444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK luxury market represents one of the most sophisticated and resilient segments within the global luxury economy, encompassing premium goods, services, and experiences across multiple categories. British luxury brands have established themselves as global icons, from heritage fashion houses to premium automotive manufacturers, creating a distinctive market landscape that combines traditional craftsmanship with contemporary innovation. The market demonstrates remarkable adaptability, with digital transformation accelerating at unprecedented rates and consumer preferences evolving toward sustainable luxury options.

Market dynamics indicate sustained growth momentum driven by affluent domestic consumers, international tourism recovery, and expanding digital channels. The sector encompasses luxury fashion, jewelry, watches, automobiles, hospitality, real estate, and experiential services, each contributing to the overall market ecosystem. Consumer behavior patterns show increasing emphasis on authenticity, sustainability, and personalized experiences, reshaping how luxury brands approach their target audiences.

Regional concentration remains heavily focused on London, with significant luxury retail presence in areas like Bond Street, Knightsbridge, and Mayfair. However, market expansion is evident across major UK cities including Edinburgh, Manchester, and Birmingham, reflecting growing affluence and luxury consumption patterns beyond the capital.

The UK luxury market refers to the comprehensive ecosystem of premium goods, services, and experiences that cater to affluent consumers seeking exceptional quality, exclusivity, and prestige. This market encompasses traditional luxury categories including high-end fashion, jewelry, watches, automobiles, and hospitality services, alongside emerging segments such as luxury technology, sustainable premium products, and experiential luxury offerings.

Luxury consumption in the UK context extends beyond mere product acquisition to encompass lifestyle choices, brand heritage appreciation, and social status expression. The market serves both domestic high-net-worth individuals and international consumers who view British luxury brands as symbols of quality, tradition, and sophistication. Market participants include established heritage brands, contemporary luxury designers, premium service providers, and luxury retailers operating across multiple channels.

Strategic analysis reveals the UK luxury market maintaining strong fundamentals despite global economic uncertainties, with digital innovation and sustainability initiatives driving transformation across all segments. Consumer preferences continue shifting toward brands that demonstrate authentic values, environmental responsibility, and personalized customer experiences, creating opportunities for both established players and emerging luxury brands.

Market performance indicators suggest robust demand across key categories, with particular strength in luxury fashion, premium automotive, and experiential luxury services. The sector benefits from the UK’s position as a global financial center, attracting international luxury consumers and supporting domestic affluent spending patterns. Digital adoption rates have accelerated significantly, with luxury brands investing heavily in e-commerce platforms, virtual experiences, and omnichannel retail strategies.

Competitive landscape analysis shows increasing consolidation among luxury conglomerates while independent luxury brands focus on niche positioning and authentic storytelling. The market demonstrates resilience through economic cycles, supported by loyal customer bases and strong brand equity built over decades or centuries of operation.

Consumer demographics analysis reveals evolving luxury buyer profiles, with younger affluent consumers driving demand for sustainable luxury options and digital-first shopping experiences. Purchasing behavior patterns indicate growing preference for investment pieces, limited editions, and personalized luxury goods that reflect individual identity and values.

Economic prosperity among high-net-worth individuals continues driving luxury consumption, with wealth accumulation creating sustained demand for premium goods and services. London’s position as a global financial hub attracts international luxury consumers while supporting domestic affluent spending patterns across multiple luxury categories.

Brand heritage represents a fundamental driver, with British luxury brands leveraging centuries of craftsmanship tradition and royal warrants to command premium positioning globally. Cultural influence through media, entertainment, and fashion continues elevating UK luxury brand desirability among international consumers seeking authentic British luxury experiences.

Digital transformation initiatives enable luxury brands to reach broader audiences while maintaining exclusivity through personalized online experiences and virtual consultations. Sustainability consciousness among affluent consumers drives demand for ethically produced luxury goods, creating opportunities for brands demonstrating environmental responsibility and social impact.

Tourism recovery supports luxury retail performance, particularly in London’s premium shopping districts where international visitors contribute significantly to luxury goods sales. Investment mentality among luxury consumers treats premium purchases as portfolio diversification, driving demand for collectible luxury items and limited edition releases.

