and roadway lighting representing the largest segment, followed by commercial and industrial outdoor applications. Residential outdoor lighting has emerged as a rapidly growing segment, driven by increasing home improvement activities and growing awareness of security and aesthetic benefits.

Government initiatives and regulatory frameworks provide the primary catalyst for market growth, with national and local policies actively promoting energy-efficient lighting solutions. The UK government’s commitment to achieving net-zero carbon emissions by 2050 has created a supportive environment for LED adoption, backed by funding programs and regulatory incentives that encourage public and private sector investment in efficient lighting infrastructure.

Energy cost pressures continue to drive adoption as organizations seek to reduce operational expenses through more efficient lighting solutions. Rising electricity prices have made the business case for LED conversion increasingly compelling, with many organizations achieving energy cost reductions of 60-75% through LED upgrades combined with intelligent control systems.

Smart city development initiatives across major UK metropolitan areas have created substantial demand for intelligent outdoor lighting systems that can integrate with broader urban infrastructure platforms. These projects require lighting solutions that provide not only illumination but also support for sensors, communications equipment, and data collection capabilities that enable more efficient city management.

Environmental consciousness among consumers, businesses, and public organizations has elevated sustainability considerations in lighting procurement decisions. The environmental benefits of LED technology, including reduced energy consumption, lower carbon emissions, and elimination of hazardous materials found in traditional lighting, align with corporate sustainability objectives and public environmental commitments.

Technology advancement continues to improve the value proposition of LED outdoor lighting through enhanced efficiency, improved light quality, and expanded functionality. Developments in areas such as tunable white lighting, integrated sensors, and wireless control systems create new applications and use cases that drive market expansion beyond simple replacement of existing lighting infrastructure.

High upfront costs remain a significant barrier to adoption, particularly for smaller organizations and budget-constrained public sector entities. While LED systems deliver substantial long-term savings, the initial capital investment required for comprehensive lighting upgrades can be substantial, especially when including smart control systems and infrastructure modifications.

Technical complexity associated with advanced LED lighting systems can create implementation challenges, particularly for organizations lacking specialized technical expertise. The integration of smart controls, sensors, and connectivity features requires careful system design and ongoing technical support that may exceed the capabilities of traditional lighting maintenance organizations.

Market fragmentation and lack of standardization in smart lighting protocols can create compatibility issues and increase implementation complexity. The absence of universal standards for communication protocols, control interfaces, and data formats can lead to vendor lock-in situations and complicate system integration efforts.

Performance concerns related to LED technology in specific applications, such as color rendering quality, light distribution patterns, and performance in extreme weather conditions, can limit adoption in certain market segments. While LED technology has matured significantly, some applications still require specialized solutions that may carry premium pricing or limited availability.

Skills shortage in the lighting industry, particularly for installation and maintenance of advanced LED systems with smart controls, can constrain market growth. The transition from traditional lighting technologies requires new technical competencies that may not be readily available in existing workforce populations.

Retrofit market potential remains substantial, with significant opportunities for LED conversion in existing outdoor lighting installations across commercial, industrial, and residential applications. MarkWide Research analysis indicates that approximately 40% of UK outdoor lighting infrastructure still utilizes conventional technologies, representing a substantial addressable market for LED upgrades.

Smart city integration presents expanding opportunities as municipalities seek to leverage lighting infrastructure for broader urban management capabilities. The integration of environmental sensors, traffic monitoring equipment, emergency communication systems, and wireless connectivity into LED lighting platforms creates new revenue streams and value propositions for lighting solution providers.

Emerging applications in areas such as horticultural lighting, sports facilities, and specialized industrial applications offer growth potential beyond traditional outdoor lighting markets. The development of application-specific LED solutions with optimized spectral characteristics and control capabilities opens new market segments with premium pricing opportunities.

Service-based business models including lighting-as-a-service (LaaS) and energy service company (ESCO) arrangements provide opportunities to overcome upfront cost barriers while creating recurring revenue streams. These models are particularly attractive to public sector organizations and cost-conscious commercial customers seeking to improve lighting efficiency without significant capital investment.

Export opportunities exist for UK-based LED lighting companies to leverage domestic market experience and technological capabilities in international markets, particularly in regions with similar regulatory frameworks and infrastructure development needs.

