444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK neurology devices market represents a dynamic and rapidly evolving sector within the broader healthcare technology landscape. This specialized market encompasses a comprehensive range of medical devices designed to diagnose, monitor, and treat neurological conditions affecting millions of patients across the United Kingdom. The market has experienced substantial growth driven by an aging population, increasing prevalence of neurological disorders, and significant technological advancements in medical device innovation.

Market dynamics indicate robust expansion with the sector demonstrating a compound annual growth rate (CAGR) of 6.2% over recent years. The increasing burden of neurological conditions such as epilepsy, Parkinson’s disease, Alzheimer’s disease, and stroke has created substantial demand for advanced diagnostic and therapeutic devices. Healthcare providers across the UK are increasingly adopting sophisticated neurology devices to improve patient outcomes and enhance treatment efficacy.

Technological innovation continues to drive market evolution, with manufacturers developing increasingly sophisticated devices incorporating artificial intelligence, machine learning, and advanced imaging capabilities. The integration of digital health technologies and telemedicine solutions has further expanded the market’s scope, enabling remote monitoring and improved patient care delivery. Regional healthcare systems are investing significantly in modernizing their neurology departments, creating substantial opportunities for device manufacturers and healthcare technology providers.

The UK neurology devices market refers to the comprehensive ecosystem of medical devices, equipment, and technologies specifically designed for the diagnosis, monitoring, treatment, and management of neurological disorders within the United Kingdom healthcare system. This market encompasses a diverse range of sophisticated medical instruments including electroencephalography (EEG) systems, magnetic resonance imaging (MRI) equipment, computed tomography (CT) scanners, neurostimulation devices, and various therapeutic intervention tools.

Neurology devices serve critical functions in modern healthcare delivery, enabling healthcare professionals to accurately diagnose complex neurological conditions, monitor disease progression, and implement targeted therapeutic interventions. These devices range from basic diagnostic tools used in primary care settings to highly sophisticated equipment deployed in specialized neurology centers and research institutions across the UK.

Market participants include medical device manufacturers, healthcare providers, research institutions, and regulatory bodies working collaboratively to advance neurological care standards. The market’s significance extends beyond commercial considerations, representing a vital component of the UK’s healthcare infrastructure dedicated to addressing the growing burden of neurological diseases affecting diverse patient populations.

The UK neurology devices market demonstrates exceptional growth potential driven by demographic trends, technological advancement, and increasing healthcare investment. The market’s expansion reflects the growing recognition of neurological disorders as a significant public health challenge requiring sophisticated diagnostic and therapeutic solutions. Key market drivers include an aging population with higher susceptibility to neurological conditions, increasing awareness of early diagnosis benefits, and substantial government investment in healthcare infrastructure modernization.

Market segmentation reveals diverse opportunities across diagnostic devices, therapeutic equipment, and monitoring systems. The diagnostic segment maintains the largest market share at approximately 45% of total market activity, driven by increasing demand for advanced imaging technologies and neurophysiological testing equipment. Therapeutic devices represent the fastest-growing segment, with neurostimulation technologies and surgical instruments experiencing particularly strong adoption rates.

Competitive landscape features a mix of established multinational corporations and innovative technology companies developing cutting-edge solutions. The market benefits from strong research and development activities, with numerous clinical trials and product development initiatives underway. Regulatory environment remains supportive, with streamlined approval processes for innovative devices that demonstrate clear clinical benefits and safety profiles.

Strategic market analysis reveals several critical insights shaping the UK neurology devices market landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Multiple factors contribute to the robust growth trajectory of the UK neurology devices market. The primary market drivers reflect both demographic trends and technological advancement creating substantial opportunities for market expansion.

Aging population dynamics represent the most significant market driver, with the UK experiencing substantial demographic shifts toward an older population more susceptible to neurological conditions. The prevalence of age-related neurological disorders including dementia, Parkinson’s disease, and stroke continues increasing, creating sustained demand for advanced diagnostic and therapeutic devices. Healthcare systems are responding by investing in sophisticated equipment capable of early detection and effective treatment of these conditions.

