444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK contraceptive device market represents a dynamic and evolving sector within the broader healthcare landscape, characterized by increasing consumer awareness, technological innovations, and changing demographic patterns. Market dynamics indicate robust growth driven by enhanced accessibility, improved product designs, and growing emphasis on reproductive health education across diverse population segments.

Contemporary trends demonstrate significant shifts toward long-acting reversible contraceptives (LARCs) and innovative barrier methods, with adoption rates increasing by approximately 12% annually among women aged 18-35. The market encompasses various device categories including intrauterine devices (IUDs), contraceptive implants, barrier methods, and emergency contraceptive devices, each serving distinct consumer preferences and medical requirements.

Healthcare infrastructure improvements and government initiatives supporting reproductive health access have contributed to market expansion, particularly in urban centers where awareness campaigns and clinical services demonstrate enhanced penetration. Digital health integration and telemedicine services have further accelerated market accessibility, enabling remote consultations and prescription services that complement traditional healthcare delivery models.

Regulatory frameworks established by the Medicines and Healthcare products Regulatory Agency (MHRA) ensure product safety and efficacy standards, fostering consumer confidence while encouraging innovation among manufacturers. The market benefits from comprehensive NHS coverage for most contraceptive devices, reducing financial barriers and promoting widespread adoption across socioeconomic demographics.

The UK contraceptive device market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and utilization of medical devices specifically designed to prevent pregnancy through various mechanisms of action. This market includes both prescription and over-the-counter contraceptive solutions that provide temporary or long-term fertility control options for individuals seeking reproductive autonomy.

Device categories within this market span mechanical barriers such as diaphragms and cervical caps, hormonal delivery systems including contraceptive patches and vaginal rings, intrauterine systems offering extended protection, and emergency contraceptive devices providing post-coital pregnancy prevention. Each category addresses specific user preferences, medical considerations, and lifestyle requirements while maintaining high efficacy standards.

Market participants include pharmaceutical companies, medical device manufacturers, healthcare providers, retail pharmacies, and digital health platforms that collectively ensure product availability, clinical support, and consumer education. The ecosystem integrates traditional healthcare delivery with modern e-commerce and telemedicine solutions, creating multiple access points for consumers seeking contraceptive solutions.

Strategic analysis reveals the UK contraceptive device market experiencing substantial transformation driven by technological advancement, changing consumer preferences, and enhanced healthcare accessibility. Growth trajectories indicate sustained expansion with particular strength in long-acting reversible contraceptives, which demonstrate adoption rates exceeding 15% annually among target demographics.

Market segmentation shows diverse product categories serving distinct consumer needs, with intrauterine devices and contraceptive implants gaining significant market share due to their convenience and long-term efficacy. Barrier methods maintain steady demand among consumers preferring non-hormonal options, while emergency contraceptives show consistent utilization patterns across age groups.

Competitive dynamics feature established pharmaceutical companies alongside innovative startups developing next-generation contraceptive technologies. Digital integration emerges as a key differentiator, with companies offering comprehensive reproductive health platforms combining device provision with educational resources and clinical support services.

Regional variations demonstrate higher adoption rates in metropolitan areas compared to rural regions, reflecting differences in healthcare access, educational initiatives, and cultural attitudes toward contraceptive use. Government support through NHS coverage and public health campaigns continues driving market accessibility and consumer awareness across diverse population segments.

Consumer behavior analysis reveals significant insights shaping market development and product innovation strategies. Primary findings indicate growing preference for long-acting contraceptive solutions among women seeking convenient, effective pregnancy prevention without daily maintenance requirements.

Technological advancement drives product innovation with smart contraceptive devices incorporating connectivity features, usage tracking, and personalized health insights. Sustainability concerns increasingly influence consumer choices, with eco-friendly contraceptive options gaining traction among environmentally conscious demographics.

Primary growth drivers propelling the UK contraceptive device market encompass demographic shifts, technological innovations, and evolving healthcare policies that collectively create favorable conditions for market expansion. Educational initiatives and awareness campaigns significantly contribute to increased contraceptive adoption across diverse population segments.

