444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK district heating industry market represents a transformative approach to energy distribution that is gaining significant momentum across Britain’s urban landscape. District heating systems provide centralized heat generation and distribution through insulated pipe networks, delivering thermal energy directly to residential, commercial, and industrial buildings. This innovative infrastructure model has emerged as a cornerstone of the UK’s decarbonization strategy, offering substantial improvements in energy efficiency and carbon emission reductions.

Market dynamics indicate robust growth potential, with the sector experiencing a 12.5% annual expansion rate in new installations across major metropolitan areas. The technology encompasses various heat sources including combined heat and power plants, biomass facilities, geothermal systems, and waste-to-energy installations. Government initiatives supporting renewable energy adoption have accelerated market development, particularly in Scotland, Wales, and Northern England where district heating penetration rates have reached 18% in urban centers.

Infrastructure development has become increasingly sophisticated, with modern systems incorporating smart grid technologies, thermal storage solutions, and advanced monitoring capabilities. The integration of renewable energy sources has positioned district heating as a viable alternative to traditional gas boilers, contributing to the UK’s net-zero carbon emissions target by 2050. Regional variations in adoption reflect local energy policies, urban density, and existing infrastructure compatibility.

The UK district heating industry market refers to the comprehensive ecosystem of companies, technologies, and infrastructure systems involved in the centralized production and distribution of thermal energy for space heating and hot water supply across British communities. District heating networks operate by generating heat at central locations and distributing it through insulated underground pipes to multiple buildings, replacing individual heating systems with shared, efficient infrastructure.

System components include heat generation facilities, distribution networks, heat exchangers, control systems, and end-user connections. The market encompasses various stakeholder categories including energy utilities, engineering contractors, equipment manufacturers, project developers, and municipal authorities. Technology variations range from traditional fossil fuel-based systems to advanced renewable energy installations incorporating solar thermal, biomass, and heat pump technologies.

Market scope extends beyond simple heat distribution to include comprehensive energy services, system maintenance, performance optimization, and customer management. Modern district heating solutions integrate digital technologies for demand forecasting, network optimization, and real-time performance monitoring, creating intelligent energy distribution systems that adapt to changing consumption patterns and weather conditions.

Strategic positioning within the UK’s energy transition framework has elevated district heating from a niche technology to a mainstream infrastructure solution. The industry demonstrates strong fundamentals driven by supportive government policies, increasing environmental awareness, and growing recognition of district heating’s role in achieving carbon neutrality objectives. Investment flows have accelerated significantly, with both public and private sector funding supporting large-scale network development projects.

Technology advancement continues to enhance system efficiency and reduce operational costs, with fourth-generation district heating systems achieving 92% overall efficiency rates compared to traditional heating methods. The integration of thermal storage, smart controls, and renewable energy sources has improved system flexibility and reduced peak demand pressures. Market maturation is evident through standardized installation procedures, established supply chains, and growing technical expertise among industry professionals.

Competitive landscape features established energy utilities expanding their district heating portfolios alongside specialized engineering firms and international technology providers. The sector benefits from cross-industry collaboration between construction companies, technology manufacturers, and energy service providers, creating comprehensive project delivery capabilities. Regional development patterns show concentrated growth in major cities and new development areas where district heating infrastructure can be integrated from the planning stage.

Market intelligence reveals several critical factors shaping the UK district heating landscape. The following insights provide comprehensive understanding of current market dynamics:

Environmental regulations serve as the primary catalyst for district heating market expansion across the UK. The government’s commitment to achieving net-zero carbon emissions by 2050 has created regulatory frameworks that favor centralized heating solutions over individual fossil fuel systems. Carbon pricing mechanisms and emissions trading schemes make district heating increasingly cost-competitive compared to traditional heating methods, particularly when renewable energy sources are integrated.

Energy security concerns have heightened awareness of the benefits associated with diversified heat sources and reduced dependence on imported fossil fuels. District heating networks can incorporate multiple energy inputs including biomass, geothermal, solar thermal, and waste heat recovery, creating resilient energy systems that reduce vulnerability to supply disruptions. Economic incentives through government grants, tax benefits, and preferential financing terms support project development and reduce investment barriers.

Urban development patterns increasingly favor high-density housing and mixed-use developments where district heating systems achieve optimal efficiency and economic viability. Planning authorities actively encourage district heating integration in new developments, recognizing the technology’s contribution to sustainable community design. Technological advancement continues to improve system performance, reduce installation costs, and expand the range of viable applications, making district heating attractive for diverse building types and locations.

