444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK geospatial analytics market represents a rapidly evolving sector that combines geographic information systems, location intelligence, and advanced data analytics to deliver actionable insights across multiple industries. Geospatial analytics has emerged as a critical technology enabling organizations to understand spatial relationships, optimize operations, and make data-driven decisions based on location-based information. The market encompasses various technologies including geographic information systems (GIS), remote sensing, global positioning systems (GPS), and spatial data mining tools.

Market dynamics indicate substantial growth potential driven by increasing demand for location-based services, smart city initiatives, and the proliferation of Internet of Things (IoT) devices generating vast amounts of spatial data. The UK market benefits from strong government support for digital transformation initiatives and significant investments in infrastructure modernization. Growth projections suggest the market is expanding at a robust CAGR of 12.8%, reflecting the increasing adoption of geospatial technologies across sectors including retail, transportation, utilities, and emergency services.

Technology advancement continues to reshape the landscape with artificial intelligence integration, machine learning algorithms, and cloud-based platforms enhancing the capabilities of geospatial analytics solutions. The market demonstrates strong momentum with enterprise adoption rates reaching approximately 68% among large organizations, while small and medium enterprises show increasing interest in accessible, cloud-based geospatial solutions.

The UK geospatial analytics market refers to the comprehensive ecosystem of technologies, services, and solutions that analyze, visualize, and interpret data with geographic or spatial components to generate business intelligence and operational insights. This market encompasses software platforms, hardware systems, data services, and consulting offerings that enable organizations to understand patterns, relationships, and trends based on location-specific information.

Geospatial analytics combines traditional geographic information systems with advanced analytical capabilities, including predictive modeling, spatial statistics, and real-time data processing. The technology enables users to overlay multiple data layers, perform complex spatial queries, and generate visualizations that reveal hidden patterns and correlations within geographic datasets. Core applications include site selection analysis, route optimization, risk assessment, market analysis, and resource management across diverse industry verticals.

Market participants include software vendors, data providers, system integrators, and specialized consulting firms that deliver end-to-end geospatial solutions. The ecosystem supports various deployment models from on-premises installations to cloud-based software-as-a-service offerings, enabling organizations of all sizes to leverage location intelligence for competitive advantage.

Strategic positioning of the UK geospatial analytics market reflects strong fundamentals driven by digital transformation initiatives, government modernization programs, and increasing recognition of location intelligence value across industries. The market demonstrates resilient growth characteristics with diverse application areas spanning from traditional mapping and surveying to advanced predictive analytics and artificial intelligence-powered spatial modeling.

Key growth drivers include the proliferation of smart city projects, increasing demand for real-time location services, and the integration of geospatial capabilities with emerging technologies such as autonomous vehicles and drone-based data collection. Government initiatives supporting digital infrastructure development contribute significantly to market expansion, with public sector adoption rates increasing by approximately 15% annually.

Competitive dynamics feature a mix of established global technology providers and innovative UK-based companies specializing in niche applications. The market benefits from strong academic research institutions, supportive regulatory frameworks, and a skilled workforce with expertise in geographic information systems and spatial analysis. Investment flows continue to support innovation with venture capital funding for geospatial startups increasing by 22% over the past year.

Future prospects remain positive with emerging applications in environmental monitoring, precision agriculture, and urban planning driving sustained demand growth. The integration of artificial intelligence and machine learning technologies is expected to unlock new use cases and enhance the value proposition of geospatial analytics solutions across all market segments.

Market intelligence reveals several critical insights shaping the UK geospatial analytics landscape. The following key observations provide strategic context for understanding market dynamics and growth opportunities:

Market maturity indicators suggest the UK geospatial analytics sector is transitioning from early adoption to mainstream deployment across multiple industries. This evolution creates opportunities for specialized service providers and drives demand for more sophisticated analytical capabilities.

Primary growth catalysts propelling the UK geospatial analytics market forward encompass technological, economic, and regulatory factors that create favorable conditions for sustained expansion. These drivers reflect both immediate market needs and long-term strategic trends shaping the geospatial technology landscape.

