444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK energy storage capacity market represents a transformative sector within the nation’s renewable energy infrastructure, experiencing unprecedented growth as the country accelerates its transition toward net-zero emissions. Energy storage systems have become critical components in managing grid stability, integrating renewable energy sources, and ensuring reliable power supply across residential, commercial, and industrial applications. The market encompasses various technologies including battery energy storage systems, pumped hydro storage, compressed air energy storage, and emerging technologies like hydrogen storage.

Market dynamics indicate robust expansion driven by government initiatives, declining technology costs, and increasing renewable energy penetration. The UK’s commitment to achieving net-zero carbon emissions by 2050 has positioned energy storage as a fundamental enabler of this transition. Current market growth demonstrates a compound annual growth rate (CAGR) of 24.7%, reflecting the sector’s rapid evolution and strategic importance in the national energy landscape.

Technological advancement continues to reshape the market landscape, with lithium-ion batteries dominating current deployments while alternative technologies gain traction for specific applications. The integration of artificial intelligence and smart grid technologies enhances system efficiency and grid management capabilities, creating new opportunities for market participants and stakeholders across the energy value chain.

The UK energy storage capacity market refers to the comprehensive ecosystem of technologies, systems, and services designed to capture, store, and release electrical energy for grid stabilization, renewable energy integration, and demand management across the United Kingdom. This market encompasses the deployment, operation, and maintenance of various energy storage technologies that enable efficient energy management and support the transition to sustainable power generation.

Energy storage capacity specifically measures the total amount of energy that can be stored and subsequently discharged by storage systems installed throughout the UK. These systems serve multiple functions including frequency regulation, peak shaving, load shifting, and providing backup power during grid disturbances. The market includes both utility-scale installations and distributed energy storage systems deployed at residential and commercial levels.

Market participants include technology manufacturers, system integrators, utility companies, independent power producers, and energy service providers who collectively contribute to the development and operation of energy storage infrastructure. The market’s significance extends beyond mere energy storage, encompassing grid services, renewable energy optimization, and the facilitation of electric vehicle charging infrastructure integration.

Strategic positioning of the UK energy storage capacity market reflects the nation’s commitment to renewable energy transition and grid modernization initiatives. The market demonstrates exceptional growth potential driven by supportive government policies, technological innovations, and increasing demand for grid flexibility solutions. Battery energy storage systems currently dominate market deployments, accounting for approximately 78% of new installations, while alternative technologies continue to evolve for specialized applications.

Investment flows into the sector have accelerated significantly, with both domestic and international investors recognizing the strategic value of energy storage infrastructure. The market benefits from favorable regulatory frameworks, including capacity market mechanisms and grid service opportunities that provide multiple revenue streams for storage operators. Utility-scale projects represent the largest segment by capacity, while distributed storage systems show rapid growth in residential and commercial sectors.

Competitive dynamics feature established technology providers alongside emerging innovators, creating a diverse ecosystem of solutions and services. The market’s evolution toward integrated energy systems and smart grid applications positions energy storage as a cornerstone technology for future energy infrastructure development. MarkWide Research analysis indicates that the sector’s growth trajectory aligns with broader decarbonization objectives and energy security priorities.

Market transformation in the UK energy storage sector reveals several critical insights that shape industry development and investment strategies:

Renewable energy integration serves as the primary driver for UK energy storage capacity expansion, as intermittent wind and solar generation require balancing resources to maintain grid stability. The UK’s substantial offshore wind capacity and growing solar installations create significant demand for storage solutions that can capture excess generation during peak production periods and release energy during low renewable output.

Government policy support provides crucial momentum through various mechanisms including the capacity market, which compensates storage providers for maintaining grid reliability. The Net Zero Strategy explicitly recognizes energy storage as essential infrastructure for achieving decarbonization targets, while regulatory reforms enable storage systems to participate in multiple revenue streams simultaneously.

Grid stability requirements drive demand for fast-responding storage technologies that can provide frequency regulation and voltage support services. As traditional fossil fuel power plants retire, energy storage systems increasingly fulfill critical grid services previously provided by conventional generation, creating substantial market opportunities for flexible resources.

Economic factors including declining battery costs and improving system performance metrics enhance project viability across market segments. The levelized cost of storage continues to decrease, making energy storage competitive with traditional grid infrastructure investments while providing additional operational benefits and environmental advantages.

