444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK lubricants market represents a dynamic and essential sector within the country’s industrial landscape, serving diverse applications across automotive, industrial, marine, and aerospace industries. Market dynamics indicate sustained growth driven by technological advancements, environmental regulations, and evolving consumer preferences toward high-performance lubricant solutions. The sector encompasses a comprehensive range of products including engine oils, hydraulic fluids, gear oils, and specialty lubricants designed to meet stringent performance standards.

Growth projections suggest the market is expanding at a steady CAGR of 3.2%, reflecting robust demand from key end-use industries and increasing adoption of synthetic and bio-based lubricant formulations. Regional distribution shows concentrated activity in industrial hubs across England, Scotland, and Wales, with automotive applications accounting for approximately 45% of total consumption. The market demonstrates resilience through economic fluctuations, supported by mandatory maintenance requirements and regulatory compliance across various sectors.

Technological innovation continues to reshape the landscape, with manufacturers investing heavily in research and development to create advanced formulations that deliver superior performance, extended service intervals, and reduced environmental impact. Sustainability initiatives are gaining momentum, driving demand for environmentally friendly lubricants and recycling programs that align with the UK’s carbon neutrality objectives.

The UK lubricants market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of lubricating substances designed to reduce friction, wear, and heat generation between moving mechanical components across various industrial and automotive applications throughout the United Kingdom.

Lubricants serve multiple critical functions including friction reduction, heat dissipation, corrosion protection, and contaminant removal in mechanical systems. The market encompasses various product categories ranging from conventional mineral-based oils to advanced synthetic formulations and bio-based alternatives. Application diversity spans automotive engines, industrial machinery, marine vessels, aviation equipment, and specialized manufacturing processes.

Market participants include global oil companies, specialty chemical manufacturers, independent blenders, and distributors who collectively serve end-users across multiple sectors. The ecosystem involves complex supply chains connecting crude oil refineries, additive suppliers, packaging facilities, and retail networks to deliver products meeting specific performance requirements and regulatory standards.

Strategic analysis reveals the UK lubricants market as a mature yet evolving sector characterized by steady growth, technological advancement, and increasing environmental consciousness. Market fundamentals remain strong, supported by consistent demand from automotive and industrial sectors, despite challenges from electric vehicle adoption and economic uncertainties.

Key growth drivers include stringent emission regulations promoting high-performance lubricants, industrial automation requiring specialized fluids, and growing awareness of total cost of ownership benefits. Synthetic lubricants are gaining market share at approximately 8% annually, driven by superior performance characteristics and extended drain intervals that reduce maintenance costs.

Competitive dynamics feature established multinational corporations alongside regional specialists, creating a diverse marketplace with varying product portfolios and distribution strategies. Innovation focus centers on developing lubricants that enhance fuel economy, reduce emissions, and support equipment longevity while meeting evolving regulatory requirements.

Future prospects indicate continued market evolution toward sustainable solutions, with bio-based lubricants and circular economy principles gaining prominence. Digital transformation is reshaping customer engagement through predictive maintenance solutions and data-driven lubricant management systems.

Market intelligence reveals several critical insights shaping the UK lubricants landscape. Demand patterns show resilience across core applications while emerging trends create new opportunities for specialized products and services.

Primary growth catalysts propelling the UK lubricants market encompass regulatory mandates, technological advancement, and evolving customer expectations. Environmental regulations continue to drive demand for high-performance lubricants that enable compliance with emission standards while delivering operational efficiency.

Automotive sector evolution creates sustained demand despite electric vehicle growth, as hybrid technologies and advanced internal combustion engines require specialized lubricant formulations. Industrial automation and digitalization trends necessitate precision lubricants that support high-speed machinery and extended operating intervals.

Economic factors including infrastructure investment and manufacturing growth support lubricant consumption across various applications. Total cost ownership considerations increasingly influence purchasing decisions, favoring premium lubricants that reduce maintenance costs and equipment downtime.

Sustainability initiatives drive innovation in bio-based and recycled lubricant products, supported by corporate environmental commitments and consumer awareness. Service differentiation through comprehensive lubrication management programs creates value-added opportunities for market participants.

Market challenges present obstacles to growth and profitability within the UK lubricants sector. Electric vehicle adoption poses long-term concerns for automotive lubricant demand, particularly in passenger car segments where electrification rates are accelerating.

