444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK commercial real estate market represents one of Europe’s most dynamic and sophisticated property investment landscapes, encompassing office buildings, retail spaces, industrial facilities, and mixed-use developments across England, Scotland, Wales, and Northern Ireland. Market dynamics indicate sustained growth driven by urbanization trends, technological advancement, and evolving workplace requirements following post-pandemic adaptations.

London remains the dominant force within the UK commercial property sector, accounting for approximately 40% of total market activity while regional cities including Manchester, Birmingham, Edinburgh, and Leeds demonstrate robust expansion patterns. The market experiences significant influence from international investors, particularly from North America, Asia-Pacific, and European Union countries seeking stable returns and portfolio diversification opportunities.

Current market conditions reflect a transformation period characterized by hybrid working models, sustainability requirements, and technological integration demands. Commercial real estate stakeholders are adapting to changing tenant preferences, with increased focus on flexible workspace solutions, energy-efficient buildings, and prime location accessibility. The market demonstrates resilience through economic uncertainties while maintaining growth momentum at approximately 6.2% annual expansion rate across key segments.

The UK commercial real estate market refers to the comprehensive ecosystem of non-residential property transactions, investments, and developments designed for business operations, retail activities, industrial purposes, and mixed-use applications throughout the United Kingdom. This market encompasses acquisition, development, leasing, and management of commercial properties serving diverse business requirements.

Commercial real estate includes multiple property categories: office buildings ranging from traditional corporate headquarters to modern flexible workspaces, retail properties including shopping centers and high-street locations, industrial facilities encompassing warehouses and manufacturing sites, and specialized properties such as hotels, healthcare facilities, and data centers. The market operates through complex networks of developers, investors, property managers, and service providers.

Investment characteristics distinguish commercial real estate from residential properties through longer lease terms, higher transaction values, institutional investor participation, and sophisticated financing structures. Market participants include real estate investment trusts (REITs), pension funds, sovereign wealth funds, private equity firms, and individual high-net-worth investors seeking stable income streams and capital appreciation opportunities.

The UK commercial real estate market demonstrates remarkable resilience and adaptation capabilities amid evolving economic conditions and changing business requirements. Market fundamentals remain strong with sustained investor interest, particularly in prime locations and modern, sustainable properties that meet contemporary tenant demands for flexibility and environmental responsibility.

Key market drivers include the ongoing digital transformation of businesses, increased demand for logistics and distribution facilities driven by e-commerce growth, and the evolution of office spaces toward hybrid working models. Regional markets outside London show particularly strong performance, with cities like Manchester and Birmingham experiencing 15% increased investment activity as businesses seek cost-effective alternatives to capital city locations.

Investment flows continue from international sources, with North American and Asian investors maintaining significant presence in UK commercial property markets. The market benefits from established legal frameworks, transparent transaction processes, and strong property rights protection, making it attractive for global capital deployment. MarkWide Research analysis indicates sustained growth potential across multiple commercial property segments through strategic market positioning and adaptive development approaches.

Market performance reveals several critical insights shaping the UK commercial real estate landscape:

Economic recovery following pandemic disruptions creates renewed confidence in commercial real estate investments, with businesses expanding operations and seeking modern facilities that support evolving work patterns. Government infrastructure investments and urban regeneration projects provide additional momentum for commercial property development across major UK cities.

Demographic shifts toward urban centers drive demand for diverse commercial properties, while changing consumer behaviors favor experiential retail spaces and mixed-use developments that combine commercial, residential, and leisure facilities. The growing emphasis on work-life balance influences office space design and location preferences, creating opportunities for innovative commercial developments.

Technological advancement necessitates modern commercial properties equipped with high-speed connectivity, flexible infrastructure, and smart building systems. Businesses increasingly prioritize locations offering technological capabilities, energy efficiency, and adaptable spaces that can accommodate changing operational requirements and hybrid working models.

E-commerce growth continues driving demand for logistics and distribution facilities, particularly in strategic locations near major population centers and transportation hubs. Last-mile delivery requirements create opportunities for urban warehouse developments and innovative logistics solutions integrated within commercial property portfolios.

Economic uncertainty related to inflation, interest rate fluctuations, and global economic conditions creates cautious investor sentiment and impacts financing availability for commercial real estate projects. Rising construction costs and material shortages challenge development economics while potentially delaying project timelines and reducing profit margins.

