444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK health and medical insurance market represents a dynamic and rapidly evolving sector within the broader financial services landscape. This comprehensive market encompasses private medical insurance, health cash plans, and supplementary health coverage solutions that complement the National Health Service (NHS). Market dynamics indicate significant growth potential driven by increasing healthcare costs, longer waiting times for NHS services, and growing consumer awareness about preventive healthcare measures.

Current market trends show a substantial shift toward digital-first insurance products and personalized health coverage options. The market demonstrates robust expansion with a compound annual growth rate of 6.2%, reflecting strong consumer demand for private healthcare alternatives. Key market segments include individual medical insurance, group corporate schemes, and specialized health cash plans, each addressing distinct consumer needs and preferences.

Industry transformation is being driven by technological innovations, regulatory changes, and evolving consumer expectations. The integration of telemedicine services, mental health coverage, and wellness programs has become increasingly important for market participants seeking competitive differentiation.

The UK health and medical insurance market refers to the comprehensive ecosystem of private insurance products designed to provide healthcare coverage beyond what is available through the National Health Service. This market encompasses various insurance products including private medical insurance (PMI), health cash plans, dental insurance, and critical illness coverage that offer individuals and organizations additional healthcare security and choice.

Market participants include established insurance providers, specialized health insurers, and emerging digital-first companies that deliver innovative coverage solutions. The market serves both individual consumers seeking personal health protection and corporate clients requiring employee benefit packages. Coverage options range from basic outpatient services to comprehensive inpatient care, with many policies now including mental health support, alternative therapies, and preventive care services.

Market performance in the UK health and medical insurance sector demonstrates sustained growth momentum driven by multiple converging factors. The increasing pressure on NHS services, combined with rising consumer expectations for immediate healthcare access, has created substantial opportunities for private insurance providers. Digital transformation initiatives have revolutionized product delivery, customer engagement, and claims processing, resulting in improved customer satisfaction rates of 78% across major providers.

Competitive landscape features both traditional insurance giants and innovative newcomers leveraging technology to deliver superior customer experiences. The market shows strong segmentation with distinct growth patterns across individual, corporate, and specialized insurance categories. Regulatory compliance remains a critical factor, with providers adapting to evolving Financial Conduct Authority requirements while maintaining competitive pricing structures.

Future growth prospects appear robust, supported by demographic trends, increasing health consciousness, and continued NHS capacity constraints. The integration of artificial intelligence, predictive analytics, and personalized health management tools represents significant opportunities for market expansion and customer value creation.

Strategic market analysis reveals several critical insights that define the current landscape and future trajectory of the UK health and medical insurance market:

Primary growth drivers propelling the UK health and medical insurance market forward include several interconnected factors that create sustained demand for private healthcare coverage. NHS capacity constraints represent the most significant driver, with increasing waiting times for non-emergency procedures encouraging consumers to seek private alternatives.

Demographic trends play a crucial role in market expansion, particularly the aging population requiring more frequent healthcare services. The growing awareness of preventive healthcare benefits has shifted consumer behavior toward proactive health management, driving demand for comprehensive insurance coverage that includes wellness programs and regular health screenings.

Corporate demand for employee benefit packages continues to strengthen as organizations recognize the value of health insurance in talent attraction and retention. Workplace wellness initiatives have become integral to corporate culture, with employers increasingly viewing health insurance as essential infrastructure for maintaining productive workforces.

Technological advancement serves as both a driver and enabler, with digital health platforms, telemedicine services, and AI-powered health management tools creating new value propositions for consumers. The integration of wearable technology and health monitoring devices has opened new opportunities for personalized insurance products and risk assessment.

Significant challenges facing the UK health and medical insurance market include cost pressures, regulatory complexity, and competitive dynamics that can limit growth potential. Premium affordability remains a primary concern for many consumers, particularly during economic uncertainty when discretionary spending faces scrutiny.

