444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK home textile market represents a dynamic and evolving sector that encompasses bedding, curtains, upholstery fabrics, towels, and decorative textiles for residential applications. Market dynamics indicate robust growth driven by increasing consumer focus on home aesthetics, sustainable materials, and premium quality products. The sector has experienced significant transformation following changing lifestyle patterns, remote working trends, and heightened emphasis on home comfort and functionality.

Consumer preferences have shifted toward eco-friendly materials, smart textiles, and customizable home décor solutions. The market demonstrates strong performance across multiple segments, with bedding and bath textiles commanding substantial market share. Digital transformation has revolutionized retail channels, with online platforms experiencing accelerated growth rates of approximately 12-15% annually. The integration of sustainable manufacturing practices and innovative fabric technologies continues to reshape market dynamics.

Regional distribution shows concentrated demand in urban centers, with London, Manchester, and Birmingham leading consumption patterns. The market benefits from strong domestic manufacturing capabilities alongside strategic imports from key textile-producing regions. Premium positioning has become increasingly important as consumers prioritize quality, durability, and design aesthetics in their home textile purchases.

The UK home textile market refers to the comprehensive sector encompassing all fabric-based products designed for residential interior applications, including bedding, bath linens, window treatments, upholstery materials, and decorative textiles used to enhance home comfort, functionality, and aesthetic appeal.

Home textiles serve both functional and decorative purposes, providing essential comfort elements while contributing to interior design schemes. The market includes natural and synthetic fiber products, ranging from basic utility items to luxury designer collections. Product categories span bed linens, towels, curtains, cushions, throws, table linens, and specialized textiles for specific home applications.

Market scope extends beyond traditional retail to include hospitality sector supplies, commercial applications, and emerging smart textile technologies. The sector encompasses both mass-market affordable options and premium luxury segments, catering to diverse consumer demographics and price points across the UK residential market.

Market performance demonstrates consistent growth trajectory supported by evolving consumer lifestyles and increased home investment following recent global events. The sector benefits from strong domestic demand, innovative product development, and expanding distribution channels. Key growth drivers include sustainability trends, premium product demand, and digital retail transformation.

Competitive landscape features established British brands alongside international players, creating dynamic market conditions. The sector shows resilience through economic fluctuations, with consumers maintaining spending on essential home comfort items. Sustainability initiatives have gained prominence, with approximately 68% of consumers expressing preference for eco-friendly home textile options.

Future prospects indicate continued expansion driven by housing market activity, renovation projects, and evolving design trends. The market demonstrates strong potential for innovation in smart textiles, antimicrobial treatments, and sustainable manufacturing processes. Digital channels are projected to capture increasing market share as consumer shopping behaviors continue evolving.

Strategic insights reveal several critical factors shaping market development and competitive positioning:

Primary growth drivers propelling market expansion include fundamental shifts in consumer behavior and lifestyle patterns. Home investment trends have intensified as consumers prioritize comfort, functionality, and aesthetic appeal in residential spaces. The growing emphasis on creating personalized living environments drives demand for diverse textile options.

Sustainability consciousness represents a major market driver, with consumers increasingly seeking eco-friendly alternatives. Organic materials, recycled fibers, and sustainable manufacturing processes attract environmentally aware buyers. This trend supports premium pricing for certified sustainable products and encourages innovation in green textile technologies.

Housing market activity directly correlates with home textile demand, as property purchases and renovations trigger comprehensive interior updates. Remote working trends have increased focus on home office comfort and multi-functional living spaces, expanding market opportunities for specialized textile products.

Digital retail evolution enables broader market reach and enhanced customer engagement. Online platforms provide extensive product selection, competitive pricing, and convenient shopping experiences that drive market growth. Social media influence and interior design content creation further stimulate consumer interest and purchasing decisions.

