444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK ceramic tiles market represents a dynamic and evolving segment of the construction and home improvement industry, characterized by increasing demand for aesthetic flooring and wall covering solutions. Market dynamics indicate robust growth driven by residential renovations, commercial construction projects, and evolving consumer preferences toward premium ceramic products. The market encompasses various ceramic tile categories including porcelain tiles, glazed ceramic tiles, and specialty decorative options that cater to diverse architectural and design requirements.

Consumer behavior in the UK ceramic tiles market reflects a growing emphasis on sustainability, durability, and design versatility. The market benefits from strong demand across residential, commercial, and industrial applications, with residential renovation projects accounting for approximately 68% of total ceramic tile consumption. Regional distribution shows concentrated demand in major metropolitan areas including London, Manchester, Birmingham, and Glasgow, where construction activity remains particularly robust.

Technology adoption within the ceramic tiles manufacturing sector has accelerated significantly, with digital printing technologies and advanced glazing techniques enabling manufacturers to produce increasingly sophisticated products. The market demonstrates strong growth potential with projected expansion at a CAGR of 5.2% through the forecast period, supported by favorable construction industry trends and increasing consumer investment in home improvement projects.

The UK ceramic tiles market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of ceramic-based flooring and wall covering products within the United Kingdom. This market includes various ceramic tile categories such as porcelain tiles, glazed ceramic tiles, unglazed options, and specialty decorative tiles designed for residential, commercial, and industrial applications.

Market scope extends beyond basic tile manufacturing to include associated services such as installation, design consultation, and maintenance solutions. The ceramic tiles market encompasses both domestic production facilities and imported products from international manufacturers, creating a diverse competitive landscape that serves varied consumer preferences and budget requirements across different market segments.

Industry definition includes all ceramic-based tile products manufactured through firing clay materials at high temperatures, resulting in durable, water-resistant surfaces suitable for various architectural applications. The market covers traditional ceramic tiles, advanced porcelain products, and innovative ceramic composites that incorporate modern manufacturing technologies and design capabilities.

Strategic analysis of the UK ceramic tiles market reveals a mature yet dynamic industry experiencing steady growth driven by construction sector recovery and increasing consumer focus on home improvement investments. The market demonstrates resilience through economic fluctuations while adapting to evolving design trends and sustainability requirements that shape contemporary consumer preferences.

Key market drivers include robust residential renovation activity, commercial construction growth, and increasing adoption of premium ceramic tile products that offer enhanced durability and aesthetic appeal. Market penetration of digital printing technologies has reached approximately 78% among major manufacturers, enabling production of highly customized and visually appealing ceramic tile products that meet diverse consumer demands.

Competitive dynamics reflect a fragmented market structure with numerous domestic and international players competing across different price segments and product categories. The market benefits from strong distribution networks including specialized tile retailers, home improvement centers, and online platforms that facilitate consumer access to diverse ceramic tile options and related services.

Future prospects indicate continued market expansion supported by favorable demographic trends, urbanization patterns, and increasing consumer willingness to invest in premium home improvement products. The market is positioned for sustained growth with emerging opportunities in sustainable ceramic tile products and smart home integration applications.

Market intelligence reveals several critical insights that define the current state and future trajectory of the UK ceramic tiles market:

Primary growth drivers propelling the UK ceramic tiles market include robust construction industry activity and increasing consumer investment in home improvement projects. Residential renovation trends continue to drive substantial demand for ceramic tile products, with homeowners prioritizing bathroom and kitchen upgrades that incorporate premium ceramic flooring and wall covering solutions.

Commercial construction growth represents another significant market driver, with new office buildings, retail spaces, and hospitality venues requiring durable and aesthetically appealing ceramic tile installations. The commercial segment benefits from ceramic tiles’ superior durability, low maintenance requirements, and design versatility that meets diverse architectural specifications and building code requirements.

Technological advancement in ceramic tile manufacturing has created new market opportunities through improved product quality, expanded design options, and enhanced performance characteristics. Digital printing technologies enable manufacturers to produce ceramic tiles with realistic wood, stone, and fabric textures that appeal to design-conscious consumers seeking premium aesthetic solutions.

