444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK countertop ice makers market represents a rapidly expanding segment within the broader home appliance industry, driven by increasing consumer demand for convenient ice production solutions. Market dynamics indicate substantial growth potential as British households and small businesses seek efficient alternatives to traditional ice cube trays and expensive commercial ice delivery services. The market encompasses various product categories, including portable ice makers, compact countertop units, and premium models with advanced features such as self-cleaning functions and multiple ice cube sizes.

Consumer preferences have shifted significantly toward convenience-oriented appliances, with countertop ice makers experiencing growing adoption rates of approximately 23% annually across residential segments. The market benefits from technological advancements in refrigeration systems, energy-efficient compressors, and user-friendly control interfaces that appeal to modern British consumers. Regional distribution shows concentrated demand in urban areas, particularly London and surrounding metropolitan regions, where space-conscious consumers value compact appliance solutions.

Product innovation continues to drive market expansion, with manufacturers introducing models featuring rapid ice production capabilities, producing ice in as little as 6-8 minutes. The integration of smart technology and IoT connectivity represents an emerging trend, enabling remote monitoring and control through smartphone applications. Market penetration remains relatively low compared to other kitchen appliances, suggesting significant growth opportunities as consumer awareness increases and product accessibility improves through expanded retail channels.

The UK countertop ice makers market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail sale of portable ice-making appliances designed for residential and small commercial use within the United Kingdom. These compact devices utilize advanced refrigeration technology to produce ice cubes quickly and efficiently without requiring permanent installation or professional setup.

Market scope includes various product categories ranging from basic portable units producing standard ice cubes to sophisticated models offering multiple ice sizes, self-cleaning capabilities, and premium materials. The market serves diverse consumer segments, including homeowners seeking convenient ice production, small businesses requiring reliable ice supplies, and recreational vehicle owners needing portable cooling solutions. Distribution channels encompass traditional retail outlets, online marketplaces, specialty appliance stores, and direct-to-consumer sales platforms.

Technological foundation relies on miniaturized refrigeration systems incorporating efficient compressors, evaporators, and automated harvesting mechanisms that enable rapid ice production cycles. Modern units typically feature user-friendly interfaces, LED indicators, and automatic shut-off functions when ice bins reach capacity. The market definition extends beyond hardware to include related services such as warranty support, maintenance programs, and replacement parts distribution throughout the UK market.

Market performance demonstrates robust growth trajectory driven by evolving consumer lifestyles and increasing demand for convenient home appliances. The UK countertop ice makers market benefits from favorable demographic trends, including rising disposable incomes, smaller household sizes, and growing preference for entertaining at home. Key growth drivers include technological improvements reducing production costs, expanded retail availability, and increased consumer awareness through digital marketing channels.

Competitive landscape features a mix of established appliance manufacturers and specialized ice maker brands competing on product features, pricing strategies, and brand recognition. Market leaders focus on innovation in ice production speed, energy efficiency, and design aesthetics to differentiate their offerings. Consumer adoption rates show particularly strong growth in the 35-55 age demographic, representing approximately 42% of total purchases, driven by higher disposable incomes and active social lifestyles.

Regional analysis reveals concentrated demand in England’s major metropolitan areas, with London accounting for approximately 28% of market share. Scotland and Wales demonstrate emerging growth potential as product awareness increases and retail distribution expands. Market challenges include seasonal demand fluctuations, competition from traditional ice sources, and consumer education regarding product benefits and applications.

Consumer behavior analysis reveals several critical insights shaping market development. British consumers increasingly prioritize convenience and time-saving appliances, with countertop ice makers addressing specific pain points related to ice availability and storage limitations. Purchase motivations include hosting capabilities, beverage enhancement, and emergency preparedness during extreme weather events.

Technology trends indicate growing integration of smart features, including Wi-Fi connectivity, mobile app control, and predictive maintenance alerts. Consumer reviews emphasize reliability, ease of cleaning, and noise levels as primary satisfaction factors influencing repeat purchases and recommendations.

Primary growth drivers propelling the UK countertop ice makers market include fundamental shifts in consumer lifestyle patterns and technological advancements making these appliances more accessible and efficient. Urbanization trends contribute significantly to market expansion as city dwellers seek space-efficient solutions for ice production without relying on traditional freezer space or commercial ice purchases.

