444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK commercial prepaid card market represents a dynamic and rapidly evolving segment of the financial services industry, characterized by innovative payment solutions and increasing adoption across various business sectors. Commercial prepaid cards have emerged as essential financial tools for organizations seeking enhanced expense management, improved cash flow control, and streamlined payment processes. The market demonstrates robust growth momentum, driven by digital transformation initiatives and the increasing demand for contactless payment solutions.

Market expansion is particularly evident in sectors such as corporate expense management, employee benefits, and B2B payments, where organizations are leveraging prepaid card technology to optimize financial operations. The UK market benefits from a mature financial infrastructure, supportive regulatory environment, and high levels of digital payment adoption among businesses and consumers alike. Growth rates in the commercial prepaid card sector are projected to maintain strong momentum, with adoption rates reaching 78% among medium to large enterprises by the end of the forecast period.

Technological advancements including mobile integration, real-time transaction monitoring, and enhanced security features are reshaping the competitive landscape. The market encompasses various card types including corporate cards, fleet cards, gift cards, and specialized industry solutions, each addressing specific business requirements and use cases.

The UK commercial prepaid card market refers to the comprehensive ecosystem of prepaid payment solutions specifically designed for business and commercial applications. These financial instruments enable organizations to preload funds onto cards that can be used for various business expenses, employee benefits, and operational payments without requiring traditional credit arrangements or bank account access.

Commercial prepaid cards differ from consumer prepaid products by offering enhanced features such as expense tracking, spending controls, multi-user management capabilities, and integration with corporate financial systems. The market encompasses card issuance, processing services, technology platforms, and related financial services that support business payment needs across diverse industry sectors.

Key characteristics include predetermined spending limits, real-time transaction monitoring, customizable controls, and comprehensive reporting capabilities that enable businesses to maintain financial oversight while providing payment flexibility to employees and stakeholders.

Market dynamics in the UK commercial prepaid card sector reflect a mature yet rapidly innovating landscape where traditional payment methods are being supplemented and replaced by flexible prepaid solutions. The market demonstrates significant growth potential driven by increasing digitalization of business processes and the need for enhanced financial control mechanisms.

Key growth drivers include the rising adoption of contactless payments, which now account for 85% of all commercial prepaid transactions, and the increasing focus on expense management optimization among UK businesses. Organizations are recognizing the value proposition of prepaid cards in reducing administrative overhead, improving compliance, and providing real-time visibility into spending patterns.

Competitive landscape features established financial institutions, specialized fintech companies, and technology providers offering comprehensive prepaid card solutions. Market leaders are differentiating through innovative features, competitive pricing, and superior customer service while addressing specific industry requirements and regulatory compliance needs.

Future prospects indicate continued expansion across multiple sectors, with particular growth expected in areas such as employee benefits, travel and entertainment expenses, and supply chain payments. The integration of artificial intelligence and machine learning technologies is expected to enhance fraud detection capabilities and provide more sophisticated spending analytics.

Strategic insights reveal several critical trends shaping the UK commercial prepaid card market landscape:

Primary growth drivers propelling the UK commercial prepaid card market include the accelerating digital transformation of business payment processes and the increasing need for enhanced financial control mechanisms. Organizations across various sectors are recognizing the operational benefits of prepaid card solutions in streamlining expense management and reducing administrative complexity.

Regulatory support from UK financial authorities has created a favorable environment for prepaid card innovation, with clear guidelines and frameworks that encourage market development while ensuring consumer protection. The implementation of open banking regulations has facilitated greater integration between prepaid card providers and traditional banking services, enhancing the overall value proposition.

Cost efficiency considerations are driving adoption as businesses seek to reduce the administrative burden associated with traditional expense reimbursement processes. Commercial prepaid cards eliminate the need for petty cash management, reduce processing costs, and provide automated reconciliation capabilities that significantly improve operational efficiency.

Employee satisfaction improvements through enhanced payment flexibility and reduced bureaucracy are encouraging organizations to adopt prepaid card solutions for various employee benefit programs. The ability to provide instant access to funds while maintaining spending controls addresses both employee needs and organizational requirements.

Technological advancement in mobile payments and contactless technology has made prepaid cards more convenient and accessible, with 92% of commercial users preferring contactless payment options for routine business expenses.

Implementation challenges present significant barriers to market expansion, particularly for smaller organizations that may lack the technical infrastructure or resources to effectively integrate commercial prepaid card systems with existing financial processes. The complexity of system integration and the need for employee training can create resistance to adoption.

