444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK cold chain logistics services market represents a critical infrastructure component supporting the nation’s food security, pharmaceutical distribution, and temperature-sensitive goods transportation. This sophisticated network encompasses refrigerated warehousing, frozen storage facilities, temperature-controlled transportation, and specialized handling services designed to maintain product integrity throughout the supply chain. Cold chain logistics has evolved into an indispensable service sector, particularly following increased consumer demand for fresh produce, frozen foods, and pharmaceutical products requiring precise temperature management.

Market dynamics indicate robust growth driven by expanding e-commerce food delivery services, pharmaceutical industry requirements, and stringent regulatory compliance standards. The sector demonstrates remarkable resilience with consistent annual growth rates of 8.2%, reflecting strong demand across multiple industry verticals. Temperature-controlled logistics providers are investing heavily in advanced refrigeration technologies, IoT monitoring systems, and automated storage solutions to enhance operational efficiency and reduce energy consumption.

Regional distribution shows concentrated activity around major metropolitan areas, with London, Manchester, Birmingham, and Glasgow serving as primary logistics hubs. The market encompasses diverse service offerings including last-mile delivery for perishable goods, pharmaceutical cold storage, and specialized transportation for biotechnology products. Industry consolidation continues as larger logistics providers acquire specialized cold chain operators to expand their temperature-controlled capabilities and geographic coverage.

The UK cold chain logistics services market refers to the comprehensive ecosystem of temperature-controlled storage, transportation, and distribution services that maintain specific temperature ranges for perishable and temperature-sensitive products throughout the supply chain from production to end consumer delivery.

Cold chain logistics encompasses multiple interconnected services designed to preserve product quality, safety, and efficacy. These services include refrigerated warehousing facilities, frozen storage operations, temperature-controlled transportation fleets, specialized packaging solutions, and real-time monitoring systems. Service providers utilize advanced refrigeration technologies, insulated containers, and sophisticated tracking systems to ensure continuous temperature maintenance during storage and transit phases.

Market participants range from large-scale logistics corporations operating nationwide networks to specialized regional providers focusing on specific temperature requirements or industry sectors. The sector serves diverse industries including food and beverage, pharmaceuticals, biotechnology, chemicals, and agricultural products. Regulatory compliance remains paramount, with service providers adhering to strict food safety standards, pharmaceutical distribution requirements, and environmental regulations governing refrigerant usage and energy efficiency.

Strategic positioning within the UK logistics landscape has elevated cold chain services to essential infrastructure status, supporting critical supply chains across multiple industries. The market demonstrates exceptional growth momentum driven by evolving consumer preferences, regulatory requirements, and technological advancement. Digital transformation initiatives are reshaping service delivery through IoT integration, predictive analytics, and automated monitoring systems that enhance operational efficiency while reducing costs.

Competitive dynamics reveal increasing consolidation as major logistics providers expand their temperature-controlled capabilities through strategic acquisitions and infrastructure investments. Market leaders are differentiating through specialized services, geographic coverage, and technological innovation. Customer demand patterns show growing requirements for flexible storage solutions, rapid delivery capabilities, and comprehensive tracking visibility throughout the cold chain process.

Investment trends indicate substantial capital allocation toward facility modernization, fleet expansion, and technology integration. Service providers are prioritizing sustainability initiatives, with energy efficiency improvements of 35% achieved through advanced refrigeration systems and renewable energy adoption. Market outlook remains highly positive, supported by expanding pharmaceutical distribution requirements, growing e-commerce food delivery services, and increasing consumer awareness of food safety standards.

Operational excellence has become the primary differentiator among cold chain logistics providers, with companies investing heavily in temperature monitoring technology and staff training programs. The following insights highlight critical market developments:

Consumer behavior transformation represents the primary catalyst driving cold chain logistics expansion across the UK market. Increasing demand for fresh, organic, and premium food products requires sophisticated temperature-controlled distribution networks to maintain quality standards. E-commerce growth in grocery and meal delivery services has created unprecedented demand for last-mile cold chain capabilities, with online food sales growing at remarkable annual rates of 12.5%.

