444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK distributed solar power generation market represents a transformative segment of the nation’s renewable energy landscape, characterized by decentralized solar installations across residential, commercial, and industrial sectors. This market encompasses small-scale photovoltaic systems that generate electricity close to the point of consumption, reducing transmission losses and enhancing grid resilience. The distributed solar sector has experienced remarkable expansion, driven by declining technology costs, supportive government policies, and increasing environmental consciousness among consumers and businesses.

Market dynamics indicate robust growth potential, with the sector benefiting from technological advancements in solar panel efficiency and energy storage solutions. The integration of smart grid technologies and net metering policies has further accelerated adoption rates across diverse market segments. Regional distribution shows concentrated activity in southern England, though installations are expanding rapidly across Scotland, Wales, and Northern Ireland as technology costs continue to decline.

Key market characteristics include the proliferation of rooftop solar installations, community solar projects, and distributed generation systems integrated with battery storage. The market demonstrates strong growth momentum, with installation rates increasing at a compound annual growth rate of 12.5% over recent years. Technology adoption patterns reveal growing preference for high-efficiency panels and integrated energy management systems that optimize power generation and consumption patterns.

The UK distributed solar power generation market refers to the comprehensive ecosystem of small-scale, decentralized photovoltaic installations that generate renewable electricity at or near the point of consumption, typically ranging from residential rooftop systems to commercial and industrial solar arrays below 5MW capacity.

Distributed solar systems fundamentally differ from utility-scale solar farms by their proximity to end users and integration with local electrical infrastructure. These installations include residential rooftop arrays, commercial building-integrated photovoltaics, industrial facility solar systems, and community solar gardens that serve multiple customers within localized areas. The distributed nature of these systems enhances grid stability, reduces transmission losses, and provides energy independence for property owners.

Market scope encompasses various technologies including monocrystalline and polycrystalline silicon panels, thin-film photovoltaics, and emerging technologies such as perovskite cells. The integration of energy storage systems, smart inverters, and advanced monitoring capabilities has expanded the definition to include comprehensive distributed energy resources that can provide grid services beyond simple electricity generation.

The UK distributed solar power generation market stands at a pivotal juncture, experiencing unprecedented growth driven by technological innovation, policy support, and economic viability. The sector has evolved from a niche renewable energy segment to a mainstream electricity generation solution, with installations spanning residential, commercial, and industrial applications across all regions of the United Kingdom.

Market penetration has accelerated significantly, with distributed solar installations accounting for approximately 35% of total UK solar capacity. This growth trajectory reflects the maturation of solar technology, declining installation costs, and increasing awareness of climate change mitigation strategies. The residential segment leads adoption rates, followed by commercial and industrial installations that leverage larger roof spaces and higher electricity consumption patterns.

Technological advancements continue to drive market expansion, with panel efficiency improvements reaching 22% average efficiency rates for residential installations. The integration of battery storage systems has reached a 25% adoption rate among new installations, enabling greater energy independence and grid flexibility. Smart inverter technology and advanced monitoring systems have become standard features, providing real-time performance optimization and predictive maintenance capabilities.

Policy framework remains supportive, with government initiatives promoting distributed renewable energy through feed-in tariffs, smart export guarantees, and planning policy reforms. The regulatory environment continues to evolve, addressing grid integration challenges and establishing frameworks for peer-to-peer energy trading and virtual power plant participation.

Market intelligence reveals several critical insights that define the current state and future trajectory of the UK distributed solar power generation sector:

Market maturation is evident in the standardization of installation practices, financing mechanisms, and performance monitoring systems. The sector has transitioned from early adopter markets to mainstream acceptance, with installation processes becoming more streamlined and cost-effective.

Primary market drivers propelling the UK distributed solar power generation sector encompass economic, environmental, and technological factors that create compelling value propositions for diverse customer segments.

Economic incentives remain fundamental drivers, with electricity cost savings providing immediate financial benefits to system owners. The payback period for residential installations has decreased to an average of 8-10 years, making solar investments increasingly attractive. Commercial and industrial customers benefit from reduced peak demand charges and long-term electricity cost predictability that supports business planning and profitability.

