444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK kitchen furniture market represents a dynamic and evolving sector within the broader home improvement and interior design industry. This market encompasses a comprehensive range of products including kitchen cabinets, countertops, kitchen islands, storage solutions, and integrated appliance housing units. Market dynamics indicate robust growth driven by increasing consumer spending on home renovations, rising property values, and evolving lifestyle preferences toward modern kitchen designs.

Consumer preferences in the UK have shifted significantly toward premium kitchen furniture solutions, with homeowners increasingly viewing kitchens as central living spaces rather than purely functional areas. The market demonstrates strong growth momentum with a projected CAGR of 6.2% over the forecast period, reflecting sustained demand across both residential and commercial segments.

Key market characteristics include the dominance of fitted kitchen solutions, growing adoption of smart storage systems, and increasing preference for sustainable materials. The market benefits from a mature retail infrastructure, established supply chains, and strong consumer awareness of kitchen furniture brands and quality standards.

The UK kitchen furniture market refers to the comprehensive industry encompassing the design, manufacturing, distribution, and retail of furniture specifically designed for kitchen spaces within the United Kingdom. This market includes both standalone furniture pieces and integrated kitchen systems that combine storage, workspace, and aesthetic elements to create functional cooking and dining environments.

Market scope extends beyond basic cabinetry to include specialized storage solutions, kitchen islands, breakfast bars, pantry systems, and custom-built furniture designed to maximize space utilization and enhance kitchen functionality. The market serves diverse customer segments ranging from budget-conscious consumers seeking affordable solutions to luxury homeowners demanding premium, bespoke kitchen furniture systems.

Industry definition encompasses both the replacement market, where existing kitchens are renovated or upgraded, and the new construction market, where kitchen furniture is installed in newly built properties. This dual market structure provides stability and growth opportunities across different economic cycles and housing market conditions.

Market performance in the UK kitchen furniture sector demonstrates resilient growth despite economic uncertainties, driven by fundamental shifts in consumer behavior and housing market dynamics. The market benefits from strong underlying demand as homeowners increasingly prioritize kitchen renovations as a key home improvement investment with high return potential.

Growth drivers include rising disposable incomes, increased home ownership rates, and growing awareness of kitchen design trends influenced by social media and home improvement television programs. Approximately 78% of UK homeowners consider kitchen renovation a priority home improvement project, indicating sustained market demand.

Competitive landscape features a mix of established UK manufacturers, international brands, and specialized kitchen furniture retailers. The market demonstrates healthy competition across different price segments, with premium brands capturing approximately 35% market share while mid-range solutions dominate volume sales.

Future prospects remain positive with continued urbanization, changing lifestyle preferences, and increasing focus on home-based activities driving sustained demand for innovative kitchen furniture solutions. The market is expected to benefit from technological integration and sustainability trends shaping consumer purchasing decisions.

Market insights reveal several critical trends shaping the UK kitchen furniture landscape:

Consumer behavior analysis indicates that UK homeowners are willing to invest significantly in kitchen furniture, with 68% of consumers prioritizing quality and durability over initial cost considerations. This trend supports premium market segments and encourages innovation in materials and construction techniques.

Primary market drivers propelling growth in the UK kitchen furniture market include several interconnected factors that create sustained demand across different consumer segments.

Housing market dynamics play a crucial role, with increasing property values encouraging homeowners to invest in kitchen renovations as a means of adding property value. The UK housing market’s resilience supports continued investment in home improvements, with kitchen renovations typically providing strong return on investment.

Lifestyle evolution represents another significant driver, as UK consumers increasingly view kitchens as central family gathering spaces rather than purely functional areas. This shift drives demand for furniture solutions that support social interaction, entertainment, and multi-purpose usage patterns.

Demographic trends including urbanization and changing household compositions create demand for space-efficient kitchen furniture solutions. Younger consumers, in particular, prioritize modern design aesthetics and smart storage solutions that maximize functionality in smaller living spaces.

Economic factors such as rising disposable incomes, low interest rates, and government incentives for home improvements support market growth. Additionally, the growth of the home improvement retail sector and increased availability of financing options make kitchen furniture more accessible to broader consumer segments.