Regulatory compliance costs continue to impact market participants, with evolving Financial Conduct Authority requirements necessitating substantial investments in compliance infrastructure and reporting systems. These regulatory burdens can disproportionately affect smaller market participants and new entrants seeking to establish market presence.

Market saturation in certain segments, particularly among higher-income demographics, limits expansion opportunities and intensifies competition for market share. The challenge of differentiating products in a mature market requires continuous innovation and significant marketing investments.

Economic volatility affects consumer spending patterns and corporate benefit budgets, creating cyclical demand fluctuations that can impact long-term growth projections. Healthcare inflation outpacing general economic growth creates ongoing pressure on premium pricing and policy sustainability.

Emerging opportunities within the UK health and medical insurance market present substantial potential for growth and innovation. Underserved demographics represent significant expansion possibilities, particularly younger consumers and middle-income households who may benefit from tailored, affordable insurance products.

Digital health integration offers transformative opportunities for product innovation and customer engagement. The development of AI-powered health coaching, predictive health analytics, and personalized wellness programs can create competitive advantages while delivering genuine value to policyholders.

Partnership opportunities with healthcare providers, technology companies, and wellness platforms can expand service offerings and improve customer experiences. Integrated care models that combine insurance coverage with direct healthcare provision represent innovative approaches to market positioning.

Specialized coverage areas such as mental health, fertility treatments, and alternative therapies present niche opportunities for market differentiation. The growing acceptance and demand for holistic healthcare approaches create space for innovative insurance products that address evolving consumer needs.

Complex market dynamics shape the competitive landscape and influence strategic decision-making across the UK health and medical insurance sector. Supply and demand equilibrium continues to evolve as new market entrants challenge established players while consumer expectations rise regarding service quality and digital capabilities.

Pricing dynamics reflect the balance between competitive pressure and cost inflation, with providers seeking to maintain profitability while offering attractive value propositions. Risk assessment sophistication has improved significantly through data analytics and predictive modeling, enabling more accurate pricing and better risk management.

Customer acquisition costs have increased as digital marketing channels become more competitive, requiring providers to optimize their marketing strategies and focus on customer lifetime value rather than short-term acquisition metrics. Retention strategies have become increasingly important as switching costs decrease and consumer choice expands.

Technological disruption continues to reshape market dynamics, with insurtech companies introducing innovative business models and customer experiences that challenge traditional approaches. According to MarkWide Research analysis, digital transformation initiatives have improved operational efficiency by 35% across leading providers.

Comprehensive research methodology employed in analyzing the UK health and medical insurance market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive surveys of insurance providers, healthcare professionals, and consumers to gather firsthand insights into market trends and preferences.

Secondary research encompasses analysis of industry reports, regulatory filings, financial statements, and market intelligence from authoritative sources. Quantitative analysis involves statistical modeling of market trends, growth patterns, and competitive dynamics to identify significant relationships and project future developments.

Qualitative research methods include in-depth interviews with industry executives, regulatory officials, and market experts to gain deeper understanding of strategic challenges and opportunities. Market segmentation analysis employs advanced clustering techniques to identify distinct consumer groups and their specific needs.

Data validation processes ensure information accuracy through cross-referencing multiple sources and applying statistical significance tests to key findings. Trend analysis utilizes time-series data to identify cyclical patterns and long-term growth trajectories within different market segments.

Regional market distribution across the UK reveals significant variations in health insurance penetration, consumer preferences, and growth opportunities. London and Southeast England dominate market activity, accounting for approximately 47% of total market share, driven by higher income levels, greater health consciousness, and proximity to private healthcare facilities.

Northern England represents an emerging growth region with increasing corporate adoption of employee health benefits and rising consumer awareness of private healthcare options. Market penetration rates in this region have grown by 23% over the past three years, indicating substantial expansion potential.

Scotland and Wales demonstrate unique market characteristics influenced by devolved healthcare policies and different demographic profiles. These regions show strong preference for basic coverage options and employer-sponsored schemes, with corporate segment growth outpacing individual market expansion.

