444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK food preservatives market represents a dynamic and essential segment of the broader food additives industry, playing a crucial role in maintaining food safety, extending shelf life, and reducing food waste across the nation. This market encompasses a diverse range of chemical and natural compounds designed to prevent spoilage, maintain nutritional value, and preserve the sensory qualities of food products throughout the supply chain.

Market dynamics in the UK are increasingly influenced by consumer preferences shifting toward natural and clean-label products, while simultaneously demanding extended shelf life and food safety assurance. The market demonstrates robust growth potential, driven by expanding food processing industries, rising consumer awareness about food safety, and stringent regulatory frameworks governing food preservation standards.

Growth trajectory analysis indicates the market is experiencing steady expansion at approximately 4.2% CAGR, supported by technological advancements in preservation techniques and increasing adoption of innovative preservation solutions. The market benefits from strong demand across multiple food categories, including bakery products, dairy items, meat and poultry, beverages, and processed foods.

Regional distribution shows concentrated activity in major urban centers and food processing hubs, with approximately 68% of market activity centered around England, particularly in the Southeast and Midlands regions. Scotland and Wales contribute significantly to the market through their specialized food processing sectors and traditional food preservation industries.

The UK food preservatives market refers to the comprehensive ecosystem of chemical and natural substances used to prevent food spoilage, maintain quality, and extend shelf life of food products throughout the United Kingdom’s food supply chain, encompassing manufacturing, distribution, and retail sectors.

Food preservatives function through various mechanisms including antimicrobial action, antioxidant properties, and pH regulation to inhibit bacterial growth, prevent rancidity, and maintain food integrity. These substances are carefully regulated under UK food safety legislation and European food additive regulations, ensuring consumer safety while enabling efficient food preservation.

Market scope includes synthetic preservatives such as sodium benzoate, potassium sorbate, and sulfur dioxide, alongside natural alternatives including rosemary extract, vitamin E, and citric acid. The market also encompasses emerging preservation technologies such as high-pressure processing aids and natural antimicrobial compounds derived from plant sources.

Industry applications span across multiple food sectors, with preservatives being integral to processed foods, beverages, baked goods, dairy products, meat processing, and convenience foods. The market serves both large-scale commercial food manufacturers and smaller artisanal producers seeking to extend product shelf life while maintaining quality standards.

The UK food preservatives market demonstrates remarkable resilience and growth potential, driven by evolving consumer preferences, regulatory compliance requirements, and technological innovations in food preservation. The market landscape is characterized by increasing demand for natural preservatives, growing awareness of food safety, and expanding applications across diverse food categories.

Key market drivers include rising consumer consciousness about food waste reduction, with approximately 73% of consumers actively seeking products with extended shelf life. The market benefits from strong regulatory support and clear guidelines that ensure both safety and efficacy of preservation solutions across the food industry.

Technological advancement plays a pivotal role in market evolution, with innovative preservation techniques gaining traction among food manufacturers. Natural preservatives segment shows particularly strong growth, capturing approximately 42% market preference among health-conscious consumers seeking clean-label alternatives to synthetic additives.

Competitive landscape features a mix of international chemical companies, specialized food additive manufacturers, and emerging natural ingredient suppliers. The market structure supports both large-scale industrial applications and niche specialty preservation solutions, creating opportunities for diverse market participants.

Future prospects indicate continued expansion driven by food industry growth, export market development, and increasing adoption of advanced preservation technologies. The market is positioned to benefit from ongoing trends toward sustainable food systems and circular economy principles in food production.

Market segmentation reveals distinct patterns in preservative usage across different food categories, with the following key insights emerging from comprehensive market analysis:

Consumer behavior analysis indicates shifting preferences toward transparency in food labeling, with approximately 81% of consumers reading ingredient lists before purchasing preserved food products. This trend drives demand for recognizable, natural preservation ingredients and clear communication about preservation methods.

Food safety regulations serve as a primary market driver, with UK food safety authorities maintaining strict standards that require effective preservation solutions across all food categories. These regulations create consistent demand for proven preservation technologies while encouraging innovation in safer, more effective preservation methods.

Consumer awareness about food waste reduction significantly drives market growth, as preservation technologies directly contribute to extending product shelf life and reducing household food waste. This environmental consciousness aligns with preservation industry capabilities, creating strong market demand for effective preservation solutions.

