444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK hospital supplies market represents a critical component of the nation’s healthcare infrastructure, encompassing a comprehensive range of medical devices, consumables, and equipment essential for patient care delivery. This dynamic market serves over 1,200 NHS hospitals and numerous private healthcare facilities across England, Scotland, Wales, and Northern Ireland, supporting a healthcare system that treats millions of patients annually.

Market dynamics indicate robust growth driven by an aging population, increasing prevalence of chronic diseases, and ongoing healthcare modernization initiatives. The market encompasses diverse product categories including surgical instruments, diagnostic equipment, patient monitoring systems, disposable medical supplies, and advanced therapeutic devices. Digital transformation and technological innovation continue to reshape supply chain management and procurement processes throughout the healthcare sector.

Healthcare expenditure in the UK continues to rise, with hospital supplies representing a significant portion of operational costs. The market benefits from strong government support for healthcare infrastructure development and the NHS’s commitment to improving patient outcomes through advanced medical technologies. Supply chain resilience has become increasingly important following recent global disruptions, driving investment in domestic manufacturing capabilities and strategic inventory management.

Growth projections suggest the market will expand at a compound annual growth rate of 6.2% over the forecast period, supported by increasing demand for minimally invasive procedures, point-of-care diagnostics, and smart medical devices. The integration of artificial intelligence and IoT technologies into hospital supplies is creating new opportunities for enhanced patient monitoring and operational efficiency.

The UK hospital supplies market refers to the comprehensive ecosystem of medical products, devices, equipment, and consumables procured and utilized by hospitals and healthcare facilities across the United Kingdom for patient diagnosis, treatment, monitoring, and care delivery. This market encompasses both disposable and durable medical supplies essential for maintaining healthcare operations and ensuring optimal patient outcomes.

Hospital supplies include a vast array of products ranging from basic consumables such as syringes, bandages, and surgical gloves to sophisticated medical equipment including MRI machines, ventilators, and robotic surgical systems. The market also covers specialized supplies for various medical departments including emergency care, intensive care units, operating theaters, laboratories, and outpatient clinics.

Procurement processes within this market involve complex supply chain networks connecting manufacturers, distributors, group purchasing organizations, and healthcare providers. The market operates under strict regulatory frameworks ensuring product safety, quality, and compliance with medical device regulations established by the MHRA and other relevant authorities.

Strategic analysis reveals the UK hospital supplies market is experiencing unprecedented transformation driven by technological advancement, demographic shifts, and evolving healthcare delivery models. The market demonstrates remarkable resilience and adaptability, with healthcare providers increasingly prioritizing supply chain optimization and cost-effective procurement strategies.

Key growth drivers include the rising prevalence of chronic diseases affecting approximately 15.4 million people in the UK, an aging population with 18.5% of citizens over 65, and increasing demand for advanced medical technologies. The COVID-19 pandemic has accelerated adoption of digital health solutions and highlighted the critical importance of supply chain resilience in healthcare delivery.

Market segmentation reveals strong performance across multiple categories, with surgical supplies, diagnostic equipment, and patient monitoring devices showing particularly robust growth. The integration of artificial intelligence, machine learning, and IoT technologies is creating new market opportunities while improving operational efficiency and patient outcomes.

Competitive landscape features a mix of global multinational corporations and specialized UK-based suppliers, with increasing emphasis on local manufacturing capabilities and sustainable supply chain practices. Strategic partnerships between healthcare providers and suppliers are becoming more prevalent, focusing on value-based procurement and long-term collaborative relationships.

Market intelligence indicates several critical trends shaping the UK hospital supplies landscape. The following insights provide comprehensive understanding of current market dynamics:

Innovation trends demonstrate significant investment in research and development, with particular emphasis on minimally invasive surgical instruments, advanced wound care products, and next-generation diagnostic technologies. The market is witnessing increased collaboration between technology companies and traditional medical device manufacturers to develop integrated healthcare solutions.

