444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK defense market represents one of the most sophisticated and technologically advanced defense ecosystems globally, encompassing a comprehensive range of military capabilities, equipment, and services. Britain’s defense sector maintains its position as a cornerstone of national security while simultaneously serving as a significant contributor to the country’s economic landscape and technological innovation. The market demonstrates remarkable resilience and adaptability, continuously evolving to address emerging threats and geopolitical challenges across multiple domains including land, sea, air, space, and cyber warfare.

Market dynamics indicate sustained growth driven by increasing defense spending commitments, modernization programs, and strategic partnerships with allied nations. The sector benefits from the UK’s commitment to maintaining defense expenditure at 2.3% of GDP, exceeding NATO’s recommended threshold and demonstrating the government’s dedication to national security priorities. Technological advancement remains a primary focus, with significant investments in artificial intelligence, autonomous systems, and next-generation warfare capabilities.

Defense procurement activities encompass a diverse portfolio ranging from traditional military hardware to cutting-edge cyber defense solutions. The market’s complexity reflects the multifaceted nature of modern security challenges, requiring integrated approaches that combine conventional defense capabilities with advanced technological solutions. Innovation hubs across the UK continue to drive research and development initiatives, fostering collaboration between government agencies, defense contractors, and academic institutions.

The UK defense market refers to the comprehensive ecosystem of military and security-related products, services, and capabilities developed, manufactured, and deployed to protect British national interests and support allied operations worldwide. This market encompasses defense equipment manufacturing, military technology development, cybersecurity solutions, intelligence systems, and support services that collectively contribute to the nation’s defense infrastructure and strategic capabilities.

Defense market scope extends beyond traditional military hardware to include sophisticated software systems, artificial intelligence applications, space-based assets, and emerging technologies that address contemporary security challenges. The market integrates both domestic production capabilities and international partnerships, creating a complex network of suppliers, contractors, and service providers that support the UK’s defense objectives across multiple operational domains.

Strategic positioning of the UK defense market reflects the nation’s commitment to maintaining advanced military capabilities while fostering innovation and technological leadership. The sector demonstrates consistent growth patterns supported by government investment priorities, international collaboration agreements, and emerging threat response requirements. Market participants range from established defense contractors to innovative technology startups, creating a dynamic ecosystem that balances traditional defense manufacturing with cutting-edge technological development.

Investment trends show increasing focus on cyber defense capabilities, autonomous systems, and space-based technologies, reflecting the evolving nature of modern warfare and security challenges. The market benefits from strong government support through dedicated funding programs, research initiatives, and procurement strategies designed to maintain the UK’s competitive advantage in global defense markets. Export opportunities continue to expand as British defense technologies gain recognition for their quality, reliability, and innovative features.

Operational efficiency improvements across the defense sector demonstrate the market’s ability to adapt to changing requirements while maintaining cost-effectiveness. The integration of digital technologies and advanced manufacturing processes has resulted in enhanced productivity levels and improved delivery timelines for critical defense programs.

Market intelligence reveals several critical insights that shape the UK defense sector’s trajectory and strategic direction:

Primary drivers propelling the UK defense market forward encompass a combination of geopolitical factors, technological advancements, and strategic policy decisions. The evolving global security landscape creates sustained demand for advanced defense capabilities, driving continuous investment in military modernization programs and technological innovation initiatives.

Geopolitical tensions across various regions necessitate enhanced defense preparedness and capability development. The UK’s strategic position as a global power requires maintaining sophisticated defense systems capable of addressing diverse threat scenarios. NATO commitments and international security obligations further reinforce the need for sustained defense investment and capability enhancement.

Technological evolution serves as a significant market driver, with emerging technologies creating new opportunities for defense applications. The integration of artificial intelligence, quantum computing, and advanced materials science opens new frontiers for defense innovation. Digital transformation initiatives across the defense sector drive demand for advanced computing systems, secure communications networks, and data analytics capabilities.

Economic considerations also contribute to market growth, as defense spending generates significant economic benefits through job creation, technology development, and export opportunities. The defense sector’s contribution to the UK’s industrial base and technological competitiveness reinforces government support for continued investment and development programs.

Budget constraints represent a primary challenge facing the UK defense market, as competing government priorities and fiscal pressures can limit available resources for defense programs. Economic uncertainties and changing political priorities may impact long-term defense spending commitments, creating challenges for sustained program development and procurement activities.

Regulatory complexities associated with defense procurement and international trade can create barriers to market growth. Export control regulations, security clearance requirements, and compliance obligations add complexity and cost to defense programs. International regulations governing arms exports and technology transfers can limit market opportunities and restrict business development activities.

