444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK data center cooling market represents a critical infrastructure segment experiencing unprecedented transformation driven by digital acceleration and sustainability imperatives. Data center cooling systems have evolved from basic air conditioning units to sophisticated thermal management solutions incorporating advanced technologies such as liquid cooling, immersion cooling, and AI-driven optimization platforms. The market encompasses diverse cooling methodologies including air-based cooling, liquid cooling, evaporative cooling, and hybrid systems designed to maintain optimal operating temperatures for mission-critical IT equipment.

Market dynamics indicate robust growth potential with the sector experiencing a compound annual growth rate of 8.2% driven by increasing data center construction, edge computing proliferation, and stringent energy efficiency regulations. The UK’s position as a leading European digital hub, combined with government initiatives promoting sustainable data center operations, creates favorable conditions for cooling technology innovation and adoption.

Technological advancement remains the primary catalyst for market evolution, with organizations increasingly adopting precision cooling solutions, intelligent thermal management systems, and renewable energy integration. The shift toward high-density computing environments and the deployment of artificial intelligence workloads necessitate more sophisticated cooling approaches, driving demand for advanced thermal management solutions across enterprise, colocation, and hyperscale data center segments.

The UK data center cooling market refers to the comprehensive ecosystem of thermal management technologies, systems, and services designed to maintain optimal operating temperatures within data center facilities across the United Kingdom. This market encompasses hardware components, software solutions, installation services, and maintenance offerings that collectively ensure reliable IT infrastructure performance while optimizing energy consumption and operational costs.

Data center cooling involves the systematic removal of heat generated by IT equipment, power distribution systems, and facility infrastructure through various methodologies including air conditioning, liquid cooling, evaporative cooling, and advanced thermal management techniques. The market includes both traditional cooling approaches and emerging technologies such as immersion cooling, direct-to-chip cooling, and AI-powered thermal optimization systems.

Market participants include cooling equipment manufacturers, system integrators, technology providers, maintenance service companies, and consulting firms specializing in data center thermal management. The ecosystem supports various facility types from small server rooms to large hyperscale data centers, each requiring tailored cooling solutions based on specific operational requirements, density levels, and efficiency targets.

The UK data center cooling market demonstrates strong growth momentum fueled by digital transformation initiatives, cloud computing adoption, and increasing focus on energy efficiency. Market expansion reflects the critical role of thermal management in supporting reliable data center operations while addressing sustainability objectives and regulatory compliance requirements.

Key market drivers include the proliferation of edge computing infrastructure, growing adoption of high-performance computing applications, and stringent environmental regulations promoting energy-efficient cooling solutions. The market benefits from technological innovations in liquid cooling systems, which demonstrate efficiency improvements of up to 40% compared to traditional air cooling methods.

Competitive landscape features established cooling equipment manufacturers alongside emerging technology providers specializing in next-generation thermal management solutions. Market consolidation trends indicate strategic partnerships between cooling technology vendors and data center operators to develop integrated solutions addressing specific operational challenges and efficiency requirements.

Regional distribution shows concentrated activity in major metropolitan areas including London, Manchester, and Edinburgh, with approximately 60% of market activity centered around these key digital hubs. The market outlook remains positive with continued investment in data center infrastructure and growing emphasis on sustainable cooling technologies driving long-term growth prospects.

Market intelligence reveals several critical insights shaping the UK data center cooling landscape:

Digital transformation acceleration serves as the primary catalyst driving UK data center cooling market expansion. Organizations across industries are increasing their digital infrastructure investments, resulting in higher data center capacity requirements and corresponding cooling demands. The proliferation of cloud computing services, big data analytics, and artificial intelligence applications creates substantial heat generation requiring sophisticated thermal management solutions.

Edge computing proliferation represents a significant growth driver as organizations deploy distributed computing infrastructure closer to end users. Edge data centers require specialized cooling solutions that operate efficiently in diverse environmental conditions while maintaining compact form factors. This trend drives innovation in micro-cooling technologies and adaptive thermal management systems.