Supply chain evolution continues to reshape the outdoor LED lighting market, with increasing vertical integration among major manufacturers and growing importance of local distribution and service capabilities. The complexity of modern LED lighting systems requires closer collaboration between component suppliers, system integrators, and end users to ensure optimal performance and customer satisfaction.

Price competition has intensified as LED technology matures and manufacturing scales increase, leading to commodity pricing pressure for basic LED products while creating opportunities for differentiation through smart features, service offerings, and specialized applications. This dynamic has encouraged market participants to focus on value-added solutions and comprehensive service capabilities.

Technology convergence between lighting, telecommunications, and information technology sectors is creating new competitive dynamics and partnership opportunities. The integration of 5G capabilities, edge computing, and IoT platforms into lighting infrastructure requires collaboration across traditional industry boundaries and new technical competencies.

Customer expectations continue to evolve beyond basic illumination requirements to include demands for intelligent control, energy monitoring, predictive maintenance, and integration with broader facility management systems. These evolving requirements drive continuous innovation and create opportunities for companies that can deliver comprehensive solutions addressing multiple customer needs.

Regulatory landscape remains supportive of LED adoption through energy efficiency standards, environmental regulations, and public procurement policies that favor sustainable lighting solutions. However, emerging regulations related to light pollution, cybersecurity, and data privacy may create new compliance requirements for smart lighting systems.

Primary research methodology employed comprehensive market analysis through structured interviews with key industry stakeholders, including LED lighting manufacturers, distributors, system integrators, and end users across multiple market segments. This approach provided direct insights into market trends, customer requirements, competitive dynamics, and emerging opportunities within the UK outdoor LED lighting sector.

Secondary research incorporated analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market context and validate primary research findings. This comprehensive approach ensured accurate representation of market conditions and reliable identification of key growth drivers and market constraints.

Data validation processes included cross-referencing multiple information sources, statistical analysis of market data, and expert review of research findings to ensure accuracy and reliability of market insights. The methodology incorporated both quantitative analysis of market metrics and qualitative assessment of industry trends and competitive dynamics.

Market segmentation analysis utilized detailed examination of application categories, technology types, customer segments, and geographic regions to provide comprehensive understanding of market structure and growth opportunities. This segmentation approach enabled identification of high-growth market segments and emerging application areas.

London and Southeast England represent the largest regional market for outdoor LED lighting, driven by extensive urban development, smart city initiatives, and high concentration of commercial and industrial facilities. The region accounts for approximately 35% of total UK market demand, supported by substantial public and private investment in infrastructure modernization and sustainability initiatives.

Northern England has emerged as a significant growth region, with major cities including Manchester, Liverpool, and Leeds implementing comprehensive LED street lighting conversion programs. Industrial heritage and ongoing urban regeneration projects in this region create substantial opportunities for outdoor LED lighting applications across multiple market segments.

Scotland demonstrates strong market potential driven by government commitment to environmental sustainability and energy efficiency. Scottish local authorities have been particularly active in LED adoption, with many councils achieving conversion rates exceeding 80% for street lighting infrastructure. The region’s focus on renewable energy and environmental stewardship aligns well with LED technology benefits.

Wales and Southwest England show steady market growth supported by tourism industry requirements, coastal infrastructure needs, and rural development initiatives. These regions present opportunities for specialized LED applications including landscape lighting, heritage site illumination, and marine environment solutions requiring enhanced durability and performance characteristics.

Midlands region benefits from strong manufacturing base and logistics infrastructure that support both market demand and supply chain capabilities for LED lighting solutions. The region’s industrial concentration creates substantial opportunities for commercial and industrial outdoor lighting applications, while urban centers drive municipal and commercial market segments.

Market leadership is characterized by a mix of established international lighting manufacturers and specialized LED technology companies, each competing through different value propositions and market positioning strategies. The competitive environment has evolved from simple product competition to comprehensive solution provision including design, installation, financing, and ongoing service capabilities.

Competitive differentiation increasingly focuses on smart lighting capabilities, energy management systems, and comprehensive service offerings rather than basic LED product features. Companies are investing heavily in IoT platforms, data analytics capabilities, and service delivery models to create sustainable competitive advantages in an increasingly commoditized market.

Market consolidation continues as companies seek to expand technological capabilities, geographic reach, and customer relationships through strategic acquisitions and partnerships. This trend has created opportunities for specialized companies with unique technologies or strong regional market positions to achieve premium valuations through strategic transactions.