Demographic transformation serves as the primary catalyst for market expansion, with the UK’s aging population creating sustained demand for hospital supplies and medical equipment. The increasing prevalence of age-related conditions such as cardiovascular disease, diabetes, and orthopedic disorders drives consistent growth in specialized medical supplies and therapeutic devices.

Healthcare policy initiatives continue to support market growth through increased NHS funding, infrastructure modernization programs, and strategic investments in medical technology. The government’s commitment to healthcare innovation and digital transformation creates favorable conditions for advanced medical device adoption and supply chain optimization.

Technological advancement accelerates market development through the introduction of innovative medical devices, smart hospital solutions, and integrated healthcare systems. The convergence of artificial intelligence, machine learning, and medical device technology enables more precise diagnostics, personalized treatment approaches, and improved patient outcomes.

Quality improvement initiatives drive demand for advanced monitoring systems, infection control products, and patient safety technologies. Healthcare providers increasingly prioritize evidence-based procurement decisions that demonstrate measurable improvements in clinical outcomes and operational efficiency.

Chronic disease management requirements fuel sustained demand for specialized medical supplies, monitoring equipment, and therapeutic devices. The growing focus on preventive care and early intervention creates opportunities for point-of-care diagnostics and remote monitoring solutions.

Budget constraints within the NHS and private healthcare sector create ongoing challenges for hospital supplies procurement, with healthcare providers facing pressure to optimize costs while maintaining quality standards. Limited capital budgets often delay equipment upgrades and technology adoption, impacting market growth potential.

Regulatory complexity presents significant barriers to market entry and product development, with stringent medical device regulations requiring extensive testing, documentation, and compliance procedures. The post-Brexit regulatory landscape adds additional complexity for international suppliers and domestic manufacturers.

Supply chain vulnerabilities exposed during recent global disruptions highlight ongoing challenges in maintaining consistent product availability and managing inventory levels. Dependency on international suppliers for critical medical supplies creates potential risks for healthcare service continuity.

Skills shortages in healthcare technology and supply chain management limit the effective implementation of advanced medical devices and inventory management systems. The need for specialized training and technical support creates additional costs and implementation challenges.

Procurement inefficiencies within healthcare organizations can limit market growth through fragmented purchasing decisions, lengthy approval processes, and resistance to innovative solutions. Traditional procurement practices may not adequately evaluate total cost of ownership or long-term value propositions.

Digital health transformation presents substantial opportunities for innovative hospital supplies that integrate with electronic health records, telemedicine platforms, and remote monitoring systems. The growing acceptance of digital health solutions creates demand for connected medical devices and smart hospital infrastructure.

Preventive healthcare focus opens new market segments for diagnostic equipment, screening devices, and early intervention technologies. Healthcare providers increasingly recognize the cost-effectiveness of preventive care approaches, driving demand for point-of-care testing and population health management tools.

Personalized medicine advancement creates opportunities for companion diagnostics, precision therapy devices, and individualized treatment solutions. The integration of genomics, biomarkers, and targeted therapies requires specialized medical supplies and diagnostic equipment.

Sustainability initiatives drive demand for environmentally friendly medical supplies, reusable devices, and circular economy solutions. Healthcare providers increasingly prioritize suppliers that demonstrate environmental responsibility and sustainable manufacturing practices.

Home healthcare expansion creates new market opportunities for portable medical devices, remote monitoring equipment, and patient self-management tools. The shift toward community-based care models requires hospital-grade supplies adapted for home use environments.

International expansion opportunities exist for UK-based suppliers to leverage expertise in NHS procurement and healthcare delivery models for global market penetration. The UK’s reputation for healthcare innovation creates competitive advantages in international markets.

Supply and demand equilibrium in the UK hospital supplies market reflects complex interactions between healthcare provider needs, regulatory requirements, and supplier capabilities. Market dynamics are influenced by seasonal variations in healthcare demand, emergency preparedness requirements, and long-term demographic trends affecting patient populations.