Digital transformation initiatives across public and private sectors represent the most significant driver, with organizations recognizing the strategic value of location intelligence for operational optimization and decision-making. Government modernization programs particularly contribute to market growth through investments in smart city infrastructure, digital mapping initiatives, and emergency response system upgrades.

IoT proliferation generates unprecedented volumes of location-tagged data, creating demand for advanced analytics platforms capable of processing and interpreting spatial information in real-time. The integration of sensors, mobile devices, and connected infrastructure produces rich datasets that require sophisticated geospatial analysis tools to extract meaningful insights.

Regulatory requirements in areas such as environmental monitoring, urban planning, and infrastructure management drive systematic adoption of geospatial analytics solutions. Compliance mandates create sustained demand for accurate spatial data collection, analysis, and reporting capabilities across multiple industry sectors.

Technological convergence between geospatial analytics and emerging technologies including artificial intelligence, machine learning, and augmented reality opens new application areas and enhances the value proposition of location-based solutions. This convergence enables more sophisticated predictive modeling and automated decision-making capabilities.

Implementation challenges present significant barriers to market growth, particularly for organizations lacking technical expertise or adequate infrastructure to support advanced geospatial analytics deployments. High initial costs associated with software licensing, hardware procurement, and system integration can deter smaller organizations from adopting comprehensive geospatial solutions.

Data quality issues remain a persistent challenge, with inconsistent spatial data formats, accuracy limitations, and integration complexities creating obstacles for organizations seeking to implement unified geospatial analytics platforms. Interoperability concerns between different systems and data sources can significantly increase implementation complexity and ongoing maintenance requirements.

Skills shortage in specialized geospatial analysis and GIS expertise limits market growth potential, as organizations struggle to find qualified professionals capable of implementing and managing sophisticated spatial analytics solutions. This talent gap affects both deployment timelines and solution effectiveness across various industry applications.

Privacy and security concerns surrounding location data collection and analysis create regulatory compliance challenges that can slow adoption rates, particularly in sectors handling sensitive personal or commercial information. Data governance requirements add complexity to solution architecture and may require significant additional investment in security infrastructure.

Technology complexity associated with advanced geospatial analytics platforms can overwhelm organizations lacking dedicated IT resources, leading to suboptimal implementations or delayed adoption decisions. The learning curve for effective utilization of sophisticated spatial analysis tools often requires substantial training investments and organizational change management.

Emerging applications in autonomous vehicle navigation, precision agriculture, and environmental monitoring present substantial growth opportunities for geospatial analytics providers. These sectors require sophisticated spatial analysis capabilities that can process real-time data streams and support automated decision-making systems.

Smart city initiatives across the UK create significant opportunities for integrated geospatial solutions supporting urban planning, traffic management, and public service optimization. Government investment in digital infrastructure modernization provides a stable foundation for sustained market growth in the public sector.

Cloud-based delivery models enable smaller organizations to access advanced geospatial analytics capabilities without substantial upfront investments, expanding the addressable market beyond traditional enterprise customers. Software-as-a-service offerings democratize access to sophisticated spatial analysis tools and create recurring revenue opportunities for solution providers.

Integration opportunities with emerging technologies including augmented reality, virtual reality, and mixed reality platforms open new application areas in training, visualization, and field operations. These convergent technologies enhance the user experience and expand the practical applications of geospatial analytics across various industries.

International expansion opportunities exist for UK-based geospatial analytics companies to leverage their expertise in global markets, particularly in regions undergoing digital transformation and infrastructure modernization. Export potential for specialized solutions and consulting services represents a significant growth avenue for established market participants.

Competitive forces shaping the UK geospatial analytics market reflect a dynamic ecosystem where established technology providers compete alongside innovative startups and specialized consulting firms. Market consolidation trends indicate increasing merger and acquisition activity as larger companies seek to expand their geospatial capabilities and market reach.

