444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK e-bike market represents one of the most dynamic and rapidly evolving segments within the broader transportation and mobility sector. Electric bicycles have transformed from niche products to mainstream transportation solutions, driven by increasing environmental consciousness, urban congestion challenges, and government initiatives promoting sustainable mobility. The market encompasses various categories including city e-bikes, mountain e-bikes, cargo e-bikes, and folding electric bicycles, each serving distinct consumer needs and preferences.

Market dynamics indicate robust growth trajectory with the UK experiencing a 15.2% annual growth rate in e-bike adoption over recent years. This expansion reflects changing consumer attitudes toward sustainable transportation, supported by improved battery technology, extended range capabilities, and declining costs. Urban areas particularly demonstrate strong adoption rates, with London, Manchester, and Birmingham leading the charge in e-bike integration within existing transport infrastructure.

Government support through various schemes and initiatives has significantly contributed to market expansion. The Cycle to Work scheme, local authority grants, and infrastructure investments in cycling lanes have created favorable conditions for e-bike adoption. Additionally, the post-pandemic shift toward personal mobility solutions and health-conscious transportation choices has accelerated market penetration across diverse demographic segments.

The UK e-bike market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, retail, and servicing of electric bicycles within the United Kingdom. Electric bicycles, commonly known as e-bikes, are pedal-assisted vehicles equipped with electric motors that provide additional power to supplement human pedaling effort, making cycling more accessible and efficient for various user groups.

Market scope includes various product categories, from basic pedal-assist models to sophisticated electric bicycles featuring advanced connectivity, GPS navigation, and smart charging systems. The market encompasses both domestic and imported products, with established bicycle manufacturers, specialized e-bike companies, and new market entrants competing across different price segments and consumer preferences.

Regulatory framework defines e-bikes as bicycles with electric motors not exceeding 250 watts, maximum assisted speed of 15.5 mph, and requiring pedaling for motor activation. This classification allows e-bikes to utilize existing cycling infrastructure without requiring registration, insurance, or licensing, contributing to their accessibility and market appeal.

Strategic analysis reveals the UK e-bike market experiencing unprecedented growth driven by convergent factors including environmental awareness, technological advancement, and changing mobility preferences. Consumer adoption has accelerated significantly, with urban professionals, recreational cyclists, and delivery services representing primary growth segments.

Technology evolution continues reshaping market dynamics through improved battery performance, lightweight materials, and integrated smart features. Lithium-ion battery technology advancements have extended range capabilities while reducing charging times, addressing key consumer concerns about e-bike practicality. Manufacturing innovation has resulted in more aesthetically appealing designs that closely resemble traditional bicycles while incorporating sophisticated electric assistance systems.

Market penetration varies significantly across regions, with metropolitan areas showing 68% higher adoption rates compared to rural locations. This disparity reflects infrastructure availability, demographic factors, and varying transportation needs. Retail channels have diversified beyond traditional bicycle shops to include online platforms, department stores, and specialized e-bike retailers, improving product accessibility and consumer choice.

Competitive landscape features established bicycle manufacturers expanding into electric segments alongside specialized e-bike companies and new market entrants. Price competition has intensified across segments, with premium brands focusing on performance and features while budget-oriented manufacturers target price-sensitive consumers seeking basic electric assistance functionality.

Consumer behavior analysis reveals distinct purchasing patterns and preferences shaping market development. The following insights highlight critical market dynamics:

Environmental consciousness serves as a fundamental driver propelling UK e-bike market expansion. Growing awareness of carbon emissions, air quality concerns, and climate change impacts motivates consumers to seek sustainable transportation alternatives. Government initiatives supporting carbon neutrality goals and clean air zones in major cities create favorable conditions for e-bike adoption as environmentally responsible mobility solutions.

Urban congestion challenges increasingly drive consumer interest in alternative transportation modes. Traditional commuting methods face growing inefficiencies due to traffic congestion, parking limitations, and public transport capacity constraints. E-bikes offer practical solutions enabling faster, more flexible urban mobility while avoiding many challenges associated with car ownership and public transport dependencies.

Health and fitness awareness contributes significantly to market growth as consumers recognize e-bikes’ ability to provide exercise benefits while reducing physical barriers to cycling. Pedal assistance enables individuals with varying fitness levels, age groups, and physical capabilities to engage in cycling activities previously considered challenging or inaccessible.

