444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK Home Equity Line of Credit market represents a dynamic segment of the British financial services landscape, offering homeowners flexible access to capital through secured lending arrangements. This market has experienced significant transformation in recent years, driven by evolving consumer needs, regulatory changes, and shifting economic conditions. Home equity lines of credit provide UK homeowners with revolving credit facilities secured against their property values, enabling access to funds for various purposes including home improvements, debt consolidation, and investment opportunities.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate of 6.2% over the past five years. The increasing property values across major UK metropolitan areas have created enhanced borrowing capacity for homeowners, while competitive interest rate environments have made these financial products more attractive to consumers. Digital transformation within the lending sector has streamlined application processes, reducing approval timeframes and improving customer experience significantly.

Regional variations across England, Scotland, Wales, and Northern Ireland demonstrate diverse market penetration rates, with London and the South East maintaining the highest adoption levels at approximately 34% of eligible homeowners. The market encompasses various product structures, from traditional variable-rate lines to innovative fixed-rate hybrid solutions, catering to diverse consumer preferences and risk profiles.

The UK Home Equity Line of Credit market refers to the comprehensive ecosystem of financial products and services that enable property owners to access revolving credit facilities secured against their residential real estate equity. These arrangements allow borrowers to draw funds up to predetermined credit limits, with repayment flexibility and interest charges applied only on utilized amounts.

Home equity lines of credit function as secured lending instruments where the borrower’s property serves as collateral, typically offering lower interest rates compared to unsecured credit alternatives. The credit line remains available for a specified draw period, usually ranging from five to ten years, followed by a repayment phase where outstanding balances must be settled according to agreed terms.

Key characteristics include variable interest rates tied to base lending rates, flexible withdrawal mechanisms through checks, cards, or online transfers, and the ability to repeatedly borrow and repay within established credit limits. This financial instrument provides homeowners with strategic capital access while leveraging their most significant asset – their property equity.

The UK Home Equity Line of Credit market demonstrates robust growth trajectory supported by favorable economic conditions, increased property values, and evolving consumer financial strategies. Market participants include traditional banks, building societies, specialist lenders, and emerging fintech platforms, creating a competitive landscape that benefits consumers through improved product offerings and competitive pricing structures.

Consumer adoption patterns reveal strong demand across multiple demographic segments, with homeowners aged 35-55 representing the primary market at 42% of total borrowers. The market serves diverse purposes including home renovations, education funding, business investments, and debt consolidation, reflecting the versatility of these financial instruments in meeting varied consumer needs.

Regulatory framework provided by the Financial Conduct Authority ensures consumer protection while maintaining market accessibility. Recent regulatory updates have enhanced transparency requirements, affordability assessments, and responsible lending practices, contributing to market stability and consumer confidence. Technology integration has revolutionized application processes, with digital platforms reducing approval times by approximately 45% compared to traditional methods.

Market outlook remains positive, supported by continued property value appreciation, low interest rate environment, and increasing consumer awareness of equity-based financing options. Strategic partnerships between traditional lenders and technology providers are expected to drive further innovation and market expansion.

Market intelligence reveals several critical insights shaping the UK Home Equity Line of Credit landscape:

Primary market drivers propelling the UK Home Equity Line of Credit sector include sustained property value appreciation across key metropolitan areas. Housing market dynamics have created substantial equity accumulation for existing homeowners, with average equity positions increasing by 15-20% annually in prime locations. This equity growth directly translates to enhanced borrowing capacity and increased market opportunity.

Consumer financial sophistication has evolved significantly, with homeowners increasingly recognizing the strategic value of leveraging property equity for various financial objectives. The growing awareness of tax-efficient borrowing strategies and the comparative cost advantages of secured lending versus unsecured alternatives drive market adoption. Lifestyle changes including remote work trends have increased home improvement investments, creating natural demand for flexible financing solutions.

Economic factors including historically low interest rates have made equity-based borrowing particularly attractive. The Bank of England’s monetary policy stance has maintained favorable borrowing conditions, while inflation concerns have encouraged consumers to secure fixed-rate components within their credit arrangements. Regulatory clarity provided by updated FCA guidelines has enhanced lender confidence and market stability.