Environmental consciousness drives adoption among consumers and businesses committed to reducing carbon footprints and supporting climate change mitigation efforts. Corporate sustainability initiatives have become significant drivers for commercial installations, with companies seeking to demonstrate environmental leadership and meet stakeholder expectations for responsible business practices.

Technology advancement continues to improve system performance and reduce costs, creating positive feedback loops that accelerate market adoption. Panel efficiency improvements, inverter reliability enhancements, and integrated monitoring systems provide better value propositions for potential customers. The emergence of building-integrated photovoltaics and aesthetic panel designs addresses architectural concerns that previously limited adoption.

Policy support through government incentives, regulatory frameworks, and planning policy reforms creates favorable market conditions. The Smart Export Guarantee provides ongoing revenue streams for excess electricity generation, while simplified planning procedures reduce installation barriers and costs.

Market constraints continue to influence the pace and scope of distributed solar adoption across the UK, despite overall positive growth trends and supportive policy environments.

Initial capital costs remain significant barriers for many potential customers, particularly in residential markets where upfront investments can exceed household budgets. While financing options have expanded, credit requirements and loan terms may exclude some customer segments from accessing solar installations. The complexity of financing arrangements can also deter customers who prefer simpler purchase decisions.

Grid integration challenges emerge as distributed solar penetration increases, particularly in areas with high installation density. Local distribution networks may require upgrades to accommodate bidirectional power flows and voltage regulation challenges. Grid connection delays and upgrade costs can impact project economics and installation timelines.

Regulatory uncertainty affects long-term investment decisions, particularly regarding future changes to export tariffs, grid connection procedures, and planning requirements. Policy changes can impact project economics and create market volatility that affects customer confidence and industry investment patterns.

Technical limitations include roof suitability constraints, shading issues, and structural considerations that limit installation potential for some properties. Building orientation, age, and construction materials can significantly impact system performance and installation feasibility, excluding portions of the potential market.

Emerging opportunities within the UK distributed solar power generation market present significant potential for continued expansion and innovation across multiple dimensions of the sector.

Energy storage integration represents a transformative opportunity, with battery costs declining and performance improving rapidly. Combined solar-plus-storage systems offer enhanced value propositions through increased self-consumption, backup power capabilities, and grid services participation. The potential for virtual power plant aggregation creates additional revenue streams and market opportunities.

Smart grid evolution enables new business models and service offerings, including peer-to-peer energy trading, demand response participation, and grid balancing services. Advanced inverter capabilities allow distributed solar systems to provide reactive power support, voltage regulation, and frequency response services that create additional value streams.

Commercial and industrial expansion offers substantial growth potential, with large roof spaces and high electricity consumption providing favorable economics for solar installations. Corporate sustainability commitments and renewable energy procurement targets drive demand for distributed solar solutions that can provide long-term price certainty and environmental benefits.

Community solar development addresses market segments unable to install rooftop systems, including renters, apartment dwellers, and properties with unsuitable roofs. Shared solar installations and community energy projects expand market accessibility and create new ownership models that can accelerate adoption rates.

Technology innovation continues to create opportunities through improved efficiency, reduced costs, and enhanced functionality. Emerging technologies such as bifacial panels, building-integrated photovoltaics, and agrivoltaics expand application possibilities and market potential.

Market dynamics within the UK distributed solar power generation sector reflect complex interactions between technological innovation, policy frameworks, economic conditions, and consumer behavior patterns that shape industry evolution.

Supply chain maturation has improved market stability and reduced costs through established manufacturer relationships, standardized components, and streamlined logistics networks. Local installer capacity has expanded significantly, with certified professionals available across most regions. Equipment availability and quality have stabilized, reducing project risks and improving customer confidence.

Competitive landscape evolution shows increasing market consolidation among larger installers while maintaining opportunities for specialized regional providers. Service differentiation focuses on system design, financing options, customer service, and post-installation support. Technology partnerships between installers and manufacturers create integrated solutions that improve customer experiences and system performance.

Customer segmentation reveals distinct adoption patterns and preferences across residential, commercial, and industrial markets. Residential customers prioritize simplicity, aesthetics, and long-term savings, while commercial customers focus on financial returns, corporate sustainability goals, and operational integration. Industrial customers emphasize system reliability, performance optimization, and grid services capabilities.