Technical challenges in developing advanced defense systems can lead to program delays and cost overruns. The complexity of modern defense technologies requires significant research and development investments with uncertain outcomes. Integration difficulties between legacy systems and new technologies can complicate modernization efforts and increase implementation costs.

Supply chain vulnerabilities pose ongoing challenges, particularly regarding critical components and materials sourced from international suppliers. Skills shortages in specialized technical areas can limit the sector’s ability to develop and deploy advanced defense capabilities effectively.

Emerging technologies present substantial opportunities for growth and innovation within the UK defense market. The development of autonomous systems, artificial intelligence applications, and quantum technologies creates new market segments with significant potential for expansion. Cyber defense represents a rapidly growing opportunity as organizations across all sectors require enhanced cybersecurity capabilities.

Export markets offer considerable potential for UK defense companies, particularly in regions seeking advanced defense technologies and systems. The UK’s reputation for quality and innovation in defense creates competitive advantages in international markets. Partnership opportunities with allied nations through joint development programs can provide access to larger markets and shared development costs.

Commercial applications of defense technologies create additional revenue streams and market opportunities. Technologies developed for military applications often have civilian uses, creating dual-use opportunities that can enhance market potential. Space-based services represent a growing market segment with applications in communications, navigation, and earth observation.

Modernization programs across various defense domains create sustained opportunities for technology providers and system integrators. The need to upgrade aging defense infrastructure and capabilities drives continuous demand for advanced solutions and services.

Market dynamics within the UK defense sector reflect the complex interplay between government policy, technological innovation, and global security requirements. The sector operates within a framework of strategic defense reviews, capability assessments, and long-term planning processes that shape investment priorities and program development activities.

Competitive dynamics involve both domestic and international players, creating a complex ecosystem of prime contractors, suppliers, and technology providers. The market demonstrates characteristics of both collaboration and competition, with companies working together on major programs while competing for individual contracts and opportunities. Innovation cycles drive continuous technology development and capability enhancement, with research and development activities spanning multiple years or decades.

According to MarkWide Research analysis, the defense market demonstrates resilience to economic fluctuations while maintaining steady growth patterns driven by consistent government investment and strategic priorities. Market consolidation trends show increasing collaboration between traditional defense contractors and technology companies, creating new partnership models and business approaches.

Procurement dynamics involve complex evaluation processes that consider technical capabilities, cost-effectiveness, and strategic value. The shift toward outcome-based contracting and through-life support models changes traditional business relationships and creates new service opportunities. Technology transfer activities between military and civilian sectors create additional market dynamics and innovation opportunities.

Comprehensive research methodology employed in analyzing the UK defense market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. The methodology combines quantitative analysis of market data with qualitative assessment of industry trends, policy developments, and technological advancements.

Primary research activities include interviews with industry executives, government officials, and subject matter experts to gather insights on market trends, challenges, and opportunities. Secondary research encompasses analysis of government publications, industry reports, academic studies, and corporate financial statements to build a comprehensive understanding of market dynamics.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert review. The methodology incorporates both historical analysis and forward-looking projections to provide comprehensive market insights. Analytical frameworks include market segmentation analysis, competitive positioning assessment, and trend identification to support strategic decision-making.

Market modeling techniques incorporate various scenarios and assumptions to project future market developments and identify potential growth opportunities. The research methodology maintains objectivity and independence while providing actionable insights for market participants and stakeholders.

Regional distribution of UK defense activities demonstrates concentration in specific geographic areas with established defense industrial capabilities and infrastructure. Southern England maintains the highest concentration of defense activities, accounting for approximately 35% of total defense employment, with major facilities located in Hampshire, Surrey, and surrounding counties.

Scotland represents a significant defense hub, particularly for naval systems and shipbuilding activities, contributing approximately 20% of UK defense output. The region benefits from established shipyards, engineering capabilities, and specialized workforce skills developed over decades of defense industry presence. Welsh defense activities focus primarily on aerospace and electronics manufacturing, representing about 12% of national defense production.

Northern England contributes substantially to defense manufacturing, particularly in aerospace and advanced materials, accounting for roughly 18% of sector activity. The region’s industrial heritage and engineering expertise provide strong foundations for defense manufacturing and technology development. Midlands region serves as a critical hub for automotive and engineering applications in defense, representing approximately 15% of market activity.