Capital investment requirements represent the most significant barrier to district heating market expansion, particularly for smaller municipalities and private developers. Initial infrastructure costs for heat generation facilities, distribution networks, and connection systems require substantial upfront investment that may not be immediately recoverable through energy sales. Financial constraints often limit project scope and delay implementation timelines, particularly in areas with lower population density where system economics are less favorable.

Technical complexity associated with district heating system design, installation, and operation requires specialized expertise that may not be readily available in all regions. Network optimization, heat load balancing, and system integration demand sophisticated engineering capabilities and ongoing technical support. Regulatory challenges include complex planning permissions, environmental assessments, and coordination with existing utility infrastructure, which can extend project development timelines and increase costs.

Market acceptance varies among end users, with some consumers expressing concerns about heating cost transparency, service reliability, and lack of individual control over heating systems. Competition from alternative technologies including heat pumps, hydrogen heating, and improved gas boiler efficiency creates market pressure and may influence consumer preferences. Legacy infrastructure in older buildings may require significant modifications to accommodate district heating connections, adding complexity and cost to retrofit projects.

Renewable energy integration presents substantial opportunities for district heating market expansion, particularly through the incorporation of solar thermal, geothermal, and biomass energy sources. The UK’s abundant renewable energy resources can be effectively harnessed through district heating networks, creating sustainable energy systems that align with national decarbonization objectives. Waste heat recovery from industrial processes, data centers, and wastewater treatment facilities offers cost-effective heat sources that improve system economics while reducing environmental impact.

Smart city initiatives across major UK metropolitan areas create favorable conditions for advanced district heating deployment. Integration with smart grid technologies, energy storage systems, and demand response programs enhances system efficiency and provides additional revenue opportunities. Retrofit opportunities in existing residential and commercial buildings represent a substantial market segment, particularly in urban areas where building density supports viable district heating economics.

International expertise and technology transfer from countries with established district heating markets, particularly in Scandinavia and Northern Europe, provide opportunities for rapid market development and best practice implementation. Public-private partnerships offer innovative financing and delivery models that can accelerate project development while sharing risks and rewards among stakeholders. The growing emphasis on community energy solutions creates opportunities for locally-owned and operated district heating systems that provide both environmental and economic benefits to communities.

Supply chain evolution within the UK district heating industry reflects increasing market maturity and growing demand for specialized components and services. Equipment manufacturers are establishing local production capabilities and service networks to support the expanding market, while engineering contractors are developing specialized expertise in district heating system design and installation. Technology standardization efforts are reducing costs and improving system compatibility, facilitating market growth and reducing technical barriers.

Competitive dynamics feature established energy utilities leveraging their existing customer relationships and infrastructure assets to develop district heating networks. Specialized engineering firms and international technology providers compete on technical expertise and innovative solutions, while municipal authorities increasingly participate as project developers and operators. Market consolidation trends indicate growing collaboration between different industry sectors, creating comprehensive service offerings that span project development, financing, construction, and operation.

Customer relationships are evolving from simple energy supply arrangements to comprehensive energy service agreements that include system maintenance, performance guarantees, and energy efficiency consulting. Digital transformation is enabling new service models including predictive maintenance, remote monitoring, and customer engagement platforms that enhance system performance and user satisfaction. According to MarkWide Research analysis, customer satisfaction rates for district heating services have improved to 87% across major UK networks, reflecting enhanced service delivery and system reliability.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the UK district heating industry market. Primary research included structured interviews with industry executives, government officials, technology providers, and end users across different market segments and geographic regions. Survey methodologies captured quantitative data on market trends, technology preferences, investment patterns, and growth projections from representative industry stakeholders.

Secondary research incorporated analysis of government publications, industry reports, academic studies, and regulatory documents to establish market context and validate primary research findings. Financial analysis of publicly available company data provided insights into market structure, competitive positioning, and financial performance trends. Technical assessment included evaluation of district heating technologies, performance metrics, and best practice implementations across different system configurations and applications.

Data validation processes ensured research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis of quantitative findings. Market modeling incorporated economic analysis, demographic trends, and policy impact assessments to develop realistic growth projections and market scenarios. Geographic analysis examined regional variations in market development, regulatory frameworks, and technology adoption patterns across England, Scotland, Wales, and Northern Ireland.

England dominates the UK district heating market with approximately 72% of total installed capacity, driven by major urban centers including London, Manchester, Birmingham, and Leeds. The capital region shows particularly strong growth with numerous large-scale district heating projects serving residential developments, commercial districts, and public buildings. Northern England demonstrates significant market potential through industrial waste heat recovery projects and new housing developments that integrate district heating infrastructure from the planning stage.