Competitive pressures drive continuous innovation and cost optimization throughout the supply chain, with suppliers investing heavily in research and development to differentiate their offerings. The market demonstrates increasing consolidation among suppliers while healthcare providers seek to rationalize their vendor relationships and achieve economies of scale.

Technology adoption cycles significantly impact market dynamics, with early adopters driving initial demand for innovative solutions while mainstream adoption follows demonstrated clinical benefits and cost-effectiveness. The integration of artificial intelligence and machine learning capabilities is accelerating technology refresh cycles across multiple product categories.

Regulatory evolution continues to shape market dynamics through updated safety standards, post-market surveillance requirements, and emerging guidelines for digital health technologies. Suppliers must navigate complex regulatory pathways while healthcare providers evaluate compliance implications of new medical devices and supplies.

Economic factors including inflation, currency fluctuations, and healthcare funding levels directly influence purchasing decisions and market growth trajectories. Healthcare providers increasingly focus on total cost of ownership evaluations and value-based procurement strategies to optimize budget utilization.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the UK hospital supplies market. Primary research involved extensive interviews with healthcare procurement professionals, clinical staff, and supply chain managers across NHS trusts and private healthcare facilities throughout the United Kingdom.

Secondary research incorporated analysis of government healthcare statistics, NHS procurement data, medical device registration databases, and industry trade publications. Financial reports from publicly traded medical device companies provided insights into market trends, competitive positioning, and growth strategies within the UK market.

Data validation processes included cross-referencing multiple sources, statistical analysis of market trends, and expert review panels comprising healthcare industry professionals and academic researchers. Quantitative analysis focused on market segmentation, growth rates, and competitive market share assessments.

Market modeling utilized advanced analytical techniques to project future market trends, identify growth opportunities, and assess potential market disruptions. Scenario analysis considered various factors including demographic changes, healthcare policy evolution, and technological advancement trajectories.

Quality assurance measures ensured research accuracy through peer review processes, data verification protocols, and continuous monitoring of market developments. Regular updates to research findings reflect dynamic market conditions and emerging trends affecting the hospital supplies sector.

England dominates the UK hospital supplies market, accounting for approximately 84% of total market share due to its larger population base and extensive healthcare infrastructure. The region benefits from major teaching hospitals, specialized medical centers, and significant private healthcare presence, driving demand for advanced medical supplies and equipment.

Scotland represents approximately 8.5% of market share, with strong government support for healthcare innovation and digital health initiatives. The region demonstrates particular strength in medical device manufacturing and research and development activities, supported by universities and technology clusters in Edinburgh and Glasgow.

Wales accounts for roughly 4.8% of market share, with healthcare supply needs concentrated around major population centers in Cardiff, Swansea, and Newport. The region shows growing interest in telemedicine solutions and remote patient monitoring to serve rural communities effectively.

Northern Ireland comprises approximately 2.7% of market share, with healthcare supply chains closely integrated with the broader UK market while maintaining some distinct procurement practices. The region benefits from cross-border healthcare cooperation and shared procurement initiatives with the Republic of Ireland.

Regional variations in healthcare delivery models, population demographics, and disease prevalence create distinct market opportunities and challenges. Urban areas typically demonstrate higher adoption rates for advanced medical technologies, while rural regions prioritize portable and telemedicine-compatible solutions.

London and Southeast England serve as major hubs for medical device innovation, clinical research, and healthcare technology development. The concentration of leading hospitals, research institutions, and technology companies creates a dynamic ecosystem for hospital supplies innovation and market development.

Market leadership is distributed among several key categories of suppliers, each bringing distinct strengths and market positioning strategies. The competitive landscape reflects a balance between global multinational corporations and specialized regional suppliers serving specific market niches.