Pharmaceutical industry expansion continues driving specialized cold chain requirements, particularly for vaccine distribution, biotechnology products, and temperature-sensitive medications. The sector demands ultra-precise temperature control with comprehensive documentation and regulatory compliance. Healthcare infrastructure modernization initiatives require reliable cold chain logistics to support hospital systems, research facilities, and pharmaceutical distribution networks throughout the UK.

Regulatory enforcement of food safety standards and pharmaceutical distribution requirements compels businesses to utilize professional cold chain services rather than managing temperature-controlled logistics internally. Quality assurance demands have intensified following high-profile food safety incidents, driving increased adoption of professional cold chain services with comprehensive tracking and documentation capabilities. International trade expansion requires sophisticated cold chain infrastructure to support import and export of temperature-sensitive products while maintaining compliance with international standards.

Capital intensity represents a significant barrier to market entry, with cold chain infrastructure requiring substantial upfront investments in specialized facilities, refrigeration equipment, and temperature-controlled transportation fleets. Operating costs remain elevated due to energy consumption requirements, specialized equipment maintenance, and regulatory compliance expenses that impact service pricing and market accessibility for smaller businesses.

Skilled workforce shortages challenge industry growth as cold chain operations require specialized training in temperature management, food safety protocols, and regulatory compliance procedures. Technical complexity of modern cold chain systems demands experienced personnel capable of managing sophisticated monitoring equipment and responding to temperature excursions or equipment failures.

Environmental regulations governing refrigerant usage and energy efficiency create compliance costs while limiting equipment options for service providers. Infrastructure limitations in certain geographic regions restrict service expansion and increase operational costs for providers attempting to serve underserved markets. Economic sensitivity affects customer demand during economic downturns, as businesses may delay cold chain investments or reduce service utilization to control costs.

Digital transformation presents substantial opportunities for cold chain logistics providers to differentiate services through advanced technology integration and data analytics capabilities. IoT implementation enables real-time monitoring, predictive maintenance, and automated reporting systems that enhance operational efficiency while providing customers with unprecedented visibility into their supply chains.

Pharmaceutical sector expansion offers significant growth potential as biotechnology companies, research institutions, and healthcare providers require increasingly sophisticated cold chain services. Specialized storage requirements for cell and gene therapies, vaccines, and research materials create opportunities for providers capable of delivering ultra-low temperature services with comprehensive regulatory compliance.

Sustainability initiatives create opportunities for providers investing in renewable energy systems, energy-efficient refrigeration technology, and alternative fuel transportation fleets. Carbon reduction commitments from major retailers and pharmaceutical companies drive demand for environmentally responsible cold chain services. Regional expansion opportunities exist in underserved markets where growing populations and economic development create demand for professional cold chain services.

Competitive intensity continues escalating as established logistics providers expand cold chain capabilities while specialized operators defend market positions through service innovation and customer relationship development. Market consolidation trends indicate larger companies acquiring specialized cold chain operators to achieve scale economies and expand service offerings.

Technology disruption is reshaping service delivery models through automation, artificial intelligence, and advanced analytics that optimize routing, inventory management, and predictive maintenance. Customer expectations for transparency and real-time visibility drive investment in tracking systems and customer portal development. Operational efficiency improvements through technology adoption have enabled service providers to achieve cost reductions of 18% while enhancing service quality.

Supply chain integration deepens as cold chain providers become strategic partners rather than transactional service suppliers. Value-added services including inventory management, order fulfillment, and quality control expand provider roles within customer operations. Risk management capabilities become increasingly important as supply chain disruptions highlight the critical nature of reliable cold chain services for business continuity.

Comprehensive market analysis employed multiple research methodologies to ensure accurate representation of UK cold chain logistics services market conditions and trends. Primary research included structured interviews with industry executives, facility managers, and logistics professionals across major service providers, pharmaceutical companies, food retailers, and technology suppliers.

Secondary research encompassed analysis of industry reports, regulatory filings, company financial statements, and trade association publications. Data validation processes included cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market insights. Quantitative analysis utilized statistical modeling to project market trends and validate growth assumptions.

