444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK contract logistics market represents a dynamic and rapidly evolving sector that serves as the backbone of modern supply chain operations across the United Kingdom. This comprehensive market encompasses third-party logistics services, warehousing solutions, distribution networks, and integrated supply chain management services that enable businesses to optimize their operational efficiency while reducing costs. The market has experienced substantial growth driven by the increasing complexity of global trade, e-commerce expansion, and the growing demand for specialized logistics expertise.

Market dynamics indicate that the UK contract logistics sector is experiencing robust expansion, with industry analysts projecting a compound annual growth rate of 6.2% through the forecast period. This growth trajectory reflects the increasing adoption of outsourced logistics solutions by businesses seeking to focus on their core competencies while leveraging specialized logistics providers’ expertise and infrastructure capabilities.

Key market characteristics include the integration of advanced technologies such as artificial intelligence, robotics, and Internet of Things solutions that enhance operational efficiency and provide real-time visibility across supply chain networks. The market serves diverse industry verticals including retail, automotive, healthcare, food and beverage, and manufacturing sectors, each requiring specialized logistics solutions tailored to their unique operational requirements.

The UK contract logistics market refers to the comprehensive ecosystem of third-party logistics service providers that offer outsourced supply chain management solutions, including warehousing, distribution, transportation, inventory management, and value-added services to businesses across various industry sectors throughout the United Kingdom.

Contract logistics services encompass a broad spectrum of supply chain activities that businesses outsource to specialized providers rather than managing internally. These services include warehouse management, order fulfillment, inventory optimization, transportation coordination, reverse logistics, and customized value-added services such as kitting, packaging, and product customization. The contractual nature of these arrangements typically involves long-term partnerships between logistics providers and their clients, fostering collaborative relationships that drive operational excellence and cost optimization.

Strategic importance of contract logistics lies in its ability to provide businesses with scalable, flexible, and cost-effective supply chain solutions that adapt to changing market conditions and customer demands. This approach enables companies to access specialized expertise, advanced technologies, and established infrastructure networks without significant capital investments, thereby improving their competitive positioning in the marketplace.

Market performance in the UK contract logistics sector demonstrates strong momentum driven by digital transformation initiatives, sustainability requirements, and evolving consumer expectations. The market benefits from the UK’s strategic geographic position as a gateway to European markets, robust transportation infrastructure, and advanced technological capabilities that support sophisticated logistics operations.

Key growth drivers include the accelerating adoption of e-commerce platforms, which has increased demand for specialized fulfillment services by approximately 45% over recent years. Additionally, the increasing complexity of global supply chains and the need for greater operational agility have prompted more businesses to partner with contract logistics providers who can offer scalable solutions and specialized expertise.

Technology integration represents a critical success factor, with leading providers investing heavily in automation, artificial intelligence, and data analytics capabilities to enhance service quality and operational efficiency. These technological advancements enable real-time inventory tracking, predictive analytics, and optimized routing solutions that deliver measurable value to clients across various industry sectors.

Market consolidation trends indicate that larger logistics providers are expanding their service portfolios through strategic acquisitions and partnerships, creating comprehensive service offerings that address the full spectrum of supply chain requirements. This consolidation enables providers to achieve economies of scale while offering clients integrated solutions that span multiple logistics functions.

Industry transformation is reshaping the UK contract logistics landscape through several key developments that are driving market evolution and creating new opportunities for growth and innovation:

Market maturity is evidenced by the sophisticated service offerings and technological capabilities that leading providers have developed to address complex supply chain challenges. This maturity enables businesses to access world-class logistics capabilities without the need for significant internal investments in infrastructure and expertise.

E-commerce expansion continues to serve as a primary catalyst for market growth, with online retail sales driving increased demand for specialized fulfillment services, last-mile delivery solutions, and returns management capabilities. The shift toward omnichannel retail strategies requires sophisticated logistics networks that can seamlessly integrate online and offline customer touchpoints.

Supply chain complexity is increasing as businesses expand their global operations and seek to optimize inventory levels while maintaining service quality. This complexity creates opportunities for contract logistics providers who possess the expertise and infrastructure necessary to manage multi-tier supply networks effectively.