Competitive strategies increasingly emphasize value-based partnerships, integrated solution offerings, and long-term collaborative relationships with healthcare providers. Companies are investing heavily in digital transformation, artificial intelligence capabilities, and sustainable manufacturing practices to differentiate their market positioning.

Market consolidation continues through strategic acquisitions, mergers, and partnership agreements aimed at expanding product portfolios and geographic reach. Smaller specialized suppliers often focus on niche markets or innovative technologies that complement larger companies’ offerings.

Product category segmentation reveals diverse market dynamics across different types of hospital supplies, each with distinct growth patterns, competitive landscapes, and customer requirements. The market demonstrates strong performance across multiple segments with varying degrees of technological sophistication and regulatory complexity.

By Product Type:

By End User:

By Technology Level:

Surgical supplies represent the largest market segment, driven by increasing surgical volumes and growing adoption of minimally invasive procedures. The segment benefits from technological advancement in robotic surgery, advanced imaging guidance, and specialized surgical instruments designed for specific procedures.

Diagnostic equipment shows robust growth supported by increasing demand for early disease detection, personalized medicine approaches, and point-of-care testing capabilities. The integration of artificial intelligence and machine learning in diagnostic devices is creating new market opportunities and improving diagnostic accuracy.

Patient monitoring systems experience strong demand driven by aging population demographics and increasing prevalence of chronic diseases requiring continuous monitoring. The shift toward remote patient monitoring and telemedicine integration is expanding market opportunities beyond traditional hospital settings.

Consumable supplies maintain steady growth through consistent healthcare service delivery requirements and increasing focus on infection prevention and control. The COVID-19 pandemic highlighted the critical importance of adequate consumable supply inventory management and supply chain resilience.

Therapeutic equipment demonstrates growth potential through advancing treatment modalities, personalized therapy approaches, and home healthcare expansion. The development of portable and user-friendly therapeutic devices enables treatment delivery in various healthcare settings.

Digital health integration across all categories creates opportunities for connected medical devices, data analytics capabilities, and integrated healthcare information systems. The convergence of traditional medical supplies with digital technologies is reshaping product development and market positioning strategies.

Healthcare providers benefit from improved patient outcomes through access to advanced medical technologies, enhanced diagnostic capabilities, and more effective treatment options. Strategic supplier partnerships enable cost optimization, supply chain efficiency, and access to innovative solutions that improve operational performance.

Patients experience enhanced care quality through advanced medical devices, minimally invasive procedures, and improved diagnostic accuracy. The availability of sophisticated hospital supplies enables healthcare providers to deliver more precise treatments, reduce recovery times, and improve overall patient satisfaction.

Medical device manufacturers gain access to a large and sophisticated healthcare market with strong demand for innovative solutions. The UK’s reputation for healthcare excellence and clinical research provides valuable opportunities for product development, clinical validation, and international market expansion.

Healthcare investors benefit from stable market growth driven by demographic trends, government healthcare spending, and continuous innovation in medical technology. The market offers diverse investment opportunities across different product categories and technology maturity levels.

Research institutions collaborate with industry partners to develop next-generation medical technologies, conduct clinical trials, and translate research discoveries into commercial applications. The UK’s strong academic healthcare sector creates valuable partnerships for innovation development.

Government stakeholders achieve healthcare policy objectives through improved patient outcomes, enhanced healthcare system efficiency, and economic benefits from a thriving medical technology sector. Strategic investments in hospital supplies infrastructure support broader healthcare system modernization goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming hospital supplies through smart medical devices, predictive analytics, and automated decision support systems. AI-enabled diagnostic equipment provides more accurate and faster results, while intelligent monitoring systems alert healthcare providers to potential patient complications before they become critical.

Sustainability initiatives are driving demand for environmentally responsible medical supplies, including biodegradable consumables, reusable medical devices, and circular economy approaches to medical equipment lifecycle management. Healthcare providers increasingly evaluate suppliers based on environmental impact and sustainable manufacturing practices.