Security concerns regarding fraud prevention and data protection continue to influence decision-making processes, despite significant improvements in prepaid card security technologies. Organizations remain cautious about potential vulnerabilities and the financial implications of security breaches, particularly in sectors handling sensitive information.

Regulatory compliance requirements, while generally supportive of market growth, can create complexity and additional costs for both providers and users. The need to maintain compliance with evolving financial regulations requires ongoing investment in systems and processes that may strain smaller market participants.

Competition from alternative payment methods, including mobile payment apps, digital wallets, and traditional corporate credit cards, creates pressure on prepaid card providers to continuously innovate and demonstrate clear value propositions. The proliferation of payment options can lead to market fragmentation and customer confusion.

Economic uncertainty and changing business priorities can impact adoption rates, particularly during periods of financial constraint when organizations may defer non-essential technology investments or seek to minimize operational changes.

Emerging opportunities in the UK commercial prepaid card market are driven by evolving business needs and technological capabilities that create new applications and use cases. The growing gig economy and remote work trends present significant opportunities for prepaid card solutions that address the unique payment needs of distributed workforces and freelance professionals.

Industry-specific solutions represent substantial growth potential, particularly in sectors such as healthcare, education, and government where specialized compliance requirements and unique operational needs create demand for tailored prepaid card offerings. These vertical markets often require specific features and integrations that command premium pricing.

International expansion opportunities for UK-based prepaid card providers are increasing as businesses seek global payment solutions that can support international operations while maintaining centralized control and reporting. Multi-currency capabilities and cross-border payment features are becoming increasingly valuable.

Partnership opportunities with fintech companies, traditional banks, and technology providers can accelerate market penetration and enhance service offerings. Collaborative approaches enable market participants to leverage complementary strengths and access new customer segments more effectively.

Sustainability initiatives are creating opportunities for providers who can offer environmentally friendly card materials and digital-first solutions that reduce physical card usage. Organizations increasingly prioritize sustainability in vendor selection processes, creating competitive advantages for environmentally conscious providers.

Dynamic market forces are reshaping the UK commercial prepaid card landscape through the interaction of technological innovation, regulatory evolution, and changing business requirements. The market demonstrates strong resilience and adaptability, with providers continuously evolving their offerings to meet emerging customer needs and competitive pressures.

Competitive intensity has increased significantly as traditional financial institutions, fintech startups, and technology companies compete for market share. This competition drives innovation and improves service quality while potentially pressuring profit margins and requiring continuous investment in product development.

Customer expectations continue to evolve, with businesses demanding more sophisticated features, better integration capabilities, and enhanced user experiences. The consumerization of business technology has raised expectations for intuitive interfaces and seamless functionality that matches consumer payment experiences.

Technological convergence is blurring the lines between different payment methods and creating opportunities for integrated solutions that combine prepaid cards with other financial services. This convergence enables providers to offer more comprehensive value propositions while addressing diverse customer requirements.

Market consolidation trends are evident as larger players acquire smaller competitors to gain market share, access new technologies, or enter specific market segments. This consolidation can create economies of scale while potentially reducing competitive diversity in certain market segments.

Comprehensive research approach employed in analyzing the UK commercial prepaid card market combines quantitative and qualitative methodologies to provide accurate and actionable market intelligence. The research framework incorporates primary data collection through industry surveys, expert interviews, and stakeholder consultations to gather firsthand insights from market participants.

Secondary research components include analysis of industry reports, regulatory filings, company financial statements, and market databases to establish baseline market understanding and validate primary research findings. This multi-source approach ensures comprehensive coverage of market dynamics and trends.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews with key stakeholders, and applying statistical analysis techniques to ensure accuracy and reliability of market insights. Quality assurance measures include peer review and expert validation of research findings.

Market segmentation analysis utilizes both top-down and bottom-up approaches to accurately assess market size, growth rates, and competitive positioning across different segments and geographic regions. This dual methodology provides robust market sizing and forecasting capabilities.

Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on identified market drivers and emerging opportunities. The analytical framework considers both quantitative metrics and qualitative factors that influence market development.

Geographic distribution of the UK commercial prepaid card market reveals significant concentration in major business centers, with London and the Southeast accounting for approximately 45% of total market activity. This concentration reflects the high density of corporate headquarters, financial services companies, and technology firms that represent primary target customers for commercial prepaid solutions.

Scotland and Northern England demonstrate strong growth potential, driven by expanding business services sectors and increasing adoption of digital payment technologies. These regions benefit from supportive local government initiatives and growing fintech ecosystems that encourage innovation in financial services.