Cost optimization pressures are prompting businesses to evaluate their logistics operations and consider outsourcing arrangements that can deliver improved efficiency and reduced operational costs. Contract logistics providers can achieve economies of scale and leverage specialized expertise to deliver cost-effective solutions that would be difficult for individual businesses to replicate internally.

Technology advancement is enabling new service capabilities and operational efficiencies that create competitive advantages for businesses that partner with innovative logistics providers. These technological capabilities include real-time tracking, predictive analytics, and automated processing systems that enhance service quality while reducing costs.

Regulatory compliance requirements are becoming increasingly complex, particularly in sectors such as healthcare, food and beverage, and automotive industries. Contract logistics providers offer specialized expertise in regulatory compliance and quality management systems that help businesses navigate these complex requirements effectively.

Capital investment requirements for advanced logistics infrastructure and technology systems represent significant barriers for some market participants. The need for continuous investment in automation, warehouse management systems, and transportation assets can strain financial resources and limit market entry for smaller providers.

Labor market challenges including skills shortages and wage inflation are impacting operational costs and service delivery capabilities across the logistics sector. The increasing demand for specialized technical skills in areas such as data analytics, automation systems, and supply chain optimization creates recruitment and retention challenges for logistics providers.

Economic uncertainty and market volatility can impact demand for contract logistics services as businesses adjust their operational strategies in response to changing economic conditions. Economic downturns may lead to reduced logistics spending and increased price pressure on service providers.

Competitive intensity in the market creates pressure on pricing and service margins, particularly in commodity logistics services where differentiation is limited. This competitive pressure can impact profitability and limit investment capacity for service enhancement and expansion initiatives.

Regulatory complexity and changing compliance requirements can create operational challenges and increase costs for logistics providers who must maintain compliance across multiple jurisdictions and industry sectors. These regulatory requirements may also limit operational flexibility and increase administrative overhead.

Digital transformation initiatives present significant opportunities for logistics providers to differentiate their service offerings through advanced technology integration and data-driven insights. The adoption of artificial intelligence, machine learning, and Internet of Things technologies can create new revenue streams and enhance customer value propositions.

Sustainability services are emerging as a key differentiator as businesses seek to reduce their environmental impact and achieve carbon neutrality goals. Contract logistics providers can develop specialized green logistics capabilities that help clients meet their sustainability objectives while potentially reducing operational costs.

Healthcare logistics represents a high-growth opportunity driven by an aging population, increasing healthcare spending, and the need for specialized cold chain and pharmaceutical distribution capabilities. The complexity of healthcare supply chains creates opportunities for providers with specialized expertise and infrastructure.

Cross-border trade facilitation services present opportunities as businesses navigate post-Brexit trade arrangements and seek to optimize their international supply chain operations. Logistics providers with expertise in customs clearance, trade compliance, and international transportation can capture significant value in this market segment.

Value-added services such as product customization, kitting, packaging, and reverse logistics create opportunities for providers to increase revenue per client and strengthen customer relationships through comprehensive service offerings that address the full spectrum of supply chain requirements.

Competitive landscape evolution is characterized by increasing consolidation as larger providers acquire specialized capabilities and expand their geographic coverage. This consolidation trend is creating more comprehensive service offerings while potentially reducing the number of independent providers in certain market segments.

Customer expectations are continuously evolving, with businesses demanding greater transparency, flexibility, and responsiveness from their logistics partners. These expectations are driving providers to invest in customer-facing technologies and develop more agile service delivery models that can adapt to changing requirements.

Technology integration is accelerating across the market, with providers investing in automation, artificial intelligence, and data analytics capabilities to improve operational efficiency and service quality. According to MarkWide Research analysis, technology adoption rates have increased by 38% among leading contract logistics providers over the past two years.

Market segmentation is becoming more pronounced as providers develop specialized expertise in specific industry verticals or service categories. This specialization enables providers to command premium pricing while delivering superior value to clients with unique operational requirements.