Point-of-care testing continues expanding as healthcare providers seek to improve patient care efficiency and reduce laboratory turnaround times. Portable diagnostic devices enable immediate test results at the bedside, in emergency departments, and in community healthcare settings, improving clinical decision-making speed and accuracy.

Remote patient monitoring technologies are extending hospital care capabilities beyond traditional facility boundaries. Connected medical devices enable continuous patient monitoring at home, reducing hospital readmissions and enabling early intervention for chronic disease management.

Minimally invasive procedures drive demand for specialized surgical instruments, advanced imaging systems, and robotic surgical platforms. These technologies reduce patient recovery times, minimize surgical complications, and improve overall treatment outcomes while potentially reducing long-term healthcare costs.

Supply chain digitalization improves inventory management, reduces waste, and enhances product traceability throughout the healthcare supply chain. RFID tracking, automated reordering systems, and predictive analytics help healthcare providers optimize supply levels and reduce stockouts.

Regulatory modernization efforts by the MHRA are streamlining medical device approval processes while maintaining safety standards. New guidelines for digital health technologies and AI-enabled medical devices provide clearer pathways for innovative product development and market entry.

NHS procurement transformation initiatives are consolidating purchasing power, standardizing product specifications, and implementing value-based procurement strategies. These changes create opportunities for suppliers that can demonstrate clear clinical and economic benefits from their products.

Technology partnerships between traditional medical device companies and technology firms are accelerating innovation in connected medical devices, data analytics, and integrated healthcare solutions. These collaborations combine medical expertise with advanced technology capabilities to create next-generation hospital supplies.

Manufacturing localization initiatives are increasing domestic production capacity for critical medical supplies, reducing dependency on international supply chains and improving supply security. Government support for medical device manufacturing is creating new opportunities for UK-based suppliers.

Clinical evidence requirements are becoming more stringent, with healthcare providers demanding robust data demonstrating clinical effectiveness and economic value. Suppliers are investing heavily in clinical studies and real-world evidence generation to support product adoption decisions.

Cybersecurity focus is increasing as connected medical devices become more prevalent in hospital environments. Suppliers are implementing enhanced security measures and healthcare providers are developing comprehensive cybersecurity strategies for medical device management.

MarkWide Research recommends that healthcare providers prioritize strategic supplier partnerships that offer comprehensive solutions, value-based pricing models, and long-term innovation roadmaps. These partnerships can provide better total cost of ownership while ensuring access to cutting-edge medical technologies and ongoing technical support.

Investment priorities should focus on digital health integration, artificial intelligence capabilities, and sustainable manufacturing practices. Companies that successfully combine traditional medical device expertise with advanced technology capabilities are likely to achieve competitive advantages in the evolving healthcare landscape.

Market entry strategies for new suppliers should emphasize clinical evidence generation, regulatory compliance excellence, and strong relationships with key opinion leaders in the healthcare community. Understanding NHS procurement processes and demonstrating clear value propositions are essential for successful market penetration.

Innovation focus should address key healthcare challenges including aging population needs, chronic disease management, and healthcare system efficiency. Products that enable better patient outcomes while reducing overall healthcare costs are most likely to achieve successful market adoption.

Supply chain resilience strategies should include diversified supplier networks, strategic inventory management, and domestic manufacturing capabilities where feasible. Healthcare providers should work closely with suppliers to develop contingency plans and ensure continuity of critical medical supply availability.

Long-term growth prospects for the UK hospital supplies market remain positive, supported by demographic trends, healthcare technology advancement, and continued government investment in healthcare infrastructure. MarkWide Research projects sustained market expansion driven by increasing healthcare demand and ongoing innovation in medical technology.

Technology evolution will continue reshaping the market through artificial intelligence integration, precision medicine advancement, and digital health platform development. The convergence of traditional medical devices with advanced technology capabilities will create new product categories and market opportunities.