Expanding food processing industry in the UK generates substantial demand for preservation solutions, as manufacturers seek to optimize product quality, extend distribution reach, and meet diverse consumer preferences. The growth of convenience foods and ready-to-eat products particularly drives preservative demand.

Export market development creates additional demand for preservation technologies, as UK food manufacturers require solutions that maintain product quality during international shipping and extended storage periods. This global market access drives investment in advanced preservation capabilities.

Technological innovation in food science enables development of more effective, consumer-friendly preservation solutions. Advances in natural preservation compounds, encapsulation technologies, and targeted preservation systems create new market opportunities and drive industry growth.

Health consciousness trends among UK consumers drive demand for preservatives that maintain nutritional value while extending shelf life. This focus on health benefits creates market opportunities for preservation solutions that enhance rather than compromise food nutritional profiles.

Consumer skepticism toward synthetic preservatives presents significant market challenges, as increasing numbers of consumers actively avoid products containing artificial additives. This trend requires industry adaptation toward natural alternatives, which may involve higher costs and technical challenges.

Regulatory complexity surrounding food additive approvals can limit market entry for innovative preservation solutions. The extensive testing and approval processes required for new preservatives create barriers for smaller companies and slow the introduction of novel preservation technologies.

Cost considerations impact market growth, particularly for natural preservatives that often command premium pricing compared to synthetic alternatives. Food manufacturers must balance preservation effectiveness with cost constraints, potentially limiting adoption of advanced preservation solutions.

Technical limitations of certain natural preservatives may restrict their application in specific food categories or processing conditions. These limitations require ongoing research and development investment to overcome technical barriers and expand application possibilities.

Supply chain constraints for natural preservation ingredients can create market volatility and availability challenges. Weather-dependent agricultural sources for natural preservatives may result in supply fluctuations that impact market stability.

Competition from alternative technologies such as modified atmosphere packaging, high-pressure processing, and other non-chemical preservation methods may reduce demand for traditional preservative solutions in certain applications.

Natural preservatives expansion represents the most significant market opportunity, with growing consumer demand for clean-label products creating substantial growth potential for plant-based and naturally-derived preservation solutions. This segment offers premium pricing opportunities and strong consumer acceptance.

Organic food market growth creates specialized opportunities for organic-certified preservatives that meet strict organic standards while providing effective preservation. The expanding UK organic food sector requires dedicated preservation solutions that maintain organic integrity.

Functional food applications offer innovative opportunities to develop preservatives that provide additional health benefits beyond preservation. These multifunctional ingredients can command premium pricing while meeting consumer demands for added nutritional value.

Export market expansion provides significant growth opportunities as UK food manufacturers increase international market penetration. Advanced preservation technologies enable longer shipping times and broader geographic reach for British food products.

Sustainable packaging integration creates opportunities to develop preservation solutions that work synergistically with eco-friendly packaging materials. This integration supports environmental goals while maintaining food safety and quality standards.

Artisanal food sector growth generates demand for specialized preservation solutions suitable for small-scale producers. This market segment values natural ingredients and traditional preservation methods while requiring modern safety standards.

Food service industry expansion creates opportunities for preservation solutions tailored to commercial food preparation and service environments. These applications require specialized preservation approaches that maintain quality under demanding service conditions.

Supply and demand equilibrium in the UK food preservatives market reflects complex interactions between consumer preferences, regulatory requirements, and technological capabilities. The market demonstrates strong demand growth driven by expanding food processing activities and increasing consumer awareness of food safety importance.

Price dynamics vary significantly between synthetic and natural preservatives, with natural alternatives commanding premium pricing that reflects higher production costs and consumer willingness to pay for clean-label products. Market pricing trends indicate gradual convergence as natural preservative production scales increase.

Innovation cycles drive market evolution through continuous development of more effective, safer, and consumer-friendly preservation solutions. Research and development investments focus on overcoming technical limitations of natural preservatives while maintaining cost-effectiveness for commercial applications.

Regulatory influence shapes market dynamics through evolving food safety standards, labeling requirements, and approval processes for new preservative compounds. These regulatory factors create both opportunities and constraints that influence market development patterns.