Technological advancement serves as another crucial driver, with manufacturers developing increasingly sophisticated devices incorporating cutting-edge technologies. Artificial intelligence integration enables more accurate diagnosis and personalized treatment approaches, while miniaturization allows for less invasive procedures and improved patient comfort. Digital health integration facilitates remote monitoring capabilities, expanding access to specialized neurological care across diverse geographic regions.

Government healthcare investment provides substantial support for market growth through funding for healthcare infrastructure modernization and research initiatives. The NHS commitment to improving neurological care standards drives procurement of advanced devices and equipment. Clinical evidence demonstrating improved patient outcomes and cost-effectiveness of modern neurology devices further supports adoption decisions across healthcare providers.

Despite positive growth trends, the UK neurology devices market faces several significant restraints that may impact expansion rates and market penetration. Understanding these challenges is essential for stakeholders developing market entry and growth strategies.

High capital costs represent a primary market restraint, with advanced neurology devices requiring substantial initial investment from healthcare providers. Many sophisticated imaging systems and therapeutic devices carry significant procurement costs, potentially limiting adoption among smaller healthcare facilities or those with constrained budgets. Budget constraints within the NHS and private healthcare systems may delay equipment upgrades or limit access to the latest technological innovations.

Regulatory complexity can create barriers to market entry, particularly for innovative devices incorporating new technologies or treatment approaches. The approval process for medical devices requires extensive clinical testing and documentation, potentially delaying product launches and increasing development costs. Compliance requirements continue evolving, requiring manufacturers to invest substantially in regulatory affairs and quality assurance capabilities.

Skills shortage in specialized healthcare professions may limit the effective utilization of advanced neurology devices. Operating sophisticated equipment requires specialized training and expertise, which may be limited in certain geographic regions or healthcare settings. Training costs and time requirements for healthcare professionals can further complicate device adoption and implementation processes.

Significant opportunities exist within the UK neurology devices market for manufacturers, healthcare providers, and technology companies willing to invest in innovation and market development. These opportunities span multiple market segments and application areas.

Artificial intelligence integration presents substantial opportunities for device manufacturers developing next-generation diagnostic and therapeutic solutions. AI-powered devices can provide enhanced diagnostic accuracy, predictive analytics, and personalized treatment recommendations, creating competitive advantages and improved patient outcomes. Machine learning algorithms enable continuous improvement in device performance and clinical effectiveness over time.

Telemedicine expansion creates new market opportunities for remote monitoring devices and digital health platforms. The growing acceptance of telemedicine solutions, accelerated by recent healthcare delivery changes, enables broader access to specialized neurological care. Remote monitoring capabilities allow healthcare providers to track patient progress and adjust treatments without requiring frequent in-person visits.

Minimally invasive technologies represent another significant opportunity area, with increasing demand for devices that reduce patient trauma and recovery times. Advanced surgical instruments, catheter-based interventions, and non-invasive treatment modalities appeal to both healthcare providers and patients seeking improved treatment experiences. Innovation in materials science and device miniaturization continues expanding possibilities for less invasive neurological interventions.

Complex market dynamics shape the UK neurology devices market, involving interactions between healthcare providers, device manufacturers, regulatory bodies, and patient populations. Understanding these dynamics is crucial for successful market participation and strategic planning.

Supply chain considerations play an increasingly important role in market dynamics, with manufacturers focusing on resilient supply chains capable of supporting consistent device availability. Recent global events have highlighted the importance of supply chain diversification and local manufacturing capabilities. Procurement processes within the NHS and private healthcare systems influence market dynamics through standardized purchasing procedures and vendor selection criteria.

Innovation cycles drive market dynamics through continuous technological advancement and product development. The rapid pace of innovation in neurology devices creates opportunities for market disruption while requiring substantial research and development investment. Clinical validation processes influence market acceptance, with healthcare providers increasingly demanding robust clinical evidence supporting device efficacy and safety claims.

Competitive dynamics involve both established medical device companies and emerging technology firms developing innovative solutions. Market consolidation trends may impact competitive landscapes, while partnerships between technology companies and healthcare providers create new market dynamics. Pricing pressures from healthcare cost containment initiatives influence market strategies and product positioning decisions.

Comprehensive research methodology underpins the analysis of the UK neurology devices market, incorporating multiple data sources and analytical approaches to ensure accuracy and reliability. The research framework combines quantitative and qualitative analysis methods to provide holistic market understanding.