Sustainability imperatives increasingly influence cooling technology selection as organizations seek to reduce their environmental footprint and achieve carbon neutrality goals. Government regulations and industry standards promote energy-efficient cooling solutions, driving adoption of advanced technologies such as free cooling, liquid cooling, and renewable energy integration.

High-density computing trends necessitate more sophisticated cooling approaches as modern IT equipment generates increased heat loads within smaller physical footprints. The deployment of graphics processing units, artificial intelligence accelerators, and high-performance computing systems requires precision cooling solutions capable of managing concentrated thermal loads effectively.

High implementation costs present significant barriers to cooling technology adoption, particularly for advanced solutions such as liquid cooling and immersion cooling systems. Initial capital investments, installation complexity, and infrastructure modifications required for next-generation cooling technologies can deter organizations from upgrading existing thermal management systems.

Technical complexity associated with modern cooling solutions creates implementation challenges for organizations lacking specialized expertise. Integration of intelligent cooling management systems, liquid cooling infrastructure, and hybrid thermal management approaches requires skilled personnel and comprehensive planning to ensure successful deployment and operation.

Infrastructure limitations in existing data center facilities constrain cooling system upgrades and modernization efforts. Legacy facilities may lack the structural capacity, power distribution capabilities, or space requirements necessary to accommodate advanced cooling technologies, limiting market growth potential in retrofit applications.

Regulatory uncertainty regarding environmental standards, refrigerant regulations, and energy efficiency requirements creates planning challenges for cooling technology investments. Evolving compliance requirements may impact technology selection decisions and long-term operational strategies, potentially slowing market adoption rates.

Artificial intelligence integration presents substantial opportunities for cooling system optimization through predictive analytics, automated thermal management, and intelligent load balancing. AI-powered cooling solutions can reduce energy consumption by up to 30% while improving system reliability and performance, creating significant value propositions for data center operators.

Liquid cooling expansion offers considerable growth potential as organizations seek more efficient thermal management solutions for high-density computing environments. Direct-to-chip cooling, immersion cooling, and hybrid liquid-air cooling systems provide superior thermal performance while reducing overall energy consumption and operational costs.

Edge computing infrastructure development creates new market segments requiring specialized cooling solutions designed for distributed deployment scenarios. Compact, efficient cooling systems suitable for edge data centers, telecommunications facilities, and industrial computing environments represent emerging opportunities for technology providers.

Sustainability services encompassing carbon footprint reduction, renewable energy integration, and circular economy principles offer differentiation opportunities for cooling solution providers. Organizations increasingly value partners capable of supporting their environmental objectives through innovative thermal management approaches and sustainable operational practices.

Supply chain evolution reflects the growing sophistication of cooling technology requirements and the need for specialized components, materials, and expertise. Manufacturers are developing closer relationships with data center operators to understand specific thermal management challenges and co-develop tailored solutions addressing unique operational requirements.

Technology convergence between cooling systems and IT infrastructure creates opportunities for integrated solutions that optimize both computing performance and thermal management. Software-defined cooling, infrastructure orchestration, and holistic data center management platforms enable more efficient resource utilization and operational optimization.

Service model transformation toward outcome-based agreements and performance guarantees aligns cooling solution providers with customer success metrics. Cooling-as-a-service offerings, predictive maintenance contracts, and energy performance guarantees create recurring revenue streams while reducing customer risk and capital requirements.

Competitive intensity drives continuous innovation in cooling technologies, system integration capabilities, and service delivery models. Market participants are investing in research and development, strategic partnerships, and geographic expansion to maintain competitive positioning and capture emerging growth opportunities.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes structured interviews with industry executives, technology providers, data center operators, and end-user organizations to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry publications, regulatory documents, company financial reports, and technology specifications to validate primary findings and provide comprehensive market context. Data triangulation techniques ensure consistency across multiple information sources and research approaches.