Partnership strategies are evolving as logistics providers form strategic alliances with technology companies, transportation carriers, and other service providers to create comprehensive supply chain solutions that address the full spectrum of client requirements.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines primary and secondary research methodologies to ensure accuracy and completeness of market insights. The research framework incorporates quantitative data analysis, qualitative assessments, and industry expert consultations to provide a holistic view of market dynamics and trends.

Primary research activities included structured interviews with industry executives, logistics providers, and end-user organizations to gather firsthand insights into market trends, challenges, and opportunities. These interviews provided valuable perspectives on operational practices, technology adoption patterns, and strategic priorities that shape market development.

Secondary research encompassed analysis of industry reports, company financial statements, regulatory filings, and trade publications to gather comprehensive market data and validate primary research findings. This secondary research provided historical context and quantitative benchmarks for market analysis.

Data validation processes were implemented to ensure accuracy and reliability of research findings through cross-referencing multiple data sources and conducting consistency checks across different market segments and geographic regions. This validation approach enhances the credibility and usefulness of market insights for strategic decision-making.

Market modeling techniques were employed to analyze market dynamics, identify growth patterns, and develop projections for future market development. These modeling approaches incorporate various market variables and scenarios to provide robust analytical foundations for market assessment.

London and Southeast England dominate the UK contract logistics market, accounting for approximately 42% of total market activity due to the concentration of major retailers, manufacturers, and distribution centers in this region. The proximity to major ports, airports, and transportation networks makes this region particularly attractive for logistics operations serving both domestic and international markets.

Midlands region serves as a critical logistics hub due to its central location and excellent transportation connectivity, representing approximately 28% of market share. The region benefits from its strategic position for distribution operations serving the entire UK market, making it an attractive location for national distribution centers and fulfillment facilities.

Northern England including Manchester, Liverpool, and Leeds metropolitan areas accounts for approximately 18% of market activity, driven by strong industrial heritage and growing e-commerce operations. The region offers competitive operational costs and skilled workforce availability that attract logistics investments.

Scotland and Wales represent emerging opportunities with combined market share of approximately 12%, driven by government incentives, infrastructure investments, and growing industrial activity. These regions offer opportunities for logistics providers seeking to establish comprehensive UK coverage and serve local market requirements.

Regional specialization is evident in different areas, with certain regions developing expertise in specific industry sectors such as automotive logistics in the Midlands, food and beverage distribution in rural areas, and high-value goods handling in metropolitan regions with enhanced security infrastructure.

Market leadership is characterized by a mix of international logistics giants and specialized regional providers who compete across different service segments and geographic markets. The competitive environment encourages innovation and service differentiation as providers seek to establish sustainable competitive advantages.

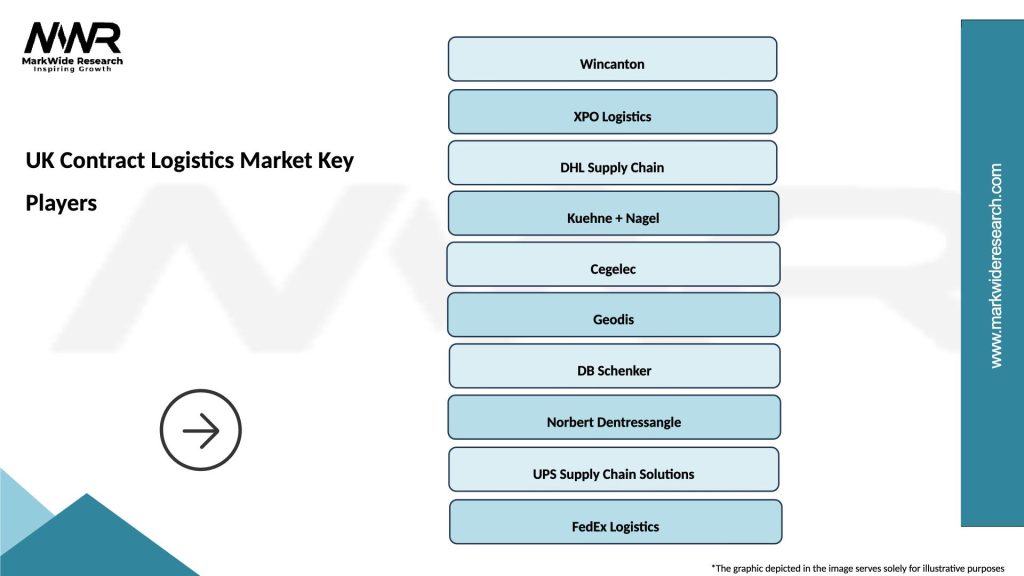

Leading market participants include:

