444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK mutual funds market represents one of Europe’s most sophisticated and mature investment landscapes, characterized by robust regulatory frameworks and diverse investment opportunities. British investors increasingly turn to mutual funds as a cornerstone of their investment portfolios, driven by professional fund management expertise and diversification benefits. The market demonstrates steady growth patterns with institutional and retail participation expanding across various asset classes and investment strategies.

Market dynamics indicate that the UK mutual funds sector continues to evolve with technological advancements, regulatory changes, and shifting investor preferences. Digital transformation has revolutionized how investors access and manage their mutual fund investments, while environmental, social, and governance (ESG) considerations increasingly influence fund selection criteria. The market shows resilient performance despite economic uncertainties, with growth rates maintaining positive momentum at approximately 6.2% CAGR over recent periods.

Investment appetite remains strong across diverse demographic segments, from young professionals seeking long-term wealth accumulation to retirees prioritizing income generation and capital preservation. The market’s maturity is reflected in the sophisticated product offerings, ranging from traditional equity and bond funds to alternative investment strategies and specialized sector-focused funds.

The UK mutual funds market refers to the comprehensive ecosystem of pooled investment vehicles that collect money from multiple investors to purchase securities, bonds, and other financial instruments under professional management. Mutual funds in the UK operate under strict regulatory oversight from the Financial Conduct Authority (FCA), ensuring investor protection and market integrity through transparent reporting and standardized operational procedures.

Fund structures in the UK market encompass various categories including unit trusts, open-ended investment companies (OEICs), and investment trusts, each offering distinct advantages and characteristics. Professional fund managers make investment decisions on behalf of shareholders, utilizing their expertise to navigate market complexities and optimize returns while managing risk exposure across diversified portfolios.

Investment objectives vary significantly across different fund types, from growth-oriented equity funds targeting capital appreciation to income-focused bond funds providing regular distributions. The market serves both institutional investors such as pension funds and insurance companies, as well as individual retail investors seeking accessible entry points into professionally managed investment strategies.

Market leadership in the UK mutual funds sector is characterized by established asset management companies offering comprehensive product ranges and innovative investment solutions. Competitive positioning depends heavily on fund performance, fee structures, and the ability to adapt to evolving investor preferences and regulatory requirements. The market demonstrates strong fundamentals with increasing adoption rates reaching approximately 73% among UK adults who actively invest in financial markets.

Growth drivers include rising awareness of long-term investment benefits, government initiatives promoting retirement savings, and technological innovations that simplify fund access and management. Digital platforms have democratized mutual fund investing, enabling smaller investors to participate in previously exclusive investment strategies while reducing transaction costs and improving transparency.

Market challenges encompass fee pressure from passive investment alternatives, regulatory compliance costs, and the need for continuous innovation to maintain competitive advantages. ESG integration has become a critical differentiator, with sustainable investment funds capturing increasing market share as investor consciousness about environmental and social impact grows.

Investment trends reveal significant shifts toward passive investing strategies, with index funds and exchange-traded funds gaining substantial market traction. Active management remains relevant for specialized strategies and emerging markets, where professional expertise can potentially generate alpha through security selection and market timing.

Economic stability and low interest rate environments encourage investors to seek higher returns through equity and alternative investment mutual funds. Government policies supporting long-term savings through ISAs (Individual Savings Accounts) and pension reforms create favorable conditions for mutual fund growth. The financial literacy improvement initiatives help investors understand the benefits of professional fund management and diversification strategies.

Technological advancement serves as a primary growth catalyst, with mobile applications and online platforms making mutual fund investing more accessible and cost-effective. Robo-advisory services provide automated portfolio management and rebalancing, attracting tech-savvy investors who prefer digital-first investment experiences. The integration of artificial intelligence and machine learning in fund management processes enhances decision-making capabilities and operational efficiency.

Demographic trends including an aging population and increasing wealth accumulation drive demand for retirement-focused investment solutions. Millennial investors entering their peak earning years represent a significant growth opportunity, particularly for funds offering sustainable investing options and flexible contribution structures. The growing awareness of inflation risks motivates investors to seek investment vehicles that can potentially preserve and grow purchasing power over time.

Fee sensitivity among investors creates pressure on fund management companies to justify active management costs, particularly when passive alternatives deliver comparable returns at lower expense ratios. Regulatory compliance requirements increase operational costs and complexity, potentially limiting innovation and reducing profit margins for fund providers. The market volatility concerns may discourage risk-averse investors from participating in equity-focused mutual funds.

