444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The UK Home Equity Lending Market has witnessed significant growth and evolution in recent years. Home equity lending refers to the practice of borrowing money against the equity built up in a property, allowing homeowners to access funds for various purposes, such as home improvements, debt consolidation, or funding major expenses. This financial product has gained popularity due to its flexibility and competitive interest rates.

Meaning

Home equity lending is a financial mechanism that enables homeowners to leverage the value of their properties to obtain loans or credit lines. The amount that can be borrowed is determined by the difference between the property’s current market value and the outstanding mortgage balance. As the property’s value appreciates or the mortgage is paid down, the available equity increases, providing homeowners with an opportunity to access additional funds.

Executive Summary

The UK Home Equity Lending Market has experienced robust growth over the past decade. Factors such as rising property prices, a stable economy, and low-interest rates have contributed to the increased demand for home equity loans and lines of credit. Financial institutions and lenders have responded by offering innovative and attractive home equity lending products to meet the diverse needs of consumers.

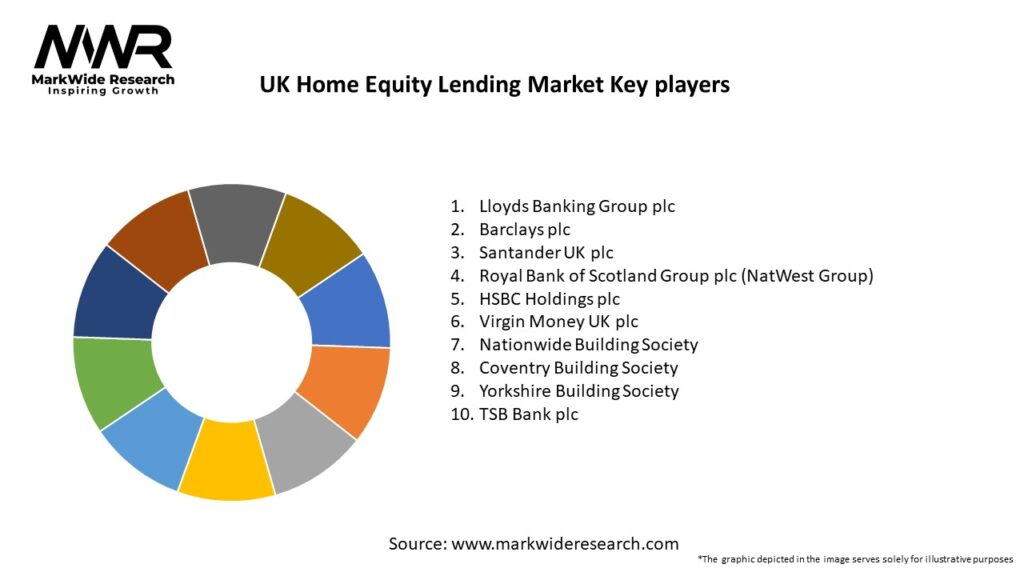

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UK Home Equity Lending Market is characterized by a delicate interplay of market drivers, restraints, and opportunities. Factors such as the property market’s stability, interest rates, regulatory environment, and consumer awareness significantly influence the dynamics of the market. While the sector has witnessed substantial growth, it is not without its challenges. Volatility in property prices, economic uncertainties, and the need to remain competitive in the financial landscape require industry players to stay agile and adaptive.

Regional Analysis

The demand for home equity lending varies across different regions of the UK, influenced by local property market conditions, economic factors, and demographics. Urban areas with higher property prices and stable economies generally exhibit greater demand for home equity loans. In contrast, rural areas might have a more subdued demand due to lower property values and less favorable economic conditions. The London and South East regions, being the economic powerhouses of the country, are expected to remain strong markets for home equity lending.

Competitive Landscape

Leading Companies in the UK Home Equity Lending Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