Scotland represents a rapidly growing market segment with 19% of national district heating capacity, supported by strong government commitment to renewable energy and carbon reduction targets. Glasgow and Edinburgh lead Scottish market development with established networks expanding to serve additional customers and new developments. Rural applications in Scotland often incorporate biomass and geothermal energy sources, creating sustainable heating solutions for remote communities.

Wales accounts for approximately 6% of UK district heating capacity, with Cardiff and Swansea leading regional development efforts. Welsh government initiatives supporting community energy projects have encouraged smaller-scale district heating systems that serve local housing developments and public buildings. Northern Ireland represents the smallest regional market at 3% of national capacity, though recent policy changes and EU funding programs are supporting increased district heating deployment, particularly in Belfast and surrounding urban areas.

Market leadership within the UK district heating industry features a diverse mix of established energy utilities, specialized engineering firms, and international technology providers. The competitive environment reflects the industry’s technical complexity and capital-intensive nature, requiring companies to demonstrate both financial strength and technical expertise.

Technology-based segmentation reveals distinct market categories based on heat generation methods and system configurations. Combined heat and power systems represent the largest segment, providing both electricity and thermal energy through efficient cogeneration processes. Biomass-fired systems demonstrate strong growth in rural and semi-urban areas where fuel supply chains are well-established and environmental benefits are particularly valued.

Application segmentation shows residential developments as the dominant market category, driven by new housing projects and urban regeneration initiatives. Commercial and institutional applications including hospitals, universities, and office complexes represent significant growth opportunities due to consistent heat demand profiles and long-term contract potential. Industrial applications focus primarily on waste heat recovery and process heating requirements, creating specialized market niches with unique technical requirements.

Geographic segmentation reflects varying market maturity levels across different UK regions, with metropolitan areas showing higher adoption rates and more sophisticated system configurations. Customer segmentation includes social housing providers, private developers, commercial property owners, and public sector organizations, each with distinct requirements, decision-making processes, and financial constraints that influence market development patterns.

By Technology: Fourth-generation district heating systems utilizing low-temperature distribution networks demonstrate superior performance and flexibility compared to traditional high-temperature systems. These advanced networks achieve 95% distribution efficiency while enabling integration of diverse renewable energy sources including solar thermal and geothermal systems. Smart control systems optimize network performance through predictive algorithms and real-time demand management, reducing energy waste and improving customer satisfaction.

By Application: Residential applications dominate market volume with new housing developments increasingly incorporating district heating infrastructure during construction phases. Mixed-use developments combining residential, commercial, and retail spaces provide optimal conditions for district heating economics through diversified heat demand profiles. Healthcare and educational facilities represent high-value market segments due to consistent heat requirements and long-term operational commitments.

By Heat Source: Natural gas-fired combined heat and power systems currently represent the largest capacity segment, though renewable energy sources are gaining market share rapidly. Biomass systems show particular strength in rural areas with established fuel supply chains, while geothermal applications are expanding in regions with suitable geological conditions. Waste heat recovery from industrial processes and data centers creates cost-effective heat sources that improve overall system economics.

Energy utilities benefit from district heating through diversified revenue streams, improved asset utilization, and enhanced customer relationships. District heating networks provide stable, long-term cash flows while supporting utilities’ decarbonization objectives and regulatory compliance requirements. Operational synergies with existing electricity and gas distribution networks create opportunities for integrated energy service delivery and improved operational efficiency.

Property developers gain competitive advantages through district heating integration, including reduced building energy costs, simplified heating system installation, and enhanced environmental credentials that appeal to environmentally conscious buyers and tenants. Planning benefits include streamlined approval processes in areas where district heating supports local energy and environmental policies, while long-term energy cost predictability enhances property value propositions.

End users experience reduced heating costs, improved system reliability, and simplified maintenance requirements compared to individual heating systems. Environmental benefits include significantly reduced carbon emissions and improved local air quality, while smart system integration provides enhanced comfort control and energy usage transparency. Municipal authorities benefit through reduced infrastructure costs, improved energy security, and progress toward carbon reduction targets while supporting local economic development and job creation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend shaping the UK district heating industry, with advanced monitoring systems, predictive maintenance capabilities, and customer engagement platforms becoming standard features. Internet of Things integration enables real-time system optimization, fault detection, and performance analytics that improve operational efficiency and reduce maintenance costs. Artificial intelligence applications are emerging for demand forecasting, network optimization, and energy trading activities.