Technology evolution continues to reshape competitive dynamics with artificial intelligence integration, real-time processing capabilities, and cloud-native architectures becoming key differentiators. Companies investing in next-generation platforms gain competitive advantages through enhanced performance, scalability, and user experience.

Customer expectations evolve toward more intuitive, mobile-friendly interfaces and self-service analytics capabilities that reduce dependence on specialized technical expertise. This trend drives solution providers to invest in user experience design and automated analysis features that broaden market accessibility.

Partnership strategies become increasingly important as organizations seek comprehensive solutions combining geospatial analytics with complementary technologies such as business intelligence, enterprise resource planning, and customer relationship management systems. Ecosystem collaboration enables more integrated offerings and enhanced customer value propositions.

Pricing pressures intensify as cloud-based alternatives and open-source solutions provide cost-effective options for basic geospatial analysis requirements. This dynamic forces traditional vendors to demonstrate clear value differentiation and focus on advanced capabilities that justify premium pricing models.

Comprehensive analysis of the UK geospatial analytics market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes structured interviews with industry executives, technology providers, end-users, and subject matter experts across various sectors utilizing geospatial analytics solutions.

Secondary research encompasses analysis of industry reports, government publications, academic studies, and company financial statements to validate market trends and quantify growth patterns. Data triangulation methods ensure consistency and accuracy across different information sources and research approaches.

Market sizing methodologies combine top-down and bottom-up approaches to develop comprehensive market assessments. Top-down analysis examines overall technology spending patterns and geospatial market allocation, while bottom-up analysis aggregates individual company revenues and market share data.

Trend analysis utilizes historical data patterns, current market indicators, and forward-looking projections to identify growth trajectories and emerging opportunities. Scenario modeling explores various market development paths under different economic and technological conditions.

Expert validation processes involve review and feedback from industry specialists, academic researchers, and market participants to ensure research findings accurately reflect market realities and provide actionable insights for stakeholders.

Geographic distribution of the UK geospatial analytics market reveals significant concentration in major metropolitan areas, with London accounting for approximately 42% of total market activity due to its concentration of financial services, technology companies, and government agencies. Southeast England represents another significant market cluster driven by aerospace, defense, and technology sectors.

Scotland demonstrates strong growth potential with increasing investments in renewable energy projects, smart city initiatives, and environmental monitoring applications. Edinburgh and Glasgow serve as regional hubs for geospatial technology adoption, supported by strong academic institutions and government modernization programs.

Northern England shows expanding market presence driven by manufacturing, logistics, and transportation applications. Manchester and Leeds emerge as significant growth centers with increasing adoption of location intelligence solutions across retail, healthcare, and public sector organizations.

Wales and Northern Ireland represent emerging markets with growing recognition of geospatial analytics value for economic development, infrastructure planning, and natural resource management. Government initiatives in these regions support digital transformation and create opportunities for geospatial solution providers.

Rural applications gain importance with precision agriculture, environmental monitoring, and renewable energy projects driving demand for specialized geospatial analytics capabilities. Regional development programs support technology adoption and create market opportunities beyond traditional urban centers.

Market leadership in the UK geospatial analytics sector features a diverse ecosystem of international technology providers, specialized UK companies, and innovative startups. The competitive environment reflects varying strengths in different market segments and application areas.

Competitive differentiation increasingly focuses on artificial intelligence integration, real-time processing capabilities, and industry-specific solutions that address particular vertical market requirements. Innovation strategies emphasize user experience improvements, mobile accessibility, and cloud-native architectures that support scalable deployments.

Partnership ecosystems become critical competitive factors as companies collaborate to deliver comprehensive solutions combining geospatial analytics with complementary technologies and services. Channel strategies expand through system integrator relationships and specialized consulting partnerships.

Market segmentation analysis reveals distinct categories based on technology type, deployment model, industry vertical, and organization size. Each segment demonstrates unique characteristics, growth patterns, and competitive dynamics that influence overall market development.

