444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK crop protection chemicals market represents a critical component of the nation’s agricultural infrastructure, encompassing a comprehensive range of pesticides, herbicides, fungicides, and insecticides designed to safeguard crop yields and ensure food security. Agricultural sustainability has become increasingly paramount as the United Kingdom faces mounting pressure to balance productive farming practices with environmental stewardship and regulatory compliance.

Market dynamics within the UK crop protection sector reflect a complex interplay of factors including climate change adaptation, integrated pest management strategies, and evolving consumer preferences for sustainable agricultural practices. The industry has witnessed significant transformation driven by technological innovation, regulatory frameworks, and the urgent need to address declining pollinator populations while maintaining agricultural productivity.

Growth trajectories indicate the market is experiencing steady expansion at approximately 4.2% CAGR, primarily fueled by increasing adoption of precision agriculture technologies and biological crop protection solutions. Sustainable farming practices have gained considerable momentum, with organic and bio-based crop protection products capturing approximately 18% market share across various agricultural segments.

Regional distribution across England, Scotland, Wales, and Northern Ireland demonstrates varying adoption patterns influenced by crop diversity, farming traditions, and local environmental conditions. Cereal crops dominate the application landscape, accounting for nearly 45% of total chemical usage, followed by oilseed rape, potatoes, and horticultural crops.

The UK crop protection chemicals market refers to the comprehensive ecosystem of chemical and biological products designed to protect agricultural crops from pests, diseases, weeds, and other harmful organisms that threaten yield quality and quantity. This market encompasses traditional synthetic pesticides, herbicides, fungicides, insecticides, as well as emerging biological alternatives and integrated pest management solutions.

Crop protection chemicals serve as essential tools enabling farmers to maintain consistent agricultural productivity while addressing challenges posed by evolving pest resistance, climate variability, and increasing food demand. Modern formulations incorporate advanced delivery systems, targeted application technologies, and reduced environmental impact profiles to align with sustainable agriculture objectives.

Market participants include multinational chemical manufacturers, specialty biological product developers, distribution networks, and agricultural service providers who collectively support the UK’s diverse farming community. Regulatory oversight by agencies such as the Health and Safety Executive ensures product safety, efficacy, and environmental compliance throughout the product lifecycle.

Strategic positioning of the UK crop protection chemicals market reflects a mature industry undergoing significant transformation toward sustainable and precision-based solutions. Market evolution is characterized by declining reliance on broad-spectrum synthetic chemicals and increasing adoption of targeted, environmentally conscious alternatives that support integrated pest management strategies.

Key growth drivers include technological advancement in precision agriculture, regulatory pressure for sustainable practices, and farmer recognition of long-term economic benefits associated with integrated crop protection approaches. Biological solutions represent the fastest-growing segment, with adoption rates increasing by approximately 12% annually across various crop categories.

Competitive landscape features established multinational corporations alongside innovative biotechnology companies developing next-generation crop protection solutions. Market consolidation continues as companies seek to expand product portfolios and geographic reach while investing heavily in research and development capabilities.

Future prospects indicate continued market expansion driven by climate adaptation needs, precision agriculture adoption, and evolving consumer preferences for sustainably produced food products. Investment priorities focus on biological alternatives, digital agriculture integration, and sustainable formulation technologies.

Market intelligence reveals several critical insights shaping the UK crop protection chemicals landscape:

According to MarkWide Research, these insights collectively indicate a market transitioning toward more sophisticated, environmentally conscious approaches to crop protection while maintaining agricultural productivity and economic viability for farming operations.

Primary growth catalysts propelling the UK crop protection chemicals market encompass diverse factors reflecting agricultural modernization and sustainability imperatives:

Climate change adaptation represents a fundamental driver as shifting weather patterns introduce new pest pressures, disease cycles, and weed species requiring innovative protection strategies. Temperature fluctuations and altered precipitation patterns create favorable conditions for previously uncommon agricultural threats, necessitating expanded crop protection arsenals.