Sustainability initiatives drive increasing demand for eco-friendly ceramic tile products manufactured using environmentally responsible processes and materials. Consumer awareness of environmental issues has created market opportunities for manufacturers offering sustainable ceramic tile options that meet green building certification requirements and support environmentally conscious construction projects.

Economic uncertainties pose significant challenges to the UK ceramic tiles market, with fluctuating construction activity and consumer spending patterns affecting demand levels across different market segments. Brexit-related impacts continue to influence supply chain dynamics and import costs, creating pricing pressures that affect market competitiveness and profitability for both manufacturers and retailers.

Raw material costs represent a persistent market restraint, with ceramic tile manufacturers facing increasing expenses for clay, glazes, and energy required for high-temperature firing processes. Supply chain disruptions have periodically affected material availability and transportation costs, impacting production schedules and pricing strategies across the industry.

Labor shortage challenges in the construction and installation sectors limit market growth potential, with skilled ceramic tile installers in high demand but limited supply. This constraint affects project completion timelines and increases installation costs, potentially deterring some consumers from pursuing ceramic tile renovation projects.

Competition from alternative flooring materials including luxury vinyl tiles, engineered hardwood, and laminate products presents ongoing market challenges. These alternatives often offer lower installation costs and easier maintenance requirements, appealing to budget-conscious consumers and creating competitive pressure on ceramic tile market share.

Emerging opportunities in the UK ceramic tiles market include growing demand for large-format ceramic tiles that create seamless, contemporary aesthetic appearances in both residential and commercial applications. Design innovation continues to create new market segments, with manufacturers developing ceramic tiles that incorporate advanced surface textures, antimicrobial properties, and enhanced slip resistance characteristics.

Smart home integration presents significant growth potential as ceramic tile manufacturers explore opportunities to incorporate heating elements, LED lighting, and sensor technologies into tile products. These innovative applications appeal to tech-savvy consumers seeking integrated home automation solutions that combine functionality with aesthetic appeal.

Export market expansion offers substantial opportunities for UK ceramic tile manufacturers to leverage their design expertise and quality reputation in international markets. European market access remains particularly attractive, with UK manufacturers well-positioned to serve continental European customers seeking premium ceramic tile products and design services.

Sustainable product development creates opportunities for manufacturers to differentiate their offerings through eco-friendly ceramic tiles manufactured using renewable energy sources and recycled materials. Green building certification requirements increasingly favor ceramic tile products that meet stringent environmental standards, creating market advantages for sustainable product lines.

Market dynamics in the UK ceramic tiles sector reflect complex interactions between supply-side manufacturing capabilities and demand-side consumer preferences that shape competitive positioning and growth strategies. Price competition remains intense across different market segments, with manufacturers and retailers balancing quality considerations against cost pressures to maintain market share and profitability.

Consumer behavior patterns demonstrate increasing sophistication in ceramic tile selection, with buyers conducting extensive research on product specifications, design options, and installation requirements before making purchase decisions. Digital influence has transformed the customer journey, with approximately 84% of ceramic tile buyers conducting online research before visiting physical retail locations.

Supply chain dynamics continue evolving as manufacturers adapt to changing trade relationships and logistics challenges that affect material sourcing and product distribution. Inventory management strategies have become increasingly sophisticated, with retailers utilizing advanced forecasting systems to optimize stock levels and minimize carrying costs while ensuring product availability.

Innovation cycles in ceramic tile design and manufacturing technology drive continuous market evolution, with successful companies investing heavily in research and development to maintain competitive advantages. Market consolidation trends reflect ongoing industry maturation, with larger players acquiring smaller manufacturers to expand product portfolios and geographic reach.

Comprehensive research approach employed in analyzing the UK ceramic tiles market incorporates multiple data collection methodologies to ensure accuracy and reliability of market insights and projections. Primary research activities include extensive interviews with industry executives, manufacturers, distributors, retailers, and end-users to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass analysis of industry publications, government statistics, trade association reports, and company financial statements to establish baseline market data and validate primary research findings. Market sizing methodologies utilize bottom-up and top-down approaches to ensure comprehensive coverage of all market segments and geographic regions within the UK ceramic tiles market.

