444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK food acidulants market represents a dynamic and essential segment within the broader food additives industry, characterized by robust growth and increasing demand across multiple food and beverage applications. Food acidulants serve as crucial ingredients that enhance flavor profiles, extend shelf life, and maintain product quality in various consumable goods. The market demonstrates significant expansion driven by evolving consumer preferences, technological advancements in food processing, and stringent quality standards across the food manufacturing sector.

Market dynamics indicate sustained growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 4.2% over the recent forecast period. This growth trajectory reflects the increasing adoption of processed foods, rising demand for convenience products, and growing awareness of food safety and preservation requirements. The market encompasses various acidulant types including citric acid, lactic acid, acetic acid, and phosphoric acid, each serving specific functional purposes in food formulation and preservation.

Regional distribution within the UK shows concentrated activity in major food manufacturing hubs, with approximately 35% of market activity centered in the Midlands and Northern England regions. The market benefits from established food processing infrastructure, proximity to raw material sources, and strong distribution networks that facilitate efficient supply chain operations throughout the country.

The UK food acidulants market refers to the comprehensive ecosystem encompassing the production, distribution, and application of acidic compounds used as food additives to enhance taste, preserve freshness, and maintain product stability across various food and beverage categories. These chemical compounds serve multiple functional purposes including pH regulation, flavor enhancement, antimicrobial preservation, and texture modification in processed food products.

Food acidulants function as essential ingredients that provide tartness, control acidity levels, and act as natural preservatives in food formulations. They play critical roles in maintaining product quality, extending shelf life, and ensuring food safety standards compliance. The market encompasses both natural and synthetic acidulants, with increasing emphasis on naturally derived options to meet consumer preferences for clean label products.

Applications span across diverse food categories including beverages, confectionery, dairy products, baked goods, processed meats, and convenience foods. Each application requires specific acidulant properties to achieve desired functional and sensory characteristics while maintaining regulatory compliance and consumer acceptance.

The UK food acidulants market demonstrates robust performance characterized by steady growth, technological innovation, and expanding application scope across the food processing industry. Market participants benefit from strong domestic demand, established manufacturing capabilities, and favorable regulatory frameworks that support product development and market expansion initiatives.

Key market drivers include increasing consumer demand for processed and convenience foods, growing awareness of food safety requirements, and rising adoption of natural preservation methods. The market shows particular strength in citric acid applications, which account for approximately 42% of total market share, followed by lactic acid and acetic acid derivatives.

Competitive landscape features a mix of international chemical companies and specialized food ingredient suppliers, with market consolidation trends evident through strategic partnerships and acquisition activities. Innovation focus centers on developing clean label solutions, improving production efficiency, and expanding application versatility to meet evolving consumer preferences.

Future prospects remain positive, supported by continued growth in food processing activities, increasing export opportunities, and technological advancements in acidulant production and application methods. The market is positioned to benefit from trends toward natural ingredients, sustainable production practices, and enhanced food safety standards.

Strategic analysis reveals several critical insights that define the current market landscape and future development trajectory:

Market penetration analysis indicates strong adoption rates across traditional food categories, with emerging opportunities in health-focused and specialty food segments. The insights reflect a market transitioning toward more sophisticated applications while maintaining strong foundations in established food processing sectors.

Primary growth drivers propelling the UK food acidulants market forward encompass multiple interconnected factors that create sustained demand across various application segments. The increasing consumption of processed and packaged foods represents a fundamental driver, as modern lifestyles drive consumer preference for convenient, ready-to-eat products that require effective preservation and flavor enhancement solutions.

Food safety regulations continue strengthening, mandating higher standards for product preservation and quality maintenance throughout the supply chain. These regulatory requirements drive increased adoption of acidulants as natural preservation agents, particularly in products with extended shelf life requirements. The emphasis on reducing chemical preservatives while maintaining product safety creates significant opportunities for acidulant applications.

Consumer health consciousness influences market dynamics through growing demand for clean label products and natural ingredients. This trend favors naturally derived acidulants such as citric acid from citrus sources and lactic acid from fermentation processes. Manufacturers respond by reformulating products to include more natural acidulants, driving market expansion in premium and health-focused food categories.

Technological advancements in food processing enable more sophisticated acidulant applications, improving product quality while reducing production costs. Enhanced manufacturing techniques allow for precise pH control, better flavor integration, and improved preservation effectiveness, making acidulants more attractive to food manufacturers seeking competitive advantages.

Cost pressures represent significant challenges for market participants, particularly regarding raw material price volatility and production cost increases. Fluctuating prices of key inputs such as citrus fruits for citric acid production and fermentation substrates for lactic acid create margin pressures that affect market growth potential and profitability across the supply chain.