Economic uncertainty creates volatility in luxury spending patterns, with affluent consumers potentially delaying discretionary purchases during periods of market instability. Brexit implications continue affecting international trade relationships and supply chain costs, impacting luxury brand operations and pricing strategies.

Supply chain challenges affect luxury goods availability and production timelines, particularly for brands dependent on international suppliers or specialized materials. Skilled craftspeople shortages limit production capacity for heritage luxury brands relying on traditional manufacturing techniques and artisanal expertise.

Changing consumer values challenge traditional luxury consumption patterns, with younger affluent demographics questioning conspicuous consumption and demanding greater brand authenticity and social responsibility. Digital competition from global luxury platforms creates pricing pressure and channel conflicts for established luxury retailers.

Regulatory compliance requirements increase operational complexity, particularly regarding sustainability reporting, supply chain transparency, and consumer protection standards affecting luxury brand operations.

Sustainable luxury presents significant growth opportunities as environmentally conscious consumers seek premium products aligned with their values. Circular economy initiatives including luxury goods resale, restoration services, and sustainable packaging create new revenue streams while appealing to sustainability-focused consumers.

Digital innovation enables luxury brands to create immersive virtual experiences, augmented reality try-on services, and personalized digital consultations that maintain exclusivity while expanding market reach. Artificial intelligence applications in customer service, inventory management, and personalized recommendations enhance operational efficiency and customer satisfaction.

Emerging markets expansion opportunities exist as global wealth distribution shifts create new luxury consumer segments seeking authentic British luxury experiences. Experiential luxury services including bespoke travel, exclusive events, and personalized lifestyle management represent high-growth segments with premium pricing potential.

Collaboration opportunities between luxury brands and technology companies create innovative products combining traditional craftsmanship with cutting-edge functionality. Direct-to-consumer channels enable luxury brands to capture higher margins while building deeper customer relationships through personalized service delivery.

Supply and demand dynamics in the UK luxury market reflect complex interactions between consumer affluence, brand exclusivity strategies, and global economic conditions. Demand patterns show increasing sophistication among luxury consumers who prioritize authenticity, sustainability, and personalized experiences over traditional status symbols.

Pricing strategies across luxury segments demonstrate premium positioning maintenance while adapting to changing consumer value perceptions. MarkWide Research analysis indicates luxury brands successfully implementing dynamic pricing models that reflect scarcity, craftsmanship quality, and brand heritage value propositions.

Distribution channel evolution shows accelerating shift toward omnichannel approaches combining flagship retail experiences with sophisticated digital platforms. Customer relationship management becomes increasingly critical as luxury brands invest in personalized service delivery and long-term customer value optimization.

Innovation cycles within luxury segments balance tradition preservation with contemporary relevance, creating products and services that honor heritage while meeting modern consumer expectations. Market consolidation trends continue as luxury conglomerates acquire independent brands while maintaining their unique positioning and creative autonomy.

Comprehensive analysis methodology incorporates multiple data sources including luxury brand performance metrics, consumer behavior studies, retail sales data, and industry expert interviews. Primary research components include surveys of luxury consumers, interviews with brand executives, and analysis of luxury retail performance across different geographic markets.

Secondary research encompasses analysis of industry reports, financial statements of publicly traded luxury companies, and luxury market trend analysis from authoritative sources. Quantitative analysis includes statistical modeling of luxury consumption patterns, price elasticity studies, and market share analysis across different luxury categories.

Qualitative research methods include focus groups with luxury consumers, expert interviews with industry professionals, and case study analysis of successful luxury brand strategies. Market validation processes ensure data accuracy through cross-referencing multiple sources and verification with industry stakeholders.

Analytical frameworks applied include SWOT analysis, Porter’s Five Forces model, and consumer behavior analysis specific to luxury market dynamics. Trend analysis methodology incorporates both historical performance data and forward-looking indicators to identify emerging market opportunities and challenges.