Data validation processes include cross-referencing multiple sources and conducting expert interviews to verify market statistics and trend analysis. Quantitative analysis incorporates statistical modeling techniques to project future market growth rates and identify key performance indicators that influence market dynamics and competitive positioning.

Qualitative research elements focus on understanding consumer behavior patterns, design preferences, and purchasing decision factors that drive ceramic tile market demand. Research methodology ensures comprehensive coverage of residential, commercial, and industrial market segments while maintaining objectivity and analytical rigor throughout the investigation process.

Geographic distribution of the UK ceramic tiles market reveals significant regional variations in demand patterns, product preferences, and competitive dynamics that reflect local economic conditions and architectural traditions. London and Southeast England represent the largest regional market, accounting for approximately 42% of total ceramic tile consumption, driven by high construction activity and affluent consumer demographics that support premium product segments.

Northern England regions including Manchester, Liverpool, and Leeds demonstrate strong market growth supported by urban regeneration projects and increasing residential renovation activity. Regional preferences in Northern England favor traditional ceramic tile designs and cost-effective product options that align with local architectural styles and budget considerations.

Scotland and Wales markets exhibit distinct characteristics with emphasis on durability and weather resistance due to challenging climate conditions. Scottish market dynamics show particular strength in commercial applications, with approximately 35% market share attributed to hospitality and retail sector installations that require high-performance ceramic tile solutions.

Regional supply chain networks vary significantly across different UK areas, with some regions heavily dependent on imported ceramic tile products while others benefit from local manufacturing capabilities. Distribution efficiency and logistics costs influence regional pricing structures and product availability, creating competitive advantages for suppliers with optimized regional coverage strategies.

Market competition in the UK ceramic tiles sector encompasses diverse players ranging from large multinational manufacturers to specialized domestic producers and importers. Competitive positioning strategies vary significantly across different market segments, with companies focusing on product innovation, pricing advantages, distribution capabilities, or specialized market niches to differentiate their offerings.

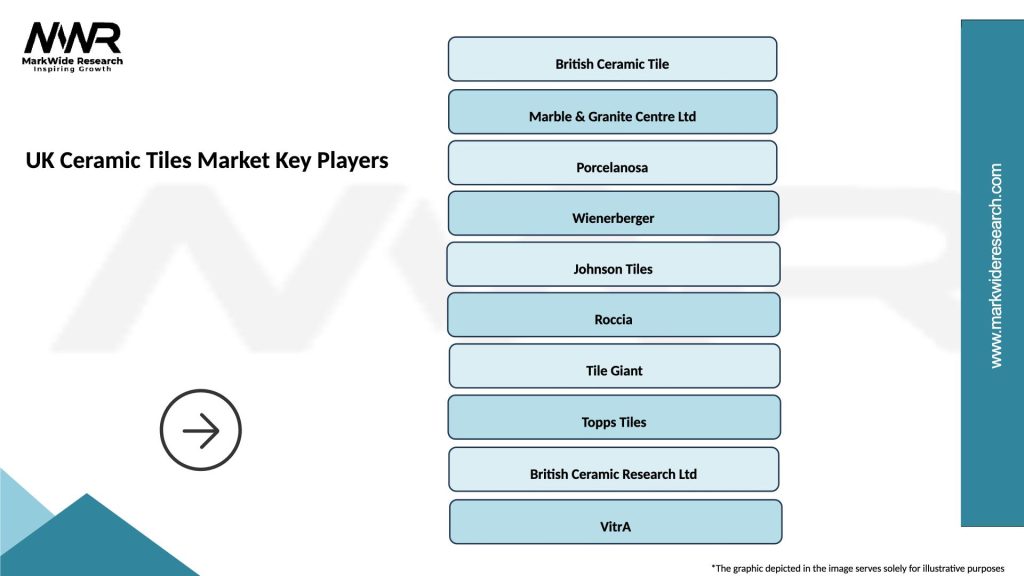

Leading market participants include:

Competitive strategies increasingly emphasize digital marketing capabilities, customer service excellence, and integrated solution offerings that combine ceramic tile products with installation services and design consultation. Market share distribution remains relatively fragmented, with the top five players collectively accounting for approximately 58% of total market revenue, leaving substantial opportunities for smaller specialized competitors.