Entertainment culture evolution represents a major market catalyst, with British consumers increasingly hosting social gatherings at home rather than frequenting pubs and restaurants. This behavioral shift, accelerated by recent global events, has created sustained demand for home bar accessories and beverage-related appliances. Convenience factor drives adoption among busy professionals who value time-saving appliances that eliminate the need for ice cube tray preparation and storage management.

Technological improvements in refrigeration efficiency and manufacturing processes have reduced production costs while enhancing product reliability and performance. Modern units consume significantly less energy while producing ice faster and more quietly than previous generations. Climate considerations also influence demand, with increasingly warm summers driving consumer interest in reliable cooling solutions for beverages and food preservation applications.

Economic factors supporting market growth include rising disposable incomes, particularly among middle-class households, and the perception of countertop ice makers as affordable luxury items rather than essential appliances. Retail accessibility has improved dramatically through expanded online availability and competitive pricing strategies from major retailers.

Significant challenges constraining market growth include consumer skepticism regarding product necessity and concerns about appliance proliferation in already crowded UK kitchens. Space limitations in typical British homes create natural barriers to adoption, particularly in older properties with smaller kitchen configurations where countertop real estate remains at a premium.

Seasonal demand fluctuations present ongoing challenges for manufacturers and retailers, with sales concentrated heavily in warmer months while experiencing dramatic declines during winter periods. This cyclical pattern complicates inventory management and marketing budget allocation across annual cycles. Competition from alternatives includes traditional ice cube trays, refrigerator ice dispensers, and commercial ice delivery services that may offer more cost-effective solutions for occasional users.

Consumer education barriers persist regarding product benefits, proper maintenance requirements, and optimal usage scenarios. Many potential customers remain unaware of technological improvements and convenience benefits offered by modern countertop ice makers. Price sensitivity among certain demographic segments limits market penetration, particularly among younger consumers with limited disposable income and older demographics resistant to new appliance categories.

Maintenance concerns and perceived complexity of cleaning procedures deter some consumers who prefer simpler ice production methods. Noise considerations in compact living spaces may limit adoption among apartment dwellers and those sensitive to appliance operational sounds during ice production cycles.

Emerging opportunities within the UK countertop ice makers market present substantial potential for growth through targeted product development and strategic market positioning. Smart home integration represents a significant opportunity as consumers increasingly adopt connected appliances and IoT ecosystems throughout their homes.

Commercial segment expansion offers promising growth avenues through targeting small businesses, cafes, offices, and hospitality establishments requiring reliable ice production without large commercial equipment investments. Rental market potential exists for temporary events, seasonal businesses, and consumers seeking trial experiences before permanent purchases.

Product differentiation opportunities include developing specialized models for specific applications such as craft cocktail enthusiasts, health-conscious consumers preferring filtered ice, and outdoor recreation markets. Sustainability positioning could attract environmentally conscious consumers through energy-efficient models and recyclable materials integration.

Geographic expansion within the UK presents opportunities in underserved regions, particularly rural areas and smaller cities where retail presence remains limited. Partnership opportunities with kitchen appliance retailers, home improvement stores, and online marketplaces could accelerate market penetration through improved distribution channels.

Demographic targeting reveals opportunities among younger consumers through social media marketing and lifestyle positioning, while premium segments could support luxury models with advanced features and superior design aesthetics.

Complex market dynamics shape the UK countertop ice makers landscape through interconnected factors influencing supply, demand, and competitive positioning. Consumer behavior patterns demonstrate increasing sophistication in appliance selection criteria, with buyers evaluating multiple factors including production speed, energy efficiency, design aesthetics, and brand reputation before making purchase decisions.

Technological evolution continues driving market transformation through innovations in refrigeration systems, user interfaces, and smart connectivity features. Manufacturers invest heavily in research and development to differentiate products and capture market share through superior performance characteristics. Supply chain dynamics influence product availability and pricing strategies, with global component sourcing affecting local market conditions.

Competitive pressures intensify as established appliance manufacturers enter the market alongside specialized ice maker brands, creating diverse product portfolios and pricing strategies. Market consolidation trends may emerge as successful brands acquire smaller competitors or form strategic partnerships to expand market reach.

Regulatory environment impacts product development through energy efficiency standards, safety requirements, and environmental regulations affecting manufacturing processes and materials selection. Economic fluctuations influence consumer spending patterns on discretionary appliances, with market performance correlating to broader economic confidence levels and disposable income trends.