Competitive pressures drive continuous improvement in preservation effectiveness, cost optimization, and consumer acceptance. Market participants invest heavily in differentiation strategies that emphasize safety, efficacy, and alignment with consumer preferences.

Technology adoption rates vary across different food industry segments, with larger manufacturers typically leading in advanced preservation technology implementation while smaller producers may rely on traditional preservation methods. This creates diverse market segments with varying technology requirements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry stakeholders, food manufacturers, regulatory officials, and consumer groups to gather firsthand market intelligence and trend identification.

Secondary research incorporates analysis of industry reports, regulatory documents, trade publications, and academic research to provide comprehensive market context. This approach ensures thorough coverage of market factors, technological developments, and regulatory influences affecting the UK food preservatives market.

Data collection methods include structured surveys of food industry professionals, analysis of import/export statistics, and evaluation of product launch data to quantify market trends and growth patterns. These quantitative approaches complement qualitative insights to provide balanced market understanding.

Market segmentation analysis utilizes statistical modeling to identify key market segments, growth drivers, and competitive dynamics. This analytical approach enables precise identification of market opportunities and challenges across different food categories and preservation applications.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert review panels, and statistical verification methods. This rigorous approach maintains research quality and reliability for strategic decision-making purposes.

Trend analysis incorporates historical data evaluation, current market assessment, and forward-looking projections to identify emerging opportunities and potential market disruptions. This temporal analysis provides valuable insights for long-term strategic planning.

England dominates the UK food preservatives market with approximately 72% of total market activity, driven by concentrated food processing industries in the Southeast, Midlands, and Northwest regions. London and surrounding areas serve as major distribution hubs for both domestic and international food preservative supply chains.

Scotland contributes significantly to the market through its specialized food processing sectors, particularly in seafood, whisky, and traditional Scottish food products. The region demonstrates strong demand for natural preservatives that align with premium product positioning and export market requirements.

Wales represents a growing market segment focused on agricultural processing and traditional food production. The region shows particular strength in dairy processing and meat preservation applications, with increasing adoption of natural preservation solutions.

Northern Ireland maintains a specialized market position through its agricultural processing industries and cross-border trade relationships. The region demonstrates consistent demand for preservation solutions that meet both UK and EU regulatory standards.

Regional specialization patterns reflect local food industry strengths, with coastal areas emphasizing seafood preservation, agricultural regions focusing on meat and dairy preservation, and urban centers driving demand for convenience food preservation solutions.

Distribution networks are well-established throughout the UK, with major chemical distributors and food ingredient suppliers maintaining comprehensive coverage. Regional preferences for specific preservation types create opportunities for targeted marketing and product development strategies.

Market leadership is distributed among several key categories of companies, each bringing distinct capabilities and market positioning to the UK food preservatives sector:

Competitive strategies emphasize innovation in natural preservation solutions, regulatory compliance expertise, and customer service excellence. Companies differentiate through technical support capabilities, product customization, and alignment with clean-label trends.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to expand product portfolios, enhance distribution capabilities, and achieve economies of scale in research and development activities.

By Product Type:

By Application:

By Function:

Natural Preservatives Category demonstrates the strongest growth momentum, driven by consumer preference for clean-label products and increasing availability of effective natural preservation solutions. This category benefits from premium pricing and strong consumer acceptance, with approximately 45% of consumers actively seeking natural preservation options.

Bakery Applications represent the largest market segment by volume, requiring diverse preservation solutions that maintain texture, flavor, and appearance while extending shelf life. This category drives significant innovation in preservation technology, particularly for artisanal and specialty baked goods.

Antimicrobial Preservatives maintain critical importance in food safety applications, particularly for meat, dairy, and processed food products. This category emphasizes regulatory compliance and proven effectiveness in preventing foodborne illness risks.

Antioxidant Solutions show growing importance as consumers become more aware of nutritional preservation benefits. This category offers opportunities for multifunctional ingredients that provide both preservation and nutritional enhancement.

Specialty Applications create niche opportunities for customized preservation solutions targeting specific food categories or processing conditions. These applications often command premium pricing and require specialized technical expertise.

Export-focused Products represent a growing category requiring preservation solutions that maintain product quality during extended shipping and storage periods. This category drives demand for advanced preservation technologies and international regulatory compliance.