Economic pressures pose significant challenges to market growth, particularly during periods of reduced consumer spending and economic uncertainty. Inflation impacts on raw material costs and manufacturing expenses create pricing pressures that may limit market accessibility for price-sensitive consumers.

Supply chain disruptions continue affecting product availability and cost structures. International trade complexities and logistics challenges impact import-dependent product categories, potentially limiting selection and increasing prices for consumers.

Intense competition from low-cost international suppliers creates pressure on domestic manufacturers and established brands. Price competition can erode profit margins and limit investment in innovation and quality improvements.

Changing retail landscape presents challenges for traditional brick-and-mortar retailers as consumer preferences shift toward online shopping. Store closures and reduced physical retail presence may limit product accessibility for consumers preferring in-person shopping experiences.

Regulatory compliance requirements for textile safety, environmental standards, and labeling create additional costs and complexity for market participants. Sustainability regulations may require significant investment in new manufacturing processes and supply chain modifications.

Emerging opportunities present significant potential for market expansion and innovation. Smart textile integration offers possibilities for products with enhanced functionality, including temperature regulation, antimicrobial properties, and connectivity features that appeal to tech-savvy consumers.

Sustainable innovation creates opportunities for companies developing eco-friendly materials and manufacturing processes. Circular economy principles enable new business models focused on textile recycling, upcycling, and extended product lifecycles that resonate with environmentally conscious consumers.

Customization services represent growing market opportunities as consumers seek personalized home décor solutions. Made-to-measure options, custom printing, and bespoke design services can command premium pricing while building customer loyalty.

Export potential exists for high-quality British textile products in international markets. Brand heritage and quality reputation provide competitive advantages in global luxury and premium market segments.

Hospitality sector recovery creates opportunities for commercial textile suppliers as hotels, restaurants, and accommodation providers update their interiors. Healthcare applications for specialized antimicrobial and easy-care textiles present additional market segments.

Dynamic interactions between supply and demand factors create complex market conditions requiring strategic adaptation. Consumer behavior evolution continues reshaping product requirements, with increased emphasis on multifunctional and sustainable options driving innovation cycles.

Seasonal fluctuations significantly impact market dynamics, with approximately 35% of annual sales occurring during peak periods including spring home improvement seasons and holiday gift-giving periods. Inventory management becomes critical for retailers managing these cyclical demand patterns.

Price sensitivity variations across different consumer segments create opportunities for targeted marketing strategies. Premium segment growth indicates consumer willingness to invest in quality, while value-conscious buyers drive demand for affordable options without compromising basic functionality.

Technology adoption influences market dynamics through enhanced manufacturing capabilities, improved product performance, and innovative retail experiences. Digital integration enables personalization, virtual design tools, and augmented reality applications that enhance customer engagement.

Competitive pressures drive continuous innovation and efficiency improvements. Market consolidation trends may reshape competitive landscape as companies seek scale advantages and expanded market reach through strategic partnerships and acquisitions.

Comprehensive research approach combines quantitative and qualitative methodologies to provide thorough market analysis. Primary research includes consumer surveys, industry interviews, and retail channel analysis to capture current market conditions and emerging trends.

Data collection methods encompass multiple sources including industry associations, government statistics, trade publications, and company financial reports. Market segmentation analysis provides detailed insights into product categories, price points, and consumer demographics.

Secondary research leverages existing industry reports, academic studies, and market intelligence databases to validate findings and provide historical context. Trend analysis incorporates social media monitoring, design trend tracking, and consumer behavior studies.

Statistical analysis employs advanced modeling techniques to project market trends and identify growth opportunities. Regional analysis includes geographic market mapping and demographic correlation studies to understand local market variations.

Quality assurance processes ensure data accuracy through cross-validation, expert review, and continuous monitoring of market developments. Regular updates maintain research relevance as market conditions evolve.

Geographic distribution reveals distinct regional patterns across the UK home textile market. London and Southeast England command approximately 42% market share, driven by higher disposable incomes, dense population, and strong housing market activity. The region demonstrates preference for premium and designer textile products.