London dominance continues characterizing the UK luxury market landscape, with the capital accounting for approximately 72% of luxury retail activity and hosting flagship stores of major international luxury brands. West End districts including Bond Street, Regent Street, and Knightsbridge maintain their position as premier luxury shopping destinations attracting both domestic and international consumers.

Regional expansion trends show luxury brands establishing presence in major cities outside London, with Manchester, Edinburgh, and Birmingham emerging as significant luxury retail markets. Scotland’s luxury market demonstrates particular strength in heritage brands, whisky, and luxury hospitality services, leveraging cultural authenticity and tourism appeal.

Northern England markets show growing luxury consumption patterns driven by increasing affluence and urban regeneration projects creating premium retail environments. Coastal regions including Brighton and Bath maintain niche luxury markets focused on lifestyle brands and experiential luxury services.

Digital reach enables luxury brands to serve consumers across all UK regions through sophisticated e-commerce platforms and virtual consultation services. Regional preferences vary with London consumers favoring international luxury brands while regional markets show stronger preference for British heritage luxury brands.

Market leadership positions are held by established British luxury brands that have successfully adapted to changing consumer preferences while maintaining their heritage appeal. International competition from French, Italian, and American luxury conglomerates creates dynamic competitive environment requiring continuous innovation and market positioning refinement.

Competitive strategies focus on digital transformation, sustainability initiatives, and experiential retail concepts that differentiate brands in increasingly crowded luxury marketplace. Innovation investment areas include artificial intelligence applications, sustainable materials research, and personalized customer service technologies.

By Product Category:

By Consumer Demographics:

By Distribution Channel:

Luxury Fashion maintains market leadership through combination of heritage British brands and international luxury houses establishing UK presence. Sustainable fashion trends drive innovation in materials, production processes, and circular economy initiatives, with consumers increasingly valuing environmental responsibility alongside traditional luxury attributes.

Premium Automotive segment demonstrates resilience with British luxury car manufacturers like Rolls-Royce, Bentley, and Aston Martin maintaining strong global demand. Electric luxury vehicles represent emerging growth opportunity as affluent consumers embrace sustainable transportation options without compromising luxury experiences.

Luxury Hospitality shows recovery momentum with premium hotels, exclusive clubs, and bespoke travel services adapting to post-pandemic consumer preferences. Experiential luxury gains prominence as consumers prioritize memorable experiences over material possessions, creating opportunities for innovative service providers.

Fine Jewelry and Watches benefit from investment mentality among luxury consumers seeking tangible assets with appreciation potential. Heritage craftsmanship commands premium pricing while contemporary designs attract younger affluent demographics seeking modern luxury expressions.

Brand owners benefit from the UK luxury market’s reputation for quality and authenticity, enabling premium pricing strategies and global market expansion opportunities. Heritage positioning provides competitive advantages in international markets where British luxury brands command respect and consumer preference.

Retailers gain access to affluent consumer segments with high lifetime value and loyalty potential through luxury market participation. Tourism synergies create additional revenue streams as international visitors seek authentic British luxury shopping experiences during UK visits.

Investors find attractive opportunities in luxury market segments that demonstrate resilience during economic downturns and strong growth potential in emerging markets. Portfolio diversification benefits include exposure to consumer discretionary spending among high-net-worth individuals and luxury brand equity appreciation.

Suppliers and partners benefit from association with luxury brands through premium positioning, quality requirements that drive operational excellence, and access to affluent customer networks. Innovation partnerships create opportunities for technology companies and service providers to develop solutions specifically for luxury market requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as fundamental trend reshaping luxury brand strategies, with consumers demanding transparency in sourcing, production, and environmental impact. Circular economy principles gain adoption through luxury goods resale platforms, restoration services, and sustainable packaging initiatives that maintain brand prestige while addressing environmental concerns.

Digital-first experiences transform luxury retail through virtual consultations, augmented reality try-on services, and personalized online shopping platforms. Artificial intelligence applications enhance customer service, inventory management, and personalized product recommendations while maintaining the exclusivity associated with luxury brands.