Food Manufacturers benefit from access to diverse preservation solutions that enable product innovation, extend shelf life, and ensure food safety compliance. Advanced preservation technologies support market expansion, reduce product recalls, and enhance consumer confidence in food products.

Retailers gain advantages through reduced product waste, extended display life, and improved inventory management capabilities. Effective preservation solutions enable broader product assortments and reduced markdown losses due to spoilage.

Consumers benefit from safer food products, reduced food waste at household level, and access to diverse food options with extended shelf life. Natural preservation solutions align with health consciousness trends while maintaining food safety standards.

Regulatory Authorities benefit from industry compliance with food safety standards, reduced foodborne illness incidents, and clear regulatory frameworks that support both safety and innovation in food preservation.

Supply Chain Partners gain from improved product stability during transportation and storage, reduced handling losses, and enhanced distribution efficiency. Preservation technologies enable longer supply chains and broader market reach.

Research Institutions benefit from collaboration opportunities with industry partners, funding for preservation research, and practical applications for food science innovations. Academic-industry partnerships drive continued advancement in preservation technology.

Environmental Stakeholders benefit from reduced food waste, more efficient resource utilization, and development of sustainable preservation solutions that minimize environmental impact while maintaining food safety.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean Label Movement represents the most significant trend affecting the UK food preservatives market, with consumers increasingly demanding recognizable, natural ingredients in food products. This trend drives innovation in plant-based preservation solutions and transparent labeling practices.

Sustainability Integration influences preservation technology development, with companies focusing on environmentally-friendly production methods, biodegradable preservation compounds, and reduced packaging requirements through improved preservation effectiveness.

Functional Preservation emerges as a key trend, combining preservation effectiveness with additional health benefits such as antioxidant properties, vitamin content, or probiotic support. This multifunctional approach creates premium market opportunities.

Personalized Nutrition trends influence preservation requirements as food manufacturers develop products targeting specific dietary needs, health conditions, or lifestyle preferences. These specialized applications require tailored preservation solutions.

Technology Convergence combines traditional preservation methods with modern food technology, creating innovative solutions that optimize preservation effectiveness while meeting consumer preferences for natural ingredients.

Global Flavor Trends drive demand for preservation solutions that maintain the integrity of international cuisines and exotic ingredients, supporting the UK’s diverse food culture and import market requirements.

Convenience Food Evolution creates demand for preservation technologies that maintain quality in ready-to-eat products, meal kits, and on-the-go food options while meeting busy lifestyle demands.

Regulatory Updates include recent revisions to UK food additive regulations following Brexit, creating opportunities for regulatory alignment with both EU standards and independent UK requirements. These changes affect approval processes and market access for preservation solutions.

Technology Partnerships between preservation companies and food manufacturers drive collaborative development of customized preservation solutions. These partnerships accelerate innovation and create competitive advantages through exclusive preservation technologies.

Investment in Natural Solutions shows significant increases as companies allocate resources to developing plant-based preservation alternatives. MarkWide Research indicates that investment in natural preservative research has increased by approximately 28% annually over recent years.

Sustainability Initiatives include development of preservation solutions that support circular economy principles, reduce food waste, and minimize environmental impact throughout the food supply chain.

Export Market Expansion drives development of preservation technologies that meet international regulatory standards while maintaining product quality during extended shipping periods. This development supports UK food industry global competitiveness.

Digital Integration includes smart packaging technologies that work synergistically with preservation systems to monitor food quality, track shelf life, and optimize preservation effectiveness through real-time data collection.

Research Collaborations between universities, research institutions, and industry partners accelerate development of next-generation preservation technologies and support evidence-based regulatory approvals for innovative preservation solutions.

Investment Priorities should focus on natural preservative development, with companies allocating significant resources to plant-based preservation research and scaling production capabilities for natural alternatives. This investment aligns with consumer trends and regulatory preferences.

Market Positioning strategies should emphasize transparency, safety, and effectiveness while addressing consumer concerns about synthetic additives. Companies should develop clear communication strategies that explain preservation benefits and safety profiles.

Technology Development should prioritize multifunctional preservation solutions that provide additional benefits beyond basic preservation. These innovations can command premium pricing while meeting consumer demands for added value.