By Technology:

By Deployment Model:

By Industry Vertical:

Enterprise GIS platforms continue to dominate market share with comprehensive functionality supporting complex spatial analysis workflows. These solutions serve large organizations requiring extensive customization, integration capabilities, and enterprise-grade security features. Growth patterns indicate steady expansion with increasing emphasis on cloud deployment options and mobile accessibility.

Location intelligence solutions represent the fastest-growing category with annual growth rates exceeding 18% as organizations recognize the business value of spatial analytics for operational optimization and strategic planning. These platforms focus on user-friendly interfaces and pre-built industry applications that reduce implementation complexity.

Real-time analytics platforms gain significant traction driven by IoT data proliferation and demand for immediate spatial insights. Applications in transportation monitoring, emergency response, and asset tracking require low-latency processing capabilities and scalable cloud architectures.

Mobile geospatial applications expand rapidly with field service optimization, data collection, and consumer location services driving adoption across various industries. Mobile-first design becomes increasingly important as organizations prioritize workforce mobility and customer engagement through location-based services.

Artificial intelligence integration transforms traditional geospatial analytics into predictive platforms capable of automated pattern recognition, anomaly detection, and decision support. Machine learning capabilities enhance the value proposition across all market categories and create new application opportunities.

Operational efficiency improvements represent primary benefits for organizations implementing geospatial analytics solutions. Location intelligence enables optimized resource allocation, improved logistics planning, and enhanced decision-making processes that reduce costs and increase productivity across various business functions.

Risk management capabilities provide significant value through enhanced situational awareness, predictive modeling, and scenario analysis. Organizations utilize geospatial analytics for environmental risk assessment, security planning, and business continuity management that protect assets and ensure operational resilience.

Customer experience enhancements result from location-based services, personalized offerings, and improved service delivery. Retail organizations leverage geospatial insights for store optimization, market analysis, and customer behavior understanding that drive revenue growth and competitive advantage.

Regulatory compliance benefits include automated reporting, audit trail capabilities, and standardized data management processes that reduce compliance costs and ensure adherence to regulatory requirements. Public sector organizations particularly benefit from improved transparency and accountability in service delivery.

Innovation opportunities emerge through integration with emerging technologies, development of new service offerings, and expansion into previously inaccessible markets. Technology providers benefit from expanding market opportunities and recurring revenue models associated with cloud-based service delivery.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming geospatial analytics capabilities. Machine learning algorithms enable automated pattern recognition, predictive modeling, and intelligent data processing that enhance the value and accessibility of spatial analysis tools across various applications.

Real-time processing capabilities gain importance as organizations require immediate insights from streaming location data generated by IoT devices, mobile applications, and sensor networks. Edge computing architectures support low-latency analysis and enable responsive applications in transportation, emergency services, and industrial monitoring.

Cloud-native platforms dominate new deployments with organizations preferring scalable, cost-effective solutions that eliminate infrastructure management requirements. Software-as-a-service models democratize access to advanced geospatial analytics capabilities and create opportunities for smaller organizations to leverage location intelligence.

Mobile-first design becomes standard practice as field workers, consumers, and decision-makers require access to geospatial insights through smartphones and tablets. Responsive interfaces and offline capabilities ensure functionality across various usage scenarios and connectivity conditions.

Industry specialization increases with solution providers developing vertical-specific applications that address unique sector requirements. Pre-configured solutions for healthcare, retail, utilities, and government reduce implementation complexity and accelerate time-to-value for end users.

Data democratization trends promote self-service analytics capabilities that enable business users to perform spatial analysis without extensive technical expertise. Intuitive interfaces and automated analysis features expand the user base beyond traditional GIS specialists.

Strategic partnerships between geospatial analytics providers and cloud infrastructure companies accelerate platform modernization and enhance scalability capabilities. MarkWide Research analysis indicates these collaborations drive innovation in real-time processing and artificial intelligence integration across the market.

Government initiatives including the Geospatial Commission’s strategy for location data infrastructure create favorable conditions for market expansion. Public sector modernization programs drive demand for integrated geospatial solutions supporting smart city development and digital service delivery.