Renewable energy integration continues accelerating with solar thermal, biomass, and geothermal systems increasingly incorporated into district heating networks. Thermal storage systems are becoming more sophisticated, enabling better load balancing and improved renewable energy utilization. Heat pump integration with district heating networks creates hybrid systems that maximize efficiency while providing flexible operation across different weather conditions and demand patterns.

Community ownership models are gaining popularity, with local authorities and community groups developing district heating systems that provide both environmental and economic benefits to residents. Energy service agreements are evolving beyond simple heat supply to include comprehensive building energy management, efficiency consulting, and performance guarantees. MWR data indicates that 43% of new district heating projects now incorporate some form of community ownership or participation structure.

Government policy initiatives have significantly accelerated market development through the Heat Networks Investment Project, which provides grant funding for district heating infrastructure development. The Green Heat Network Fund represents the latest policy support mechanism, offering substantial financial assistance for renewable energy integration and network expansion projects. Regulatory framework improvements include streamlined planning processes and standardized connection procedures that reduce project development timelines and costs.

Technology advancement continues through research and development programs focusing on fourth-generation district heating systems, advanced materials, and smart control technologies. International collaboration with leading district heating countries including Denmark, Sweden, and Germany has accelerated technology transfer and best practice implementation across UK projects. Major equipment manufacturers are establishing UK production facilities and service centers to support growing market demand.

Strategic partnerships between energy utilities, engineering contractors, and technology providers are creating comprehensive service offerings that span project development, financing, construction, and long-term operation. Investment activity has increased substantially with pension funds, infrastructure investors, and international energy companies recognizing district heating as an attractive long-term investment opportunity. Recent acquisitions and joint ventures indicate growing market consolidation and increasing commercial confidence in the sector’s growth prospects.

Strategic positioning recommendations emphasize the importance of early market entry in high-growth regions and market segments where district heating adoption is accelerating. Companies should focus on developing comprehensive service capabilities that span the entire project lifecycle from initial feasibility assessment through long-term operation and maintenance. Technology investment in digital solutions and renewable energy integration will provide competitive advantages and align with market trends toward smart, sustainable energy systems.

Partnership development represents a critical success factor, with companies advised to establish strategic relationships with complementary service providers, technology suppliers, and financial partners. Geographic expansion strategies should prioritize urban areas with supportive local policies, suitable building density, and established development pipelines. Rural and semi-urban opportunities require different approaches focusing on community engagement, renewable energy integration, and innovative financing models.

Risk management strategies should address technical, financial, and regulatory uncertainties through diversified project portfolios, robust contract structures, and active policy engagement. Customer education initiatives will be essential for market development, requiring investment in marketing, demonstration projects, and stakeholder engagement programs. According to MarkWide Research projections, companies implementing comprehensive market development strategies can expect to achieve 25-30% higher growth rates compared to those focusing solely on technical delivery capabilities.

Market expansion prospects remain highly positive with continued government support, increasing environmental awareness, and improving technology economics driving sustained growth across all market segments. The UK district heating industry is positioned to play a crucial role in achieving national carbon reduction targets while providing economic benefits to communities and investors. Technology evolution will continue enhancing system performance, reducing costs, and expanding the range of viable applications.

Investment flows are expected to increase substantially as institutional investors recognize district heating as a stable, long-term infrastructure asset class with attractive risk-adjusted returns. International expansion opportunities may emerge as UK companies develop expertise and seek growth markets in other countries pursuing similar decarbonization strategies. The integration of district heating with broader smart city initiatives will create additional value propositions and market opportunities.

Innovation drivers including artificial intelligence, advanced materials, and renewable energy technologies will continue transforming the industry and creating new competitive dynamics. Market maturation will bring standardization, improved financing mechanisms, and streamlined delivery processes that reduce costs and accelerate deployment. The sector is projected to achieve 15-20% annual growth rates over the next five years, establishing district heating as a mainstream infrastructure solution across the UK’s urban landscape.

The UK district heating industry market represents a transformative opportunity within the nation’s energy transition framework, offering substantial environmental, economic, and social benefits through centralized, efficient heating solutions. Market fundamentals remain strong with supportive government policies, advancing technologies, and growing recognition of district heating’s role in achieving carbon neutrality objectives driving sustained growth across diverse applications and geographic regions.