Primary research activities include extensive interviews with key market participants including healthcare providers, device manufacturers, regulatory experts, and clinical specialists. These interviews provide insights into market trends, challenges, and opportunities from diverse stakeholder perspectives. Survey methodologies capture quantitative data regarding market preferences, adoption patterns, and future purchasing intentions across different healthcare settings.

Secondary research encompasses analysis of published clinical studies, regulatory filings, industry reports, and academic literature related to neurology devices and healthcare technology trends. Government healthcare statistics and demographic data provide context for market sizing and growth projections. Market intelligence from industry associations and professional organizations contributes additional insights into market dynamics and competitive landscapes.

Data validation processes ensure research accuracy through triangulation of multiple data sources and expert review of findings. Statistical analysis methods support quantitative conclusions while qualitative analysis provides context and interpretation of market trends. MarkWide Research analytical frameworks ensure consistent methodology application and reliable market insights for stakeholders.

Regional market analysis reveals significant variations in neurology device adoption and market development across different areas of the United Kingdom. These regional differences reflect variations in healthcare infrastructure, population demographics, and clinical specialization levels.

London and Southeast England represent the largest regional market segment, accounting for approximately 35% of total market activity. This region benefits from concentration of specialized neurological centers, research institutions, and private healthcare facilities. Advanced medical facilities in this region often serve as early adopters of innovative neurology devices, driving market trends and clinical best practices.

Northern England demonstrates strong market growth potential, with major medical centers in Manchester, Leeds, and Newcastle investing substantially in neurology department modernization. The region accounts for approximately 22% of market share, supported by strong NHS investment and academic medical center presence. Regional healthcare networks facilitate knowledge sharing and coordinated procurement strategies across multiple healthcare providers.

Scotland and Wales represent emerging market opportunities with increasing investment in specialized neurological care capabilities. These regions collectively account for 18% of market activity, with growth driven by government initiatives to improve healthcare access and clinical outcomes. Rural healthcare delivery challenges in these regions create opportunities for telemedicine and remote monitoring solutions.

The competitive landscape of the UK neurology devices market features a diverse mix of established multinational corporations and innovative technology companies developing cutting-edge solutions. Market competition drives continuous innovation and improvement in device capabilities and clinical outcomes.

Market competition focuses on technological innovation, clinical outcomes, and cost-effectiveness. Companies invest substantially in research and development to maintain competitive advantages and address evolving clinical needs. Strategic partnerships between device manufacturers and healthcare providers facilitate product development and market penetration strategies.

Market segmentation analysis provides detailed insights into different product categories, applications, and end-user segments within the UK neurology devices market. This segmentation enables targeted market strategies and investment decisions.

By Product Type:

By Application:

By End User:

Detailed category analysis reveals specific trends and opportunities within major product segments of the UK neurology devices market. Each category demonstrates unique growth patterns and market dynamics.

Diagnostic Devices Category maintains market leadership with consistent demand for advanced imaging and neurophysiology equipment. This category benefits from increasing emphasis on early diagnosis and precision medicine approaches. Neuroimaging systems experience particularly strong demand, with healthcare providers investing in high-resolution MRI and CT technologies. The integration of artificial intelligence in diagnostic devices enhances accuracy and efficiency, driving adoption rates across healthcare settings.

Therapeutic Devices Category demonstrates the highest growth rates, driven by expanding applications of neurostimulation technologies and minimally invasive surgical instruments. Deep brain stimulation systems show exceptional market performance, with increasing applications beyond traditional movement disorders. Spinal cord stimulation devices gain traction for chronic pain management, while emerging technologies like focused ultrasound create new therapeutic possibilities.

Monitoring Equipment Category benefits from growing emphasis on continuous patient monitoring and real-time clinical decision support. Portable monitoring devices enable expanded access to neurological care, particularly in community healthcare settings. The integration of wireless technologies and cloud-based data management systems enhances monitoring capabilities while reducing healthcare costs.

Industry participants and stakeholders across the UK neurology devices market ecosystem realize substantial benefits from market participation and strategic investment. These benefits extend beyond financial returns to include clinical impact and societal value creation.