Demographic trends including delayed childbearing, increased female workforce participation, and changing family planning preferences drive demand for reliable, long-term contraceptive solutions. Career-focused women particularly seek contraceptive devices offering extended protection without interfering with professional responsibilities or lifestyle choices.

Healthcare accessibility improvements through NHS coverage expansion and private healthcare options reduce financial barriers while increasing product availability. Telemedicine integration enables remote consultations and prescription services, particularly benefiting consumers in underserved areas or those preferring discrete healthcare interactions.

Technological innovation introduces smart contraceptive devices with enhanced user experience, improved efficacy, and integrated health monitoring capabilities. Digital health platforms provide comprehensive reproductive health management, combining contraceptive device provision with educational resources and clinical support services.

Government initiatives supporting reproductive health education and contraceptive access create supportive policy environments encouraging market growth. Public health campaigns addressing teenage pregnancy prevention and family planning awareness contribute to increased contraceptive device utilization across age groups.

Significant challenges impacting UK contraceptive device market growth include cultural barriers, side effect concerns, and regulatory complexities that may limit product adoption and market penetration. Consumer hesitancy regarding certain contraceptive methods stems from misinformation, cultural stigma, and inadequate healthcare provider communication.

Side effect apprehensions particularly affect hormonal contraceptive device adoption, with consumers expressing concerns about weight gain, mood changes, and long-term health implications. Medical contraindications limit device suitability for certain population segments, requiring alternative contraceptive solutions or specialized medical supervision.

Healthcare provider limitations including insufficient training on newer contraceptive technologies and time constraints during clinical consultations may impact appropriate device selection and patient counseling. Regional disparities in healthcare access and specialist availability create uneven market penetration across different geographic areas.

Regulatory requirements for new contraceptive device approvals involve extensive clinical trials and safety assessments, potentially delaying product launches and increasing development costs. Insurance coverage variations and changing healthcare policies may affect product accessibility and consumer adoption patterns.

Competition from alternative contraceptive methods including oral contraceptives and permanent sterilization procedures may limit device market share in certain demographic segments. Economic pressures affecting healthcare budgets could impact NHS coverage decisions and private healthcare contraceptive service availability.

Emerging opportunities within the UK contraceptive device market present significant potential for innovation, market expansion, and improved reproductive health outcomes. Technological advancement creates possibilities for next-generation contraceptive devices incorporating artificial intelligence, personalized medicine, and enhanced user experience features.

Digital health integration offers opportunities for comprehensive reproductive health platforms combining contraceptive device provision with fertility tracking, health monitoring, and educational resources. Telemedicine expansion enables improved access to contraceptive services, particularly benefiting underserved populations and consumers preferring remote healthcare interactions.

Personalized contraception represents a growing opportunity as genetic testing and individual health profiling enable customized contraceptive device recommendations based on personal medical history, lifestyle factors, and genetic predispositions. Precision medicine approaches could significantly improve contraceptive efficacy and reduce side effects.

Sustainability initiatives create opportunities for eco-friendly contraceptive devices addressing environmental concerns while maintaining contraceptive efficacy. Biodegradable materials and sustainable manufacturing processes appeal to environmentally conscious consumers seeking responsible reproductive health solutions.

International expansion opportunities exist for UK-based contraceptive device manufacturers seeking global market presence, particularly in developing markets with growing healthcare infrastructure and increasing contraceptive awareness. Export potential leverages UK regulatory standards and product quality reputation in international markets.

Complex market dynamics shape the UK contraceptive device landscape through interconnected factors including regulatory changes, technological innovation, consumer behavior evolution, and healthcare system modifications. Dynamic interactions between these elements create both challenges and opportunities for market participants.

Supply chain considerations affect product availability and pricing, with global manufacturing dependencies potentially impacting device accessibility during supply disruptions. Brexit implications continue influencing regulatory alignment, import procedures, and manufacturing location decisions for contraceptive device companies operating in the UK market.