Northern England represents significant market opportunity with growing urban centers in Manchester, Liverpool, and Leeds driving demand. Regional preferences tend toward practical and value-oriented products, though premium segment growth indicates evolving consumer aspirations.

Scotland and Wales show steady market development with approximately 18% combined market share. Rural areas demonstrate different purchasing patterns, with emphasis on durability and traditional designs, while urban centers align more closely with national trends.

Midlands region benefits from strong manufacturing heritage and growing residential development. Birmingham and surrounding areas show robust demand growth, particularly in the affordable and mid-market segments.

Regional retail infrastructure varies significantly, with urban areas offering diverse shopping options while rural regions rely more heavily on online channels. Distribution strategies must account for these geographic variations in retail accessibility and consumer preferences.

Market competition features diverse players ranging from established British heritage brands to international retailers and emerging direct-to-consumer companies. Competitive positioning varies across price segments and product categories.

Competitive strategies include brand differentiation, exclusive product lines, sustainable positioning, and omnichannel retail approaches. Market share distribution remains fragmented, providing opportunities for both established players and new entrants.

Product segmentation reveals distinct market categories with varying growth patterns and consumer preferences:

By Product Type:

By Material Type:

By Price Segment:

Bedding category maintains market leadership with consistent demand driven by replacement cycles and style updates. Thread count emphasis and premium material positioning create opportunities for value-added products. Seasonal collections and coordinated sets appeal to consumers seeking complete bedroom makeovers.

Bath textiles demonstrate steady growth with focus on absorbency, quick-drying properties, and antimicrobial treatments. Luxury spa experiences at home drive demand for premium towels and bath accessories. Color coordination and matching sets increase average transaction values.

Window treatments benefit from home renovation trends and energy efficiency considerations. Thermal properties and light-filtering capabilities add functional value. Smart home integration creates opportunities for automated window covering systems.

Kitchen textiles show growth potential through increased home cooking trends and entertaining activities. Antimicrobial properties and easy-care features address practical consumer needs. Decorative elements allow expression of personal style in functional spaces.

Decorative textiles including cushions, throws, and accent pieces enable affordable room updates and seasonal décor changes. Trend responsiveness and fashion-forward designs drive frequent replacement cycles and impulse purchases.

Manufacturers benefit from growing market demand and opportunities for product innovation. Sustainable manufacturing capabilities provide competitive advantages and access to premium market segments. Technology integration enables efficiency improvements and enhanced product performance.

Retailers gain from diverse product portfolios and multiple price point coverage. Omnichannel strategies expand market reach and improve customer engagement. Private label opportunities offer higher margins and brand differentiation possibilities.

Consumers enjoy expanded product selection, improved quality standards, and competitive pricing. Sustainable options align with environmental values while innovative features enhance home comfort and functionality. Digital shopping provides convenience and access to extensive product information.

Supply chain partners benefit from stable demand patterns and opportunities for specialization. Logistics providers gain from growing e-commerce volumes and direct-to-consumer delivery requirements. Raw material suppliers see increased demand for sustainable and innovative fiber options.

Economic stakeholders benefit from employment opportunities, export potential, and contribution to domestic manufacturing capabilities. Regional development occurs through manufacturing investments and retail expansion in underserved markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend reshaping market dynamics. Eco-conscious consumers increasingly prioritize organic materials, recycled fibers, and environmentally responsible manufacturing processes. This trend drives innovation in sustainable textile technologies and creates premium market opportunities.

Smart home integration introduces technology-enhanced textiles with functional benefits. Antimicrobial treatments, temperature regulation, and connectivity features appeal to tech-savvy consumers seeking enhanced home comfort and convenience.

Personalization demand grows as consumers seek unique home décor solutions. Custom printing, made-to-measure options, and bespoke design services enable individual expression while commanding premium pricing.

