444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The UK Factoring Services Market is a crucial component of the financial landscape, providing businesses with a valuable tool for managing cash flow. Factoring services play a pivotal role in supporting companies by offering a financial mechanism that converts accounts receivable into immediate working capital.

Meaning

Factoring services involve the sale of accounts receivable to a third-party financial institution, known as a factor. In return for the receivables, the business receives an immediate infusion of cash, allowing it to meet short-term financial obligations and invest in growth opportunities.

Executive Summary

The UK Factoring Services Market has experienced significant growth as businesses recognize the benefits of leveraging their accounts receivable to enhance liquidity. This financial strategy not only aids in managing working capital but also provides a flexible and responsive solution to the ever-changing financial needs of businesses.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UK Factoring Services Market operates within a dynamic environment shaped by economic conditions, financial regulations, and the evolving needs of businesses. Factors that adapt to technological advancements and provide tailored solutions are likely to thrive in this dynamic landscape.

Regional Analysis

Regional variations may exist in the demand for factoring services based on factors such as industry composition, economic activity, and the prevalence of SMEs. Understanding regional nuances allows factors to tailor their services to specific market segments.

Competitive Landscape

Leading Companies in UK Factoring Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

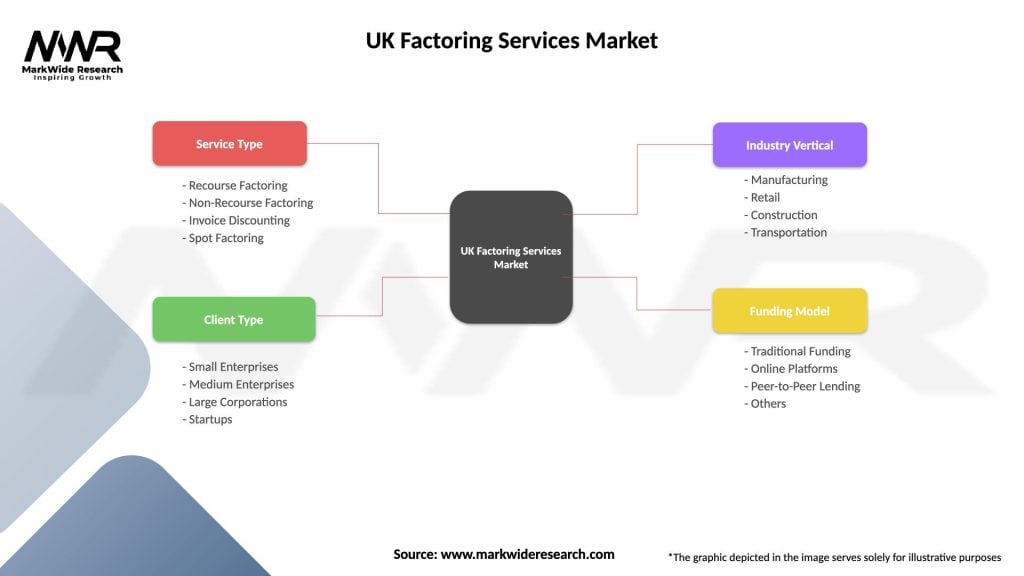

Segmentation

The factoring services market can be segmented based on factors such as industry verticals, size of businesses, and the nature of receivables. Offering specialized factoring solutions allows providers to address the unique requirements of diverse clients.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The UK Factoring Services Market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides an overview of the UK Factoring Services Market’s strengths, weaknesses, opportunities, and threats:

Understanding these factors through a SWOT analysis helps businesses identify their competitive advantages, address weaknesses, capitalize on opportunities, and mitigate potential threats.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had significant implications for the UK Factoring Services Market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the UK Factoring Services Market is optimistic, driven by the increasing recognition of factoring as a strategic financial tool. The market’s evolution will be influenced by technological advancements, industry-specific solutions, and the ability of factoring providers to adapt to changing economic conditions.

Conclusion

The UK Factoring Services Market continues to play a vital role in supporting businesses in managing their working capital and navigating financial challenges. As businesses increasingly recognize the benefits of factoring, the market is poised for further growth. Factoring providers that prioritize innovation, industry-specific solutions, and effective communication are likely to thrive in this dynamic financial landscape. The resilience and adaptability of factoring make it a valuable option for businesses seeking flexible and responsive financing solutions.

What is Factoring Services?

Factoring services involve the financial transaction where a business sells its accounts receivable to a third party, known as a factor, at a discount. This allows businesses to improve cash flow, manage working capital, and reduce the risk of bad debts.

What are the key players in the UK Factoring Services Market?

Key players in the UK factoring services market include Aldermore, Close Brothers, and Bibby Financial Services, among others. These companies provide various factoring solutions tailored to different business needs.

What are the growth factors driving the UK Factoring Services Market?

The growth of the UK factoring services market is driven by increasing demand for cash flow management, the rise of small and medium-sized enterprises (SMEs), and the need for flexible financing options. Additionally, businesses are seeking to mitigate credit risk through factoring.

What challenges does the UK Factoring Services Market face?

Challenges in the UK factoring services market include the perception of high costs associated with factoring, potential client reluctance due to concerns over customer relationships, and competition from alternative financing options. These factors can hinder market growth.

What opportunities exist in the UK Factoring Services Market?

Opportunities in the UK factoring services market include the expansion of digital platforms for easier access to services, increasing awareness of factoring among businesses, and the potential for tailored solutions for niche industries. These factors can enhance market penetration.

What trends are shaping the UK Factoring Services Market?

Trends in the UK factoring services market include the adoption of technology for streamlined processes, a shift towards more flexible and customized factoring solutions, and an increasing focus on sustainability in financing practices. These trends are influencing how services are delivered.

UK Factoring Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Recourse Factoring, Non-Recourse Factoring, Invoice Discounting, Spot Factoring |

| Client Type | Small Enterprises, Medium Enterprises, Large Corporations, Startups |

| Industry Vertical | Manufacturing, Retail, Construction, Transportation |

| Funding Model | Traditional Funding, Online Platforms, Peer-to-Peer Lending, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in UK Factoring Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at