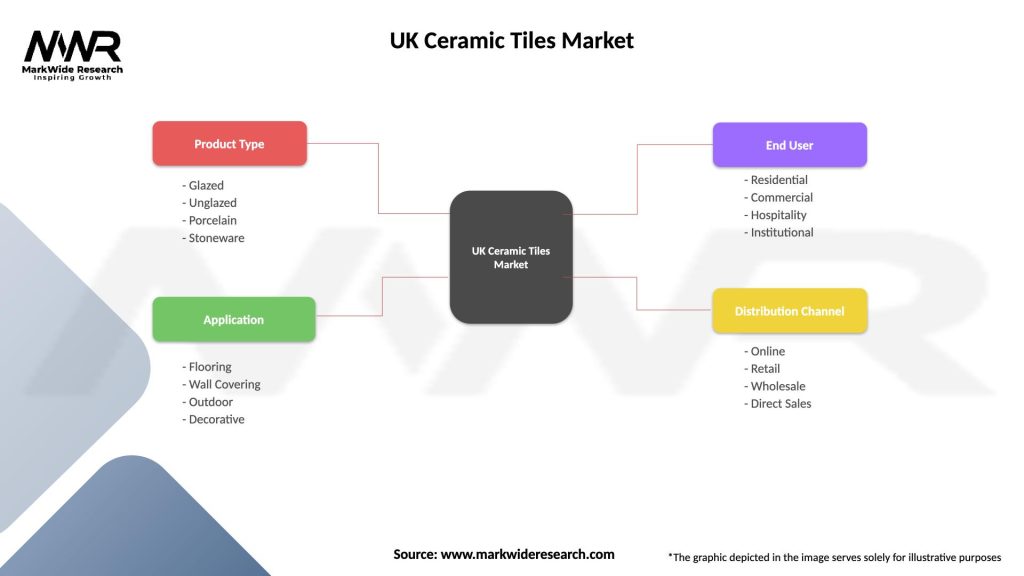

Market segmentation analysis reveals distinct categories within the UK ceramic tiles market based on product type, application, distribution channel, and price positioning that serve different consumer needs and preferences.

By Product Type:

By Application:

By Distribution Channel:

Porcelain tiles category demonstrates the strongest growth trajectory within the UK ceramic tiles market, driven by consumer preference for premium products that offer superior durability and design sophistication. Market penetration of porcelain tiles has reached approximately 46% of total ceramic tile sales, reflecting increasing consumer willingness to invest in higher-quality flooring solutions that provide long-term value and aesthetic appeal.

Glazed ceramic tiles maintain significant market presence as the traditional mainstream category, appealing to cost-conscious consumers seeking reliable performance and diverse design options. Product innovation within this category focuses on improved glazing technologies that enhance durability and stain resistance while maintaining competitive pricing structures.

Large-format tiles represent an emerging high-growth category, with sizes exceeding 600mm gaining popularity among design-conscious consumers and commercial applications. Installation challenges associated with large-format tiles have driven demand for specialized installation services and advanced adhesive systems that ensure proper performance and longevity.

Textured and slip-resistant tiles constitute a specialized category experiencing steady growth driven by safety requirements in commercial applications and consumer preference for tactile surface experiences. Technology advancement in surface texturing enables manufacturers to create ceramic tiles that combine aesthetic appeal with enhanced functional performance characteristics.

Manufacturers benefit from growing market demand and opportunities to differentiate products through design innovation and advanced manufacturing technologies. Production efficiency improvements enable manufacturers to optimize costs while maintaining quality standards that meet evolving consumer expectations and regulatory requirements.

Retailers and distributors gain advantages from expanding market opportunities and increasing consumer investment in home improvement projects. Digital transformation enables retailers to reach broader customer bases while optimizing inventory management and customer service capabilities that enhance competitive positioning.

Installation professionals benefit from steady demand for ceramic tile installation services and opportunities to specialize in premium product categories that command higher service fees. Skill development in advanced installation techniques creates competitive advantages and supports professional growth within the expanding market.