Comprehensive research approach employed for analyzing the UK countertop ice makers market incorporates multiple data collection methodologies and analytical frameworks to ensure accurate market assessment and reliable insights. Primary research activities include consumer surveys, retailer interviews, manufacturer discussions, and industry expert consultations providing firsthand market intelligence.

Secondary research components encompass analysis of industry reports, government statistics, trade publications, and company financial statements to establish market context and validate primary findings. Data triangulation methods ensure research accuracy through cross-referencing multiple information sources and identifying consistent trends and patterns.

Market sizing methodology utilizes bottom-up and top-down approaches combining retail sales data, import/export statistics, and manufacturer shipment information to establish comprehensive market parameters. Consumer behavior analysis incorporates demographic segmentation, purchasing pattern evaluation, and satisfaction surveys to understand market drivers and constraints.

Competitive intelligence gathering includes product feature analysis, pricing comparisons, marketing strategy evaluation, and distribution channel assessment across major market participants. Trend analysis examines historical data patterns and emerging developments to project future market directions and identify growth opportunities.

Quality assurance protocols ensure research reliability through peer review processes, data validation procedures, and methodology transparency throughout the analysis framework.

Geographic distribution across the UK reveals distinct regional patterns in countertop ice maker adoption and market development. England dominates market activity with approximately 78% of total demand, driven by higher population density, increased disposable incomes, and greater retail infrastructure supporting appliance sales.

London metropolitan area represents the largest single market concentration, accounting for roughly 28% of national sales volume. The capital’s diverse population, active entertainment culture, and higher average incomes create ideal conditions for premium appliance adoption. Southeast England demonstrates strong secondary market performance through affluent suburban communities and growing awareness of convenience appliances.

Northern England regions including Manchester, Liverpool, and Leeds show emerging growth potential as retail distribution expands and consumer awareness increases. Scotland represents approximately 12% of market share with concentrated demand in Edinburgh and Glasgow metropolitan areas, while rural regions remain underserved by traditional retail channels.

Wales and Northern Ireland collectively account for 10% of market activity, presenting growth opportunities through targeted marketing campaigns and improved retail presence. Regional preferences vary regarding product features, with urban consumers favoring compact designs while rural buyers prioritize durability and larger capacity models.

Distribution challenges in remote areas create opportunities for online retailers and direct-to-consumer sales strategies, while regional price sensitivity influences product positioning and promotional strategies across different geographic markets.

Market competition features diverse participants ranging from established appliance manufacturers to specialized ice maker brands, each employing distinct strategies to capture market share and build consumer loyalty. Competitive dynamics emphasize product innovation, pricing strategies, and brand positioning as primary differentiation factors.

Competitive strategies include product line extensions, strategic partnerships with retailers, and targeted marketing campaigns emphasizing unique selling propositions. Innovation focus areas encompass energy efficiency improvements, smart connectivity features, and enhanced user experience design.

Market positioning varies from premium brands emphasizing quality and performance to value brands focusing on affordability and basic functionality, creating diverse options for different consumer segments and price points.