Food security concerns continue driving demand for effective crop protection solutions as the UK seeks to enhance domestic food production capabilities. Population growth and changing dietary preferences require sustained agricultural productivity improvements while working within environmental constraints and limited arable land availability.

Technological advancement in precision agriculture enables more efficient and targeted chemical applications, reducing overall usage while maintaining or improving efficacy. Digital farming tools including drone technology, satellite monitoring, and predictive analytics optimize application timing and placement for maximum impact.

Economic pressures on farming operations drive adoption of crop protection solutions that demonstrate clear return on investment through yield protection and quality maintenance. Market volatility in agricultural commodities emphasizes the importance of consistent crop production and risk mitigation strategies.

Regulatory constraints pose significant challenges to market growth as increasingly stringent approval processes limit product availability and extend development timelines. Environmental regulations require extensive safety testing and environmental impact assessments, creating barriers for new product introductions and increasing development costs.

Public perception concerns regarding chemical residues in food products and environmental impact create market headwinds affecting consumer acceptance and policy decisions. Media coverage of potential health and environmental risks influences public opinion and regulatory approaches, constraining market expansion opportunities.

Resistance development in target pest populations reduces the effectiveness of existing products, requiring continuous innovation and rotation strategies that increase complexity and costs for farmers. Genetic adaptation of pests, weeds, and diseases necessitates ongoing research and development investments to maintain product efficacy.

Cost pressures on agricultural operations limit farmers’ ability to invest in premium crop protection solutions, particularly during periods of low commodity prices or economic uncertainty. Input cost inflation affects adoption rates of newer, more expensive products despite their potential benefits.

Biological alternatives present substantial growth opportunities as farmers seek sustainable solutions that align with environmental stewardship goals while maintaining crop protection efficacy. Biopesticide development offers pathways to address regulatory concerns while meeting market demand for environmentally conscious agricultural practices.

Precision agriculture integration creates opportunities for companies developing smart application systems, monitoring technologies, and data-driven decision support tools. Digital platforms that optimize chemical usage through real-time monitoring and predictive analytics represent high-growth market segments.

Specialty crop markets including organic farming, greenhouse production, and high-value horticultural crops offer premium pricing opportunities for specialized crop protection solutions. Niche applications in urban agriculture, vertical farming, and controlled environment agriculture present emerging market segments.

Export potential for UK-developed crop protection technologies and products creates international growth opportunities, particularly in markets with similar climate conditions and agricultural practices. Knowledge transfer and technology licensing represent additional revenue streams for innovative companies.

Competitive forces within the UK crop protection chemicals market reflect intense rivalry among established multinational corporations and emerging biotechnology companies. Innovation cycles drive continuous product development as companies seek to differentiate offerings through improved efficacy, reduced environmental impact, and enhanced application convenience.

Supply chain dynamics have evolved significantly following global disruptions, with increased emphasis on domestic production capabilities and supply security. Raw material availability and pricing volatility influence product development strategies and market positioning decisions across the industry.

Customer relationships between manufacturers, distributors, and farmers continue evolving toward more collaborative partnerships focused on integrated solutions rather than individual product sales. Service integration including application support, monitoring services, and agronomic advice becomes increasingly important for market differentiation.

Regulatory dynamics create both challenges and opportunities as companies adapt to changing approval requirements while developing products that meet evolving safety and environmental standards. Policy alignment with sustainable agriculture objectives influences product development priorities and market positioning strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UK crop protection chemicals market. Primary research includes extensive interviews with industry stakeholders, farmers, distributors, regulatory officials, and technology providers to gather firsthand perspectives on market trends and challenges.

Secondary research incorporates analysis of government statistics, industry reports, academic publications, and regulatory filings to establish market baselines and identify emerging trends. Data triangulation ensures consistency and reliability across multiple information sources while identifying potential discrepancies or biases.

Quantitative analysis utilizes statistical modeling techniques to project market growth, segment performance, and competitive positioning. Market sizing methodologies incorporate bottom-up and top-down approaches to validate findings and ensure accuracy in growth projections and market share assessments.