High capital costs remain a significant barrier to energy storage deployment, particularly for large-scale utility projects requiring substantial upfront investment. While technology costs continue declining, the initial capital requirements can challenge project financing and limit market participation, especially for smaller developers and commercial customers seeking distributed storage solutions.

Regulatory complexity creates challenges for market participants navigating multiple regulatory frameworks and grid codes that govern energy storage operations. The evolving nature of energy storage regulations and grid service definitions can create uncertainty for investors and developers, potentially slowing project development timelines and increasing transaction costs.

Grid connection constraints limit deployment opportunities in certain regions where transmission and distribution infrastructure lacks sufficient capacity to accommodate new storage installations. Network reinforcement requirements can add significant costs and delays to storage projects, particularly in areas with aging grid infrastructure or high renewable energy penetration.

Technology limitations including cycle life, efficiency losses, and performance degradation over time affect long-term project economics and operational planning. While battery technologies continue improving, concerns about resource availability for critical materials and end-of-life recycling create additional considerations for sustainable market development.

Emerging applications in electric vehicle charging infrastructure present substantial growth opportunities as the UK accelerates EV adoption. Energy storage systems can optimize charging operations, reduce grid impact, and provide additional services including demand response and grid support functions, creating new revenue streams and market segments.

Industrial decarbonization initiatives create demand for energy storage solutions that support manufacturing processes, reduce carbon emissions, and improve operational efficiency. Large industrial facilities increasingly recognize energy storage as essential infrastructure for achieving sustainability targets while managing energy costs and ensuring operational resilience.

Hybrid renewable projects combining wind or solar generation with energy storage offer enhanced value propositions and improved grid integration characteristics. These co-located systems can provide firm capacity, reduce curtailment, and optimize renewable energy utilization while accessing multiple revenue streams through grid services and energy arbitrage.

International market expansion opportunities emerge as UK companies develop expertise and technologies applicable to global energy storage markets. The experience gained in the domestic market positions UK firms to compete internationally while contributing to global decarbonization efforts and creating export opportunities for British energy storage solutions.

Supply chain evolution reflects the market’s maturation as domestic manufacturing capabilities develop alongside international technology partnerships. UK companies increasingly participate in global supply chains while building local expertise in system integration, project development, and operational services. This evolution enhances supply security and creates domestic employment opportunities across the energy storage value chain.

Competitive intensity increases as established utility companies, technology manufacturers, and new market entrants compete for market share across different segments. The market demonstrates healthy competition between various technology approaches, business models, and service offerings, driving innovation and cost reduction while expanding customer choice and solution diversity.

Financial market development supports sector growth through specialized financing products, insurance solutions, and risk management tools tailored to energy storage projects. Investment funds increasingly recognize energy storage as an attractive asset class, providing capital for project development while institutional investors seek exposure to the growing clean energy infrastructure sector.

Technology convergence creates synergies between energy storage, renewable generation, electric vehicles, and smart grid systems. These integrated solutions offer enhanced value propositions and operational efficiencies, with system optimization achieving performance improvements of 15-25% compared to standalone deployments. MWR analysis indicates that convergence trends will accelerate as digital technologies enable more sophisticated energy management capabilities.

Comprehensive analysis of the UK energy storage capacity market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, technology providers, utility companies, and regulatory officials to capture current market conditions and future development plans.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and regulatory filings to establish market baselines and identify trends. Data sources include the Department for Business, Energy and Industrial Strategy, National Grid ESO, and various industry associations representing energy storage stakeholders.

Market modeling utilizes quantitative analysis techniques to project market growth, segment development, and technology adoption patterns. The methodology incorporates scenario analysis to account for policy changes, technology developments, and economic factors that could influence market evolution over the forecast period.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert review, and market participant feedback. The research methodology maintains objectivity while providing actionable insights for market participants, investors, and policymakers involved in UK energy storage market development.

England dominates the UK energy storage capacity market, accounting for approximately 72% of total installations, driven by high population density, industrial concentration, and proximity to major renewable energy resources. The region benefits from established grid infrastructure, favorable planning policies, and strong investor interest in clean energy projects.

Scotland represents a rapidly growing market segment with substantial renewable energy resources and supportive government policies for energy storage deployment. The region’s abundant wind resources create significant opportunities for co-located storage projects, while island communities benefit from storage solutions that enhance grid stability and reduce reliance on fossil fuel generation.