Financing evolution has expanded options beyond traditional cash purchases to include solar loans, leasing arrangements, and power purchase agreements. Third-party ownership models reduce upfront costs and transfer performance risks, making solar accessible to broader customer segments. According to MarkWide Research analysis, financing innovations have contributed to 40% of new residential installations utilizing alternative ownership structures.

Research approach for analyzing the UK distributed solar power generation market employs comprehensive methodologies that combine quantitative data analysis with qualitative market intelligence to provide accurate and actionable insights.

Primary research encompasses structured interviews with industry stakeholders including equipment manufacturers, system installers, project developers, and end customers across residential, commercial, and industrial segments. Survey methodologies capture installation trends, technology preferences, financing patterns, and customer satisfaction metrics that inform market understanding.

Secondary research utilizes government databases, industry reports, trade association publications, and regulatory filings to establish market baselines and track installation trends. Energy generation data, grid connection statistics, and policy documentation provide quantitative foundations for market analysis and growth projections.

Data validation processes ensure accuracy through cross-referencing multiple sources, statistical analysis of trends, and expert review of findings. Market sizing methodologies account for various installation categories, regional variations, and technology types to provide comprehensive market coverage.

Analytical frameworks incorporate economic modeling, technology assessment, and policy impact analysis to evaluate market drivers, constraints, and opportunities. Scenario planning methodologies assess potential future developments under different policy, technology, and economic conditions.

Regional market distribution across the UK reveals distinct patterns influenced by solar resource availability, population density, economic conditions, and local policy initiatives that shape distributed solar adoption rates.

Southern England maintains market leadership with approximately 45% of total installations, benefiting from higher solar irradiance levels, dense population centers, and established installer networks. London and surrounding counties show strong commercial adoption rates, while suburban areas drive residential market growth. The region’s mature market infrastructure supports continued expansion and technology innovation.

Northern England demonstrates accelerating growth with 25% market share, driven by industrial installations and supportive local policies. Manufacturing regions leverage large roof spaces and high electricity consumption for favorable project economics. Urban centers show increasing residential adoption as technology costs decline and financing options expand.

Scotland represents an emerging growth market with 15% market share, supported by ambitious renewable energy targets and government incentives. Rural areas benefit from community solar projects, while urban centers drive residential and commercial adoption. The region’s commitment to renewable energy creates supportive policy environments for distributed solar development.

Wales and Northern Ireland collectively account for 15% of installations, with growth accelerating through targeted support programs and community energy initiatives. Rural communities leverage distributed solar for energy independence, while urban areas focus on residential and small commercial applications.

Market competition within the UK distributed solar power generation sector encompasses diverse players ranging from large multinational corporations to specialized regional installers, creating a dynamic competitive environment that drives innovation and service improvement.

Competitive differentiation focuses on technology offerings, financing flexibility, customer service quality, and post-installation support services. Market leaders leverage economies of scale, established supply chains, and brand recognition to maintain competitive advantages while smaller players compete through specialized services and local market knowledge.

Market segmentation analysis reveals distinct customer categories and application types that define the UK distributed solar power generation landscape, each with unique characteristics, requirements, and growth patterns.

By Customer Type:

By Technology Type:

By Installation Type:

Residential segment analysis reveals strong growth momentum driven by homeowner interest in energy independence and environmental sustainability. Installation sizes typically range from 3-6kW, with system costs declining to levels that provide attractive payback periods. Technology preferences favor high-efficiency monocrystalline panels that maximize generation from limited roof space. Battery storage adoption reaches 35% of new residential installations, enabling greater self-consumption and backup power capabilities.

Commercial sector dynamics show increasing adoption among businesses pursuing corporate sustainability goals and operational cost reduction. Installation sizes range from 50kW to 1MW, leveraging larger roof spaces and higher electricity consumption patterns. Financial drivers include reduced peak demand charges, long-term price certainty, and corporate renewable energy procurement targets. Advanced monitoring and energy management systems become standard features for optimizing performance and demonstrating environmental benefits.

Industrial applications focus on large-scale installations that can significantly offset facility electricity consumption while providing grid services capabilities. System sizes often exceed 1MW, requiring sophisticated design and integration with existing electrical infrastructure. Performance optimization becomes critical for maximizing financial returns and operational benefits. Energy storage integration enables demand charge management and backup power for critical operations.