Qualitative insights from expert interviews and focus groups provide context for quantitative findings while identifying nuanced market dynamics that may not be apparent in numerical data alone. Scenario analysis explores potential future developments under various regulatory, economic, and technological conditions.

England dominates the UK crop protection chemicals market, accounting for approximately 72% of total consumption due to its extensive arable farming operations and diverse crop portfolio. East Anglia and the East Midlands represent the highest-intensity usage regions, driven by large-scale cereal production and intensive agricultural practices.

Scotland’s market focuses primarily on cereal crops, potatoes, and oilseed rape, with growing emphasis on sustainable farming practices aligned with environmental stewardship programs. Highland regions demonstrate increasing adoption of precision application technologies to address challenging terrain and weather conditions.

Wales exhibits diverse agricultural patterns with significant livestock farming complemented by crop production in lowland areas. Sustainable agriculture initiatives in Wales drive adoption of biological crop protection products and integrated pest management approaches at rates approximately 15% above national averages.

Northern Ireland maintains distinct market characteristics influenced by its agricultural focus on dairy farming, potatoes, and grassland management. Cross-border trade considerations and unique regulatory requirements create specific market dynamics requiring specialized product positioning and distribution strategies.

Market leadership is distributed among several major players, each bringing distinct strengths and strategic approaches to the UK crop protection chemicals market:

Competitive strategies increasingly emphasize sustainability credentials, digital integration capabilities, and comprehensive service offerings beyond traditional product sales. Partnership development with technology companies, research institutions, and agricultural service providers becomes crucial for maintaining competitive advantage.

Product segmentation reveals distinct market dynamics across different crop protection categories:

By Product Type:

By Crop Type:

By Application Method:

Herbicide category maintains market dominance driven by intensive weed management requirements across cereal production systems. Glyphosate alternatives gain traction as resistance concerns and regulatory pressures drive adoption of diverse mode-of-action products. Pre-emergence herbicides show strong growth as farmers adopt proactive weed management strategies.

Fungicide applications demonstrate increasing sophistication with disease forecasting systems and targeted application timing optimizing efficacy while reducing overall usage. Resistance management drives adoption of multi-site mode-of-action products and rotation strategies. Biological fungicides capture growing market share in organic and sustainable farming systems.

Insecticide segment faces significant regulatory pressure leading to development of more selective, environmentally compatible formulations. Pollinator protection requirements drive innovation in application timing, formulation technology, and alternative active ingredients. Integrated pest management approaches combine chemical and biological controls for sustainable pest suppression.

Biological products represent the highest growth potential with MWR analysis indicating adoption rates increasing by approximately 16% annually across various crop categories. Microbial solutions, plant extracts, and beneficial organism releases provide sustainable alternatives to synthetic chemicals while addressing regulatory and consumer concerns.

Farmers benefit from comprehensive crop protection solutions that enhance yield stability, improve crop quality, and reduce production risks associated with pest pressure and disease outbreaks. Economic advantages include improved return on investment through consistent harvests and premium pricing for high-quality produce.

Manufacturers gain opportunities for product differentiation, market expansion, and sustainable business growth through innovation in environmentally compatible formulations. Research investments in biological alternatives and precision application technologies create competitive advantages and regulatory compliance pathways.

Distributors and retailers benefit from expanding product portfolios that address diverse farmer needs while supporting sustainable agriculture initiatives. Service integration opportunities including application support and agronomic advice create additional revenue streams and strengthen customer relationships.

Consumers receive assurance of food safety and quality through effective crop protection programs that minimize post-harvest losses and maintain nutritional value. Environmental benefits from sustainable crop protection practices support broader sustainability goals and ecosystem health.

Regulatory agencies achieve policy objectives related to sustainable agriculture, environmental protection, and food security through effective oversight of crop protection product development and usage. Innovation incentives encourage development of safer, more effective solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable intensification emerges as the dominant trend driving market evolution, with farmers seeking solutions that increase productivity while minimizing environmental impact. Biological integration accelerates as companies develop hybrid approaches combining synthetic and biological active ingredients for enhanced efficacy and sustainability profiles.