Wales and Southwest England show emerging opportunities, particularly in sectors such as tourism, agriculture, and manufacturing where prepaid cards can address specific operational payment needs. The regional distribution reflects varying levels of business digitalization and technology adoption across different geographic areas.

Urban versus rural adoption patterns reveal higher penetration rates in metropolitan areas where businesses have greater access to technology infrastructure and financial services. However, rural areas present growth opportunities as connectivity improves and businesses seek efficient payment solutions for distributed operations.

Regional partnerships with local financial institutions and business organizations are becoming increasingly important for market penetration, particularly in areas where established relationships and local market knowledge provide competitive advantages for service providers.

Market leadership in the UK commercial prepaid card sector is characterized by a diverse ecosystem of established financial institutions, specialized fintech companies, and technology providers, each bringing unique strengths and capabilities to the competitive landscape.

Competitive differentiation strategies focus on technological innovation, customer service excellence, and specialized industry solutions that address specific market segments and use cases. Market leaders invest heavily in research and development to maintain competitive advantages and respond to evolving customer requirements.

Partnership strategies are increasingly important as companies seek to leverage complementary capabilities and access new market segments through collaborative relationships with technology providers, financial institutions, and industry specialists.

Market segmentation analysis reveals distinct categories based on application, industry vertical, card type, and organization size, each with unique characteristics and growth patterns that influence market dynamics and competitive positioning.

By Application:

By Industry Vertical:

By Organization Size:

Corporate expense management represents the dominant category within the UK commercial prepaid card market, driven by organizations seeking to streamline expense processes and improve financial control. This category benefits from strong demand for real-time expense tracking, automated reconciliation, and integration with existing financial systems.

Employee benefits applications demonstrate the highest growth rates, with adoption increasing by 23% annually as organizations recognize the value of prepaid cards in delivering flexible employee benefits programs. This category includes meal vouchers, wellness programs, and flexible spending accounts that provide tax advantages and improved employee satisfaction.

Fleet management solutions serve specialized needs in transportation and logistics sectors, offering features such as fuel purchase controls, vehicle maintenance tracking, and driver expense management. This category requires specialized merchant networks and industry-specific reporting capabilities.

Gift and incentive programs address business-to-business marketing needs and employee recognition programs, with customizable branding options and flexible redemption features. This category often requires integration with customer relationship management systems and marketing platforms.

Industry-specific solutions are gaining traction as providers develop specialized offerings for healthcare, education, and government sectors that address unique compliance requirements and operational needs. These vertical solutions often command premium pricing due to specialized features and regulatory compliance capabilities.

Organizational benefits from commercial prepaid card adoption include significant improvements in expense management efficiency, with organizations reporting average administrative cost reductions of 35% through automated processes and reduced manual intervention requirements.

Financial control advantages enable organizations to establish spending limits, restrict merchant categories, and monitor transactions in real-time, providing unprecedented visibility into business expenses and reducing the risk of unauthorized or inappropriate spending.

Employee satisfaction improvements result from reduced bureaucracy, faster expense reimbursements, and increased payment flexibility that eliminates the need for personal expense advances and lengthy reimbursement processes.

Compliance benefits include automated expense reporting, audit trail maintenance, and regulatory compliance support that reduces the administrative burden associated with financial oversight and reporting requirements.

Technology integration capabilities enable seamless connection with existing business systems, including accounting software, human resources platforms, and enterprise resource planning systems, creating comprehensive financial management solutions.

Cost savings extend beyond administrative efficiency to include reduced processing fees, eliminated check processing costs, and improved cash flow management through better expense timing and control.

Security enhancements provide superior fraud protection compared to traditional payment methods, with real-time monitoring, transaction alerts, and the ability to immediately suspend or replace compromised cards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first approaches are transforming the commercial prepaid card landscape, with providers increasingly offering mobile-centric solutions that prioritize smartphone integration and digital wallet compatibility. This trend reflects changing user preferences and the need for seamless payment experiences across multiple channels and devices.

Artificial intelligence integration is enhancing fraud detection capabilities and providing sophisticated spending analytics that help organizations optimize their expense management processes. AI-powered solutions are becoming standard features rather than premium add-ons, with 67% of new implementations including some form of machine learning capability.

Sustainability focus is driving demand for eco-friendly card materials and digital-first solutions that minimize environmental impact. Organizations are increasingly considering environmental factors in vendor selection processes, creating competitive advantages for providers who can demonstrate sustainability credentials.

Real-time capabilities are becoming essential requirements, with businesses expecting instant transaction notifications, real-time balance updates, and immediate spending controls. This trend is driving infrastructure investments and technological upgrades across the industry.