Raw material volatility affects production costs and pricing strategies, with base oil and additive price fluctuations impacting profit margins. Regulatory complexity creates compliance burdens and development costs, particularly for smaller market participants lacking extensive technical resources.

Economic uncertainties including inflation, supply chain disruptions, and geopolitical tensions influence customer spending patterns and industrial activity levels. Extended drain intervals enabled by advanced lubricant formulations reduce consumption volumes despite performance benefits.

Competitive pressure from low-cost imports and private label products challenges premium positioning strategies. Environmental concerns regarding petroleum-based products drive regulatory scrutiny and potential restrictions on conventional lubricant formulations.

Emerging opportunities within the UK lubricants market span technological innovation, sustainability initiatives, and service expansion. Bio-based lubricants represent significant growth potential, with market acceptance increasing at approximately 12% annually as environmental consciousness rises.

Industrial digitalization creates demand for smart lubricants integrated with condition monitoring systems and predictive maintenance platforms. Specialty applications in renewable energy, aerospace, and marine sectors offer premium pricing opportunities for technically advanced formulations.

Circular economy principles enable development of re-refined lubricant products and comprehensive recycling programs that address sustainability concerns while creating new revenue streams. Service integration through lubrication management contracts and technical consulting services provides differentiation and customer retention benefits.

Export potential exists for UK-manufactured specialty lubricants and technical expertise, particularly in emerging markets seeking advanced lubrication solutions. Partnership opportunities with equipment manufacturers enable co-development of application-specific lubricant solutions and market access.

Market forces shaping the UK lubricants landscape reflect complex interactions between supply-side capabilities, demand-side requirements, and external influences. Supply chain dynamics involve global raw material sourcing, domestic manufacturing, and multi-channel distribution networks serving diverse customer segments.

Demand fluctuations correlate with economic activity, seasonal patterns, and industry-specific cycles that influence consumption volumes and product mix preferences. Price sensitivity varies significantly across applications, with industrial users often prioritizing performance over cost while consumer segments remain price-conscious.

Innovation cycles drive product development timelines and market introduction strategies, with research and development investments averaging 4-6% of revenue among leading manufacturers. Regulatory evolution creates both compliance challenges and market opportunities for environmentally advanced formulations.

Competitive intensity varies by segment, with commodity products experiencing price pressure while specialty applications support premium positioning. Customer relationships increasingly emphasize technical support, application expertise, and comprehensive service offerings beyond product supply.

Comprehensive analysis of the UK lubricants market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves extensive interviews with industry executives, technical specialists, and end-users across various sectors to gather firsthand insights on market trends and challenges.

Secondary research encompasses analysis of industry publications, regulatory documents, company reports, and trade statistics to establish market baselines and validate primary findings. Quantitative analysis utilizes statistical modeling and trend analysis to project market developments and identify growth patterns.

Market segmentation analysis examines consumption patterns across product categories, application sectors, and geographic regions to identify specific opportunities and challenges. Competitive intelligence evaluates market participant strategies, product portfolios, and positioning approaches through public information and industry sources.

Expert validation ensures research accuracy through consultation with industry specialists and technical experts who provide context and verification of findings. Data triangulation combines multiple information sources to enhance reliability and reduce potential biases in market assessment.

Geographic distribution of the UK lubricants market reflects industrial concentration, population density, and economic activity patterns across England, Scotland, Wales, and Northern Ireland. England dominates market consumption with approximately 75% market share, driven by major industrial centers, automotive manufacturing, and dense population centers.

Scotland contributes significantly through oil and gas industry activities, marine applications, and manufacturing sectors, representing roughly 15% of national consumption. Regional specialization includes offshore lubricants, renewable energy applications, and traditional industrial sectors.

Wales maintains steady demand through steel production, automotive components, and industrial manufacturing, accounting for approximately 7% of market volume. Port activities and logistics operations create additional demand for marine and industrial lubricants.

Northern Ireland represents a smaller but stable market segment focused on agriculture, manufacturing, and transportation applications. Cross-border trade with the Republic of Ireland creates unique distribution considerations and regulatory compliance requirements.

Urban concentrations around London, Birmingham, Manchester, and Glasgow drive consumer automotive lubricant demand while industrial regions support specialized applications and bulk distribution networks.