Regulatory complexity surrounding planning permissions, environmental compliance, and building standards increases development costs and project timelines. Brexit-related uncertainties continue affecting international investment flows and cross-border transaction processes, though impacts have stabilized compared to initial transition periods.

Changing work patterns create uncertainty regarding long-term office space demand, with some businesses reducing their physical footprint while others seek larger, more flexible spaces. This transition period challenges traditional office property valuations and lease structures, requiring adaptive approaches from property owners and investors.

Competition for prime locations intensifies pricing pressures and reduces yields in sought-after areas, while secondary locations may struggle to attract tenants and maintain occupancy rates. Market polarization between high-quality, well-located properties and older, less adaptable buildings creates challenges for certain property segments.

Regeneration projects across UK cities create substantial opportunities for commercial real estate development, particularly in areas benefiting from government investment in infrastructure, transportation, and urban renewal initiatives. These projects often combine commercial, residential, and community facilities, offering diversified investment opportunities.

Sustainability initiatives present significant opportunities for property developers and investors focusing on energy-efficient buildings, renewable energy integration, and environmentally responsible development practices. Green building certifications and ESG compliance become competitive advantages attracting quality tenants and premium rental rates.

Alternative property sectors including data centers, healthcare facilities, student accommodation, and co-living spaces offer diversification opportunities with different risk-return profiles compared to traditional commercial properties. These sectors often demonstrate resilient demand patterns and attractive yield characteristics.

Technology integration creates opportunities for smart building developments incorporating IoT systems, automated management platforms, and advanced security features. Properties offering superior technological capabilities command premium rents and attract forward-thinking tenants seeking competitive operational advantages.

Supply and demand dynamics vary significantly across property types and geographic regions, with London maintaining premium positioning while regional cities offer attractive yield opportunities and growth potential. Office markets experience transformation as businesses adapt to hybrid working models, creating demand for flexible, technology-enabled spaces.

Investment capital flows from domestic and international sources continue supporting market liquidity, though investors demonstrate increased selectivity regarding property quality, location, and tenant profiles. Institutional investors particularly favor properties with strong ESG credentials and long-term lease agreements with creditworthy tenants.

Rental market conditions reflect varying dynamics across sectors, with prime office locations maintaining rental growth while secondary markets face pressure. Industrial and logistics properties experience strong rental growth driven by e-commerce demand, while retail properties undergo significant restructuring and adaptation processes.

Development activity focuses increasingly on mixed-use projects that combine commercial, residential, and leisure components, creating vibrant urban environments that attract diverse tenant bases. Build-to-suit developments gain popularity as businesses seek customized facilities meeting specific operational requirements.

Comprehensive market analysis employs multiple research methodologies including primary data collection through industry interviews, surveys, and direct market observations combined with secondary research from authoritative sources including government statistics, industry reports, and transaction databases.

Data collection processes encompass quantitative analysis of transaction volumes, pricing trends, occupancy rates, and yield patterns across different property sectors and geographic regions. Qualitative research includes stakeholder interviews with property developers, investors, agents, and end-users to understand market sentiment and future expectations.

Market segmentation analysis examines performance across property types, geographic regions, and investment categories to identify trends, opportunities, and risk factors. Research methodology includes comparative analysis with international markets to provide context for UK market performance and positioning.

Validation procedures ensure data accuracy through cross-referencing multiple sources, expert review processes, and continuous market monitoring to maintain current and relevant insights. Research findings undergo rigorous quality assurance processes to ensure reliability and actionable intelligence for market participants.

London dominates the UK commercial real estate landscape, accounting for approximately 45% of total investment activity with prime Central London locations commanding premium valuations and attracting international capital. The capital city benefits from established financial services sector presence, excellent transportation infrastructure, and global business connectivity.

Manchester emerges as a leading regional commercial property market, experiencing 18% growth in investment volumes driven by technology sector expansion, university presence, and significant infrastructure development including airport expansion and urban regeneration projects. The city offers attractive yields compared to London while maintaining strong tenant demand.

Birmingham demonstrates robust commercial property performance supported by major infrastructure investments including HS2 railway development, creating opportunities for office, retail, and mixed-use developments. The city’s central location and improving connectivity enhance its appeal for businesses seeking cost-effective alternatives to London locations.

Edinburgh and Glasgow represent Scotland’s primary commercial property markets, with Edinburgh benefiting from financial services sector presence and tourism industry while Glasgow offers industrial and logistics opportunities. Both cities demonstrate steady growth patterns with 12% annual investment increase across commercial property sectors.