Healthcare delivery transformation toward more personalized, preventive, and community-based care models will drive demand for portable medical devices, remote monitoring systems, and point-of-care diagnostic solutions. This shift represents significant market opportunities for innovative suppliers.

Sustainability requirements will become increasingly important in procurement decisions, with healthcare providers prioritizing suppliers that demonstrate environmental responsibility and circular economy principles. This trend will drive innovation in eco-friendly medical supplies and sustainable manufacturing practices.

Market consolidation is likely to continue as suppliers seek to achieve economies of scale and healthcare providers rationalize their vendor relationships. Strategic partnerships and collaborative relationships will become more important for market success.

Regulatory evolution will continue adapting to technological advancement while maintaining patient safety standards. Suppliers must stay current with regulatory requirements and invest in compliance capabilities to maintain market access and competitive positioning.

The UK hospital supplies market represents a dynamic and essential component of the nation’s healthcare infrastructure, demonstrating remarkable resilience and continuous evolution in response to changing healthcare needs and technological advancement. Market growth is supported by strong demographic drivers, government healthcare investment, and ongoing innovation in medical technology.

Strategic opportunities exist across multiple market segments, with particular potential in digital health integration, artificial intelligence applications, and sustainable medical supply solutions. Healthcare providers increasingly prioritize value-based procurement strategies that consider total cost of ownership and long-term clinical outcomes rather than initial purchase price alone.

Market participants who successfully navigate regulatory requirements, demonstrate clear clinical value, and develop strong partnerships with healthcare providers are well-positioned for sustained growth. The integration of advanced technologies with traditional medical supplies creates new opportunities for innovation and market differentiation.

Future success in the UK hospital supplies market will depend on suppliers’ ability to adapt to evolving healthcare delivery models, embrace digital transformation, and address sustainability requirements while maintaining the highest standards of product quality and patient safety. The market’s continued evolution presents both challenges and opportunities for all stakeholders in the healthcare supply chain.

What is Hospital Supplies?

Hospital supplies refer to a range of products used in healthcare settings, including medical devices, surgical instruments, and consumables necessary for patient care and hospital operations.

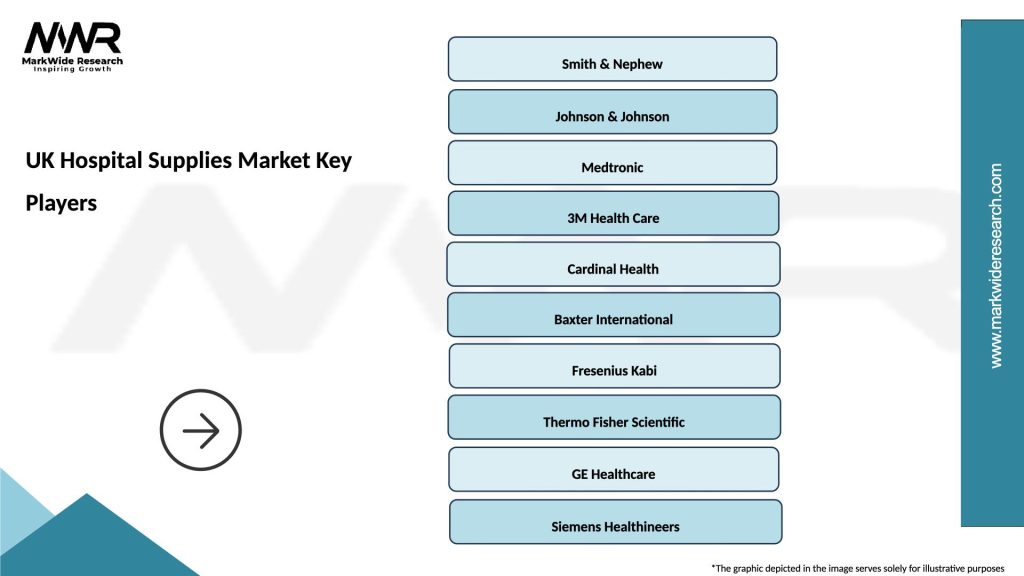

What are the key players in the UK Hospital Supplies Market?