Market competition features a diverse mix of global oil companies, specialty manufacturers, and regional distributors serving various customer segments. Leading participants maintain competitive advantages through brand recognition, distribution networks, and technical capabilities.

Competitive strategies emphasize product differentiation, technical support, and service integration to create customer loyalty and defend market positions. Innovation investment focuses on synthetic formulations, bio-based alternatives, and application-specific solutions.

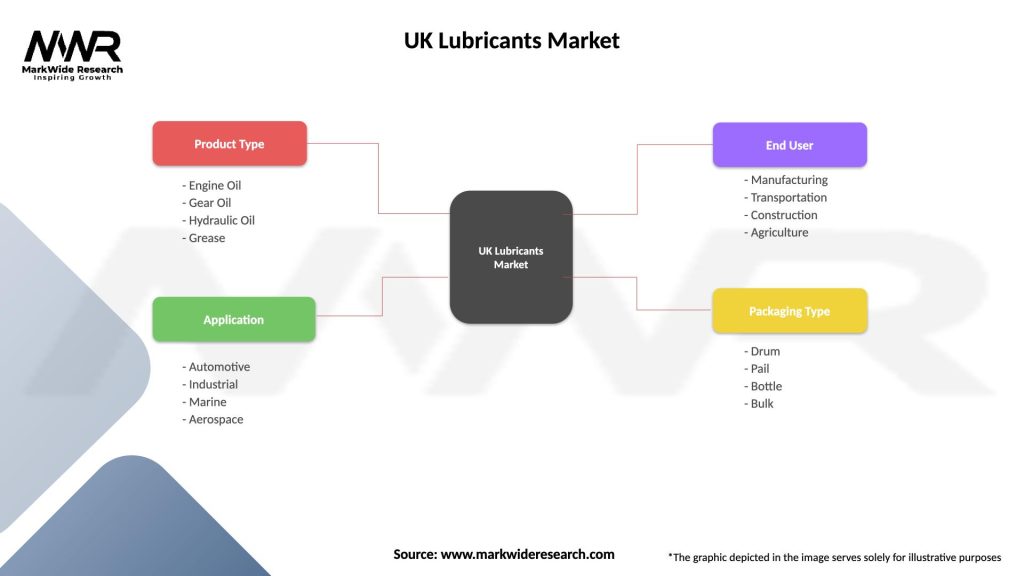

Market segmentation analysis reveals distinct characteristics and growth patterns across product categories, applications, and customer segments. Product-based segmentation encompasses engine oils, industrial lubricants, hydraulic fluids, gear oils, and specialty formulations.

By Product Type:

By Application:

Automotive lubricants represent the largest market category, driven by vehicle maintenance requirements and regulatory compliance needs. Engine oils dominate this segment with growing demand for low-viscosity formulations that improve fuel economy while meeting emission standards.

Industrial lubricants demonstrate steady growth supported by manufacturing activity and equipment modernization. Hydraulic fluids show particular strength due to automation trends and precision machinery requirements. Metalworking fluids benefit from advanced manufacturing processes and quality requirements.

Specialty lubricants command premium pricing through technical differentiation and application-specific performance benefits. Food-grade lubricants experience growth driven by food processing industry expansion and regulatory compliance requirements.

Marine lubricants face challenges from shipping industry consolidation but benefit from environmental regulations requiring advanced formulations. Aviation lubricants maintain steady demand despite industry volatility, supported by safety requirements and performance specifications.

Synthetic lubricants gain market share across categories due to superior performance characteristics and total cost benefits, growing at approximately 6% annually across all applications.

Market participants across the UK lubricants value chain realize various benefits through strategic positioning and operational excellence. Manufacturers benefit from stable demand patterns, premium pricing opportunities for advanced products, and service revenue potential through integrated offerings.

Distributors gain value through market access, inventory management efficiency, and customer relationship development. Technical expertise and application support capabilities create competitive advantages and customer loyalty. Digital platforms enable improved customer service and operational efficiency.

End-users benefit from improved equipment reliability, reduced maintenance costs, and enhanced operational efficiency through proper lubricant selection and management. Total cost ownership improvements justify premium product investments and comprehensive service agreements.

