444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK hair care market represents one of the most dynamic and rapidly evolving segments within the broader personal care industry. Consumer preferences are shifting dramatically toward premium, sustainable, and personalized hair care solutions, driving unprecedented innovation across product categories. The market encompasses a comprehensive range of products including shampoos, conditioners, styling products, treatments, and specialized formulations targeting specific hair concerns.

Market dynamics indicate robust growth driven by increasing consumer awareness about hair health, rising disposable income, and the influence of social media on beauty trends. The sector has experienced a 6.2% annual growth rate over the past three years, with premium and organic segments showing particularly strong performance. Digital transformation has revolutionized how consumers discover, purchase, and engage with hair care brands, creating new opportunities for both established players and emerging companies.

Regional distribution shows London and Southeast England commanding approximately 35% market share, followed by the Midlands and Northern regions. The market’s resilience during economic uncertainties demonstrates the essential nature of hair care products in consumer spending patterns, with professional salon treatments and at-home care solutions both contributing significantly to overall market expansion.

The UK hair care market refers to the comprehensive ecosystem of products, services, and technologies designed to cleanse, condition, style, and treat hair across diverse consumer segments. This market encompasses traditional retail channels, professional salon services, e-commerce platforms, and subscription-based delivery models that cater to the evolving needs of British consumers.

Market scope includes mass-market brands available in supermarkets and pharmacies, premium products sold through specialty beauty retailers, professional-grade formulations used in salons, and innovative direct-to-consumer brands leveraging digital marketing strategies. The definition extends beyond basic cleansing products to include specialized treatments for hair loss, scalp conditions, color protection, and styling solutions that address specific hair types and concerns.

Contemporary market understanding recognizes hair care as an integral component of personal wellness and self-expression, with consumers increasingly viewing hair health as connected to overall well-being. This holistic approach has expanded the market to include nutritional supplements, scalp care devices, and personalized formulation services that create customized products based on individual hair analysis and lifestyle factors.

Strategic market analysis reveals the UK hair care sector is experiencing transformative growth driven by consumer demand for premium, sustainable, and technologically advanced products. The market demonstrates remarkable resilience and adaptability, with companies successfully navigating supply chain challenges while maintaining innovation momentum across multiple product categories.

Key performance indicators show consistent expansion across all major segments, with natural and organic formulations experiencing 12.8% growth rate compared to conventional products. The rise of personalized hair care solutions represents a significant market opportunity, with customization services gaining traction among younger demographics who prioritize individualized beauty experiences.

Competitive landscape features established multinational corporations alongside innovative startup brands that leverage direct-to-consumer models and social media marketing. The market’s evolution toward sustainability has created new competitive advantages for brands demonstrating genuine environmental commitment through packaging innovations, ingredient sourcing, and carbon-neutral operations.

Future trajectory indicates continued growth supported by technological advancement, demographic shifts, and changing lifestyle patterns. The integration of artificial intelligence in product recommendation systems and the expansion of subscription-based services position the market for sustained long-term expansion across traditional and digital channels.

Consumer behavior analysis reveals fundamental shifts in how British consumers approach hair care, with emphasis moving from basic cleansing to comprehensive hair health management. The following insights demonstrate the market’s current dynamics:

Market penetration data indicates strong adoption rates across all age groups, with millennials and Generation Z consumers showing particular enthusiasm for innovative formulations and sustainable packaging solutions.

Primary growth drivers propelling the UK hair care market forward encompass demographic, technological, and cultural factors that create sustained demand for innovative products and services. These drivers work synergistically to expand market opportunities across multiple consumer segments.

Demographic influences include an aging population seeking anti-aging hair solutions, increasing ethnic diversity driving demand for specialized products, and rising female workforce participation supporting premium product adoption. The growing awareness of hair health’s connection to overall wellness has elevated hair care from basic hygiene to essential self-care, encouraging consumers to invest in higher-quality products.