Competition from alternative investment platforms including direct stock investing, cryptocurrency, and peer-to-peer lending diverts potential mutual fund investments. Economic uncertainty and geopolitical tensions can reduce investor confidence and lead to redemptions during market stress periods. The complexity of fund selection may overwhelm inexperienced investors, creating barriers to market entry despite available educational resources.

Performance pressure on active fund managers intensifies as benchmark-beating returns become increasingly difficult to achieve consistently. Tax implications of mutual fund investments, including capital gains distributions, may deter tax-sensitive investors who prefer more tax-efficient investment structures. The minimum investment requirements for certain specialized funds may exclude smaller investors from accessing premium investment strategies.

ESG investing presents substantial growth opportunities as environmental and social consciousness drives investment decisions across all demographic segments. Sustainable funds are experiencing rapid asset growth, with adoption rates increasing by approximately 42% annually among UK investors. The development of impact measurement tools and reporting standards creates competitive advantages for funds that can demonstrate positive environmental and social outcomes alongside financial returns.

Emerging market exposure through mutual funds offers UK investors diversification benefits and access to higher growth potential economies. Technology sector funds capitalize on digital transformation trends across industries, while healthcare and biotechnology funds benefit from aging demographics and medical innovation advances. The infrastructure investment theme gains traction as governments prioritize sustainable development and modernization projects.

Personalized investment solutions using artificial intelligence and big data analytics enable fund companies to offer tailored strategies matching individual investor profiles and objectives. Multi-asset funds provide one-stop investment solutions for investors seeking professional asset allocation across different investment categories. The direct-to-consumer distribution model reduces intermediary costs and enables fund companies to build stronger relationships with end investors.

Supply and demand dynamics in the UK mutual funds market reflect changing investor preferences and economic conditions. Asset flows demonstrate cyclical patterns influenced by market performance, economic outlook, and investor sentiment. The market shows increasing concentration among larger fund management companies that can leverage economies of scale and technology investments to maintain competitive positioning.

Pricing dynamics continue evolving with fee compression across most fund categories, particularly in passive investment strategies where cost becomes the primary differentiator. Performance differentiation becomes increasingly important for active fund managers to justify higher fees and attract investor assets. The distribution landscape transforms as traditional financial advisors compete with digital platforms and direct-to-consumer offerings.

Regulatory dynamics shape product development and operational practices, with ongoing reforms aimed at improving investor protection and market transparency. Innovation cycles accelerate as fund companies invest in technology and alternative investment strategies to differentiate their offerings. The competitive intensity increases as new entrants, including fintech companies and international asset managers, challenge established market participants.

Primary research methodologies employed in analyzing the UK mutual funds market include comprehensive surveys of fund managers, financial advisors, and institutional investors to gather insights on market trends and investment preferences. Secondary research incorporates analysis of regulatory filings, fund performance data, and industry reports to establish market size, growth patterns, and competitive positioning across different fund categories.

Data collection processes utilize both quantitative and qualitative approaches, combining statistical analysis of fund flows, performance metrics, and fee structures with in-depth interviews of industry stakeholders. Market segmentation analysis examines various fund types, distribution channels, and investor demographics to identify growth opportunities and market dynamics. The research methodology ensures data accuracy through multiple source verification and cross-referencing of information from regulatory bodies and industry associations.

Analytical frameworks incorporate economic modeling, trend analysis, and scenario planning to project future market developments and identify potential risks and opportunities. Validation processes include peer review and expert consultation to ensure research findings accurately reflect market realities and provide actionable insights for stakeholders.

London and Southeast England dominate the UK mutual funds market, accounting for approximately 68% of total assets under management due to the concentration of financial services companies and high-net-worth individuals. Scotland represents a significant regional market with strong institutional investor presence, particularly in Edinburgh’s financial district where several major fund management companies maintain operations.

Northern England shows growing mutual fund adoption rates, driven by economic development and increasing disposable income among professional workers. Wales and Northern Ireland demonstrate emerging market characteristics with lower penetration rates but significant growth potential as financial literacy programs expand and digital investment platforms increase accessibility.

Regional preferences vary significantly, with London investors showing higher risk tolerance and preference for international equity funds, while investors in other regions tend to favor more conservative balanced funds and domestic equity strategies. Distribution channels also differ regionally, with digital platforms gaining faster adoption in urban areas while traditional financial advisors remain important in rural and smaller metropolitan areas.