API-first development is enabling greater integration flexibility and supporting the creation of comprehensive financial ecosystems that combine prepaid cards with other business services. This approach facilitates customization and enables providers to address specific industry requirements more effectively.

Biometric authentication is being integrated to enhance security while improving user experience, with fingerprint and facial recognition technologies becoming more common in commercial prepaid card applications.

Recent industry developments highlight the dynamic nature of the UK commercial prepaid card market, with significant investments in technology infrastructure, strategic partnerships, and regulatory compliance initiatives shaping the competitive landscape.

Technology partnerships between traditional financial institutions and fintech companies are accelerating innovation and enabling the development of more sophisticated prepaid card solutions. These collaborations combine established market presence with cutting-edge technology capabilities.

Regulatory compliance initiatives, particularly related to Strong Customer Authentication requirements and open banking regulations, are driving significant system upgrades and process improvements across the industry. These developments enhance security while creating new opportunities for service integration.

Market consolidation activities include strategic acquisitions and mergers that are reshaping the competitive landscape and creating larger, more comprehensive service providers capable of addressing diverse customer requirements.

Product innovation continues at a rapid pace, with new features such as cryptocurrency integration, enhanced analytics capabilities, and industry-specific solutions being introduced regularly to maintain competitive differentiation.

International expansion efforts by UK-based providers are creating new growth opportunities and establishing the UK as a center of excellence for commercial prepaid card innovation and services.

Strategic recommendations for market participants emphasize the importance of focusing on customer experience, technological innovation, and strategic partnerships to maintain competitive positioning in the evolving commercial prepaid card landscape.

Investment priorities should focus on mobile technology development, security enhancement, and API integration capabilities that enable seamless connection with existing business systems. MarkWide Research analysis indicates that organizations investing in these areas achieve higher customer retention rates of 89% compared to those focusing solely on traditional features.

Market entry strategies for new participants should consider specialized industry verticals or unique value propositions that differentiate from established competitors. Success in this market requires clear positioning and demonstrated expertise in addressing specific customer needs.

Partnership development opportunities with technology providers, financial institutions, and industry specialists can accelerate market penetration and enhance service offerings. Collaborative approaches enable market participants to leverage complementary strengths and access new customer segments.

Customer education initiatives are essential for driving adoption, particularly among smaller organizations that may not fully understand the benefits and capabilities of modern commercial prepaid card solutions. Educational marketing approaches can significantly improve conversion rates and customer satisfaction.

Regulatory compliance should be viewed as a competitive advantage rather than a burden, with proactive compliance strategies enabling providers to build trust and credibility with customers while avoiding potential regulatory issues.

Future market prospects for the UK commercial prepaid card sector remain highly positive, with continued growth expected across multiple segments and applications. The market is positioned to benefit from ongoing digital transformation initiatives and the increasing sophistication of business payment requirements.

Technology evolution will continue to drive market development, with emerging technologies such as blockchain, Internet of Things integration, and advanced analytics creating new opportunities for innovation and differentiation. These technological advances are expected to enhance security, improve user experience, and enable new applications.

Market expansion is anticipated in underserved segments and geographic regions, with particular growth potential in small and medium-sized businesses that have historically been underrepresented in the commercial prepaid card market. SME adoption rates are projected to increase by 31% over the next three years as solutions become more accessible and cost-effective.

Industry consolidation trends are expected to continue, with larger players acquiring specialized providers to enhance their capabilities and market coverage. This consolidation may create opportunities for innovative startups while potentially reducing competitive diversity in certain segments.

International opportunities for UK-based providers are expanding as businesses seek global payment solutions that can support international operations while maintaining centralized control and reporting capabilities.

Regulatory evolution will continue to shape market development, with new requirements potentially creating both challenges and opportunities for market participants. Proactive engagement with regulatory developments will be essential for maintaining competitive positioning.

The UK commercial prepaid card market represents a mature yet dynamic sector characterized by continuous innovation, strong growth potential, and increasing adoption across diverse business applications. The market benefits from a supportive regulatory environment, advanced financial infrastructure, and high levels of digital payment acceptance that create favorable conditions for continued expansion.

Key success factors for market participants include technological innovation, customer-centric service delivery, and the ability to address specific industry requirements through specialized solutions. The market rewards providers who can demonstrate clear value propositions and deliver superior customer experiences while maintaining competitive pricing and comprehensive feature sets.