Digital agriculture adoption transforms application practices through precision timing, variable rate application, and real-time monitoring systems. Data analytics enable predictive pest management and optimized chemical usage patterns, reducing overall input costs while maintaining crop protection effectiveness.

Resistance management becomes increasingly critical as companies develop multi-mode action products and rotation strategies to preserve product longevity. Stewardship programs promote responsible usage practices and delay resistance development through farmer education and monitoring initiatives.

Regulatory harmonization efforts seek to streamline approval processes while maintaining safety standards, potentially accelerating product development timelines and market access. Risk assessment modernization incorporates new scientific methodologies and real-world usage data to improve regulatory decision-making.

Recent innovations in the UK crop protection chemicals market demonstrate significant advancement in sustainable technology development and application efficiency. Biological product launches have accelerated with several companies introducing microbial-based solutions for major crop diseases and pest management applications.

Precision application technologies continue evolving with introduction of AI-powered spray systems that adjust application rates based on real-time crop and pest monitoring data. Drone technology integration enables targeted applications in difficult-to-reach areas while reducing operator exposure and environmental impact.

Regulatory developments include updated approval pathways for biological products and revised risk assessment methodologies that consider environmental fate and non-target organism effects. Pollinator protection measures have strengthened with new application restrictions and product labeling requirements.

Industry consolidation continues with strategic acquisitions focused on biological product portfolios and digital agriculture capabilities. Research partnerships between chemical companies and biotechnology firms accelerate development of next-generation crop protection solutions combining multiple modes of action.

Strategic recommendations for market participants emphasize the importance of sustainable innovation and digital integration to maintain competitive positioning in the evolving UK crop protection landscape. Investment priorities should focus on biological product development, precision application technologies, and comprehensive farmer support services.

Market entry strategies for new participants should emphasize niche applications, specialty crops, or innovative delivery systems that differentiate from established competitors. Partnership development with technology companies, research institutions, and distribution networks provides pathways to market access and capability enhancement.

Regulatory compliance requires proactive engagement with approval processes and investment in comprehensive safety and efficacy data generation. Stewardship programs demonstrating responsible product usage and environmental protection support long-term market access and social license to operate.

Customer relationship management should evolve toward integrated solution provision including application support, monitoring services, and agronomic advice. Digital platform development creates opportunities for enhanced farmer engagement and data-driven service delivery that strengthens competitive positioning.

Long-term prospects for the UK crop protection chemicals market indicate continued growth driven by climate adaptation needs, sustainable agriculture adoption, and technological advancement. Market evolution will likely favor companies successfully integrating biological solutions, digital technologies, and comprehensive service offerings.

Growth projections suggest the market will expand at approximately 5.1% CAGR over the next decade, with biological products and precision application technologies driving the highest growth rates. Sustainable solutions are expected to capture increasing market share as regulatory requirements and consumer preferences align with environmental stewardship objectives.

Innovation trajectories point toward more sophisticated integrated pest management systems combining multiple control methods optimized through artificial intelligence and predictive analytics. Personalized agriculture approaches will enable customized crop protection programs tailored to specific field conditions and farmer objectives.

MarkWide Research projections indicate that companies successfully navigating regulatory challenges while delivering demonstrable sustainability benefits will capture disproportionate market growth opportunities. Market leadership will increasingly depend on comprehensive solution provision rather than individual product excellence, requiring significant investment in service capabilities and digital infrastructure.

The UK crop protection chemicals market stands at a critical juncture where traditional agricultural practices intersect with sustainability imperatives and technological innovation. Market transformation toward biological alternatives, precision application systems, and integrated pest management approaches reflects broader agricultural evolution driven by environmental consciousness and regulatory requirements.

Sustainable growth opportunities exist for companies embracing innovation in biological products, digital agriculture integration, and comprehensive farmer support services. Competitive success will increasingly depend on ability to demonstrate environmental compatibility while maintaining agricultural productivity and economic viability for farming operations.

Future market dynamics will be shaped by climate adaptation needs, evolving pest pressures, and continued regulatory evolution toward more stringent environmental protection requirements. Industry participants must balance innovation investment with regulatory compliance while building sustainable business models that support long-term agricultural productivity and environmental stewardship objectives in the United Kingdom.