Regional specialization patterns reflect historical development, available infrastructure, and workforce capabilities. Each region develops distinct competitive advantages in specific defense domains, creating a distributed but integrated national defense industrial base. Investment patterns show continued government support for regional defense capabilities through targeted funding programs and infrastructure development initiatives.

Competitive landscape within the UK defense market encompasses a diverse mix of multinational corporations, domestic specialists, and emerging technology companies. The market structure reflects both consolidation trends and new entrant activities, creating dynamic competitive conditions across various defense segments.

Market positioning strategies vary among competitors, with some focusing on comprehensive system integration while others specialize in specific technologies or market segments. Innovation competition drives continuous technology development and capability enhancement across the competitive landscape.

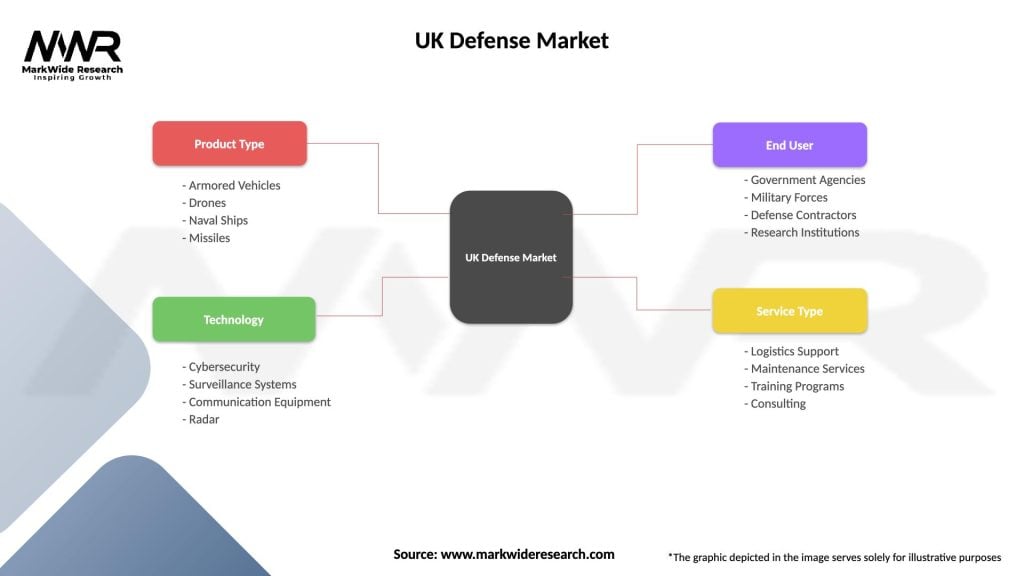

Market segmentation within the UK defense sector reflects the diverse nature of military requirements and technological capabilities. Segmentation approaches consider multiple dimensions including platform type, technology category, end-user application, and operational domain.

By Platform Type:

By Technology Category:

By End-User Application:

Aerospace category demonstrates the strongest growth momentum within the UK defense market, driven by modernization programs and international collaboration initiatives. The segment benefits from the UK’s established aerospace industrial base and technological expertise in advanced propulsion systems, avionics, and aircraft integration. Fighter aircraft programs represent significant long-term opportunities, with the Tempest program positioning the UK as a leader in next-generation combat aircraft development.

Naval systems category maintains steady growth supported by shipbuilding programs and maritime security requirements. The UK’s island geography and global maritime interests drive sustained investment in naval capabilities. Submarine programs represent particular strength areas, with nuclear propulsion technology and advanced sonar systems demonstrating world-class capabilities.

Cybersecurity category shows the fastest expansion rate, reflecting the growing importance of digital defense capabilities. The segment benefits from the UK’s strong information technology sector and government emphasis on cyber resilience. Artificial intelligence applications within cybersecurity create new market opportunities and competitive advantages.

Space systems category emerges as a high-growth segment with increasing strategic importance. The UK’s space program development and commercial space industry growth create synergies that benefit defense applications. Satellite technologies for communications, navigation, and earth observation represent key growth areas within this category.

Industry participants in the UK defense market benefit from substantial advantages including access to advanced technology development programs, government research funding, and international collaboration opportunities. The sector provides stable, long-term revenue streams through multi-year defense contracts and through-life support agreements.

Technology development benefits include access to cutting-edge research facilities, collaboration with leading universities, and participation in innovative defense programs. Companies gain competitive advantages through technology transfer opportunities and dual-use applications that create additional commercial markets. Export opportunities provide access to global markets and international partnerships that expand business potential.