Regulatory Compliance requires proactive engagement with regulatory authorities to ensure smooth approval processes for new preservation technologies. Companies should invest in regulatory expertise and maintain current knowledge of evolving requirements.

Supply Chain Optimization should focus on securing reliable sources for natural preservation ingredients while developing backup supply options to manage potential disruptions. Vertical integration may provide competitive advantages in natural preservative supply.

Market Expansion opportunities exist in export markets, specialty food segments, and emerging application areas. Companies should evaluate international market potential while maintaining strong domestic market positions.

Partnership Development with food manufacturers, research institutions, and technology companies can accelerate innovation and market penetration. Strategic partnerships provide access to expertise, resources, and market channels.

Market growth prospects remain positive, with the UK food preservatives market positioned for continued expansion driven by food industry growth, export market development, and increasing consumer awareness of food safety importance. MWR analysis projects steady growth momentum continuing through the forecast period.

Natural preservatives segment is expected to capture increasing market share, potentially reaching 55% of total market preference within the next five years as production capabilities expand and costs decrease through economies of scale.

Technology innovation will continue driving market evolution, with emerging preservation technologies offering improved effectiveness, consumer acceptance, and environmental sustainability. These innovations will create new market segments and competitive opportunities.

Regulatory environment is expected to remain supportive of innovation while maintaining strict safety standards. Future regulatory developments may favor natural preservation solutions and provide clearer pathways for novel preservation technology approvals.

International market expansion offers significant growth potential as UK food manufacturers increase global market penetration. Advanced preservation technologies will enable broader geographic reach and longer supply chains for British food products.

Sustainability requirements will increasingly influence market development, with preservation solutions that support environmental goals gaining competitive advantages. This trend will drive innovation in eco-friendly preservation technologies and sustainable production methods.

The UK food preservatives market stands at a pivotal point in its evolution, balancing traditional preservation effectiveness with emerging consumer demands for natural, sustainable, and transparent food ingredients. The market demonstrates robust growth potential driven by expanding food processing industries, increasing export opportunities, and growing consumer awareness of food safety importance.

Key success factors for market participants include investment in natural preservation technologies, regulatory compliance expertise, and strategic partnerships that accelerate innovation and market penetration. Companies that successfully navigate the transition toward clean-label solutions while maintaining preservation effectiveness will capture the greatest market opportunities.

Market dynamics favor companies that can demonstrate clear value propositions combining safety, effectiveness, and consumer acceptance. The ongoing shift toward natural preservatives creates both challenges and opportunities, requiring significant investment in research and development while offering premium pricing potential.

Future market leadership will belong to organizations that successfully integrate sustainability principles, technological innovation, and consumer preferences into comprehensive preservation solutions. The UK food preservatives market offers substantial opportunities for companies positioned to meet evolving industry requirements while maintaining the highest standards of food safety and quality.

What is Food Preservatives?

Food preservatives are substances added to food products to prevent spoilage, maintain freshness, and extend shelf life. They can be natural or synthetic and are commonly used in various food categories, including meats, dairy, and baked goods.

What are the key players in the UK Food Preservatives Market?