Regulatory complexity poses ongoing challenges as food safety standards continue evolving, requiring continuous compliance investments and product reformulation efforts. The complexity of navigating multiple regulatory frameworks for different food categories creates barriers for smaller market participants and increases operational costs for established players.

Consumer perception issues occasionally arise regarding synthetic acidulants, with some consumers preferring products without any added acidulants despite their safety and functionality benefits. This perception challenge requires ongoing education efforts and investment in natural acidulant alternatives to maintain market acceptance.

Supply chain disruptions can impact raw material availability and distribution efficiency, particularly for imported ingredients or specialized acidulant types. These disruptions create operational challenges and potential cost increases that affect market stability and growth consistency.

Emerging food categories present substantial growth opportunities, particularly in plant-based alternatives, functional foods, and specialty dietary products. These categories often require specific acidulant properties to achieve desired taste profiles and preservation characteristics, creating demand for innovative acidulant solutions and specialized formulations.

Export market expansion offers significant potential as UK food ingredient manufacturers leverage quality reputation and regulatory compliance expertise to access international markets. Growing global demand for high-quality food ingredients creates opportunities for UK acidulant producers to expand beyond domestic markets and achieve economies of scale.

Sustainability initiatives drive opportunities for developing environmentally friendly acidulant production methods and sourcing strategies. Companies investing in sustainable production practices can differentiate their offerings and appeal to environmentally conscious food manufacturers and consumers, potentially commanding premium pricing.

Technology integration enables development of smart acidulant systems that provide enhanced functionality, improved stability, and better integration with modern food processing equipment. These technological advances create opportunities for market differentiation and value-added product development.

Supply and demand dynamics within the UK food acidulants market reflect complex interactions between raw material availability, production capacity, and end-user requirements. The market demonstrates resilience through diversified supply sources and flexible production capabilities that adapt to changing demand patterns across different food categories.

Competitive dynamics show increasing consolidation as larger companies acquire specialized producers to expand product portfolios and market reach. This consolidation trend creates opportunities for operational synergies while potentially reducing competition in certain market segments. Strategic partnerships between acidulant producers and food manufacturers become increasingly important for securing long-term supply relationships.

Innovation dynamics drive continuous product development focused on improving functionality, reducing costs, and meeting evolving consumer preferences. Research and development investments concentrate on developing new acidulant formulations, improving production efficiency, and creating specialized solutions for emerging applications. The innovation cycle accelerates as companies compete to introduce differentiated products.

Pricing dynamics reflect balance between raw material costs, production efficiency, and market competition. Price stability improves as production technologies advance and supply chains optimize, though periodic volatility occurs due to raw material price fluctuations and demand surges in specific application segments.

Comprehensive research approach employed for analyzing the UK food acidulants market incorporates multiple data collection methods and analytical techniques to ensure accuracy and reliability of market insights. The methodology combines primary research through industry interviews and surveys with secondary research utilizing published reports, regulatory filings, and industry databases.

Primary research activities include structured interviews with key market participants including acidulant manufacturers, food processors, distributors, and regulatory experts. Survey methodologies capture quantitative data regarding market size, growth rates, and competitive positioning while qualitative interviews provide insights into market trends, challenges, and opportunities.

Secondary research sources encompass industry publications, government statistics, trade association reports, and company financial statements. Data validation processes ensure consistency and accuracy across multiple sources while analytical frameworks provide structured approaches for interpreting market dynamics and forecasting future trends.

Analytical techniques include statistical analysis, trend modeling, and competitive benchmarking to develop comprehensive market understanding. The research methodology ensures robust data foundation for strategic decision-making while maintaining objectivity and analytical rigor throughout the research process.

Geographic distribution across the UK reveals distinct regional patterns in food acidulants market activity, with concentration in areas featuring established food processing infrastructure and proximity to major consumer markets. The Midlands region accounts for approximately 28% of market activity, benefiting from central location, transportation networks, and concentration of food manufacturing facilities.

Northern England represents another significant market hub, particularly around Manchester and Leeds, where food processing companies leverage skilled workforce availability and competitive operational costs. This region demonstrates strong growth in specialty acidulant applications, driven by innovative food manufacturers seeking differentiated products.

Southern England including London and surrounding areas shows high demand for premium acidulant products, reflecting consumer preferences for quality food products and willingness to pay premium prices. The region benefits from proximity to major retail chains and distribution centers that facilitate market access.

Scotland and Wales present emerging opportunities, particularly in niche food categories and artisanal products where specialized acidulant applications create value-added opportunities. These regions show increasing investment in food processing capabilities and growing export activities that drive acidulant demand.