Technological advancement has eliminated traditional barriers to market entry, with streamlined application processes and rapid approval mechanisms attracting previously underserved consumer segments. Digital platforms have reduced operational costs for lenders, enabling more competitive pricing and expanded market reach.

Significant market restraints include stringent regulatory requirements that, while protecting consumers, can limit product flexibility and increase compliance costs for lenders. Affordability assessment protocols require comprehensive income verification and stress testing, potentially excluding otherwise qualified borrowers during economic uncertainty periods.

Property market volatility presents ongoing challenges, as declining property values can trigger margin calls or credit line reductions, creating potential financial stress for borrowers. Interest rate sensitivity remains a critical concern, with variable rate products exposing consumers to payment shock risks during monetary policy tightening cycles.

Consumer education gaps persist regarding the complexities of equity-based lending, including understanding of compound interest effects, repayment obligations, and potential foreclosure risks. Economic uncertainty related to Brexit implications, inflation pressures, and global market volatility can reduce consumer confidence in taking on additional secured debt obligations.

Competition from alternative financing sources including personal loans, credit cards, and emerging peer-to-peer lending platforms can limit market growth. Demographic constraints affect market expansion, as younger consumers often lack sufficient property equity, while older consumers may face age-related lending restrictions.

Substantial market opportunities exist within underserved demographic segments, particularly among younger homeowners who have benefited from recent property appreciation but remain unaware of equity-based financing options. Product innovation presents significant potential, including development of interest-only payment periods, seasonal payment adjustments, and integration with broader wealth management services.

Digital transformation opportunities include artificial intelligence-powered underwriting systems, blockchain-based documentation processes, and mobile-first customer experiences. Partnership strategies with property developers, real estate agents, and home improvement retailers can create integrated financing solutions that capture consumers at point-of-need.

Geographic expansion into previously underserved regions, particularly in Northern England, Scotland, and Wales, offers growth potential as property values in these areas continue appreciating. Niche market development including products tailored for buy-to-let investors, self-employed individuals, and retirees can address specific consumer segments with unique financing needs.

Regulatory evolution may create opportunities for more flexible product structures while maintaining consumer protection standards. Economic recovery following pandemic-related disruptions is expected to drive increased consumer confidence and borrowing activity, particularly for home improvement and investment purposes.

Market dynamics within the UK Home Equity Line of Credit sector reflect complex interactions between regulatory frameworks, economic conditions, and consumer behavior patterns. Supply-side factors include lender risk appetite, funding costs, and competitive positioning strategies that influence product availability and pricing structures.

Demand-side influences encompass consumer confidence levels, property market sentiment, and alternative financing availability. MarkWide Research analysis indicates that consumer demand patterns correlate strongly with regional economic performance, with areas experiencing job growth showing 25-30% higher application rates compared to economically stagnant regions.

Competitive dynamics have intensified as traditional banks face challenges from specialist lenders and fintech platforms offering streamlined processes and competitive rates. Market consolidation trends suggest potential merger and acquisition activity as smaller players seek scale advantages and larger institutions pursue market share expansion.

Regulatory dynamics continue evolving, with ongoing consultations regarding responsible lending practices, consumer protection enhancements, and market stability measures. Technology dynamics drive operational efficiency improvements and customer experience enhancements, while creating new competitive advantages for early adopters of advanced lending technologies.

Comprehensive research methodology employed for analyzing the UK Home Equity Line of Credit market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes structured interviews with industry executives, consumer surveys, and focus group discussions with current and potential borrowers across diverse demographic segments.

Secondary research encompasses analysis of regulatory filings, industry reports, economic data, and property market statistics from authoritative sources including the Office for National Statistics, Bank of England, and Financial Conduct Authority. Quantitative analysis utilizes statistical modeling techniques to identify trends, correlations, and predictive indicators within market data sets.

Market segmentation analysis examines consumer behavior patterns, product preferences, and regional variations through demographic and psychographic profiling. Competitive intelligence gathering includes product comparison analysis, pricing studies, and market positioning assessments across major industry participants.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on identified market drivers and constraints.

Regional market analysis reveals significant variations in Home Equity Line of Credit adoption and utilization patterns across the United Kingdom. London and South East England dominate market activity, accounting for approximately 45% of total market volume, driven by high property values, affluent demographics, and sophisticated financial services infrastructure.