Environmental stakeholders benefit from industry sustainability initiatives including recycling programs, bio-based product development, and emission reduction technologies. Regulatory compliance support helps customers meet environmental requirements while maintaining operational performance.

Economic benefits include job creation, export opportunities, and technology development that supports UK competitiveness in global markets. Innovation ecosystems foster collaboration between industry, academia, and government stakeholders.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the UK lubricants market reflect technological advancement, environmental consciousness, and changing customer expectations. Synthetic lubricant adoption accelerates across applications, driven by performance benefits and total cost advantages.

Sustainability initiatives gain momentum through bio-based product development, circular economy principles, and carbon footprint reduction programs. Digital transformation enables predictive maintenance, condition monitoring, and data-driven lubrication management solutions.

Service integration trends toward comprehensive lubrication programs that combine products, technical support, and maintenance services. Customization demand increases for application-specific formulations that address unique operating conditions and performance requirements.

Regulatory evolution drives innovation in low-emission formulations and environmentally acceptable lubricants. Supply chain optimization focuses on resilience, sustainability, and cost efficiency through strategic partnerships and technology adoption.

Customer engagement shifts toward digital channels and self-service platforms while maintaining technical support capabilities. Performance monitoring integration enables real-time lubricant condition assessment and optimized maintenance scheduling.

Recent developments within the UK lubricants market demonstrate industry adaptation to changing conditions and emerging opportunities. Product launches focus on advanced synthetic formulations, bio-based alternatives, and application-specific solutions that address evolving customer needs.

Strategic partnerships between lubricant manufacturers and equipment producers enable co-development of optimized lubrication solutions and market access. Acquisition activity consolidates market positions and expands technical capabilities across various segments.

Investment programs target manufacturing capacity expansion, research and development enhancement, and digital platform development. Sustainability initiatives include recycling facility development, bio-based feedstock sourcing, and carbon reduction commitments.

Regulatory compliance preparations address upcoming environmental standards and performance requirements. Technology integration projects focus on condition monitoring systems, predictive analytics, and customer engagement platforms.

Market expansion efforts target emerging applications in renewable energy, electric vehicle components, and advanced manufacturing processes. According to MarkWide Research, these developments position the market for sustained growth despite traditional sector challenges.

Strategic recommendations for UK lubricants market participants emphasize adaptation to changing conditions while leveraging core strengths. Product portfolio optimization should prioritize high-performance synthetic formulations and sustainable alternatives that command premium pricing.

Service integration represents a critical differentiation strategy, with comprehensive lubrication management programs creating customer loyalty and recurring revenue streams. Digital transformation investments should focus on customer engagement platforms and predictive maintenance capabilities.

Sustainability positioning requires proactive development of bio-based products, recycling programs, and carbon reduction initiatives that align with customer environmental objectives. Innovation investment should target emerging applications and next-generation formulations.

Partnership strategies with equipment manufacturers, technology providers, and distribution partners can expand market access and technical capabilities. Geographic expansion opportunities exist in specialty applications and export markets.

Operational excellence through supply chain optimization, manufacturing efficiency, and quality management supports competitive positioning. Talent development in technical sales and application engineering capabilities enhances customer value delivery.

Market projections indicate continued evolution of the UK lubricants sector toward higher-performance, environmentally conscious solutions. Growth expectations remain positive despite challenges from electric vehicle adoption and economic uncertainties, with specialty applications and services driving expansion.

Technology advancement will accelerate development of smart lubricants, bio-based formulations, and application-specific solutions that deliver superior performance and environmental benefits. Digital integration will transform customer relationships through predictive maintenance and data-driven optimization.

Sustainability requirements will intensify, driving demand for recycled content, bio-based feedstocks, and circular economy solutions. Regulatory evolution will continue shaping product development and market opportunities while creating compliance challenges.

Market consolidation may accelerate as companies seek scale advantages and technical capabilities to compete effectively. Service differentiation will become increasingly important for maintaining customer relationships and premium positioning.

MWR analysis suggests the market will demonstrate resilience through adaptation and innovation, with successful participants leveraging sustainability trends and digital transformation to create competitive advantages and sustainable growth.

The UK lubricants market presents a complex landscape of opportunities and challenges shaped by technological advancement, environmental consciousness, and evolving customer expectations. Market fundamentals remain strong despite transformation pressures, with steady demand from core applications supporting continued growth and investment.