Market challenges facing the UK kitchen furniture industry include several factors that may limit growth potential or create operational difficulties for market participants.

Economic uncertainty related to Brexit implications, inflation pressures, and potential recession concerns may impact consumer spending on discretionary home improvement projects. Economic volatility can lead to delayed purchase decisions and reduced market demand during uncertain periods.

Supply chain disruptions continue to affect the industry, with material shortages, transportation delays, and increased logistics costs impacting product availability and pricing. These challenges particularly affect manufacturers relying on imported materials or components.

Skilled labor shortages in installation and manufacturing sectors create capacity constraints and may limit market growth. The shortage of qualified kitchen fitters and cabinet makers can lead to extended lead times and increased service costs.

Regulatory compliance requirements related to safety standards, environmental regulations, and building codes add complexity and costs to product development and manufacturing processes. Compliance with evolving sustainability requirements may require significant investment in new materials and production methods.

Emerging opportunities in the UK kitchen furniture market present significant potential for growth and innovation across multiple dimensions.

Sustainability focus creates opportunities for manufacturers developing eco-friendly kitchen furniture solutions using recycled materials, sustainable wood sources, and low-emission manufacturing processes. Consumer awareness of environmental issues drives demand for sustainable furniture options.

Technology integration offers substantial growth potential through smart kitchen furniture incorporating IoT connectivity, automated storage systems, and integrated charging solutions. The growing smart home market creates demand for technology-enabled furniture solutions.

Customization services represent a significant opportunity as consumers increasingly seek personalized kitchen solutions tailored to specific space requirements and design preferences. Advanced manufacturing technologies enable cost-effective customization at scale.

Online retail expansion provides opportunities to reach broader customer bases and offer enhanced shopping experiences through virtual design tools, augmented reality applications, and comprehensive online product catalogs. Digital transformation can improve customer engagement and streamline the purchase process.

Commercial market growth in restaurants, hotels, and office spaces creates additional demand for specialized kitchen furniture solutions designed for commercial applications and high-usage environments.

Market dynamics in the UK kitchen furniture sector reflect complex interactions between supply and demand factors, competitive pressures, and evolving consumer preferences that shape industry development.

Demand patterns show seasonal variations with peak activity during spring and summer months when homeowners typically undertake renovation projects. However, the market demonstrates overall stability with consistent underlying demand driven by replacement cycles and new construction activity.

Competitive intensity varies across different market segments, with premium segments showing less price competition and greater focus on design innovation and quality differentiation. Mid-market segments experience more intense price competition, driving efficiency improvements and value engineering initiatives.

Innovation cycles in the industry are accelerating, with manufacturers introducing new materials, finishes, and functional features to differentiate their offerings. Product development cycles have shortened as companies respond more quickly to changing consumer preferences and design trends.

Supply chain evolution includes increasing localization of production to reduce transportation costs and improve delivery times. Some manufacturers are investing in UK-based production facilities to serve the domestic market more effectively while reducing supply chain risks.

Research approach for analyzing the UK kitchen furniture market employs comprehensive methodologies combining primary and secondary research techniques to ensure accurate and reliable market insights.

Primary research includes structured interviews with industry executives, kitchen furniture manufacturers, retailers, and distributors to gather firsthand insights into market trends, challenges, and opportunities. Consumer surveys provide valuable data on purchasing behavior, preferences, and satisfaction levels across different market segments.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements to establish market size, growth trends, and competitive positioning. This research includes examination of import/export data, construction industry statistics, and home improvement spending patterns.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert consultation, and statistical analysis techniques. Market sizing methodologies employ both top-down and bottom-up approaches to validate findings and ensure consistency across different data sources.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and market segmentation analysis to provide comprehensive understanding of industry structure, competitive dynamics, and growth opportunities within the UK kitchen furniture market.

Regional distribution across the UK kitchen furniture market shows distinct patterns reflecting economic conditions, housing market dynamics, and demographic characteristics in different geographic areas.