Industry expert consultations provided qualitative insights into market dynamics, competitive positioning, and future outlook scenarios. Regulatory analysis examined compliance requirements, policy changes, and their impact on market development. Technology assessment evaluated emerging solutions and their potential influence on service delivery models and operational efficiency improvements.

London and Southeast England dominate cold chain logistics activity, accounting for approximately 42% of market concentration due to population density, major airports, and proximity to European markets. The region hosts numerous pharmaceutical companies, food importers, and distribution centers requiring sophisticated cold chain services. Infrastructure development continues with major facility expansions and technology upgrades supporting growing demand.

Northern England represents a significant growth region with Manchester, Liverpool, and Leeds serving as major logistics hubs. The area benefits from lower operational costs while maintaining excellent transportation connectivity. Manufacturing presence in pharmaceuticals and food processing drives consistent demand for cold chain services. Investment activity includes facility modernization and capacity expansion projects.

Scotland and Wales demonstrate growing cold chain requirements driven by food production, pharmaceutical manufacturing, and tourism-related demand. Geographic challenges create opportunities for specialized providers capable of serving remote locations while maintaining temperature integrity. Regional development initiatives support infrastructure improvements and technology adoption across these markets.

Market leadership is distributed among several major logistics providers who have expanded into cold chain services through organic growth and strategic acquisitions. The competitive environment features both large-scale operators with nationwide coverage and specialized regional providers focusing on specific industry segments or geographic areas.

Service type segmentation reveals diverse cold chain logistics offerings tailored to specific industry requirements and temperature specifications. Storage services include refrigerated warehousing, frozen storage, and specialized ultra-low temperature facilities supporting biotechnology applications.

By Temperature Range:

By Industry Vertical:

Food and beverage cold chain represents the largest market category, driven by consumer demand for fresh, organic, and premium food products. Retail integration has deepened as major supermarket chains require sophisticated distribution networks supporting their fresh food offerings. E-commerce growth in grocery delivery services creates new requirements for last-mile cold chain capabilities with delivery success rates exceeding 96%.

Pharmaceutical cold chain demonstrates the highest growth rates and profit margins due to specialized requirements and regulatory compliance demands. Vaccine distribution capabilities became critical during recent healthcare challenges, highlighting the strategic importance of pharmaceutical cold chain infrastructure. Biotechnology applications require ultra-low temperature storage and transportation with comprehensive documentation and chain of custody protocols.

Industrial cold chain serves chemical, agricultural, and manufacturing sectors requiring temperature-controlled storage and transportation for raw materials and finished products. Specialized handling requirements create opportunities for providers with technical expertise and appropriate certifications. International trade support includes customs clearance and documentation services for temperature-sensitive imports and exports.

Operational efficiency improvements enable businesses to focus on core competencies while leveraging specialized cold chain expertise for temperature-controlled logistics requirements. Cost optimization through professional cold chain services eliminates the need for internal infrastructure investments while providing access to advanced technology and operational expertise.

Risk mitigation benefits include comprehensive insurance coverage, regulatory compliance management, and temperature monitoring systems that protect product integrity throughout the supply chain. Quality assurance protocols ensure consistent temperature maintenance and documentation supporting product safety and regulatory requirements.

Scalability advantages allow businesses to adjust cold chain capacity based on seasonal demand fluctuations or business growth without infrastructure investments. Technology access provides customers with advanced tracking systems, real-time monitoring, and data analytics capabilities that enhance supply chain visibility and decision-making processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the cold chain logistics sector with providers implementing comprehensive IoT networks, artificial intelligence, and blockchain technology for enhanced traceability and operational optimization. Predictive analytics applications enable proactive maintenance scheduling and demand forecasting, reducing operational disruptions while improving service reliability.

Sustainability focus drives adoption of renewable energy systems, energy-efficient refrigeration technology, and alternative fuel transportation fleets. Carbon neutrality commitments from major customers compel cold chain providers to invest in environmental initiatives and report sustainability metrics. Circular economy principles influence packaging solutions and waste reduction strategies throughout cold chain operations.