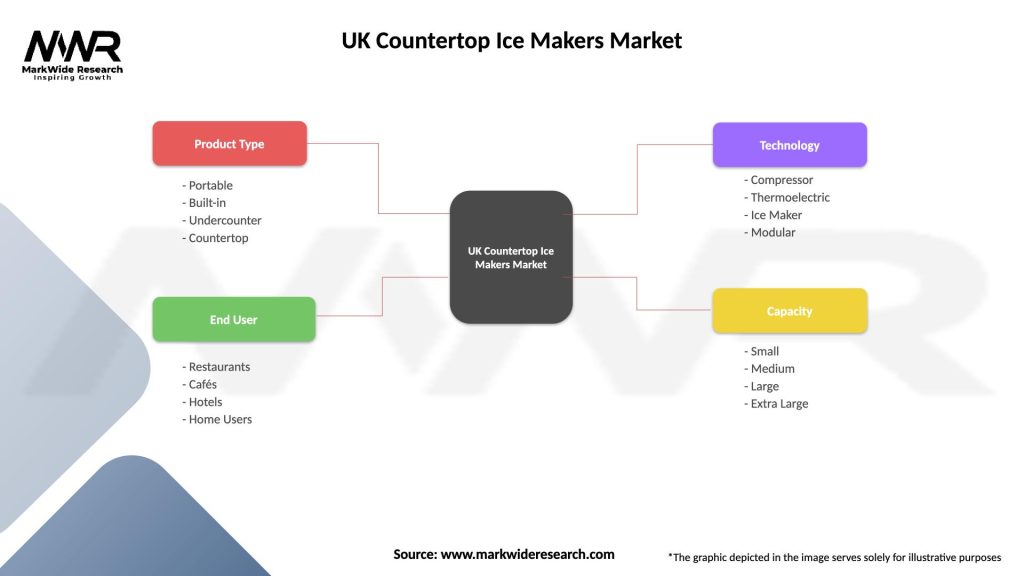

Market segmentation analysis reveals distinct categories based on product characteristics, consumer demographics, and application scenarios. Product-based segmentation encompasses portable countertop units, built-in models, and specialty designs targeting specific use cases and consumer preferences.

By Capacity:

By Price Range:

By Application:

Demographic segmentation identifies key consumer groups including young professionals, families with children, empty nesters, and small business owners, each with distinct needs and purchasing behaviors influencing product development and marketing strategies.

Portable countertop models dominate market share through versatility and ease of use, appealing to consumers seeking flexible ice production solutions without permanent installation requirements. Performance characteristics vary significantly across categories, with premium models producing ice in 6-8 minutes compared to 12-15 minutes for budget alternatives.

Compact designs specifically engineered for UK kitchen constraints demonstrate strong market acceptance, with successful models measuring under 35cm in width while maintaining adequate production capacity. Energy efficiency categories show growing importance as consumers become more environmentally conscious and utility costs increase.

Smart-enabled models represent emerging category growth with features including mobile app control, maintenance alerts, and integration with home automation systems. Adoption rates for smart features remain relatively low at approximately 15% of total sales but show rapid growth potential among tech-savvy consumers.

Commercial-grade residential units attract consumers seeking superior durability and performance, commanding premium pricing while delivering enhanced reliability and longer service life. Specialty categories include models producing different ice shapes, filtered ice options, and units designed for specific beverage applications such as craft cocktails or whiskey service.

Maintenance-free designs incorporating self-cleaning functions and antimicrobial materials address consumer concerns about hygiene and upkeep requirements, driving adoption among busy households and commercial applications.

Manufacturers benefit from expanding market opportunities through product innovation and differentiation strategies that command premium pricing while building brand loyalty. Revenue diversification opportunities exist through expanding into related product categories and developing comprehensive appliance ecosystems appealing to modern consumers.

Retailers gain from high-margin appliance sales and opportunities to cross-sell complementary products including water filters, cleaning supplies, and beverage accessories. Online retailers particularly benefit from direct-to-consumer sales models eliminating traditional distribution markups while providing detailed product information and customer reviews.

Consumers receive significant convenience benefits through reliable ice production, time savings compared to traditional methods, and enhanced entertainment capabilities. Cost savings accumulate over time through reduced commercial ice purchases and elimination of freezer space requirements for ice storage.

Commercial users benefit from reliable ice supplies without expensive commercial equipment investments, improved customer service capabilities, and reduced operational complexity compared to traditional ice sourcing methods. Small businesses particularly value the flexibility and scalability offered by countertop solutions.

Supply chain participants including component suppliers, logistics providers, and service technicians benefit from market growth creating expanded business opportunities and revenue streams throughout the value chain ecosystem.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological integration trends dominate market evolution with manufacturers incorporating smart features, improved energy efficiency, and enhanced user interfaces. IoT connectivity enables remote monitoring and control through smartphone applications, appealing to tech-savvy consumers seeking integrated home automation solutions.

Design aesthetics increasingly influence purchase decisions as consumers seek appliances complementing modern kitchen décor and personal style preferences. Compact engineering continues advancing to address UK space constraints while maintaining production capacity and performance standards.

Sustainability focus drives development of energy-efficient models using environmentally friendly refrigerants and recyclable materials. Consumer consciousness regarding environmental impact influences brand selection and product positioning strategies across the market.

Customization trends include models producing different ice shapes and sizes, filtered ice options, and specialized features for specific beverage applications. User experience improvements encompass quieter operation, easier cleaning procedures, and intuitive control interfaces enhancing overall satisfaction.