London and Southeast England represent the largest market segment, accounting for approximately 42% of total market demand. This region benefits from higher disposable incomes, premium housing stock, and strong renovation activity driven by property value appreciation. The market in this region shows preference for high-end, custom kitchen furniture solutions.

Northern England including Manchester, Liverpool, and Leeds metropolitan areas contributes approximately 23% of market volume. This region demonstrates strong demand for mid-range kitchen furniture solutions with good value propositions. Industrial heritage and urban regeneration projects drive renovation activity in these markets.

Scotland represents a distinct market segment with approximately 12% market share, characterized by preference for traditional design elements combined with modern functionality. The Scottish market shows strong loyalty to local manufacturers and suppliers while embracing contemporary kitchen furniture trends.

Wales and Southwest England account for approximately 15% of market demand, with rural areas showing preference for country-style kitchen furniture while urban centers demonstrate more contemporary design preferences. This region benefits from tourism-related commercial kitchen furniture demand.

Regional preferences vary significantly, with urban areas favoring modern, space-efficient designs while rural regions show continued demand for traditional styles and natural materials. Regional economic conditions influence price sensitivity and purchase timing across different geographic markets.

Competitive structure in the UK kitchen furniture market features a diverse mix of participants ranging from large multinational corporations to specialized local manufacturers and custom furniture makers.

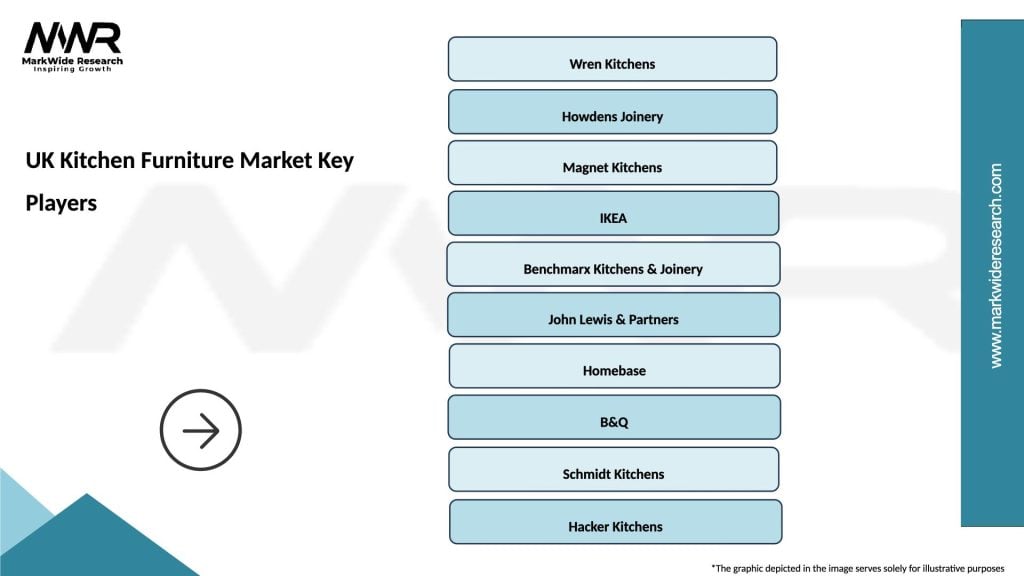

Major market players include:

Competitive strategies vary significantly across market participants, with some focusing on vertical integration and manufacturing efficiency while others emphasize retail experience, design services, and customer support. Premium brands differentiate through exclusive designs, superior materials, and comprehensive installation services.

Market consolidation trends show increasing concentration among larger players while niche manufacturers maintain positions through specialization and superior customer service. MarkWide Research analysis indicates that the top five companies control approximately 58% of total market share.

Market segmentation in the UK kitchen furniture industry reveals distinct categories based on product type, price range, distribution channel, and customer segment characteristics.

By Product Type:

By Price Segment:

By Distribution Channel:

Kitchen cabinets dominate the market, representing approximately 65% of total category volume. This segment shows strong demand for modular systems that offer flexibility and customization options. Consumer preferences favor soft-close mechanisms, integrated lighting, and innovative storage solutions within cabinet designs.