Technological advancement enables the development of sophisticated formulations incorporating cutting-edge ingredients like peptides, plant stem cells, and microencapsulated vitamins. Innovation in packaging technology supports sustainability goals while maintaining product efficacy, and digital tools facilitate personalized product recommendations based on individual hair analysis and lifestyle factors.

Cultural shifts toward self-expression and personal branding drive demand for diverse styling products and color treatments. The influence of social media beauty trends creates rapid adoption cycles for new products, while increasing environmental consciousness supports the growth of sustainable and ethically sourced formulations. Professional salon closures during recent disruptions accelerated the adoption of premium at-home treatments, permanently expanding this market segment.

Market challenges present obstacles that companies must navigate to maintain growth momentum and market position. These restraints require strategic responses and innovative solutions to minimize their impact on overall market development.

Economic pressures including inflation and reduced disposable income affect consumer spending patterns, potentially shifting demand toward lower-priced alternatives. Supply chain disruptions impact ingredient availability and manufacturing costs, while regulatory changes regarding cosmetic ingredients require reformulation investments and compliance expenses that particularly burden smaller companies.

Competitive intensity creates pricing pressures and marketing cost inflation as brands compete for consumer attention across crowded retail and digital channels. The proliferation of new brands makes market differentiation increasingly challenging, while established players leverage economies of scale to maintain competitive advantages that newer entrants struggle to match.

Consumer skepticism regarding marketing claims and ingredient efficacy requires substantial investment in clinical testing and transparent communication. The complexity of hair care science makes it difficult for consumers to evaluate product benefits, leading to decision paralysis and brand switching behavior that affects customer loyalty and lifetime value calculations.

Emerging opportunities within the UK hair care market present significant potential for companies willing to invest in innovation and adapt to changing consumer preferences. These opportunities span product development, distribution channels, and service delivery models.

Personalization technology offers substantial growth potential through AI-powered product recommendation systems and custom formulation services. The integration of hair analysis tools with mobile applications enables brands to offer truly personalized solutions, while subscription models provide predictable revenue streams and enhanced customer relationships.

Sustainability initiatives create competitive advantages for brands demonstrating genuine environmental commitment. Opportunities include refillable packaging systems, waterless formulations, and carbon-neutral supply chains that appeal to environmentally conscious consumers. The development of biodegradable ingredients and plastic-free packaging solutions addresses growing regulatory pressures while meeting consumer expectations.

Digital transformation enables new business models including virtual consultations, augmented reality try-on experiences, and social commerce integration. The expansion of direct-to-consumer channels allows brands to build stronger customer relationships while improving profit margins through reduced retail intermediation.

Demographic targeting presents opportunities in underserved segments including men’s grooming, senior hair care, and products for specific ethnic hair types. The growing awareness of scalp health creates demand for specialized treatments, while the trend toward gender-neutral products opens new market categories.

Market forces interact dynamically to shape the competitive landscape and influence strategic decision-making across the UK hair care sector. Understanding these dynamics enables companies to anticipate changes and position themselves advantageously for future growth.

Supply and demand equilibrium reflects strong consumer appetite for innovative products balanced against manufacturing capacity and ingredient availability. Recent supply chain challenges have highlighted the importance of diversified sourcing strategies and local production capabilities. Companies investing in supply chain resilience demonstrate 15-20% better performance during disruption periods compared to those relying on single-source suppliers.

Innovation cycles accelerate as companies compete to introduce breakthrough formulations and delivery systems. The integration of biotechnology and nanotechnology in hair care products creates new efficacy standards while requiring substantial research and development investments. Successful innovation translates to market share gains, with companies introducing breakthrough technologies typically achieving 8-12% market share increases within two years of launch.

Consumer empowerment through digital platforms enables rapid feedback loops and direct brand communication, forcing companies to maintain high quality standards and responsive customer service. Social media influence creates viral marketing opportunities while also amplifying negative experiences, making brand reputation management increasingly critical for sustained success.