Commercial crossover trends show residential consumers seeking commercial-grade reliability and performance in home appliances, driving demand for premium models with enhanced durability and production capabilities. Subscription services for maintenance supplies and replacement parts represent emerging business model innovations.

Recent industry developments demonstrate accelerating innovation and market maturation across multiple dimensions. Product launches from major manufacturers introduce advanced features including rapid ice production, smart connectivity, and improved energy efficiency addressing evolving consumer demands.

Strategic partnerships between appliance manufacturers and technology companies enable integration of advanced features and smart home compatibility. Retail expansion initiatives by major UK retailers increase product accessibility and consumer awareness through dedicated appliance sections and promotional campaigns.

Manufacturing innovations reduce production costs while improving product quality and reliability, enabling competitive pricing strategies and market expansion. Supply chain optimization efforts address component sourcing challenges and improve delivery times to retailers and consumers.

Regulatory compliance initiatives ensure products meet evolving energy efficiency standards and safety requirements while maintaining competitive positioning. Market research investments by leading companies provide deeper consumer insights driving product development and marketing strategies.

Distribution channel evolution includes expanded online presence, direct-to-consumer sales platforms, and partnerships with home improvement retailers broadening market reach and accessibility. Customer service enhancements through extended warranties, technical support, and maintenance programs improve overall ownership experience and brand loyalty.

Strategic recommendations for market participants emphasize the importance of consumer education initiatives to increase awareness of product benefits and applications. MarkWide Research analysis suggests that manufacturers should prioritize compact designs specifically engineered for UK kitchen constraints while maintaining adequate production capacity and performance standards.

Product development focus should emphasize energy efficiency improvements, quieter operation, and simplified maintenance procedures addressing primary consumer concerns. Smart feature integration represents significant opportunity for differentiation, but implementation should prioritize user-friendly interfaces over complex functionality that may deter mainstream adoption.

Distribution strategy optimization requires balanced approach combining online presence with traditional retail partnerships to maximize market reach and consumer accessibility. Pricing strategies should consider regional variations in disposable income and competitive landscape dynamics while maintaining sustainable profit margins.

Marketing initiatives should target specific demographic segments through tailored messaging emphasizing relevant benefits and applications. Seasonal marketing campaigns can help mitigate demand fluctuations while building year-round brand awareness and consideration.

Partnership opportunities with kitchen appliance retailers, home improvement stores, and complementary product manufacturers could accelerate market penetration and create synergistic sales opportunities. Customer service excellence through comprehensive support programs will become increasingly important for building brand loyalty and positive word-of-mouth recommendations.

Market projections indicate continued growth driven by technological advancement, increasing consumer awareness, and expanding distribution channels throughout the UK. Long-term trends suggest mainstream adoption will accelerate as product prices decline and performance improvements address current market constraints.

Technology evolution will likely focus on enhanced energy efficiency, reduced noise levels, and improved smart connectivity features appealing to modern consumers seeking integrated home automation solutions. Market maturation may lead to consolidation among smaller manufacturers while established brands strengthen market positions through innovation and strategic partnerships.

Consumer behavior evolution toward convenience-oriented appliances and home entertainment solutions supports sustained market growth potential. MWR projections suggest the market will experience steady expansion with growth rates of approximately 18-22% annually over the next five years, driven by increasing adoption across diverse consumer segments.

Geographic expansion opportunities exist in underserved regions as retail distribution improves and consumer awareness increases through targeted marketing initiatives. Commercial market development presents significant growth potential as small businesses recognize cost and convenience benefits compared to traditional ice sourcing methods.

Sustainability considerations will increasingly influence product development and consumer selection criteria, driving innovation in energy-efficient designs and environmentally friendly materials. Market diversification through specialized products targeting specific applications and consumer segments will create additional growth opportunities and competitive differentiation possibilities.

The UK countertop ice makers market represents a dynamic and rapidly evolving segment with substantial growth potential driven by changing consumer lifestyles, technological advancement, and increasing demand for convenience appliances. Market fundamentals remain strong despite seasonal fluctuations and space constraints that characterize the UK residential market.

Key success factors for market participants include product innovation focusing on compact designs, energy efficiency, and user-friendly features that address specific UK consumer needs and preferences. Strategic positioning through targeted marketing, optimized distribution channels, and competitive pricing will determine market share capture and long-term sustainability.