Competitive strategies focus on technology differentiation, industry specialization, and comprehensive service portfolios that address the full spectrum of client requirements. Leading providers are investing heavily in automation, data analytics, and sustainability initiatives to maintain competitive positioning.

Market entry barriers include significant capital requirements for infrastructure development, technology systems, and regulatory compliance capabilities. These barriers tend to favor established providers with existing infrastructure and operational expertise.

By Service Type:

By Industry Vertical:

By Contract Duration:

Warehousing and Distribution represents the largest service category, driven by increasing demand for sophisticated inventory management and order fulfillment capabilities. This segment benefits from automation investments and advanced warehouse management systems that enhance operational efficiency and accuracy.

Transportation Management services are experiencing growth driven by the need for route optimization, carrier management, and real-time visibility across transportation networks. Advanced analytics and optimization algorithms are enabling significant cost reductions and service improvements in this category.

Value-Added Services represent high-margin opportunities for logistics providers to differentiate their offerings and increase revenue per client. These services include product customization, kitting, packaging, and other specialized activities that add value beyond basic logistics functions.

Industry-Specific Solutions are becoming increasingly important as businesses seek providers with deep expertise in their particular sector requirements. Healthcare logistics, automotive supply chains, and e-commerce fulfillment each require specialized capabilities and infrastructure investments.

Technology-Enabled Services are emerging as a key differentiator, with providers offering advanced analytics, artificial intelligence, and Internet of Things capabilities that provide clients with enhanced visibility and optimization opportunities across their supply chain operations.

Cost Optimization represents a primary benefit for businesses partnering with contract logistics providers, as outsourcing enables access to economies of scale, specialized expertise, and optimized infrastructure without significant capital investments. Businesses can achieve operational cost reductions of 15-25% through effective logistics outsourcing arrangements.

Operational Flexibility enables businesses to scale their logistics operations up or down based on market conditions and seasonal requirements without the constraints of fixed infrastructure investments. This flexibility is particularly valuable for businesses with variable demand patterns or growth trajectories.

Technology Access provides businesses with advanced logistics technologies and capabilities that would be cost-prohibitive to develop internally. Contract logistics providers invest in cutting-edge warehouse management systems, transportation optimization platforms, and data analytics tools that benefit all their clients.

Risk Mitigation through professional logistics management reduces operational risks related to inventory management, transportation, regulatory compliance, and supply chain disruptions. Experienced providers have established processes and contingency plans that minimize business risks.

Focus Enhancement allows businesses to concentrate on their core competencies while leveraging specialized logistics expertise for supply chain operations. This focus can improve overall business performance and competitive positioning in the marketplace.

Market Access through established logistics networks enables businesses to expand their geographic reach and serve new markets without significant infrastructure investments. Contract logistics providers offer established networks and local expertise that facilitate market expansion initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation Integration is accelerating across warehouse operations, with providers implementing robotic systems, automated storage and retrieval systems, and autonomous vehicles to improve efficiency and reduce labor dependency. These automation investments are delivering productivity improvements of 30-40% in leading facilities.

Sustainability Focus is becoming a critical differentiator as businesses seek logistics partners who can help them achieve environmental objectives. This trend includes adoption of electric vehicles, renewable energy systems, and carbon-neutral logistics operations that align with corporate sustainability goals.

Data Analytics and artificial intelligence applications are enabling predictive logistics capabilities, demand forecasting, and proactive supply chain optimization. These analytical capabilities provide clients with enhanced visibility and decision-making support that drives operational improvements.