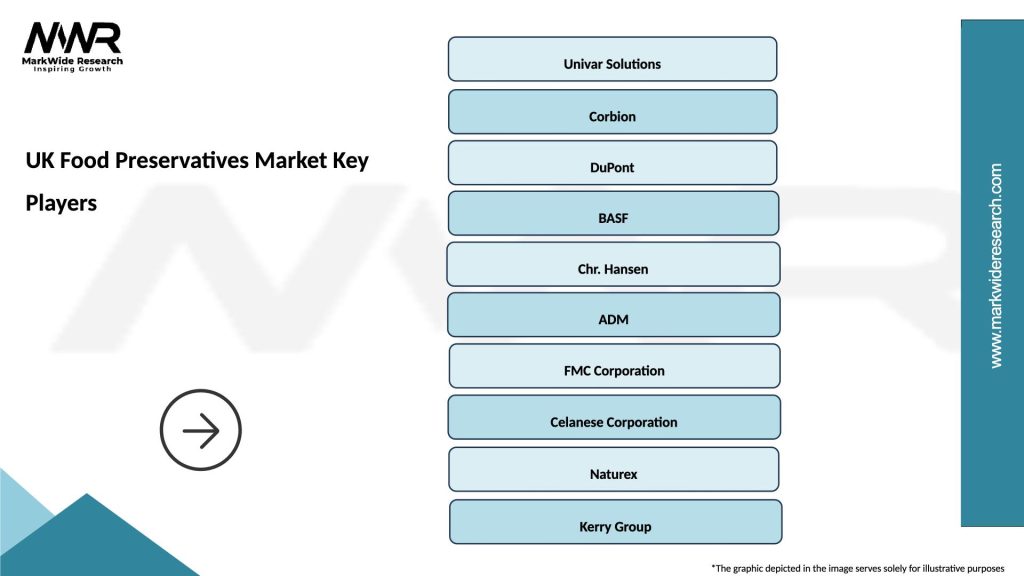

Key players in the UK Food Preservatives Market include companies like Tate & Lyle, Kerry Group, and DuPont, which are known for their innovative preservative solutions and extensive product portfolios, among others.

What are the main drivers of the UK Food Preservatives Market?

The main drivers of the UK Food Preservatives Market include the increasing demand for processed foods, the growing awareness of food safety, and the rising consumer preference for longer shelf life in food products.

What challenges does the UK Food Preservatives Market face?

The UK Food Preservatives Market faces challenges such as regulatory scrutiny over the use of certain preservatives, consumer concerns regarding health impacts, and the shift towards clean label products that limit synthetic additives.

What opportunities exist in the UK Food Preservatives Market?

Opportunities in the UK Food Preservatives Market include the development of natural preservatives, the rise of plant-based food products, and innovations in packaging technologies that enhance food preservation.

What trends are shaping the UK Food Preservatives Market?

Trends shaping the UK Food Preservatives Market include a growing focus on sustainability, the increasing popularity of organic and natural food products, and advancements in food preservation technologies that improve product safety and quality.

UK Food Preservatives Market

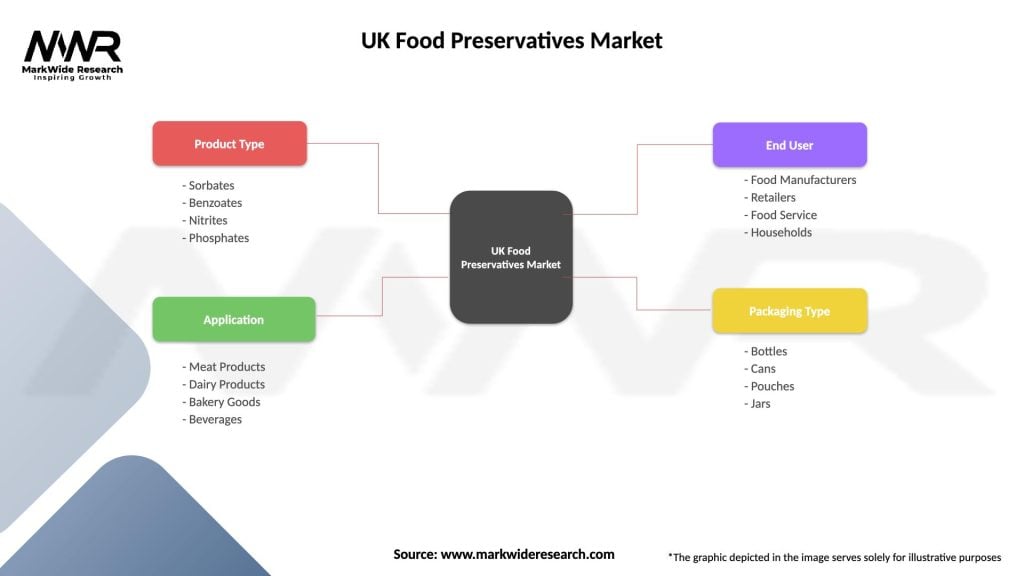

| Segmentation Details | Description |

|---|---|

| Product Type | Sorbates, Benzoates, Nitrites, Phosphates |

| Application | Meat Products, Dairy Products, Bakery Goods, Beverages |

| End User | Food Manufacturers, Retailers, Food Service, Households |

| Packaging Type | Bottles, Cans, Pouches, Jars |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Food Preservatives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at