Healthcare system evolution toward value-based care models emphasizes contraceptive device cost-effectiveness and long-term health outcomes rather than initial acquisition costs. Clinical evidence requirements increasingly focus on real-world effectiveness data and patient-reported outcomes measuring contraceptive satisfaction and quality of life impacts.

Competitive pressures drive continuous innovation and product differentiation as manufacturers seek market share in established device categories while developing breakthrough technologies. Market consolidation trends through mergers and acquisitions create larger entities with enhanced research capabilities and broader product portfolios.

Consumer empowerment through increased health literacy and digital access enables more informed contraceptive decisions, potentially shifting market dynamics toward products offering transparency, education, and comprehensive support services. Social media influence and peer recommendations increasingly impact contraceptive device selection processes.

Comprehensive research methodology employed in analyzing the UK contraceptive device market incorporates multiple data sources, analytical techniques, and validation processes ensuring accurate market assessment and reliable insights. Primary research includes healthcare provider interviews, consumer surveys, and industry expert consultations providing firsthand market intelligence.

Secondary research encompasses government health statistics, clinical trial databases, regulatory filings, and published academic studies offering quantitative market data and trend analysis. Market intelligence gathering involves monitoring competitor activities, product launches, pricing strategies, and marketing initiatives across the contraceptive device landscape.

Data triangulation methods validate findings through cross-referencing multiple information sources, ensuring research accuracy and minimizing potential biases. Statistical analysis employs advanced modeling techniques identifying market patterns, growth projections, and correlation factors affecting contraceptive device adoption.

Qualitative analysis explores consumer motivations, healthcare provider perspectives, and market trend drivers through structured interviews and focus group discussions. Quantitative assessment utilizes market sizing models, adoption rate calculations, and demographic analysis providing measurable market insights.

Continuous monitoring processes track market developments, regulatory changes, and emerging trends ensuring research findings remain current and relevant for strategic decision-making. Expert validation involves industry specialist review of research findings and methodology verification ensuring analytical rigor and market accuracy.

Geographic distribution across the UK reveals distinct regional patterns in contraceptive device adoption, healthcare access, and market penetration reflecting local demographics, healthcare infrastructure, and cultural factors. London and Southeast England demonstrate the highest utilization rates, accounting for approximately 35% of total market activity due to concentrated healthcare facilities and diverse population demographics.

Northern England regions including Manchester, Liverpool, and Leeds show strong market presence with 22% market share, supported by comprehensive NHS services and active public health initiatives. Urban centers consistently demonstrate higher contraceptive device adoption rates compared to rural areas, reflecting improved healthcare access and educational resources.

Scotland represents approximately 18% of market activity with distinctive preferences for long-acting reversible contraceptives supported by progressive healthcare policies and comprehensive reproductive health services. Welsh markets account for 8% of total utilization with growing emphasis on contraceptive accessibility in rural communities through mobile health services and telemedicine initiatives.

Northern Ireland demonstrates unique market characteristics influenced by cultural considerations and healthcare system differences, representing 5% of overall market activity with gradual adoption increases following policy modifications and awareness campaigns.

Regional disparities in healthcare provider availability and specialist services create varying access levels for advanced contraceptive devices, particularly affecting rural populations seeking specialized contraceptive consultations. Transportation barriers and appointment availability influence contraceptive device selection in remote areas, often favoring longer-acting solutions requiring fewer clinical visits.

Market competition within the UK contraceptive device sector features established pharmaceutical companies, specialized medical device manufacturers, and emerging digital health platforms creating a dynamic competitive environment. Leading market participants leverage extensive research capabilities, established healthcare provider relationships, and comprehensive product portfolios.

Competitive strategies emphasize product differentiation through technological innovation, clinical evidence generation, and comprehensive patient support programs. Digital transformation initiatives enable companies to offer integrated reproductive health platforms combining device provision with educational resources and remote monitoring capabilities.

Strategic partnerships between device manufacturers and healthcare providers facilitate improved product access and clinical support services. Research collaborations with academic institutions accelerate innovation and clinical evidence development supporting new product approvals and market expansion initiatives.