Regional healthcare infrastructure variations impact insurance product design and pricing strategies, with providers adapting offerings to reflect local healthcare provider networks and service availability. Urban versus rural market dynamics create distinct opportunities for targeted product development and distribution strategies.

Market leadership in the UK health and medical insurance sector is characterized by intense competition among established insurers and emerging digital-first companies. Key market participants include:

Competitive strategies increasingly emphasize digital transformation, customer experience enhancement, and value-added services beyond traditional insurance coverage. Market consolidation trends suggest potential merger and acquisition activity as companies seek scale advantages and expanded capabilities.

Market segmentation within the UK health and medical insurance sector reveals distinct categories based on coverage type, customer demographics, and distribution channels. Primary segmentation includes:

By Coverage Type:

By Customer Type:

By Distribution Channel:

Private Medical Insurance (PMI) continues to dominate the market landscape, representing the most comprehensive and sought-after coverage option. Premium PMI products include extensive hospital networks, consultant choice, and rapid access to treatments, appealing to affluent consumers seeking maximum healthcare flexibility.

Health Cash Plans demonstrate strong growth potential among cost-conscious consumers seeking affordable healthcare support. These products typically cover routine expenses such as dental check-ups, optical care, and physiotherapy, providing accessible entry points into private healthcare coverage.

Corporate group schemes represent the fastest-growing segment, with employee benefit adoption rates increasing by 28% annually as employers recognize health insurance as essential talent management tools. Flexible benefit platforms allow employees to customize coverage based on individual needs and preferences.

Digital-first products are gaining traction among younger demographics who prefer mobile-centric experiences and streamlined claims processes. These products often feature telemedicine integration, AI-powered health coaching, and gamified wellness programs that encourage healthy behaviors.

Specialized coverage areas such as mental health insurance and fertility treatment coverage are experiencing rapid growth as social attitudes evolve and awareness increases. Mental health claims now represent 31% of total claims volume, reflecting changing healthcare priorities and reduced stigma around mental health treatment.

Insurance providers benefit from expanding market opportunities, diversified revenue streams, and enhanced customer relationships through comprehensive health coverage offerings. Digital transformation initiatives enable operational efficiency improvements, cost reduction, and superior customer experiences that drive competitive advantage.

Healthcare providers gain access to additional patient volumes, reduced payment delays, and opportunities for premium service delivery through private insurance partnerships. Network participation in insurance schemes provides revenue stability and market positioning advantages.

Employers utilizing group health insurance schemes benefit from improved employee satisfaction, reduced absenteeism, and enhanced talent attraction capabilities. Workplace wellness programs integrated with health insurance contribute to productivity improvements and reduced healthcare costs.

Consumers enjoy expanded healthcare choices, reduced waiting times, and access to premium medical services that complement NHS provision. Preventive care benefits support early intervention and long-term health maintenance, potentially reducing overall healthcare costs.

Technology partners and service providers benefit from growing demand for digital health solutions, data analytics platforms, and integrated care management systems. Innovation opportunities in telemedicine, wearable technology, and AI-powered health coaching create new revenue streams and market positioning possibilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the UK health and medical insurance market, with providers investing heavily in mobile applications, online platforms, and automated claims processing systems. Customer experience enhancement through digital channels has become a primary competitive differentiator.

Personalization trends are driving the development of customized insurance products that adapt to individual health profiles, lifestyle factors, and coverage preferences. Data analytics enable more sophisticated risk assessment and pricing models that better reflect individual risk characteristics.

Wellness integration has evolved from optional add-on services to core product features, with insurers partnering with fitness platforms, nutrition apps, and mental health providers to deliver comprehensive health management solutions. Preventive care emphasis reflects changing consumer priorities and potential cost savings for insurers.

Telemedicine adoption has accelerated significantly, with virtual consultations becoming standard policy inclusions. Remote healthcare delivery offers convenience for consumers while providing cost-effective service delivery for insurers.