Community solar development addresses market segments unable to install individual systems, including renters, apartment dwellers, and properties with unsuitable roofs. Subscription models provide access to solar benefits without property ownership requirements. Local authority partnerships and community energy groups facilitate project development and customer acquisition.

Industry participants across the UK distributed solar power generation value chain realize significant benefits from market participation, creating value for customers, communities, and the broader energy system.

For System Owners:

For Installers and Developers:

For Grid Operators:

For Society:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the UK distributed solar power generation market reflect technological advancement, changing customer preferences, and evolving policy frameworks that shape industry development.

Energy Storage Integration represents the most significant trend, with battery systems becoming standard components of new installations. Storage adoption rates have increased to 30% of new residential systems, driven by declining battery costs and enhanced value propositions. Combined solar-plus-storage systems enable greater energy independence, backup power capabilities, and participation in grid services markets.

Smart Grid Integration advances through deployment of advanced inverters, smart meters, and energy management systems that optimize system performance and enable grid services participation. Vehicle-to-grid integration emerges as electric vehicle adoption accelerates, creating synergies between distributed solar and transportation electrification.

Community Energy Development expands through shared solar installations, local energy trading platforms, and community ownership models. These initiatives address market segments unable to install individual systems while fostering local economic development and energy democracy.

Corporate Procurement accelerates as businesses pursue renewable energy targets and carbon neutrality goals. Power purchase agreements and virtual power purchase agreements enable corporate customers to access distributed solar benefits without direct ownership requirements.

Technology Innovation continues through improved panel efficiency, bifacial technology adoption, and building-integrated photovoltaic development. MWR data indicates that average panel efficiency has improved to 20.5% for residential installations, enhancing system performance and space utilization.

Recent industry developments demonstrate the dynamic nature of the UK distributed solar power generation market, with significant advances in technology, policy, and business models shaping sector evolution.

Technology Advancement: Major manufacturers have introduced next-generation solar panels with efficiency ratings exceeding 22%, while inverter technology has evolved to provide advanced grid support capabilities. Energy storage integration has become mainstream, with leading installers offering integrated solar-plus-battery solutions as standard offerings.

Policy Evolution: The government has implemented planning policy reforms that streamline approval processes for distributed solar installations, while the Smart Export Guarantee provides ongoing revenue streams for excess electricity generation. Grid connection procedures have been simplified to reduce barriers and accelerate installation timelines.

Market Consolidation: The installer market has experienced consolidation as larger companies acquire regional players to expand geographic coverage and service capabilities. This consolidation has improved service standardization while maintaining competitive pricing through economies of scale.

Financing Innovation: New financing models including solar loans, leasing arrangements, and community investment schemes have expanded customer access to distributed solar installations. Third-party ownership models have gained traction, particularly in residential markets where upfront costs remain barriers to adoption.

Grid Integration: Distribution network operators have invested in smart grid infrastructure to better accommodate distributed generation, while developing new connection standards and grid codes that facilitate solar integration while maintaining system reliability.

Strategic recommendations for industry participants focus on capitalizing on market opportunities while addressing challenges that could constrain growth in the UK distributed solar power generation sector.

For System Installers: Diversify service offerings to include energy storage, smart home integration, and ongoing maintenance services that create recurring revenue streams. Invest in digital marketing and customer acquisition strategies that target emerging market segments including commercial customers and community projects. Develop partnerships with financing providers to offer comprehensive solutions that address upfront cost barriers.

For Technology Providers: Focus on product innovation that addresses specific UK market needs including aesthetic considerations, grid integration capabilities, and performance optimization for local weather conditions. Develop integrated solutions that combine solar generation, energy storage, and smart grid capabilities to provide comprehensive value propositions.

For Policy Makers: Maintain supportive policy frameworks while addressing grid integration challenges through infrastructure investment and regulatory reform. Consider mechanisms to support community energy development and ensure equitable access to distributed solar benefits across different customer segments and geographic regions.

For Investors: Evaluate opportunities across the distributed solar value chain, with particular focus on companies offering integrated solutions, innovative financing models, and grid services capabilities. Consider the potential for consolidation in the installer market and emerging opportunities in energy storage and smart grid technologies.

