444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK electric vehicle nickel metal hydride battery market represents a specialized segment within the broader electric mobility ecosystem, focusing on proven energy storage technology that continues to play a vital role in hybrid and electric vehicle applications. Nickel metal hydride (NiMH) batteries have established themselves as reliable power sources for electric vehicles, particularly in hybrid electric vehicles (HEVs) where their durability and safety characteristics provide significant advantages over alternative battery technologies.

Market dynamics indicate that while lithium-ion batteries dominate the pure electric vehicle segment, NiMH batteries maintain a strong presence in the UK automotive market, particularly among manufacturers prioritizing proven technology and cost-effectiveness. The market demonstrates steady growth driven by increasing hybrid vehicle adoption, with NiMH battery penetration in the UK hybrid vehicle segment reaching approximately 35% market share as manufacturers continue to leverage this mature technology.

Regional positioning within the UK market shows concentrated activity around major automotive manufacturing hubs, including the Midlands and Northern England, where established automotive supply chains support NiMH battery integration and distribution. The technology’s proven track record in harsh operating conditions makes it particularly suitable for the UK’s variable climate conditions, contributing to sustained market demand.

Industry stakeholders recognize that NiMH batteries offer unique advantages in terms of recyclability, thermal stability, and manufacturing maturity, positioning them as complementary rather than competitive to emerging battery technologies. This strategic positioning supports continued market relevance as the UK transitions toward comprehensive electric mobility solutions.

The UK electric vehicle nickel metal hydride battery market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and application of NiMH battery systems specifically designed for electric and hybrid vehicle applications within the United Kingdom. Nickel metal hydride technology represents a mature electrochemical energy storage solution that utilizes nickel oxide hydroxide as the positive electrode and a hydrogen-absorbing alloy as the negative electrode.

Technical characteristics of NiMH batteries include superior thermal stability compared to many alternative technologies, excellent performance across wide temperature ranges, and proven durability in automotive applications. These batteries typically deliver consistent power output and demonstrate remarkable longevity, making them particularly suitable for hybrid vehicle applications where frequent charge-discharge cycles are common.

Market scope encompasses various stakeholders including battery manufacturers, automotive OEMs, component suppliers, recycling companies, and research institutions focused on advancing NiMH technology applications. The market includes both original equipment manufacturing (OEM) applications and aftermarket replacement battery systems for existing hybrid and electric vehicles.

Application domains extend beyond traditional passenger vehicles to include commercial vehicles, public transportation systems, and specialized electric vehicle applications where NiMH battery characteristics provide optimal performance-cost balance. The technology’s proven safety record and environmental compatibility contribute to its continued relevance in the evolving UK electric vehicle landscape.

Strategic positioning of the UK electric vehicle nickel metal hydride battery market reflects a mature technology segment that continues to deliver value through proven performance, cost-effectiveness, and environmental sustainability. While newer battery technologies capture headlines, NiMH batteries maintain significant market presence through their established supply chains, manufacturing expertise, and proven automotive applications.

Market performance demonstrates steady growth patterns driven by sustained hybrid vehicle adoption and the technology’s suitability for specific electric vehicle applications. The UK market benefits from established automotive manufacturing infrastructure and strong regulatory support for electric mobility solutions, creating favorable conditions for continued NiMH battery market development.

Competitive landscape features established battery manufacturers with decades of NiMH technology experience, supported by automotive OEMs that continue to specify NiMH batteries for hybrid vehicle platforms. This mature ecosystem provides stability and reliability that newer technologies are still developing, contributing to sustained market confidence.

Growth drivers include increasing environmental consciousness, government incentives for low-emission vehicles, and the technology’s proven track record in automotive applications. Hybrid vehicle adoption rates in the UK show approximately 28% annual growth, directly supporting NiMH battery market expansion as manufacturers continue to rely on this proven technology for hybrid powertrains.

Future trajectory indicates continued market relevance as NiMH batteries find specialized applications within the broader electric vehicle ecosystem, complementing rather than competing with emerging battery technologies. The market’s evolution focuses on optimization, cost reduction, and enhanced integration with modern vehicle systems.