Healthcare Providers benefit from improved patient outcomes through access to advanced diagnostic and therapeutic technologies. Modern neurology devices enable more accurate diagnoses, personalized treatment approaches, and enhanced monitoring capabilities. Clinical efficiency improvements reduce procedure times and resource utilization while maintaining high-quality care standards. Healthcare providers also benefit from enhanced reputation and competitive positioning through adoption of innovative technologies.

Device Manufacturers realize substantial revenue opportunities in a growing market with strong demand fundamentals. The UK market provides access to sophisticated healthcare systems and clinical expertise supporting product development and validation. Regulatory environment offers clear pathways for device approval and market entry, while strong intellectual property protections encourage innovation investment.

Patients and Families benefit from improved treatment outcomes, reduced invasiveness of procedures, and enhanced quality of life through advanced neurology devices. Early diagnosis capabilities enable proactive treatment approaches, while therapeutic devices offer new hope for previously untreatable conditions. Remote monitoring capabilities provide convenience and peace of mind for patients and their families.

Healthcare Systems realize cost-effectiveness benefits through improved resource utilization and reduced long-term care costs. Preventive care capabilities enabled by advanced diagnostic devices reduce expensive emergency interventions and hospitalizations. The overall healthcare system benefits from improved population health outcomes and reduced burden of neurological diseases.

Comprehensive SWOT analysis provides strategic insights into the UK neurology devices market’s internal strengths and weaknesses, as well as external opportunities and threats affecting market development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Several key trends are reshaping the UK neurology devices market, driven by technological advancement, changing healthcare delivery models, and evolving patient expectations. These trends influence market development and strategic planning across industry participants.

Artificial Intelligence Integration represents the most significant trend transforming neurology devices. AI-powered diagnostic systems demonstrate enhanced accuracy rates of up to 25% compared to traditional methods, while machine learning algorithms enable personalized treatment recommendations. Predictive analytics capabilities help healthcare providers identify high-risk patients and implement preventive interventions before clinical symptoms appear.

Miniaturization and Portability trends enable broader deployment of neurology devices across diverse healthcare settings. Portable EEG systems and handheld ultrasound devices expand access to neurological diagnostics in community healthcare settings and remote locations. Wearable monitoring devices provide continuous patient monitoring capabilities while maintaining patient mobility and quality of life.

Digital Health Integration facilitates seamless connectivity between neurology devices and electronic health records systems. Cloud-based data management platforms enable real-time data sharing and collaborative care approaches across multiple healthcare providers. Telemedicine integration allows remote consultation and monitoring, expanding access to specialized neurological care.

Personalized Medicine Approaches drive demand for devices capable of supporting individualized treatment strategies. Genetic testing integration and biomarker analysis capabilities enable precision medicine approaches in neurological care. Treatment customization based on individual patient characteristics improves outcomes while reducing adverse effects.

Recent industry developments highlight the dynamic nature of the UK neurology devices market and provide insights into future market direction. These developments reflect ongoing innovation, regulatory changes, and strategic initiatives across market participants.

Regulatory Approvals for innovative neurology devices continue accelerating, with several breakthrough technologies receiving approval for UK market entry. Recent approvals include advanced neurostimulation systems for treatment-resistant depression and innovative surgical robotics for minimally invasive neurosurgery. Expedited approval pathways for devices addressing unmet medical needs facilitate faster market access for innovative technologies.

Strategic Partnerships between device manufacturers and healthcare providers are expanding, creating collaborative development and implementation programs. Major NHS trusts are establishing innovation partnerships with technology companies to co-develop solutions addressing specific clinical needs. Academic collaborations between universities and industry partners accelerate research and development activities while ensuring clinical relevance.

Investment Activities in neurology device companies demonstrate strong investor confidence in market growth potential. Venture capital and private equity investment in innovative neurology technologies has increased substantially, supporting development of next-generation devices. Government funding initiatives provide additional support for research and development activities in neurological healthcare technologies.

Market Consolidation trends include strategic acquisitions and mergers among device manufacturers seeking to expand product portfolios and market reach. These consolidation activities create opportunities for enhanced research and development capabilities while potentially affecting competitive dynamics. MWR analysis indicates continued consolidation activity as companies seek to achieve scale advantages and technological synergies.