For Customers: Assess distributed solar opportunities based on individual circumstances including roof suitability, electricity consumption patterns, and financial objectives. Consider integrated solutions that include energy storage and smart home capabilities to maximize value and future-proof investments.

Future market prospects for the UK distributed solar power generation sector remain highly positive, with multiple factors converging to support continued growth and market evolution over the coming decade.

Growth projections indicate sustained expansion across all market segments, with residential installations expected to maintain strong momentum while commercial and industrial adoption accelerates. MarkWide Research analysis suggests the market could achieve 15% annual growth rates through 2030, driven by declining costs, improving technology, and supportive policy frameworks.

Technology evolution will continue to enhance system performance and reduce costs, with next-generation solar panels, advanced inverters, and integrated energy storage becoming standard components. Building-integrated photovoltaics and aesthetic panel designs will address architectural concerns and expand installation opportunities in urban environments.

Market maturation will bring standardization of installation practices, financing mechanisms, and performance monitoring systems. The sector will transition from early adopter markets to mainstream acceptance, with streamlined processes and improved customer experiences driving broader adoption.

Grid integration will advance through smart grid infrastructure deployment, advanced metering systems, and regulatory frameworks that enable distributed solar systems to provide grid services. Virtual power plant aggregation will create new revenue streams and enhance the value proposition for distributed solar investments.

Policy support is expected to continue through renewable energy targets, carbon reduction commitments, and economic recovery initiatives that prioritize clean energy investment. Local authority initiatives and community energy programs will expand access to distributed solar benefits across diverse customer segments.

The UK distributed solar power generation market represents a transformative force in the nation’s energy landscape, demonstrating remarkable growth potential and technological sophistication that positions the sector for continued expansion. The convergence of declining costs, improving technology, and supportive policy frameworks creates compelling value propositions across residential, commercial, and industrial market segments.

Market fundamentals remain strong, with installation rates accelerating and customer acceptance reaching mainstream levels. The integration of energy storage systems, smart grid technologies, and advanced monitoring capabilities enhances the value proposition while addressing traditional limitations of solar power generation. Regional expansion beyond traditional high-adoption areas demonstrates the technology’s viability across diverse geographic and economic conditions.

Industry evolution continues through technological innovation, business model development, and market consolidation that improves service quality while maintaining competitive pricing. The emergence of community solar projects, corporate procurement programs, and integrated energy solutions expands market accessibility and creates new growth opportunities for industry participants.

Future prospects indicate sustained growth momentum supported by environmental consciousness, economic benefits, and technological advancement. The sector’s contribution to carbon emission reduction, energy security, and economic development aligns with national priorities and stakeholder interests, ensuring continued policy support and market development. As the UK pursues ambitious climate targets and energy transition goals, distributed solar power generation will play an increasingly important role in delivering clean, affordable, and reliable electricity to communities across the nation.

What is Distributed Solar Power Generation?

Distributed Solar Power Generation refers to the production of solar energy from small-scale solar installations, typically located close to the point of use. This includes residential solar panels, community solar projects, and commercial solar systems that contribute to local energy needs.