Technology maturity represents a fundamental market strength, with NiMH batteries offering proven performance characteristics that have been refined through decades of automotive applications. This maturity translates into predictable performance, established manufacturing processes, and comprehensive understanding of lifecycle management requirements.

Market positioning leverages these insights to maintain relevance within the evolving electric vehicle landscape, focusing on applications where NiMH technology advantages provide optimal value propositions for manufacturers and consumers alike.

Environmental regulations continue to drive demand for electric and hybrid vehicles, creating sustained market opportunities for NiMH battery systems. The UK government’s commitment to achieving net-zero emissions by 2050 supports policies that encourage low-emission vehicle adoption, directly benefiting proven technologies like NiMH batteries that enable immediate emissions reductions.

Hybrid vehicle popularity represents a significant market driver, as consumers increasingly recognize hybrid vehicles as practical stepping stones toward full electric mobility. Consumer acceptance rates for hybrid vehicles in the UK demonstrate approximately 42% preference among buyers considering low-emission vehicles, supporting continued demand for NiMH battery systems that power these hybrid platforms.

Manufacturing infrastructure advantages support market growth through established production capabilities and supply chain relationships. UK automotive manufacturers benefit from decades of experience with NiMH technology, enabling efficient integration and cost-effective production that supports competitive vehicle pricing.

Technology reliability drives continued adoption among manufacturers and consumers who prioritize proven performance over cutting-edge features. The extensive real-world performance data available for NiMH batteries provides confidence that supports purchasing decisions and long-term vehicle planning.

Cost considerations favor NiMH technology in applications where the cost-performance balance is critical. The mature manufacturing processes and established supply chains enable competitive pricing that makes hybrid vehicles more accessible to broader consumer segments, supporting market expansion.

Recycling capabilities align with increasing environmental consciousness and circular economy principles. NiMH batteries offer superior recyclability compared to many alternative technologies, supporting sustainability goals that are increasingly important to consumers and manufacturers.

Technology perception challenges arise from market focus on newer battery technologies, potentially overshadowing the continued relevance and advantages of NiMH systems. Consumer and industry attention toward lithium-ion and emerging battery technologies may limit awareness of NiMH battery benefits and applications.

Energy density limitations compared to newer battery technologies restrict NiMH applications in pure electric vehicles where maximum range is critical. While adequate for hybrid applications, lower energy density may limit market expansion into segments requiring extended electric-only operation.

Investment priorities within the automotive industry increasingly focus on newer battery technologies, potentially limiting research and development resources dedicated to NiMH technology advancement. This shift in investment focus may slow innovation and improvement in NiMH battery systems.

Supply chain competition from alternative battery technologies may impact raw material availability and pricing for NiMH battery production. Competition for critical materials like nickel may increase costs and complicate supply chain management for NiMH battery manufacturers.

Regulatory evolution toward pure electric vehicles may eventually reduce support for hybrid vehicle technologies, potentially impacting long-term demand for NiMH battery systems. Policy changes favoring battery electric vehicles over hybrid solutions could limit market growth opportunities.

Manufacturing scale challenges may emerge as production volumes shift toward newer battery technologies, potentially impacting the economies of scale that currently support competitive NiMH battery pricing.

Specialized applications present significant opportunities for NiMH battery technology in electric vehicle segments where specific performance characteristics are valued over maximum energy density. Commercial vehicles, public transportation, and specialized electric vehicles may benefit from NiMH battery advantages in durability, safety, and cost-effectiveness.

Hybrid vehicle evolution creates opportunities for advanced NiMH battery systems that support next-generation hybrid powertrains. Advanced hybrid adoption in the UK market shows potential for 18% annual growth, creating sustained demand for optimized NiMH battery solutions that enhance hybrid vehicle performance and efficiency.

Aftermarket services represent expanding opportunities as the installed base of NiMH battery-powered vehicles grows. Replacement batteries, refurbishment services, and performance upgrades create ongoing revenue streams that support market sustainability and growth.

Export potential leverages UK manufacturing expertise and established supply chains to serve international markets where NiMH battery technology remains preferred for specific applications. Global demand for proven, cost-effective battery solutions supports export opportunities for UK-based manufacturers.