Technological advancement continues driving market expansion through improved product performance, reliability, and user experience. Battery technology improvements deliver extended range, faster charging, and longer lifespan, addressing primary consumer concerns about e-bike practicality. Smart features, connectivity options, and integrated navigation systems enhance value propositions and appeal to tech-savvy consumers.

Economic factors including rising fuel costs, parking fees, and public transport expenses make e-bikes increasingly attractive from cost-benefit perspectives. Total ownership costs for e-bikes compare favorably to car ownership and public transport annual passes, particularly for regular commuters and urban residents.

High initial costs represent significant barriers to market expansion, particularly for quality e-bikes featuring advanced technology and reliable components. Price sensitivity among potential consumers often results in delayed purchase decisions or selection of lower-quality alternatives that may negatively impact user experience and market perception.

Infrastructure limitations constrain market growth in areas lacking adequate cycling lanes, secure parking facilities, and charging infrastructure. Safety concerns related to sharing road space with motor vehicles deter potential users, particularly in regions with limited dedicated cycling infrastructure and inadequate traffic management systems.

Regulatory uncertainties and varying local regulations create confusion among consumers and retailers regarding e-bike classifications, usage restrictions, and compliance requirements. Insurance and liability questions surrounding e-bike accidents and theft protection add complexity to ownership decisions and may discourage adoption among risk-averse consumers.

Technical challenges including battery degradation, maintenance requirements, and repair complexities concern potential buyers unfamiliar with electric vehicle technology. Service availability limitations in certain regions create additional barriers, as consumers worry about accessing qualified technicians and replacement parts for specialized e-bike components.

Weather dependency affects year-round usability in the UK climate, with seasonal variations impacting consistent usage patterns. Storage and security challenges in urban environments, particularly for apartment dwellers and those lacking secure parking options, limit adoption among potential users concerned about theft and weather protection.

Corporate adoption presents substantial growth opportunities as businesses recognize e-bikes’ potential for employee benefits programs, sustainable transportation initiatives, and last-mile delivery solutions. Fleet management services for corporate clients, delivery companies, and shared mobility providers represent emerging revenue streams with significant scaling potential.

Tourism and leisure sectors offer expanding opportunities for e-bike rental services, guided tours, and recreational cycling experiences. Rural tourism particularly benefits from e-bike integration, enabling visitors to explore countryside areas with reduced physical demands while supporting local economic development and sustainable tourism practices.

Demographic expansion into underserved segments including older adults, individuals with mobility challenges, and families with children creates new market opportunities. Specialized products designed for specific user groups, such as cargo e-bikes for families and lightweight models for seniors, represent growing niche markets with premium pricing potential.

Technology integration opportunities include smart connectivity features, IoT integration, and data analytics services that enhance user experience and create additional revenue streams. Subscription models for maintenance, insurance, and upgrade services provide recurring revenue opportunities while improving customer relationships and retention.

Government partnerships for public sector initiatives, educational programs, and infrastructure development create opportunities for market expansion and brand visibility. Policy support through grants, incentives, and regulatory frameworks favorable to e-bike adoption can accelerate market penetration and establish long-term growth foundations.

Supply chain evolution reflects changing market dynamics as manufacturers adapt to growing demand, component availability, and quality requirements. Global supply chains face ongoing challenges related to component sourcing, shipping costs, and delivery timelines, impacting pricing strategies and product availability across different market segments.

Competitive intensity continues increasing as established bicycle manufacturers, automotive companies, and specialized e-bike brands compete for market share. Price competition particularly affects entry-level segments, while premium manufacturers focus on differentiation through technology, design, and service quality to maintain margins and brand positioning.

Consumer education plays crucial roles in market development as potential buyers require information about e-bike benefits, technology features, and maintenance requirements. Demonstration programs, trial periods, and educational initiatives help overcome knowledge barriers and build consumer confidence in e-bike technology and performance capabilities.

Retail channel evolution reflects changing consumer preferences and shopping behaviors, with online sales gaining 35% market share while traditional bicycle shops adapt through service specialization and experiential retail approaches. Omnichannel strategies combining online convenience with physical touchpoints for testing and service support optimal customer experiences.