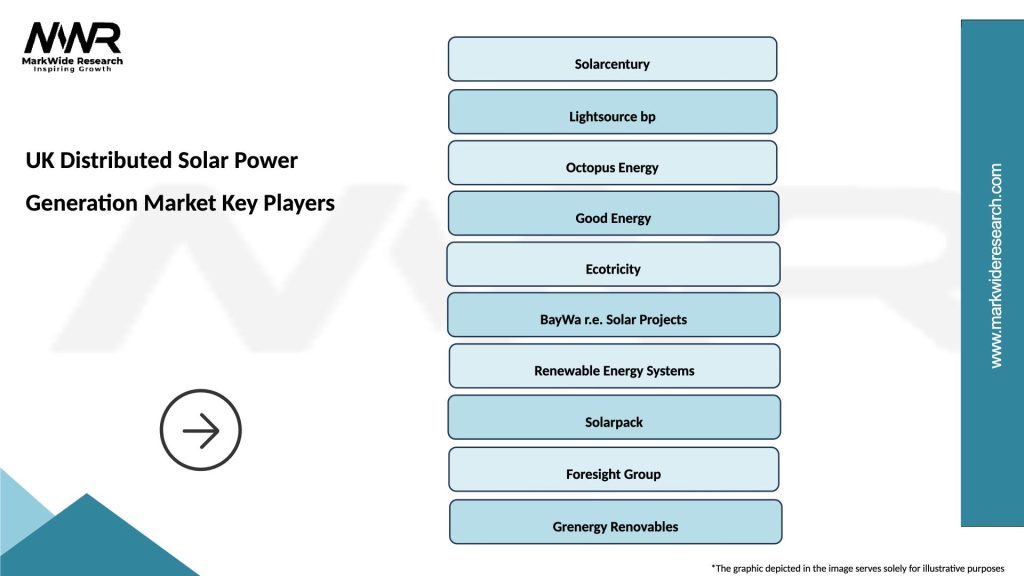

What are the key players in the UK Distributed Solar Power Generation Market?

Key players in the UK Distributed Solar Power Generation Market include companies like Octopus Energy, Lightsource BP, and Solarcentury, which are involved in the development and installation of solar energy systems, among others.

What are the growth factors driving the UK Distributed Solar Power Generation Market?

The UK Distributed Solar Power Generation Market is driven by factors such as increasing energy demand, government incentives for renewable energy, and advancements in solar technology that enhance efficiency and reduce costs.

What challenges does the UK Distributed Solar Power Generation Market face?

Challenges in the UK Distributed Solar Power Generation Market include regulatory hurdles, the intermittency of solar energy, and the need for significant upfront investment in solar infrastructure.

What opportunities exist in the UK Distributed Solar Power Generation Market?

Opportunities in the UK Distributed Solar Power Generation Market include the potential for energy storage solutions, the expansion of community solar projects, and increasing corporate investments in sustainability initiatives.

What trends are shaping the UK Distributed Solar Power Generation Market?

Trends in the UK Distributed Solar Power Generation Market include the rise of smart solar technologies, integration with electric vehicle charging infrastructure, and a growing emphasis on energy independence among consumers.

UK Distributed Solar Power Generation Market

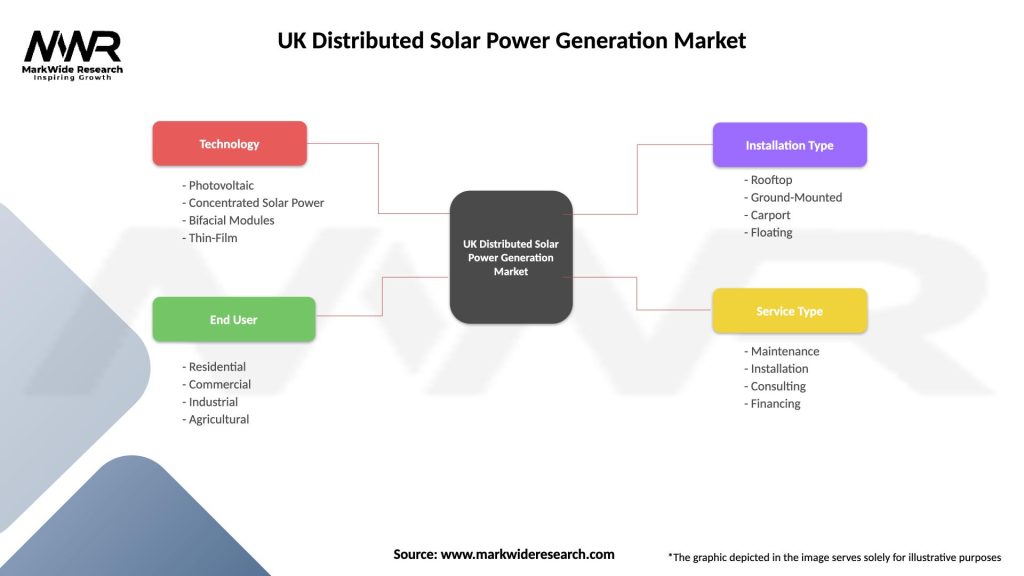

| Segmentation Details | Description |

|---|---|

| Technology | Photovoltaic, Concentrated Solar Power, Bifacial Modules, Thin-Film |

| End User | Residential, Commercial, Industrial, Agricultural |

| Installation Type | Rooftop, Ground-Mounted, Carport, Floating |

| Service Type | Maintenance, Installation, Consulting, Financing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Distributed Solar Power Generation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at