Comprehensive research approach employed in analyzing the UK hair care market combines quantitative data analysis with qualitative consumer insights to provide accurate market intelligence and strategic recommendations. The methodology ensures reliability and validity of findings through multiple data validation techniques.

Primary research includes consumer surveys conducted across diverse demographic segments, in-depth interviews with industry executives, and focus groups examining product preferences and purchasing behavior. Retail audits and point-of-sale data collection provide real-time market performance metrics, while expert interviews with dermatologists and trichologists offer scientific perspectives on product efficacy and market trends.

Secondary research encompasses analysis of company financial reports, regulatory filings, and industry publications to establish market baselines and competitive positioning. Patent analysis reveals innovation trends and technological developments, while social media monitoring provides insights into consumer sentiment and emerging trends.

Data validation processes include cross-referencing multiple sources, statistical significance testing, and peer review by industry experts. MarkWide Research analytical frameworks ensure consistency and accuracy across all research components, while regular methodology updates incorporate new data sources and analytical techniques to maintain research quality standards.

Geographic distribution across the UK reveals distinct regional preferences and market characteristics that influence product positioning and distribution strategies. Regional analysis provides insights into local consumer behavior and competitive dynamics.

London and Southeast England dominate market activity with approximately 35% of total market share, driven by higher disposable income, diverse population demographics, and concentration of premium retail outlets. This region shows strong preference for luxury and organic products, with consumers willing to pay premium prices for innovative formulations and sustainable packaging.

Northern England and Scotland represent 28% of market activity, characterized by value-conscious consumers who prioritize product efficacy over premium branding. These regions show growing adoption of online purchasing channels and subscription services, particularly among younger demographics seeking convenience and competitive pricing.

Midlands and Wales account for 22% of market share, demonstrating balanced preferences between premium and mass-market products. These regions exhibit strong loyalty to established brands while showing increasing interest in natural and organic formulations, particularly among families with children.

Regional opportunities include targeted product development for specific climate conditions, localized marketing campaigns addressing cultural preferences, and distribution partnerships with regional retailers. The expansion of e-commerce infrastructure enables smaller brands to access previously underserved regional markets while established companies can optimize their supply chain efficiency.

Market competition features a diverse ecosystem of multinational corporations, regional brands, and innovative startups competing across multiple product categories and price points. The competitive environment drives continuous innovation while creating opportunities for differentiation through specialized positioning.

Emerging competitors include direct-to-consumer brands leveraging digital marketing and personalization technology, while niche players focus on specific consumer segments such as curly hair specialists and men’s grooming brands.

Market segmentation analysis reveals distinct consumer groups with specific needs, preferences, and purchasing behaviors that require tailored product development and marketing strategies.

By Product Type:

By Hair Type:

By Demographics:

Detailed category analysis provides specific insights into performance drivers and growth opportunities within each major product segment of the UK hair care market.

Shampoo Category: Represents the largest market segment with consistent demand across all consumer demographics. Sulfate-free formulations show 18% higher growth rates compared to traditional formulas, driven by consumer awareness of ingredient gentleness. Premium shampoos incorporating botanical extracts and protein complexes command higher price points while demonstrating superior customer loyalty rates.

Treatment Products: Fastest-growing category with consumers increasingly investing in intensive care solutions. Hair masks and serums show particularly strong performance, with weekly treatment products experiencing 22% annual growth. The integration of professional-grade ingredients in consumer products drives premium positioning and market expansion.

Styling Products: Evolution toward multifunctional formulations that provide hold while offering hair health benefits. Heat protection products gain importance as styling tool usage increases, while natural hold products appeal to consumers seeking chemical-free alternatives. The category benefits from social media influence driving trend adoption and product trial.

Color Products: Home coloring solutions gain market share as consumers seek salon-quality results with convenience and cost savings. Semi-permanent options appeal to experimental consumers, while gray coverage solutions address aging population needs. Innovation in application methods and color longevity drives category differentiation.

Strategic advantages available to industry participants span multiple areas of value creation, from operational efficiency to market positioning and customer relationship development.