Seasonal demand patterns require strategic inventory management and marketing approaches to optimize sales throughout the year. Winter months present opportunities for maintenance services, accessory sales, and preparation for peak season demand, while summer periods focus on maximizing unit sales and market penetration.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into UK e-bike market dynamics. Primary research includes consumer surveys, industry interviews, and retailer feedback sessions providing direct insights into market trends, preferences, and challenges affecting various stakeholders throughout the value chain.

Secondary research incorporates government statistics, industry reports, trade association data, and academic studies to establish market context and validate primary research findings. Data triangulation methods ensure consistency and reliability across different information sources while identifying potential discrepancies requiring additional investigation or clarification.

Market segmentation analysis utilizes demographic data, geographic information, and behavioral patterns to identify distinct consumer groups and their specific needs, preferences, and purchasing behaviors. Statistical modeling techniques help project market trends, growth patterns, and potential scenarios affecting future market development and competitive dynamics.

Industry expert consultations provide specialized insights into technical developments, regulatory changes, and strategic considerations affecting market participants. Retailer surveys offer valuable perspectives on consumer behavior, sales patterns, and operational challenges faced by businesses directly serving end customers in various market segments.

Continuous monitoring of market indicators, policy developments, and technological advancement ensures research findings remain current and relevant to rapidly evolving market conditions. MarkWide Research methodologies incorporate real-time data collection and analysis to provide timely insights supporting strategic decision-making for industry participants and stakeholders.

London and Southeast England dominate UK e-bike market activity, accounting for approximately 45% of total market share due to high population density, extensive cycling infrastructure, and strong environmental consciousness among urban residents. Transport for London initiatives supporting cycling infrastructure development and congestion charging policies create favorable conditions for e-bike adoption as practical alternatives to traditional transportation modes.

Northern England including Manchester, Liverpool, and Leeds demonstrates growing e-bike adoption driven by urban regeneration projects, cycling infrastructure investments, and increasing environmental awareness. Industrial heritage cities particularly benefit from e-bike integration into sustainable transportation strategies supporting economic development and quality of life improvements for residents and workers.

Scotland shows strong growth potential despite challenging topography, with Edinburgh and Glasgow leading adoption rates supported by government initiatives promoting sustainable transportation. Rural Scotland presents unique opportunities for e-bike tourism and recreational applications, leveraging natural landscapes and outdoor activity traditions to attract both domestic and international visitors.

Wales demonstrates increasing interest in e-bike solutions for both urban and rural applications, with Cardiff and Swansea showing strong adoption rates. Welsh Government support for sustainable transportation and active travel initiatives creates favorable policy environments for continued market expansion across diverse geographic and demographic segments.

Regional variations in adoption rates reflect differences in infrastructure development, demographic characteristics, and local transportation needs. Rural areas show 28% lower adoption rates compared to urban centers, primarily due to infrastructure limitations and different mobility requirements, though recreational and tourism applications show growing potential.

Market leadership reflects diverse competitive dynamics with established bicycle manufacturers, specialized e-bike companies, and new market entrants competing across different segments and price points. The competitive landscape features both domestic and international players adapting strategies to UK market conditions and consumer preferences.

Competitive strategies vary significantly across market participants, with premium brands emphasizing technology leadership, design innovation, and comprehensive service support. Value-oriented competitors focus on cost optimization, basic functionality, and broad market accessibility to capture price-sensitive consumer segments.

Market consolidation trends indicate potential for mergers and acquisitions as companies seek scale advantages, technology capabilities, and market access. Strategic partnerships between manufacturers, retailers, and service providers create integrated value propositions addressing complete customer lifecycle needs from purchase through ongoing maintenance and support.

Product category segmentation reveals distinct market segments serving different consumer needs and applications. City e-bikes represent the largest segment, designed for urban commuting and daily transportation with emphasis on comfort, practicality, and ease of use. These models typically feature upright riding positions, integrated lighting, and cargo-carrying capabilities.

Mountain e-bikes serve recreational and sport cycling applications, featuring robust construction, advanced suspension systems, and powerful motors for challenging terrain navigation. Performance characteristics emphasize durability, handling, and extended range capabilities to support longer recreational rides and demanding off-road conditions.

Cargo e-bikes address specific transportation needs for families, delivery services, and commercial applications requiring substantial carrying capacity. Design variations include front-loading, rear-loading, and mid-tail configurations optimized for different cargo types and usage patterns.