Market segmentation analysis reveals distinct product categories, user demographics, and distribution channels serving diverse contraceptive needs across the UK population. Product-based segmentation encompasses various device types offering different mechanisms of action, duration of effectiveness, and user experience characteristics.

By Product Type:

By Age Demographics:

By Distribution Channel:

Intrauterine devices represent the fastest-growing segment within the UK contraceptive device market, driven by their long-acting nature and high efficacy rates exceeding 99% effectiveness. Copper IUDs appeal to consumers seeking non-hormonal contraception, while hormonal IUDs offer additional benefits including reduced menstrual bleeding and potential therapeutic effects.

Contraceptive implants demonstrate strong adoption among younger demographics seeking discrete, long-term contraceptive solutions. Single-rod implants provide three-year protection with minimal maintenance requirements, appealing to busy professionals and students prioritizing convenience and reliability.

Barrier methods maintain steady market presence among health-conscious consumers preferring non-hormonal contraception and those with medical contraindications to hormonal devices. Modern barrier designs incorporate improved materials and user-friendly features enhancing comfort and effectiveness.

Emergency contraceptives show consistent utilization patterns with increased accessibility through pharmacy services and online platforms. Copper IUD insertion for emergency contraception gains recognition as the most effective post-coital pregnancy prevention method among healthcare providers.

Contraceptive patches and rings serve consumers preferring self-administered hormonal contraception with monthly or weekly maintenance cycles. User preference studies indicate growing interest in these methods among women transitioning from oral contraceptives seeking improved compliance and convenience.

Healthcare providers benefit from expanded contraceptive device options enabling personalized patient care and improved reproductive health outcomes. Clinical advantages include reduced consultation frequency for long-acting devices and enhanced patient satisfaction through diverse contraceptive choices matching individual preferences and medical requirements.

Pharmaceutical companies and device manufacturers gain access to a stable, growing market with opportunities for innovation and product differentiation. Revenue diversification through contraceptive device portfolios provides steady income streams while supporting broader women’s health initiatives and corporate social responsibility objectives.

Patients and consumers receive enhanced reproductive autonomy through diverse contraceptive options addressing various lifestyle needs, medical considerations, and personal preferences. Long-term cost savings from extended-duration devices offset initial investment costs while providing reliable pregnancy prevention and potential health benefits.

Healthcare systems achieve cost-effectiveness through reduced unintended pregnancy rates and associated healthcare costs. Public health benefits include improved maternal health outcomes, reduced healthcare utilization, and enhanced population health metrics through effective family planning services.

Retail pharmacies expand service offerings and customer engagement through contraceptive device provision and related health services. Professional development opportunities for pharmacists include specialized contraceptive counseling and reproductive health expertise enhancing patient care capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend reshaping contraceptive device access and patient support services. Telemedicine platforms enable remote consultations, prescription services, and follow-up care, particularly benefiting consumers seeking discrete healthcare interactions or those in underserved areas.

Personalized contraception gains momentum through genetic testing, individual health profiling, and artificial intelligence applications enabling customized device recommendations. Precision medicine approaches promise improved contraceptive efficacy and reduced side effects through individualized treatment protocols.

Sustainability consciousness influences consumer preferences toward eco-friendly contraceptive devices and sustainable manufacturing practices. Biodegradable materials and environmentally responsible packaging appeal to consumers prioritizing environmental impact alongside reproductive health needs.

Long-acting reversible contraceptives continue gaining market share as consumers seek convenient, effective solutions requiring minimal maintenance. Extended-duration devices offering 5-10 years of protection attract users prioritizing long-term family planning and career considerations.

Integration with fertility awareness creates comprehensive reproductive health platforms combining contraceptive devices with fertility tracking, ovulation monitoring, and family planning support. Smart device connectivity enables real-time health monitoring and personalized insights enhancing user experience and contraceptive effectiveness.

Recent industry developments demonstrate significant innovation and market evolution within the UK contraceptive device sector. Regulatory approvals for next-generation contraceptive devices expand treatment options while maintaining high safety and efficacy standards through rigorous clinical evaluation processes.