Property developers and contractors leverage ceramic tiles’ durability and aesthetic appeal to enhance property values and meet buyer preferences for quality finishes. Design flexibility offered by modern ceramic tile products enables architects and designers to create distinctive spaces that differentiate their projects in competitive real estate markets.

End consumers benefit from expanding product choices, improved quality standards, and competitive pricing that make ceramic tile installations more accessible and affordable. Long-term value provided by quality ceramic tile installations supports property values while reducing maintenance requirements and replacement costs over time.

Strengths:

Weaknesses:

Opportunities:

Threats:

Design trend evolution in the UK ceramic tiles market reflects increasing consumer sophistication and preference for products that replicate natural materials while providing superior performance characteristics. Wood-look ceramic tiles have gained substantial market traction, offering the aesthetic appeal of hardwood flooring with enhanced durability and moisture resistance that suits UK climate conditions.

Large-format tile adoption continues accelerating as consumers and designers seek to create seamless, contemporary appearances with minimal grout lines. Installation innovation has evolved to support large-format applications, with specialized tools and techniques enabling successful installation of tiles exceeding 1200mm in length.

Sustainability focus drives increasing demand for ceramic tiles manufactured using recycled materials and energy-efficient production processes. Environmental certification programs influence purchasing decisions, with approximately 29% of consumers actively seeking ceramic tile products that meet recognized sustainability standards.

Digital printing advancement enables production of highly realistic surface textures and patterns that closely replicate natural stone, fabric, and metal appearances. Customization capabilities allow consumers to specify unique designs and patterns, creating opportunities for manufacturers to serve niche market segments and premium applications.

Smart home integration represents an emerging trend with manufacturers exploring opportunities to incorporate heating elements, LED lighting, and sensor technologies into ceramic tile products. Connected home systems create potential for ceramic tiles to serve functional roles beyond traditional flooring and wall covering applications.

Manufacturing technology advancement has transformed ceramic tile production capabilities, with digital printing systems enabling unprecedented design flexibility and customization options. Industry investment in advanced kiln technologies and automated production systems has improved energy efficiency while reducing manufacturing costs and environmental impact.

Retail channel evolution reflects changing consumer shopping preferences, with traditional tile showrooms expanding digital capabilities and online retailers developing virtual design tools that help consumers visualize ceramic tile installations. Omnichannel strategies have become essential for retailers seeking to serve diverse customer preferences and shopping behaviors.

Product innovation initiatives focus on developing ceramic tiles with enhanced performance characteristics including improved slip resistance, antimicrobial properties, and thermal conductivity for underfloor heating applications. Research and development investments continue expanding as manufacturers seek to differentiate their products in competitive market conditions.

Supply chain optimization efforts have intensified following Brexit-related trade changes and global logistics disruptions. Inventory management systems have become more sophisticated, with retailers and distributors utilizing advanced forecasting tools to optimize stock levels and minimize supply chain risks.

Sustainability initiatives across the industry include adoption of renewable energy sources for manufacturing operations and development of ceramic tile recycling programs that support circular economy principles. Environmental compliance requirements continue evolving, driving industry adaptation to more stringent sustainability standards.

Strategic recommendations for UK ceramic tiles market participants emphasize the importance of digital transformation and customer experience enhancement to maintain competitive positioning in evolving market conditions. MarkWide Research analysis indicates that companies investing in comprehensive digital strategies achieve approximately 23% higher customer retention rates compared to traditional approaches.

Product portfolio optimization should focus on expanding premium ceramic tile offerings while maintaining competitive pricing in mainstream market segments. Innovation investment in sustainable product development and advanced manufacturing technologies will create long-term competitive advantages as environmental considerations become increasingly important to consumers and regulatory bodies.

Distribution strategy enhancement requires integration of online and offline channels to serve diverse customer preferences and shopping behaviors. Customer service capabilities including design consultation and installation support services represent key differentiators that can justify premium pricing and build customer loyalty in competitive market conditions.

Market expansion opportunities exist in specialized segments including large-format tiles, textured surfaces, and sustainable product lines that appeal to design-conscious consumers willing to pay premium prices for superior quality and performance. Export market development offers additional growth potential for UK manufacturers with strong design capabilities and quality reputations.