For Manufacturers:

For Retailers:

For Consumers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the UK hair care market reflect broader societal changes and technological advancement that create new opportunities while challenging traditional business models.

Clean Beauty Movement: Consumers increasingly demand transparent ingredient lists and chemical-free formulations, driving growth in natural and organic product segments. This trend extends beyond ingredients to include sustainable packaging and ethical sourcing practices that demonstrate genuine environmental commitment.

Personalization Revolution: Technology-enabled customization allows brands to offer bespoke formulations based on individual hair analysis, lifestyle factors, and personal preferences. AI-powered recommendation systems and subscription models create deeper customer relationships while improving product efficacy and satisfaction rates.

Professional-Consumer Convergence: The line between professional salon products and consumer formulations continues to blur as brands introduce salon-quality ingredients in retail products. This trend accelerated during salon closures, with consumers seeking professional results from home-use products.

Wellness Integration: Hair care increasingly viewed as component of overall wellness, with products incorporating aromatherapy benefits, stress-relief properties, and scalp health optimization. The connection between hair health and nutrition drives demand for supplement integration and holistic treatment approaches.

Digital-First Brands: New companies launching exclusively through digital channels leverage social media marketing, influencer partnerships, and direct-to-consumer models to build brand awareness and customer loyalty without traditional retail infrastructure investments.

Recent industry developments demonstrate the dynamic nature of the UK hair care market and highlight strategic initiatives that shape competitive positioning and market evolution.

Sustainability Initiatives: Major brands announce carbon-neutral commitments and plastic-free packaging goals, with several companies introducing refillable systems and biodegradable formulations. These initiatives respond to consumer environmental concerns while creating competitive differentiation opportunities.

Technology Integration: Companies invest in AI-powered personalization platforms and virtual consultation tools that enhance customer experience while generating valuable consumer data. Mobile applications incorporating hair analysis technology enable precise product recommendations and track treatment progress over time.

Acquisition Activity: Consolidation continues as established companies acquire innovative startups to access new technologies and consumer segments. These acquisitions typically focus on digital-native brands, sustainable formulation expertise, and specialized demographic targeting.

Regulatory Compliance: Industry adapts to evolving regulations regarding ingredient safety and marketing claims, with companies investing in clinical testing and transparent communication strategies. New labeling requirements drive reformulation efforts and supply chain adjustments across multiple product categories.

Retail Evolution: Traditional retailers expand beauty services and experiential shopping opportunities, while e-commerce platforms introduce virtual try-on technology and subscription services that enhance online shopping experiences for hair care products.

Strategic recommendations for market participants focus on leveraging emerging opportunities while mitigating competitive risks through innovation, positioning, and operational excellence.

Innovation Investment: Companies should prioritize research and development in personalization technology, sustainable formulations, and multifunctional products that address multiple hair concerns simultaneously. Investment in clinical testing and efficacy validation supports premium positioning and builds consumer trust in an increasingly skeptical market environment.

Digital Transformation: Brands must develop comprehensive omnichannel strategies that integrate traditional retail with e-commerce platforms and social media marketing. MarkWide Research analysis indicates companies with strong digital presence achieve 25% higher customer retention rates compared to traditional retail-focused competitors.

Sustainability Leadership: Environmental initiatives should extend beyond marketing messages to include genuine operational changes in packaging design, ingredient sourcing, and manufacturing processes. Companies demonstrating authentic sustainability commitment typically achieve premium pricing power and enhanced brand loyalty among environmentally conscious consumers.

Market Segmentation: Targeted approaches addressing specific demographic groups, hair types, and lifestyle preferences create opportunities for specialized positioning and reduced competitive pressure. Focus on underserved segments such as men’s grooming, senior hair care, and ethnic hair specialization offers growth potential with less established competition.

Partnership Strategies: Collaboration with professional salons, dermatologists, and wellness practitioners enhances credibility while expanding distribution reach. Strategic partnerships with technology companies enable access to advanced personalization capabilities without substantial internal development investments.