Market leadership in the UK mutual funds sector is characterized by both domestic and international asset management companies offering diverse product ranges and investment expertise. Competitive positioning depends on factors including fund performance, fee structures, distribution reach, and brand reputation among financial advisors and institutional investors.

By Fund Type: The UK mutual funds market encompasses equity funds, bond funds, balanced funds, money market funds, and alternative investment funds, each serving different investor objectives and risk profiles. Equity funds represent the largest segment by assets, offering exposure to domestic and international stock markets across various sectors and market capitalizations.

By Investment Strategy: Active management strategies compete with passive index-tracking approaches, with passive funds gaining market share due to lower fees and consistent performance relative to benchmarks. ESG and sustainable investment strategies form a rapidly growing segment, attracting investors focused on environmental and social impact alongside financial returns.

By Distribution Channel: Fund distribution occurs through financial advisors, direct-to-consumer platforms, institutional channels, and digital investment platforms. Online platforms capture increasing market share, particularly among younger investors who prefer self-directed investment management and lower-cost access to professional fund management.

By Investor Type: Retail investors represent the largest segment by number of accounts, while institutional investors including pension funds, insurance companies, and endowments contribute significantly to total assets under management. High-net-worth individuals form a distinct segment with access to specialized investment strategies and personalized portfolio management services.

Equity Funds: UK and international equity funds continue attracting investor interest despite market volatility concerns. Technology sector funds demonstrate strong performance and asset growth, while emerging market equity funds offer diversification benefits despite higher risk profiles. The segment shows fee compression trends as passive alternatives gain acceptance among cost-conscious investors.

Fixed Income Funds: Bond funds face challenges from low interest rate environments but remain important for portfolio diversification and income generation. Corporate bond funds attract investors seeking higher yields than government securities, while inflation-protected bond funds gain popularity amid rising inflation concerns. The segment benefits from professional credit analysis and active duration management capabilities.

Balanced and Multi-Asset Funds: These funds provide one-stop investment solutions for investors seeking professional asset allocation across multiple investment categories. Target-date funds gain traction for retirement planning, automatically adjusting asset allocation based on investor age and retirement timeline. The segment shows innovation in risk management and dynamic allocation strategies.

Alternative Investment Funds: Real estate, commodity, and hedge fund strategies attract investors seeking portfolio diversification beyond traditional asset classes. Infrastructure funds benefit from government investment priorities and long-term income characteristics. The segment requires sophisticated risk management and specialized investment expertise.

For Investors: Mutual funds provide professional investment management, diversification benefits, and access to investment strategies that would be difficult or expensive to implement individually. Liquidity advantages allow investors to buy and sell fund shares on business days, providing flexibility for changing financial circumstances. The regulatory protection and transparency requirements ensure investor interests are safeguarded through standardized reporting and oversight.

For Fund Management Companies: The mutual funds business model provides recurring revenue streams through management fees and potential performance incentives. Scale economies enable efficient portfolio management and operational cost distribution across large asset bases. The brand building opportunities through consistent performance and investor service excellence create competitive advantages and market differentiation.

For Financial Advisors: Mutual funds offer comprehensive investment solutions that can be tailored to individual client needs and risk profiles. Due diligence support from fund companies helps advisors evaluate and recommend appropriate investment strategies. The ongoing monitoring and reporting capabilities enable advisors to demonstrate value and maintain client relationships through market cycles.

For Regulatory Bodies: The mutual funds industry provides a regulated framework for retail investment that promotes market stability and investor protection. Standardized reporting and compliance requirements facilitate market oversight and systemic risk monitoring. The innovation within regulatory boundaries encourages product development while maintaining appropriate investor safeguards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable Investing emerges as the dominant trend, with ESG-focused funds experiencing rapid asset growth and mainstream adoption across all investor segments. Impact measurement and reporting standards continue evolving to provide investors with meaningful data on environmental and social outcomes alongside financial performance. The trend shows integration across traditional investment strategies rather than remaining a separate category.

Digital Transformation accelerates across the mutual funds industry, with robo-advisors, mobile applications, and artificial intelligence enhancing investor experience and operational efficiency. Personalization capabilities enable customized investment recommendations and portfolio management based on individual investor profiles and preferences. The direct-to-consumer trend reduces intermediary costs and enables fund companies to build stronger investor relationships.