Regional cities including Leeds, Liverpool, Bristol, and Newcastle show increasing commercial property investment activity as businesses seek expansion opportunities outside traditional centers. These markets offer development potential, competitive operating costs, and access to skilled workforce populations.

Major property developers and investment companies shape the UK commercial real estate market through large-scale projects and strategic acquisitions:

By Property Type:

By Investment Type:

By Geographic Region:

Office Properties undergo significant transformation as businesses adapt to hybrid working models, creating demand for flexible, technology-enabled spaces that support both in-person collaboration and remote work integration. Modern office developments emphasize wellness features, sustainability credentials, and adaptable layouts that can accommodate changing business requirements.

Retail Properties face ongoing challenges from e-commerce growth but demonstrate resilience through experiential retail concepts, mixed-use integration, and focus on convenience-based locations. Successful retail developments combine shopping, dining, entertainment, and community spaces to create destinations that attract diverse visitor demographics.

Industrial Properties experience unprecedented demand driven by e-commerce expansion, supply chain optimization, and last-mile delivery requirements. Modern logistics facilities incorporate advanced technology, automation capabilities, and strategic locations near major population centers and transportation infrastructure.

Mixed-Use Developments gain popularity as they create vibrant communities combining commercial, residential, and leisure facilities. These projects offer diversified income streams, reduced vacancy risks, and appeal to modern lifestyle preferences for integrated living and working environments.

Property Investors benefit from stable income streams, capital appreciation potential, and portfolio diversification opportunities across multiple commercial property sectors. The UK market offers transparent legal frameworks, established transaction processes, and strong property rights protection that support long-term investment strategies.

Developers capitalize on urbanization trends, infrastructure investments, and changing business requirements to create innovative commercial properties that meet evolving market demands. Opportunities exist for sustainable development practices, technology integration, and mixed-use projects that serve diverse tenant needs.

Tenants gain access to modern, flexible commercial spaces that support business growth, operational efficiency, and employee satisfaction. Quality commercial properties offer technological capabilities, sustainability features, and strategic locations that enhance business competitiveness and brand positioning.

Financial Institutions participate in commercial real estate financing, investment products, and advisory services that support market growth while generating attractive returns. The sector offers opportunities for green financing, ESG-focused investment products, and innovative funding structures.

Service Providers including property managers, consultants, and technology companies benefit from increasing demand for professional services supporting commercial property operations, transactions, and optimization initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Flexible Workspace Adoption accelerates as businesses seek adaptable office solutions that accommodate hybrid working models and changing team sizes. Co-working spaces, serviced offices, and flexible lease arrangements gain popularity among companies prioritizing operational agility and cost management.

Sustainability Integration becomes essential with 80% of new commercial developments targeting environmental certifications and energy efficiency standards. Green building features, renewable energy systems, and sustainable materials influence tenant decisions and investment valuations.

Technology Enhancement drives demand for smart building systems, high-speed connectivity, and IoT-enabled facilities that support modern business operations. Properties offering advanced technological capabilities command premium rents and attract quality tenants seeking competitive advantages.

Mixed-Use Development trends toward integrated projects combining commercial, residential, retail, and leisure facilities that create vibrant communities and diversified income streams. These developments appeal to modern lifestyle preferences and offer reduced vacancy risks through multiple revenue sources.

ESG Compliance influences investment decisions with increasing focus on environmental, social, and governance factors affecting property valuations and tenant attraction. MWR research indicates growing importance of ESG credentials in commercial property investment strategies.

Major infrastructure projects including HS2 railway development, Crossrail completion, and regional transportation improvements create new commercial property opportunities and enhance connectivity between major UK cities. These investments support business expansion and property value appreciation in strategic locations.

Planning reform initiatives aim to streamline development processes and increase commercial property supply, particularly in areas designated for economic growth and urban regeneration. Government policies support sustainable development practices and affordable workspace provision.

Technology sector expansion drives demand for modern office spaces and data center facilities, with major technology companies establishing UK operations and requiring specialized commercial properties. This trend supports premium rental rates and development opportunities in key markets.

Retail sector transformation continues with emphasis on experiential retail concepts, click-and-collect facilities, and mixed-use developments that combine shopping with dining, entertainment, and community spaces. Successful retail properties adapt to changing consumer behaviors and omnichannel retail strategies.