Experiential luxury gains prominence as affluent consumers prioritize memorable experiences over material possessions, driving growth in bespoke travel, exclusive events, and personalized lifestyle services. Wellness integration creates opportunities for luxury brands to expand into health, fitness, and mental wellbeing services targeting affluent demographics.

Personalization demand drives luxury brands to offer customized products, bespoke services, and individualized customer experiences that reflect personal identity and values. MWR research indicates personalized luxury offerings achieving significantly higher customer satisfaction and loyalty rates compared to standard luxury products.

Digital transformation initiatives accelerate across luxury brands with significant investments in e-commerce platforms, virtual reality showrooms, and artificial intelligence-powered customer service systems. Omnichannel integration creates seamless experiences connecting physical flagship stores with sophisticated digital platforms.

Sustainability commitments drive luxury brands to adopt carbon-neutral operations, sustainable sourcing practices, and circular economy business models. Innovation partnerships between luxury brands and technology companies create smart luxury products combining traditional craftsmanship with cutting-edge functionality.

Market consolidation continues as luxury conglomerates acquire independent brands while maintaining their unique positioning and creative autonomy. Direct-to-consumer strategies gain adoption enabling luxury brands to capture higher margins and build deeper customer relationships.

International expansion accelerates with British luxury brands establishing presence in emerging markets while maintaining their authentic British heritage positioning. Experiential retail concepts transform flagship stores into immersive brand destinations offering personalized services and exclusive experiences.

Strategic positioning recommendations emphasize authentic brand storytelling that connects heritage craftsmanship with contemporary relevance and sustainability values. Digital investment priorities should focus on personalized customer experiences, virtual consultation services, and seamless omnichannel integration that maintains luxury exclusivity.

Sustainability integration requires comprehensive approach encompassing supply chain transparency, environmental impact reduction, and circular economy initiatives that appeal to environmentally conscious luxury consumers. Innovation partnerships with technology companies can create differentiated luxury products combining traditional craftsmanship with modern functionality.

Market expansion strategies should balance international growth opportunities with domestic market strengthening, particularly in regional UK markets showing increasing luxury consumption patterns. Customer relationship management investments enable luxury brands to build long-term value through personalized service delivery and exclusive experiences.

Operational excellence initiatives should focus on supply chain resilience, skilled workforce development, and quality maintenance while adapting to changing consumer preferences and market conditions. MarkWide Research analysis suggests luxury brands achieving sustainable competitive advantage through authentic differentiation and customer-centric innovation strategies.

Growth trajectory projections indicate continued expansion driven by digital innovation, sustainability initiatives, and experiential luxury service development. Consumer evolution toward values-based purchasing decisions creates opportunities for luxury brands demonstrating authentic commitment to social and environmental responsibility.

Technology integration will accelerate with artificial intelligence, virtual reality, and blockchain applications enhancing luxury brand operations and customer experiences. Personalization capabilities will become increasingly sophisticated, enabling luxury brands to offer truly individualized products and services at scale.

International market expansion opportunities remain strong, particularly in emerging economies where growing affluence creates new luxury consumer segments seeking authentic British luxury experiences. Sustainability requirements will intensify, driving innovation in materials, production processes, and business models that align with environmental consciousness.

Market resilience characteristics suggest the UK luxury market will maintain its position as global leader through economic cycles, supported by strong brand equity, loyal customer bases, and continuous adaptation to changing consumer preferences and market conditions.

The UK luxury market demonstrates remarkable resilience and adaptability, successfully navigating global challenges while maintaining its position as a leader in premium goods and services. Strategic evolution toward sustainability, digital innovation, and experiential luxury creates new growth opportunities while honoring the heritage craftsmanship that defines British luxury brands.

Market fundamentals remain strong, supported by affluent domestic consumers, recovering international tourism, and expanding global demand for authentic British luxury experiences. Digital transformation initiatives enable luxury brands to reach broader audiences while maintaining exclusivity through personalized service delivery and immersive brand experiences.