Omnichannel Integration is driving demand for logistics solutions that seamlessly support both online and offline retail channels. This integration requires sophisticated inventory management and fulfillment capabilities that can optimize across multiple customer touchpoints.

Collaborative Logistics models are emerging as providers develop shared infrastructure and consolidated services that reduce costs and environmental impact while maintaining service quality. These collaborative approaches enable smaller businesses to access enterprise-level logistics capabilities.

Real-time Visibility requirements are driving investment in tracking technologies and communication systems that provide end-to-end supply chain transparency. Customers increasingly expect real-time updates and proactive communication regarding their shipments and inventory status.

Technology Partnerships between logistics providers and technology companies are accelerating innovation and service capability development. These partnerships enable rapid deployment of advanced solutions such as artificial intelligence, machine learning, and Internet of Things applications across logistics operations.

Facility Expansion initiatives are addressing capacity constraints and enabling service enhancement through strategic investments in modern logistics infrastructure. Leading providers are developing state-of-the-art facilities with advanced automation and sustainability features.

Acquisition Activity continues to reshape the competitive landscape as larger providers acquire specialized capabilities and expand their service portfolios. Recent acquisitions have focused on technology companies, specialized service providers, and regional logistics networks.

Sustainability Initiatives are gaining momentum with providers implementing comprehensive environmental programs including carbon-neutral operations, renewable energy adoption, and sustainable packaging solutions. These initiatives respond to increasing customer and regulatory demands for environmental responsibility.

Workforce Development programs are addressing skills shortages through training initiatives, apprenticeship programs, and partnerships with educational institutions. These programs focus on developing technical skills required for modern logistics operations and technology management.

Strategic positioning recommendations emphasize the importance of technology differentiation and industry specialization for logistics providers seeking to maintain competitive advantages. MWR analysis suggests that providers should focus on developing deep expertise in specific industry verticals while investing in advanced technology capabilities.

Investment priorities should focus on automation technologies, data analytics capabilities, and sustainability initiatives that align with evolving customer requirements and regulatory expectations. These investments can provide long-term competitive advantages and operational efficiencies.

Partnership strategies should emphasize collaboration with technology providers, transportation carriers, and complementary service providers to create comprehensive solution offerings. Strategic partnerships can accelerate capability development while reducing investment requirements.

Market expansion opportunities should be evaluated based on industry growth potential, competitive dynamics, and alignment with existing capabilities. Healthcare logistics, e-commerce fulfillment, and sustainability services represent particularly attractive growth segments.

Operational excellence initiatives should focus on continuous improvement, quality management, and customer satisfaction enhancement. These initiatives can strengthen client relationships and support premium pricing strategies in competitive market segments.

Market evolution is expected to continue driven by technological advancement, changing customer expectations, and evolving business models that reshape logistics service requirements. The market is projected to maintain strong growth momentum with annual growth rates of 6-8% over the next five years.

Technology transformation will accelerate with increased adoption of artificial intelligence, robotics, and autonomous systems that fundamentally change logistics operations. These technologies will enable new service capabilities while improving efficiency and reducing operational costs.

Sustainability requirements will become increasingly important as businesses and regulators demand environmentally responsible logistics solutions. Providers who develop comprehensive sustainability capabilities will gain competitive advantages in serving environmentally conscious clients.

Industry consolidation is expected to continue as larger providers acquire specialized capabilities and expand their geographic coverage. This consolidation will create more comprehensive service offerings while potentially reducing the number of independent providers in certain market segments.

Customer expectations will continue evolving toward greater transparency, flexibility, and responsiveness from logistics partners. Providers who can deliver superior customer experiences through technology and service innovation will capture disproportionate market share growth.

The UK contract logistics market represents a dynamic and rapidly evolving sector that plays a critical role in supporting modern business operations across diverse industry verticals. The market demonstrates strong growth potential driven by e-commerce expansion, supply chain complexity, and increasing demand for specialized logistics expertise that enables businesses to optimize their operational efficiency while focusing on core competencies.

Technology integration and sustainability initiatives are reshaping market dynamics, creating opportunities for providers who can deliver innovative solutions that address evolving customer requirements and regulatory expectations. The competitive landscape continues to evolve through consolidation, strategic partnerships, and service differentiation strategies that enhance value propositions for clients across various industry sectors.