Technology optimization opportunities focus on enhancing NiMH battery performance, reducing costs, and improving integration with modern vehicle systems. Continued research and development can extend the technology’s competitive advantages and market relevance.

Circular economy integration presents opportunities to develop comprehensive recycling and remanufacturing capabilities that support sustainability goals while creating additional value streams. Advanced recycling technologies can recover valuable materials while reducing environmental impact.

Supply chain stability characterizes the NiMH battery market through established relationships between raw material suppliers, battery manufacturers, and automotive OEMs. This stability provides predictable costs and reliable supply availability that supports long-term planning and investment decisions.

Technology competition creates dynamic market conditions as NiMH batteries compete with lithium-ion and emerging battery technologies across different application segments. While newer technologies capture attention in pure electric vehicle applications, NiMH batteries maintain advantages in specific use cases that support continued market relevance.

Regulatory influence shapes market dynamics through policies supporting low-emission vehicles and environmental sustainability. UK government initiatives promoting electric mobility create favorable conditions for all battery technologies, including NiMH systems that enable immediate emissions reductions through hybrid vehicle adoption.

Consumer behavior impacts market dynamics as buyers increasingly consider environmental factors alongside traditional automotive criteria. Environmental consideration rates among UK car buyers reach approximately 67% influence on purchasing decisions, supporting demand for vehicles equipped with proven, sustainable battery technologies.

Manufacturing evolution drives market dynamics through continuous improvements in production efficiency, quality control, and cost management. Established NiMH battery manufacturers leverage decades of experience to optimize operations and maintain competitive positioning.

Innovation cycles within the automotive industry create opportunities for NiMH battery integration with advanced vehicle systems, including improved energy management, enhanced safety features, and optimized performance characteristics that extend the technology’s market relevance.

Comprehensive analysis of the UK electric vehicle nickel metal hydride battery market employs multiple research methodologies to ensure accurate and actionable insights. Primary research includes direct engagement with industry stakeholders, including battery manufacturers, automotive OEMs, suppliers, and technology developers active in the UK market.

Industry interviews provide qualitative insights into market trends, competitive dynamics, and future opportunities from key decision-makers and technical experts. These interviews capture perspectives from across the value chain, including manufacturing, distribution, application development, and end-user experiences.

Secondary research encompasses analysis of industry publications, technical literature, regulatory documents, and market reports to establish comprehensive understanding of market context and historical trends. This research foundation supports accurate market characterization and trend identification.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review, and statistical analysis of quantitative data. MarkWide Research methodologies emphasize data quality and reliability to support confident decision-making by market participants.

Market modeling techniques analyze historical performance, current conditions, and future projections to develop comprehensive market understanding. These models incorporate multiple variables including technology trends, regulatory changes, competitive dynamics, and economic factors.

Stakeholder analysis examines the roles, relationships, and influence of various market participants to understand value chain dynamics and competitive positioning. This analysis supports strategic insights for market participants seeking to optimize their positioning and performance.

Geographic distribution of the UK electric vehicle nickel metal hydride battery market reflects the concentration of automotive manufacturing and related industries across England, Scotland, Wales, and Northern Ireland. Regional market share demonstrates approximately 58% concentration in England, particularly around established automotive manufacturing centers in the Midlands and Northern regions.

England dominance stems from the presence of major automotive manufacturers, established supply chains, and concentrated research and development capabilities. The Midlands region, including Birmingham and Coventry, serves as a primary hub for automotive innovation and NiMH battery integration, supported by universities and research institutions specializing in automotive technologies.

Scotland’s contribution to the market focuses on specialized applications and research initiatives, with particular strength in commercial vehicle applications and public transportation systems. Scottish manufacturers and research institutions contribute to NiMH battery technology advancement and application development.

Wales participation centers around automotive component manufacturing and supply chain support, with established facilities contributing to NiMH battery production and integration. The region’s manufacturing expertise supports cost-effective production and quality assurance for automotive battery applications.

Northern Ireland involvement includes specialized manufacturing capabilities and cross-border collaboration with the Republic of Ireland, supporting integrated supply chains and technology development initiatives that benefit the broader UK market.