Long-term market projections indicate sustained growth driven by technological innovation, demographic changes, and evolving consumer preferences that create new opportunities across traditional and emerging product categories.

Technology Integration will accelerate with artificial intelligence and machine learning enabling increasingly sophisticated personalization capabilities. Biotechnology advancement will introduce new active ingredients with enhanced efficacy, while nanotechnology applications improve product delivery and performance. The integration of IoT devices and smart packaging will provide real-time usage data and personalized recommendations.

Sustainability Evolution will move beyond current initiatives to include circular economy principles, carbon-negative formulations, and regenerative ingredient sourcing. Consumer expectations for environmental responsibility will drive innovation in waterless products, solid formulations, and biodegradable packaging systems that minimize environmental impact throughout product lifecycles.

Market Expansion opportunities include wellness integration connecting hair care with overall health monitoring, professional service expansion through at-home salon experiences, and global brand extension leveraging UK market success. MWR projections suggest the market will experience sustained growth rates of 5-7% annually over the next five years, driven primarily by premium and personalized product segments.

Consumer Evolution will continue toward informed purchasing decisions based on ingredient transparency, clinical efficacy, and brand authenticity. The rise of conscious consumerism will reward companies demonstrating genuine commitment to social responsibility and environmental stewardship while penalizing those perceived as engaging in superficial marketing tactics.

The UK hair care market represents a dynamic and rapidly evolving sector characterized by strong consumer demand, continuous innovation, and significant growth opportunities across multiple product categories and consumer segments. Market fundamentals remain robust despite economic uncertainties, with consumers demonstrating consistent willingness to invest in hair health and appearance enhancement.

Strategic success in this competitive environment requires companies to balance innovation investment with operational efficiency while maintaining authentic connections with increasingly sophisticated consumers. The convergence of sustainability trends, personalization technology, and digital transformation creates unprecedented opportunities for brands willing to adapt their strategies and embrace emerging market dynamics.

Future market leaders will distinguish themselves through genuine innovation, transparent communication, and sustainable business practices that align with evolving consumer values. The integration of advanced technology with natural formulations and personalized experiences positions the UK hair care market for continued expansion and evolution, making it an attractive sector for both established companies and emerging brands seeking growth opportunities in the personal care industry.

What is Hair Care?

Hair care refers to the practices and products used to maintain and enhance the health and appearance of hair. This includes a variety of products such as shampoos, conditioners, styling agents, and treatments designed for different hair types and concerns.

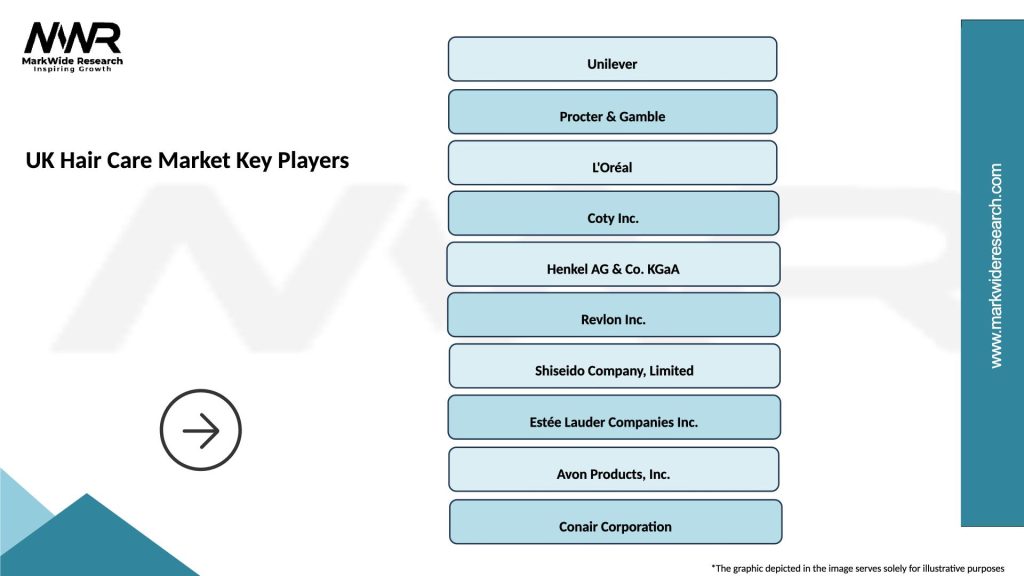

What are the key companies in the UK Hair Care Market?