Industrial automation influences warehouse and distribution facility design, with increased demand for properties supporting automated systems, robotics integration, and advanced logistics operations. Modern industrial properties incorporate technology infrastructure and flexible layouts accommodating evolving operational requirements.

Investment Strategy should focus on high-quality properties in prime locations with strong tenant covenants and long-term lease agreements. Investors should prioritize assets with sustainability credentials, technological capabilities, and flexibility to adapt to changing market conditions.

Geographic Diversification across London and regional markets can optimize risk-return profiles while capitalizing on different growth dynamics and yield opportunities. Regional cities offer attractive alternatives to London with competitive returns and development potential.

Sector Allocation should consider alternative property types including data centers, healthcare facilities, and logistics properties that demonstrate resilient demand patterns and attractive yield characteristics. Traditional sectors require careful selection focusing on quality and location advantages.

Development Focus should emphasize mixed-use projects, sustainable building practices, and technology integration that meet evolving tenant requirements and regulatory standards. Build-to-suit opportunities offer premium returns for developers meeting specific business needs.

Risk Management strategies should address interest rate volatility, economic uncertainty, and changing work patterns through diversified portfolios, flexible lease structures, and active asset management approaches that optimize property performance and tenant satisfaction.

Market evolution toward sustainability, technology integration, and flexible workspace solutions positions the UK commercial real estate sector for continued growth and adaptation. MarkWide Research projects sustained expansion driven by urbanization trends, business modernization, and infrastructure development across major UK markets.

Investment opportunities will increasingly focus on properties meeting ESG criteria, offering technological capabilities, and providing flexible solutions for evolving business requirements. Alternative property sectors including data centers, healthcare facilities, and specialized logistics properties show particular growth potential with 22% expected expansion over the next five years.

Regional development outside London will accelerate as businesses seek cost-effective locations with good connectivity and skilled workforce access. Cities including Manchester, Birmingham, and Edinburgh will benefit from continued investment and development activity supporting commercial property growth.

Technology integration will become standard across commercial properties, with smart building systems, IoT capabilities, and advanced security features essential for attracting quality tenants and commanding premium rents. Properties lacking technological infrastructure may face competitive disadvantages and reduced valuations.

Sustainability requirements will intensify with stricter environmental regulations and tenant demands for energy-efficient buildings. Commercial properties with strong environmental credentials will outperform traditional buildings in terms of occupancy rates, rental growth, and investment returns.

The UK commercial real estate market demonstrates remarkable resilience and adaptation capabilities while navigating economic uncertainties and evolving business requirements. Strong fundamentals including transparent legal frameworks, international investor appeal, and diverse property sectors support continued market growth and investment opportunities.

Market transformation toward sustainability, technology integration, and flexible workspace solutions creates opportunities for forward-thinking investors and developers who can meet changing tenant demands. Regional markets offer attractive alternatives to London with competitive yields and development potential, while alternative property sectors provide diversification opportunities.

Future success in the UK commercial real estate market will depend on adaptability, quality focus, and strategic positioning in prime locations with strong growth fundamentals. Stakeholders who embrace sustainability, technology, and flexible solutions while maintaining high property standards will capitalize on the market’s continued evolution and expansion potential.

What is UK Commercial Real Estate?

UK Commercial Real Estate refers to properties used for business purposes, including office buildings, retail spaces, warehouses, and industrial facilities. This sector plays a crucial role in the economy by providing spaces for businesses to operate and grow.