Market modeling utilizes statistical analysis, trend extrapolation, and scenario planning to develop growth projections and market forecasts. Quantitative analysis incorporates historical market data, technology adoption curves, and economic indicators to establish baseline assumptions and growth trajectories.

Expert validation through industry advisory panels and subject matter expert reviews ensures research findings accurately reflect market realities and emerging trends. Continuous monitoring of market developments and technology innovations provides ongoing validation and refinement of research conclusions.

London metropolitan area dominates the UK data center cooling market with approximately 45% market concentration driven by high data center density, financial services sector presence, and robust digital infrastructure requirements. The region benefits from established technology ecosystems, skilled workforce availability, and proximity to major cloud service providers and enterprise customers.

Manchester and surrounding regions represent the second-largest market segment with roughly 20% market share, supported by growing technology sector presence, competitive real estate costs, and strategic geographic positioning. The area attracts data center investments due to favorable operating conditions and government incentives promoting digital infrastructure development.

Scotland, particularly Edinburgh and Glasgow, accounts for approximately 15% of market activity with strong growth potential driven by renewable energy availability, competitive operating costs, and supportive government policies. The region’s focus on sustainable technology development aligns with cooling market trends toward energy-efficient solutions.

Emerging regional markets including Birmingham, Bristol, and Cardiff collectively represent about 20% of market opportunity with increasing data center development activity and growing enterprise digitalization requirements. These markets benefit from strategic geographic positioning, improving connectivity infrastructure, and competitive operational advantages.

Market leadership is distributed among established cooling equipment manufacturers, specialized technology providers, and integrated solution companies offering comprehensive thermal management capabilities:

Competitive strategies focus on technology innovation, service capability expansion, and strategic partnerships to address evolving customer requirements and market opportunities. Companies are investing in liquid cooling technologies, AI-powered optimization systems, and sustainable cooling solutions to differentiate their offerings.

By Cooling Type:

By Data Center Type:

By Component:

Air-Based Cooling Systems continue to dominate the market due to established infrastructure, proven reliability, and lower implementation costs. However, efficiency limitations and increasing power density requirements are driving gradual migration toward more advanced cooling technologies. Precision air conditioning systems with variable speed drives and intelligent controls offer improved efficiency while maintaining compatibility with existing infrastructure.

Liquid Cooling Technologies demonstrate the highest growth potential with adoption rates increasing by 35% annually among new data center deployments. Direct-to-chip cooling solutions provide superior thermal performance for high-density computing environments, while immersion cooling offers dramatic efficiency improvements for specialized applications such as cryptocurrency mining and high-performance computing.

Hybrid Cooling Approaches gain traction as organizations seek to optimize thermal management across diverse computing workloads and environmental conditions. These systems combine air and liquid cooling technologies to provide flexible, efficient solutions that adapt to changing operational requirements and seasonal variations.

Edge Cooling Solutions represent an emerging category driven by distributed computing requirements and 5G network deployment. Compact, efficient cooling systems designed for unmanned operation and diverse environmental conditions address the unique challenges of edge data center infrastructure.

Data Center Operators benefit from improved operational efficiency, reduced energy costs, and enhanced system reliability through advanced cooling technologies. Modern thermal management solutions enable higher computing density, improved power usage effectiveness, and predictive maintenance capabilities that minimize downtime and operational disruptions.

Technology Providers gain access to growing market opportunities driven by digital transformation and sustainability requirements. The evolution toward intelligent cooling systems, liquid cooling technologies, and integrated solutions creates differentiation opportunities and recurring revenue streams through service-based business models.

End-User Organizations achieve improved IT infrastructure performance, reduced total cost of ownership, and enhanced sustainability credentials through optimized cooling solutions. Advanced thermal management enables support for emerging technologies such as artificial intelligence and edge computing while meeting environmental objectives.