Kitchen islands represent the fastest-growing category with annual growth rates of 8.4%, driven by open-plan living trends and desire for additional workspace. This category benefits from multifunctional designs incorporating seating, storage, and appliance integration.

Countertop solutions show increasing preference for engineered materials over natural stone, with quartz surfaces gaining market share due to durability and maintenance advantages. This category demonstrates strong correlation with overall kitchen renovation cycles.

Storage solutions category experiences innovation-driven growth as manufacturers develop space-maximizing systems for smaller UK homes. Pull-out drawers, corner solutions, and vertical storage systems show particularly strong demand.

Smart kitchen furniture represents an emerging category with integration of technology features including USB charging ports, LED lighting systems, and IoT connectivity. While currently a small market segment, growth potential remains substantial as smart home adoption increases.

Manufacturers benefit from stable demand patterns, opportunities for product innovation, and potential for premium pricing through design differentiation and quality improvements. The market supports both large-scale production efficiency and specialized niche manufacturing strategies.

Retailers gain from high-margin product categories, opportunities for value-added services including design consultation and installation, and strong customer loyalty once relationships are established. Kitchen furniture purchases often lead to additional home improvement sales.

Consumers benefit from extensive product choice, competitive pricing across different segments, and improving quality standards driven by market competition. Enhanced design services and installation support improve overall purchase experience and satisfaction levels.

Property developers utilize kitchen furniture as a key differentiator in new construction projects, with quality kitchen installations significantly impacting property values and sales velocity. Bulk purchasing arrangements provide cost advantages and specification control.

Installation professionals benefit from steady work demand, opportunities for specialization in premium installations, and potential for long-term customer relationships through quality service delivery. The market supports both independent contractors and larger installation companies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend with manufacturers increasingly adopting eco-friendly materials, sustainable production processes, and circular economy principles. Consumer awareness of environmental impact drives demand for responsibly sourced wood, recycled materials, and low-emission finishes.

Customization demand continues growing as consumers seek kitchen furniture solutions tailored to specific space requirements and personal preferences. Advanced manufacturing technologies enable cost-effective customization while maintaining production efficiency.

Color and finish evolution shows movement toward natural tones, matte finishes, and textured surfaces that complement contemporary interior design trends. Traditional white kitchens remain popular while darker tones and natural wood finishes gain market share.

Space optimization becomes increasingly important as UK housing sizes remain constrained. Innovative storage solutions, multi-functional furniture, and vertical space utilization drive product development across all market segments.

Digital integration transforms both product features and shopping experiences, with virtual reality showrooms, online design tools, and smart furniture features becoming standard market expectations. MWR data indicates that 73% of consumers now research kitchen furniture online before making purchase decisions.

Manufacturing innovation includes adoption of advanced production technologies such as CNC machining, automated assembly systems, and digital printing for custom finishes. These developments improve production efficiency while enabling greater design flexibility and customization options.

Retail transformation encompasses expansion of experiential showrooms, integration of virtual reality design tools, and development of comprehensive online platforms. Major retailers invest in omnichannel strategies that combine physical and digital customer experiences.

Supply chain optimization focuses on reducing lead times, improving inventory management, and developing more resilient supplier networks. Some companies establish UK-based production facilities to reduce dependence on international supply chains.

Sustainability initiatives include development of recycling programs, adoption of renewable energy in manufacturing, and certification through recognized environmental standards. Industry collaboration on sustainability standards helps establish consumer confidence in eco-friendly products.

Partnership developments between manufacturers, retailers, and technology companies create integrated solutions that combine furniture, appliances, and smart home systems. These partnerships enable comprehensive kitchen solutions that address evolving consumer needs.

Strategic recommendations for market participants focus on positioning for long-term growth while addressing current market challenges and opportunities.

Innovation investment should prioritize sustainable materials, smart technology integration, and space-efficient designs that address core consumer needs. Companies should balance innovation costs with market acceptance and pricing considerations.

Digital transformation requires comprehensive approach including e-commerce capabilities, virtual design tools, and customer relationship management systems. Investment in digital infrastructure becomes essential for competitive positioning.