Wales demonstrates strong growth potential with increasing renewable energy development and government support for clean energy infrastructure. The region’s industrial heritage provides opportunities for large-scale storage deployments supporting manufacturing operations and grid services, while rural areas benefit from distributed storage solutions enhancing energy security.

Northern Ireland shows emerging market development with unique characteristics including island grid operations and specific regulatory frameworks. The region’s energy storage market benefits from EU funding programs and cross-border electricity trading opportunities, while local renewable energy development creates demand for balancing resources and grid support services.

Market leadership in the UK energy storage sector features a diverse mix of international technology providers, domestic system integrators, and utility companies developing comprehensive energy storage solutions:

Strategic partnerships between technology providers, project developers, and financial investors create integrated solutions and risk-sharing arrangements that accelerate market development. These collaborations combine technological expertise with local market knowledge and financial resources to deliver successful energy storage projects across various market segments.

By Technology:

By Application:

By Ownership Model:

Utility-scale storage represents the largest market segment by capacity, driven by grid service requirements and renewable energy integration needs. These systems typically range from 10MW to 100MW+ and provide multiple services including frequency response, capacity provision, and energy arbitrage. Project economics benefit from economies of scale and access to wholesale electricity markets.

Commercial and industrial storage shows rapid growth as businesses seek to reduce energy costs and improve operational resilience. These systems typically range from 100kW to 10MW and focus on demand charge reduction, backup power, and time-of-use optimization. Market adoption accelerates as payback periods decrease and financing options expand.

Residential storage demonstrates strong growth potential driven by solar PV integration and increasing electricity prices. Home battery systems typically range from 5kWh to 20kWh capacity and provide self-consumption optimization, backup power, and participation in demand response programs. Market development benefits from government incentives and improving technology performance.

Grid-scale pumped hydro continues to provide the majority of UK energy storage capacity, with existing facilities offering proven long-duration storage capabilities. While new pumped hydro development faces geographical and environmental constraints, existing facilities undergo upgrades and optimization to enhance performance and extend operational life.

Utility companies benefit from energy storage deployment through enhanced grid flexibility, reduced infrastructure investment requirements, and improved system reliability. Storage systems provide cost-effective alternatives to traditional grid upgrades while offering multiple services that optimize network operations and defer capital expenditures.

Renewable energy developers gain significant advantages from storage integration, including improved project economics, enhanced grid connection opportunities, and reduced curtailment risks. Co-located storage enables renewable projects to provide firm capacity and participate in additional revenue streams while improving overall project viability.

Commercial and industrial customers achieve substantial cost savings through demand charge management, energy arbitrage, and improved power quality. Energy storage systems provide operational resilience during grid outages while enabling participation in demand response programs and grid service markets that generate additional revenue.

Investors and financial institutions benefit from energy storage as an attractive infrastructure asset class offering stable returns, inflation protection, and exposure to the growing clean energy sector. Long-term contracts and multiple revenue streams provide predictable cash flows while supporting portfolio diversification and ESG investment objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology convergence represents a dominant trend as energy storage systems integrate with renewable generation, electric vehicle charging, and smart grid technologies. These hybrid solutions offer enhanced value propositions and operational efficiencies, with integrated systems achieving performance improvements and cost reductions compared to standalone deployments.

Digitalization and artificial intelligence transform energy storage operations through predictive maintenance, optimized dispatch strategies, and automated grid services provision. Machine learning algorithms enhance system performance and extend asset life while reducing operational costs and improving revenue generation capabilities.

Distributed energy resource aggregation enables smaller storage systems to participate in wholesale markets and provide grid services collectively. Virtual power plants combine multiple distributed storage assets to create larger, more valuable resources that can compete with utility-scale installations while maintaining local benefits.

Circular economy principles gain importance as the market matures, with focus on battery recycling, second-life applications, and sustainable material sourcing. End-of-life management becomes increasingly critical as early storage installations approach replacement, creating opportunities for recycling and refurbishment services.

Long-duration storage development addresses seasonal energy storage requirements and grid reliability needs beyond current battery capabilities. Technologies including compressed air energy storage, hydrogen systems, and advanced battery chemistries target applications requiring storage durations of 8+ hours with growing market interest and investment.