Wellness focus influences product development with emphasis on sleep quality, stress reduction, and overall health benefits. Hypoallergenic materials and therapeutic properties address specific consumer health concerns.

Minimalist aesthetics drive demand for clean, simple designs with neutral color palettes. Scandinavian influences and Japanese-inspired minimalism shape contemporary home textile preferences.

Seasonal flexibility becomes important as consumers seek versatile products suitable for year-round use. Reversible designs and adaptable textiles provide value through extended usability.

Recent developments demonstrate industry evolution toward sustainability and innovation. Major retailers have launched comprehensive sustainability initiatives, including carbon-neutral shipping, recycled packaging, and circular economy programs that reshape competitive positioning.

Technology partnerships between textile manufacturers and tech companies create innovative product offerings. Smart fabric development includes temperature-regulating bedding, antimicrobial treatments, and connectivity features that enhance user experience.

Supply chain innovations focus on transparency and traceability, with blockchain technology enabling consumers to track product origins and manufacturing processes. This development supports sustainability claims and builds consumer trust.

Retail format evolution includes experiential showrooms, virtual reality design tools, and augmented reality applications that enhance customer engagement. Pop-up stores and temporary installations create brand awareness and test new market concepts.

Manufacturing investments in automated production systems and sustainable technologies improve efficiency while reducing environmental impact. Nearshoring initiatives bring production closer to end markets, reducing logistics costs and delivery times.

Collaborative initiatives between brands, retailers, and sustainability organizations promote industry-wide environmental improvements. Certification programs and standards development create consumer confidence in sustainable product claims.

Strategic recommendations for market participants focus on sustainable differentiation and digital transformation. MarkWide Research analysis suggests companies should prioritize sustainability initiatives as core competitive advantages rather than peripheral marketing messages.

Investment priorities should emphasize technology integration, supply chain transparency, and customer experience enhancement. Digital capabilities require continuous development to meet evolving consumer expectations for convenience and personalization.

Product development should focus on multifunctional textiles that address multiple consumer needs simultaneously. Innovation partnerships with technology companies and material science organizations can accelerate development of next-generation products.

Market expansion opportunities exist in underserved segments including elderly consumers, small living spaces, and commercial applications. Targeted marketing strategies should address specific demographic needs and preferences.

Pricing strategies must balance competitive pressures with value proposition communication. Premium positioning requires clear differentiation through quality, sustainability, or innovative features that justify higher prices.

Distribution optimization should include omnichannel integration, logistics efficiency, and customer service excellence. Direct-to-consumer channels offer opportunities for higher margins and better customer relationships.

Long-term prospects indicate continued market growth driven by evolving consumer lifestyles and technological advancement. Sustainability trends will likely accelerate, with approximately 75% of consumers expected to prioritize eco-friendly options within the next five years.

Technology integration will expand beyond current applications to include advanced smart features, health monitoring capabilities, and seamless home automation integration. Internet of Things connectivity may become standard in premium textile products.

Market consolidation may occur as companies seek scale advantages and expanded capabilities through strategic partnerships and acquisitions. Vertical integration trends could reshape supply chain structures and competitive dynamics.

Demographic shifts including aging population and changing household compositions will create new market segments and product requirements. Urbanization trends drive demand for space-efficient and multifunctional textile solutions.

International expansion opportunities exist for British brands leveraging quality reputation and heritage positioning. Export growth could reach 20-25% annually in premium market segments with proper market development strategies.

Regulatory evolution toward stricter environmental standards will favor companies with established sustainability capabilities while creating challenges for traditional manufacturers. MWR projections suggest regulatory compliance will become a key competitive differentiator.

The UK home textile market demonstrates robust fundamentals and promising growth trajectory supported by evolving consumer preferences, technological innovation, and sustainability trends. Market dynamics favor companies that successfully integrate environmental responsibility with product innovation and customer experience excellence.