Strategic recommendations for market participants focus on leveraging growth opportunities while addressing market challenges and competitive pressures. These analyst suggestions provide actionable insights for different stakeholder categories.

For Device Manufacturers: Focus investment on artificial intelligence integration and digital health capabilities to differentiate products and improve clinical outcomes. Develop strategic partnerships with healthcare providers to ensure clinical relevance and accelerate adoption. Regulatory strategy should emphasize early engagement with regulatory bodies to streamline approval processes for innovative devices. Consider regional manufacturing capabilities to enhance supply chain resilience and reduce costs.

For Healthcare Providers: Develop comprehensive technology assessment frameworks to evaluate neurology devices based on clinical outcomes, cost-effectiveness, and integration capabilities. Invest in staff training and development to maximize utilization of advanced device capabilities. Procurement strategies should emphasize total cost of ownership rather than initial purchase price, considering long-term operational and maintenance costs.

For Investors: Focus investment on companies developing innovative technologies with clear clinical differentiation and strong intellectual property positions. Consider the regulatory pathway and market access strategy when evaluating investment opportunities. Market timing considerations should account for healthcare budget cycles and technology adoption patterns across different healthcare settings.

For Policymakers: Continue supporting innovation through research funding and regulatory pathway optimization while ensuring patient safety and cost-effectiveness. Develop workforce development initiatives to address skills gaps in specialized neurology device operation and maintenance. Healthcare infrastructure investment should prioritize equitable access to advanced neurological care across all regions.

The future outlook for the UK neurology devices market remains highly positive, with multiple growth drivers supporting sustained expansion over the coming years. Market projections indicate continued robust growth driven by demographic trends, technological innovation, and healthcare system evolution.

Growth projections suggest the market will maintain a compound annual growth rate of 7.1% through the next five years, supported by increasing prevalence of neurological conditions and expanding treatment options. The aging population will continue driving demand for diagnostic and therapeutic devices, while technological advancement creates new market opportunities. MarkWide Research forecasts indicate particularly strong growth in therapeutic devices and remote monitoring solutions.

Technology evolution will fundamentally transform neurology device capabilities, with artificial intelligence becoming standard across most device categories. Brain-computer interfaces and advanced neurostimulation technologies will create entirely new treatment possibilities for previously untreatable conditions. Nanotechnology integration will enable more precise and less invasive interventions, improving patient outcomes and reducing healthcare costs.

Market expansion will extend beyond traditional hospital settings to include community healthcare, home care, and telemedicine applications. The integration of neurology devices with digital health platforms will enable new care delivery models and improved patient engagement. Preventive care applications will gain prominence as devices become capable of identifying neurological conditions before clinical symptoms appear.

Regulatory environment evolution will likely emphasize real-world evidence and post-market surveillance while maintaining rigorous safety standards. Adaptive regulatory pathways may accelerate approval for breakthrough technologies addressing significant unmet medical needs. International harmonization of regulatory standards will facilitate global market access for innovative UK-developed technologies.

The UK neurology devices market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by demographic trends, technological innovation, and evolving healthcare delivery models. The market demonstrates strong fundamentals with sustained demand from an aging population increasingly affected by neurological conditions requiring sophisticated diagnostic and therapeutic interventions.

Key success factors for market participants include technological innovation, clinical validation, regulatory compliance, and strategic partnerships with healthcare providers. The integration of artificial intelligence, digital health technologies, and personalized medicine approaches creates substantial opportunities for differentiation and market leadership. Market dynamics favor companies capable of delivering clinically proven solutions that improve patient outcomes while demonstrating cost-effectiveness.

Strategic positioning in this market requires understanding of complex healthcare systems, regulatory requirements, and clinical needs across diverse patient populations. The most successful market participants will be those capable of combining technological innovation with deep clinical expertise and strong healthcare provider relationships. Future market leaders will likely emerge from companies investing substantially in research and development while maintaining focus on real-world clinical applications and patient benefit demonstration.

Overall market outlook remains highly positive, with multiple growth drivers supporting sustained expansion and innovation. The UK neurology devices market will continue evolving as a critical component of modern healthcare delivery, offering substantial opportunities for stakeholders committed to advancing neurological care standards and improving patient outcomes across the United Kingdom.