By Application:

By Technology:

By End User:

Street and roadway lighting represents the most mature and largest segment within the UK outdoor LED lighting market, characterized by extensive government-driven conversion programs and established procurement processes. This segment has achieved LED penetration rates exceeding 65% in major metropolitan areas, with continued growth driven by remaining conversion opportunities and smart lighting upgrades.

Commercial outdoor lighting demonstrates strong growth potential driven by corporate sustainability initiatives, energy cost reduction objectives, and enhanced security requirements. This segment shows increasing adoption of smart lighting features including occupancy sensing, daylight harvesting, and integration with building management systems to optimize energy consumption and operational efficiency.

Industrial applications focus primarily on functional illumination requirements with emphasis on durability, reliability, and low maintenance characteristics. The segment is experiencing growing interest in smart features that support predictive maintenance, energy monitoring, and integration with industrial IoT platforms for comprehensive facility management.

Residential outdoor lighting has emerged as a rapidly growing segment driven by home improvement trends, security concerns, and increasing availability of affordable LED solutions. Smart home integration and voice control capabilities are becoming important differentiators in this segment, with connected lighting adoption growing at 25% annually.

Specialized applications including sports lighting, architectural illumination, and transportation infrastructure represent niche segments with specific performance requirements and premium pricing opportunities. These applications often require customized solutions and specialized technical expertise, creating barriers to entry and opportunities for differentiation.

Energy efficiency benefits provide the primary value proposition for LED outdoor lighting adoption, with typical energy consumption reductions of 50-70% compared to conventional lighting technologies. These savings translate directly to reduced operational costs and improved environmental performance, supporting both financial and sustainability objectives for organizations across all market segments.

Maintenance cost reduction represents a significant additional benefit, with LED systems typically requiring 60-80% less maintenance than traditional lighting due to extended lifespan and improved reliability. This benefit is particularly valuable for applications in difficult-to-access locations or where maintenance activities create safety risks or operational disruptions.

Enhanced functionality through smart lighting capabilities provides opportunities for organizations to leverage lighting infrastructure for additional purposes including security monitoring, environmental sensing, and communications support. These capabilities can generate additional value and justify premium pricing for advanced LED lighting systems.

Improved light quality and control flexibility enable better illumination design and user experience compared to traditional lighting technologies. LED systems can provide precise light distribution, color temperature control, and dimming capabilities that enhance safety, security, and aesthetic appeal in outdoor applications.

Environmental benefits including reduced carbon emissions, elimination of hazardous materials, and improved recyclability support corporate sustainability objectives and regulatory compliance requirements. These benefits are increasingly important for organizations with environmental commitments and public sector entities with sustainability mandates.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart lighting integration continues to accelerate as organizations seek to maximize the value of lighting infrastructure investments through additional functionality and capabilities. The integration of sensors, wireless connectivity, and data analytics transforms lighting from a basic utility service into an intelligent platform supporting multiple operational objectives and creating new value propositions.

Sustainability focus drives increasing emphasis on environmental performance, circular economy principles, and lifecycle assessment in lighting procurement decisions. Organizations are evaluating LED solutions based on comprehensive environmental impact including manufacturing, transportation, operation, and end-of-life considerations rather than focusing solely on energy efficiency benefits.

Service-based business models are gaining traction as customers seek to access LED technology benefits without significant capital investment. MWR data indicates that lighting-as-a-service adoption has grown 40% over the past two years, particularly among public sector organizations and cost-conscious commercial customers seeking predictable operational expenses.

Customization and specialization trend toward application-specific LED solutions optimized for particular use cases, environmental conditions, or performance requirements. This trend creates opportunities for premium pricing and differentiation while addressing specific customer needs that generic LED products cannot adequately serve.

Data monetization opportunities are emerging as smart LED lighting systems generate valuable information about usage patterns, environmental conditions, and infrastructure performance. Organizations are exploring ways to leverage this data for operational optimization, predictive maintenance, and new service offerings that create additional revenue streams.

Technology advancement in LED efficacy continues to improve the value proposition of outdoor lighting solutions, with latest generation products achieving efficacy levels exceeding 150 lumens per watt while maintaining high light quality and reliability standards. These improvements enable further energy savings and support adoption in applications where efficiency requirements are particularly demanding.