Competitive landscape evolution creates opportunities for both established players and emerging brands to capture market share through differentiated positioning and strategic focus. Digital transformation continues reshaping retail channels and customer engagement models, requiring adaptive strategies from all market participants.

Future success will depend on companies’ ability to balance sustainability imperatives with commercial viability while meeting diverse consumer needs across price segments and product categories. The market’s resilience and growth potential position it as an attractive sector for continued investment and development in the evolving UK retail landscape.

What is Home Textile?

Home textile refers to a variety of textile products used in the home, including bed linens, curtains, upholstery, and towels. These products enhance the aesthetic appeal and comfort of living spaces.

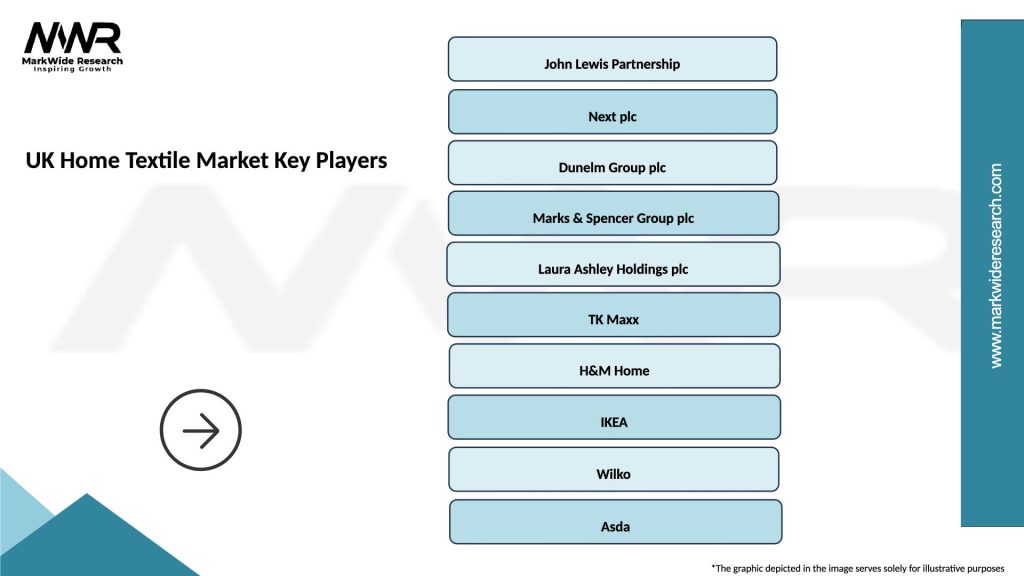

What are the key players in the UK Home Textile Market?

Key players in the UK Home Textile Market include companies like John Lewis, Dunelm, and IKEA, which offer a wide range of home textile products. These companies compete on quality, design, and price to attract consumers.

What are the growth factors driving the UK Home Textile Market?

The UK Home Textile Market is driven by factors such as increasing consumer spending on home improvement, a growing trend towards home decor, and the rising popularity of online shopping for home textiles.

What challenges does the UK Home Textile Market face?

Challenges in the UK Home Textile Market include intense competition among retailers, fluctuating raw material prices, and changing consumer preferences towards sustainable and eco-friendly products.

What opportunities exist in the UK Home Textile Market?

Opportunities in the UK Home Textile Market include the growing demand for smart textiles, the rise of e-commerce platforms, and the increasing focus on sustainable materials and production methods.

What trends are shaping the UK Home Textile Market?

Trends in the UK Home Textile Market include the increasing popularity of minimalistic designs, the use of natural fibers, and the integration of technology in textiles, such as washable fabrics and smart home solutions.

UK Home Textile Market

| Segmentation Details | Description |

|---|---|

| Product Type | Curtains, Cushions, Bed Linen, Tablecloths |

| Material | Cotton, Polyester, Linen, Silk |

| End User | Residential, Hospitality, Healthcare, Educational |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Home Textile Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at