Strategic partnerships between pharmaceutical companies and digital health platforms create integrated reproductive health solutions combining device provision with comprehensive patient support services. Collaboration initiatives leverage complementary expertise accelerating innovation and market access for advanced contraceptive technologies.

Clinical research advancement generates robust evidence supporting contraceptive device safety and effectiveness across diverse population groups. Real-world evidence studies provide valuable insights into device performance, patient satisfaction, and long-term health outcomes informing clinical practice and regulatory decisions.

Manufacturing innovations improve device design, materials, and production processes enhancing user experience and product reliability. Quality improvements focus on reducing side effects, improving insertion procedures, and extending device lifespan while maintaining contraceptive effectiveness.

Market access initiatives expand contraceptive device availability through enhanced distribution networks, pharmacy services, and online platforms. Educational programs targeting healthcare providers and consumers improve contraceptive knowledge and appropriate device selection supporting optimal reproductive health outcomes.

Strategic recommendations for market participants emphasize innovation, accessibility, and patient-centered approaches to capitalize on growth opportunities within the UK contraceptive device market. MarkWide Research analysis suggests focusing on digital health integration and personalized contraceptive solutions addressing evolving consumer preferences and healthcare delivery models.

Product development priorities should emphasize user experience improvements, side effect reduction, and extended-duration options appealing to convenience-seeking consumers. Technology integration opportunities include smart device connectivity, mobile health applications, and artificial intelligence-powered personalization enhancing contraceptive effectiveness and patient satisfaction.

Market access strategies require comprehensive approaches addressing regional disparities, cultural barriers, and healthcare provider education needs. Partnership development with NHS trusts, private healthcare providers, and digital health platforms can expand market reach and improve patient access to contraceptive devices.

Educational initiatives targeting both healthcare providers and consumers remain critical for market growth and appropriate device utilization. Evidence generation through real-world studies and patient-reported outcomes research supports clinical adoption and regulatory approval processes for innovative contraceptive technologies.

Sustainability integration presents opportunities for market differentiation and consumer appeal among environmentally conscious demographics. International expansion strategies leveraging UK regulatory standards and product quality reputation can access global growth opportunities while diversifying revenue streams.

Future projections for the UK contraceptive device market indicate sustained growth driven by technological innovation, demographic trends, and evolving healthcare delivery models. Market expansion is expected to continue at a robust pace with projected growth rates of 8-10% annually over the next five years, supported by increasing contraceptive awareness and accessibility initiatives.

Technological advancement will likely introduce breakthrough contraceptive devices incorporating nanotechnology, biocompatible materials, and smart monitoring capabilities. Personalized medicine approaches utilizing genetic profiling and individual health data promise customized contraceptive solutions optimizing efficacy while minimizing side effects.

Digital health integration will expand significantly, with comprehensive reproductive health platforms becoming standard care delivery models. Artificial intelligence applications may enable predictive contraceptive counseling, automated health monitoring, and personalized device recommendations based on individual health patterns and preferences.

Regulatory evolution toward adaptive approval pathways and real-world evidence acceptance may accelerate innovative contraceptive device market entry. International harmonization of regulatory standards could facilitate global market access for UK-developed contraceptive technologies.

Sustainability initiatives will likely become mandatory rather than optional, driving innovation in biodegradable materials and environmentally responsible manufacturing processes. Market consolidation through strategic mergers and acquisitions may create larger entities with enhanced research capabilities and global market presence, while maintaining competitive innovation dynamics.

The UK contraceptive device market represents a dynamic and evolving sector characterized by significant growth potential, technological innovation, and expanding accessibility. Market analysis reveals robust demand drivers including demographic shifts, healthcare system support, and increasing consumer awareness of reproductive health options.

Key success factors for market participants include embracing digital transformation, prioritizing user experience, and developing comprehensive patient support services. Innovation opportunities in personalized medicine, smart device connectivity, and sustainable manufacturing present pathways for market differentiation and growth.