Market structure features diverse competitive landscape combining international chemical companies, specialized food ingredient suppliers, and regional distributors. Competition intensifies as companies pursue market share growth through product innovation, strategic partnerships, and operational efficiency improvements.

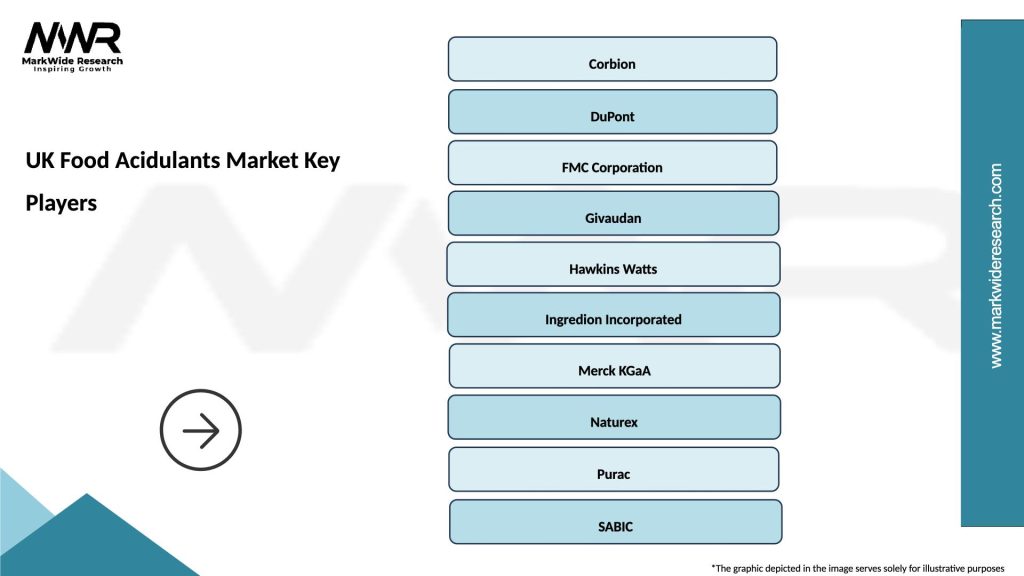

Leading market participants include:

Competitive strategies emphasize product differentiation, cost optimization, and customer relationship development. Companies invest in research and development to create specialized acidulant formulations while pursuing operational excellence to maintain competitive pricing. Strategic acquisitions and partnerships enable market expansion and capability enhancement.

Market positioning varies among competitors, with some focusing on volume applications while others target premium specialty segments. Success factors include product quality consistency, technical support capabilities, supply chain reliability, and ability to meet evolving regulatory requirements.

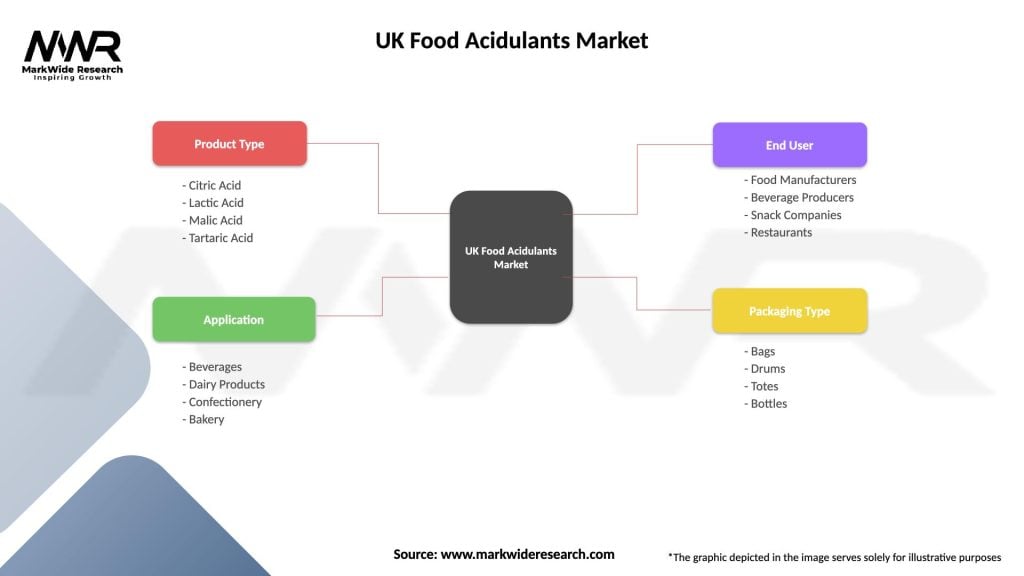

Product-based segmentation reveals distinct market categories based on acidulant type and chemical composition:

Application-based segmentation demonstrates diverse end-use categories:

Distribution channel segmentation includes direct sales to manufacturers, specialty distributors, and online platforms, each serving specific customer segments with tailored service approaches.