Supply chain resilience development should include diversification of supplier base, strategic inventory management, and consideration of nearshoring production capabilities. Risk management strategies should address potential disruptions from various sources.

Customer experience enhancement through improved design services, installation quality, and after-sales support can differentiate companies in competitive markets. Investment in staff training and service capabilities provides sustainable competitive advantages.

Market expansion opportunities include commercial segments, export markets, and adjacent product categories that leverage existing capabilities and customer relationships. Expansion strategies should align with core competencies and market positioning.

Market prospects for the UK kitchen furniture industry remain positive despite economic uncertainties, supported by fundamental demographic trends, housing market dynamics, and evolving consumer preferences that drive sustained demand.

Growth projections indicate continued market expansion with expected CAGR of 5.8% over the next five years, driven by replacement demand, new construction activity, and increasing consumer investment in home improvement projects. Premium segments are expected to outperform overall market growth rates.

Technology adoption will accelerate with smart kitchen furniture becoming mainstream rather than niche products. Integration with home automation systems, IoT connectivity, and advanced materials will reshape product offerings and consumer expectations.

Sustainability requirements will become more stringent, driving innovation in materials, manufacturing processes, and product lifecycle management. Companies that proactively address environmental concerns will gain competitive advantages in increasingly conscious consumer markets.

Market structure evolution may include further consolidation among larger players while creating opportunities for specialized manufacturers focusing on niche segments or innovative solutions. MarkWide Research analysis suggests that successful companies will combine operational efficiency with design innovation and customer service excellence.

The UK kitchen furniture market demonstrates resilient growth characteristics supported by strong underlying demand drivers, evolving consumer preferences, and continued innovation across product categories and service offerings. Market participants benefit from a mature industry infrastructure while facing opportunities for differentiation through sustainability, technology integration, and enhanced customer experiences.

Strategic success factors include balancing operational efficiency with design innovation, developing comprehensive digital capabilities, and maintaining focus on customer satisfaction through quality products and services. Companies that effectively address sustainability requirements while embracing technological advancement will be best positioned for long-term growth.

Market outlook remains positive with sustained demand expected across all segments, driven by demographic trends, housing market dynamics, and increasing consumer investment in home improvement. The industry’s ability to adapt to changing consumer needs while maintaining quality standards and competitive pricing will determine future success in this dynamic and evolving market.

What is Kitchen Furniture?

Kitchen furniture refers to the various types of furniture designed specifically for kitchen use, including cabinets, countertops, islands, and storage solutions. These items are essential for both functionality and aesthetics in modern kitchens.

What are the key players in the UK Kitchen Furniture Market?

Key players in the UK Kitchen Furniture Market include companies like Howdens Joinery, Magnet, and Wren Kitchens. These companies are known for their innovative designs and extensive product ranges, catering to diverse consumer needs.

What are the growth factors driving the UK Kitchen Furniture Market?

The growth of the UK Kitchen Furniture Market is driven by factors such as increasing home renovation activities, rising disposable incomes, and a growing trend towards open-plan living spaces. Additionally, the demand for customized kitchen solutions is on the rise.

What challenges does the UK Kitchen Furniture Market face?

The UK Kitchen Furniture Market faces challenges such as fluctuating raw material prices and supply chain disruptions. Additionally, competition from low-cost imports can impact local manufacturers.

What opportunities exist in the UK Kitchen Furniture Market?

Opportunities in the UK Kitchen Furniture Market include the growing interest in sustainable materials and eco-friendly designs. There is also potential for innovation in smart kitchen technologies that enhance functionality and user experience.

What trends are shaping the UK Kitchen Furniture Market?

Trends in the UK Kitchen Furniture Market include a shift towards minimalist designs, the use of bold colors, and the integration of technology in kitchen furniture. Additionally, there is an increasing focus on multifunctional furniture that maximizes space efficiency.

UK Kitchen Furniture Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cabinets, Countertops, Tables, Chairs |

| Material | Wood, Metal, Glass, Laminate |

| Style | Modern, Traditional, Rustic, Contemporary |

| End User | Homeowners, Contractors, Designers, Retailers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Kitchen Furniture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at