Smart city partnerships between lighting manufacturers, technology companies, and municipal authorities are creating comprehensive urban infrastructure platforms that integrate lighting with telecommunications, environmental monitoring, and traffic management systems. These partnerships demonstrate the potential for lighting infrastructure to support broader urban management objectives.

Regulatory developments including updated energy efficiency standards, environmental regulations, and public procurement policies continue to support LED adoption while creating new requirements for smart lighting systems. Recent developments in cybersecurity regulations and data privacy requirements are beginning to impact smart lighting system design and implementation approaches.

Market consolidation through strategic acquisitions and partnerships continues to reshape the competitive landscape as companies seek to expand technological capabilities, geographic reach, and customer relationships. Recent transactions have focused on smart lighting technologies, service capabilities, and specialized application expertise.

Innovation in financing and service delivery models is expanding market access and creating new business opportunities for lighting solution providers. Energy service company models, lighting-as-a-service offerings, and performance-based contracts are becoming increasingly sophisticated and widely available across multiple market segments.

Market participants should focus on developing comprehensive solution capabilities that extend beyond basic LED products to include smart controls, data analytics, and ongoing service support. The increasing commoditization of LED technology requires differentiation through value-added services and specialized expertise that address specific customer requirements and operational challenges.

Investment priorities should emphasize smart lighting technologies, IoT integration capabilities, and service delivery infrastructure that can support long-term customer relationships and recurring revenue models. Companies that can successfully transition from product sales to service provision will be best positioned for sustainable growth in an increasingly competitive market.

Partnership strategies with technology companies, system integrators, and service providers can help lighting manufacturers access new capabilities and market opportunities without requiring substantial internal investment. Strategic partnerships are particularly important for accessing smart city projects and complex commercial applications that require multidisciplinary expertise.

Geographic expansion opportunities should be evaluated based on regulatory environment, infrastructure development needs, and competitive landscape characteristics. Markets with supportive government policies, aging lighting infrastructure, and limited local competition may offer attractive growth opportunities for established UK market participants.

Customer education and market development activities remain important for accelerating adoption and supporting premium pricing for advanced LED solutions. Many potential customers still lack comprehensive understanding of LED technology benefits and smart lighting capabilities, creating opportunities for companies that invest in educational marketing and technical support capabilities.

Market growth prospects remain positive driven by continued LED adoption in remaining conventional lighting applications, growing demand for smart lighting capabilities, and expansion into new application areas. MarkWide Research projects continued market expansion with annual growth rates of 6-8% over the next five years, supported by technology advancement and favorable regulatory environment.

Technology evolution will continue to enhance LED performance, reduce costs, and expand functionality through developments in areas such as tunable white lighting, integrated sensors, and artificial intelligence applications. These advances will create new market opportunities while potentially disrupting existing competitive positions and business models.

Smart city development will drive increasing integration of lighting infrastructure with broader urban management systems, creating opportunities for lighting companies to participate in larger infrastructure projects and develop new revenue streams through data services and platform capabilities. This trend will require new technical competencies and partnership strategies.

Sustainability requirements will become increasingly important in lighting procurement decisions, with growing emphasis on circular economy principles, carbon footprint reduction, and comprehensive lifecycle assessment. Companies that can demonstrate superior environmental performance will gain competitive advantages in environmentally conscious market segments.

Market maturation will lead to increased focus on service quality, customer relationships, and specialized applications as basic LED technology becomes commoditized. Success will increasingly depend on ability to provide comprehensive solutions, ongoing support, and value-added services rather than simply competitive product pricing.

The UK outdoor LED lighting market represents a dynamic and evolving sector with substantial growth opportunities driven by technology advancement, regulatory support, and increasing customer sophistication. While the market faces challenges related to cost barriers, technical complexity, and competitive intensity, the fundamental drivers of energy efficiency, environmental sustainability, and smart city development provide a strong foundation for continued expansion.

Market participants that can successfully navigate the transition from product-focused to solution-oriented business models will be best positioned to capitalize on emerging opportunities and achieve sustainable competitive advantages. The integration of smart technologies, comprehensive service capabilities, and specialized expertise will become increasingly important differentiators in a maturing market environment.

Future success will depend on ability to adapt to evolving customer requirements, leverage emerging technologies, and develop new value propositions that extend beyond basic illumination to encompass broader infrastructure and operational benefits. Organizations that can effectively combine technological innovation with customer-focused service delivery will thrive in the evolving UK outdoor LED lighting market landscape.