What is Crop Protection Chemicals?

Crop protection chemicals are substances used to protect crops from pests, diseases, and weeds. They include herbicides, insecticides, fungicides, and other chemical agents that enhance agricultural productivity.

What are the key players in the UK Crop Protection Chemicals Market?

Key players in the UK Crop Protection Chemicals Market include Syngenta, BASF, Bayer, and Corteva Agriscience, among others. These companies are involved in the development and distribution of various crop protection products.

What are the main drivers of the UK Crop Protection Chemicals Market?

The main drivers of the UK Crop Protection Chemicals Market include the increasing demand for food production, the need for effective pest management, and advancements in agricultural technology. These factors contribute to the growth of the market as farmers seek to maximize yields.

What challenges does the UK Crop Protection Chemicals Market face?

The UK Crop Protection Chemicals Market faces challenges such as regulatory pressures, public concerns over chemical use, and the development of pest resistance. These issues can hinder the adoption and effectiveness of crop protection products.

What opportunities exist in the UK Crop Protection Chemicals Market?

Opportunities in the UK Crop Protection Chemicals Market include the development of biopesticides, integrated pest management solutions, and sustainable farming practices. These innovations can help meet the growing demand for environmentally friendly agricultural solutions.

What trends are shaping the UK Crop Protection Chemicals Market?

Trends shaping the UK Crop Protection Chemicals Market include the increasing focus on sustainable agriculture, the rise of precision farming technologies, and the integration of digital tools for crop management. These trends are influencing how crop protection chemicals are developed and applied.

UK Crop Protection Chemicals Market

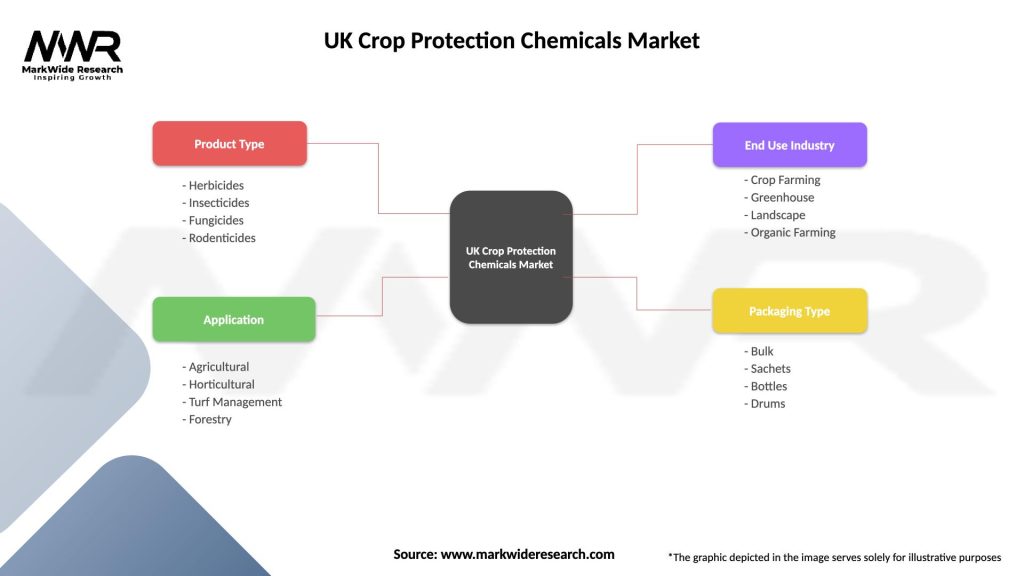

| Segmentation Details | Description |

|---|---|

| Product Type | Herbicides, Insecticides, Fungicides, Rodenticides |

| Application | Agricultural, Horticultural, Turf Management, Forestry |

| End Use Industry | Crop Farming, Greenhouse, Landscape, Organic Farming |

| Packaging Type | Bulk, Sachets, Bottles, Drums |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Crop Protection Chemicals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at