Citric acid category maintains market leadership through versatile applications and consumer acceptance as a natural ingredient. This category benefits from established supply chains, competitive pricing, and broad regulatory approval across food applications. Growth drivers include increasing demand for natural preservatives and expanding applications in emerging food categories.

Lactic acid segment demonstrates strong growth potential driven by clean label trends and natural fermentation origins. Applications expand beyond traditional uses into plant-based products and functional foods where natural preservation and pH control provide competitive advantages. The segment shows approximately 6.8% annual growth rate reflecting increasing market adoption.

Specialty acidulants including tartaric and malic acids serve niche applications with higher value propositions. These categories require specialized knowledge and technical support, creating opportunities for differentiation and premium pricing. Market development focuses on expanding applications and improving cost-effectiveness through production optimization.

Beverage applications represent the largest end-use category, accounting for approximately 38% of total acidulant consumption. This category drives innovation in flavor profiles, natural ingredients, and functional beverages that require sophisticated acidulant solutions. Growth continues through new product development and expanding beverage categories.

Manufacturers benefit from acidulants through enhanced product quality, extended shelf life, and improved cost-effectiveness in food production processes. These ingredients enable precise pH control, consistent flavor profiles, and natural preservation that meets consumer preferences while maintaining regulatory compliance and operational efficiency.

Retailers gain advantages through improved product stability, reduced waste, and enhanced customer satisfaction with better-tasting, longer-lasting products. Acidulants contribute to supply chain efficiency by extending product shelf life and reducing inventory turnover requirements while supporting premium product positioning.

Consumers receive benefits including better-tasting products, improved food safety, and access to natural preservation solutions that align with health-conscious lifestyle preferences. Acidulants enable food manufacturers to reduce artificial preservatives while maintaining product quality and safety standards.

Supply chain participants benefit from stable demand patterns, diverse application opportunities, and growing market size that supports business expansion and investment in improved capabilities. The market provides opportunities for specialization and value-added services that enhance profitability and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient preference represents the most significant trend shaping market development, with consumers increasingly seeking products containing naturally derived acidulants over synthetic alternatives. This trend drives innovation in fermentation-based production methods and sourcing from natural origins, creating opportunities for premium positioning and market differentiation.

Clean label movement influences product formulation strategies as food manufacturers reformulate products to eliminate artificial additives while maintaining functionality and taste. Acidulants play crucial roles in these reformulations by providing natural preservation and flavor enhancement that meets clean label requirements without compromising product quality.

Sustainability initiatives gain prominence as companies implement environmentally responsible production methods and sourcing strategies. This trend includes reducing carbon footprints, minimizing waste generation, and utilizing renewable energy sources in acidulant production processes. MarkWide Research indicates that sustainability considerations influence approximately 23% of purchasing decisions in the food ingredients sector.

Functional food development creates new applications for acidulants in products designed to provide health benefits beyond basic nutrition. These applications require specialized acidulant properties to maintain stability and effectiveness of functional ingredients while providing desired taste and preservation characteristics.

Technology integration enables precision manufacturing and quality control improvements that enhance acidulant effectiveness while reducing production costs. Advanced processing technologies allow for customized acidulant formulations tailored to specific applications and customer requirements.

Production capacity expansions occur across multiple market participants as companies invest in meeting growing demand and improving operational efficiency. Recent investments focus on sustainable production technologies and flexible manufacturing systems that can adapt to changing market requirements and product specifications.

Strategic partnerships between acidulant producers and food manufacturers strengthen supply relationships while enabling collaborative product development. These partnerships facilitate innovation in acidulant applications and ensure stable supply chains for critical food production processes.

Regulatory approvals for new acidulant applications expand market opportunities while ensuring consumer safety and product quality. Recent approvals include specialized applications in organic foods and novel food categories that require specific preservation and flavor enhancement solutions.

Technology investments in production automation and quality control systems improve manufacturing efficiency while ensuring consistent product quality. These investments enable companies to maintain competitive positioning while meeting increasingly stringent quality requirements from food manufacturers.

Market consolidation continues through acquisitions and mergers that create larger, more capable organizations with enhanced product portfolios and market reach. This consolidation trend enables operational synergies while providing customers with comprehensive acidulant solutions and technical support capabilities.