Strategic positioning requires addressing regional disparities, cultural barriers, and healthcare provider education needs while leveraging technological advancement and regulatory support. Future market development will likely emphasize integrated reproductive health platforms combining contraceptive devices with comprehensive health monitoring and educational resources, creating enhanced value propositions for consumers and healthcare providers alike.

What is Contraceptive Device?

Contraceptive devices are medical products designed to prevent pregnancy. They include various types such as intrauterine devices (IUDs), implants, and barrier methods like condoms.

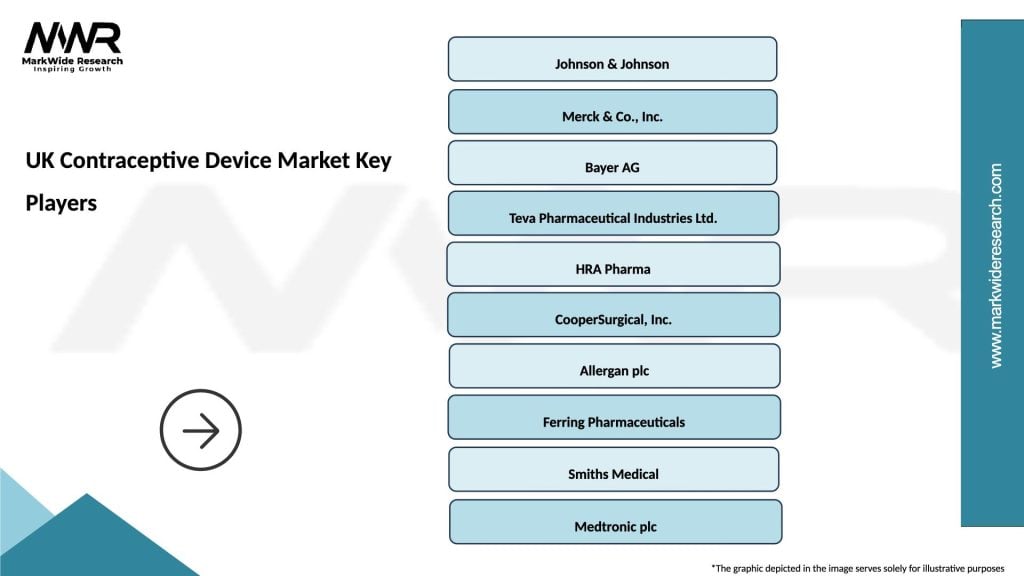

What are the key players in the UK Contraceptive Device Market?

Key players in the UK Contraceptive Device Market include Bayer AG, Merck & Co., and Teva Pharmaceutical Industries. These companies are known for their innovative contraceptive solutions and extensive distribution networks, among others.

What are the growth factors driving the UK Contraceptive Device Market?

The growth of the UK Contraceptive Device Market is driven by increasing awareness of family planning, advancements in contraceptive technology, and a rise in the number of women seeking long-term contraceptive solutions.

What challenges does the UK Contraceptive Device Market face?

Challenges in the UK Contraceptive Device Market include regulatory hurdles, varying consumer preferences, and the stigma associated with contraceptive use in certain demographics.

What opportunities exist in the UK Contraceptive Device Market?

Opportunities in the UK Contraceptive Device Market include the development of new, more effective contraceptive methods, increasing partnerships between healthcare providers and manufacturers, and the growing trend of personalized healthcare solutions.

What trends are shaping the UK Contraceptive Device Market?

Trends in the UK Contraceptive Device Market include the rise of digital health solutions for contraceptive management, increased focus on sustainable and eco-friendly products, and the growing acceptance of long-acting reversible contraceptives (LARCs).

UK Contraceptive Device Market

| Segmentation Details | Description |

|---|---|

| Product Type | Intrauterine Devices, Contraceptive Implants, Condoms, Diaphragms |

| Technology | Hormonal, Non-Hormonal, Barrier, Permanent |

| End User | Clinics, Hospitals, Pharmacies, Home Users |

| Distribution Channel | Online, Retail, Direct Sales, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Contraceptive Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at