Key companies in the UK Hair Care Market include L’Oréal, Procter & Gamble, Unilever, and Coty, among others. These companies offer a wide range of products catering to various consumer needs and preferences.

What are the growth factors driving the UK Hair Care Market?

The UK Hair Care Market is driven by increasing consumer awareness about personal grooming, the rise in demand for organic and natural hair care products, and the influence of social media on beauty trends. Additionally, innovations in product formulations are attracting more consumers.

What challenges does the UK Hair Care Market face?

The UK Hair Care Market faces challenges such as intense competition among brands, changing consumer preferences towards sustainable products, and regulatory pressures regarding product safety and ingredient transparency. These factors can impact market dynamics and brand loyalty.

What opportunities exist in the UK Hair Care Market?

Opportunities in the UK Hair Care Market include the growing trend of personalized hair care solutions, the expansion of e-commerce platforms for product distribution, and the increasing popularity of hair care services in salons. These trends present avenues for innovation and market growth.

What trends are shaping the UK Hair Care Market?

Trends shaping the UK Hair Care Market include the rise of clean beauty products, the incorporation of technology in hair care routines, and the focus on inclusivity in product offerings. Consumers are increasingly seeking products that cater to diverse hair types and concerns.

UK Hair Care Market

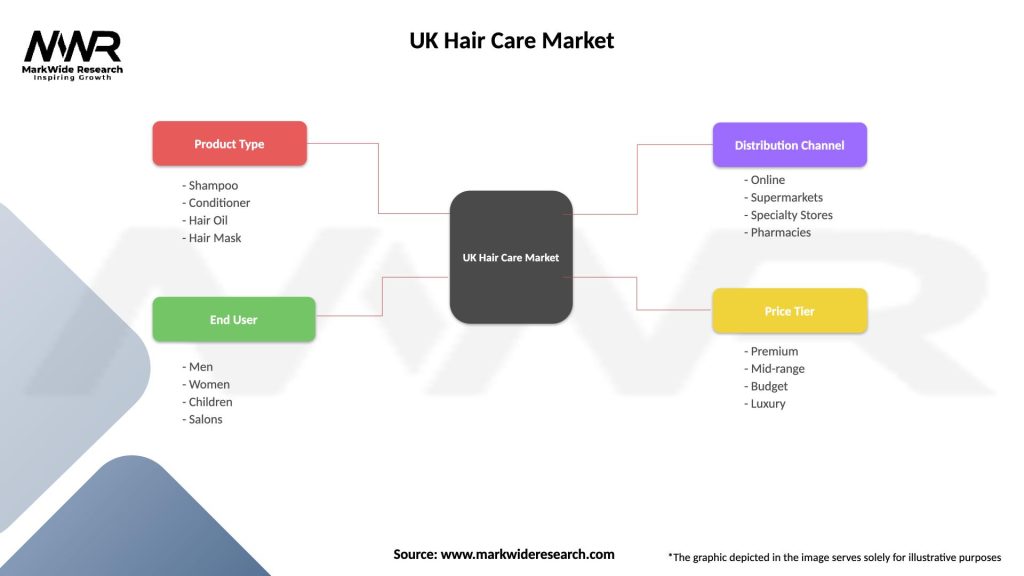

| Segmentation Details | Description |

|---|---|

| Product Type | Shampoo, Conditioner, Hair Oil, Hair Mask |

| End User | Men, Women, Children, Salons |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Pharmacies |

| Price Tier | Premium, Mid-range, Budget, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Hair Care Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at