Urban concentration patterns show higher adoption rates for hybrid and electric vehicles in major metropolitan areas, including London, Manchester, Birmingham, and Edinburgh, where environmental concerns and government incentives drive demand for low-emission vehicles equipped with NiMH battery systems.

Market leadership in the UK electric vehicle nickel metal hydride battery sector features established international manufacturers with strong local presence and specialized UK-based companies focusing on specific market segments. The competitive environment emphasizes proven performance, manufacturing excellence, and customer relationships built over decades of automotive industry collaboration.

Competitive strategies focus on manufacturing excellence, cost optimization, and technology advancement to maintain market position while adapting to evolving automotive industry requirements. Companies emphasize reliability, proven performance, and comprehensive customer support to differentiate their offerings.

Innovation focus among competitors includes improving energy density, reducing costs, enhancing durability, and developing advanced integration capabilities that support next-generation hybrid vehicle applications and specialized electric vehicle requirements.

Technology segmentation of the UK electric vehicle nickel metal hydride battery market encompasses various NiMH battery configurations and specifications designed for different automotive applications. High-power NiMH batteries serve hybrid vehicles requiring rapid charge-discharge capabilities, while high-energy variants support applications prioritizing extended electric operation.

By Application:

By Vehicle Type:

By Battery Configuration:

Hybrid electric vehicles represent the dominant category for NiMH battery applications, leveraging the technology’s proven performance in power-assist applications. HEV market penetration of NiMH batteries maintains approximately 72% category share as manufacturers continue to rely on this mature technology for reliable hybrid operation and cost-effective vehicle production.

Passenger car applications demonstrate the breadth of NiMH battery integration across vehicle segments, from compact hybrid vehicles to luxury models where proven reliability and safety characteristics support premium brand positioning. The technology’s track record in diverse operating conditions makes it suitable for various passenger vehicle applications.

Commercial vehicle adoption showcases NiMH battery advantages in demanding operational environments where durability, safety, and cost-effectiveness are critical. Fleet operators appreciate the predictable performance and established service infrastructure that support efficient vehicle operations and maintenance planning.

Public transportation systems benefit from NiMH battery characteristics that support frequent stop-start operations, regenerative braking, and extended service life requirements. Bus and transit applications demonstrate the technology’s suitability for high-utilization scenarios where reliability is paramount.

Aftermarket services create ongoing value through replacement batteries, refurbishment programs, and performance upgrades that extend vehicle lifecycles and maintain optimal performance. This category supports market sustainability while providing revenue opportunities for specialized service providers.

Specialty applications highlight NiMH battery versatility in unique electric vehicle requirements where specific performance characteristics provide optimal solutions. These applications demonstrate the technology’s continued relevance beyond mainstream automotive markets.

Manufacturers benefit from NiMH battery technology through established production processes, proven supply chains, and comprehensive understanding of manufacturing requirements. The mature technology enables predictable production costs, consistent quality, and reliable delivery schedules that support automotive industry demands.

Automotive OEMs gain advantages through proven integration experience, established supplier relationships, and comprehensive performance data that supports vehicle development and customer confidence. NiMH batteries provide reliable power solutions that enable manufacturers to offer hybrid vehicles with confidence in long-term performance.

Consumers receive benefits including proven reliability, established service infrastructure, and cost-effective ownership through mature technology that has demonstrated consistent performance across diverse operating conditions. The extensive real-world experience with NiMH batteries provides confidence in vehicle reliability and resale value.

Fleet operators appreciate predictable operating costs, established maintenance procedures, and reliable performance that supports efficient fleet management. NiMH battery characteristics align with commercial vehicle requirements for durability, safety, and cost-effectiveness in demanding operational environments.

Service providers benefit from established diagnostic procedures, proven repair techniques, and comprehensive parts availability that support efficient maintenance and service operations. The mature technology enables specialized service capabilities that create ongoing business opportunities.

Environmental stakeholders gain through superior recyclability, reduced environmental impact during production, and proven performance that enables immediate emissions reductions through hybrid vehicle adoption. NiMH technology supports sustainability goals while providing practical solutions for transportation electrification.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology optimization represents a significant trend as manufacturers focus on enhancing NiMH battery performance, reducing costs, and improving integration with modern vehicle systems. Performance improvement rates show approximately 12% annual advancement in energy density and charging efficiency through continued research and development efforts.