Automation expansion includes robotic systems for warehouse operations, automated guided vehicles for facility transportation, and AI-powered inventory management systems. Labor optimization through automation addresses workforce shortages while improving operational consistency and reducing human error risks. Customer integration deepens through direct system connections enabling real-time inventory visibility and automated replenishment processes.

Infrastructure investments continue expanding across the UK with major cold chain providers announcing facility construction and modernization projects. Technology partnerships between logistics providers and technology companies accelerate innovation in monitoring systems, automation, and data analytics applications. Acquisition activity remains robust as larger companies expand cold chain capabilities through strategic purchases of specialized operators.

Regulatory developments include updated food safety standards and pharmaceutical distribution requirements that impact operational procedures and compliance costs. MarkWide Research analysis indicates increasing regulatory scrutiny of cold chain operations with enhanced documentation and reporting requirements. International standards harmonization facilitates cross-border cold chain operations while maintaining product integrity and regulatory compliance.

Innovation initiatives focus on sustainable refrigeration technologies, alternative energy systems, and advanced packaging solutions that extend product shelf life while reducing environmental impact. Collaborative platforms enable smaller businesses to access professional cold chain services through shared infrastructure and consolidated shipping arrangements.

Strategic positioning recommendations emphasize technology investment and sustainability initiatives as key differentiators in an increasingly competitive market environment. Service providers should prioritize IoT integration, predictive analytics, and customer portal development to enhance service value and operational efficiency.

Geographic expansion strategies should focus on underserved regions where growing demand and limited competition create opportunities for market entry and growth. Specialized services development in pharmaceutical and biotechnology cold chain applications offers higher margins and growth potential compared to traditional food logistics.

Partnership development with technology companies, pharmaceutical manufacturers, and retail chains can create competitive advantages through integrated service offerings and enhanced customer relationships. Sustainability investments in renewable energy and energy-efficient systems will become increasingly important for customer retention and regulatory compliance. MWR recommends focusing on operational excellence and customer service quality as primary strategies for market differentiation and growth.

Market trajectory indicates continued robust growth driven by expanding pharmaceutical requirements, e-commerce food delivery services, and increasing consumer awareness of food safety standards. Technology integration will accelerate with artificial intelligence, machine learning, and blockchain applications becoming standard operational tools rather than competitive differentiators.

Industry consolidation is expected to continue as larger logistics providers acquire specialized cold chain operators to achieve scale economies and expand service capabilities. Regional expansion will focus on underserved markets where economic development and population growth create new demand for professional cold chain services. Service innovation will emphasize sustainability, automation, and customer integration as primary development areas.

Regulatory evolution will likely increase compliance requirements while harmonizing international standards to facilitate cross-border trade. Environmental considerations will drive adoption of renewable energy systems and carbon-neutral transportation options. Market growth projections indicate sustained expansion with annual growth rates maintaining 7.5% to 9.2% over the next five years, supported by fundamental demand drivers across multiple industry sectors.

The UK cold chain logistics services market represents a dynamic and essential component of the nation’s supply chain infrastructure, supporting critical industries including food and beverage, pharmaceuticals, and biotechnology. Market fundamentals remain strong with robust demand drivers, technological advancement opportunities, and expanding service requirements across multiple industry verticals.

Competitive dynamics continue evolving through consolidation, technology integration, and service specialization as providers seek to differentiate their offerings in an increasingly sophisticated market environment. Investment priorities focus on automation, sustainability, and customer integration capabilities that enhance operational efficiency while meeting evolving regulatory and environmental requirements.

Future success in the UK cold chain logistics market will depend on providers’ ability to adapt to technological change, meet sustainability expectations, and deliver specialized services that address specific industry requirements. Market outlook remains highly positive with sustained growth expected across all major segments, supported by fundamental demographic trends, regulatory requirements, and evolving consumer preferences that prioritize product quality and safety throughout the supply chain.

What is Cold Chain Logistics Services?