Strategic success requires adaptation to changing conditions while leveraging established strengths in product quality, technical expertise, and customer relationships. Innovation focus on synthetic formulations, bio-based alternatives, and digital integration creates differentiation opportunities and premium positioning potential.

Sustainability imperatives drive market evolution toward environmentally responsible solutions that deliver performance benefits while addressing regulatory requirements and customer environmental objectives. Service integration emerges as a critical success factor for maintaining customer loyalty and creating recurring revenue streams.

Future prospects indicate continued market evolution with successful participants demonstrating agility in product development, customer engagement, and operational excellence. The UK lubricants market will continue serving as an essential component of the country’s industrial infrastructure while adapting to emerging trends and requirements that shape its long-term trajectory.

What is Lubricants?

Lubricants are substances used to reduce friction between surfaces in mutual contact, which ultimately reduces the heat generated when the surfaces move. They are essential in various applications, including automotive, industrial machinery, and consumer products.

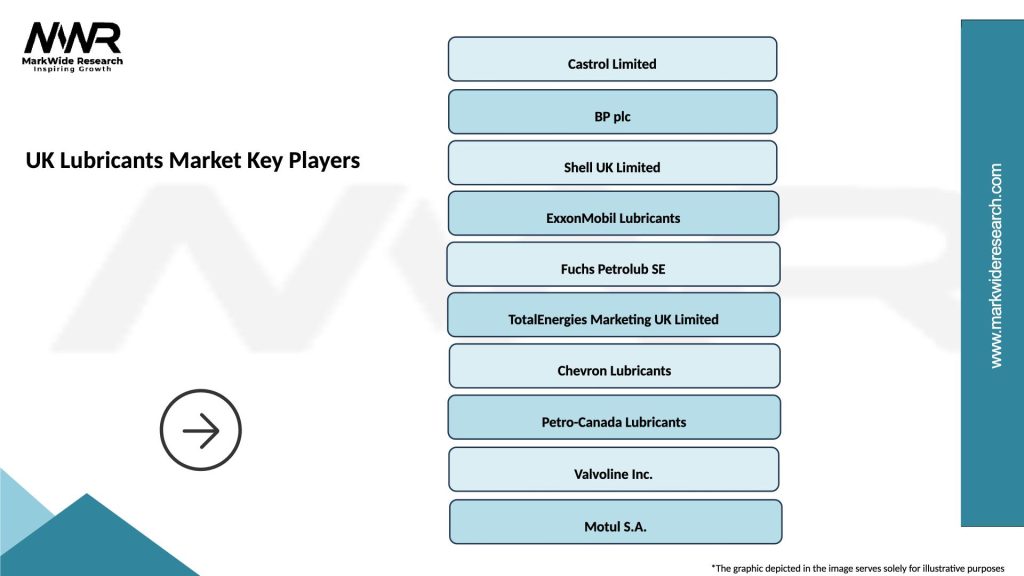

What are the key players in the UK Lubricants Market?

Key players in the UK Lubricants Market include companies like Castrol, Mobil, and Fuchs Petrolub, which offer a range of products for automotive and industrial applications, among others.

What are the growth factors driving the UK Lubricants Market?

The UK Lubricants Market is driven by factors such as the increasing demand for high-performance lubricants in automotive applications, the growth of the manufacturing sector, and advancements in lubricant formulations that enhance efficiency.

What challenges does the UK Lubricants Market face?

Challenges in the UK Lubricants Market include stringent environmental regulations, the rising cost of raw materials, and competition from alternative products such as bio-lubricants.

What opportunities exist in the UK Lubricants Market?

Opportunities in the UK Lubricants Market include the growing trend towards sustainability, which is driving demand for eco-friendly lubricants, and the expansion of electric vehicles that require specialized lubricants.

What trends are shaping the UK Lubricants Market?

Trends in the UK Lubricants Market include the increasing adoption of synthetic lubricants, innovations in lubricant technology for improved performance, and a shift towards more sustainable and biodegradable options.

UK Lubricants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Gear Oil, Hydraulic Oil, Grease |

| Application | Automotive, Industrial, Marine, Aerospace |

| End User | Manufacturing, Transportation, Construction, Agriculture |

| Packaging Type | Drum, Pail, Bottle, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Lubricants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at