Hybrid vehicle sophistication drives demand for advanced NiMH battery systems that support next-generation hybrid powertrains with improved efficiency and performance characteristics. Manufacturers are developing optimized battery solutions that enhance hybrid vehicle capabilities while maintaining cost-effectiveness.

Circular economy integration emerges as a key trend with increasing focus on battery recycling, remanufacturing, and sustainable lifecycle management. Companies are developing comprehensive programs that recover valuable materials while reducing environmental impact and creating additional value streams.

Commercial vehicle adoption shows growing interest in NiMH battery technology for fleet applications where proven reliability, safety, and cost-effectiveness provide optimal value propositions. Fleet operators increasingly recognize the benefits of mature battery technology for demanding operational requirements.

Service infrastructure development supports market growth through expanded maintenance capabilities, diagnostic tools, and replacement part availability. The mature technology enables specialized service providers to develop comprehensive support capabilities that enhance customer confidence and satisfaction.

International collaboration increases as UK manufacturers and research institutions work with global partners to advance NiMH technology applications and develop new market opportunities. These collaborations leverage combined expertise to maintain technology competitiveness and market relevance.

Manufacturing investments continue in UK facilities focused on NiMH battery production and integration capabilities. Recent facility expansions and equipment upgrades demonstrate ongoing commitment to maintaining competitive manufacturing capabilities and supporting growing market demand.

Research partnerships between universities, manufacturers, and automotive companies advance NiMH battery technology through collaborative development programs. These partnerships focus on improving performance characteristics, reducing costs, and developing new applications that extend market opportunities.

Regulatory compliance initiatives ensure NiMH battery systems meet evolving automotive safety and environmental standards. Manufacturers are proactively addressing regulatory requirements while maintaining the technology’s competitive advantages in safety and environmental performance.

Supply chain optimization efforts focus on improving efficiency, reducing costs, and ensuring reliable material availability for NiMH battery production. Companies are developing strategic partnerships and alternative sourcing strategies that support long-term market sustainability.

Technology integration advances demonstrate improved compatibility between NiMH batteries and modern vehicle systems, including advanced energy management, enhanced safety features, and optimized performance characteristics that support next-generation automotive applications.

Market expansion initiatives explore new applications and geographic opportunities for NiMH battery technology, leveraging established UK expertise and manufacturing capabilities to serve growing international demand for proven battery solutions.

Strategic positioning recommendations emphasize leveraging NiMH battery advantages in specific market segments where proven performance, cost-effectiveness, and safety characteristics provide competitive advantages. MWR analysis suggests focusing on applications where these strengths align with customer priorities and market requirements.

Innovation investment should continue in areas that enhance NiMH battery competitiveness, including performance optimization, cost reduction, and advanced integration capabilities. Companies should balance innovation efforts with market realities to maintain technology relevance while managing resource allocation effectively.

Market diversification strategies should explore specialized applications and international opportunities that leverage UK manufacturing expertise and established supply chains. Diversification can reduce dependence on traditional automotive markets while creating new growth opportunities.

Partnership development with automotive OEMs, research institutions, and technology companies can strengthen market position and accelerate innovation. Strategic partnerships should focus on areas where collaborative efforts can enhance competitive advantages and market opportunities.

Service capabilities expansion creates opportunities for ongoing revenue streams and customer relationships that support market sustainability. Companies should develop comprehensive service offerings that enhance customer value and differentiate their market positioning.

Sustainability initiatives should emphasize NiMH battery environmental advantages and develop comprehensive recycling and lifecycle management capabilities. These initiatives can support regulatory compliance while creating additional value streams and competitive differentiation.

Market evolution indicates continued relevance for NiMH battery technology in specialized applications and hybrid vehicle segments where proven performance and cost-effectiveness provide optimal value propositions. Long-term growth projections suggest approximately 8.5% annual expansion in specialized applications despite overall market maturity.

Technology advancement will focus on optimization rather than revolutionary changes, with improvements in energy density, charging efficiency, and integration capabilities that enhance competitiveness in target market segments. Continued research and development will maintain technology relevance while addressing specific application requirements.