Major project announcements demonstrate the market’s rapid expansion, with several utility-scale battery storage facilities exceeding 100MW capacity entering development or operation. These projects showcase the technology’s maturation and ability to provide significant grid services while achieving competitive economics in wholesale electricity markets.

Regulatory framework evolution includes new market mechanisms and grid codes that better accommodate energy storage participation and value recognition. Recent developments enable storage systems to provide multiple services simultaneously while clarifying technical requirements and operational standards for different applications and market segments.

Corporate partnerships between technology providers, utilities, and financial investors create integrated solutions and risk-sharing arrangements that accelerate market development. These collaborations combine technological expertise with market knowledge and financial resources to deliver successful projects across various market segments.

Innovation initiatives supported by government funding and private investment advance next-generation storage technologies and applications. Research and development programs focus on improving performance, reducing costs, and developing new applications that expand market opportunities and enhance system capabilities.

International expansion by UK companies demonstrates the sector’s growing expertise and competitiveness in global markets. British energy storage developers and technology providers increasingly participate in international projects while attracting foreign investment in domestic market development.

Strategic positioning recommendations for market participants emphasize the importance of developing integrated solutions that combine energy storage with complementary technologies and services. Companies should focus on value stacking opportunities that maximize revenue generation while building long-term competitive advantages through technological innovation and market expertise.

Investment strategies should prioritize projects with multiple revenue streams and strong contractual foundations while maintaining flexibility to adapt to evolving market conditions. MarkWide Research analysis suggests that successful market participants will combine technical expertise with financial innovation and strategic partnerships to optimize project development and operational performance.

Technology development efforts should focus on applications that address specific market needs while building on existing capabilities and market positions. Companies should evaluate emerging technologies for their potential to create new market opportunities while ensuring compatibility with existing infrastructure and regulatory frameworks.

Risk management strategies must address technology, market, and regulatory risks through diversification, insurance, and contractual arrangements. Market participants should develop comprehensive risk assessment capabilities while maintaining operational flexibility to respond to changing market conditions and opportunities.

Partnership development should focus on creating strategic alliances that combine complementary capabilities and market access while sharing risks and resources. Successful partnerships will integrate technology providers, project developers, financial investors, and end-users to create comprehensive solutions and sustainable competitive advantages.

Market expansion projections indicate continued robust growth driven by renewable energy integration requirements, grid modernization needs, and supportive policy frameworks. The sector’s growth trajectory aligns with broader decarbonization objectives and energy security priorities, with storage capacity expected to grow at a CAGR of 26.3% through the forecast period.

Technology evolution will continue driving cost reductions and performance improvements while enabling new applications and market segments. Next-generation battery technologies and alternative storage solutions will expand the range of viable applications while improving system economics and operational characteristics.

Market maturation will bring increased standardization, improved financing mechanisms, and more sophisticated risk management tools that reduce barriers to entry and accelerate deployment. The development of secondary markets for storage assets will enhance liquidity and provide additional exit strategies for investors and developers.

Integration opportunities with electric vehicle infrastructure, hydrogen production, and industrial processes will create new market segments and revenue streams. These applications will drive demand for specialized storage solutions while contributing to broader decarbonization efforts across multiple economic sectors.

International competitiveness of UK energy storage companies will strengthen through domestic market experience and technological innovation, creating export opportunities and attracting foreign investment. The sector’s development will contribute to UK leadership in clean energy technologies while supporting domestic economic growth and employment creation.

The UK energy storage capacity market stands at a pivotal moment in its evolution, with strong fundamentals supporting continued growth and market development. The sector benefits from comprehensive policy support, technological advancement, and increasing recognition of energy storage’s critical role in achieving net-zero emissions and maintaining grid reliability.

Market opportunities span multiple segments and applications, from utility-scale grid services to distributed residential systems, creating diverse pathways for market participation and investment. The convergence of energy storage with renewable generation, electric vehicles, and smart grid technologies enhances value propositions while expanding market potential across various customer segments.

Competitive dynamics reflect a healthy balance between established players and emerging innovators, driving continued innovation and cost reduction while expanding customer choice and solution diversity. The market’s maturation brings improved financing mechanisms, standardized approaches, and reduced risks that support accelerated deployment and broader market participation.