Stakeholder advantages encompass economic benefits through job creation, technology spillovers, and industrial capability development. The defense sector contributes significantly to the UK’s advanced manufacturing base and technological competitiveness. Skills development programs create highly qualified workforce capabilities that benefit broader industrial sectors.

Strategic benefits include enhanced national security capabilities, technological sovereignty, and international influence through defense partnerships. The sector supports the UK’s position as a global defense technology leader and enables effective participation in international security arrangements. Innovation ecosystems created around defense programs generate broader economic and technological benefits for the UK economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the UK defense market, with artificial intelligence, machine learning, and data analytics becoming integral to defense systems and operations. This transformation affects all aspects of defense from logistics and maintenance to combat operations and strategic planning. Autonomous systems development accelerates across all domains, with unmanned platforms becoming increasingly sophisticated and capable.

Cyber-physical integration creates new paradigms for defense systems design and operation. The convergence of physical and digital systems enables new capabilities while creating new vulnerabilities that require innovative security approaches. MWR analysis indicates that cyber-physical systems represent the fastest-growing segment within defense technology development.

Sustainability initiatives gain prominence as environmental considerations become integrated into defense procurement and operations. The military’s environmental footprint reduction drives innovation in energy-efficient systems, alternative fuels, and sustainable manufacturing processes. Green defense technologies create new market opportunities while addressing environmental responsibilities.

Modular system architectures enable more flexible and cost-effective defense solutions. Open architecture approaches facilitate technology insertion and system upgrades while reducing lifecycle costs. Interoperability standards become increasingly important as coalition operations require seamless integration between different national systems and platforms.

Major program launches continue to shape the UK defense market landscape, with the Tempest fighter aircraft program representing the largest single defense technology initiative. This program demonstrates the UK’s commitment to maintaining air combat superiority while fostering international partnerships with Italy, Japan, and other allied nations. Investment levels in the program exceed traditional defense spending patterns, indicating strategic priority status.

Cyber defense initiatives expand significantly with the establishment of new cybersecurity centers and increased funding for digital resilience programs. The National Cyber Force represents a new organizational approach to cyber operations, combining military and civilian capabilities. Public-private partnerships in cybersecurity create new collaboration models between government and industry.

Space program developments include the establishment of UK Space Command and increased investment in satellite capabilities. The UK’s space strategy emphasizes both military and commercial applications, creating synergies between defense and civilian space activities. Launch capability development through programs like the UK’s spaceport initiatives demonstrates commitment to space domain leadership.

International collaboration expands through programs like AUKUS, which creates new partnerships in advanced technology development. These collaborations enable sharing of development costs while accessing larger markets and complementary capabilities. Technology sharing agreements facilitate innovation while maintaining security requirements and competitive advantages.

Strategic recommendations for UK defense market participants emphasize the importance of technology innovation and international partnership development. Companies should prioritize investment in emerging technologies while maintaining core competencies in traditional defense domains. Digital transformation initiatives require sustained investment and organizational change management to realize full potential benefits.

Market positioning strategies should focus on developing unique capabilities that differentiate companies in competitive markets. Specialization in niche technology areas can provide competitive advantages while participation in larger programs ensures market access. Partnership strategies become increasingly important as program complexity and costs require collaborative approaches.

Investment priorities should emphasize research and development activities that support long-term competitiveness. The rapid pace of technological change requires continuous innovation and capability development. Skills development programs are essential for maintaining technical capabilities and attracting talent in competitive markets.

Risk management approaches should address supply chain vulnerabilities, cybersecurity threats, and regulatory changes. Diversification strategies can reduce dependence on single markets or technologies while maintaining focus on core competencies. Scenario planning helps organizations prepare for various future market conditions and policy changes.

Future prospects for the UK defense market remain positive, supported by sustained government commitment to defense spending and technological innovation. The market is projected to maintain steady growth rates of approximately 4.2% annually over the next decade, driven by modernization programs and emerging technology adoption. Long-term trends indicate increasing emphasis on autonomous systems, artificial intelligence, and cyber defense capabilities.

Technology evolution will continue to reshape defense requirements and market opportunities. Quantum computing, advanced materials, and biotechnology applications in defense create new market segments with substantial growth potential. MarkWide Research projects that emerging technology segments will account for approximately 25% of total defense spending by 2030.

International market expansion offers significant opportunities for UK defense companies, particularly in regions seeking advanced defense technologies. Export growth rates are expected to exceed domestic market growth, with international sales potentially reaching 60% of total UK defense industry revenue within the next decade. Partnership programs with allied nations will continue to drive collaborative development and shared market access.