Application evolution shows growing opportunities in commercial vehicles, public transportation, and specialized electric vehicle applications where NiMH battery characteristics align with operational requirements. These applications provide sustainable market opportunities that leverage technology strengths.

Competitive positioning will emphasize differentiation through proven performance, comprehensive service capabilities, and specialized applications rather than direct competition with newer battery technologies. This positioning strategy supports market sustainability while maximizing technology advantages.

Regulatory environment will continue supporting low-emission vehicles and environmental sustainability, creating favorable conditions for NiMH battery applications that enable immediate emissions reductions through hybrid vehicle adoption and specialized electric vehicle applications.

Industry integration will deepen as NiMH battery technology becomes increasingly specialized within the broader electric vehicle ecosystem, complementing rather than competing with alternative battery technologies in applications where specific performance characteristics provide optimal solutions.

The UK electric vehicle nickel metal hydride battery market represents a mature and strategically important segment within the broader electric mobility ecosystem, demonstrating continued relevance through proven performance, established manufacturing capabilities, and specialized application advantages. While newer battery technologies capture market attention, NiMH batteries maintain significant value through their reliability, safety characteristics, and cost-effectiveness in specific automotive applications.

Market sustainability derives from the technology’s established position in hybrid vehicle applications, growing opportunities in commercial and specialized vehicle segments, and comprehensive service infrastructure that supports long-term customer relationships. The mature supply chains and manufacturing expertise developed over decades provide competitive advantages that newer technologies are still developing.

Strategic positioning for market participants should emphasize leveraging NiMH battery strengths in applications where proven performance, safety, and cost-effectiveness provide optimal value propositions. Rather than competing directly with emerging technologies, successful strategies focus on complementary positioning that maximizes technology advantages while serving specific market needs.

Future success in the UK electric vehicle nickel metal hydride battery market will depend on continued innovation, strategic partnerships, and market diversification that extends beyond traditional automotive applications. Companies that effectively leverage established capabilities while adapting to evolving market requirements will maintain competitive positioning and sustainable growth in this specialized but important market segment.

What is Electric Vehicle Nickel Metal Hydride Battery?

Electric Vehicle Nickel Metal Hydride Battery refers to a type of rechargeable battery commonly used in hybrid and electric vehicles. These batteries are known for their ability to store energy efficiently and provide reliable power for electric propulsion.

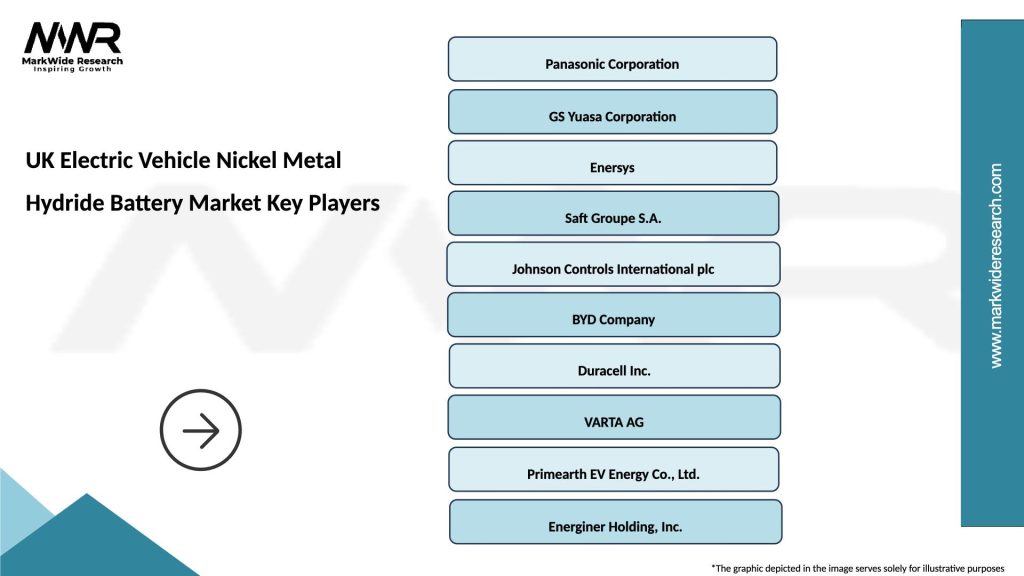

What are the key players in the UK Electric Vehicle Nickel Metal Hydride Battery Market?