Northern England demonstrates emerging growth potential, with cities like Manchester, Leeds, and Liverpool experiencing increased market penetration as property values appreciate and economic development accelerates. Market share in this region has grown by 18% annually over the past three years, reflecting improving economic conditions and increased consumer awareness.

Scotland presents unique market characteristics, with Edinburgh and Glasgow leading adoption rates while rural areas remain underserved. Regulatory alignment with UK-wide standards has facilitated market development, though cultural preferences for traditional mortgage products continue influencing consumer behavior patterns.

Wales and Northern Ireland represent developing markets with substantial growth potential as property values continue appreciating and financial services infrastructure expands. Regional lenders play important roles in these markets, often providing more personalized service and local market expertise compared to national institutions.

The competitive landscape encompasses diverse market participants ranging from established high street banks to innovative fintech platforms. Major players have established strong market positions through comprehensive product offerings, extensive branch networks, and established customer relationships.

Competitive strategies include product differentiation, pricing optimization, technology investment, and customer service enhancement. Market consolidation trends suggest ongoing merger and acquisition activity as participants seek scale advantages and expanded market reach.

Market segmentation analysis reveals distinct consumer categories with varying needs, preferences, and risk profiles within the UK Home Equity Line of Credit market.

By Purpose:

By Demographics:

By Property Type:

Product category analysis reveals distinct market segments with specific characteristics and growth patterns within the UK Home Equity Line of Credit market.

Variable Rate Products: Dominate market share at approximately 72% of total originations, offering competitive initial rates and payment flexibility. These products appeal to consumers comfortable with interest rate risk and seeking maximum borrowing capacity. Rate adjustment mechanisms typically track Bank of England base rates with predetermined margins, providing transparency and predictability in pricing changes.

Fixed Rate Components: Growing popularity among risk-averse consumers, with hybrid products combining fixed and variable elements gaining 15% market share annually. These offerings provide payment certainty for specified periods while maintaining access to variable rate advantages. Consumer preference for fixed components increases during periods of anticipated interest rate volatility.

Interest-Only Options: Specialized products serving specific consumer segments including investors and cash flow-constrained borrowers. Regulatory scrutiny ensures appropriate consumer suitability assessments while maintaining product availability for qualified applicants. These products typically require higher equity positions and comprehensive affordability documentation.

Digital-First Products: Emerging category leveraging technology for streamlined applications, automated underwriting, and enhanced customer experiences. Processing efficiency improvements of up to 60% faster approval times compared to traditional channels drive consumer adoption and competitive advantage.

Industry participants realize substantial benefits from the expanding UK Home Equity Line of Credit market through diversified revenue streams and enhanced customer relationships.

For Lenders:

For Consumers:

For Stakeholders:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the UK Home Equity Line of Credit market, with lenders investing heavily in technology platforms that streamline application processes and enhance customer experiences. Artificial intelligence and machine learning applications are revolutionizing underwriting processes, enabling faster decisions while maintaining risk management standards.

Product hybridization continues gaining momentum as lenders develop innovative solutions combining fixed and variable rate components to address diverse consumer risk preferences. Flexible repayment options including seasonal adjustments and payment holidays are becoming standard features, reflecting evolving consumer lifestyle patterns and financial management approaches.

Sustainability integration emerges as lenders incorporate environmental considerations into product offerings, with preferential rates for energy-efficient home improvements and green building projects. ESG compliance requirements are driving product development and marketing strategies across major market participants.

Demographic shifts influence product development, with specialized offerings targeting younger homeowners, retirees, and self-employed individuals. MWR analysis indicates that millennial homeowners represent the fastest-growing segment, with adoption rates increasing 35% annually as this demographic achieves homeownership and builds equity positions.

Regulatory evolution continues shaping market dynamics, with enhanced consumer protection measures and responsible lending requirements influencing product design and distribution strategies. Open banking integration enables more comprehensive affordability assessments while reducing documentation requirements for consumers.

Recent industry developments highlight the dynamic nature of the UK Home Equity Line of Credit market, with significant innovations and strategic initiatives reshaping competitive dynamics.

Technology Partnerships: Major lenders have established strategic alliances with fintech companies to accelerate digital transformation initiatives. These partnerships focus on developing AI-powered underwriting systems, blockchain-based documentation processes, and mobile-first customer interfaces that reduce processing times and improve user experiences.