Fee Compression continues across most fund categories, driven by competitive pressure and investor cost consciousness. Passive investing gains market share as investors recognize the difficulty of consistently beating market benchmarks through active management. The trend toward outcome-oriented investing focuses on achieving specific financial goals rather than simply outperforming benchmarks.

Alternative Strategies gain mainstream acceptance as investors seek diversification beyond traditional equity and bond investments. Multi-asset approaches provide comprehensive investment solutions that adapt to changing market conditions and investor needs. The globalization trend continues as UK investors seek international diversification and emerging market growth opportunities.

Regulatory Evolution: The FCA continues refining mutual fund regulations to enhance investor protection and market transparency. Cost disclosure requirements provide investors with clearer understanding of fund expenses and their impact on investment returns. The sustainability reporting standards help investors evaluate ESG credentials and impact measurement across different fund strategies.

Technology Advancement: MarkWide Research analysis indicates that artificial intelligence and machine learning applications in portfolio management are becoming more sophisticated and widespread. Blockchain technology exploration for fund administration and settlement processes shows potential for operational efficiency improvements. The mobile-first approach to investor engagement transforms how fund companies interact with shareholders.

Market Consolidation: Merger and acquisition activity continues as fund companies seek scale advantages and expanded distribution capabilities. Strategic partnerships between traditional asset managers and fintech companies create innovative investment solutions and distribution channels. The international expansion of UK-based fund managers provides growth opportunities in emerging markets.

Product Innovation: Development of outcome-oriented funds that target specific investment objectives such as retirement income or inflation protection. Factor-based investing strategies gain popularity as investors seek systematic approaches to capturing market premiums. The liquid alternatives category expands to provide retail investors access to hedge fund-like strategies with daily liquidity.

Strategic Focus recommendations emphasize the importance of developing comprehensive ESG capabilities and sustainable investment expertise to capture growing market demand. Technology investment priorities should focus on enhancing investor experience through digital platforms and improving operational efficiency through automation and artificial intelligence applications.

Product Development strategies should prioritize outcome-oriented investment solutions that address specific investor needs such as retirement planning, education funding, and wealth preservation. Fee optimization remains critical for maintaining competitive positioning, particularly in passive investment strategies where cost becomes the primary differentiator.

Distribution Enhancement through multi-channel approaches that combine traditional financial advisor relationships with direct-to-consumer digital platforms. Partnership strategies with fintech companies and digital investment platforms can expand market reach and attract younger investor demographics. The global expansion opportunities should focus on emerging markets with growing middle-class populations and increasing investment sophistication.

Risk Management capabilities must evolve to address new challenges including cybersecurity threats, regulatory changes, and market volatility. Talent acquisition and retention strategies should focus on attracting professionals with expertise in sustainable investing, technology, and alternative investment strategies. The client engagement approaches should leverage data analytics to provide personalized investment advice and portfolio management services.

Growth projections for the UK mutual funds market remain positive, with MWR forecasting continued expansion driven by demographic trends, technological innovation, and increasing investment sophistication among retail investors. ESG integration will become standard practice across all fund categories rather than remaining a specialized segment, with sustainability criteria influencing investment decisions and performance evaluation.

Technology transformation will accelerate, with artificial intelligence and machine learning becoming integral to portfolio management, risk assessment, and investor service delivery. Personalization capabilities will enable fund companies to offer customized investment solutions that adapt to individual investor circumstances and preferences. The digital-first approach will become the standard for investor engagement and fund distribution.

Market structure evolution will likely see continued consolidation among fund management companies, with successful firms demonstrating scale advantages, technological capabilities, and specialized expertise. Alternative investment strategies will gain mainstream acceptance as investors seek diversification and yield enhancement opportunities. The global integration trend will continue as UK investors seek international diversification and emerging market growth potential.

Regulatory development will focus on enhancing investor protection while promoting innovation and competition within the mutual funds industry. Outcome measurement and reporting standards will become more sophisticated, enabling investors to better evaluate fund performance relative to their specific financial objectives. The market is expected to maintain steady growth momentum with projected expansion rates of approximately 5.8% annually over the next five years.

The UK mutual funds market stands at a pivotal juncture, characterized by technological transformation, evolving investor preferences, and increasing focus on sustainable investing principles. Market fundamentals remain strong despite challenges from fee compression and alternative investment platforms, with professional fund management continuing to provide value through expertise, diversification, and regulatory protection.