Future success will depend on luxury brands’ ability to balance tradition with innovation, authenticity with accessibility, and profitability with sustainability. The UK luxury market is well-positioned to capitalize on emerging opportunities while addressing evolving consumer expectations and global market dynamics, ensuring continued growth and market leadership in the global luxury economy.

What is Luxury?

Luxury refers to high-quality goods and services that offer exclusivity, superior craftsmanship, and premium pricing. In the context of the UK luxury market, this includes luxury fashion, fine jewelry, high-end automobiles, and upscale travel experiences.

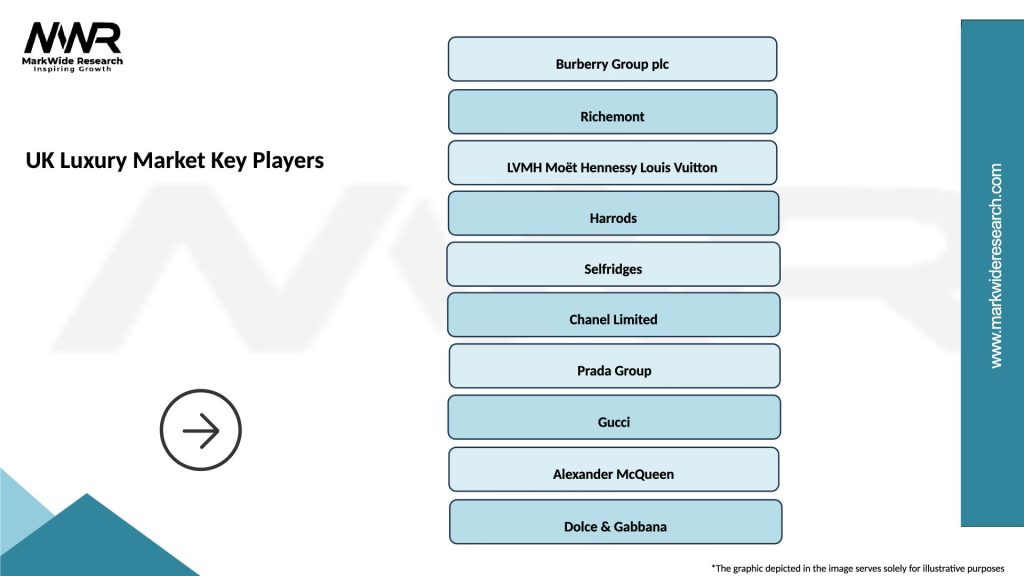

What are the key players in the UK Luxury Market?

Key players in the UK luxury market include renowned brands such as Burberry, Rolls-Royce, and Harrods. These companies are known for their commitment to quality and innovation, catering to affluent consumers seeking luxury products and experiences, among others.

What are the growth factors driving the UK Luxury Market?

The UK luxury market is driven by factors such as increasing disposable income among high-net-worth individuals, a growing interest in sustainable luxury, and the rise of digital shopping experiences. Additionally, the demand for personalized services and unique products continues to fuel market growth.

What challenges does the UK Luxury Market face?

The UK luxury market faces challenges such as economic uncertainty, changing consumer preferences, and the impact of global events on travel and tourism. Additionally, competition from emerging luxury brands and the need for digital transformation pose significant hurdles.

What opportunities exist in the UK Luxury Market?

Opportunities in the UK luxury market include the expansion of e-commerce platforms, the integration of technology in luxury experiences, and the growing demand for sustainable and ethically produced luxury goods. Brands that adapt to these trends can capture new consumer segments.

What trends are shaping the UK Luxury Market?

Trends shaping the UK luxury market include a focus on sustainability, the rise of experiential luxury, and the increasing influence of social media on consumer purchasing decisions. Additionally, personalization and customization are becoming key differentiators for luxury brands.

UK Luxury Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fashion, Jewelry, Watches, Accessories |

| Price Tier | Premium, Super Premium, Ultra Luxury, Exclusive |

| Distribution Channel | Online, Department Stores, Boutiques, Outlets |

| Customer Type | Affluent Consumers, High Net Worth Individuals, Celebrities, Collectors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Luxury Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at