Folding e-bikes target urban commuters with limited storage space and multimodal transportation needs. Compact design enables easy storage in apartments, offices, and public transport while maintaining electric assistance functionality for practical urban mobility.

Price segmentation reflects varying consumer budgets and feature requirements:

Urban commuter e-bikes demonstrate strongest growth momentum driven by increasing numbers of professionals seeking sustainable transportation alternatives. Feature priorities include reliable battery performance, integrated lighting systems, theft protection, and weather resistance to support daily usage requirements across varying conditions.

Recreational e-bikes benefit from growing interest in outdoor activities and health-conscious lifestyle choices. Weekend usage patterns emphasize longer rides, scenic routes, and social cycling activities, requiring extended battery range and comfortable riding positions for sustained use.

Delivery and commercial e-bikes represent rapidly expanding segments driven by e-commerce growth and last-mile delivery demands. Fleet applications require durability, high utilization rates, and cost-effective maintenance to support commercial viability and operational efficiency.

Family-oriented e-bikes including cargo models and child-carrying configurations address specific demographic needs for practical family transportation. Safety features, stability characteristics, and carrying capacity represent primary considerations for parents seeking alternatives to car-based family transportation.

Senior-focused e-bikes emphasize accessibility, ease of use, and safety features supporting older adult mobility needs. Design considerations include step-through frames, comfortable seating, intuitive controls, and enhanced stability to accommodate age-related physical considerations and preferences.

Performance and sport e-bikes serve enthusiast markets seeking advanced technology and superior performance characteristics. Technical specifications emphasize motor power, battery capacity, component quality, and integration with cycling computer systems for serious recreational and competitive applications.

Manufacturers benefit from expanding market opportunities, technological innovation drivers, and diversified revenue streams across multiple product categories and consumer segments. Production scaling enables cost optimization while meeting growing demand for various e-bike configurations and feature combinations.

Retailers gain access to higher-margin products, expanded customer bases, and opportunities for value-added services including maintenance, accessories, and financing options. Service revenue streams provide recurring income opportunities while building stronger customer relationships and brand loyalty.

Consumers benefit from improved transportation options, reduced environmental impact, enhanced mobility capabilities, and potential cost savings compared to traditional transportation modes. Health benefits include increased physical activity, reduced stress, and improved overall well-being through regular cycling activity.

Government entities achieve multiple policy objectives including reduced carbon emissions, decreased traffic congestion, improved public health outcomes, and enhanced quality of life for citizens. Infrastructure investments in cycling facilities generate economic returns through increased property values and business activity.

Environmental stakeholders benefit from reduced carbon emissions, improved air quality, and decreased noise pollution in urban areas. Sustainability goals receive support through widespread adoption of clean transportation alternatives replacing fossil fuel-dependent mobility options.

Healthcare systems potentially benefit from improved population health outcomes through increased physical activity and reduced air pollution exposure. Preventive health benefits may contribute to reduced healthcare costs and improved quality of life for regular e-bike users across various age groups.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration represents a dominant trend transforming e-bike functionality and user experience. Smartphone integration enables GPS navigation, ride tracking, theft protection, and remote diagnostics, appealing to tech-savvy consumers seeking connected mobility solutions. Advanced models incorporate IoT capabilities for fleet management and predictive maintenance applications.

Design evolution toward more aesthetically appealing and lightweight models addresses consumer preferences for bicycles that closely resemble traditional designs while incorporating electric assistance technology. Battery integration improvements create cleaner visual profiles and better weight distribution, enhancing both appearance and riding characteristics.

Subscription and service models gain traction as consumers seek comprehensive solutions including maintenance, insurance, and upgrade options. Mobility-as-a-Service concepts integrate e-bikes with other transportation modes, providing flexible access without ownership requirements and reducing barriers to adoption.

Cargo and utility applications expand rapidly driven by e-commerce growth and last-mile delivery demands. Commercial adoption by delivery companies, food services, and logistics providers demonstrates e-bike viability for business applications beyond personal transportation.

Customization and personalization trends reflect consumer desires for products matching individual preferences and requirements. Modular designs enable component upgrades and configuration changes, extending product lifecycles and enhancing customer satisfaction through personalized solutions.

Sustainability focus extends beyond basic electric assistance to encompass entire product lifecycles including manufacturing processes, material selection, and end-of-life recycling programs. Circular economy principles influence product design and business models, appealing to environmentally conscious consumers.