Mental health coverage expansion reflects growing awareness and reduced stigma around mental health treatment. Comprehensive mental health benefits are increasingly viewed as essential policy components rather than optional extras.

Recent industry developments highlight the dynamic nature of the UK health and medical insurance market and the continuous evolution of products, services, and business models. Regulatory updates from the Financial Conduct Authority have strengthened consumer protection while encouraging innovation in product design and distribution.

Technology partnerships between traditional insurers and healthtech companies have accelerated, creating integrated platforms that combine insurance coverage with health monitoring, wellness coaching, and preventive care services. Strategic alliances enable rapid capability development without extensive internal investment.

Market consolidation activity has increased as companies seek scale advantages and expanded geographic coverage. Merger and acquisition transactions reflect the industry’s maturation and the need for operational efficiency in competitive markets.

Product innovation continues with the launch of usage-based insurance models, outcome-based coverage options, and integrated health management platforms. Customer-centric design principles drive product development focused on simplicity, transparency, and value delivery.

Sustainability initiatives are gaining prominence as insurers recognize environmental and social governance responsibilities. Green health insurance products that promote sustainable healthcare practices represent emerging market opportunities.

Strategic recommendations for market participants focus on leveraging technology, expanding customer segments, and enhancing value propositions to maintain competitive advantage. Digital investment priorities should emphasize customer experience improvement, operational efficiency, and data analytics capabilities that enable personalized product offerings.

Market expansion strategies should target underserved demographics, particularly younger consumers and middle-income households through affordable, flexible coverage options. Regional growth opportunities exist outside traditional strongholds, requiring tailored marketing approaches and local partnership development.

Product development focus should emphasize integration of wellness services, mental health coverage, and preventive care benefits that align with evolving consumer priorities. Value-based pricing models that reward healthy behaviors and preventive care engagement can differentiate offerings while managing risk.

Partnership strategies with healthcare providers, technology companies, and wellness platforms can expand service capabilities while sharing development costs and risks. Ecosystem development creates competitive moats and enhances customer retention through integrated service delivery.

Regulatory compliance excellence should be viewed as competitive advantage rather than burden, with proactive engagement in policy development and transparent customer communication building trust and market credibility.

Long-term market prospects for the UK health and medical insurance sector appear robust, supported by demographic trends, technological advancement, and evolving healthcare needs. MWR projections indicate sustained growth momentum with particular strength in corporate segments and digital-first product categories.

Technology integration will continue reshaping market dynamics, with artificial intelligence, machine learning, and predictive analytics enabling more sophisticated risk assessment, personalized pricing, and proactive health management. Digital health platforms will become increasingly central to insurance value propositions.

Market maturation is expected to drive consolidation among smaller players while creating opportunities for specialized providers focusing on niche segments or innovative service delivery models. Competitive differentiation will increasingly depend on customer experience quality and integrated health management capabilities.

Regulatory evolution will likely emphasize consumer protection, market transparency, and innovation encouragement, creating both challenges and opportunities for market participants. Policy developments may influence product design requirements and distribution practices.

Consumer expectations will continue evolving toward greater personalization, digital convenience, and comprehensive health support beyond traditional insurance coverage. Successful providers will be those that adapt quickly to changing preferences while maintaining operational efficiency and regulatory compliance.

The UK health and medical insurance market stands at a pivotal juncture, characterized by strong growth fundamentals, technological transformation, and evolving consumer expectations. Market dynamics favor providers that embrace digital innovation, focus on customer experience, and develop comprehensive health management solutions beyond traditional insurance coverage.

Competitive success will increasingly depend on the ability to integrate technology, wellness services, and personalized care management into cohesive value propositions that address the full spectrum of consumer health needs. Strategic positioning should emphasize complementarity with NHS services while delivering clear value through improved access, choice, and service quality.

Future growth opportunities remain substantial, particularly in underserved market segments, regional expansion, and innovative product categories that address emerging health priorities such as mental wellness, preventive care, and integrated health management. Market participants that successfully navigate regulatory requirements, technological change, and competitive pressures will be well-positioned to capitalize on the sector’s continued expansion and evolution.