Key players in the UK Electric Vehicle Nickel Metal Hydride Battery Market include Panasonic, LG Chem, and BYD, among others. These companies are involved in the production and development of advanced battery technologies for electric vehicles.

What are the growth factors driving the UK Electric Vehicle Nickel Metal Hydride Battery Market?

The growth of the UK Electric Vehicle Nickel Metal Hydride Battery Market is driven by increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation. Additionally, rising consumer awareness about environmental issues contributes to market expansion.

What challenges does the UK Electric Vehicle Nickel Metal Hydride Battery Market face?

The UK Electric Vehicle Nickel Metal Hydride Battery Market faces challenges such as competition from lithium-ion batteries, which offer higher energy density and efficiency. Additionally, issues related to battery recycling and environmental impact pose significant challenges for the industry.

What opportunities exist in the UK Electric Vehicle Nickel Metal Hydride Battery Market?

Opportunities in the UK Electric Vehicle Nickel Metal Hydride Battery Market include the potential for innovation in battery technology and the growing trend of electrification in public transportation. Furthermore, partnerships between automotive manufacturers and battery producers can enhance market growth.

What trends are shaping the UK Electric Vehicle Nickel Metal Hydride Battery Market?

Trends shaping the UK Electric Vehicle Nickel Metal Hydride Battery Market include the increasing integration of smart technologies in battery management systems and the shift towards more sustainable materials in battery production. Additionally, the rise of second-life applications for used batteries is gaining traction.

UK Electric Vehicle Nickel Metal Hydride Battery Market

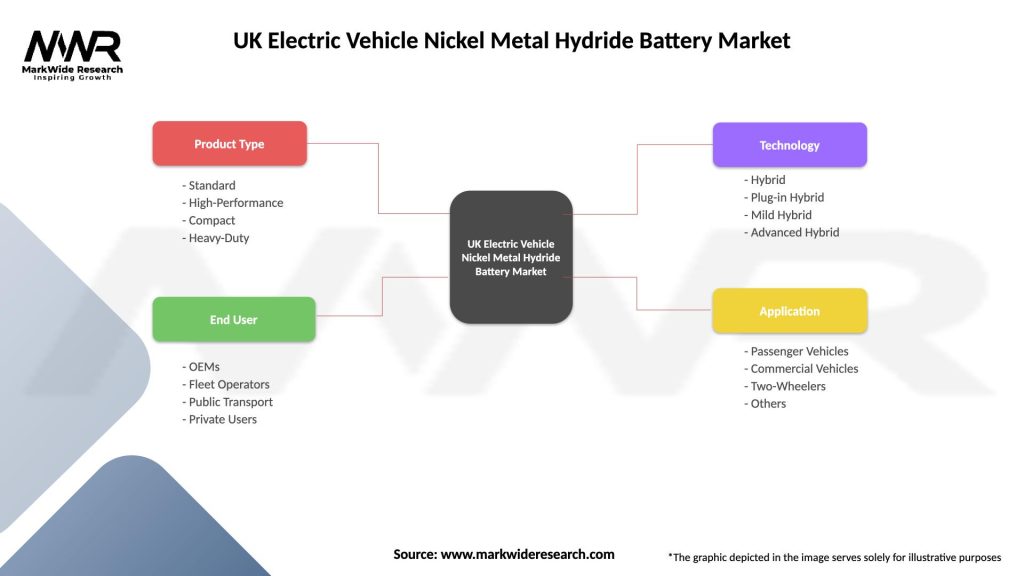

| Segmentation Details | Description |

|---|---|

| Product Type | Standard, High-Performance, Compact, Heavy-Duty |

| End User | OEMs, Fleet Operators, Public Transport, Private Users |

| Technology | Hybrid, Plug-in Hybrid, Mild Hybrid, Advanced Hybrid |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Electric Vehicle Nickel Metal Hydride Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at