Future market development will likely emphasize smart technology integration, sustainability features, and expanded applications serving both residential and commercial segments. Consumer education initiatives remain critical for accelerating adoption and building market awareness across diverse demographic groups throughout the United Kingdom.

Overall market outlook remains positive with multiple growth drivers supporting continued expansion and market maturation. Industry participants who successfully navigate competitive dynamics while delivering superior value propositions will benefit from this expanding market opportunity and establish strong positions for long-term growth and profitability in the evolving UK appliance landscape.

What is Countertop Ice Makers?

Countertop ice makers are compact appliances designed to produce ice quickly and efficiently for home or small business use. They are popular for their convenience and ability to provide a steady supply of ice for beverages, food preservation, and entertaining.

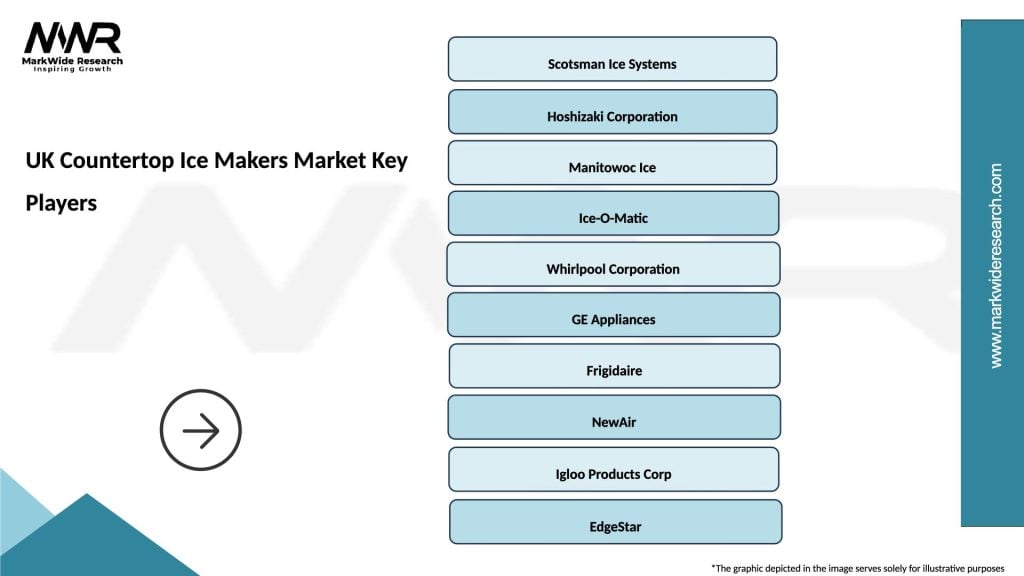

What are the key players in the UK Countertop Ice Makers Market?

Key players in the UK Countertop Ice Makers Market include companies like Igloo Products Corp, NewAir, and Dometic, which offer a range of models catering to different consumer needs. These companies focus on innovation and quality to maintain competitiveness in the market, among others.

What are the growth factors driving the UK Countertop Ice Makers Market?

The UK Countertop Ice Makers Market is driven by increasing consumer demand for convenience in food and beverage preparation, rising popularity of home entertaining, and the growth of outdoor activities. Additionally, advancements in technology have led to more efficient and user-friendly models.

What challenges does the UK Countertop Ice Makers Market face?

Challenges in the UK Countertop Ice Makers Market include competition from traditional ice-making methods, such as freezer trays, and potential regulatory hurdles regarding energy efficiency standards. Additionally, consumer preferences for multifunctional appliances can impact sales.

What opportunities exist in the UK Countertop Ice Makers Market?

Opportunities in the UK Countertop Ice Makers Market include the potential for product innovation, such as smart ice makers that connect to home automation systems. There is also a growing trend towards eco-friendly models that appeal to environmentally conscious consumers.

What trends are shaping the UK Countertop Ice Makers Market?

Trends in the UK Countertop Ice Makers Market include the rise of portable and compact designs that cater to small living spaces and outdoor use. Additionally, there is an increasing focus on energy-efficient models that reduce environmental impact while meeting consumer needs.

UK Countertop Ice Makers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable, Built-in, Undercounter, Countertop |

| End User | Restaurants, Cafés, Hotels, Home Users |

| Technology | Compressor, Thermoelectric, Ice Maker, Modular |

| Capacity | Small, Medium, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Countertop Ice Makers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at