Future prospects remain highly positive, with the UK energy storage capacity market positioned to play an increasingly important role in the nation’s energy system transformation. Success in this dynamic market will require strategic focus, technological innovation, and collaborative partnerships that create sustainable competitive advantages while contributing to broader decarbonization and energy security objectives.

What is Energy Storage Capacity?

Energy storage capacity refers to the ability to store energy for later use, which is crucial for balancing supply and demand in energy systems. It includes various technologies such as batteries, pumped hydro storage, and thermal storage, enabling the integration of renewable energy sources and enhancing grid reliability.

What are the key players in the UK Energy Storage Capacity Market?

Key players in the UK Energy Storage Capacity Market include companies like Fluence, SSE, and EDF Energy, which are involved in developing and operating energy storage projects. These companies focus on various applications, including grid stabilization, renewable energy integration, and peak shaving, among others.

What are the main drivers of the UK Energy Storage Capacity Market?

The main drivers of the UK Energy Storage Capacity Market include the increasing demand for renewable energy, the need for grid stability, and government policies promoting energy efficiency. Additionally, advancements in battery technology and decreasing costs are also contributing to market growth.

What challenges does the UK Energy Storage Capacity Market face?

The UK Energy Storage Capacity Market faces challenges such as regulatory hurdles, high initial investment costs, and competition from traditional energy sources. Additionally, the integration of storage systems into existing grid infrastructure can be complex and requires careful planning.

What opportunities exist in the UK Energy Storage Capacity Market?

Opportunities in the UK Energy Storage Capacity Market include the potential for innovative storage solutions, such as community energy storage and hybrid systems. Furthermore, as the demand for electric vehicles grows, there is an opportunity to leverage vehicle-to-grid technologies to enhance energy storage capabilities.

What trends are shaping the UK Energy Storage Capacity Market?

Trends shaping the UK Energy Storage Capacity Market include the increasing adoption of lithium-ion batteries, the rise of decentralized energy systems, and the integration of artificial intelligence for energy management. These trends are driving efficiency and enhancing the overall performance of energy storage solutions.

UK Energy Storage Capacity Market

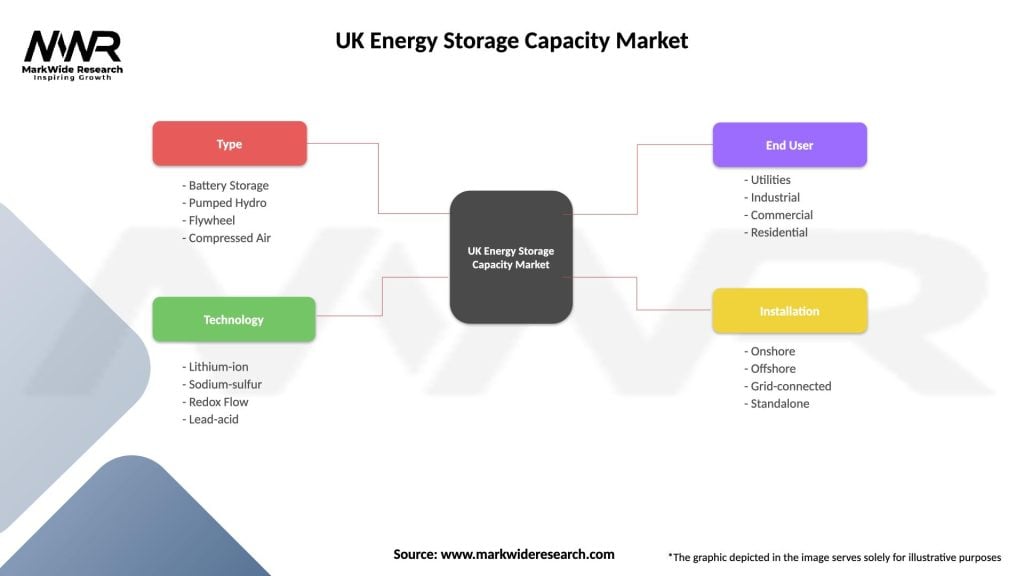

| Segmentation Details | Description |

|---|---|

| Type | Battery Storage, Pumped Hydro, Flywheel, Compressed Air |

| Technology | Lithium-ion, Sodium-sulfur, Redox Flow, Lead-acid |

| End User | Utilities, Industrial, Commercial, Residential |

| Installation | Onshore, Offshore, Grid-connected, Standalone |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Energy Storage Capacity Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at