What is Health And Medical Insurance?

Health and medical insurance refers to coverage that pays for medical expenses incurred by the insured. This can include hospital visits, surgeries, and preventive care, ensuring individuals have access to necessary healthcare services.

What are the key players in the UK Health And Medical Insurance Market?

Key players in the UK Health And Medical Insurance Market include Bupa, AXA Health, and Aviva, among others. These companies offer a range of health insurance products catering to individuals and businesses.

What are the main drivers of the UK Health And Medical Insurance Market?

The main drivers of the UK Health And Medical Insurance Market include an increasing aging population, rising healthcare costs, and a growing awareness of health and wellness. These factors contribute to a higher demand for comprehensive health insurance coverage.

What challenges does the UK Health And Medical Insurance Market face?

The UK Health And Medical Insurance Market faces challenges such as regulatory changes, competition from public healthcare systems, and rising claims costs. These factors can impact profitability and market dynamics.

What opportunities exist in the UK Health And Medical Insurance Market?

Opportunities in the UK Health And Medical Insurance Market include the expansion of digital health services, personalized insurance plans, and the integration of telemedicine. These trends can enhance customer engagement and improve service delivery.

What trends are shaping the UK Health And Medical Insurance Market?

Trends shaping the UK Health And Medical Insurance Market include the rise of health technology solutions, increased focus on mental health coverage, and the growing popularity of wellness programs. These trends reflect changing consumer preferences and the evolving healthcare landscape.

UK Health And Medical Insurance Market

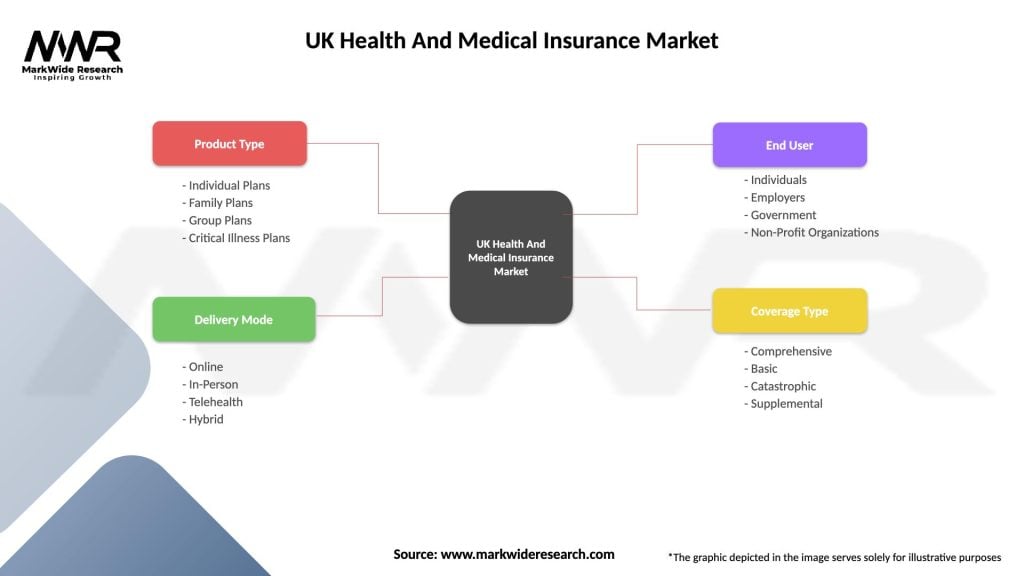

| Segmentation Details | Description |

|---|---|

| Product Type | Individual Plans, Family Plans, Group Plans, Critical Illness Plans |

| Delivery Mode | Online, In-Person, Telehealth, Hybrid |

| End User | Individuals, Employers, Government, Non-Profit Organizations |

| Coverage Type | Comprehensive, Basic, Catastrophic, Supplemental |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Health And Medical Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at