What is Outdoor LED Lighting?

Outdoor LED lighting refers to lighting solutions that utilize light-emitting diodes (LEDs) for outdoor applications, including street lighting, landscape lighting, and architectural illumination. These systems are known for their energy efficiency, longevity, and ability to provide bright illumination in various outdoor settings.

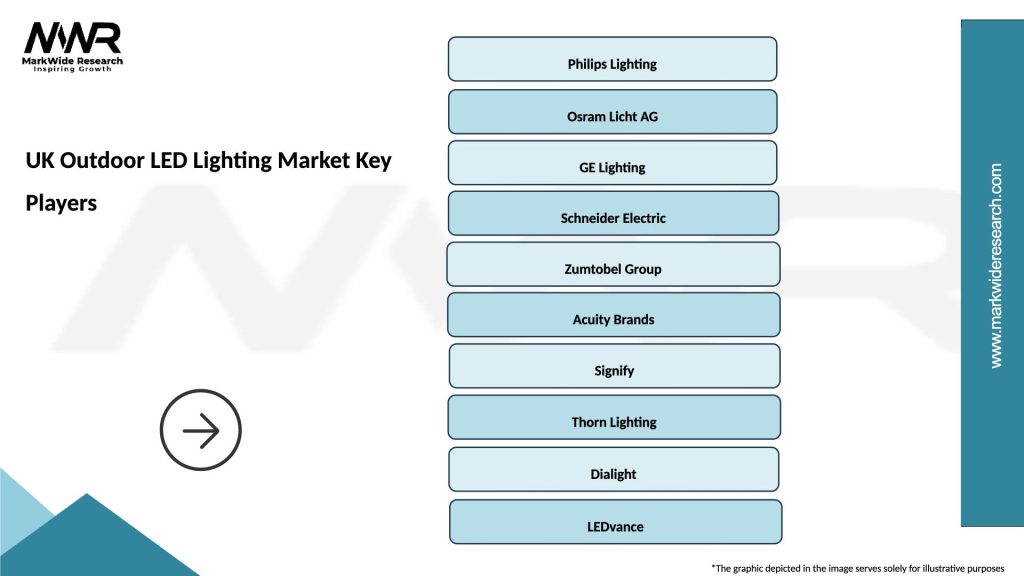

What are the key players in the UK Outdoor LED Lighting Market?

Key players in the UK Outdoor LED Lighting Market include Philips Lighting, Osram, and Cree, which are known for their innovative LED solutions and extensive product ranges. These companies focus on developing energy-efficient lighting technologies for urban and rural outdoor environments, among others.

What are the main drivers of the UK Outdoor LED Lighting Market?

The main drivers of the UK Outdoor LED Lighting Market include the increasing demand for energy-efficient lighting solutions, government initiatives promoting sustainable lighting, and the growing need for smart city infrastructure. Additionally, advancements in LED technology are enhancing performance and reducing costs.

What challenges does the UK Outdoor LED Lighting Market face?

The UK Outdoor LED Lighting Market faces challenges such as high initial installation costs and the need for ongoing maintenance. Additionally, competition from traditional lighting technologies and concerns over light pollution can hinder market growth.

What opportunities exist in the UK Outdoor LED Lighting Market?

Opportunities in the UK Outdoor LED Lighting Market include the integration of smart lighting systems and the expansion of renewable energy sources. The increasing focus on urban development and infrastructure upgrades also presents significant growth potential for innovative outdoor lighting solutions.

What trends are shaping the UK Outdoor LED Lighting Market?

Trends shaping the UK Outdoor LED Lighting Market include the rise of smart lighting technologies, which allow for remote control and automation, and the growing emphasis on sustainability and energy efficiency. Additionally, the use of solar-powered LED lights is gaining popularity in various outdoor applications.

UK Outdoor LED Lighting Market

| Segmentation Details | Description |

|---|---|

| Product Type | Flood Lights, Street Lights, Garden Lights, Wall Lights |

| Technology | Solar, Smart LED, Traditional LED, Motion Sensor |

| End User | Municipalities, Commercial Properties, Residential Areas, Parks |

| Installation | Ground-mounted, Wall-mounted, Pole-mounted, Ceiling-mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Outdoor LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at