Supply chain resilience improvements should focus on diversifying supplier relationships and developing flexible inventory management systems that can adapt to changing market conditions and trade relationships. Risk management strategies must address potential disruptions while maintaining cost competitiveness and service quality standards.

Long-term prospects for the UK ceramic tiles market remain positive, supported by favorable demographic trends, urbanization patterns, and increasing consumer investment in home improvement projects. Market growth projections indicate continued expansion at a CAGR of 5.2% through the forecast period, driven by residential renovation activity and commercial construction recovery following economic uncertainties.

Technology integration will continue transforming the ceramic tiles industry, with advanced manufacturing capabilities enabling production of increasingly sophisticated products that meet evolving consumer preferences and performance requirements. Digital transformation across retail and distribution channels will enhance customer experiences while optimizing operational efficiency and market reach.

Sustainability considerations will become increasingly important market drivers, with consumers and regulatory bodies demanding environmentally responsible ceramic tile products and manufacturing processes. Circular economy principles will influence product development and business model innovation as the industry adapts to changing environmental expectations and requirements.

Market consolidation trends may accelerate as larger players seek to expand market share and geographic coverage through strategic acquisitions and partnerships. Competitive dynamics will continue evolving as companies invest in differentiation strategies and specialized market positioning to maintain profitability in mature market conditions.

Export opportunities will expand as UK ceramic tile manufacturers leverage their design expertise and quality reputation to serve international markets seeking premium products and innovative solutions. Global market access will support industry growth while reducing dependence on domestic market fluctuations and economic uncertainties.

Comprehensive analysis of the UK ceramic tiles market reveals a dynamic and resilient industry positioned for continued growth despite economic uncertainties and competitive challenges. Market fundamentals remain strong, supported by robust construction activity, increasing consumer investment in home improvement projects, and ongoing product innovation that enhances ceramic tiles’ appeal across diverse applications and market segments.

Strategic opportunities exist for market participants willing to invest in digital transformation, sustainable product development, and customer experience enhancement initiatives that differentiate their offerings in competitive market conditions. MWR research indicates that companies successfully implementing comprehensive market strategies achieve superior performance and sustainable competitive advantages in evolving industry landscapes.

Future success in the UK ceramic tiles market will depend on companies’ ability to adapt to changing consumer preferences, regulatory requirements, and technological capabilities while maintaining cost competitiveness and service quality standards. The UK ceramic tiles market represents significant opportunities for growth and profitability for organizations that effectively navigate market dynamics and invest in long-term strategic positioning initiatives.

What is Ceramic Tiles?

Ceramic tiles are durable, hard-wearing materials made from clay and other natural resources, commonly used for flooring, walls, and decorative purposes in residential and commercial spaces.

What are the key players in the UK Ceramic Tiles Market?

Key players in the UK Ceramic Tiles Market include companies like Johnson Tiles, British Ceramic Tile, and Marazzi, among others.

What are the main drivers of growth in the UK Ceramic Tiles Market?

The growth of the UK Ceramic Tiles Market is driven by increasing demand for stylish and durable flooring solutions, rising construction activities, and a growing trend towards home renovation and improvement.

What challenges does the UK Ceramic Tiles Market face?

The UK Ceramic Tiles Market faces challenges such as fluctuating raw material prices, competition from alternative flooring options, and environmental regulations impacting production processes.

What opportunities exist in the UK Ceramic Tiles Market?

Opportunities in the UK Ceramic Tiles Market include the rising popularity of eco-friendly tiles, advancements in manufacturing technology, and the increasing use of tiles in innovative applications like outdoor spaces and commercial interiors.

What trends are shaping the UK Ceramic Tiles Market?

Current trends in the UK Ceramic Tiles Market include the growing preference for large-format tiles, the use of digital printing technology for unique designs, and an increasing focus on sustainability and recycled materials.

UK Ceramic Tiles Market

| Segmentation Details | Description |

|---|---|

| Product Type | Glazed, Unglazed, Porcelain, Stoneware |

| Application | Flooring, Wall Covering, Outdoor, Decorative |

| End User | Residential, Commercial, Hospitality, Institutional |

| Distribution Channel | Online, Retail, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Ceramic Tiles Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at