Key players in the UK Hospital Supplies Market include companies like Smith & Nephew, Johnson & Johnson, and Medtronic, which provide a variety of medical devices and supplies, among others.

What are the main drivers of growth in the UK Hospital Supplies Market?

The growth of the UK Hospital Supplies Market is driven by factors such as the increasing demand for advanced medical technologies, the rise in chronic diseases, and the expansion of healthcare facilities.

What challenges does the UK Hospital Supplies Market face?

Challenges in the UK Hospital Supplies Market include regulatory compliance issues, the high cost of advanced medical equipment, and supply chain disruptions that can affect product availability.

What opportunities exist in the UK Hospital Supplies Market?

Opportunities in the UK Hospital Supplies Market include the development of innovative medical technologies, the growing trend of telemedicine, and the increasing focus on patient-centered care.

What trends are shaping the UK Hospital Supplies Market?

Trends in the UK Hospital Supplies Market include the rise of minimally invasive surgical techniques, the integration of digital health solutions, and a growing emphasis on sustainability in medical supply production.

UK Hospital Supplies Market

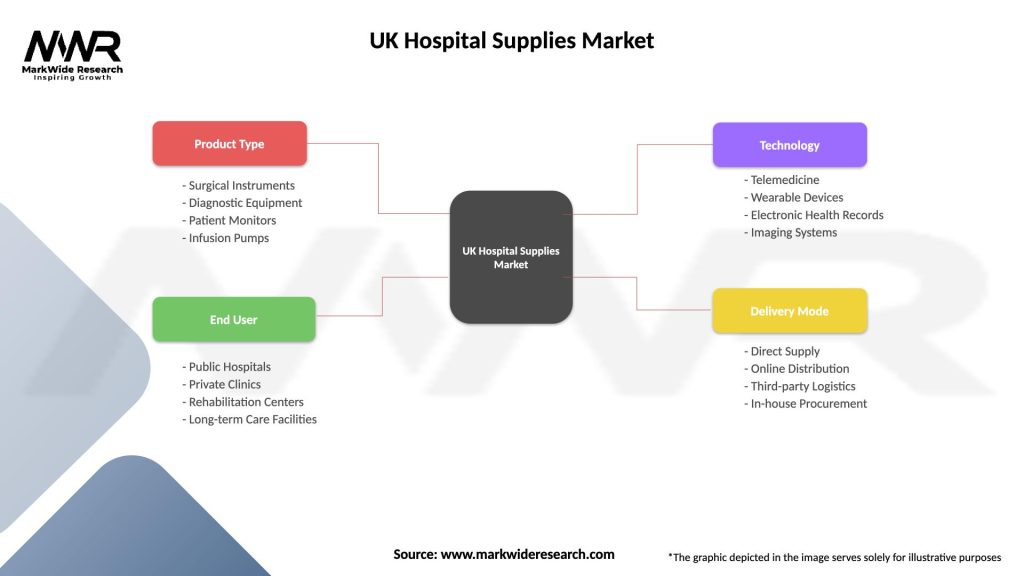

| Segmentation Details | Description |

|---|---|

| Product Type | Surgical Instruments, Diagnostic Equipment, Patient Monitors, Infusion Pumps |

| End User | Public Hospitals, Private Clinics, Rehabilitation Centers, Long-term Care Facilities |

| Technology | Telemedicine, Wearable Devices, Electronic Health Records, Imaging Systems |

| Delivery Mode | Direct Supply, Online Distribution, Third-party Logistics, In-house Procurement |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Hospital Supplies Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at