Investment priorities should focus on natural acidulant production capabilities and sustainable manufacturing technologies that align with market trends and consumer preferences. Companies investing in these areas position themselves advantageously for long-term growth while meeting evolving customer requirements and regulatory standards.

Market expansion strategies should emphasize export opportunities and emerging food categories where specialized acidulant solutions create competitive advantages. MWR analysis suggests that companies pursuing international expansion achieve 15% higher growth rates compared to those focusing solely on domestic markets.

Innovation investments in specialized acidulant formulations and application development enable market differentiation and premium positioning. Companies should prioritize research and development activities that address specific customer needs while creating intellectual property advantages and technical barriers to competition.

Partnership development with food manufacturers and distributors strengthens market position while providing insights into emerging customer requirements. Strategic relationships enable collaborative innovation and ensure stable demand for acidulant products across various application segments.

Operational excellence initiatives focusing on cost reduction, quality improvement, and supply chain optimization maintain competitive positioning while improving profitability. Companies should implement continuous improvement programs that enhance efficiency while maintaining product quality and customer satisfaction.

Market prospects remain positive with continued growth expected across multiple application segments and geographic regions. The outlook benefits from sustained demand for processed foods, increasing emphasis on natural ingredients, and expanding export opportunities that create diverse revenue streams for market participants.

Growth projections indicate sustained expansion with the market expected to maintain a steady growth trajectory of 4.5% CAGR over the next five years. This growth reflects increasing food processing activities, expanding applications in emerging food categories, and growing international demand for UK-produced food ingredients.

Technology advancement will continue driving market evolution through improved production methods, enhanced product functionality, and new application development. Innovation in fermentation technologies and sustainable production methods creates opportunities for market leadership and competitive differentiation.

Regulatory environment evolution supports market growth through clearer guidelines and expanded approval for natural acidulant applications. Regulatory developments favor naturally derived products while maintaining stringent safety standards that protect consumer interests and market integrity.

Competitive dynamics will intensify as companies pursue market share growth through innovation, operational excellence, and strategic partnerships. Success will depend on ability to adapt to changing customer requirements while maintaining cost competitiveness and operational efficiency in an evolving market landscape.

The UK food acidulants market demonstrates robust fundamentals and positive growth prospects driven by increasing demand for processed foods, growing preference for natural ingredients, and expanding application opportunities across diverse food categories. Market participants benefit from established infrastructure, strong regulatory frameworks, and growing export opportunities that support sustainable business development.

Strategic success factors include investment in natural acidulant capabilities, operational excellence, and innovation in specialized applications that meet evolving customer requirements. Companies positioning themselves in growth segments while maintaining competitive cost structures and quality standards are best positioned for long-term success in this dynamic market environment.

Future market development will be shaped by sustainability trends, technological advancement, and changing consumer preferences that favor natural, clean label products. The market offers attractive opportunities for companies willing to invest in innovation and adapt to evolving customer requirements while maintaining operational excellence and competitive positioning in an increasingly sophisticated marketplace.

What is Food Acidulants?

Food acidulants are substances used to impart a sour taste, enhance flavor, and preserve food products. They play a crucial role in various applications, including beverages, dairy products, and confectionery.

What are the key players in the UK Food Acidulants Market?

Key players in the UK Food Acidulants Market include Tate & Lyle, Cargill, and DuPont, which are known for their innovative solutions and extensive product portfolios in food ingredients, among others.

What are the growth factors driving the UK Food Acidulants Market?

The UK Food Acidulants Market is driven by increasing consumer demand for natural and organic food products, the rising popularity of convenience foods, and the need for effective preservation methods in the food industry.

What challenges does the UK Food Acidulants Market face?

Challenges in the UK Food Acidulants Market include regulatory compliance regarding food safety, fluctuating raw material prices, and competition from alternative preservatives and flavoring agents.

What opportunities exist in the UK Food Acidulants Market?

Opportunities in the UK Food Acidulants Market include the growing trend towards clean label products, advancements in food technology, and the increasing use of acidulants in health-focused food formulations.

What trends are shaping the UK Food Acidulants Market?

Trends in the UK Food Acidulants Market include a shift towards plant-based acidulants, innovations in flavor enhancement techniques, and a focus on sustainability in sourcing and production practices.

UK Food Acidulants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Citric Acid, Lactic Acid, Malic Acid, Tartaric Acid |

| Application | Beverages, Dairy Products, Confectionery, Bakery |

| End User | Food Manufacturers, Beverage Producers, Snack Companies, Restaurants |

| Packaging Type | Bags, Drums, Totes, Bottles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Food Acidulants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at