Future success in the UK contract logistics market will depend on providers’ ability to adapt to changing market conditions, invest in advanced technologies, and develop specialized expertise that delivers measurable value to clients. The market outlook remains positive, with continued growth expected across key service segments and industry verticals that drive demand for sophisticated logistics solutions.

What is Contract Logistics?

Contract logistics refers to the outsourcing of logistics services to a third-party provider, which manages the entire supply chain process. This includes transportation, warehousing, inventory management, and order fulfillment, tailored to meet specific client needs.

What are the key players in the UK Contract Logistics Market?

Key players in the UK Contract Logistics Market include DHL Supply Chain, XPO Logistics, and Kuehne + Nagel, which provide comprehensive logistics solutions across various sectors such as retail, automotive, and healthcare, among others.

What are the main drivers of growth in the UK Contract Logistics Market?

The main drivers of growth in the UK Contract Logistics Market include the increasing demand for e-commerce fulfillment, the need for cost-effective supply chain solutions, and advancements in technology that enhance logistics efficiency.

What challenges does the UK Contract Logistics Market face?

Challenges in the UK Contract Logistics Market include rising transportation costs, labor shortages, and regulatory compliance issues that can impact service delivery and operational efficiency.

What opportunities exist in the UK Contract Logistics Market?

Opportunities in the UK Contract Logistics Market include the expansion of e-commerce, the integration of automation and AI in logistics operations, and the growing emphasis on sustainability practices within supply chains.

What trends are shaping the UK Contract Logistics Market?

Trends shaping the UK Contract Logistics Market include the adoption of digital technologies for real-time tracking, increased focus on sustainability initiatives, and the rise of omnichannel logistics strategies to meet diverse consumer demands.

UK Contract Logistics Market

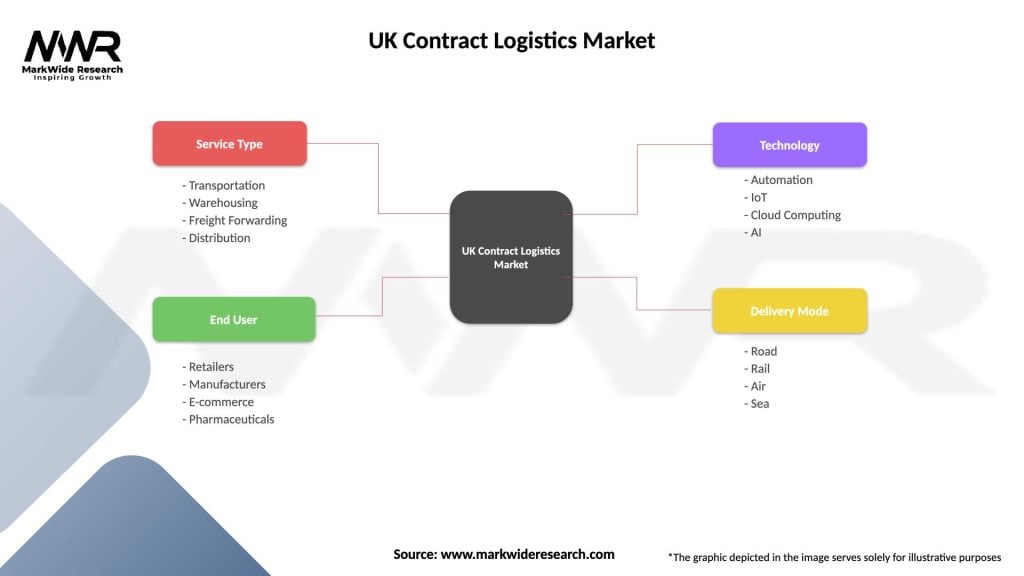

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Freight Forwarding, Distribution |

| End User | Retailers, Manufacturers, E-commerce, Pharmaceuticals |

| Technology | Automation, IoT, Cloud Computing, AI |

| Delivery Mode | Road, Rail, Air, Sea |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Contract Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at