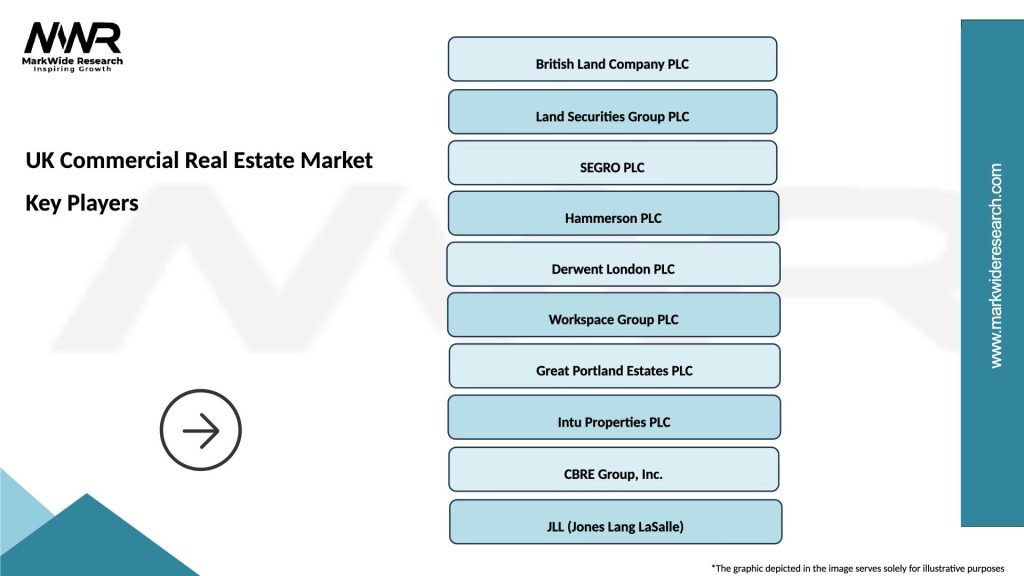

What are the key players in the UK Commercial Real Estate Market?

Key players in the UK Commercial Real Estate Market include companies like British Land, Land Securities, and SEGRO, which are involved in property development, management, and investment. These firms significantly influence market trends and property values, among others.

What are the main drivers of the UK Commercial Real Estate Market?

The main drivers of the UK Commercial Real Estate Market include economic growth, demand for office and retail spaces, and urbanization trends. Additionally, the rise of e-commerce has increased the need for logistics and warehouse facilities.

What challenges does the UK Commercial Real Estate Market face?

The UK Commercial Real Estate Market faces challenges such as regulatory changes, economic uncertainty, and shifts in consumer behavior. The impact of remote working trends has also led to decreased demand for traditional office spaces.

What opportunities exist in the UK Commercial Real Estate Market?

Opportunities in the UK Commercial Real Estate Market include the growth of flexible workspaces, increased investment in sustainable buildings, and the demand for mixed-use developments. These trends are reshaping how commercial properties are designed and utilized.

What are the current trends in the UK Commercial Real Estate Market?

Current trends in the UK Commercial Real Estate Market include a focus on sustainability, the integration of technology in property management, and the rise of co-working spaces. These trends reflect changing tenant preferences and the need for more adaptable spaces.

UK Commercial Real Estate Market

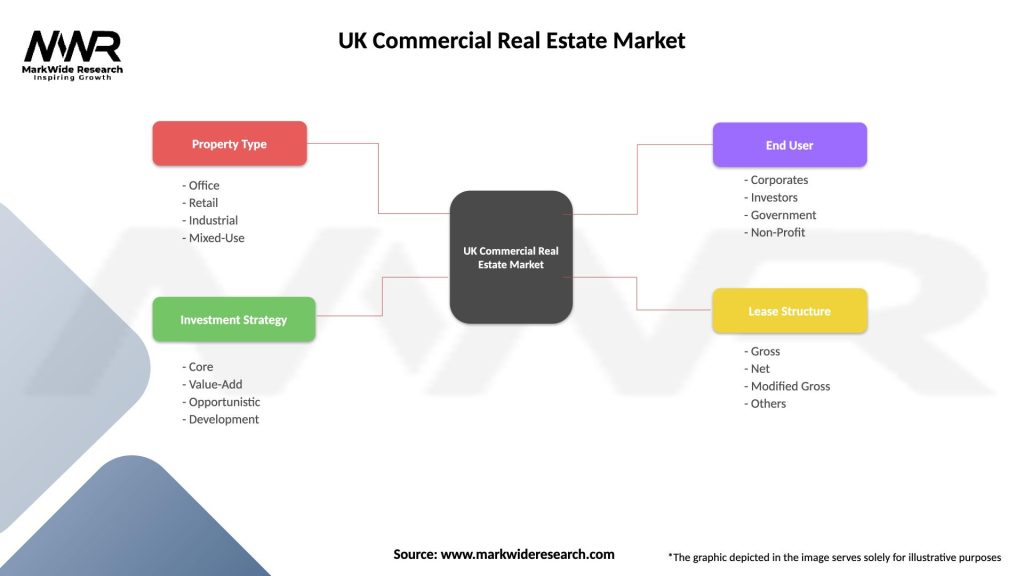

| Segmentation Details | Description |

|---|---|

| Property Type | Office, Retail, Industrial, Mixed-Use |

| Investment Strategy | Core, Value-Add, Opportunistic, Development |

| End User | Corporates, Investors, Government, Non-Profit |

| Lease Structure | Gross, Net, Modified Gross, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Commercial Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at