Product Launches: Several institutions have introduced innovative hybrid products combining traditional equity lines with investment management services, enabling consumers to optimize their borrowing strategies while building wealth. Flexible repayment structures including interest-only periods and seasonal payment adjustments have gained market acceptance.

Regulatory Updates: The Financial Conduct Authority has implemented enhanced consumer protection measures, including improved disclosure requirements and strengthened affordability assessments. These changes have increased compliance costs but enhanced market credibility and consumer confidence.

Market Consolidation: Strategic acquisitions and mergers have reshaped competitive dynamics, with larger institutions acquiring specialist lenders to expand market reach and technological capabilities. Vertical integration strategies include partnerships with property valuation services and home improvement retailers.

International Expansion: Some UK-based lenders have explored opportunities in international markets, leveraging their expertise in equity-based lending to serve expatriate communities and international property investors.

Strategic recommendations for market participants focus on leveraging technology advancement opportunities while maintaining strong risk management practices. Digital investment should prioritize customer experience enhancement and operational efficiency improvements, with particular emphasis on mobile-first platforms and automated underwriting systems.

Product development strategies should address evolving consumer needs through flexible repayment options, sustainability-focused offerings, and specialized products for underserved demographic segments. MarkWide Research recommends focusing on hybrid products that combine fixed and variable rate components to address consumer risk preferences while maintaining competitive positioning.

Market expansion opportunities exist in underserved geographic regions and demographic segments, particularly among younger homeowners and self-employed individuals. Partnership strategies with property professionals, financial advisors, and home improvement retailers can create integrated solutions that capture consumers at point-of-need.

Risk management enhancement should incorporate advanced analytics and stress testing capabilities to navigate potential economic volatility and property market fluctuations. Regulatory compliance investments should focus on automated monitoring systems and comprehensive documentation processes to ensure ongoing adherence to evolving requirements.

Competitive positioning strategies should emphasize unique value propositions, whether through pricing advantages, superior customer service, or innovative product features. Brand differentiation becomes increasingly important as market maturity increases and consumer choice expands.

The future outlook for the UK Home Equity Line of Credit market remains positive, supported by fundamental drivers including continued property value appreciation, evolving consumer financial strategies, and ongoing technological advancement. Market growth is projected to accelerate, with adoption rates expected to increase by 8-12% annually over the next five years as consumer awareness expands and product accessibility improves.

Technology integration will continue driving market evolution, with artificial intelligence, blockchain, and open banking creating new opportunities for operational efficiency and customer experience enhancement. Digital-native consumers will increasingly demand seamless, mobile-first experiences that traditional lenders must provide to remain competitive.

Regulatory development is expected to focus on enhanced consumer protection while maintaining market accessibility and innovation potential. Sustainable finance requirements may influence product development, with preferential terms for environmentally beneficial purposes becoming standard market features.

Demographic trends suggest expanding market opportunity as millennial homeowners mature and build substantial property equity positions. Product innovation will likely focus on flexible structures that accommodate diverse lifestyle patterns and financial management approaches characteristic of younger consumer segments.

Economic factors including interest rate normalization and inflation management will influence market dynamics, with successful participants adapting product offerings and risk management strategies to navigate changing conditions while maintaining growth momentum and profitability.

The UK Home Equity Line of Credit market represents a mature yet dynamic segment of the British financial services landscape, characterized by strong growth potential, evolving consumer needs, and continuous innovation. Market fundamentals remain robust, supported by sustained property value appreciation, favorable regulatory frameworks, and increasing consumer sophistication regarding equity-based financing strategies.

Key success factors for market participants include technology investment, product innovation, risk management excellence, and customer experience optimization. The competitive landscape will continue evolving as traditional lenders adapt to digital transformation requirements while new entrants leverage technology advantages to capture market share.

Consumer benefits from market development include expanded access to cost-effective financing, improved product flexibility, and enhanced service delivery through digital platforms. Regulatory oversight ensures appropriate consumer protection while maintaining market accessibility and innovation potential.