Major manufacturer expansions into UK markets reflect growing confidence in long-term growth potential and consumer acceptance. Production facility investments and local assembly operations demonstrate commitment to market development while potentially reducing costs and delivery times for UK consumers.

Retail channel evolution includes specialized e-bike stores, online direct-sales models, and integration with traditional bicycle retailers. Experiential retail concepts featuring test ride facilities and comprehensive service centers enhance customer experience and support informed purchasing decisions.

Government policy developments including infrastructure funding, safety regulations, and incentive programs shape market conditions and growth trajectories. Local authority initiatives supporting cycling infrastructure and e-bike sharing programs create favorable environments for market expansion.

Technology partnerships between e-bike manufacturers and technology companies accelerate innovation in battery systems, smart features, and connectivity solutions. Automotive industry involvement brings advanced manufacturing capabilities and technology expertise to e-bike development and production.

Insurance and financing product development addresses consumer concerns about theft protection and affordability. Specialized insurance products and flexible financing options reduce barriers to adoption while providing peace of mind for potential buyers concerned about investment protection.

Research and development investments focus on next-generation battery technology, lightweight materials, and advanced motor systems. University partnerships and government-funded research programs support innovation in areas critical to continued market growth and technological advancement.

Market participants should prioritize consumer education initiatives to address knowledge gaps and build confidence in e-bike technology and benefits. Demonstration programs and trial opportunities enable potential customers to experience e-bike advantages firsthand, potentially accelerating adoption rates across various demographic segments.

Infrastructure collaboration with government entities and urban planners can help address fundamental barriers to market expansion. Public-private partnerships for cycling infrastructure development create win-win scenarios supporting both commercial interests and public policy objectives for sustainable transportation.

Service capability development represents critical success factors as markets mature and consumers expect comprehensive support throughout product lifecycles. Maintenance networks, parts availability, and technician training programs ensure positive ownership experiences and support long-term market growth.

Segmentation strategies should recognize diverse consumer needs and preferences across different demographic groups and usage applications. Targeted product development and marketing approaches can more effectively address specific segment requirements while optimizing resource allocation and market penetration efforts.

Technology roadmap planning must balance innovation with affordability to ensure continued market accessibility while advancing product capabilities. MWR analysis suggests focusing on features providing clear consumer value while avoiding over-engineering that increases costs without proportional benefits.

Partnership strategies with complementary businesses including insurance providers, financing companies, and service organizations can create comprehensive value propositions addressing complete customer needs. Ecosystem development supports market maturation and enhances competitive positioning through integrated solutions.

Long-term growth prospects remain highly positive driven by fundamental trends supporting sustainable transportation adoption and technological advancement. Market maturation is expected to continue with projected growth rates of 12-18% annually over the next five years, supported by improving infrastructure, declining costs, and expanding consumer acceptance.

Technology evolution will likely focus on battery performance improvements, weight reduction, and enhanced connectivity features. Next-generation batteries may offer significantly extended range and faster charging capabilities, addressing remaining consumer concerns about e-bike practicality for longer commutes and recreational applications.

Market segmentation is expected to become more sophisticated with specialized products serving distinct consumer groups and applications. Niche markets including senior-focused designs, family cargo solutions, and performance-oriented models will likely develop into substantial market segments with dedicated product lines and marketing approaches.

Integration with smart city initiatives and transportation planning will create new opportunities for e-bike adoption and infrastructure development. Mobility-as-a-Service platforms may incorporate e-bikes as key components of comprehensive urban transportation solutions, potentially accelerating adoption through reduced ownership barriers.

Regulatory environment evolution may include updated safety standards, insurance requirements, and infrastructure specifications supporting continued market growth while ensuring public safety and consumer protection. Standardization efforts could improve interoperability and reduce costs across the industry.

Global market integration will likely increase with UK manufacturers and retailers participating in international supply chains and technology development initiatives. MarkWide Research projects continued convergence of global e-bike standards and practices, potentially reducing costs and improving product availability for UK consumers.

The UK e-bike market represents a dynamic and rapidly evolving sector with substantial growth potential driven by environmental consciousness, technological advancement, and changing mobility preferences. Market fundamentals remain strong with supportive government policies, improving infrastructure, and growing consumer acceptance creating favorable conditions for continued expansion across diverse segments and applications.