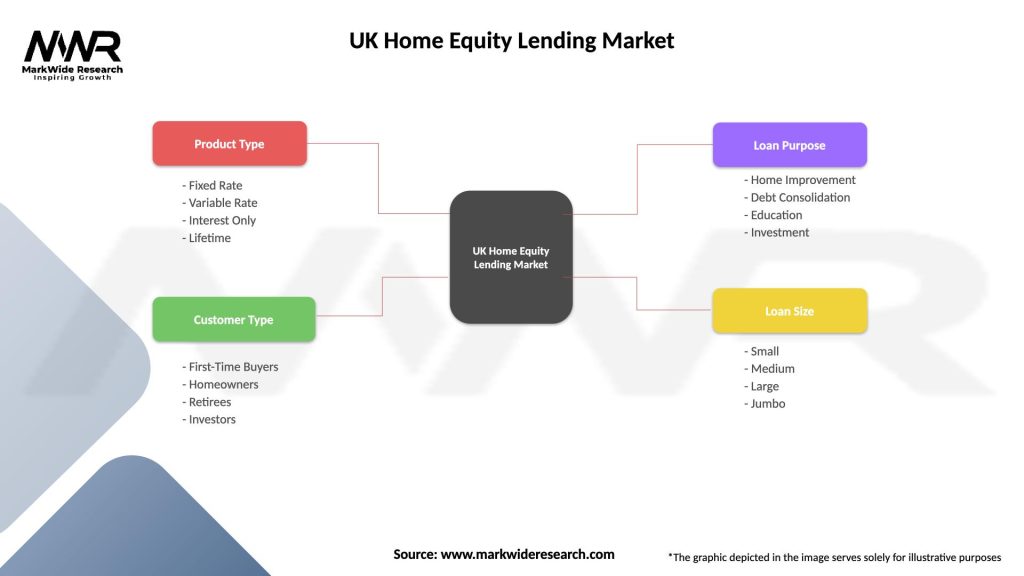

Segmentation

The UK Home Equity Lending Market can be segmented based on various factors, including borrower demographics, loan types, loan-to-value ratios, and geographic regions. Common segmentation includes:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had significant effects on the UK Home Equity Lending Market. During the initial phase of the pandemic, economic uncertainties and job losses affected borrower confidence, leading to a temporary slowdown in home equity lending. However, as the economy rebounded and interest rates remained low, the market quickly regained momentum. The pandemic also accelerated the adoption of digital lending platforms, as consumers preferred contactless and remote application processes.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the UK Home Equity Lending Market is optimistic. With continued economic recovery, low-interest rates, and a growing awareness of home equity lending, the demand for these products is likely to increase. As the industry adopts more advanced digital solutions, the lending process will become more efficient and accessible to a broader customer base. Lenders that prioritize customer-centric approaches and innovation are expected to thrive in this competitive market.

Conclusion

The UK Home Equity Lending Market has experienced significant growth and transformation over the years, driven by factors such as rising property prices, favorable interest rates, and innovative lending products. Despite challenges like property market volatility and regulatory changes, the industry has adapted and remained resilient. The future holds promising opportunities for lenders who prioritize digital transformation, customer-centricity, and tailored lending solutions. With prudent risk management practices and a commitment to responsible lending, the UK Home Equity Lending Market is poised for continued success in the years to come.

What is Home Equity Lending?

Home equity lending refers to the process of borrowing against the equity built up in a property. This type of lending allows homeowners to access funds for various purposes, such as home improvements, debt consolidation, or major purchases.

What are the key players in the UK Home Equity Lending Market?

Key players in the UK Home Equity Lending Market include major banks and financial institutions such as Lloyds Banking Group, Barclays, and Nationwide Building Society, among others.

What are the main drivers of the UK Home Equity Lending Market?

The main drivers of the UK Home Equity Lending Market include rising property values, increased consumer confidence, and a growing demand for home improvement financing. Additionally, low interest rates have made borrowing more attractive for homeowners.

What challenges does the UK Home Equity Lending Market face?

Challenges in the UK Home Equity Lending Market include regulatory scrutiny, potential economic downturns affecting property values, and the risk of borrowers defaulting on loans. These factors can create uncertainty for lenders and borrowers alike.

What opportunities exist in the UK Home Equity Lending Market?

Opportunities in the UK Home Equity Lending Market include the potential for innovative lending products tailored to specific consumer needs, such as flexible repayment options and digital lending platforms. Additionally, the growing trend of home renovations presents a significant market opportunity.

What trends are shaping the UK Home Equity Lending Market?

Trends shaping the UK Home Equity Lending Market include the rise of technology-driven lending solutions, increased focus on customer experience, and the growing popularity of equity release schemes. These trends are influencing how lenders engage with consumers and structure their offerings.

UK Home Equity Lending Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed Rate, Variable Rate, Interest Only, Lifetime |

| Customer Type | First-Time Buyers, Homeowners, Retirees, Investors |

| Loan Purpose | Home Improvement, Debt Consolidation, Education, Investment |

| Loan Size | Small, Medium, Large, Jumbo |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UK Home Equity Lending Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at