Service Providers benefit from expanding market opportunities in installation, maintenance, monitoring, and consulting services. The increasing complexity of cooling systems and growing emphasis on performance optimization create demand for specialized expertise and ongoing support services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Liquid Cooling Mainstream Adoption represents the most significant trend transforming the data center cooling landscape. Organizations are increasingly deploying direct-to-chip cooling, immersion cooling, and hybrid liquid-air systems to address high-density computing requirements and improve energy efficiency. This trend accelerates as liquid cooling technologies mature and demonstrate proven operational benefits.

AI-Powered Cooling Optimization emerges as a critical trend enabling intelligent thermal management through machine learning algorithms, predictive analytics, and automated control systems. These solutions optimize cooling performance in real-time, reduce energy consumption, and prevent thermal-related equipment failures through proactive management approaches.

Sustainability Integration drives adoption of renewable energy-powered cooling systems, waste heat recovery technologies, and circular economy principles in cooling system design and operation. Organizations prioritize cooling solutions that support carbon neutrality goals and demonstrate measurable environmental benefits.

Edge Computing Cooling Solutions gain prominence as distributed computing infrastructure requires specialized thermal management approaches. Compact, efficient cooling systems designed for unmanned operation and diverse environmental conditions address the unique requirements of edge data center deployments.

Modular Cooling Architectures provide scalability and flexibility advantages enabling organizations to adapt cooling capacity to changing requirements. Prefabricated cooling modules, containerized solutions, and scalable thermal management systems support rapid deployment and capacity expansion scenarios.

Technology partnerships between cooling equipment manufacturers and data center operators drive innovation in thermal management solutions. Collaborative development programs focus on addressing specific operational challenges and developing next-generation cooling technologies optimized for emerging computing workloads.

Regulatory initiatives promoting energy efficiency and environmental sustainability influence cooling technology development and adoption patterns. Government incentives for efficient cooling systems and carbon reduction targets create favorable conditions for advanced thermal management solution deployment.

Investment activity in cooling technology startups and established companies accelerates innovation in liquid cooling, AI-powered optimization, and sustainable thermal management solutions. Venture capital and strategic investments support development of breakthrough cooling technologies and market expansion initiatives.

Standards development for liquid cooling systems, thermal management best practices, and energy efficiency metrics provide industry guidance and facilitate technology adoption. Industry organizations collaborate on establishing standards that ensure interoperability and performance consistency across cooling solutions.

MarkWide Research recommends that organizations evaluate liquid cooling technologies for new data center deployments and high-density computing applications. The superior thermal performance and energy efficiency benefits of liquid cooling systems justify the additional implementation complexity and costs in appropriate applications.

Investment prioritization should focus on cooling solutions that provide measurable efficiency improvements, scalability advantages, and integration capabilities with existing infrastructure. Organizations should consider total cost of ownership implications including energy consumption, maintenance requirements, and operational flexibility when selecting cooling technologies.

Strategic partnerships with cooling technology providers offer opportunities to access specialized expertise, innovative solutions, and performance guarantees that reduce implementation risks and optimize operational outcomes. Collaborative approaches enable customized solutions addressing specific thermal management challenges and operational requirements.

Sustainability integration should be a key consideration in cooling technology selection, with emphasis on solutions that support environmental objectives and regulatory compliance requirements. Organizations should evaluate cooling systems based on their contribution to overall sustainability goals and carbon footprint reduction initiatives.

Market growth prospects remain robust with continued expansion expected across all cooling technology segments. The increasing adoption of artificial intelligence, edge computing, and high-performance computing applications will drive demand for advanced thermal management solutions capable of handling concentrated heat loads efficiently.

Technology evolution will focus on intelligent cooling systems incorporating artificial intelligence, machine learning, and predictive analytics to optimize thermal management performance. Integration with building management systems and infrastructure orchestration platforms will enable holistic data center optimization and automated operational management.