Strategic opportunities exist for market participants willing to invest in consumer education, service capabilities, and targeted product development addressing specific demographic and usage requirements. Technology integration and smart connectivity features will likely become increasingly important differentiators as markets mature and consumer expectations evolve.

Long-term success will depend on addressing current market restraints including infrastructure limitations, cost barriers, and service availability while capitalizing on emerging opportunities in corporate adoption, tourism applications, and demographic expansion. Collaborative approaches involving manufacturers, retailers, government entities, and service providers can accelerate market development while ensuring sustainable growth benefiting all stakeholders in the evolving UK e-bike ecosystem.

What is E-Bike?

E-Bikes, or electric bicycles, are bicycles equipped with an electric motor that assists with pedaling. They are designed to enhance the cycling experience by providing additional power, making it easier to travel longer distances and tackle challenging terrains.

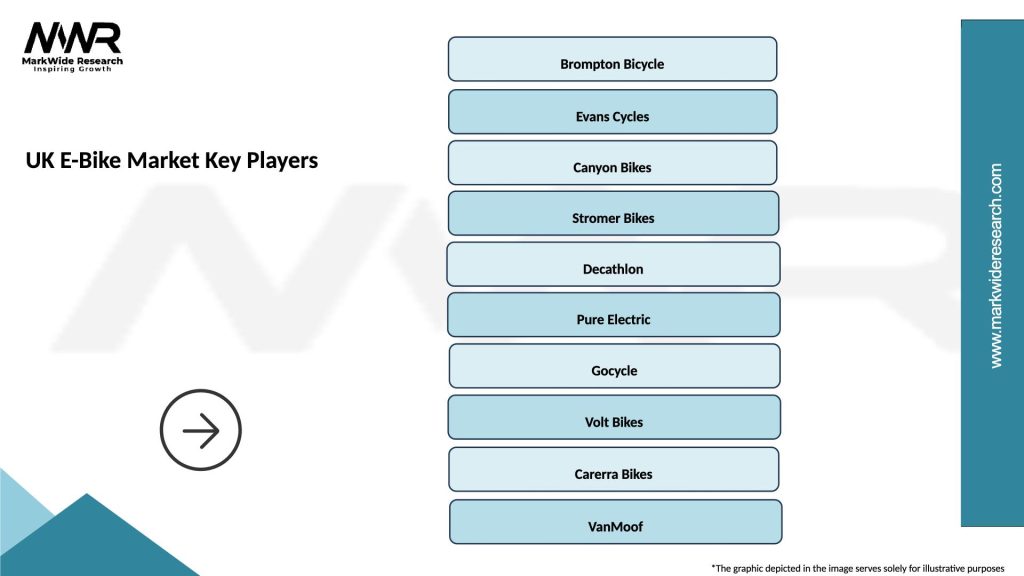

What are the key players in the UK E-Bike Market?

Key players in the UK E-Bike Market include companies like Brompton Bicycle, Raleigh, and Specialized. These companies are known for their innovative designs and commitment to sustainability, among others.

What are the growth factors driving the UK E-Bike Market?

The UK E-Bike Market is driven by factors such as increasing environmental awareness, rising fuel prices, and the growing popularity of cycling as a mode of transport. Additionally, government initiatives promoting green transportation contribute to market growth.

What challenges does the UK E-Bike Market face?

Challenges in the UK E-Bike Market include regulatory hurdles, high initial costs, and concerns about battery life and maintenance. These factors can hinder consumer adoption and market expansion.

What opportunities exist in the UK E-Bike Market?

The UK E-Bike Market presents opportunities such as the development of new technologies, expansion into urban areas, and increasing demand for eco-friendly transportation solutions. These trends can lead to innovative product offerings and enhanced consumer engagement.

What trends are shaping the UK E-Bike Market?

Trends in the UK E-Bike Market include the rise of smart E-Bikes with integrated technology, increased focus on sustainability, and the growth of bike-sharing programs. These trends reflect changing consumer preferences and advancements in E-Bike design.

UK E-Bike Market

| Segmentation Details | Description |

|---|---|

| Product Type | City E-Bikes, Mountain E-Bikes, Folding E-Bikes, Cargo E-Bikes |

| Technology | Hub Motor, Mid-Drive Motor, Battery Management System, Regenerative Braking |

| End User | Commuters, Delivery Services, Recreational Users, Tourists |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK E-Bike Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at