Acquisition activity intensifies as larger technology companies seek to expand their geospatial capabilities through strategic purchases of specialized analytics firms and innovative startups. These transactions consolidate market expertise and accelerate technology development across various application areas.

Open data initiatives increase availability of high-quality geospatial datasets, reducing barriers to entry and enabling new application development. Data sharing programs between public and private organizations create opportunities for innovative analytics solutions and collaborative platforms.

Technology convergence with augmented reality, virtual reality, and mixed reality platforms opens new visualization and interaction paradigms for geospatial data. These developments enhance user experience and create opportunities for immersive analytics applications across training, planning, and field operations.

Regulatory developments in data protection and privacy influence solution architecture and deployment strategies. Compliance requirements drive investment in security features and data governance capabilities that ensure responsible use of location information.

Investment priorities should focus on artificial intelligence integration, cloud-native architectures, and mobile-first design principles that align with evolving customer expectations and technology trends. Organizations considering geospatial analytics implementations should prioritize solutions offering scalability, integration capabilities, and user-friendly interfaces.

Skills development initiatives require immediate attention to address the growing demand for geospatial expertise across various industries. Training programs combining technical GIS knowledge with business analytics skills will create competitive advantages for both individuals and organizations in the expanding market.

Partnership strategies become increasingly important for solution providers seeking to deliver comprehensive offerings that combine geospatial analytics with complementary technologies. Ecosystem collaboration enables more integrated solutions and enhanced customer value propositions across different market segments.

Data quality investments should receive priority attention as accurate, standardized spatial information forms the foundation for effective analytics implementations. Organizations must establish robust data governance frameworks and quality assurance processes to maximize the value of geospatial analytics investments.

Vertical specialization strategies offer significant opportunities for solution providers to differentiate their offerings and command premium pricing through industry-specific functionality. Deep sector expertise combined with advanced technology capabilities creates sustainable competitive advantages in targeted market segments.

International expansion opportunities exist for UK-based companies to leverage their expertise in global markets undergoing digital transformation. Export strategies should focus on regions with strong government support for technology adoption and infrastructure modernization initiatives.

Long-term prospects for the UK geospatial analytics market remain highly positive with sustained growth expected across all major segments and application areas. Technology evolution continues to expand the addressable market and create new opportunities for innovation and value creation.

Emerging applications in autonomous vehicles, smart cities, and environmental monitoring will drive significant market expansion over the next decade. Integration opportunities with Internet of Things platforms, artificial intelligence systems, and augmented reality technologies create substantial growth potential beyond traditional GIS applications.

Market maturation trends indicate evolution toward more standardized, interoperable solutions that reduce implementation complexity and accelerate adoption rates. Industry consolidation may continue as larger companies acquire specialized capabilities and innovative technologies to strengthen their market positions.

Government support for digital transformation and smart infrastructure development provides a stable foundation for sustained market growth. Public sector investments in location data infrastructure and analytics capabilities will continue to drive demand and create opportunities for private sector participation.

Global competitiveness of UK geospatial analytics companies positions them well for international expansion and export growth. MWR projections suggest the market will maintain strong growth momentum with compound annual growth rates exceeding 12% through the forecast period, supported by continued technology innovation and expanding application areas.

The UK geospatial analytics market demonstrates robust growth characteristics driven by digital transformation initiatives, government modernization programs, and increasing recognition of location intelligence value across diverse industries. Technology advancement continues to expand capabilities and create new application opportunities that drive sustained market expansion.

Competitive dynamics reflect a healthy ecosystem combining established global providers with innovative UK companies specializing in vertical applications and emerging technologies. Market consolidation trends and strategic partnerships create opportunities for enhanced solution offerings and expanded market reach across different customer segments.

Future growth prospects remain positive with emerging applications in artificial intelligence, autonomous systems, and smart city development creating substantial opportunities for market participants. Investment in skills development, technology innovation, and international expansion will be critical for organizations seeking to capitalize on the expanding geospatial analytics opportunity in the UK market.

