444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The UK Insurtech market has been experiencing significant growth and innovation in recent years. Insurtech, a combination of insurance and technology, refers to the application of advanced digital solutions to enhance the insurance industry’s efficiency, customer experience, and product offerings. It encompasses various technologies such as artificial intelligence, big data analytics, blockchain, and Internet of Things (IoT), among others. The UK, being one of the leading financial centers globally, has become a hub for insurtech startups and initiatives.

Meaning

Insurtech is revolutionizing the traditional insurance landscape by leveraging technology to streamline processes, reduce costs, and provide personalized services to policyholders. It encompasses a wide range of applications, including digital underwriting, automated claims processing, usage-based insurance, peer-to-peer insurance, and innovative distribution channels. By integrating technology into insurance operations, insurtech companies aim to create a more customer-centric, efficient, and transparent insurance ecosystem.

Executive Summary

The UK Insurtech market is witnessing rapid growth, driven by factors such as increasing customer expectations, digital transformation in the insurance sector, and regulatory support for innovation. Insurtech startups are disrupting traditional insurance models and collaborating with established insurers to drive innovation across the value chain. The market offers significant opportunities for stakeholders to tap into the potential of emerging technologies and transform the insurance industry.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UK Insurtech market is characterized by intense competition and a rapidly evolving technological landscape. Insurtech startups are disrupting traditional insurance models and challenging established players by offering innovative products, services, and business models. Traditional insurers are responding by investing in digital transformation initiatives, partnering with insurtech startups, or establishing their own innovation labs. Customer expectations are changing, and insurers need to adapt by providing seamless digital experiences, personalized offerings, and on-demand services.

Regional Analysis

The UK is a leading market for insurtech in Europe, with London serving as a major hub for innovation and investment in the sector. The presence of a strong financial services ecosystem, supportive regulatory environment, and access to talent has contributed to the growth of the UK Insurtech market. Other regions in the UK, such as Manchester, Birmingham, and Edinburgh, are also witnessing the emergence of insurtech startups and initiatives. The regional market dynamics are shaped by factors such as local regulations, customer preferences, and industry collaborations.

Competitive Landscape

Leading Companies in the UK Insurtech Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

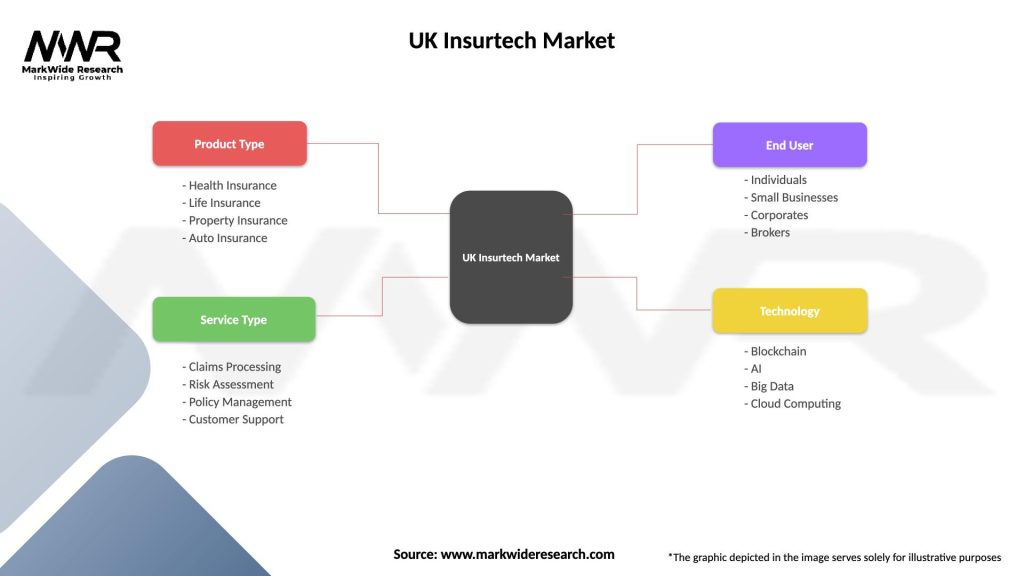

The UK Insurtech market can be segmented based on various parameters, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated digital transformation in the insurance industry and highlighted the importance of insurtech solutions. Insurers had to adapt quickly to remote working environments and digital channels to serve customers effectively during lockdowns. The pandemic has also increased awareness of emerging risks and the need for innovative insurance solutions. Insurtech companies have played a crucial role in developing products like pandemic insurance, contactless claims processing, and digital health platforms to address the evolving needs of customers during the crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

The UK Insurtech market is poised for continued growth and disruption in the coming years. Rapid advancements in technology, changing customer expectations, and regulatory support will shape the future of the market. Insurtech startups will continue to drive innovation, while traditional insurers will leverage technology to transform their operations and enhance customer experiences. Emerging technologies like AI, blockchain, and IoT will play a crucial role in enabling new business models, improving risk management, and creating more personalized insurance solutions. The market will also witness increased collaboration and partnerships between insurtech startups, insurers, and technology companies to unlock new growth opportunities.

Conclusion

The UK Insurtech market is undergoing a transformational phase, driven by digital innovation, changing consumer preferences, and regulatory initiatives. Insurtech startups are disrupting the insurance landscape by leveraging advanced technologies to deliver personalized, efficient, and transparent insurance solutions. Traditional insurers are embracing digital transformation and collaborating with insurtech startups to stay competitive. The future of the UK Insurtech market looks promising, with ample opportunities for industry participants and stakeholders to tap into the potential of emerging technologies and create a more customer-centric and efficient insurance ecosystem.

What is Insurtech?

Insurtech refers to the use of technology innovations designed to enhance and streamline the insurance industry. This includes applications in underwriting, claims processing, and customer service, among others.

What are the key players in the UK Insurtech Market?

Key players in the UK Insurtech Market include companies like Zego, Bought By Many, and Cuvva, which focus on providing innovative insurance solutions and improving customer experiences, among others.

What are the main drivers of growth in the UK Insurtech Market?

The main drivers of growth in the UK Insurtech Market include the increasing demand for personalized insurance products, advancements in data analytics, and the rise of digital platforms that enhance customer engagement.

What challenges does the UK Insurtech Market face?

Challenges in the UK Insurtech Market include regulatory compliance, data privacy concerns, and the need for traditional insurers to adapt to rapidly changing technology landscapes.

What opportunities exist in the UK Insurtech Market?

Opportunities in the UK Insurtech Market include the potential for partnerships between traditional insurers and tech startups, the expansion of usage-based insurance models, and the integration of artificial intelligence for better risk assessment.

What trends are shaping the UK Insurtech Market?

Trends shaping the UK Insurtech Market include the growing adoption of blockchain for secure transactions, the rise of on-demand insurance products, and the increasing focus on sustainability and ESG factors in insurance offerings.

UK Insurtech Market

| Segmentation Details | Description |

|---|---|

| Product Type | Health Insurance, Life Insurance, Property Insurance, Auto Insurance |

| Service Type | Claims Processing, Risk Assessment, Policy Management, Customer Support |

| End User | Individuals, Small Businesses, Corporates, Brokers |

| Technology | Blockchain, AI, Big Data, Cloud Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UK Insurtech Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at