Liquid cooling penetration is projected to reach 40% of new data center deployments within the next five years as organizations seek more efficient thermal management solutions for high-density computing environments. Immersion cooling and direct-to-chip cooling technologies will gain broader acceptance as operational benefits become more widely recognized.

Sustainability requirements will increasingly influence cooling technology selection with organizations prioritizing solutions that demonstrate measurable environmental benefits and support carbon neutrality objectives. Renewable energy integration, waste heat recovery, and circular economy principles will become standard considerations in cooling system design and operation.

Service model transformation toward outcome-based agreements and performance guarantees will reshape the competitive landscape, with providers offering comprehensive solutions that align with customer success metrics. Cooling-as-a-service models will gain traction as organizations seek operational flexibility and reduced capital requirements.

The UK data center cooling market stands at a critical juncture characterized by technological innovation, sustainability imperatives, and evolving infrastructure requirements. Market growth is driven by digital transformation acceleration, edge computing proliferation, and increasing focus on energy efficiency across data center operations.

Technology advancement in liquid cooling systems, AI-powered optimization, and integrated thermal management solutions creates significant opportunities for market participants while addressing the evolving needs of data center operators. The transition toward more sophisticated cooling approaches reflects the industry’s commitment to operational efficiency and environmental responsibility.

Future success in the UK data center cooling market will depend on organizations’ ability to adapt to changing technology requirements, regulatory expectations, and customer demands for sustainable, efficient solutions. Companies that invest in innovation, develop strategic partnerships, and focus on customer outcomes will be best positioned to capitalize on emerging growth opportunities and maintain competitive advantage in this dynamic market landscape.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperature and humidity levels in data centers, ensuring the efficient operation of servers and IT equipment. Effective cooling is crucial for preventing overheating and ensuring reliability in data processing environments.

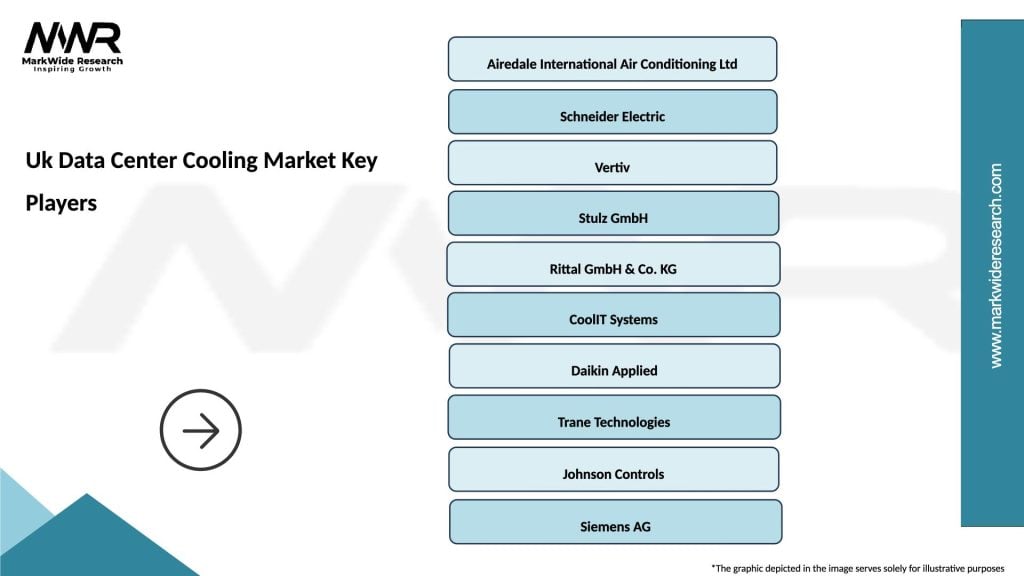

What are the key players in the Uk Data Center Cooling Market?