Strategic opportunities abound for companies positioned to capitalize on the sector’s expansion through comprehensive service offerings, innovative financing models, and advanced technology integration. The convergence of renewable energy, digital technologies, and community ownership models is creating new market dynamics that reward innovation, collaboration, and customer-focused service delivery. Investment prospects continue attracting both domestic and international capital, reflecting confidence in the sector’s long-term growth potential and strategic importance to the UK’s energy future.

Future success will depend on industry participants’ ability to navigate technical complexity, manage project risks, and deliver reliable, cost-effective heating services that meet evolving customer expectations. The UK district heating industry market is well-positioned to achieve significant expansion while contributing meaningfully to national decarbonization goals and community energy security objectives.

What is District Heating?

District heating refers to a system that delivers heat generated in a centralized location through a network of insulated pipes for residential and commercial heating. It is an efficient way to provide heating and hot water to multiple buildings from a single source.

What are the key players in the UK District Heating Industry Market?

Key players in the UK District Heating Industry Market include companies like Veolia, ENGIE, and E.ON, which are involved in the development and operation of district heating systems. These companies focus on providing sustainable heating solutions and expanding their networks across urban areas, among others.

What are the growth factors driving the UK District Heating Industry Market?

The UK District Heating Industry Market is driven by factors such as the increasing demand for energy-efficient heating solutions, government initiatives promoting low-carbon technologies, and the rising focus on reducing greenhouse gas emissions. Additionally, urbanization and population growth contribute to the expansion of district heating networks.

What challenges does the UK District Heating Industry Market face?

Challenges in the UK District Heating Industry Market include high initial investment costs, regulatory hurdles, and the need for public acceptance. Additionally, competition from alternative heating solutions can hinder the growth of district heating systems.

What opportunities exist in the UK District Heating Industry Market?

Opportunities in the UK District Heating Industry Market include the potential for integrating renewable energy sources, such as biomass and solar thermal, into existing systems. Furthermore, advancements in smart grid technology can enhance the efficiency and reliability of district heating networks.

What trends are shaping the UK District Heating Industry Market?

Trends in the UK District Heating Industry Market include the increasing adoption of smart technologies for monitoring and managing heat distribution, as well as a shift towards more sustainable energy sources. Additionally, there is a growing emphasis on community-based heating solutions that engage local stakeholders.

UK District Heating Industry Market

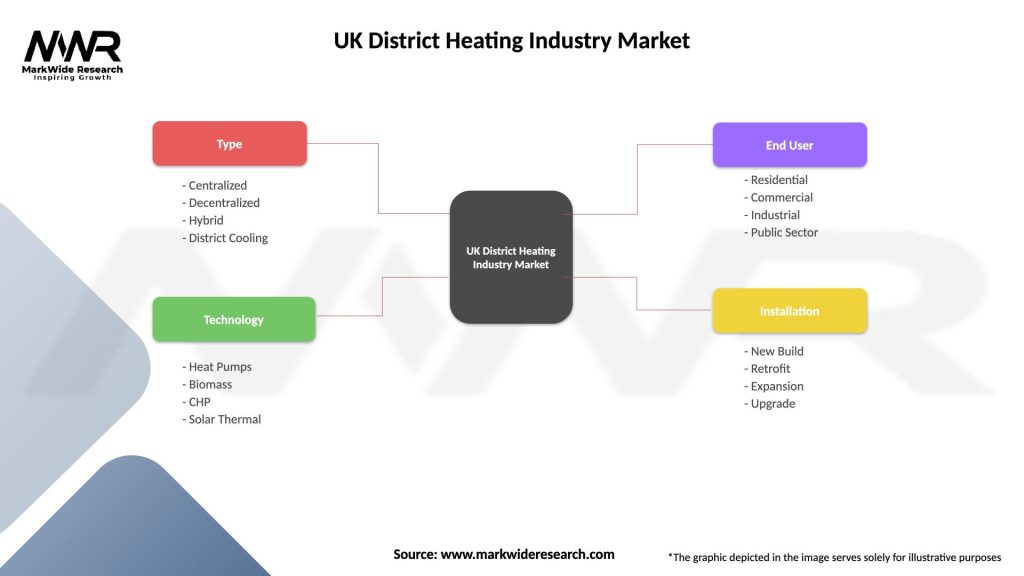

| Segmentation Details | Description |

|---|---|

| Type | Centralized, Decentralized, Hybrid, District Cooling |

| Technology | Heat Pumps, Biomass, CHP, Solar Thermal |

| End User | Residential, Commercial, Industrial, Public Sector |

| Installation | New Build, Retrofit, Expansion, Upgrade |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK District Heating Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at