Cold Chain Logistics Services refer to the temperature-controlled supply chain processes that ensure the safe transportation and storage of perishable goods, such as food, pharmaceuticals, and chemicals. These services are crucial for maintaining product quality and safety throughout the supply chain.

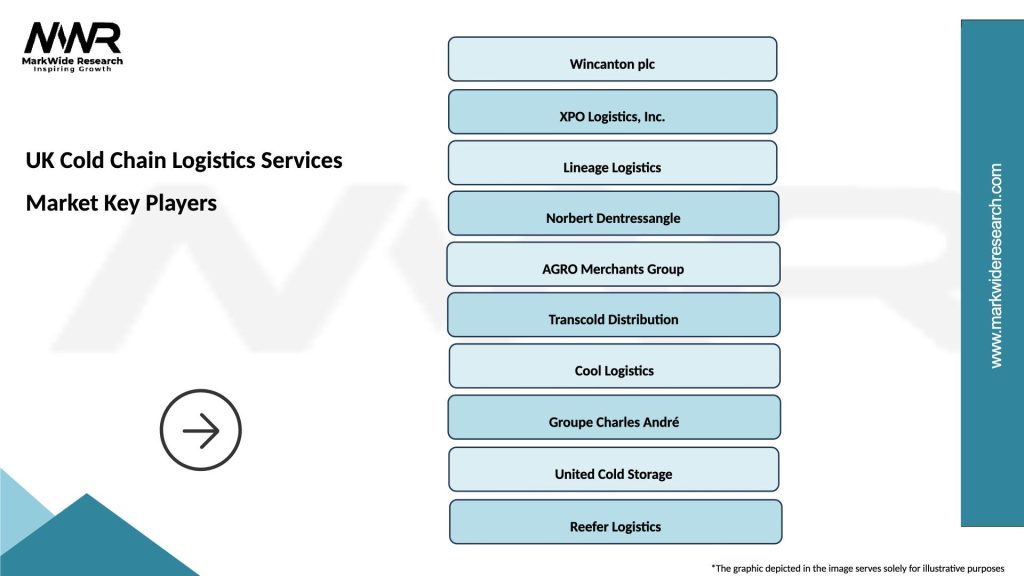

What are the key players in the UK Cold Chain Logistics Services Market?

Key players in the UK Cold Chain Logistics Services Market include companies like XPO Logistics, DHL Supply Chain, and Norbert Dentressangle, which provide specialized temperature-controlled logistics solutions. These companies focus on various sectors, including food distribution and pharmaceutical logistics, among others.

What are the main drivers of growth in the UK Cold Chain Logistics Services Market?

The growth of the UK Cold Chain Logistics Services Market is driven by increasing demand for fresh food products, the rise in e-commerce for perishable goods, and stringent regulations regarding food safety. Additionally, the expansion of the pharmaceutical sector also contributes to the market’s growth.

What challenges does the UK Cold Chain Logistics Services Market face?

The UK Cold Chain Logistics Services Market faces challenges such as high operational costs, the need for advanced technology to monitor temperature, and regulatory compliance issues. Additionally, fluctuations in fuel prices can impact logistics expenses significantly.

What opportunities exist in the UK Cold Chain Logistics Services Market?

Opportunities in the UK Cold Chain Logistics Services Market include the adoption of innovative technologies like IoT for real-time monitoring and the growing trend of sustainable logistics practices. Furthermore, the increasing demand for online grocery shopping presents new avenues for growth.

What trends are shaping the UK Cold Chain Logistics Services Market?

Trends shaping the UK Cold Chain Logistics Services Market include the integration of automation and robotics in warehousing, the use of eco-friendly refrigerants, and the rise of data analytics for optimizing supply chain efficiency. These trends are enhancing operational efficiency and sustainability.

UK Cold Chain Logistics Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Packaging, Monitoring |

| End User | Pharmaceuticals, Food & Beverage, Biotechnology, Cosmetics |

| Technology | Refrigerated Trucks, Temperature-Controlled Containers, IoT Sensors, Cold Storage Facilities |

| Distribution Channel | Direct Sales, Third-Party Logistics, E-commerce, Retail |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Cold Chain Logistics Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at