Future market development will be shaped by demographic shifts, technological advancement, and evolving economic conditions. Successful market participants will be those who effectively balance innovation with risk management, customer service with operational efficiency, and growth ambitions with regulatory compliance requirements. The UK Home Equity Line of Credit market is positioned for continued expansion and evolution, providing valuable financial solutions for homeowners while generating sustainable returns for industry participants.

What is Home Equity Line of Credit?

A Home Equity Line of Credit (HELOC) is a financial product that allows homeowners to borrow against the equity in their property. It functions like a revolving credit line, enabling borrowers to access funds as needed for various purposes such as home improvements, debt consolidation, or education expenses.

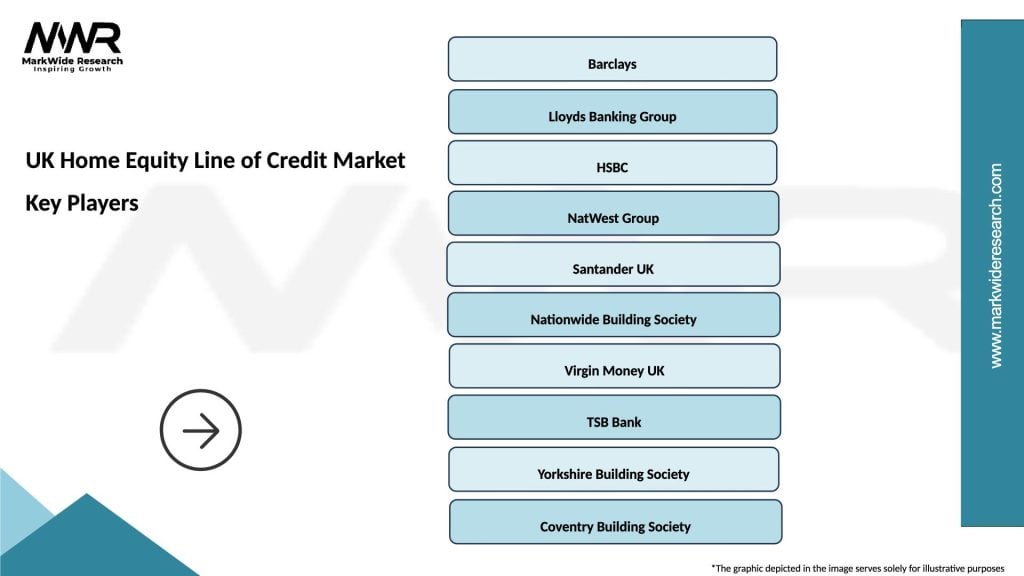

What are the key players in the UK Home Equity Line of Credit Market?

Key players in the UK Home Equity Line of Credit Market include major banks and financial institutions such as Barclays, Lloyds Banking Group, and Santander. These companies offer various HELOC products tailored to different consumer needs, among others.

What are the growth factors driving the UK Home Equity Line of Credit Market?

The UK Home Equity Line of Credit Market is driven by factors such as rising property values, increasing consumer demand for flexible financing options, and a growing trend of home renovations. Additionally, low-interest rates have made HELOCs more attractive to homeowners.

What challenges does the UK Home Equity Line of Credit Market face?

Challenges in the UK Home Equity Line of Credit Market include regulatory scrutiny, potential fluctuations in property values, and the risk of borrowers over-leveraging their homes. These factors can impact lender confidence and consumer borrowing behavior.

What opportunities exist in the UK Home Equity Line of Credit Market?

Opportunities in the UK Home Equity Line of Credit Market include the potential for product innovation, such as integrating digital platforms for easier access and management of HELOCs. Additionally, targeting underserved demographics can expand the customer base.

What trends are shaping the UK Home Equity Line of Credit Market?

Trends in the UK Home Equity Line of Credit Market include the increasing use of technology for application processes and customer service, as well as a shift towards more personalized lending solutions. There is also a growing awareness of financial literacy among consumers, influencing their borrowing decisions.

UK Home Equity Line of Credit Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed Rate, Variable Rate, Interest Only, Drawdown |

| Customer Type | Homeowners, Landlords, First-Time Buyers, Retirees |

| Loan Amount | Up to £25,000, £25,001 – £50,000, £50,001 – £100,000, Over £100,000 |

| Term Length | 5 Years, 10 Years, 15 Years, 20 Years |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Home Equity Line of Credit Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at