What is Neurology Devices?

Neurology devices are medical instruments and technologies used for diagnosing, monitoring, and treating neurological disorders. These devices include neurostimulation systems, imaging equipment, and diagnostic tools that aid in the management of conditions such as epilepsy, Parkinson’s disease, and multiple sclerosis.

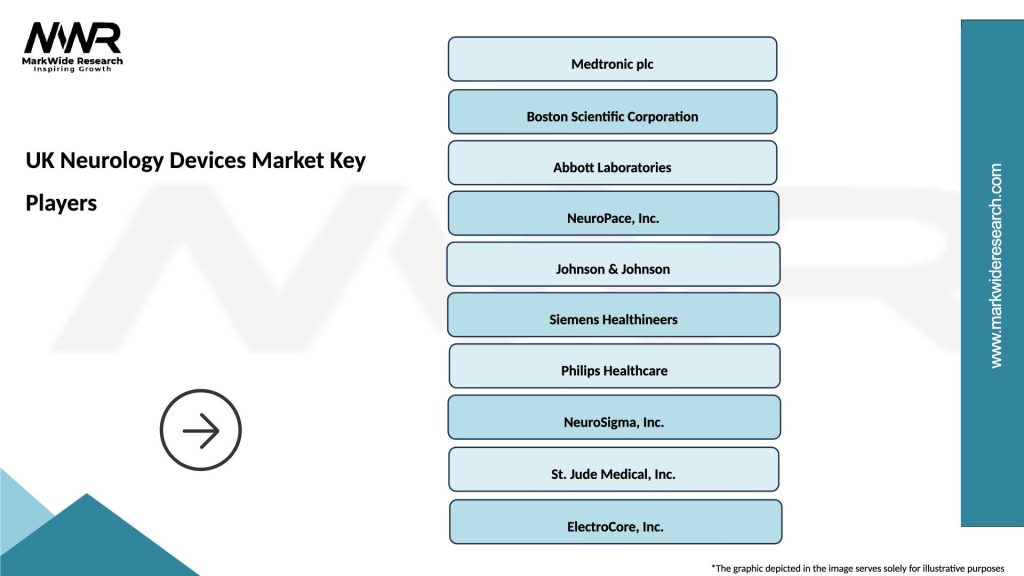

What are the key players in the UK Neurology Devices Market?

Key players in the UK Neurology Devices Market include Medtronic, Boston Scientific, and Abbott Laboratories. These companies are known for their innovative products and solutions in the field of neurology, focusing on areas such as neurostimulation and diagnostic imaging, among others.

What are the growth factors driving the UK Neurology Devices Market?

The UK Neurology Devices Market is driven by factors such as the increasing prevalence of neurological disorders, advancements in technology, and a growing aging population. Additionally, rising awareness about neurological conditions and the demand for minimally invasive procedures contribute to market growth.

What challenges does the UK Neurology Devices Market face?

The UK Neurology Devices Market faces challenges such as stringent regulatory requirements, high costs of advanced devices, and the need for continuous innovation. Additionally, the complexity of neurological disorders can complicate treatment options and device effectiveness.

What opportunities exist in the UK Neurology Devices Market?

Opportunities in the UK Neurology Devices Market include the development of wearable devices for continuous monitoring and the integration of artificial intelligence in diagnostics. Furthermore, expanding telemedicine services can enhance patient access to neurological care.

What trends are shaping the UK Neurology Devices Market?

Trends shaping the UK Neurology Devices Market include the rise of digital health technologies, increased focus on personalized medicine, and advancements in neuroimaging techniques. These trends are enhancing the accuracy of diagnoses and improving treatment outcomes for patients with neurological conditions.

UK Neurology Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Neurostimulators, EEG Devices, MRI Machines, Ultrasound Devices |

| Technology | Deep Brain Stimulation, Transcranial Magnetic Stimulation, Electrophysiology, Neuroimaging |

| End User | Hospitals, Neurology Clinics, Research Institutions, Rehabilitation Centers |

| Application | Chronic Pain Management, Epilepsy Treatment, Stroke Rehabilitation, Cognitive Disorders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Neurology Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at