What is Geospatial Analytics?

Geospatial Analytics refers to the collection, analysis, and visualization of data related to geographic locations. It is used in various applications such as urban planning, environmental monitoring, and transportation management.

What are the key players in the UK Geospatial Analytics Market?

Key players in the UK Geospatial Analytics Market include companies like Esri, Hexagon AB, and Trimble, which provide advanced geospatial solutions and technologies for various industries, among others.

What are the main drivers of growth in the UK Geospatial Analytics Market?

The main drivers of growth in the UK Geospatial Analytics Market include the increasing demand for location-based services, advancements in satellite imagery technology, and the growing need for data-driven decision-making in sectors like logistics and urban development.

What challenges does the UK Geospatial Analytics Market face?

Challenges in the UK Geospatial Analytics Market include data privacy concerns, the complexity of integrating geospatial data with existing systems, and the high costs associated with advanced analytics technologies.

What opportunities exist in the UK Geospatial Analytics Market?

Opportunities in the UK Geospatial Analytics Market include the expansion of smart city initiatives, the rise of IoT devices generating geospatial data, and the increasing use of geospatial analytics in sectors like agriculture and disaster management.

What trends are shaping the UK Geospatial Analytics Market?

Trends shaping the UK Geospatial Analytics Market include the integration of artificial intelligence for predictive analytics, the growing use of cloud-based geospatial solutions, and the emphasis on real-time data processing for enhanced decision-making.

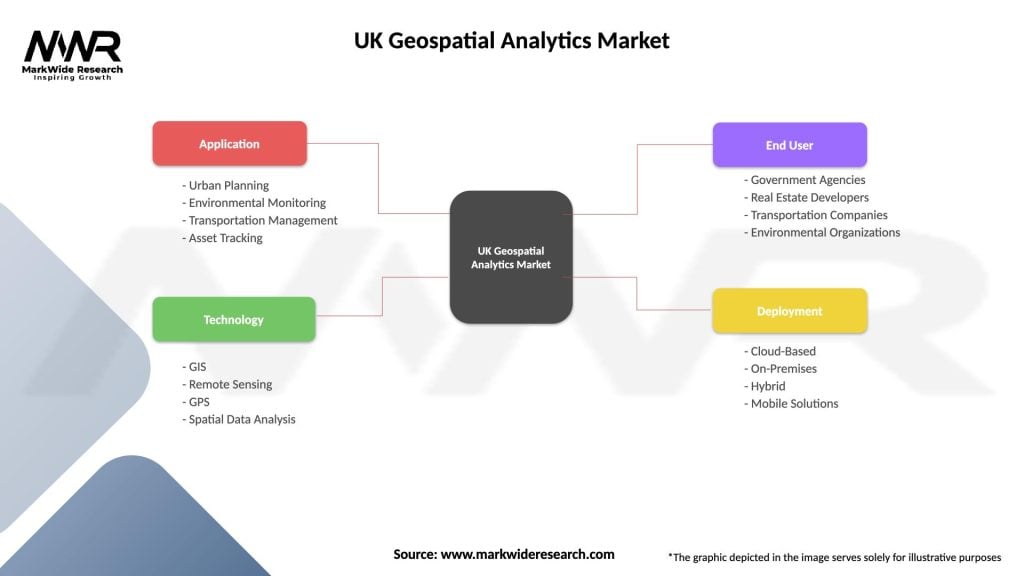

UK Geospatial Analytics Market

| Segmentation Details | Description |

|---|---|

| Application | Urban Planning, Environmental Monitoring, Transportation Management, Asset Tracking |

| Technology | GIS, Remote Sensing, GPS, Spatial Data Analysis |

| End User | Government Agencies, Real Estate Developers, Transportation Companies, Environmental Organizations |

| Deployment | Cloud-Based, On-Premises, Hybrid, Mobile Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Geospatial Analytics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at