Market consolidation trends may continue as companies seek scale advantages and complementary capabilities. However, the market will likely maintain diversity through continued innovation and new entrant activities in emerging technology areas. Investment patterns will increasingly favor companies demonstrating strong technology capabilities and international market access.

The UK defense market demonstrates remarkable resilience and adaptability in addressing evolving security challenges while maintaining technological leadership and industrial competitiveness. The sector’s comprehensive capabilities across traditional and emerging defense domains position it well for continued growth and international success. Strategic investments in advanced technologies, international partnerships, and workforce development create strong foundations for future market expansion.

Market dynamics reflect the complex interplay between government policy, technological innovation, and global security requirements. The sector’s ability to balance traditional defense capabilities with cutting-edge technology development ensures continued relevance and competitive advantage. Sustained growth prospects are supported by consistent government commitment, strong industrial capabilities, and expanding international opportunities that collectively reinforce the UK’s position as a global defense technology leader.

What is UK Defense?

UK Defense refers to the strategies, policies, and activities undertaken by the United Kingdom to ensure national security and protect its interests. This includes military operations, defense procurement, and collaboration with international allies.

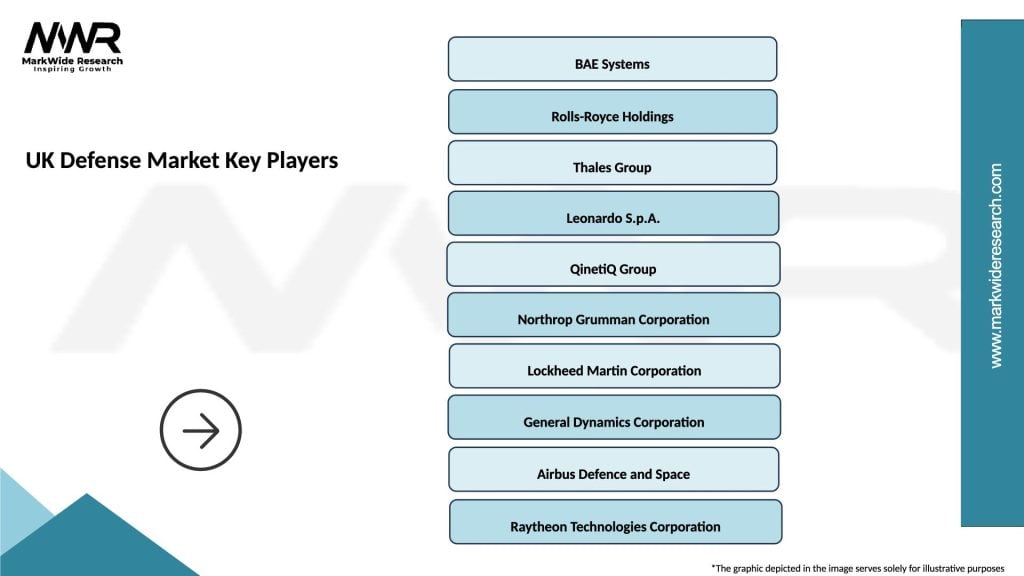

What are the key players in the UK Defense Market?

Key players in the UK Defense Market include BAE Systems, Rolls-Royce, and Thales Group, which are involved in various sectors such as aerospace, naval defense, and cybersecurity, among others.

What are the main drivers of growth in the UK Defense Market?

The main drivers of growth in the UK Defense Market include increasing geopolitical tensions, advancements in military technology, and the need for modernization of defense systems to address emerging threats.

What challenges does the UK Defense Market face?

The UK Defense Market faces challenges such as budget constraints, the complexity of procurement processes, and the need to balance defense spending with other public priorities.

What opportunities exist in the UK Defense Market?

Opportunities in the UK Defense Market include the development of innovative defense technologies, partnerships with private sector firms, and increased investment in cybersecurity and unmanned systems.

What trends are shaping the UK Defense Market?

Trends shaping the UK Defense Market include a focus on digital transformation, the integration of artificial intelligence in defense operations, and a shift towards more sustainable defense practices.

UK Defense Market

| Segmentation Details | Description |

|---|---|

| Product Type | Armored Vehicles, Drones, Naval Ships, Missiles |

| Technology | Cybersecurity, Surveillance Systems, Communication Equipment, Radar |

| End User | Government Agencies, Military Forces, Defense Contractors, Research Institutions |

| Service Type | Logistics Support, Maintenance Services, Training Programs, Consulting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Defense Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at