Key players in the Uk Data Center Cooling Market include companies like Vertiv, Schneider Electric, and Airedale International. These companies provide a range of cooling solutions, including air conditioning systems, liquid cooling technologies, and thermal management services, among others.

What are the main drivers of the Uk Data Center Cooling Market?

The main drivers of the Uk Data Center Cooling Market include the increasing demand for data storage and processing, the rise of cloud computing, and the need for energy-efficient cooling solutions. Additionally, the growth of big data analytics and IoT applications is contributing to the expansion of data centers.

What challenges does the Uk Data Center Cooling Market face?

The Uk Data Center Cooling Market faces challenges such as high energy consumption and operational costs associated with cooling systems. Additionally, the rapid evolution of technology requires continuous upgrades and innovations in cooling solutions to keep pace with increasing data center densities.

What opportunities exist in the Uk Data Center Cooling Market?

Opportunities in the Uk Data Center Cooling Market include the development of advanced cooling technologies, such as liquid cooling and free cooling systems. Furthermore, the growing emphasis on sustainability and energy efficiency presents avenues for companies to innovate and offer eco-friendly cooling solutions.

What trends are shaping the Uk Data Center Cooling Market?

Trends shaping the Uk Data Center Cooling Market include the adoption of modular cooling systems, the integration of AI for predictive maintenance, and the shift towards more sustainable cooling practices. Additionally, the increasing use of renewable energy sources in data centers is influencing cooling strategies.

Uk Data Center Cooling Market

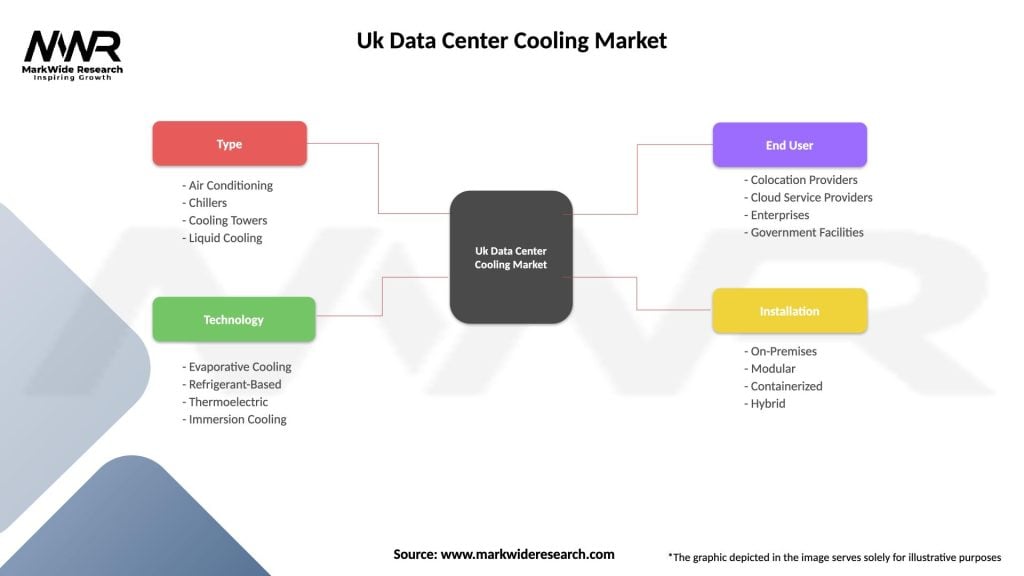

| Segmentation Details | Description |

|---|---|

| Type | Air Conditioning, Chillers, Cooling Towers, Liquid Cooling |

| Technology | Evaporative Cooling, Refrigerant-Based, Thermoelectric, Immersion Cooling |

| End User | Colocation Providers, Cloud Service Providers, Enterprises, Government Facilities |

| Installation | On-Premises, Modular, Containerized, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Uk Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at