Future success in the UK mutual funds market will depend on fund companies’ ability to adapt to changing investor needs, embrace technological innovation, and develop comprehensive ESG capabilities. Digital transformation and personalized investment solutions will become essential differentiators, while maintaining cost competitiveness and delivering consistent performance remains crucial for long-term sustainability.

Investment opportunities abound for stakeholders who can navigate the evolving landscape effectively, with particular promise in sustainable investing, technology-enabled solutions, and outcome-oriented investment strategies. The UK mutual funds market is well-positioned for continued growth and evolution, serving as a cornerstone of the broader UK investment management industry and contributing to the financial well-being of millions of investors across the country.

What is Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They offer investors a way to invest in a managed fund, providing access to a range of asset classes and professional management.

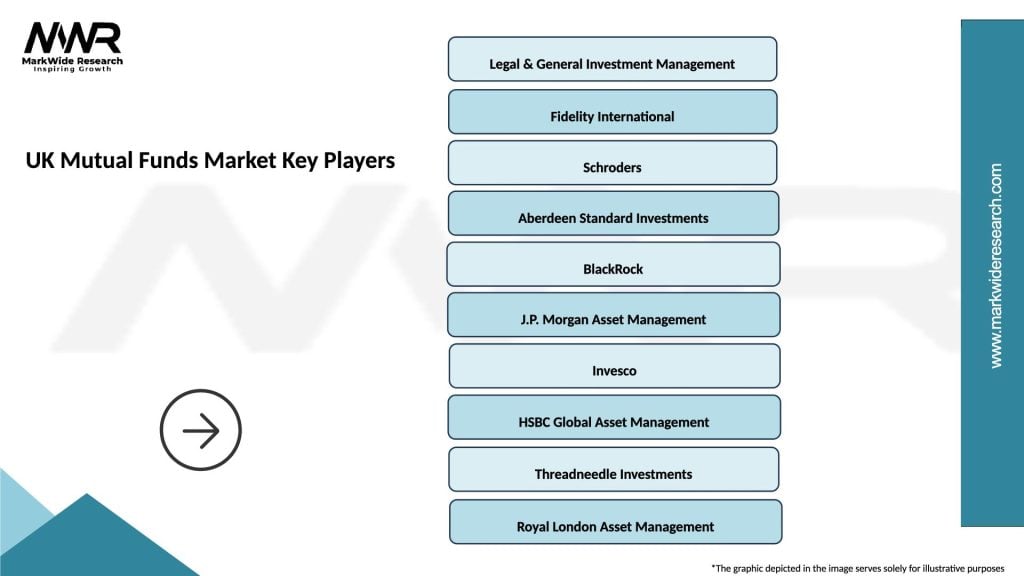

What are the key players in the UK Mutual Funds Market?

Key players in the UK Mutual Funds Market include companies like Fidelity International, Schroders, and Legal & General Investment Management. These firms offer a variety of mutual fund products catering to different investment strategies and risk profiles, among others.

What are the growth factors driving the UK Mutual Funds Market?

The UK Mutual Funds Market is driven by factors such as increasing investor awareness of diversified investment options, the growth of retirement savings plans, and the rising demand for professional asset management services. Additionally, favorable regulatory changes have also contributed to market growth.

What challenges does the UK Mutual Funds Market face?

Challenges in the UK Mutual Funds Market include regulatory compliance complexities, market volatility affecting investor confidence, and competition from alternative investment vehicles like ETFs. These factors can impact fund performance and investor returns.

What opportunities exist in the UK Mutual Funds Market?

Opportunities in the UK Mutual Funds Market include the potential for growth in sustainable and ESG-focused funds, as well as the increasing adoption of digital platforms for fund distribution. Additionally, there is a growing interest in thematic investing among younger investors.

What trends are shaping the UK Mutual Funds Market?

Trends in the UK Mutual Funds Market include a shift towards passive investment strategies, the rise of robo-advisors, and an increasing focus on environmental, social, and governance (ESG) criteria in fund selection. These trends reflect changing investor preferences and market dynamics.

UK Mutual Funds Market

| Segmentation Details | Description |

|---|---|

| Product Type | Equity Funds, Bond Funds, Balanced Funds, Money Market Funds |

| Investor Type | Retail Investors, Institutional Investors, High Net Worth Individuals, Pension Funds |

| Distribution Channel | Direct Sales, Financial Advisors, Online Platforms, Banks |

| Fund Size | Small Cap, Mid Cap, Large Cap, Mega Cap |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Mutual Funds Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at