Growth opportunities remain substantial, particularly in underserved market segments, emerging applications, and international expansion initiatives. The increasing sophistication of business payment requirements and the ongoing digital transformation of business processes create favorable conditions for continued market development and innovation.

Future success in the UK commercial prepaid card market will depend on the ability to adapt to changing customer needs, leverage emerging technologies, and maintain strong competitive positioning through continuous innovation and strategic partnerships. Organizations that can effectively balance technological advancement with practical business value will be best positioned to capitalize on the significant opportunities available in this evolving market landscape.

What is Commercial Prepaid Card?

Commercial prepaid cards are payment cards that allow businesses to load funds in advance for various expenses, such as travel, employee rewards, and operational costs. They provide a controlled spending mechanism and can be used for online and in-store purchases.

What are the key players in the UK Commercial Prepaid Card Market?

Key players in the UK Commercial Prepaid Card Market include companies like Prepaid Financial Services, Wirecard, and Edenred, which offer a range of prepaid card solutions for businesses. These companies focus on enhancing financial management and employee benefits, among others.

What are the growth factors driving the UK Commercial Prepaid Card Market?

The UK Commercial Prepaid Card Market is driven by factors such as the increasing demand for cashless transactions, the need for better expense management, and the rise of digital payment solutions. Additionally, businesses are adopting prepaid cards for employee incentives and travel expenses.

What challenges does the UK Commercial Prepaid Card Market face?

Challenges in the UK Commercial Prepaid Card Market include regulatory compliance issues, competition from traditional banking solutions, and concerns over security and fraud. These factors can hinder the adoption and growth of prepaid card solutions.

What opportunities exist in the UK Commercial Prepaid Card Market?

Opportunities in the UK Commercial Prepaid Card Market include the expansion of digital wallets, the integration of advanced technologies like blockchain for security, and the growing trend of remote work, which increases the need for flexible payment solutions.

What trends are shaping the UK Commercial Prepaid Card Market?

Trends in the UK Commercial Prepaid Card Market include the rise of contactless payments, the increasing use of mobile apps for card management, and the focus on sustainability through eco-friendly card options. These trends reflect changing consumer preferences and technological advancements.

UK Commercial Prepaid Card Market

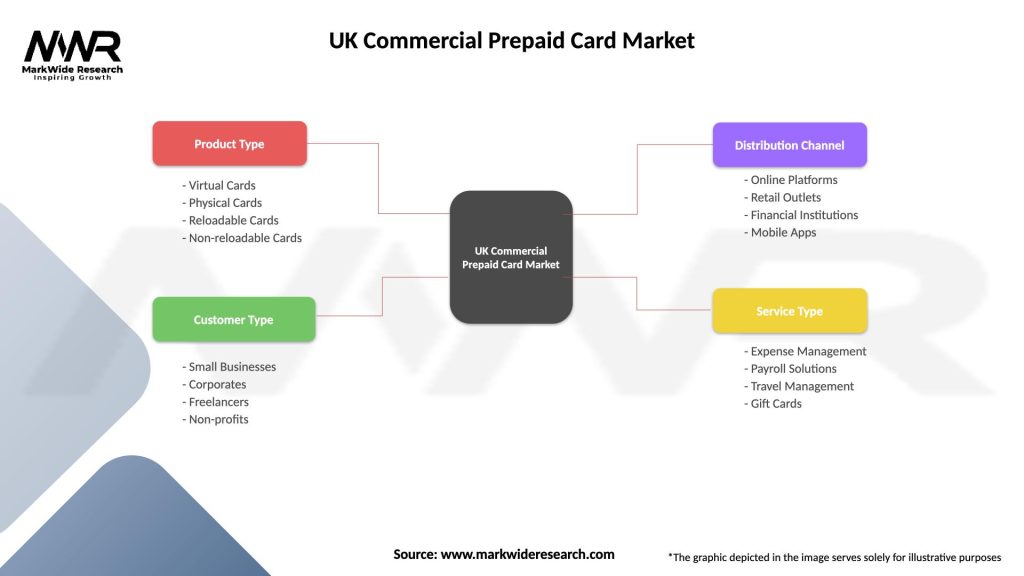

| Segmentation Details | Description |

|---|---|

| Product Type | Virtual Cards, Physical Cards, Reloadable Cards, Non-reloadable Cards |

| Customer Type | Small Businesses, Corporates, Freelancers, Non-profits |

| Distribution Channel | Online Platforms, Retail Outlets, Financial Institutions, Mobile Apps |

| Service Type | Expense Management, Payroll Solutions, Travel Management, Gift Cards |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Commercial Prepaid Card Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at